Irs 1099 Nec Printable Form You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

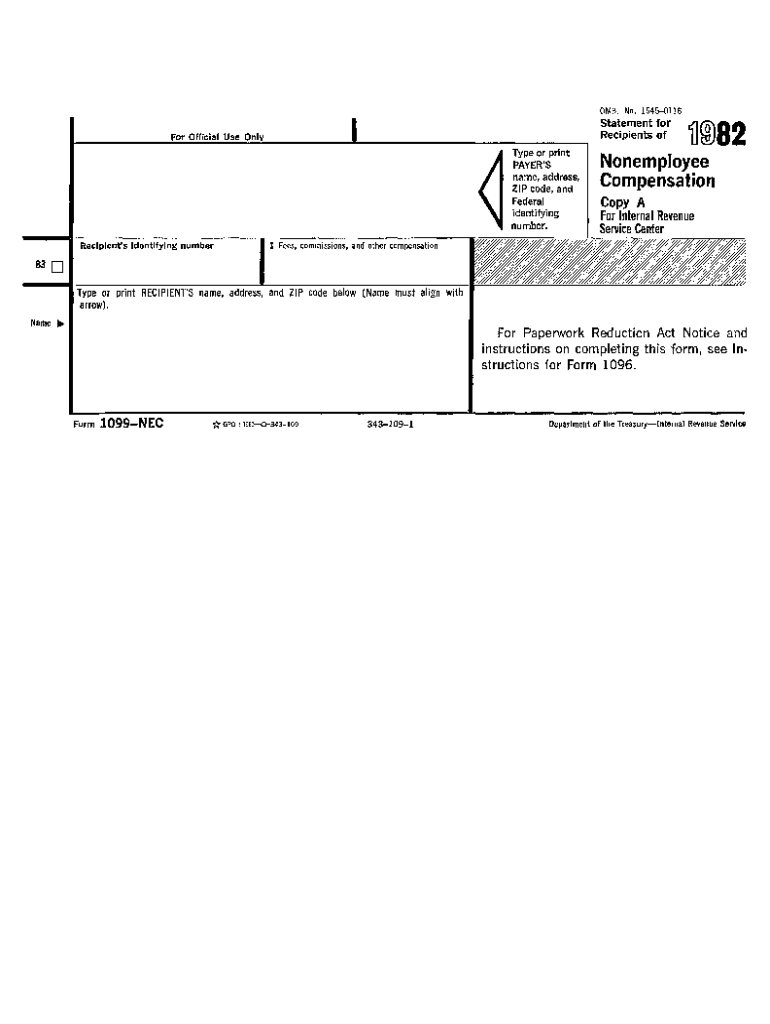

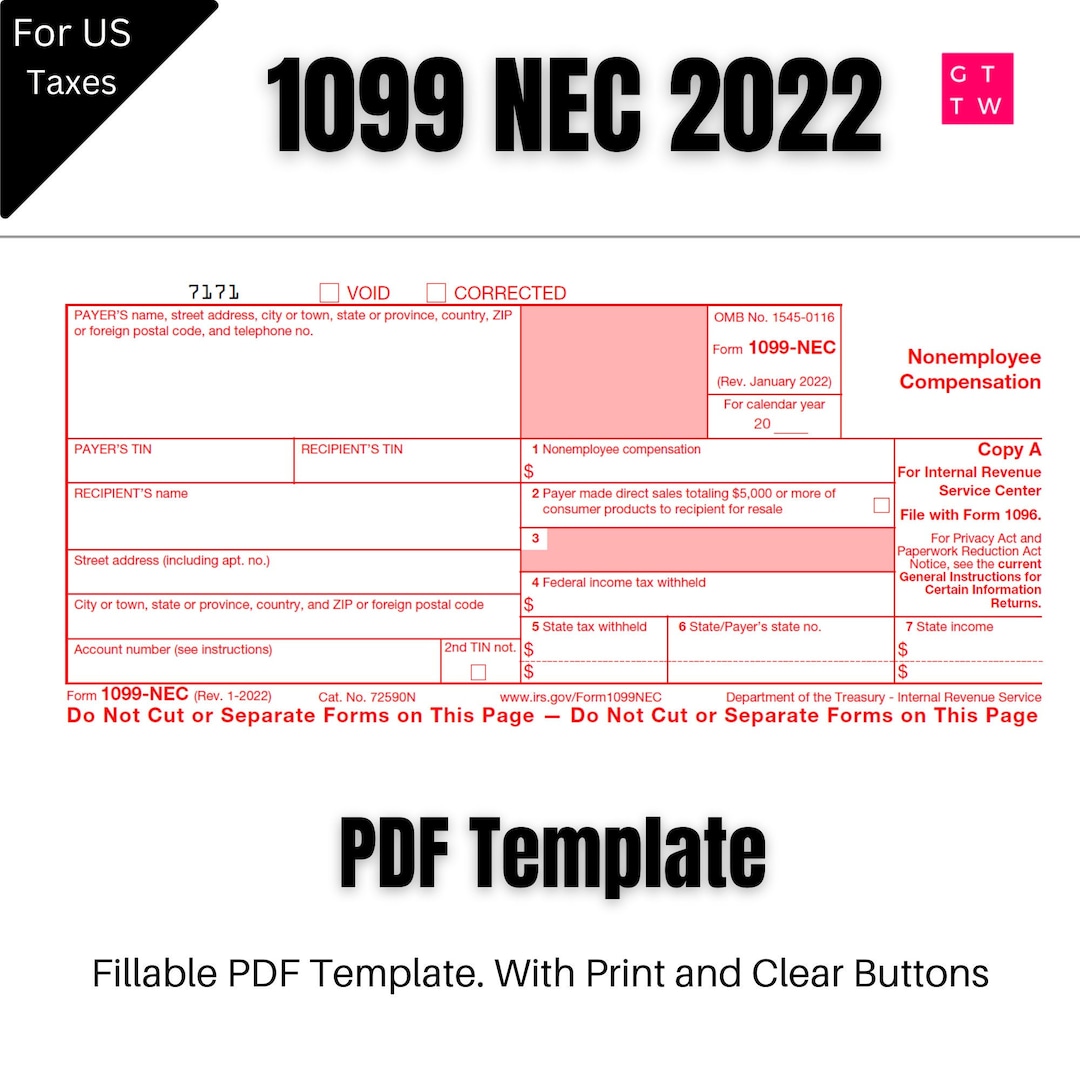

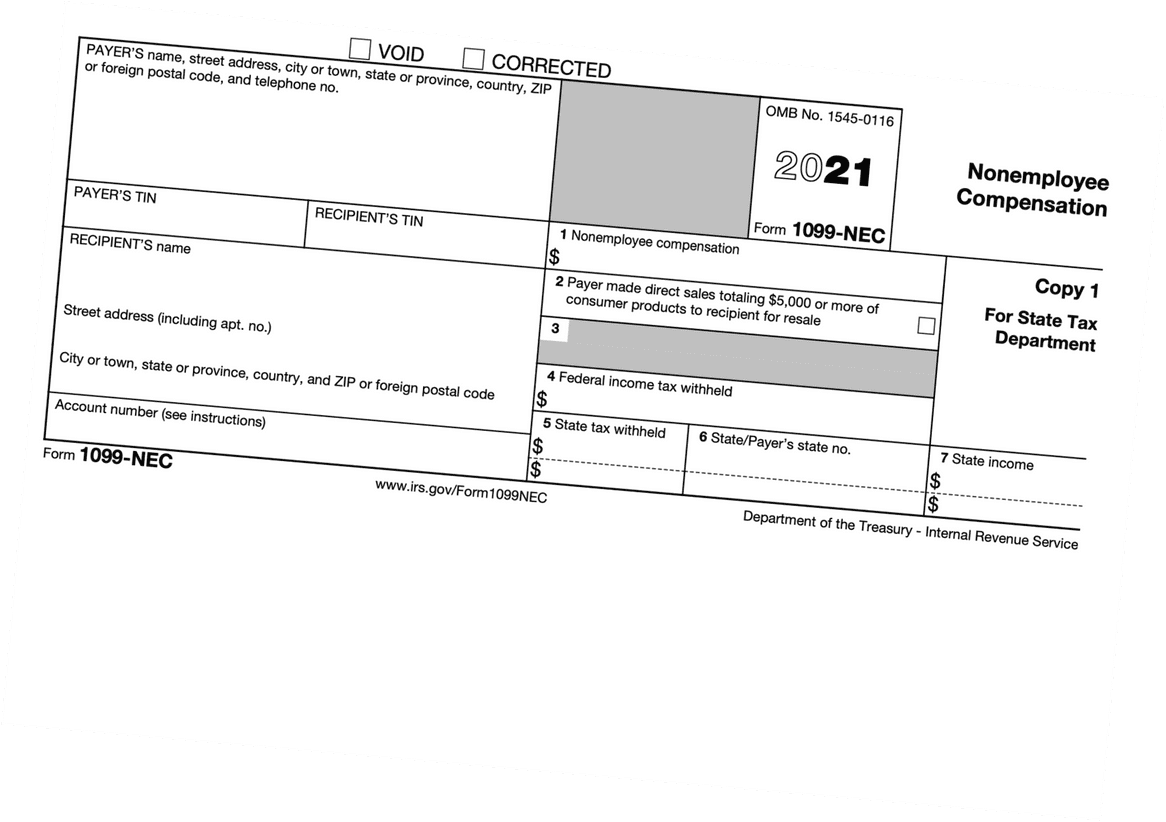

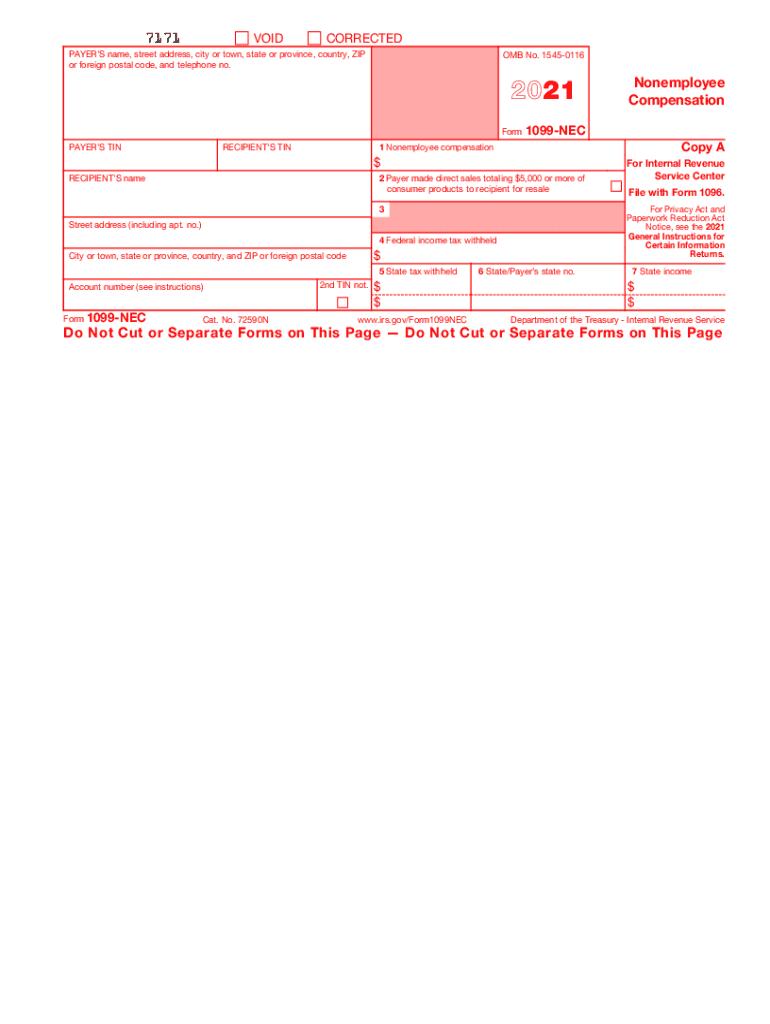

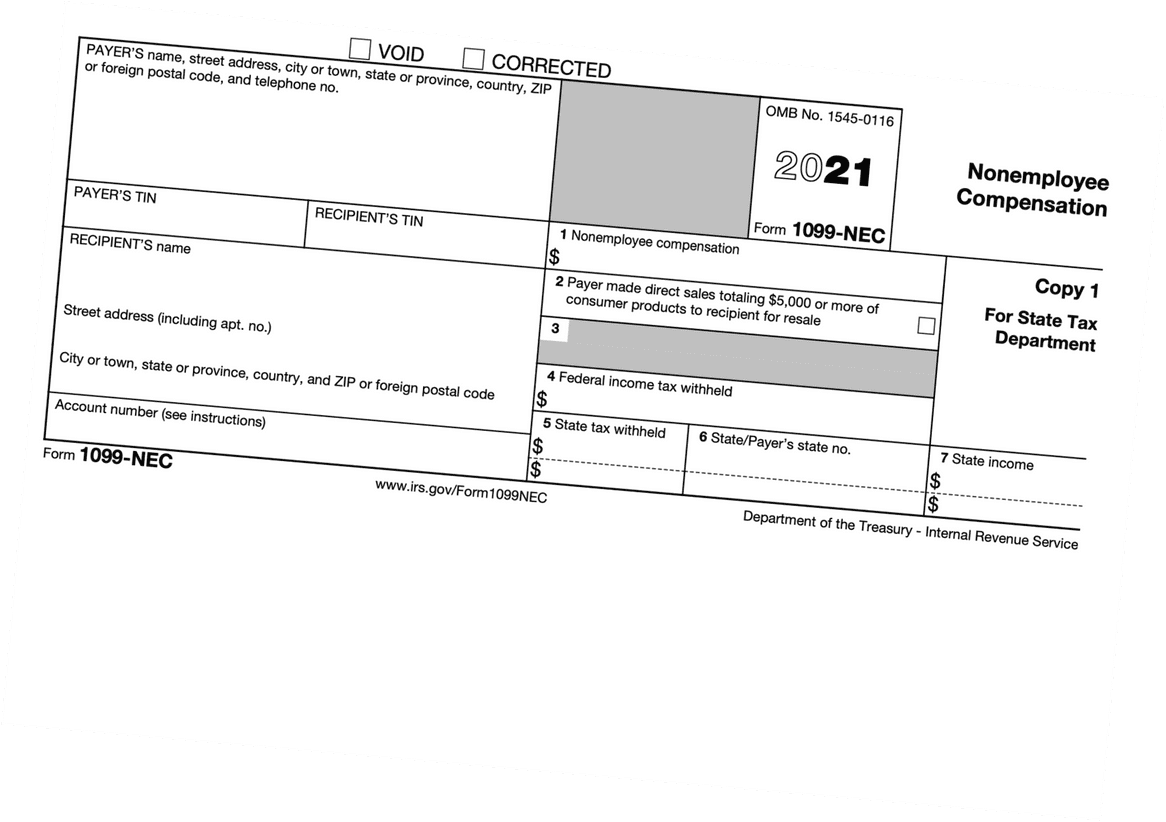

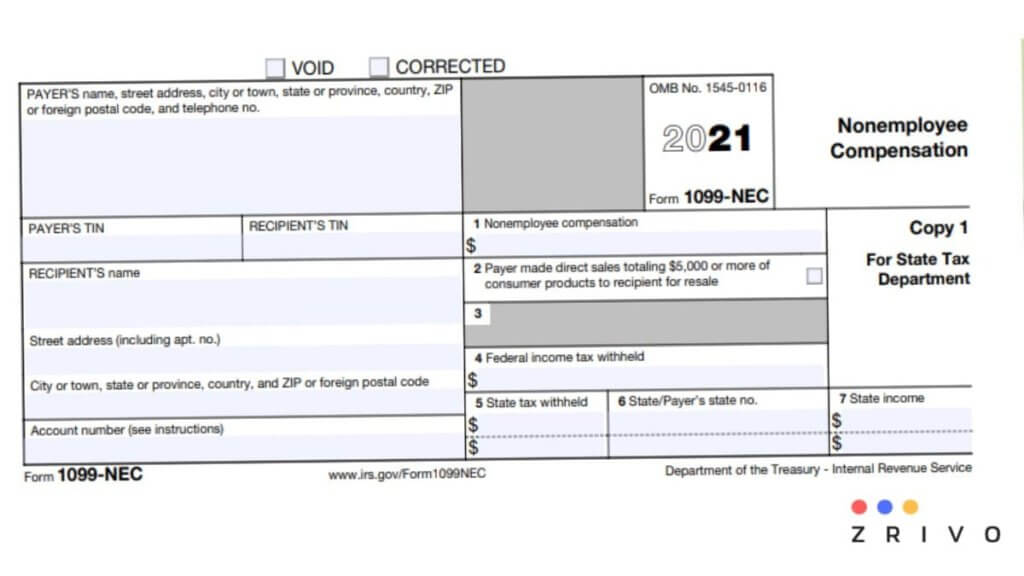

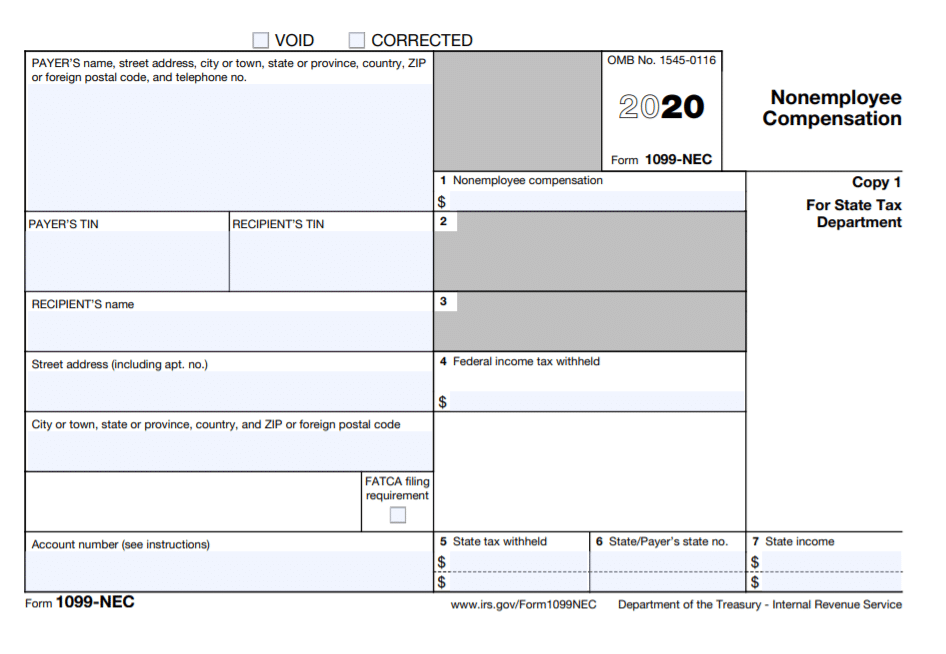

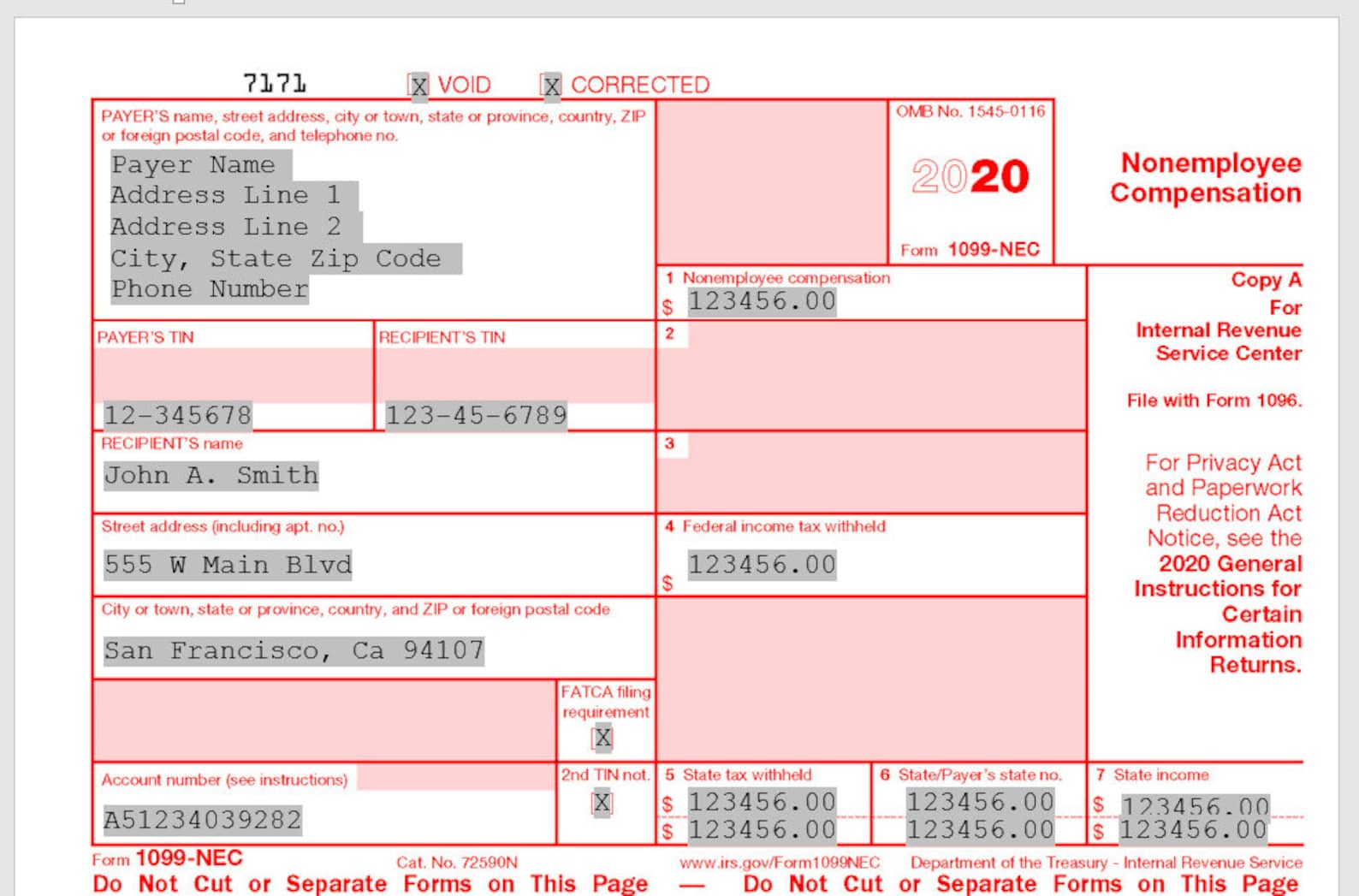

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes 2020 Form 1099 NEC Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

Irs 1099 Nec Printable Form

Irs 1099 Nec Printable Form

https://www.pdffiller.com/preview/533/156/533156765/large.png

How To File Your Taxes If You Received A Form 1099 NEC

https://forst.tax/wp-content/uploads/2020/01/1099-nec.jpg

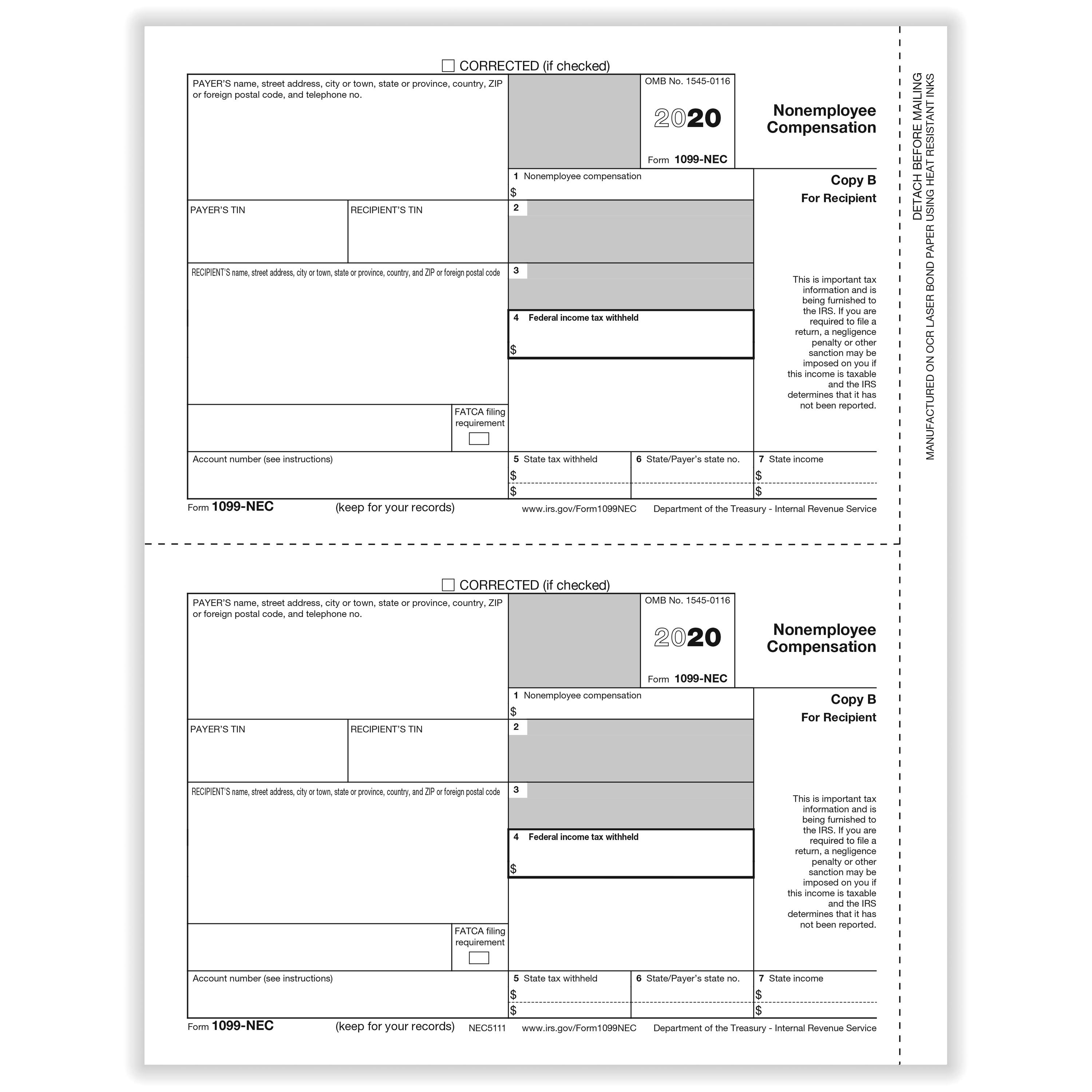

Blank 1099 Nec Form 2020 Printable Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/103/100103817/large.png

Payers file Forms 1099 MISC and 1099 NEC with the IRS and provide them to the person or business that received the payment Additional Information Tax Topic 752 Filing Forms W 2 and W 3 General Instructions for Forms W 2 and W 3 General Instructions for Certain Information Returns What is Form 1099 NEC Beginning with the 2020 tax year the IRS requires businesses to report nonemployee compensation on Form 1099 NEC instead of on Form 1099 MISC Businesses will use this form if they made payments totaling 600 or more to certain nonemployees such as an independent contractor If you are self employed

What is Form 1099 NEC This tax season millions of independent workers will receive Form 1099 NEC in the mail for the first time The 1099 NEC is the new form to report nonemployee compensation that is pay from independent contractor jobs also sometimes referred to as self employment income Where To Get Form 1099 NEC You can get 1099 NEC forms from office supply stores directly from the IRS from your accountant or using business tax software programs You can t use a template 1099 NEC form that you find on the internet because the red ink on Copy A is special and can t be copied You must use the official form

More picture related to Irs 1099 Nec Printable Form

Fill Out A 1099 NEC

https://assets.website-files.com/5fbc22d336f673712db66095/5fbc25f076bd933980bbf983_progress-1099nec-img-2x-p-1080.png

How To Fill Out And Print 1099 NEC Forms

https://www.halfpricesoft.com/1099-nec-software/images/1099-nec-3-per-page-big.jpg

1099 NEC Editable PDF Fillable Template 2022 With Print And Clear Buttons Courier Font Etsy

https://i.etsystatic.com/25616924/r/il/53e8da/4486482592/il_1080xN.4486482592_n0gk.jpg

If you use Form 1099 NEC to report sales totaling 5 000 or more then you are required to file Form 1099 NEC with the IRS by January 31 You must also file Form 1099 NEC for each person from whom you have withheld any federal income tax report in CAUTION Instr for Forms 1099 MISC and 1099 NEC Rev 01 2022 7 Any nonemployee who made 600 or more will receive a 1099 NEC You ll receive the 1099 NEC by early February as businesses are required to send them out by Jan 31 Form 1099 NEC is a tax

There are a few ways to file 1099 NEC forms including Online You can e file your 1099 NEC Form with the IRS through the Information Returns Intake System IRIS Taxpayer Portal This is a free filing method that allows you to electronically file your 1099 NEC Form as well as apply for extensions make amendments and more Payers are required to give a 1099 NEC form to non employees only when the total income during the year was 600 or more If you had income under 600 from that payer you won t receive a 1099 NEC form but you still must include the income amount on your tax return

Free Printable 1099 NEC File Online 1099FormTemplate

https://d9hhrg4mnvzow.cloudfront.net/www.1099formtemplate.com/1099-nec-printable/ecff6d62-1099-nec-long-5_10we0mu000000000000028.png

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://lh5.googleusercontent.com/yfJqNRzKg7JnBlldtckvQFvy5qVRsIS3JJXdwN399u-d9tKmqelmVgCn3xLWUUcMx4jdv8P-xmtjqP9nn5I1cjh5RCpNVbpl5wtQCIu7TiJbknR6nbICGdVDiATvNc1cejqGsiuL

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

https://eforms.com/irs/form-1099/nec/

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

Form 1099 NEC Instructions And Tax Reporting Guide

Free Printable 1099 NEC File Online 1099FormTemplate

1099 Nec Form 2021 Printable Get Your Hands On Amazing Free Printables

How To Fill Out And Print 1099 NEC Forms

Printable Irs Form 1099 Nec

2020 Form IRS 1099 NECFill Online Printable Fillable Blank PdfFiller

2020 Form IRS 1099 NECFill Online Printable Fillable Blank PdfFiller

1099 Nec Form 2020 Printable Customize And Print

Printable Blank 1099 Nec Form Printable World Holiday

1099 Nec Word Template

Irs 1099 Nec Printable Form - What is Form 1099 NEC Beginning with the 2020 tax year the IRS requires businesses to report nonemployee compensation on Form 1099 NEC instead of on Form 1099 MISC Businesses will use this form if they made payments totaling 600 or more to certain nonemployees such as an independent contractor If you are self employed