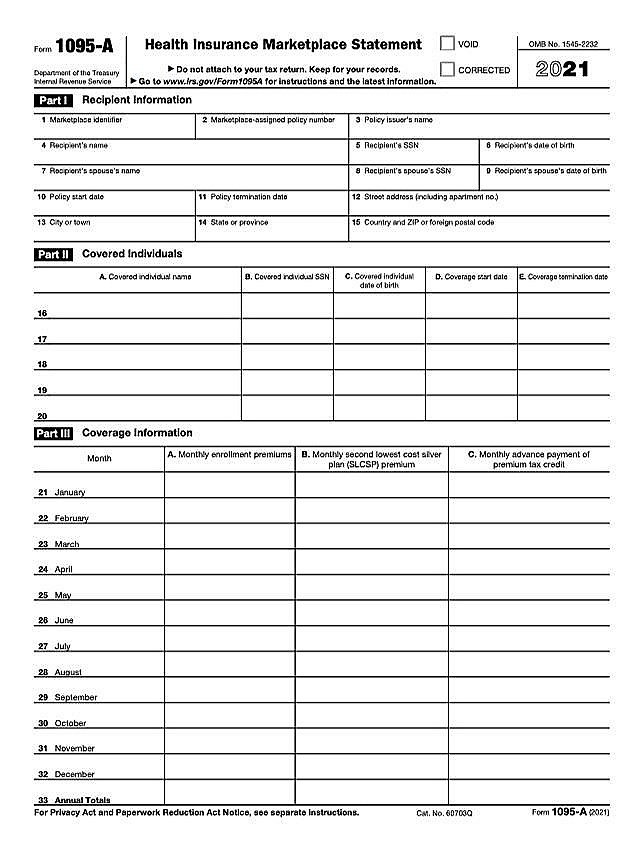

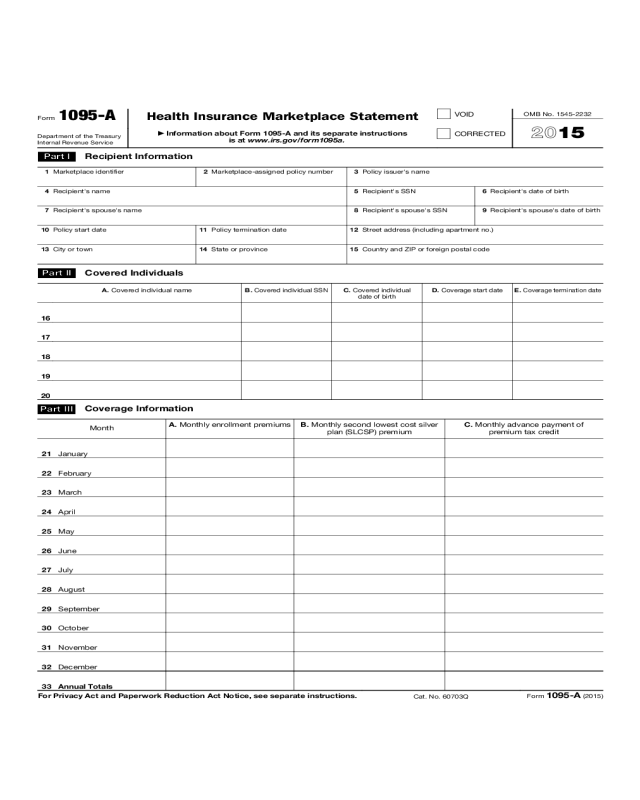

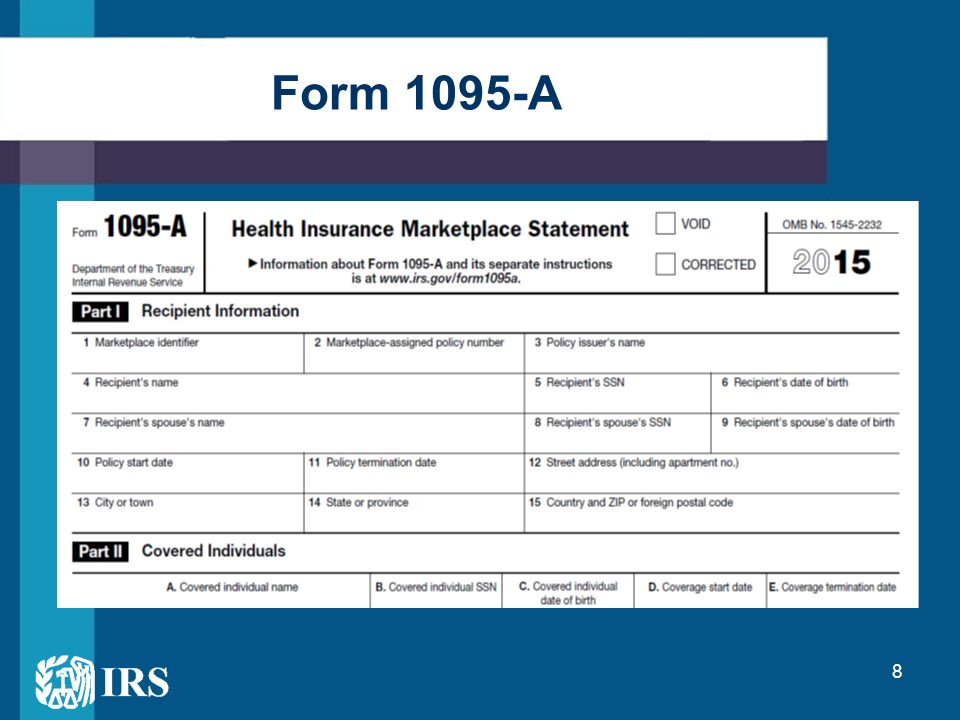

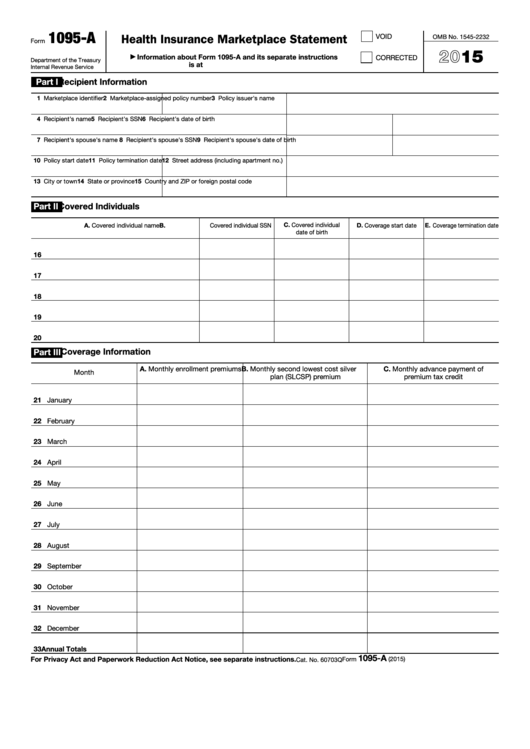

Irs Form 1095 A Printable Form 1095 A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an accurate tax return Who Must File

STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2023 application not your 2024 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095 A online 2 STEP 4 Under Your Forms 1095 A for Tax Filing select Download PDF and follow these steps based on your browser File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A

Irs Form 1095 A Printable

Irs Form 1095 A Printable

https://1095a-form-print.com/images/uploads/2023-03-16/1095a-rain1-main-scrn-4ppds.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

https://www.investopedia.com/thmb/ZafAiXFzwdLceDsfIYn9CLaYFKg=/680x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

Form 1095 A Definition Filing Requirements How To Get One

https://www.investopedia.com/thmb/U3Gx2rovb9daQpEWbBl3sdclaY4=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png

The form provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy Insurance companies in health care exchanges provide you with the 1095 A form This form includes Your name Amount of coverage you have The tax filing deadline is April 18 2023 If anyone in your household had a Marketplace plan in 2022 use Form 1095 A Health Insurance Marketplace Statement to file your federal taxes You ll get this form from the Marketplace not the IRS Check your Form 1095 A to make sure your information is correct

Form 1095 A An IRS form sent to anybody who received health insurance coverage through a Health Insurance Marketplace The form shows such information as the effective date of the coverage You will use your Form 1095 A to fill out Form 8962 PDF when you file your taxes IRS Form 8962 is a form used by the IRS to determine if the tax credits your health insurance company received based on what you estimated your income to be matches the amount of financial assistance you qualify for based on your actual income as reported on

More picture related to Irs Form 1095 A Printable

What Is A Tax Form 1095 A And How Do I Use It Stride Blog

https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/25856afd-66d6-4966-946b-e3f92a60bdbd/screencapture-irs-gov-pub-irs-pdf-f1095a-pdf-2021-12-15-14_16_39.jpg

Free Printable 1095 A Form Printable Templates

https://www.viralcovert.com/wp-content/uploads/2018/11/print-1095-a-tax-form.jpg

IRS Form 1095 A Katz Insurance Group

https://vamedicalplans.com/wp-content/uploads/2015/02/irs-1095.jpg

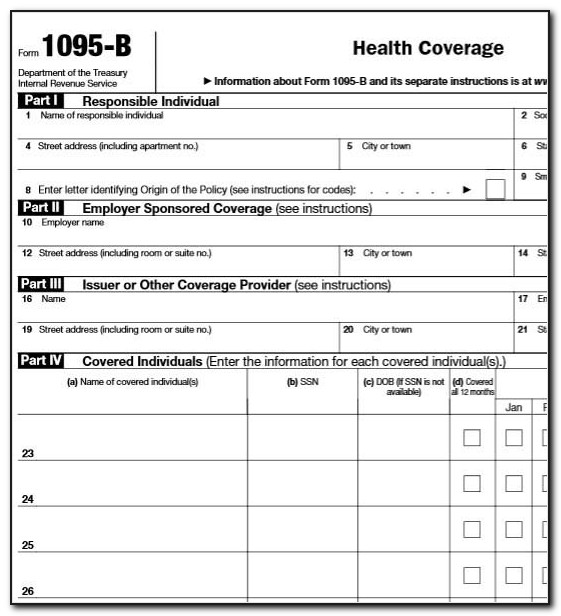

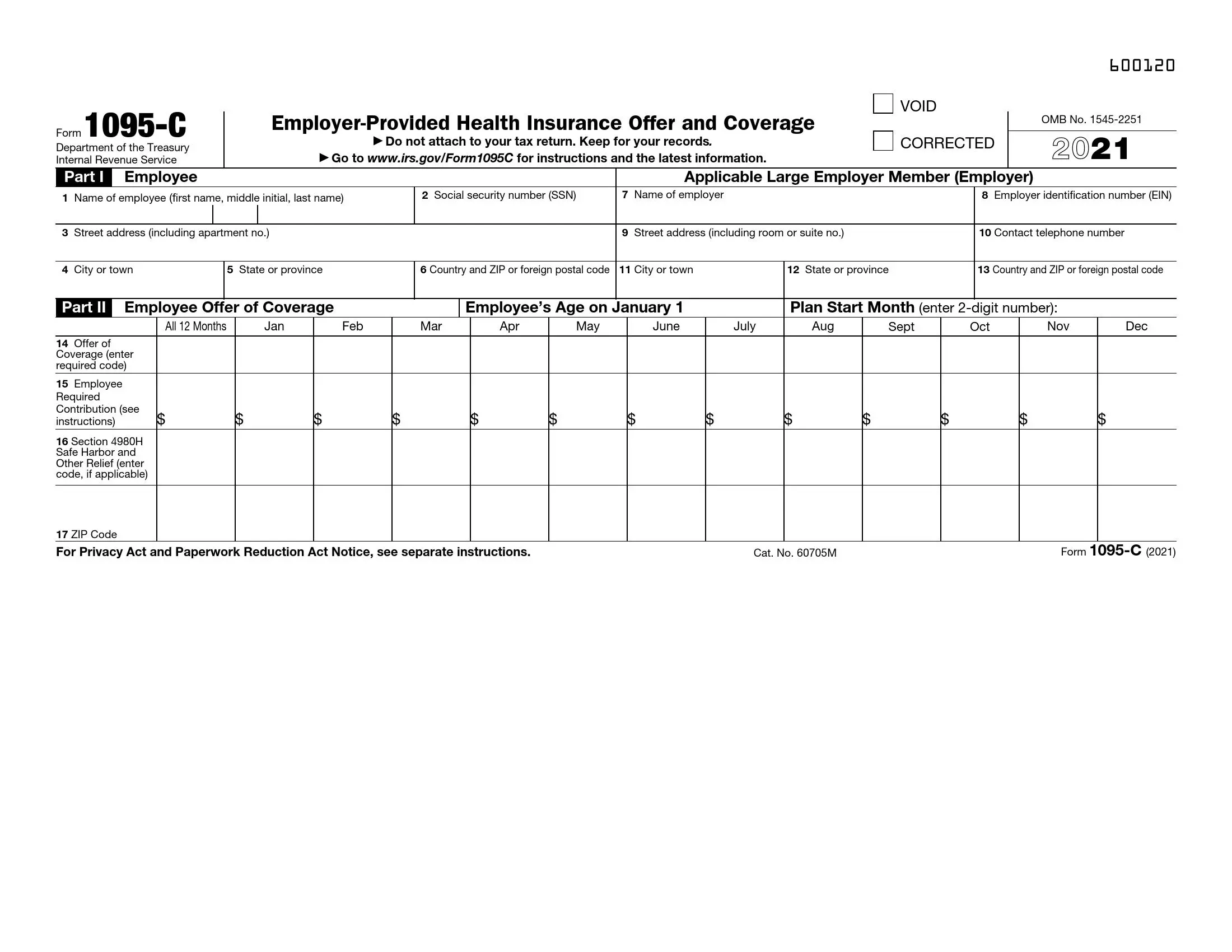

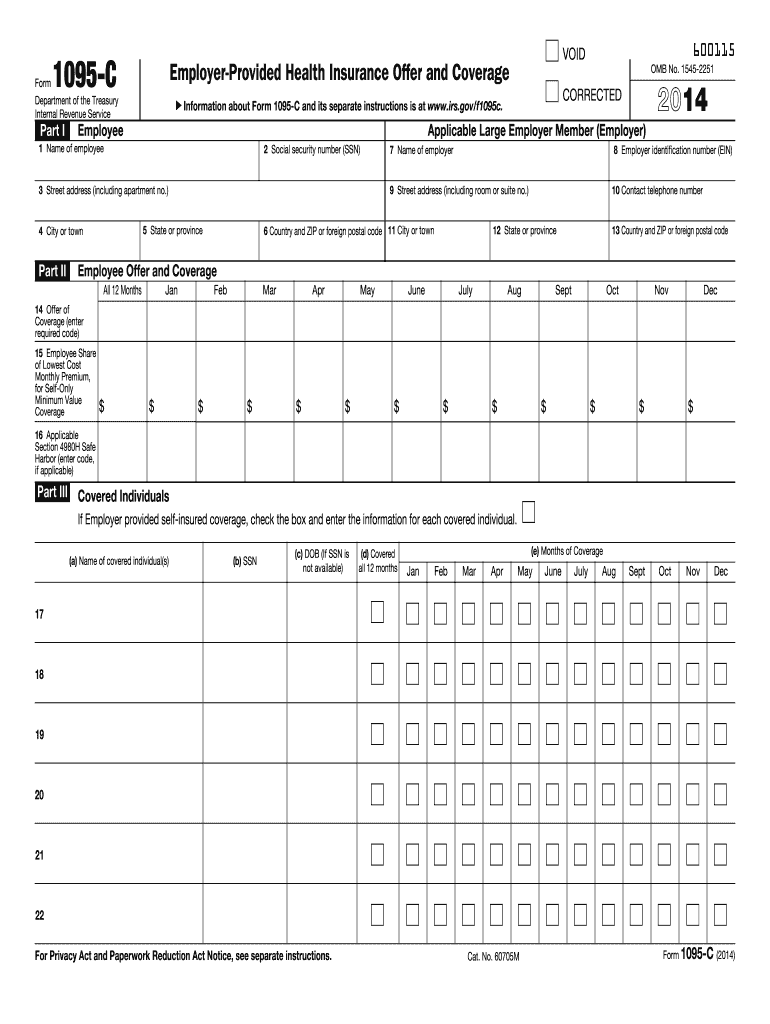

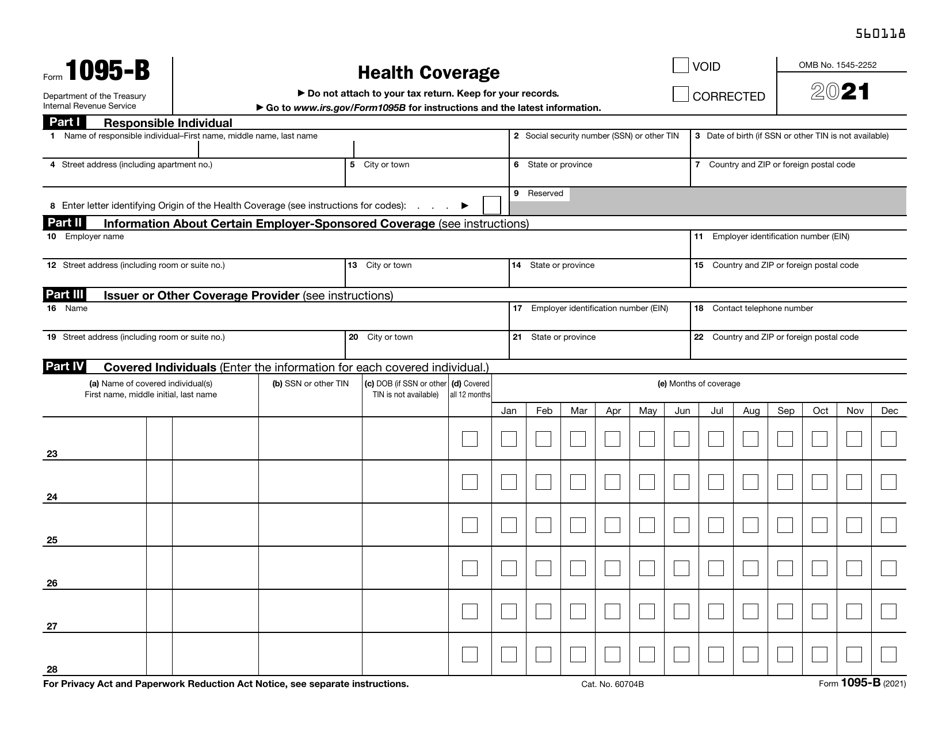

Understanding your IRS 1095 forms Important tax document information for 1095 B Kaiser Permanente is changing the annual tax mailing process for the 2023 tax year This means 1095 B forms for proof of minimal essential coverage will no longer be automatically mailed 1094 B 1095 B Forms 1095 C 1095 B The critical 2024 filing deadlines for 2023 coverage are as follows Paper filing with IRS Feb 28 1095 forms delivered to employees Mar 1 Electronic

What is it The Qualifying Health Coverage QHC notice lets you know that your Medicare Part A Hospital Insurance coverage is considered to be qualifying health coverage under the Affordable Care Act If you have Part A you can ask Medicare to send you an IRS Form 1095 B In general you don t need this form to file your federal taxes As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095 A available on IRS gov Individuals receiving a completed Form 1095 A from the Health Insurance Marketplace will use the information received on the form and the guidance in the instructions to assist them in filing an accurate tax return Form

1095 A Printable Form Get Latest Free Printable Calendar Worksheets Template And More

https://robertwelk.com/wp-content/uploads/2018/06/Form1095-A.jpg

1095 A Form Printable Printable Forms Free Online

https://www.irs.gov/pub/xml_bc/66452q06.gif

https://www.irs.gov/instructions/i1095a

Form 1095 A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an accurate tax return Who Must File

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png?w=186)

https://www.healthcare.gov/downloads/how-to-find-form-1095-a-online.pdf

STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2023 application not your 2024 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095 A online 2 STEP 4 Under Your Forms 1095 A for Tax Filing select Download PDF and follow these steps based on your browser

1095 A Printable Form Download All Latest Free Printable Form For 2023

1095 A Printable Form Get Latest Free Printable Calendar Worksheets Template And More

1095 A Printable Form Download All Latest Free Printable Form For 2023

Form 1095 A Sample Amulette

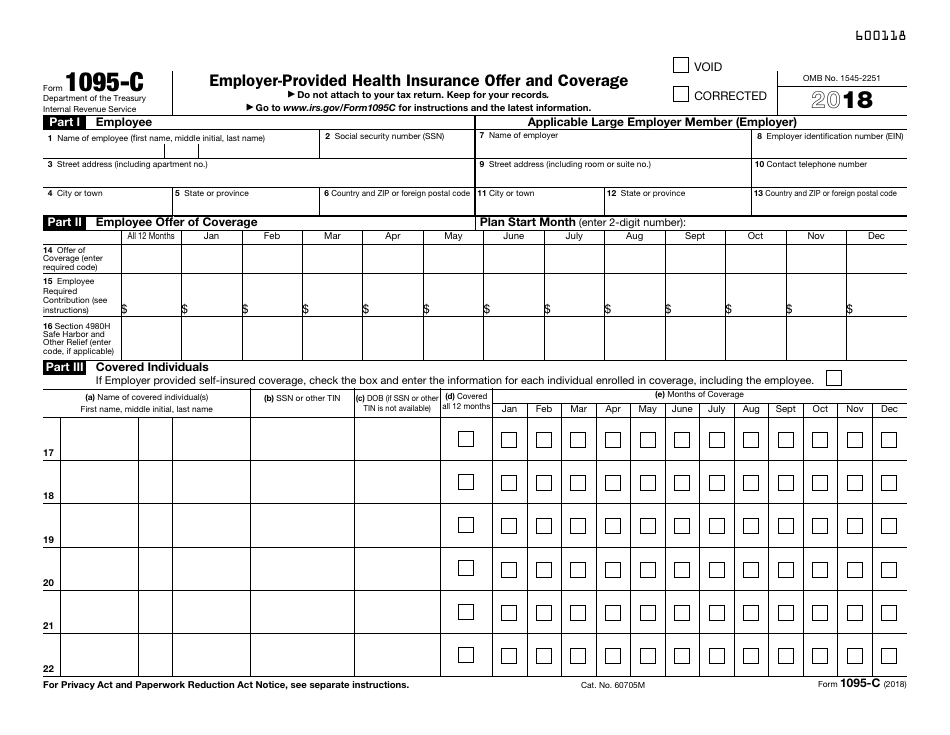

IRS Form 1095 C Fill Out Printable PDF Forms Online

Fillable 1095 A Form Printable Forms Free Online

Fillable 1095 A Form Printable Forms Free Online

2014 1095 Form Fill Out Sign Online DocHub

IRS Form 1095 B Download Fillable PDF Or Fill Online Health Coverage 2021 Templateroller

IRS Form 1095 C 2018 Fill Out Sign Online And Download Fillable PDF Templateroller

Irs Form 1095 A Printable - If you your spouse or your dependent s enrolled in coverage through IMG in 2023 that qualifies as minimum essential coverage under the Affordable Care Act 1095 B tax forms are now available insured s name click PDF to open or save the form with your information on it The primary insured s 1095 B form will include information for