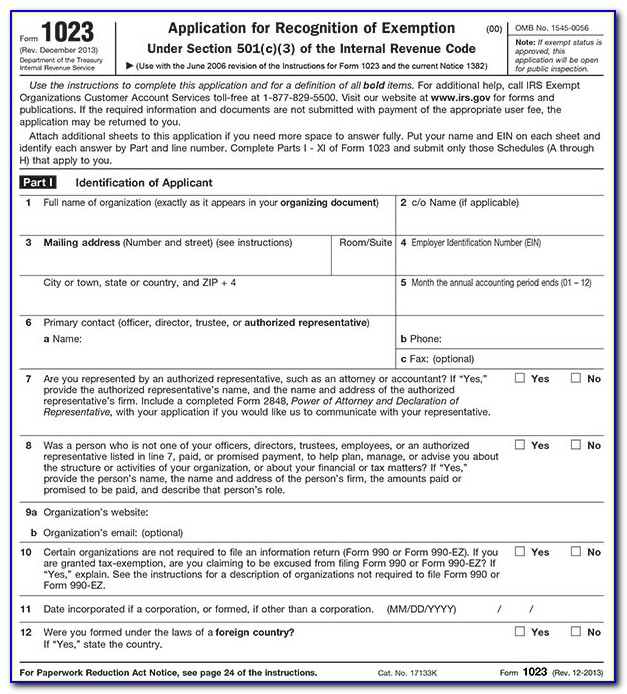

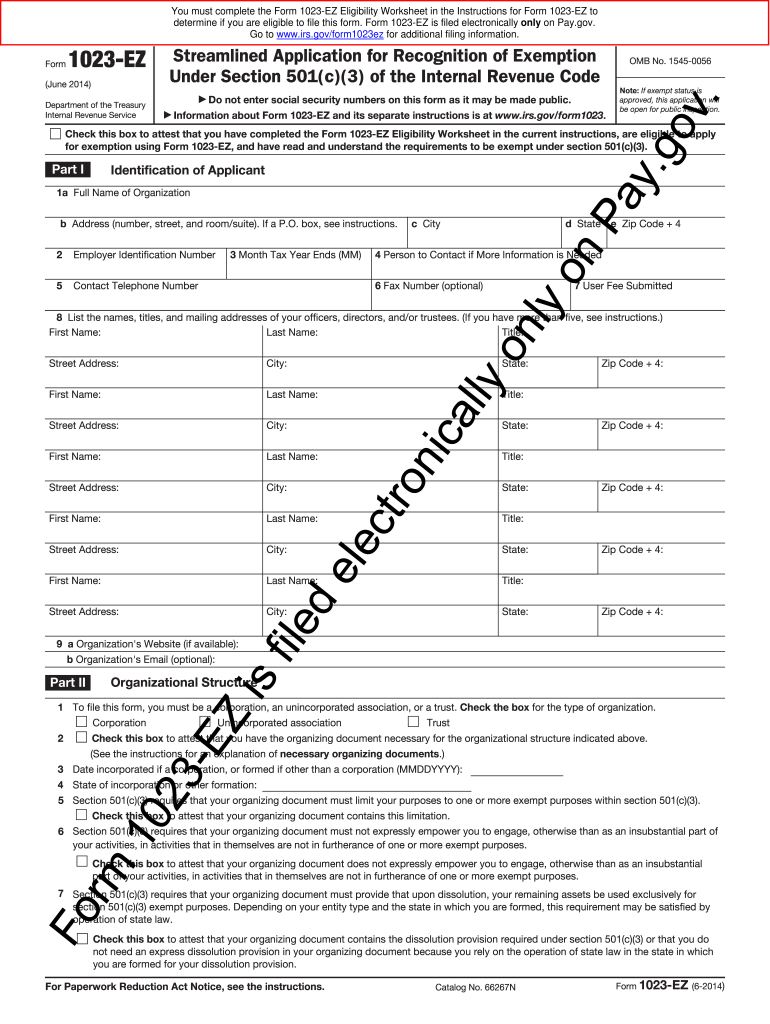

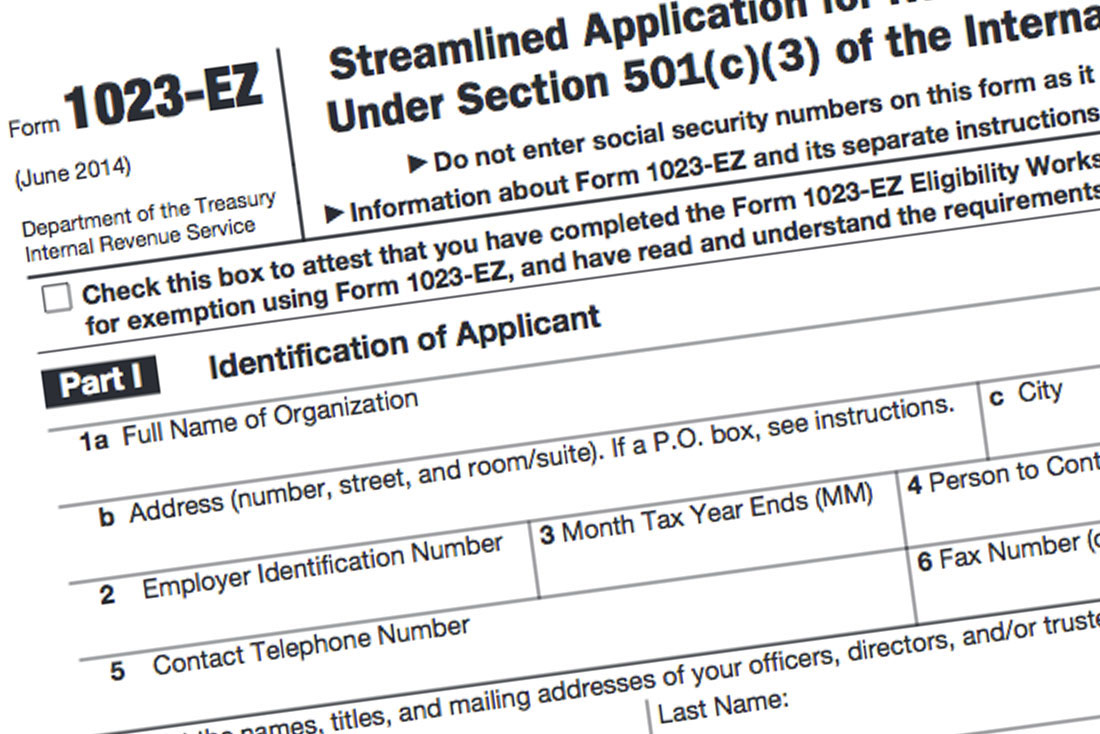

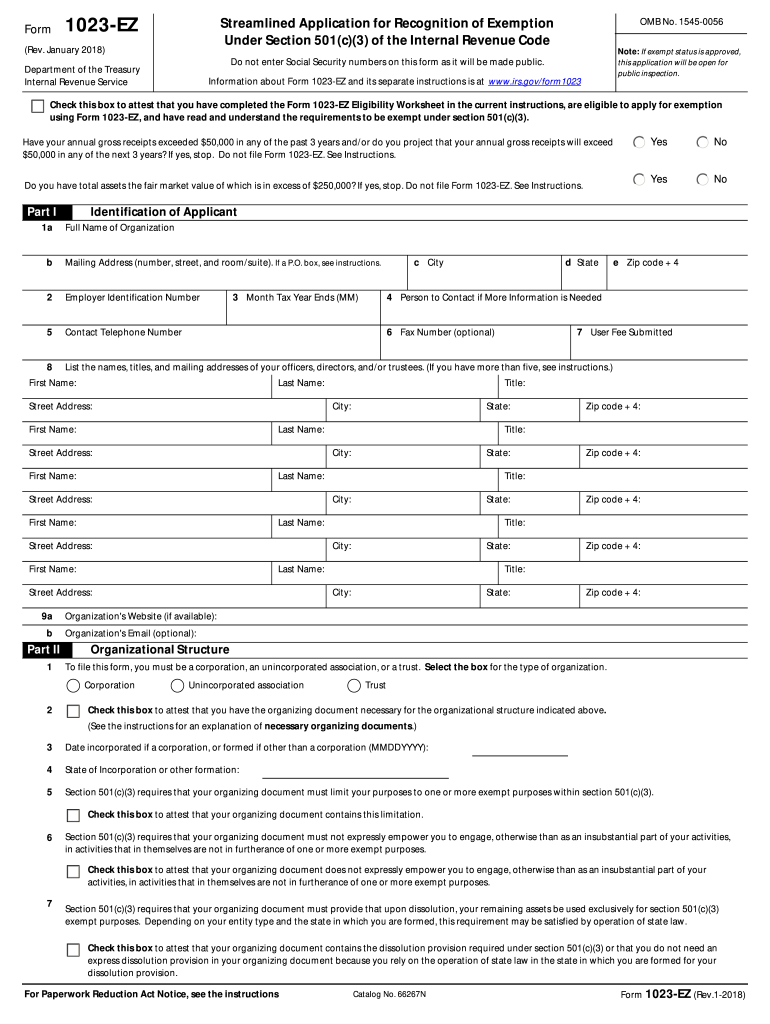

Indiana 501c3 Ez Form Printable Information about Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code including recent updates related forms and instructions on how to file This form is used to apply for recognition as a 501 c 3 tax exempt organization

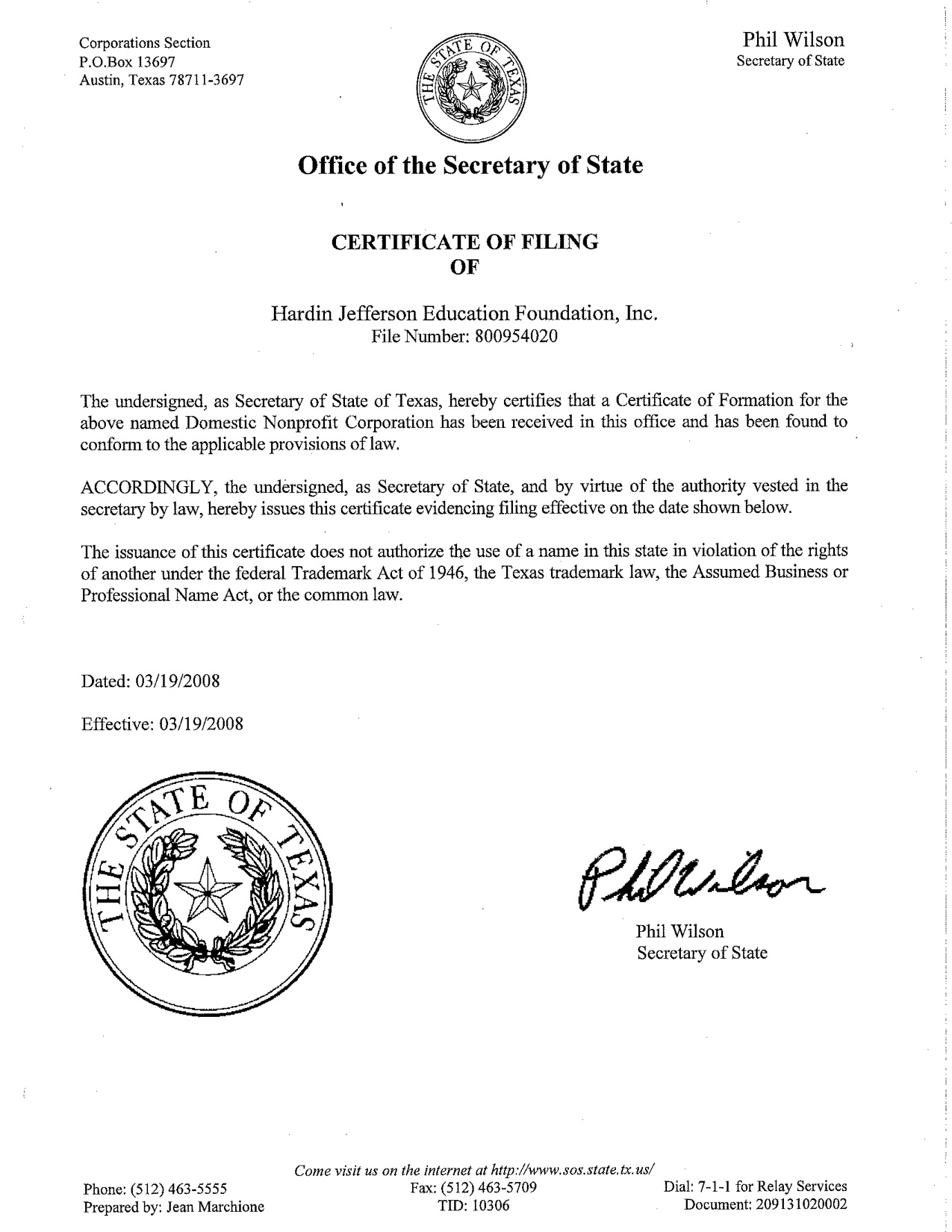

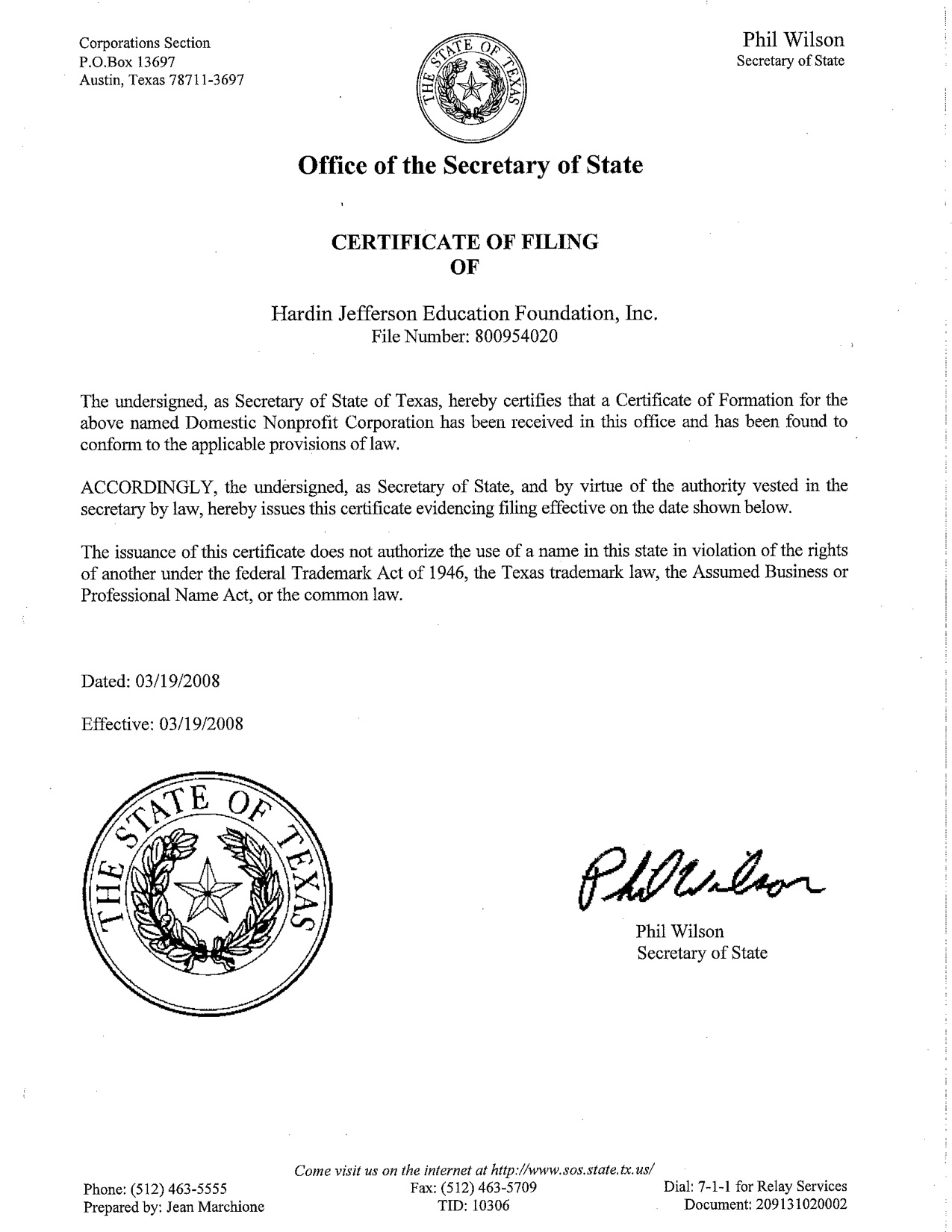

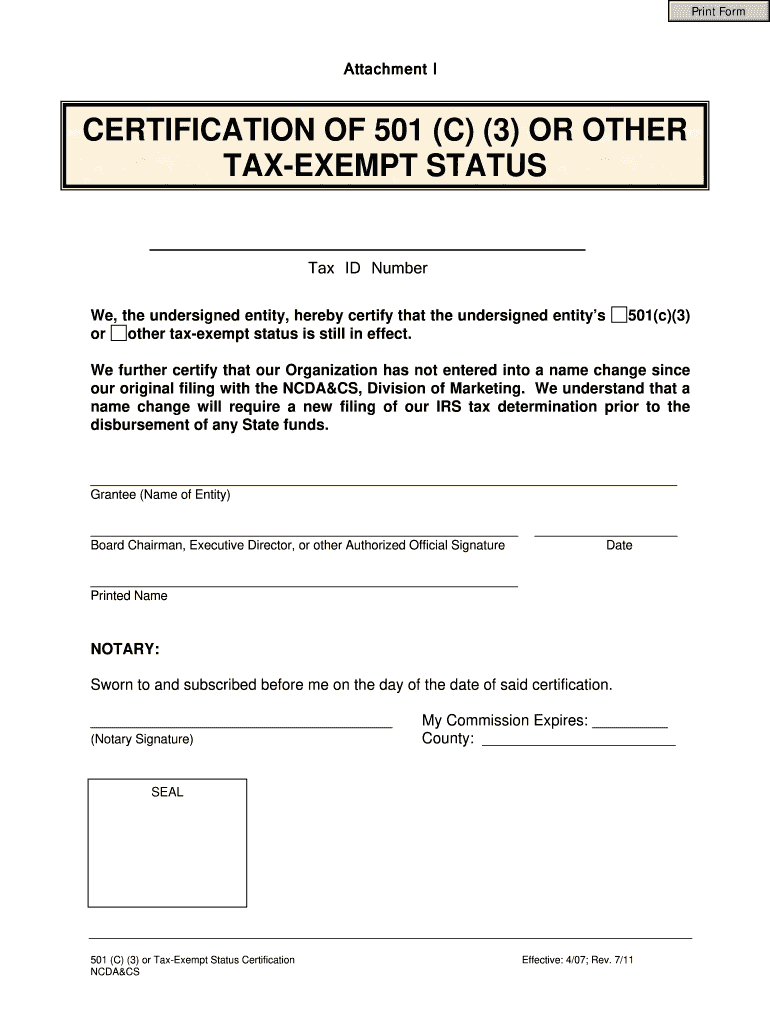

Nonprofit customers with open and active accounts and a sales tax exempt checkbox marked in the Indiana Tax System ITS received a letter in early November 2022 detailing upcoming changes to sales tax requirements and annual report filings Beginning Jan 1 2023 exemption certificates Form NP 1 will no longer be mailed In Indiana this document is filed with the Indiana Secretary of State s office FORM NAME Articles of Incorporation FILING FEE 50 if mailed 30 to file online FOR ADDITIONAL INFORMATION http www in gov sos FOUNDATION GROUP SERVICE Yes a component of SureStart

Indiana 501c3 Ez Form Printable

Indiana 501c3 Ez Form Printable

http://www.certificatestemplatesfree.com/wp-content/uploads/2018/01/501c3-certificate-501-c-3-certificate-ybHqcU.jpg

Tax Forms For 501c3 Organizations Form Resume Examples lV8NeRg30o

https://i2.wp.com/childforallseasons.com/wp-content/uploads/2018/10/501c3-form-sample.jpg

Printable 501C3 Form

https://www.viralcovert.com/wp-content/uploads/2019/01/irs-501c3-application-form-1023.jpg

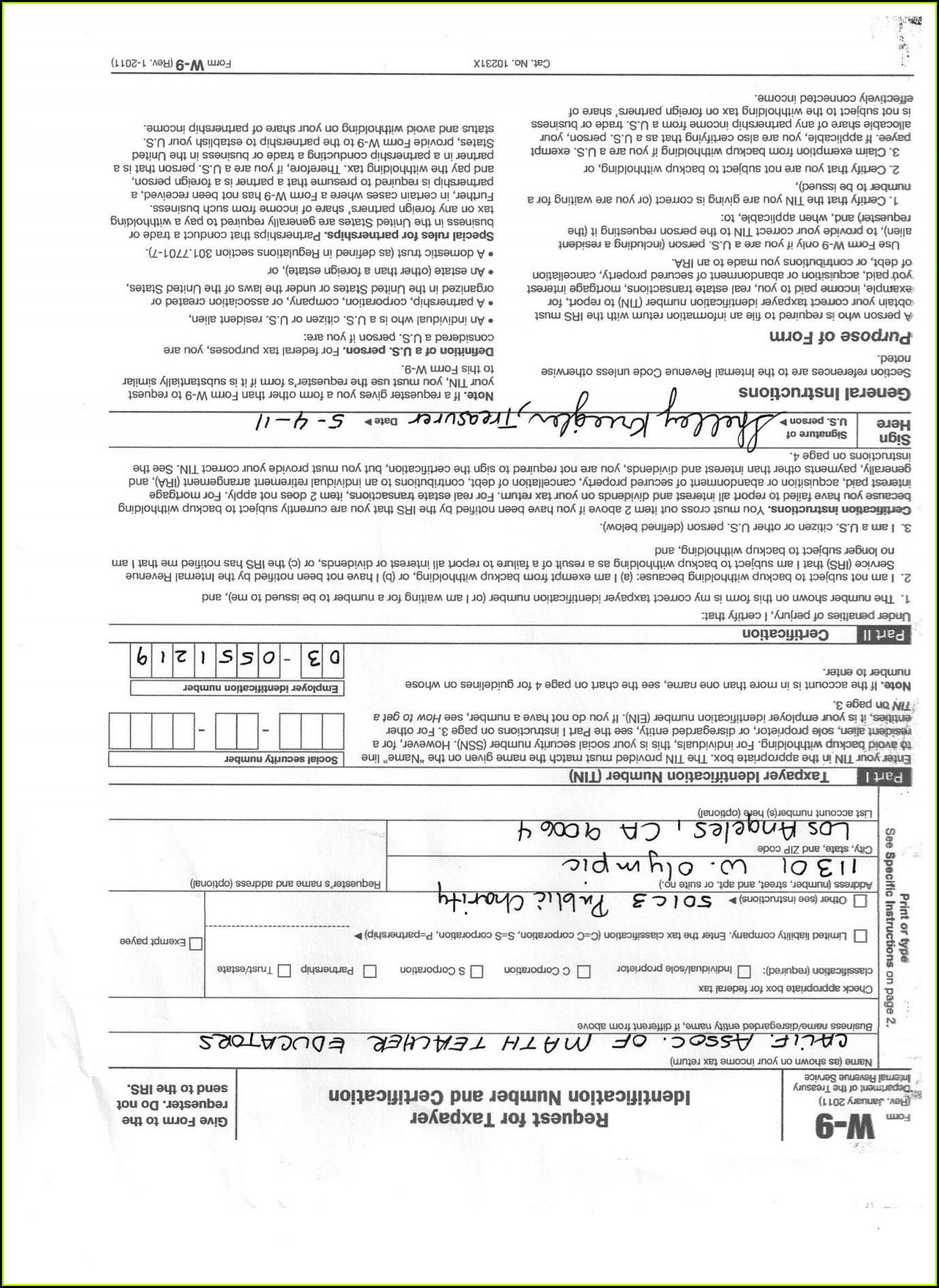

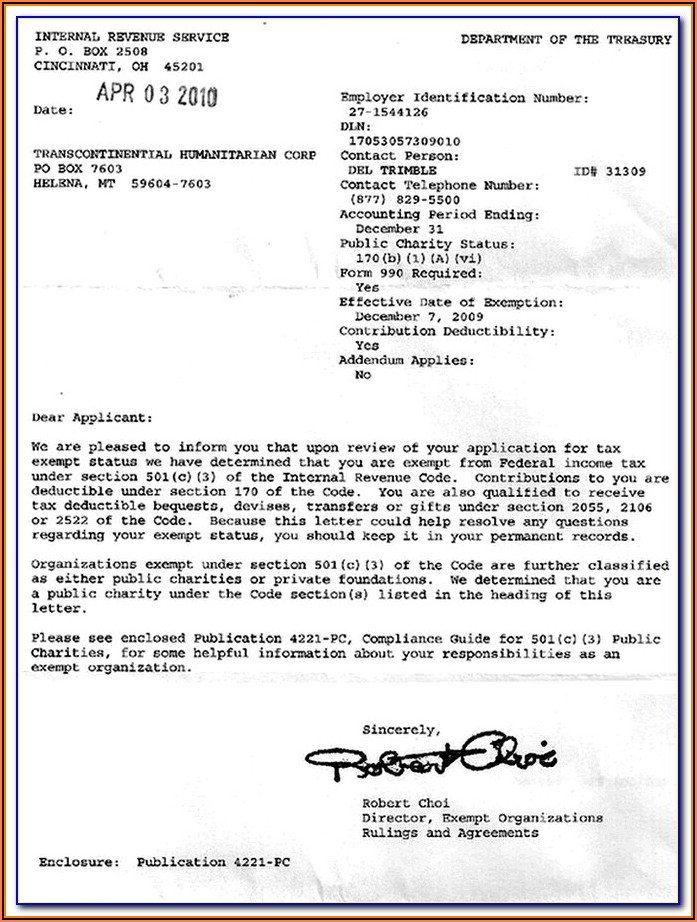

Only certain organizations are eligible to apply for exemption under section 501 c 3 using Form 1023 EZ To determine if you are eligible to file Form 1023 EZ you must complete the Form 1023 EZ Eligibility Worksheet Information about Form 1023 Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code including recent updates related forms and instructions on how to file Form 1023 is used to apply for recognition as a tax exempt organization

Form 1023 Filing Fee 600 275 for IRS Form 1023 EZ Form 1024 Filing Fee 600 Notes As of January 31 2020 the IRS requires that Form 1023 Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code be completed and submitted online through Pay gov Applicants must have a Pay gov account and payment of Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 Note You must complete the Form 1023 EZ Eligibility Worksheet in the Instructions for Form 1023 EZ to determine if you are eligible to file Form 1023 EZ

More picture related to Indiana 501c3 Ez Form Printable

Fillable Form 1023 Ez Printable Forms Free Online

https://www.pdffiller.com/preview/100/373/100373382/large.png

501c3 Tax Form 990 Universal Network

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/501c3-tax-form-990.jpg

2020 2023 Form IRS 1023Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/495/226/495226055/large.png

Explore the Indiana Department of Revenue DOR s forms related to enterprise zones State Form Number Description File Type IT 40QEC fill in pdf Schedule LIC 21926 Enterprise Zone Loan Interest Credit fill in pdf Schedule EZ Parts 1 2 3 49178 Enterprise Zone Schedule 1 2 3 Instructions fill in pdf Latest News Click here to Step 4 Indiana Articles of Incorporation To become a nonprofit corporation in Indiana you must file Form 4162 the Articles of Incorporation for domestic nonprofit corporations In order to qualify for 501 c 3 status the organization s purpose must explicitly be limited to one or more of the following Charitable

To start a nonprofit in Indiana and get 501c3 status follow these steps Step 1 Name Your Indiana Nonprofit Step 2 Choose Your Registered Agent Step 3 Select Your Board Members Officers Step 4 Adopt Bylaws Conflict of Interest Policy Step 5 File the Articles of Incorporation Step 6 Get an EIN Step 7 Apply for 501c3 Form 1023 EZ 6 2014 Page 2 Part III Your Specific Activities 1 Enter the appropriate 3 character NTEE Code that best describes your activities See the instructions 2 To qualify for exemption as a section 501 c 3 organization you must be organized and operated exclusively to further one or more of the following purposes

Printable 501C3 Form

https://www.universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-501c3-ez.jpg

Form 1023 EZ The Faster Easier 501 c 3 Application For Small Nonprofits Aspect Law Group

http://static1.squarespace.com/static/56eefa32cf80a10be6c9d5f8/56ef6fc67923f04836d0c4ab/56ef6fd77923f04836d0c68f/1458617846498/Form1023EZ_hp.jpg?format=1500w

https://www.irs.gov/forms-pubs/about-form-1023-ez

Information about Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code including recent updates related forms and instructions on how to file This form is used to apply for recognition as a 501 c 3 tax exempt organization

https://www.in.gov/dor/tax-forms/nonprofit-tax-forms/

Nonprofit customers with open and active accounts and a sales tax exempt checkbox marked in the Indiana Tax System ITS received a letter in early November 2022 detailing upcoming changes to sales tax requirements and annual report filings Beginning Jan 1 2023 exemption certificates Form NP 1 will no longer be mailed

Top 501c3 Form Templates Free To Download In PDF Format

Printable 501C3 Form

How To Apply For 501c3 Tax Exemption Using Form 1023 EZ

Irs Form 501c3 Ez Form Resume Examples 7NYAPMR9pv

501c3 Form Sample Form Resume Examples wRYPBlP24a

501c3 Ez Application Form Universal Network Free Nude Porn Photos

501c3 Ez Application Form Universal Network Free Nude Porn Photos

1023 Ez 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

501c3 Form PDF Fill Out And Sign Printable PDF Template SignNow

Printable 501C3 Form

Indiana 501c3 Ez Form Printable - Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 Note You must complete the Form 1023 EZ Eligibility Worksheet in the Instructions for Form 1023 EZ to determine if you are eligible to file Form 1023 EZ