Iowa Local Option Sales Tax Jurisdictions Printable Form A Tax Professional A Local Government I Need To File My Taxes Track My Return Make a Payment Register for a Permit Change or Cancel a Permit Learn About Property Tax File a W 2 or 1099 Request Tax Guidance Tax Forms Tax Forms Index IA 1040 Instructions Resources Online Services Law Policy Information Reports Resources Education Tax Guidance

CHAPTER 107 LOCAL OPTION SALES AND SERVICE TAX Prior to 12 17 86 Revenue Department 730 IAC 8 23 00 701 107 1 422B Definitions In 1985 Iowa s state legislature passed a law SF395 allowing local governments to impose a LOST on top of the state sales tax to raise additional revenue for specific projects and needs within their communities The new legislation allowed cities and counties to impose a 1 LOST after a successful vote of the people

Iowa Local Option Sales Tax Jurisdictions Printable Form

Iowa Local Option Sales Tax Jurisdictions Printable Form

https://data.formsbank.com/pdf_docs_html/303/3037/303747/page_1_thumb_big.png

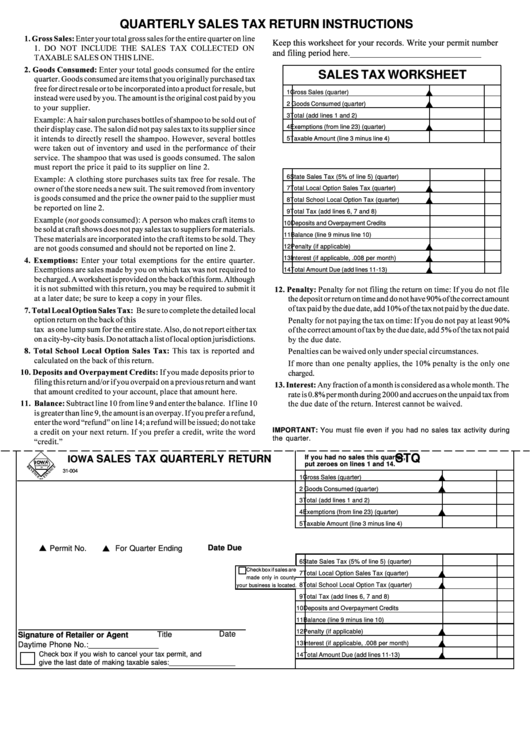

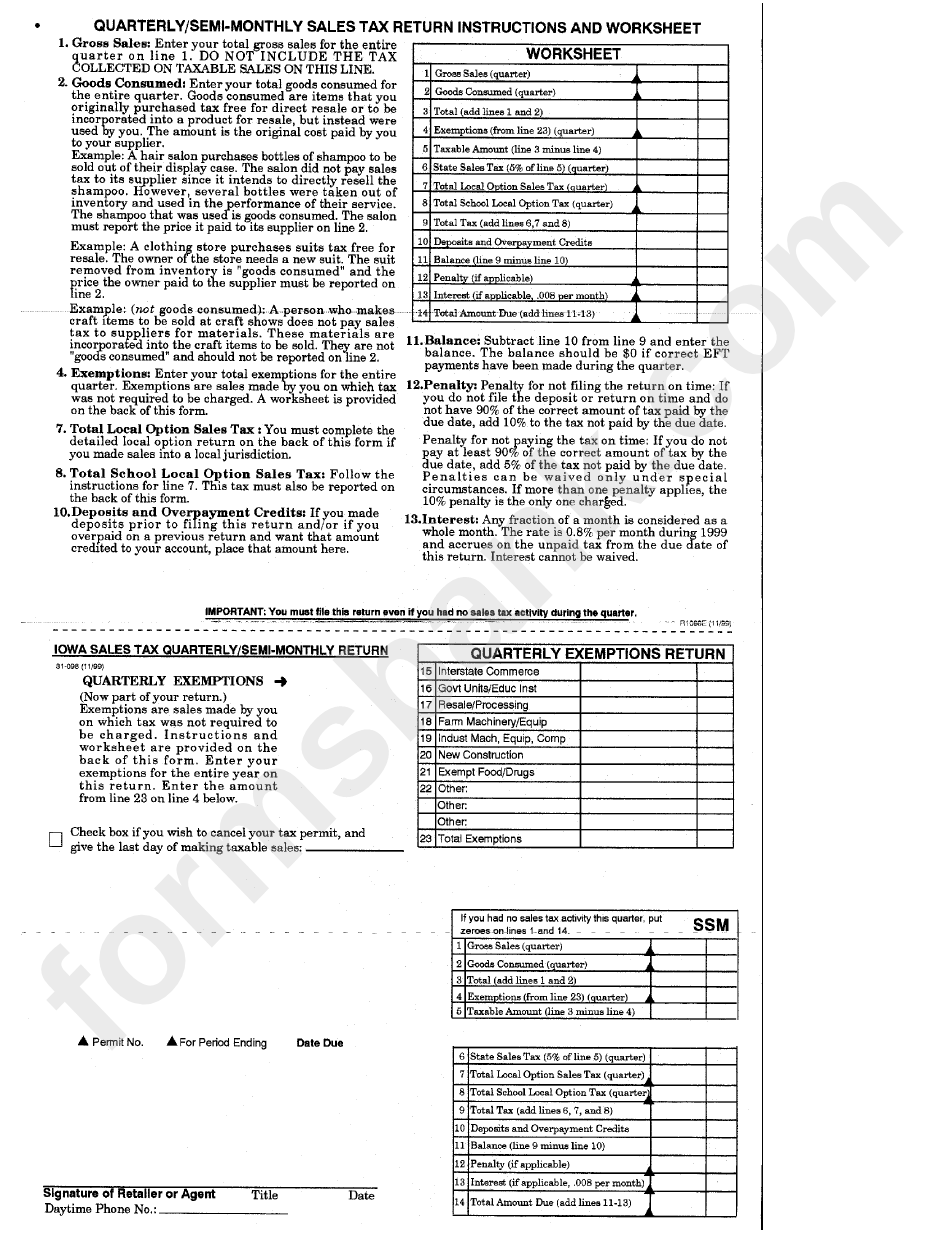

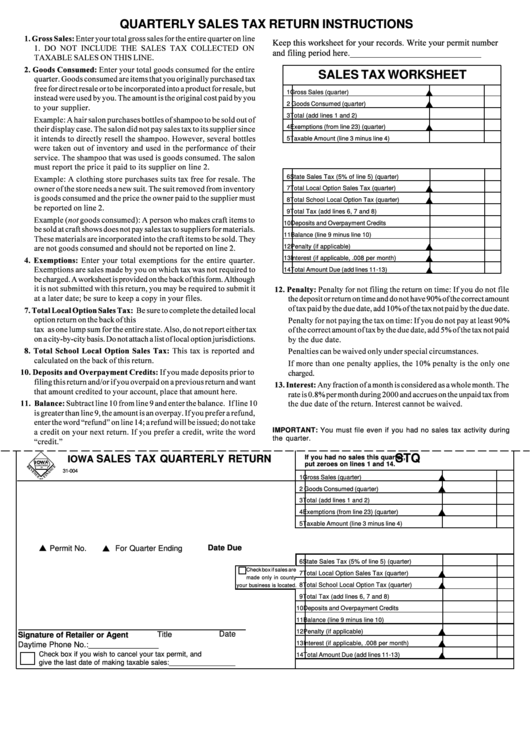

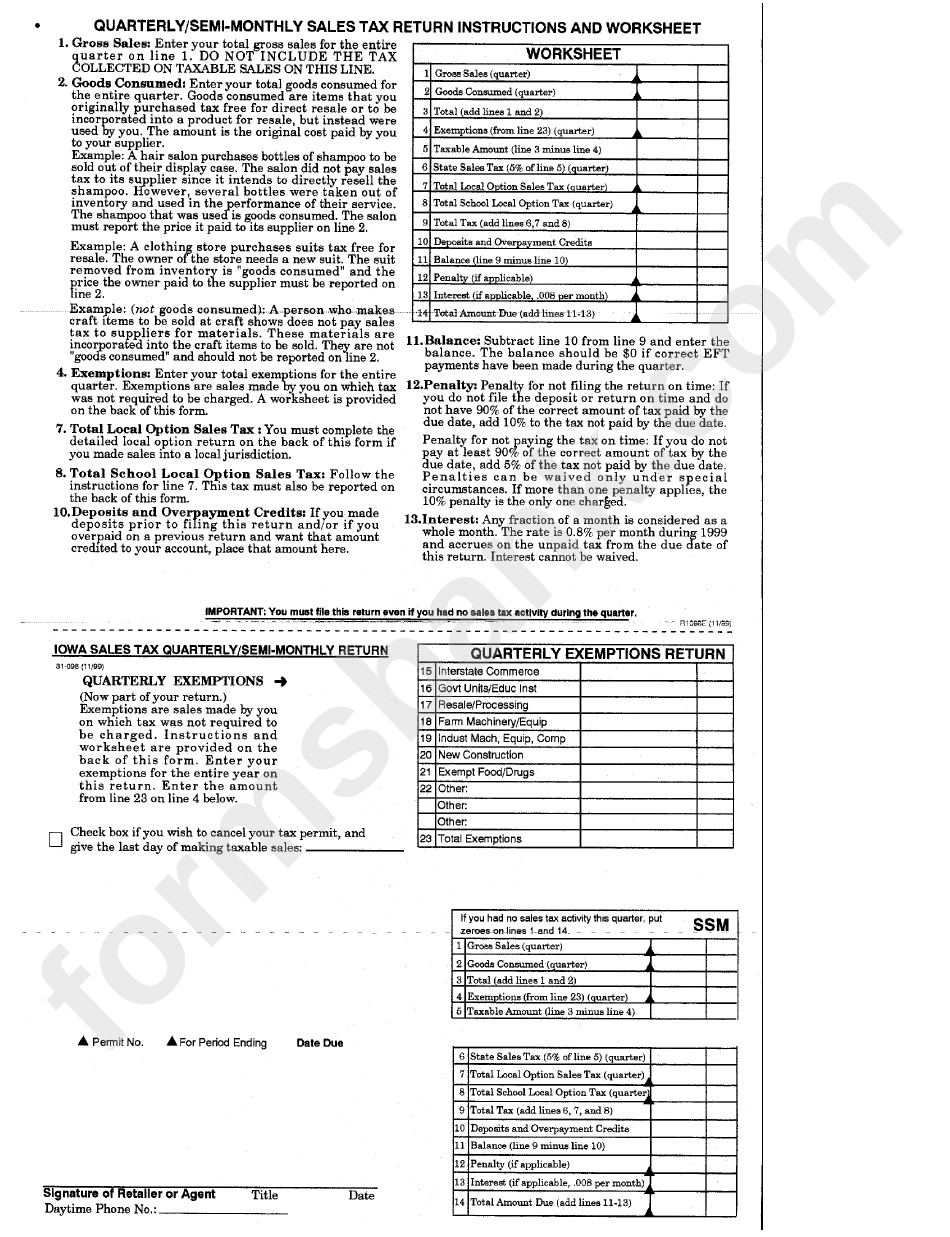

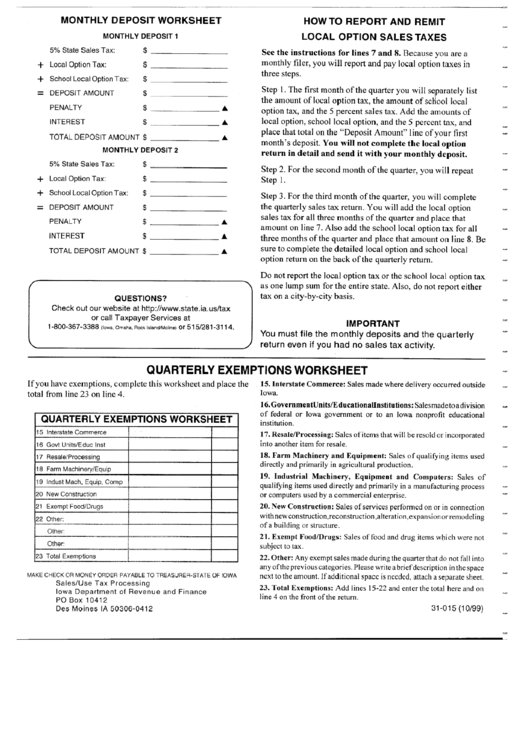

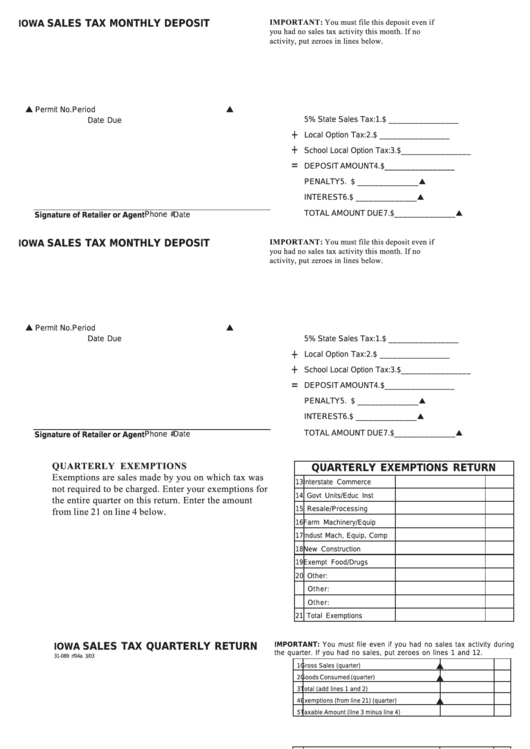

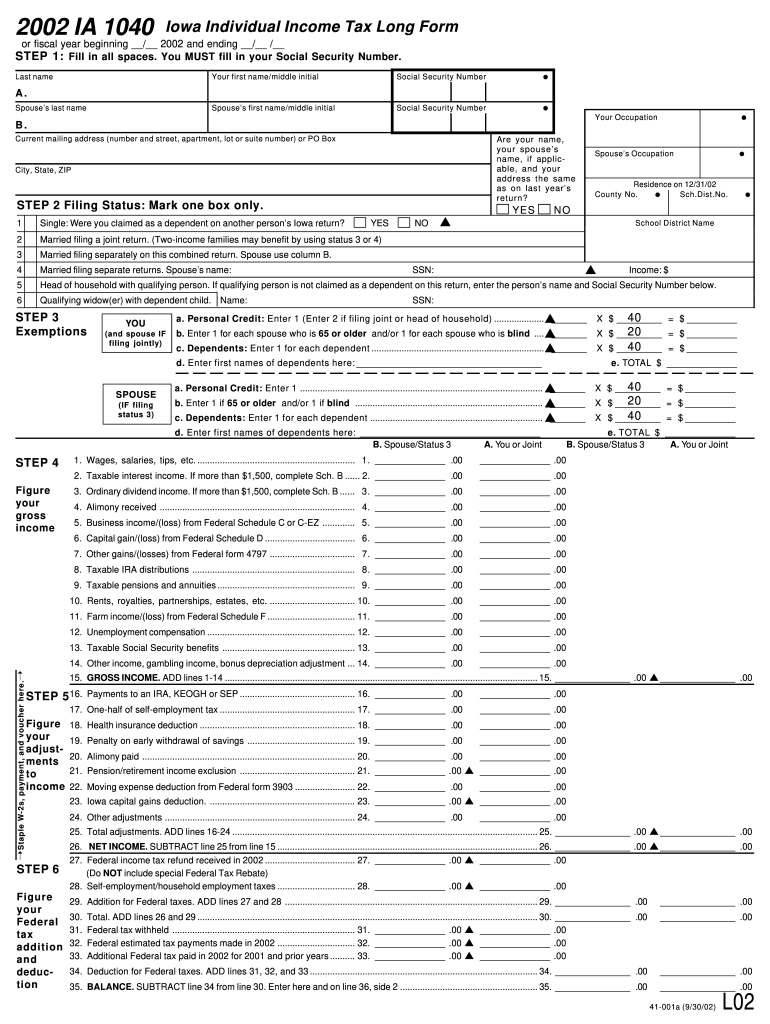

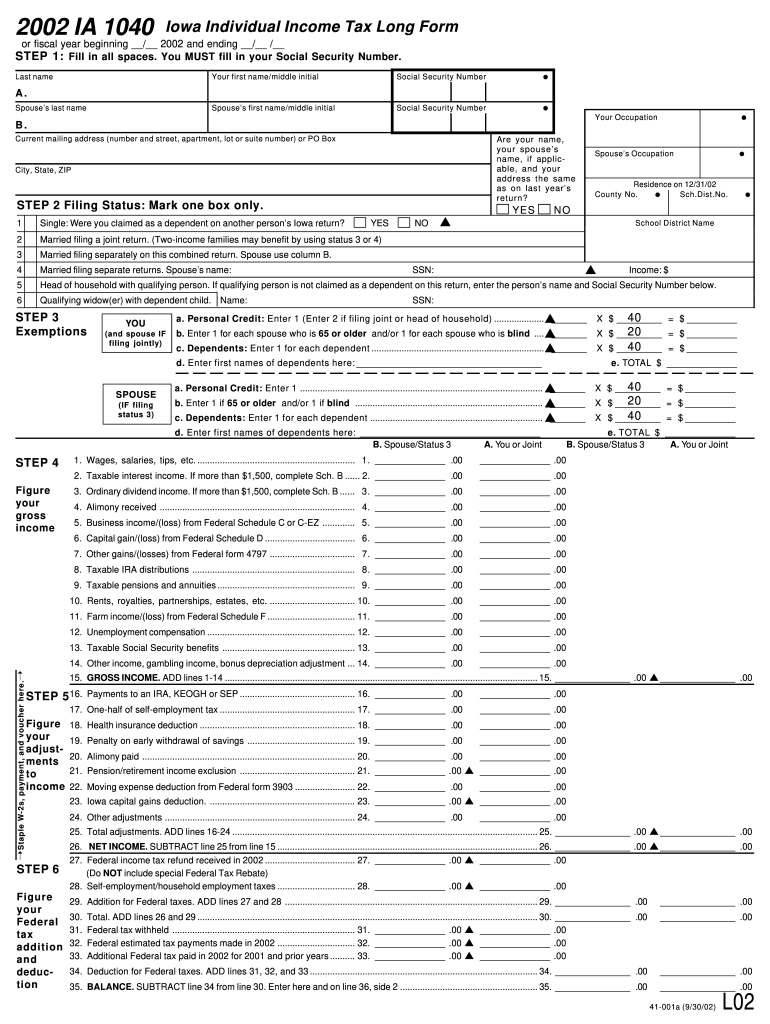

Form 31 098 Iowa Sales Tax Quarterly semi Monthly Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/292/2926/292631/page_1_bg.png

SOURCES OF LOCAL OPTION SALES TAXES FOR IOWA SURPLUS COUNTIES FOR 10 YEARS Download Table

https://www.researchgate.net/profile/Kenneth-Stone-3/publication/23505054/figure/tbl2/AS:669425749463052@1536614944738/SOURCES-OF-LOCAL-OPTION-SALES-TAXES-FOR-IOWA-SURPLUS-COUNTIES-FOR-10-YEARS_Q640.jpg

In order for a city to have a local option sales and service tax LOSST a majority of the eligible electors in that city must approve it in a county wide election to impose the LOSST The LOSST is placed on the ballot through a petition of 5 of the county electors having voted in the last state general election or by a motion or motions of So the local option sales tax becomes the the most realistic viable policy tool out there Dawson introduced a similar measure in 2022 The bill also implements new property tax assessment limitations makes changes to tax credits including the Homestead Property Tax Credit and provides funding for Iowa s Water Land and Legacy program

The Revenue Department hereby amends Chapter 107 Local Option Sales and Service Tax Iowa Administrative Code Legal Authority for Rule Making This rule making is adopted under the authority provided in Iowa Code section 421 14 State or Federal Law Implemented If the item is brought into Iowa by the seller in the seller s own vehicle or common carrier Yes local option sales tax is due if delivery occurs in a local option jurisdiction See the page on remote sales to determine when retailers must register and collect local option taxes on sales delivered into Iowa

More picture related to Iowa Local Option Sales Tax Jurisdictions Printable Form

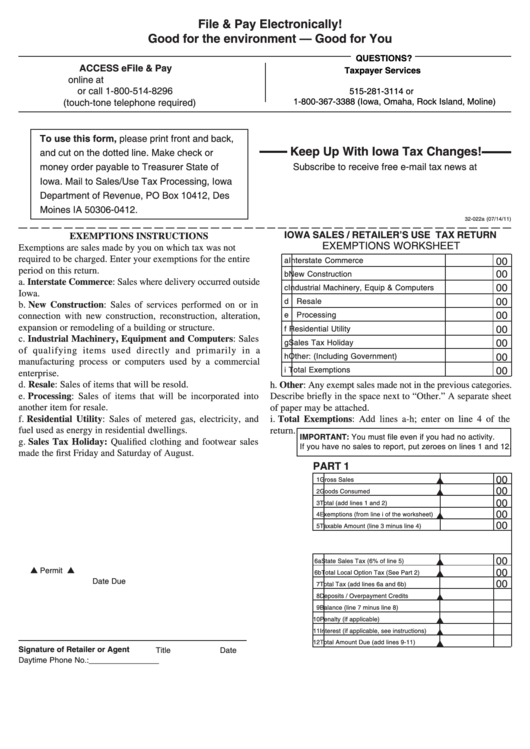

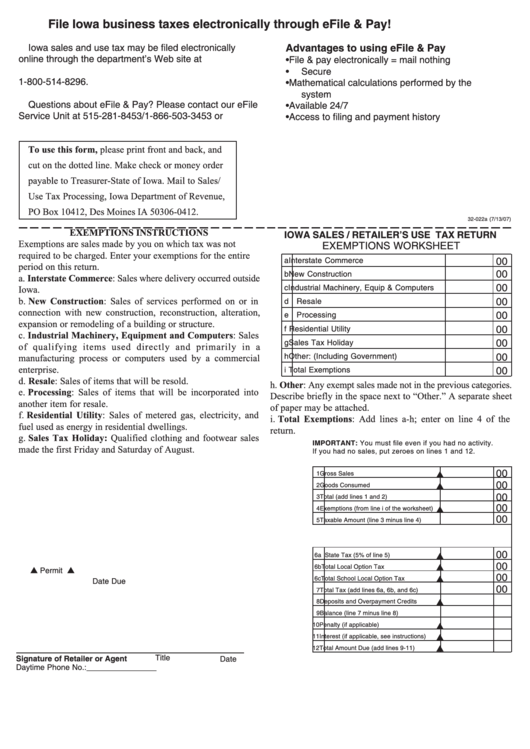

Form 32 022 Iowa Sales retailer S Use Tax Return 2012 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/261/2612/261214/page_1_thumb_big.png

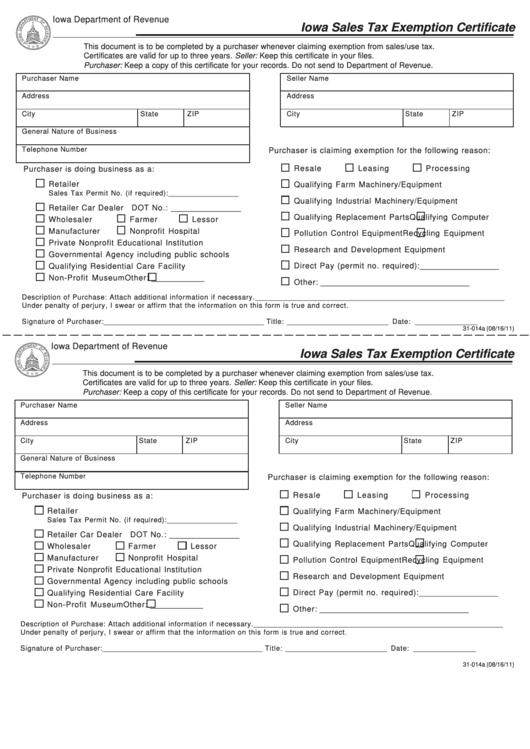

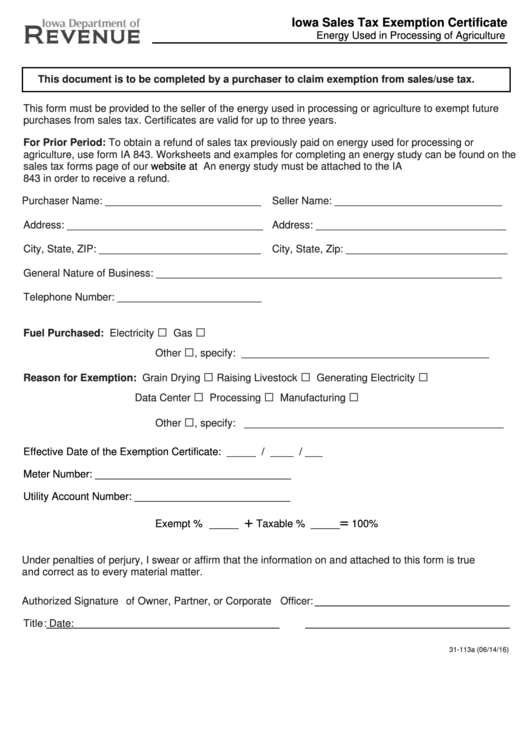

Form 31 014a Iowa Sales Tax Exemption Certificate 2011 Form 31 014b Exemption

https://data.formsbank.com/pdf_docs_html/266/2668/266891/page_1_thumb_big.png

Fillable Online Sales Tax Exemption Certificate Multi Jurisdiction Wright Fax Email

https://www.pdffiller.com/preview/586/376/586376137/large.png

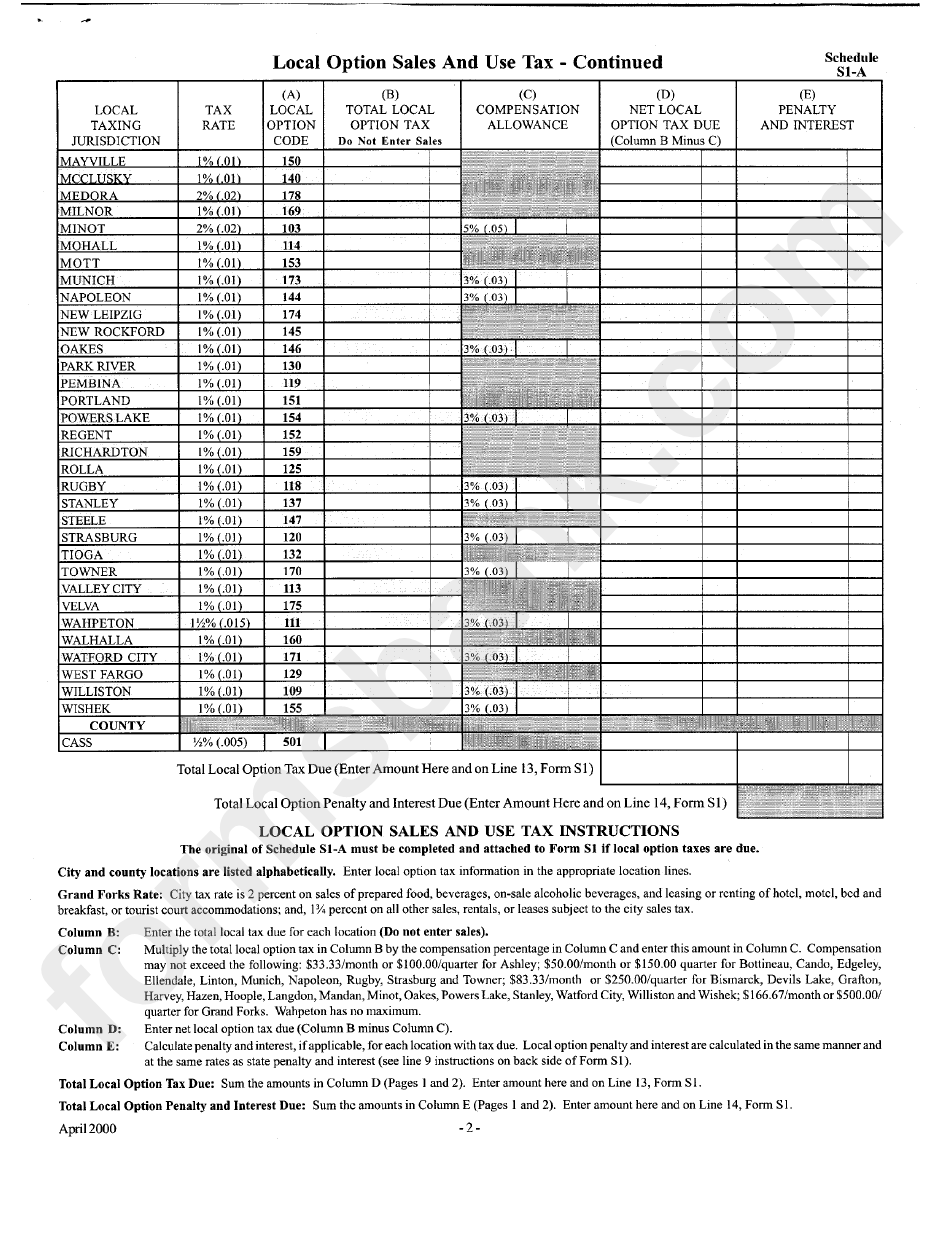

LOCAL OPTION SALES AND SERVICE TAX CHAPTER 107 701 107 2 422B Local option sales and service tax 107 2 1 Imposition and jurisdiction Only a county may impose a tax upon the gross receipts of found in Iowa Code section 422 52 Local option tax collections shall not be included in the computation Local Option Sales Tax Distributions data iowa gov Skip to Main Content Open Data Platform Home Catalog Iowa Financial Resources Other Data Sites Pandemic Recovery Report Quick Start Videos Data Request Sign In Menu

View the new local option sales tax jurisdictions effective July 1 2019 Sunset dates for communities are listed here as well Contact us with questions 701 270 7 Sales not subject to local option tax including transactions subject to Iowa use tax 701 270 8 Local option sales and services tax payments to local governments 701 270 9 Allocation procedure when sourcing of local option sales tax remitted to the department is unknown 701 270 10 Application of payments 701 270 11 Computation of

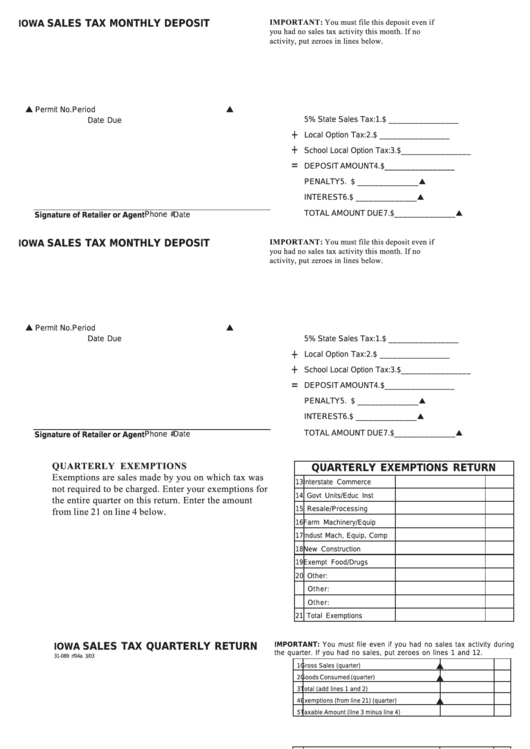

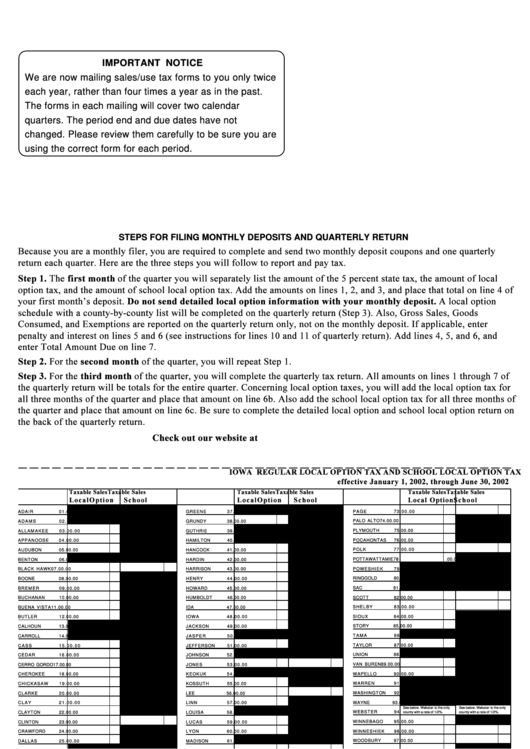

Form 31 089 Iowa Sales Tax Monthly Deposit Iowa Regular Local Option Tax And School Local

https://data.formsbank.com/pdf_docs_html/368/3688/368847/page_1_thumb_big.png

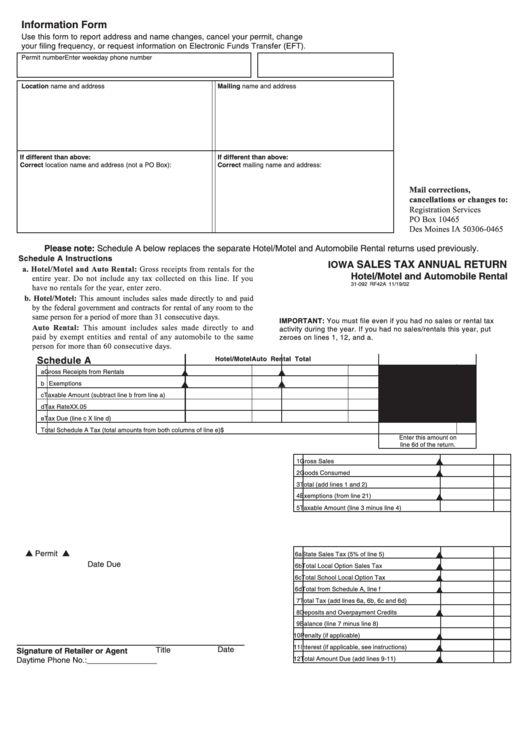

Form 31 092 Iowa Sales Tax Annual Return 2002 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/274/2747/274713/page_1_thumb_big.png

https://tax.iowa.gov/local-option-tax-information-local-government

A Tax Professional A Local Government I Need To File My Taxes Track My Return Make a Payment Register for a Permit Change or Cancel a Permit Learn About Property Tax File a W 2 or 1099 Request Tax Guidance Tax Forms Tax Forms Index IA 1040 Instructions Resources Online Services Law Policy Information Reports Resources Education Tax Guidance

https://www.legis.iowa.gov/law/administrativeRules/chapters?chapterDocID=560201

CHAPTER 107 LOCAL OPTION SALES AND SERVICE TAX Prior to 12 17 86 Revenue Department 730 IAC 8 23 00 701 107 1 422B Definitions

Monthly Sales Tax Return Instructions Iowa Department Of Revenue And Finance Printable Pdf

Form 31 089 Iowa Sales Tax Monthly Deposit Iowa Regular Local Option Tax And School Local

Form 32 022a Iowa Sales retailer S Use Tax Return Printable Pdf Download

Iowa Sales Tax Exemption Certificate Form Iowa Department Of Revenue Printable Pdf Download

Iowa s Local Option Sales Tax A Primer ITR Foundation

Iowa Tax Forms Fill Out And Sign Printable PDF Template SignNow

Iowa Tax Forms Fill Out And Sign Printable PDF Template SignNow

Form 31 089 Iowa Regular Local Option Tax And School Local Option Tax Printable Pdf Download

Iowa Sales Tax Small Business Guide TRUiC

Schedule S1 A Local Option Sales And Use Tax Printable Pdf Download

Iowa Local Option Sales Tax Jurisdictions Printable Form - If the item is brought into Iowa by the seller in the seller s own vehicle or common carrier Yes local option sales tax is due if delivery occurs in a local option jurisdiction See the page on remote sales to determine when retailers must register and collect local option taxes on sales delivered into Iowa