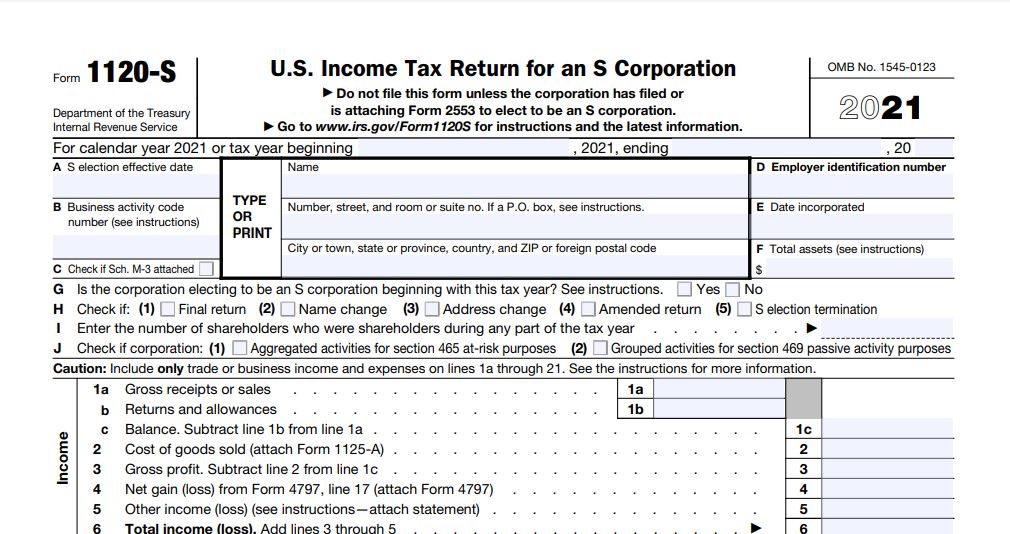

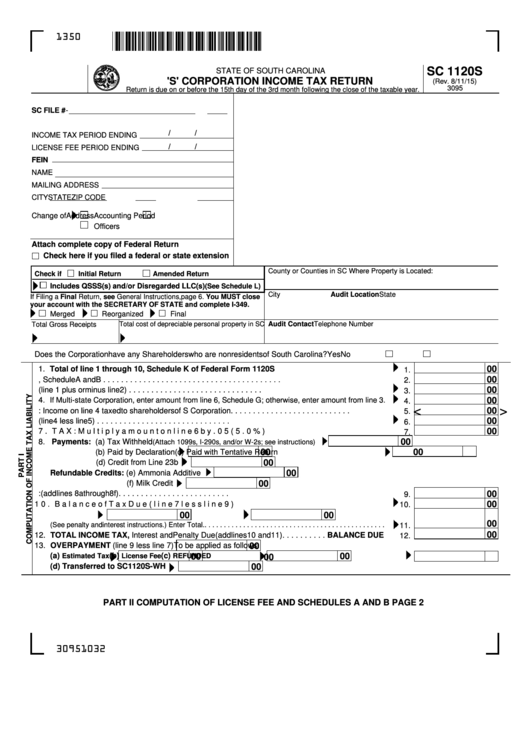

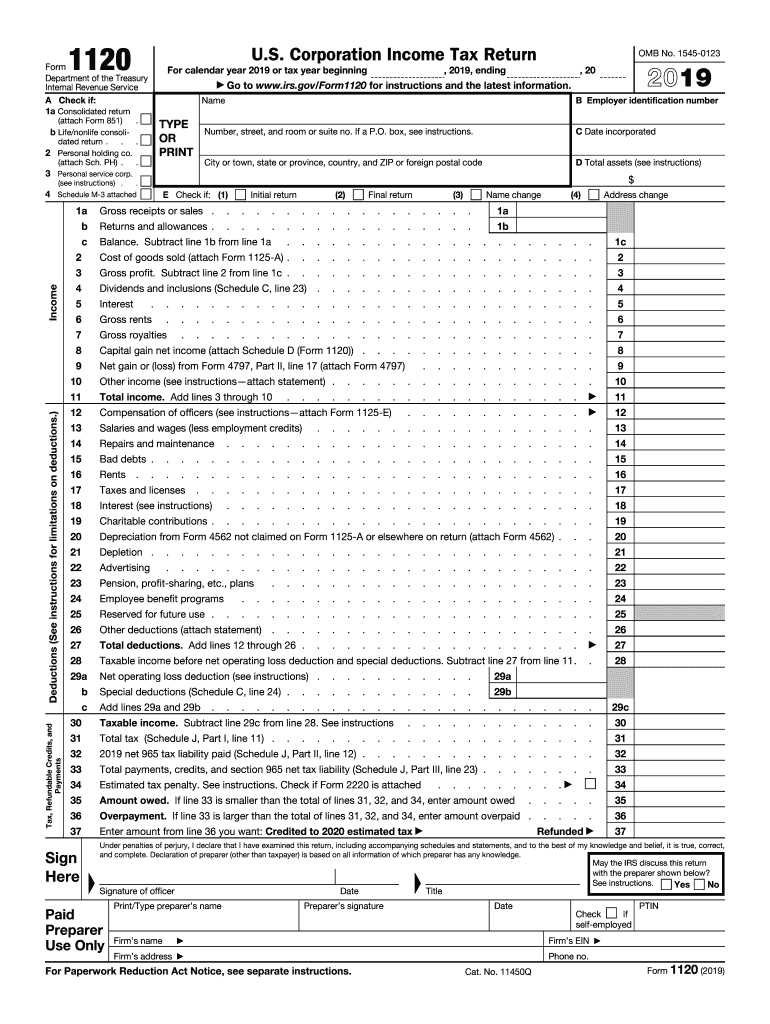

Irs 1120s Schedule K Printable Tax Form Form 1120S includes six schedules All S corporations S corps must complete Schedules B D and K The other three Schedules L M 1 and M 2 depend on whether the corporation has more than 250 000 in income and assets If you re ready to fill out the form you can download Form 1120S from the IRS and fill it out by hand

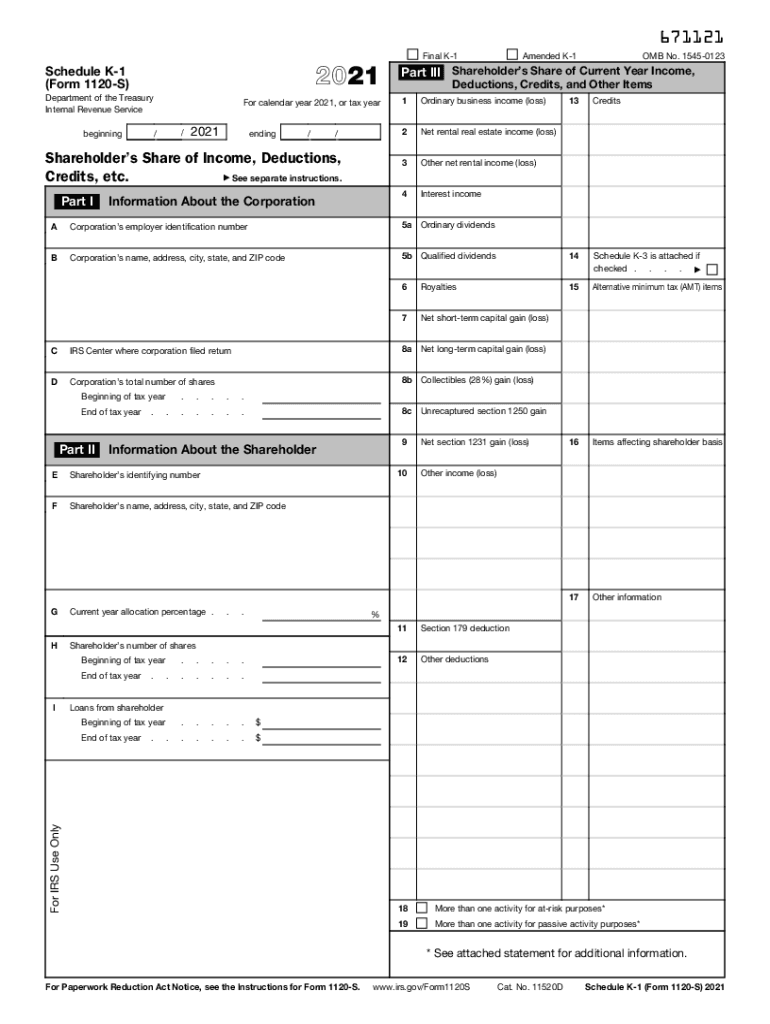

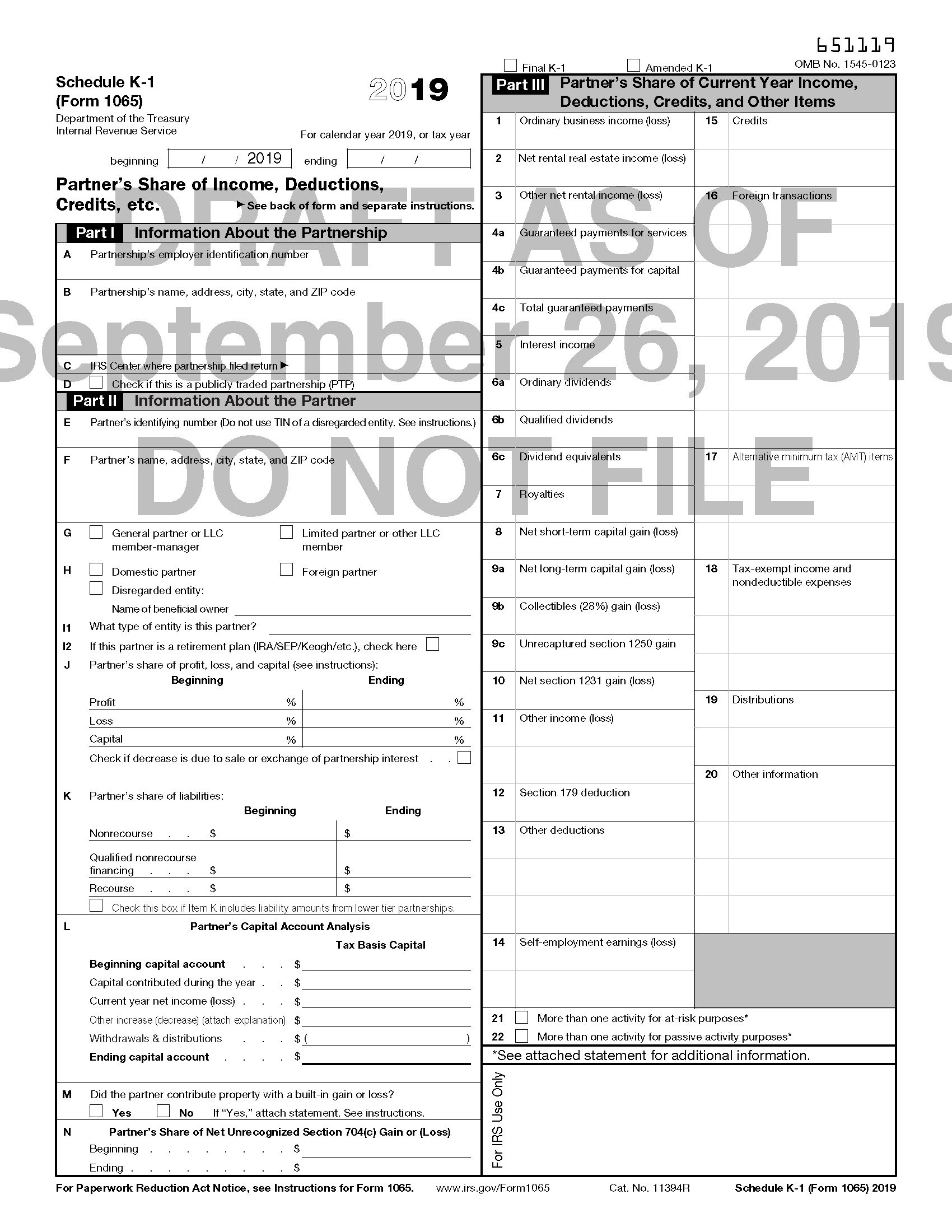

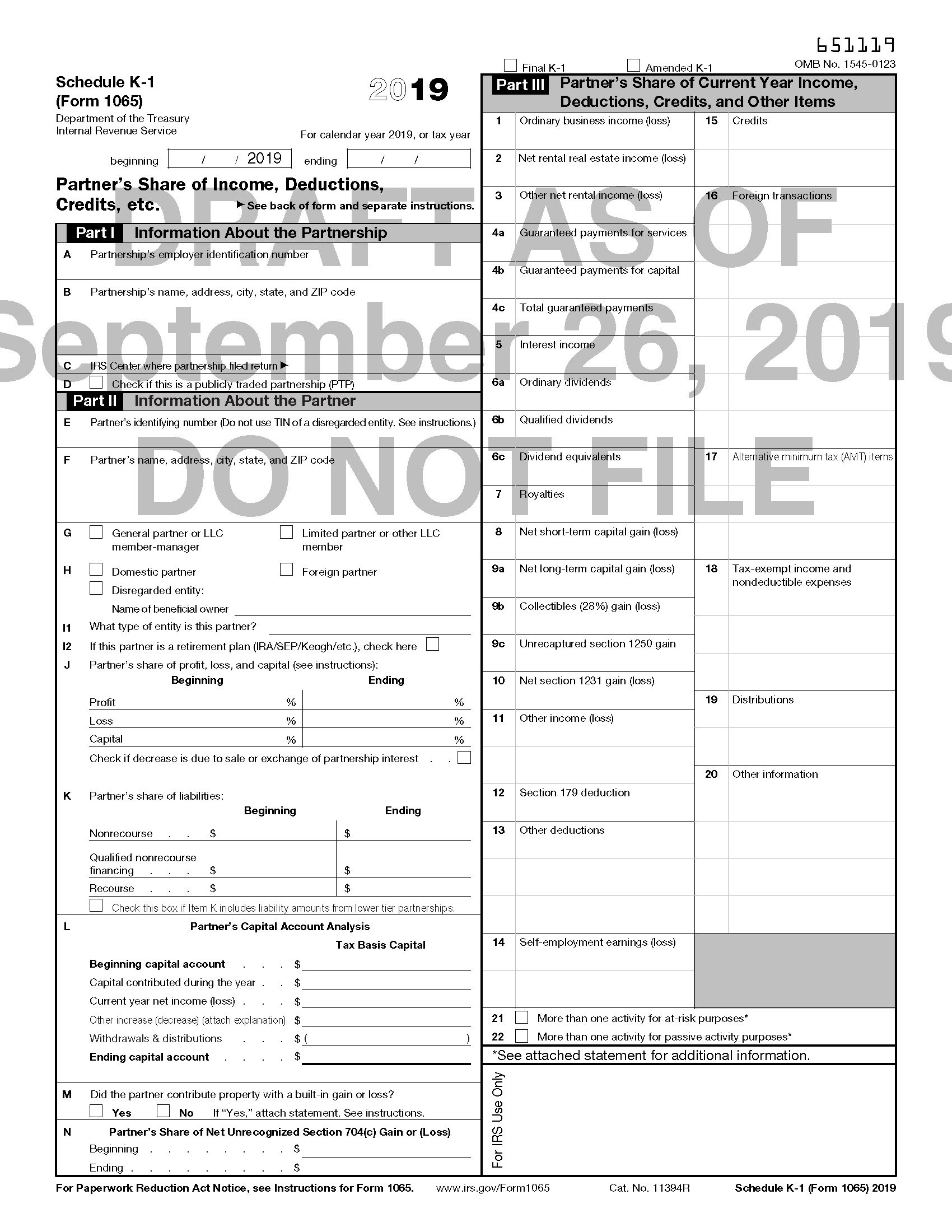

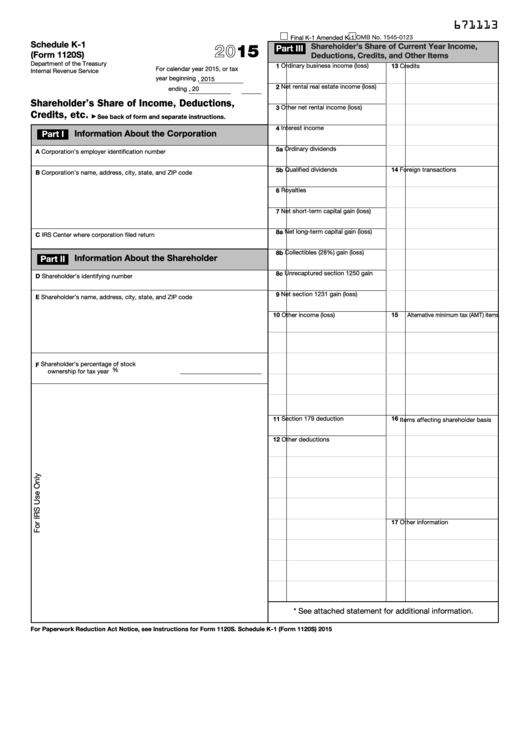

1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on the IRS website Schedule K 1 records each owners share of the business s income deductions credits and other financial items Form 1120S can be downloaded straight from the IRS website It s also available through most tax filing software programs You need to have the following information on hand while filling out Form 1120S Date you became an S corp Date your business was incorporated Your business activity code

Irs 1120s Schedule K Printable Tax Form

Irs 1120s Schedule K Printable Tax Form

https://www.pdffiller.com/preview/577/387/577387475/large.png

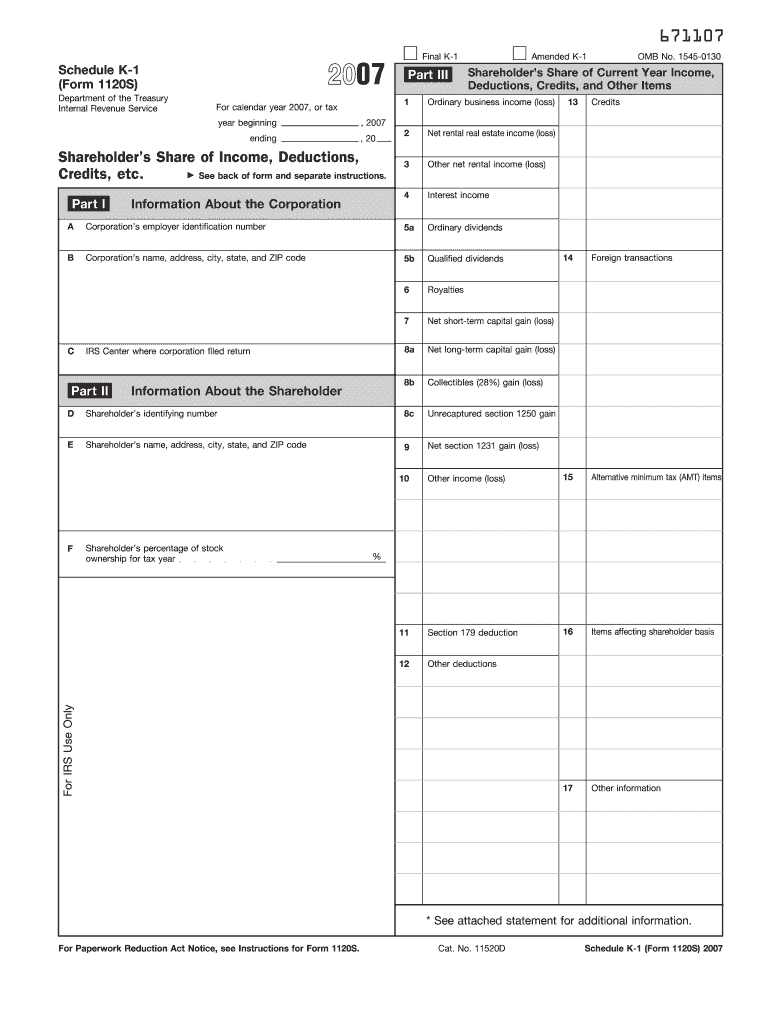

2007 Form IRS 1120S Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/21/100021148/large.png

1 How To Complete 2021 IRS Form 1120S And Schedule K 1 For Your LLC Taxed As An S Corporation

https://ninasoap.com/wp-content/uploads/2022/02/How-to-complete-form-1120S-for-2021.jpg

Userid SD NY3HB schema instrx Leadpct 0 Pt size 9 5 Draft Ok to Print PAGER XML Fileid C Documents and Settings ny3hb My Documents 11i1120S 1 30a xml Init date Page 1 of 42 Instructions for Form 1120S 13 33 31 JAN 2012 The type and rule above prints on all proofs including departmental reproduction proofs November 9 2023 Are you a shareholder in a corporation Do you need to file Form 1120S and Schedule K 1 for tax purposes Understanding the intricacies of these forms and their filing instructions is crucial to ensure compliance with the IRS and accurate reporting of income and deductions

On Nov 21 2023 in Notice 2023 74 the IRS announced that calendar year 2023 would be a transition year for third party settlement organizations TPSOs TPSOs which include popular payment apps and online marketplaces must file with the IRS and provide taxpayers a Form 1099 K that reports payments for goods or services where gross payments Form 1120S allows S corporations to avoid double taxation by passing income and losses onto shareholders to report individually Schedule K itemizes each shareholder s allocated share of these tax items for the year Key purposes include Reporting S corporation revenue expenses and tax items Allocating tax items among shareholders

More picture related to Irs 1120s Schedule K Printable Tax Form

Schedule K 1 Form 1120 S Shareholder s Share Of Income Overview Support

https://support.taxslayer.com/hc/article_attachments/17604583957133

Printable Form 1120s Printable Forms Free Online

https://www.signnow.com/preview/490/783/490783251/large.png

Printable Form 1120s Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/327/3279/327953/page_1_thumb_big.png

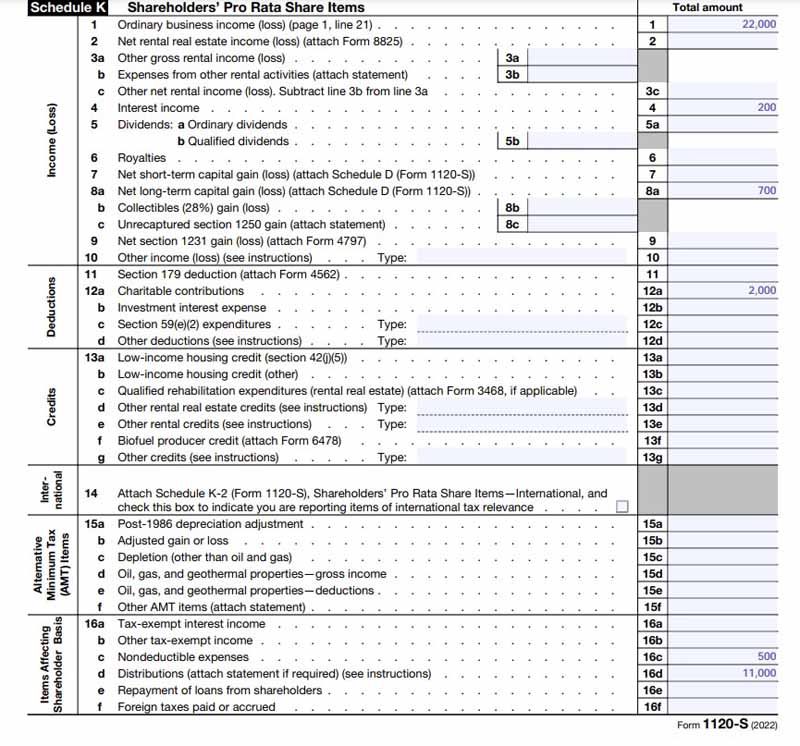

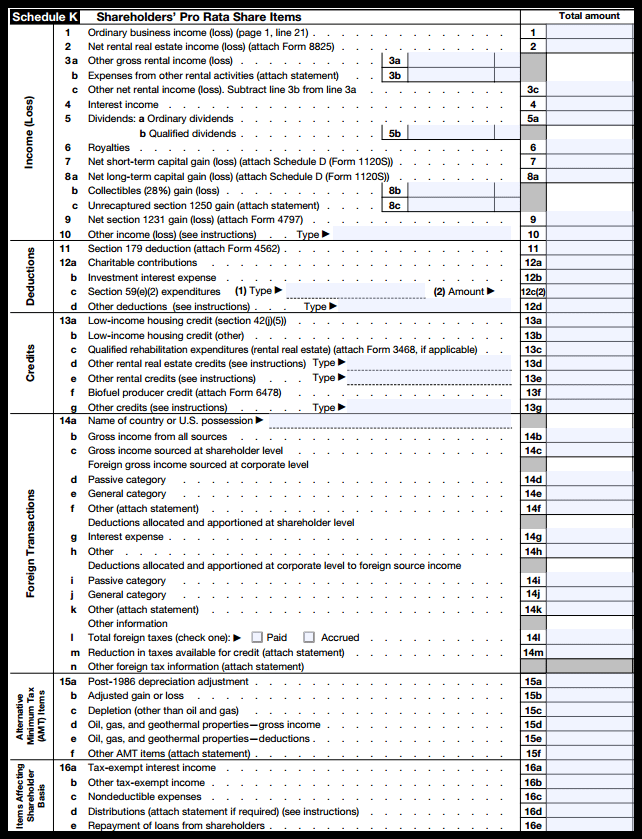

1120 S Schedule K 1 is a Federal Corporate Income Tax form States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar for dollar reduction of tax liability Some common tax credits apply to many taxpayers while others only apply to extremely specific situations 7 Complete Schedule K and K 1 on Form 1120S The S net corp s business income investment income deductions and credits for the year are summarized on Schedule K Schedule K gets its data from page 1 Schedule D the profit and loss statement and a variety of other tax forms K Schedule IRS Form 1120S Prepare a K 1 form for each

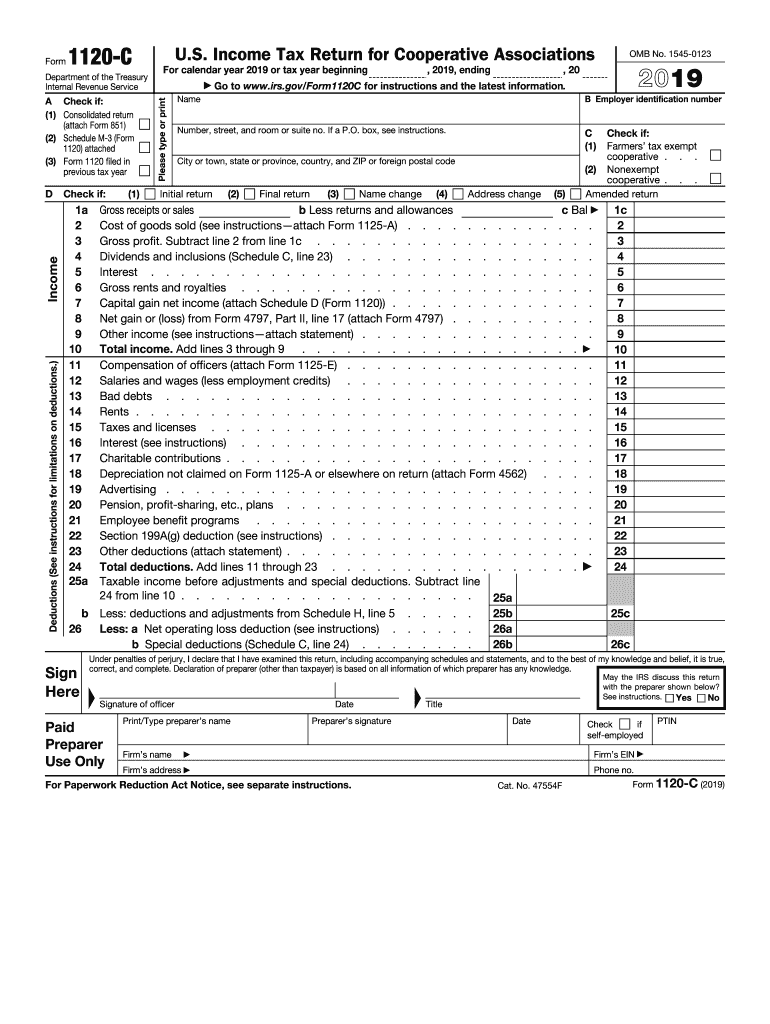

Is located in a foreign country or a U S territory file Form 1120 C at the following IRS center address Internal Revenue Service P O Box 409101 Ogden UT 84409 When To File Generally a cooperative described in section 6072 d must file its income tax return by the 15th day of the 9th month after the end of its tax year 2 Instructions Partnerships prepare a Schedule K 1 to report each partner s share of the income losses tax deductions and tax credits that the business reported on the 1065 tax form S corporations provide a Schedule K 1 that reports each shareholder s share of income losses deductions and credits that are reported to the IRS on Form 1120S

IRS Instruction 1120S Schedule K 1 2021 2022 Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/584/735/584735907/large.png

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_Form_1120-S_Shareholder_Pro_Rata_Share_1-16.jpg

https://fitsmallbusiness.com/how-to-complete-form-1120s/

Form 1120S includes six schedules All S corporations S corps must complete Schedules B D and K The other three Schedules L M 1 and M 2 depend on whether the corporation has more than 250 000 in income and assets If you re ready to fill out the form you can download Form 1120S from the IRS and fill it out by hand

https://www.bench.co/blog/tax-tips/form-1120s-k1

1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on the IRS website Schedule K 1 records each owners share of the business s income deductions credits and other financial items

How To Complete Form 1120s S Corporation Tax Return Heading

IRS Instruction 1120S Schedule K 1 2021 2022 Fill And Sign Printable Template Online US

IRS 1120 2019 Fill And Sign Printable Template Online US Legal Forms

What Is Form 1120S And How Do I File It Ask Gusto

What Is A Schedule K 1 Tax Form Meru Accounting

Drafts Of 2019 Forms 1065 And 1120S As Well As K 1s Issued By IRS Current Federal Tax

Drafts Of 2019 Forms 1065 And 1120S As Well As K 1s Issued By IRS Current Federal Tax

IRS 1120S 2023 Form Printable Blank PDF Online

Fillable Schedule K 1 Form 1120s Shareholder S Share Of Income Deductions Credits Etc

How To Complete Form 1120S Income Tax Return For An S Corp

Irs 1120s Schedule K Printable Tax Form - IR 2024 33 Feb 6 2024 WASHINGTON In an effort to provide more resources for taxpayers during this filing season the Internal Revenue Service today revised frequently asked questions FAQs for Form 1099 K Payment Card and Third Party Network Transactions in Fact Sheet 2024 03 PDF The revised FAQs provide more general information for taxpayers including common situations along