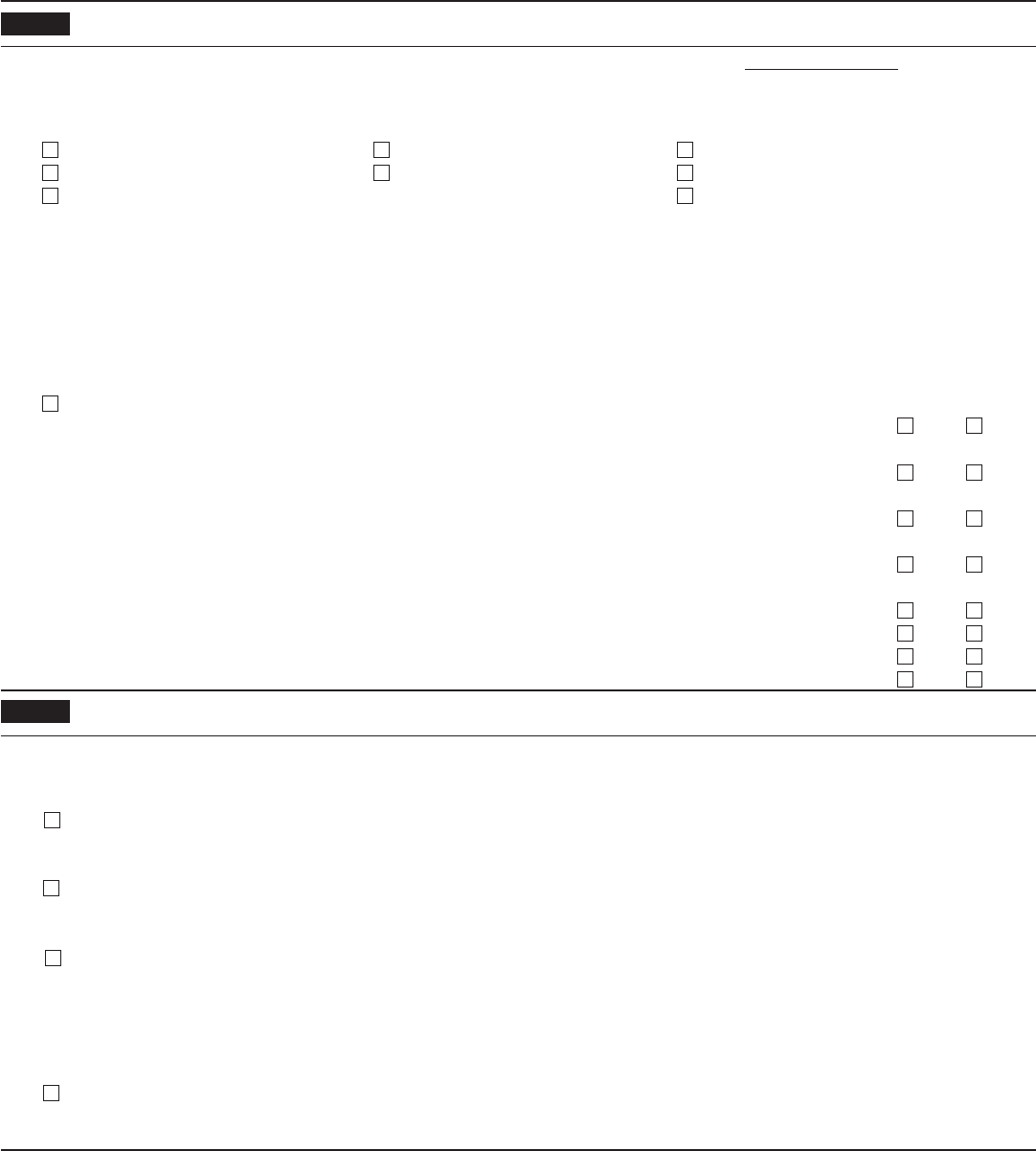

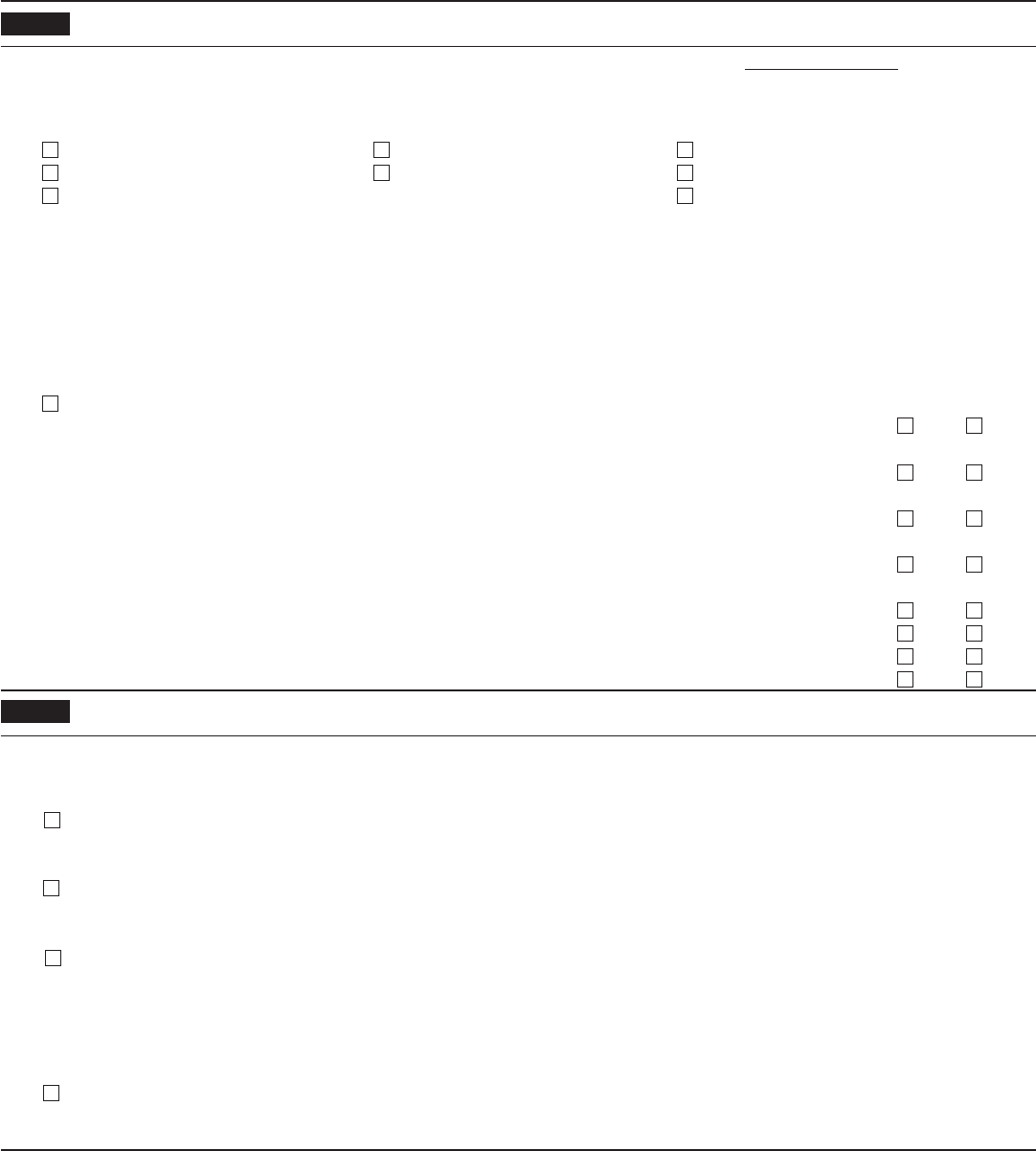

Irs Form 1023 Ez Printable Form 1023 EZ 6 2014 Page 2 Part III Your Specific Activities 1 Enter the appropriate 3 character NTEE Code that best describes your activities See the instructions 2 To qualify for exemption as a section 501 c 3 organization you must be organized and operated exclusively to further one or more of the following purposes

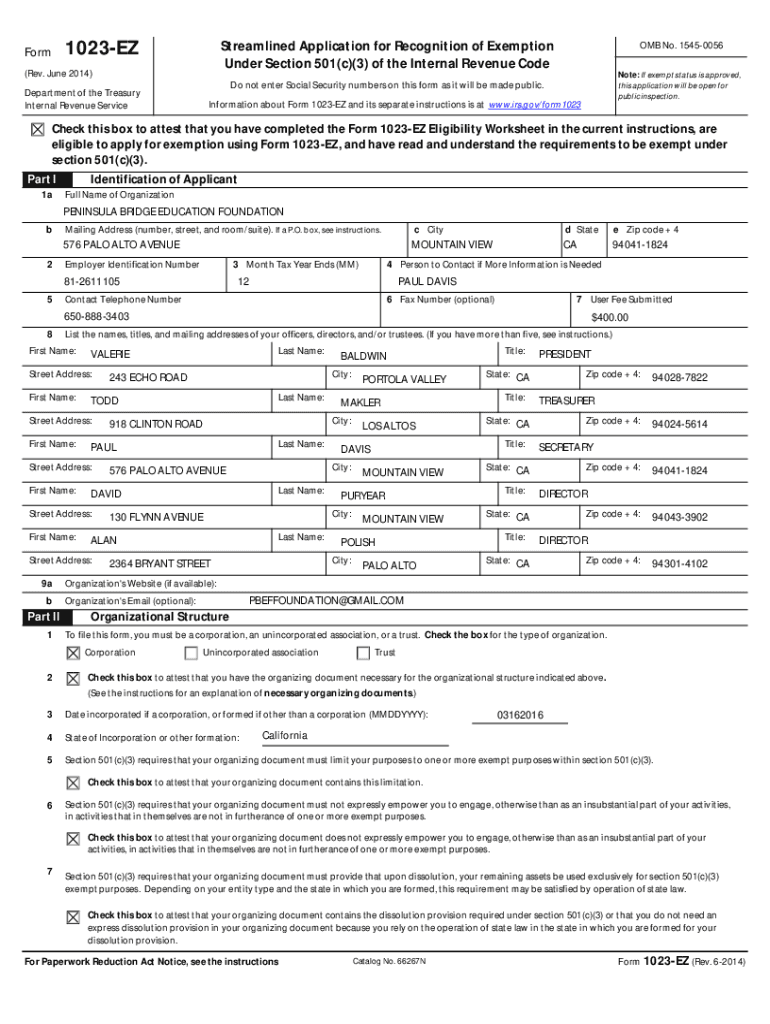

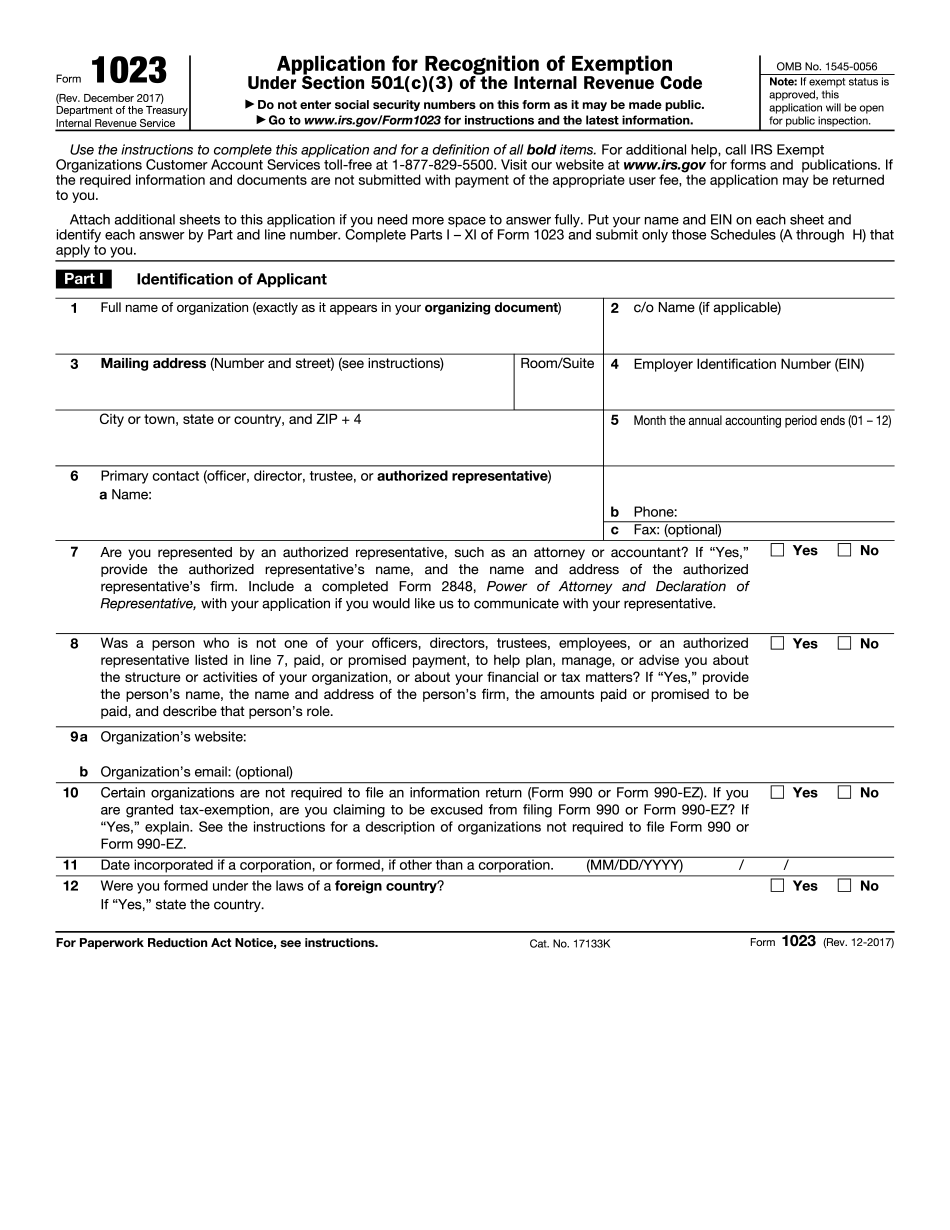

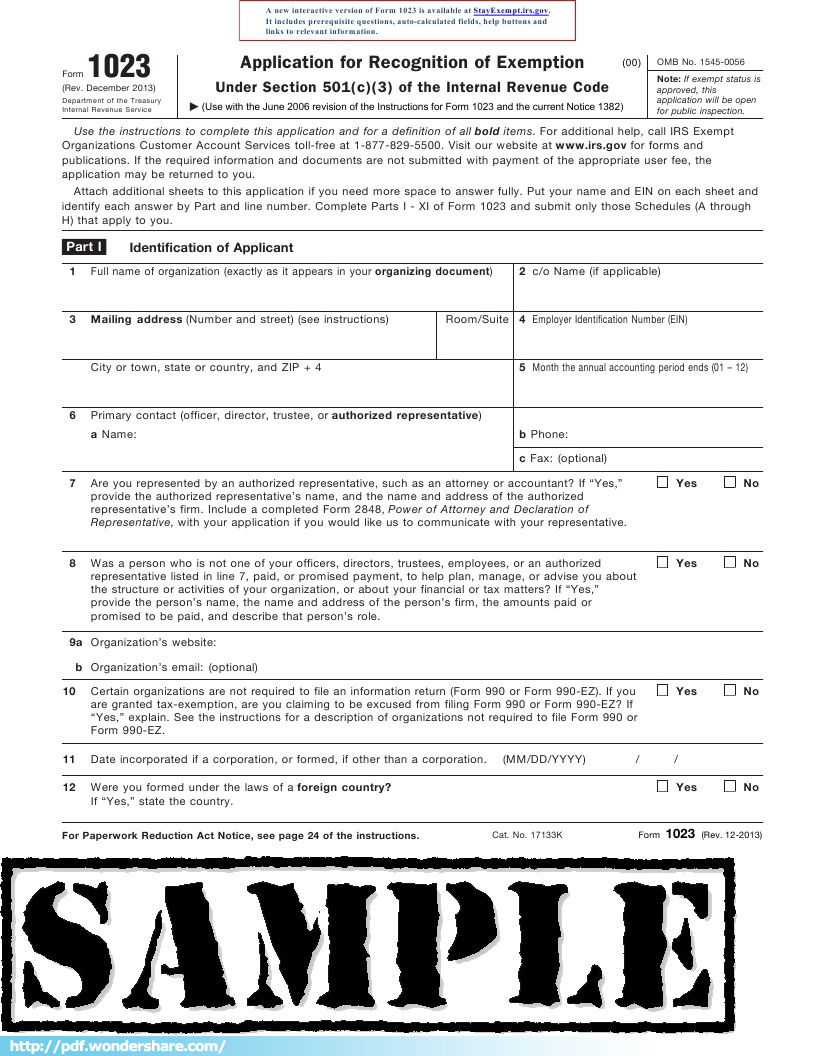

Form 1023 EZ is the streamlined version of Form 1023 Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Any organization may file Form 1023 to apply for recognition of exemption from federal income tax under section 501 c 3 Register for an account on Pay gov Enter 1023 in the search box and select Form 1023 Complete the form Instructions for Form 1023 Print Version PDF Recent Developments LLC Applying for Tax exempt Status under Section 501 c 3 Must Submit Information Described in Notice 2021 56

Irs Form 1023 Ez Printable

Irs Form 1023 Ez Printable

https://www.pdffiller.com/preview/438/615/438615143/big.png

Form 1023 EZ The Faster Easier 501 c 3 Application For Small Nonprofits Aspect Law Group

https://images.squarespace-cdn.com/content/v1/56eefa32cf80a10be6c9d5f8/1458617072762-JTBKKWSECG2HHDKX9IHM/ke17ZwdGBToddI8pDm48kBNlb3YTZqUPkFjxqfaKshkUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKc5Tm_BXtt0MhdEqYUDHRRzuXSw7G3JGkqFndqLRpn1dOILI_Nql-yM-LsUHSXHFh6/Form1023EZ_hp.jpg

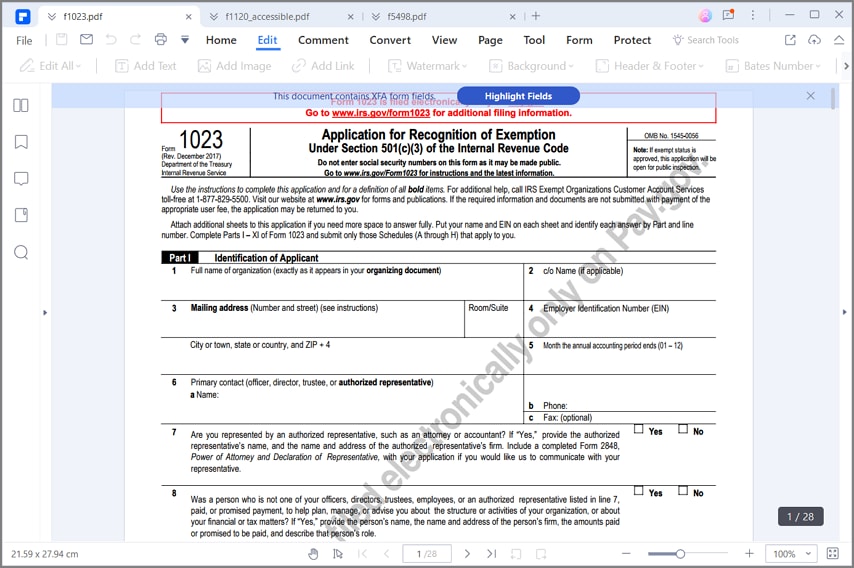

IRS Form 1023 Filling Now Made Easy With PDFelement

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1023-part1.png

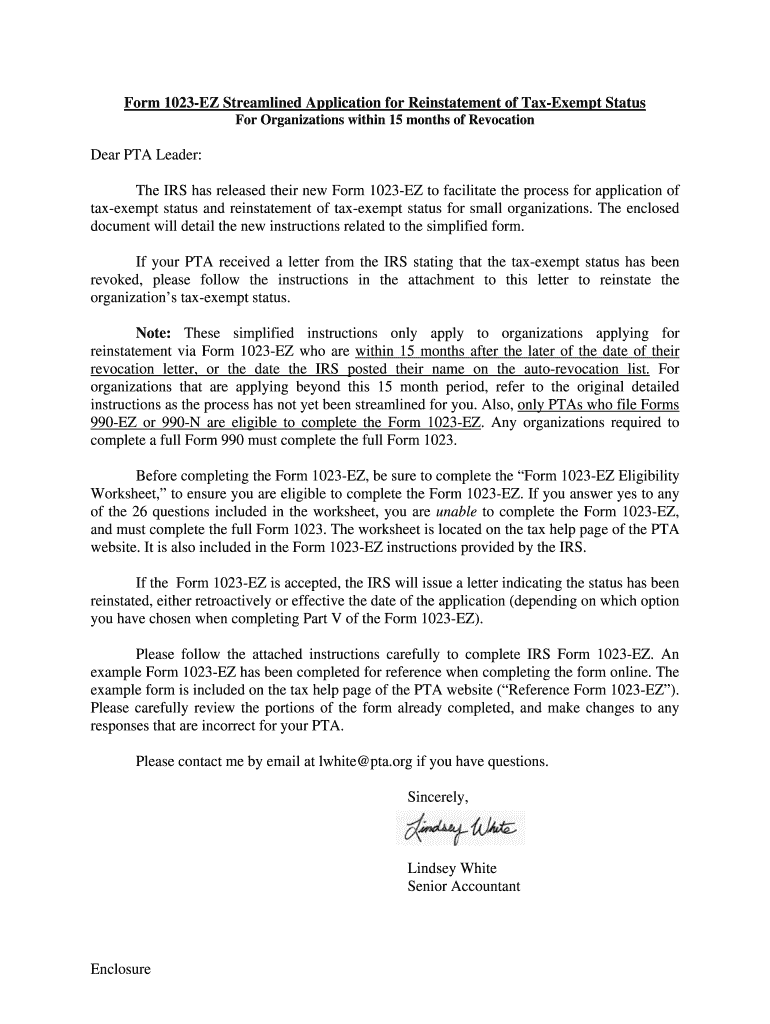

The IRS revised Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code and its instructions to help small charities apply for 501 c 3 tax exempt status These revisions don t change the Form 1023 EZ user fee Here s a summary of the revisions we made to the Form 1023 EZ This form requires enteringa 3 characterNational Taxonomy of Exempt Entities NTEE Code that best describes your organizations activities See the Instructions for Form 1023 EZ beginning on page 21 for a listing of NTEE codes

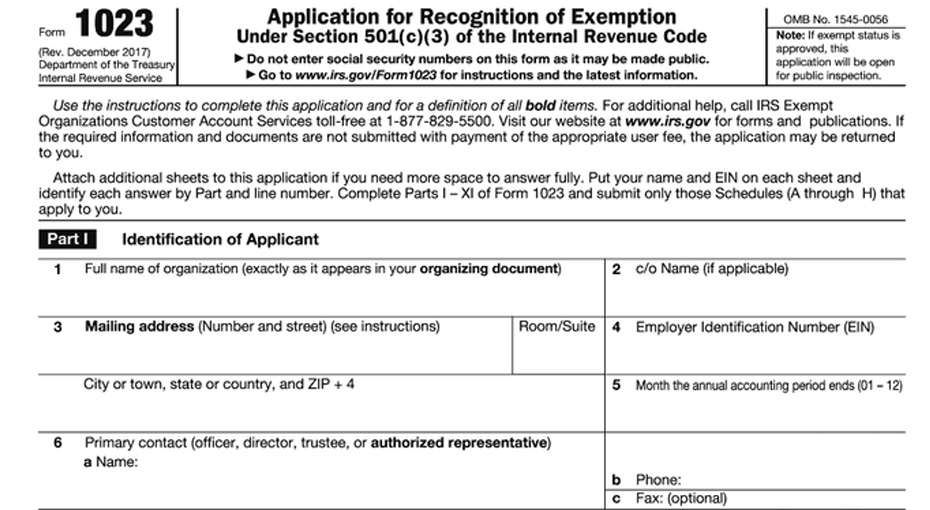

Home File Charities and Nonprofits Form 1023 Obtaining a copy of Form 1023 Form 1023 Obtaining a copy of Form 1023 How can I get a copy of Form 1023 Form 1023 must be submitted electronically on Pay gov where you can also preview a copy of the form Additional information Department of the Treasury Internal Revenue Service Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Do not enter social security numbers on this form as it may be made public inspection Go to www irs gov Form1023 for instructions and the latest information OMB No 1545 0056 Note

More picture related to Irs Form 1023 Ez Printable

IRS Proposes Form 1023 EZ HomeschoolCPA

https://i0.wp.com/homeschoolcpa.com/wp-content/uploads/2014/05/Form1023EZ.jpg?ssl=1

Irs Form 1023 Printable Printable Forms Free Online

https://handypdf.com/resources/formfile/htmls/10002/form-1023-ez/bg1.png

Form 1023 Tax Exempt Form 1023

https://www.expresstaxexempt.com/Content/Images/newImages/form1023.png

FORM 1023 EZ Recognition As a Tax Exempt Organization Is Now Virtually Automatic for Most Applicants Which Invites Noncompliance Diverts Tax Dollars and Taxpayer Donations and Harms Organizations Later Determined to Be Taxable RESPONSIBLE OFFICIAL Sunita Lough Commissioner Tax Exempt and Government Entities Division TAXPAYER RIGHTS IMPACTED1 EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax Other Federal Corporate Income Tax Forms

Overview of the Form 1023 e Filing process Instructions for Form 1023 Print Version Form 1023 EZ May only be used by small organizations with gross receipts of 50 000 or less and assets of 250 000 or less exceptions include churches schools and organizations with mailing addresses outside the U S The fee to file the Form 1023 EZ is How long does it take the IRS to review the Form 1023 EZ In general you can expect the IRS to review your IRS Form 1023 EZ in approximately 1 3 months If you haven t heard from the IRS within 90 days of submission you may contact them proactively by calling 877 829 5500 To check on the status of IRS reviews consult the IRS website

Form 1023 EZ Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/10002/form-1023-ez/bg2.png

Fillable Online 15 Printable Irs Form 1023 ez Templates Fax Email Print PdfFiller

https://www.pdffiller.com/preview/646/590/646590311/large.png

https://www.irs.gov/pub/irs-pdf/f1023ez.pdf

Form 1023 EZ 6 2014 Page 2 Part III Your Specific Activities 1 Enter the appropriate 3 character NTEE Code that best describes your activities See the instructions 2 To qualify for exemption as a section 501 c 3 organization you must be organized and operated exclusively to further one or more of the following purposes

https://www.irs.gov/instructions/i1023ez

Form 1023 EZ is the streamlined version of Form 1023 Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Any organization may file Form 1023 to apply for recognition of exemption from federal income tax under section 501 c 3

2017 2019 IRS Form 1023 Fill Out Online PDF Template

Form 1023 EZ Edit Fill Sign Online Handypdf

IRS Form 1023 Free Download Create Edit Fill Print

Instructions For 1023 EZ Rev January 2023 IRS Doc Template PdfFiller

Structure Examples Form 1023ez Pdf

Structure Examples Form 1023 Instructions

Structure Examples Form 1023 Instructions

How To Fill Out Form 1023 Form 1023 EZ For Nonprofits Step By Step

Form 1023 Ez Eligibility Worksheet Fill Out And Sign Printable PDF Template SignNow

2020 2023 Form IRS 1023Fill Online Printable Fillable Blank PdfFiller

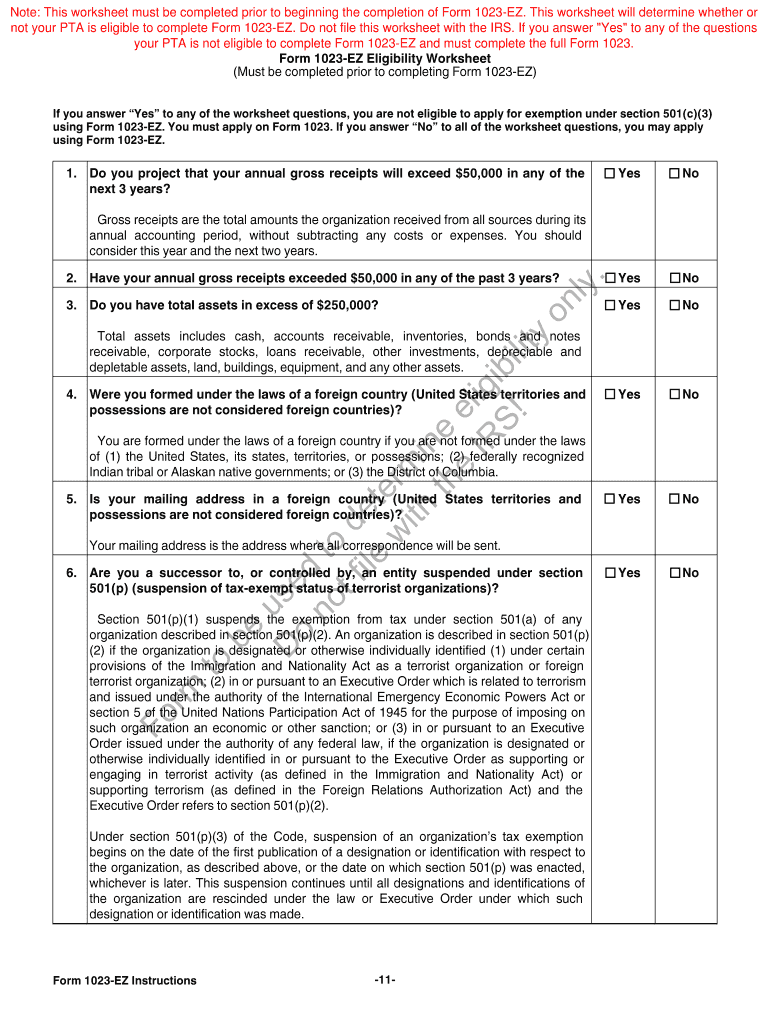

Irs Form 1023 Ez Printable - You must apply on Form 1023 If you answer No to all of the worksheet questions you may apply using Form 1023 EZ 15 you applying for exemption as a qualified charitable risk pool under section 501 n A qualified charitable risk pool is treated as organized and operated exclusively for charitable purposes