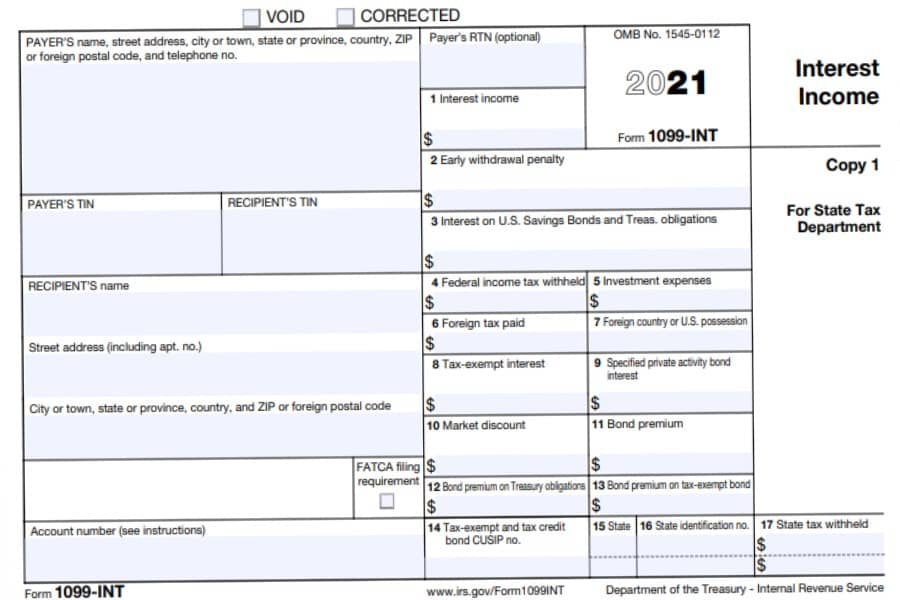

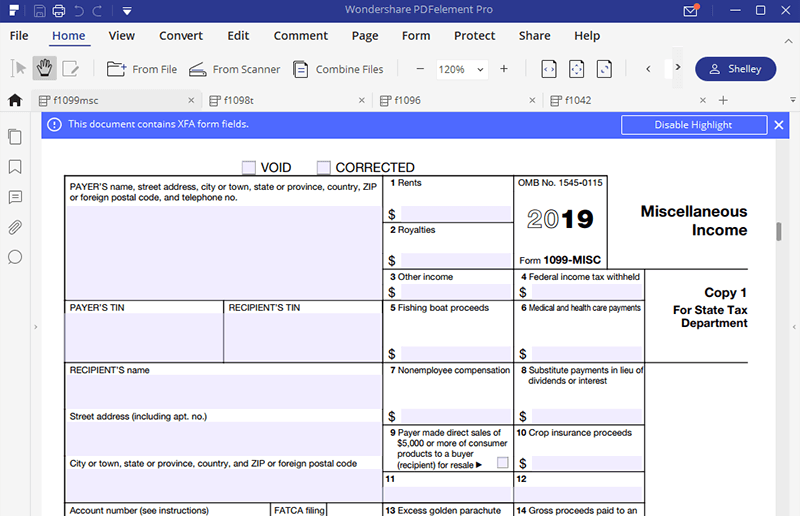

Irs Form 1099 Misc Printable Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New E filing returns

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer

Irs Form 1099 Misc Printable

Irs Form 1099 Misc Printable

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN The due date for filing Form 1099 MISC with the IRS is February 28 2024 if you file on paper or March 31 2024 if you file electronically Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare your return and forms or schedules included in your

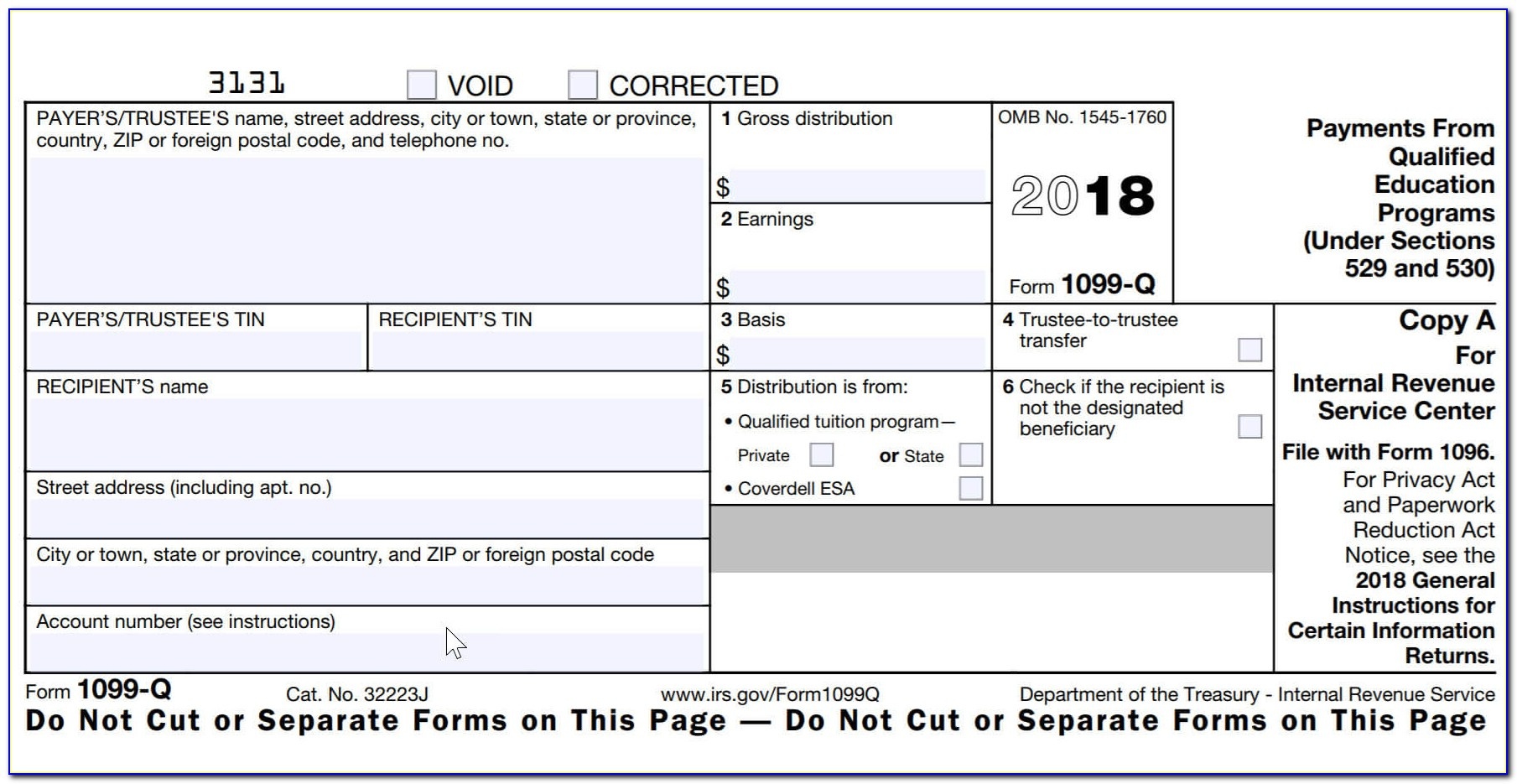

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt In tax year 2020 the IRS reintroduced Form 1099 NEC for reporting independent contractor income otherwise known as nonemployee compensation If you re self employed income you receive during the year might be reported on the 1099 NEC but Form 1099 MISC is still used to report certain payments of 600 or more you made to other businesses and people This article covers the 1099 MISC

More picture related to Irs Form 1099 Misc Printable

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/1099-misc-software/images/1099-copyA.jpg

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

https://www.irs.gov/instructions/i1099mec

Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New E filing returns

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

How To Fill Out And Print 1099 MISC Forms

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season

Printable Form 1099 Misc For 2021 Printable Form 2023

IRS Form 1099 MISC How To Fill It Right

1099 MISC Form Rellenable Imprimible Descargar Gratis Instrucciones 2020 Mark s Trackside

1099 MISC Form Rellenable Imprimible Descargar Gratis Instrucciones 2020 Mark s Trackside

1099 Misc Form Printable Instructions

2022 1099 MISC IRS Forms Print Template PDF Fillable With Etsy

1099 Misc Printable Template Free Printable Templates

Irs Form 1099 Misc Printable - As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most