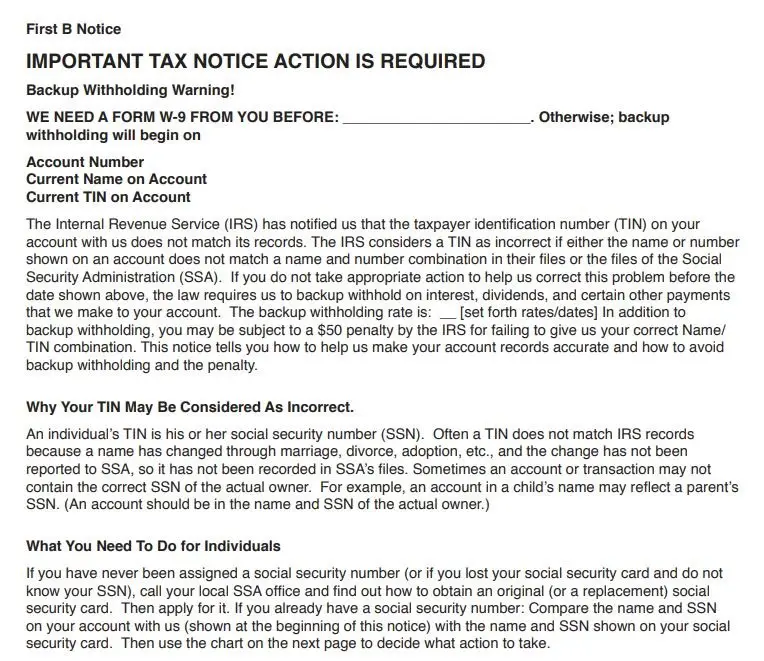

Irs First B Notice Form Printable You must send us a signed IRS Form W 9 before the due date of this notice even if the name and number SSN or EIN on your account with us match the name and number SSN or EIN on your social security card or the document issuing you an EIN

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF What is backup withholding There are situations when the payer is required to withhold at the current rate of 24 percent This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income This is known as Backup Withholding BWH and may be required

Irs First B Notice Form Printable

Irs First B Notice Form Printable

https://lh3.googleusercontent.com/proxy/swconOy_ADpN5dfq6dI7kNuj64IOS_cDv8Rev3slZniPu2S3FT3YNSTShS-xur8gb-pN-_K_-s7w57wtq0XomkzZK_OZkSbOQm4jOVC6=w1200-h630-p-k-no-nu

Ir s Schedule B Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/398/1398673/large.png

First B Notice Template

https://data.formsbank.com/pdf_docs_html/60/604/60428/page_1_thumb_big.png

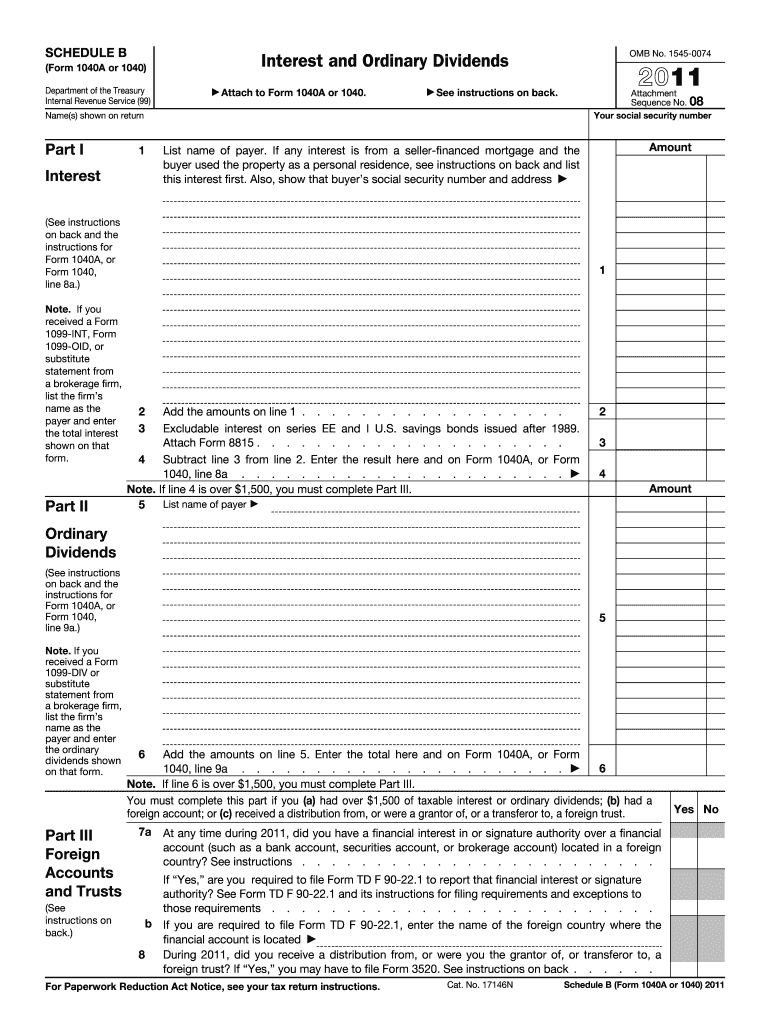

Step 1 Identify Which IRS Notice You Received The IRS will send you a CP2100 Notice or a CP2100A Notice if your tax documents contain Missing TINs or Incorrect Name TIN Combinations A Taxpayer Identification Number TIN can be a Social Security Number SSN for an individual Employer Identification Number EIN for a business Form 1040 line 3b Note If you received a Form 1099 DIV or substitute statement from a brokerage firm list the firm s name as the payer and enter the ordinary dividends shown on that form 5 List name of payer Amount 5 6 Add the amounts on line 5 Enter the total here and on Form 1040 or 1040 SR line 3b 6 Note

Updated 11 14 2023 The IRS has resumed sending collection notices in limited circumstances The notices will resume for individual taxpayers with tax debts for tax periods ending Dec 31 2022 or later for business taxpayers with tax debts for tax periods Aug 31 2023 or later and tax debts connected to Form 941 Employer s Quarterly Federal Tax Return for tax periods Sept 30 2023 or A backup withholding notice sometimes called a B notice states that the nonemployee s taxpayer ID number is either missing or incorrect When you receive the first IRS notice you should follow these steps Send a copy of the B notice to the individual within 15 business days of receiving the first notice and ask them to sign a new W 9 form

More picture related to Irs First B Notice Form Printable

First B Notice Fillable Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/first-b-notice-fillable/first-b-notice-fillable-preview.webp

9 Types Of IRS Letters And Notices And What They Mean Irs Tax Prep Checklist Tax Prep

https://i.pinimg.com/originals/6e/d4/98/6ed498643e7dbc781372a9b50c1897ac.jpg

Printable First B Notice Template Printable Templates

https://i.pinimg.com/originals/57/32/da/5732da7e44155acc689e76491717b360.jpg

The B Notice creates potential backup withholding exposure incorrect filing penalties and potentially an IRS Form 1099 audit B Notices are sent to IRS Form 1099 filers who ve submitted a name and taxpayer identification number TIN combination that doesn t match the IRS database Filers have a 15 day window to take action on the notices Send the payee the first B Notice and a Form W 9 within 15 business days The vendor must complete sign and return the W 9 to you They certify under penalties of perjury that the name and number is correct

When a Form 1099 is filed the IRS undergoes a process to match the recipient name and TIN information listed on the Form 1099 they receive with the IRS database First B Notice A first B Notice refers to a combination of a name and TIN that hasn t been recognized in any B Notice obtained within the preceding three calendar years by the An IRS B Notice is an annual IRS notification to payers that IRS Forms 1099 have been filed with either missing or incorrect name TIN combinations A first B Notice mailing is used when there is a mismatch between the IRS registration and the tax reporting information that was supplied via IRS Form 1099 The first B Notice is mailed to a

Get Our Image Of First B Notice Form Template Templates One Form

https://i.pinimg.com/736x/04/2d/24/042d24293cd2b11b392f765127dd2ae2.jpg

Explore Our Example Of First B Notice Form Template In 2020 Letter Templates Lettering

https://i.pinimg.com/originals/a7/d2/db/a7d2db23c7ba40e80381d7c8ef52e120.jpg

https://www.businessasap.com/wp-content/uploads/IRS-First-B-Notice.pdf

You must send us a signed IRS Form W 9 before the due date of this notice even if the name and number SSN or EIN on your account with us match the name and number SSN or EIN on your social security card or the document issuing you an EIN

https://www.irs.gov/forms-instructions

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

First B Notice Template

Get Our Image Of First B Notice Form Template Templates One Form

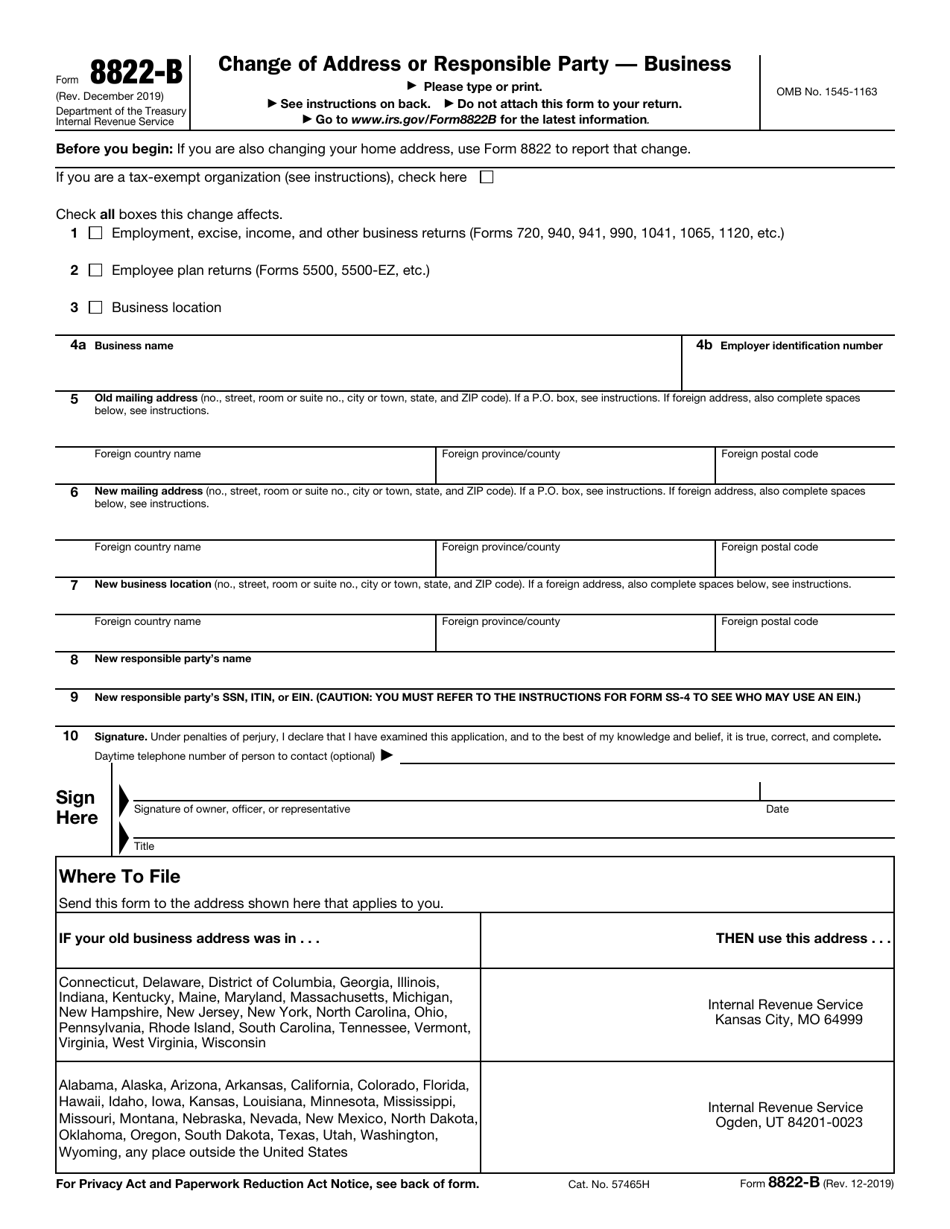

Printable Irs Form 8822 B Printable Forms Free Online

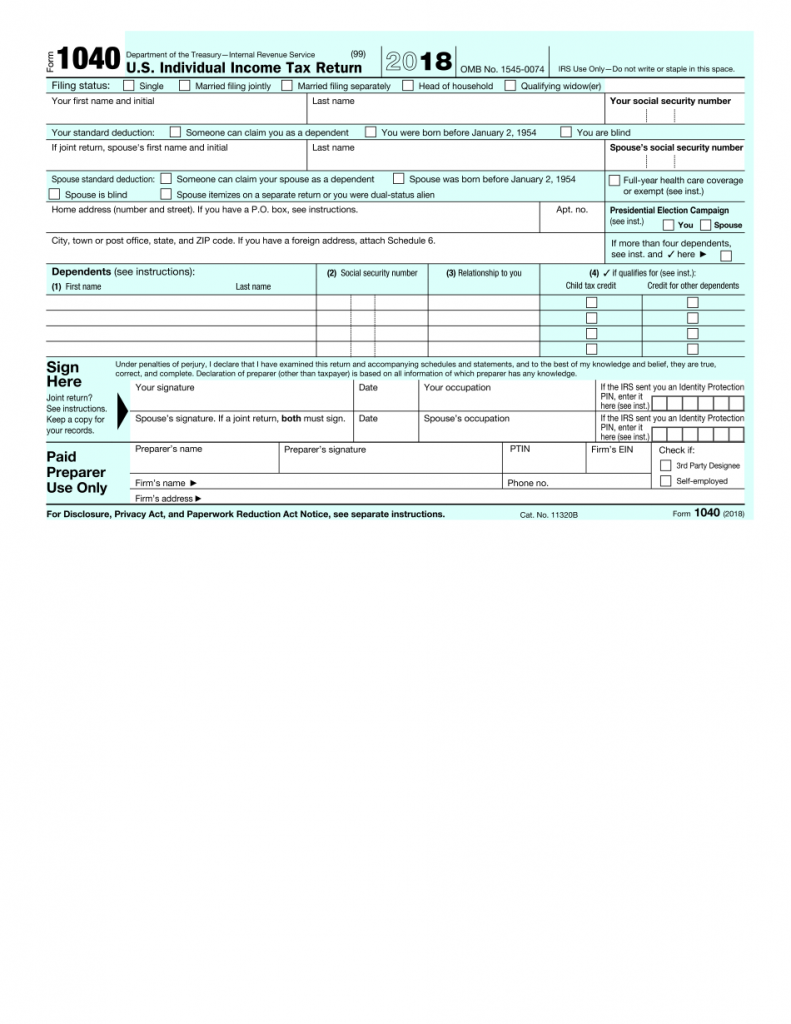

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

Printable First B Notice Template Printable Templates

Printable First B Notice Template Printable Templates

Printable First B Notice Template Printable Templates

First B Notice Template

B Notice Template

Irs First B Notice Form Template Free

Irs First B Notice Form Printable - Updated 11 14 2023 The IRS has resumed sending collection notices in limited circumstances The notices will resume for individual taxpayers with tax debts for tax periods ending Dec 31 2022 or later for business taxpayers with tax debts for tax periods Aug 31 2023 or later and tax debts connected to Form 941 Employer s Quarterly Federal Tax Return for tax periods Sept 30 2023 or