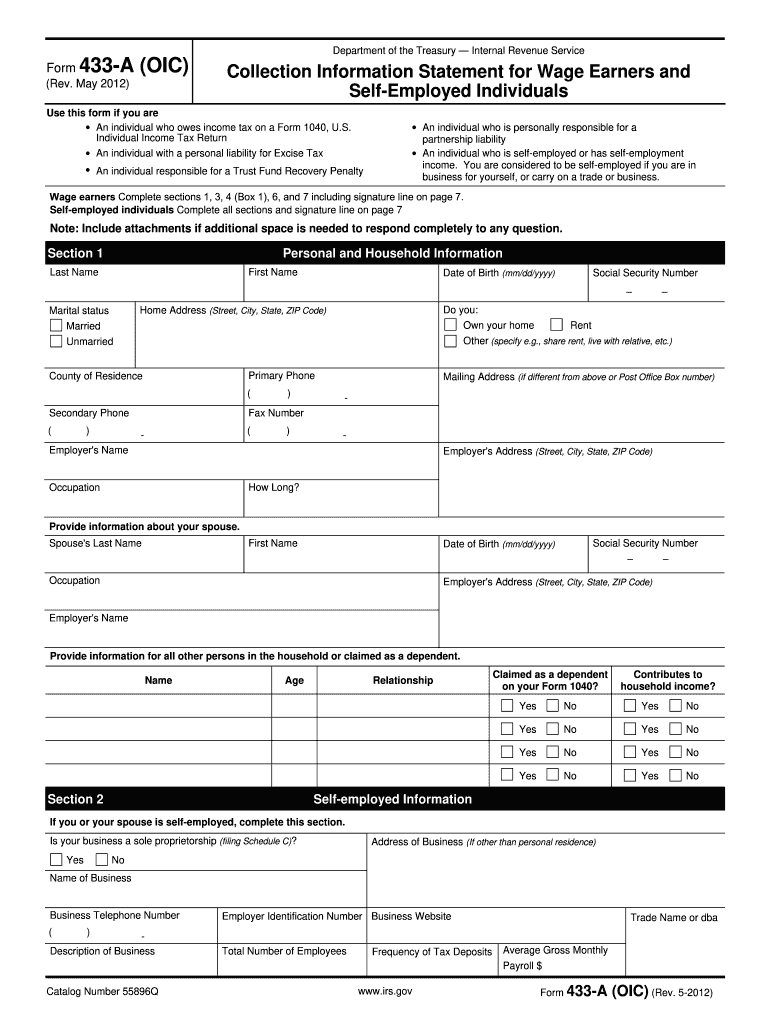

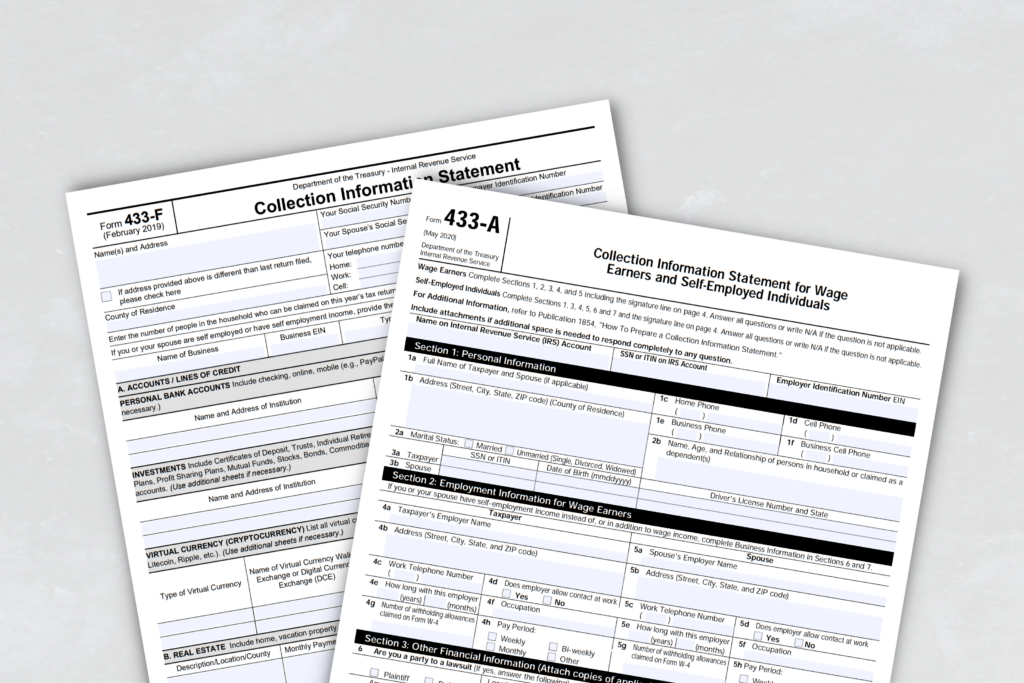

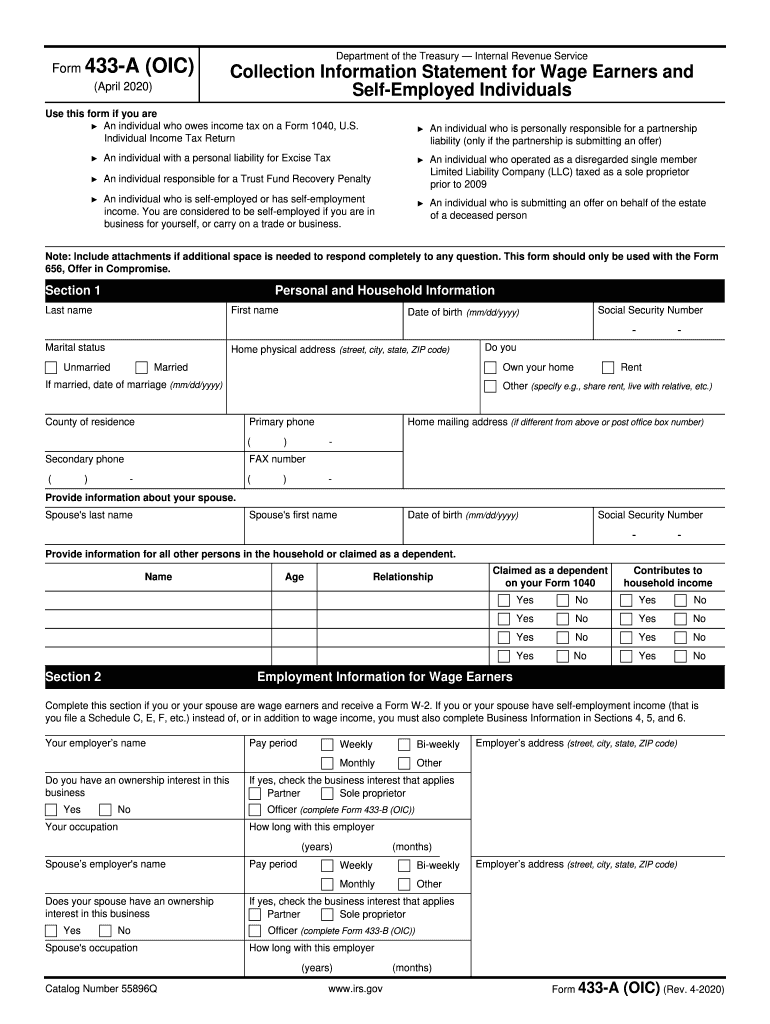

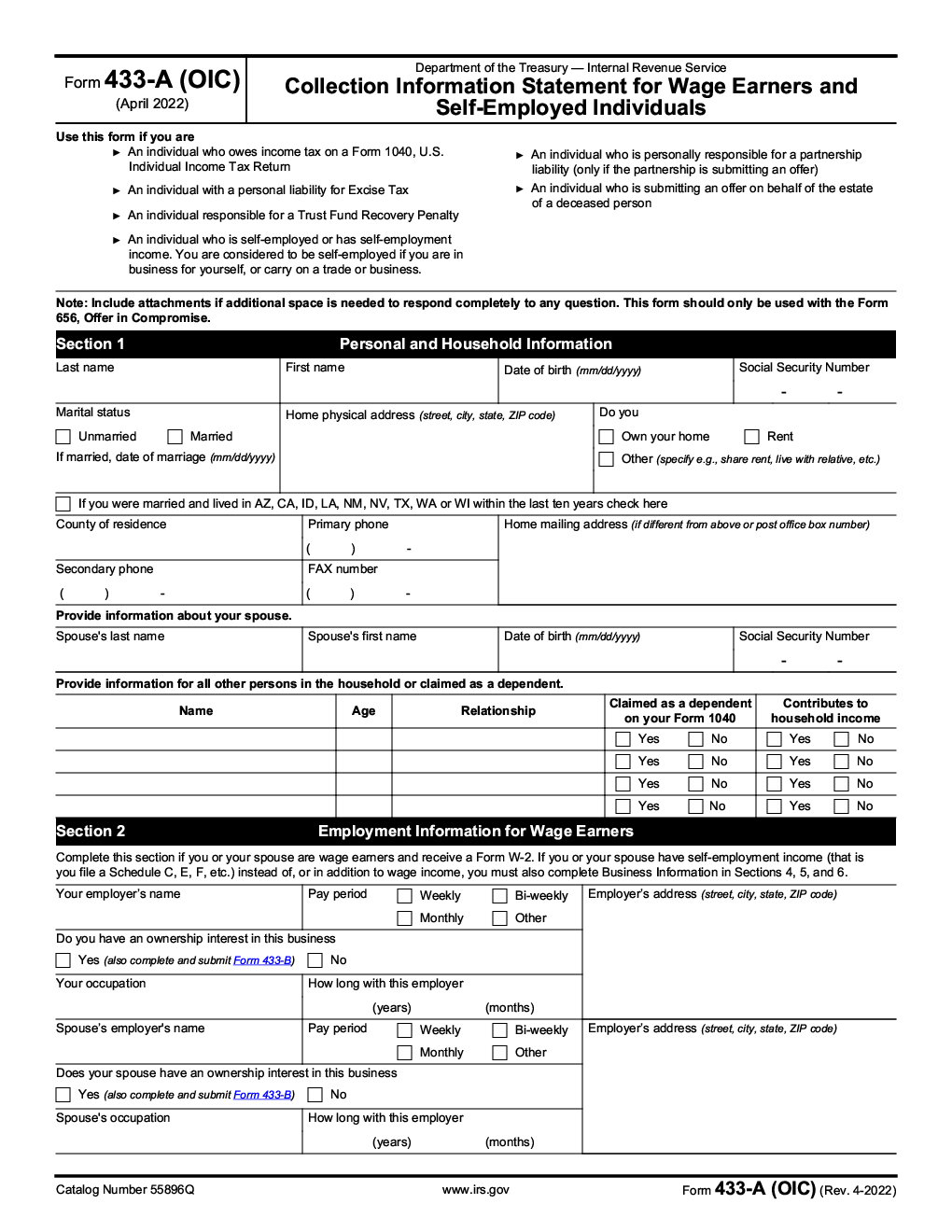

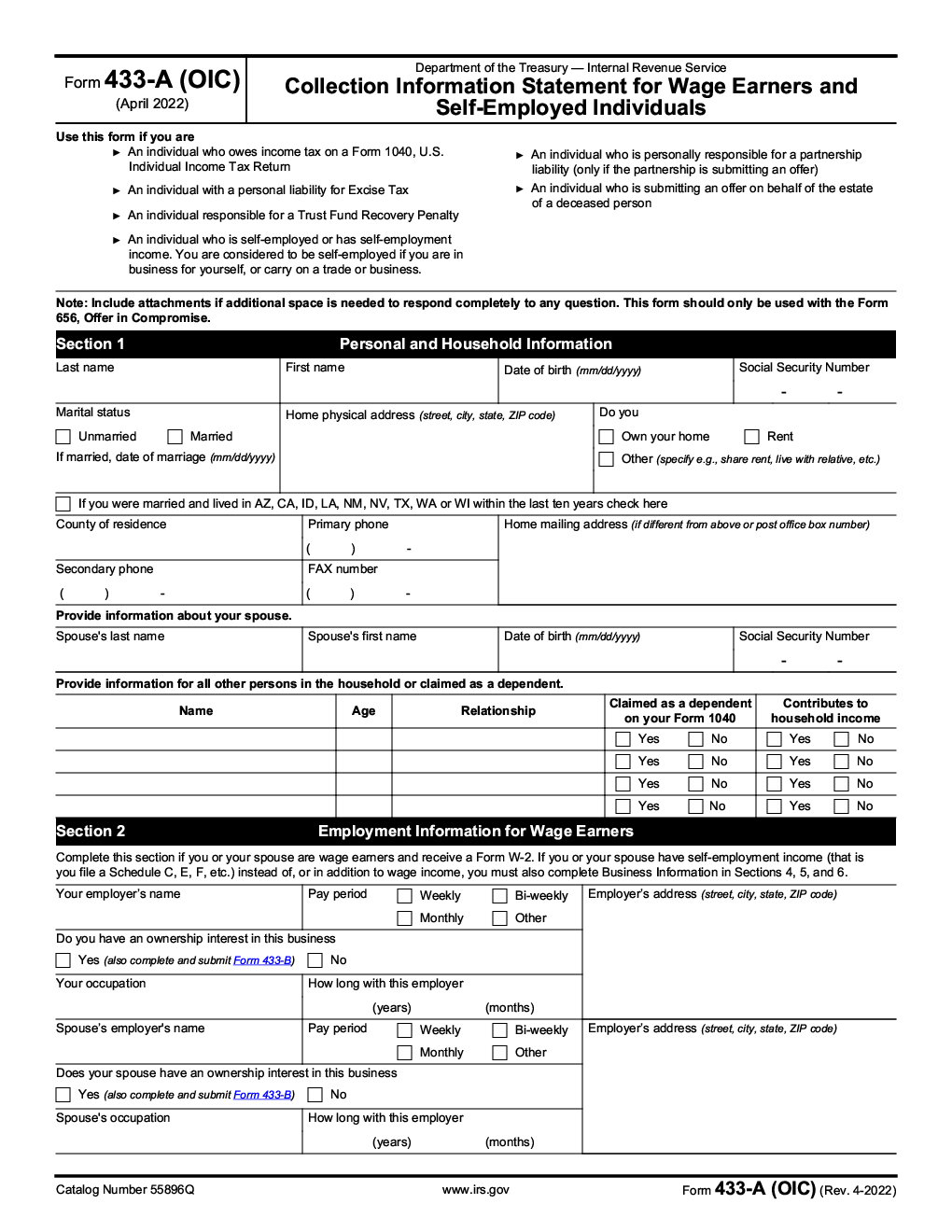

Irs Form 433 A Printable Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

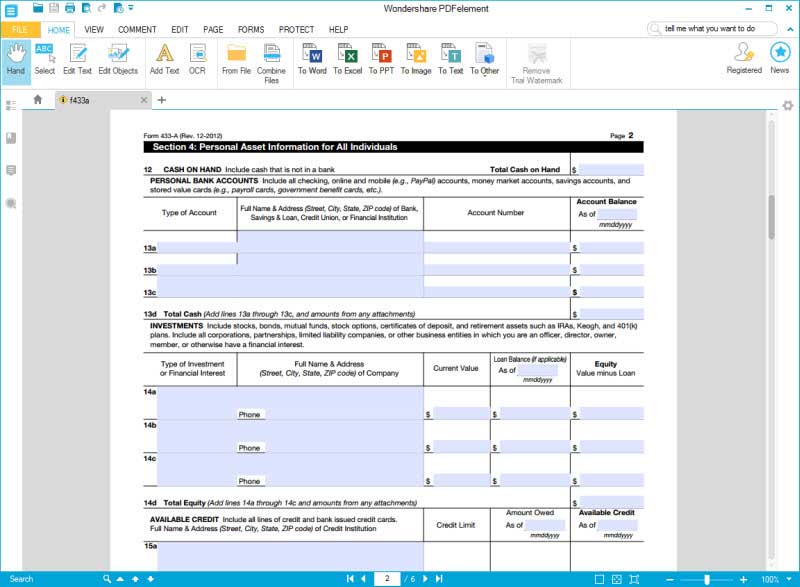

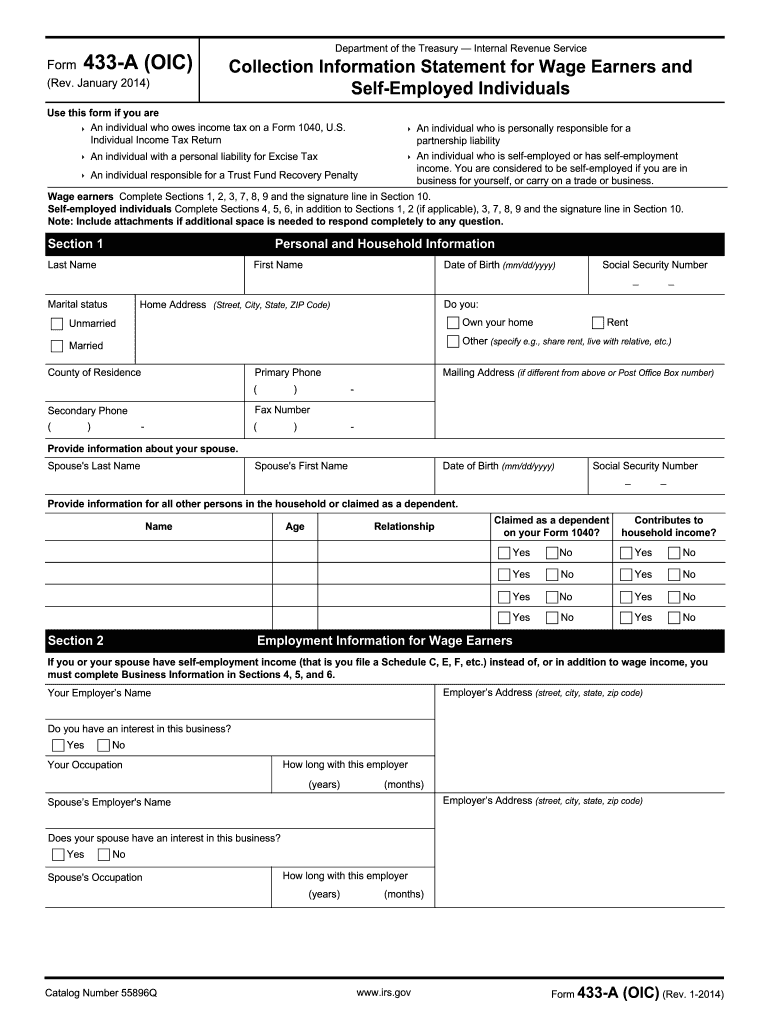

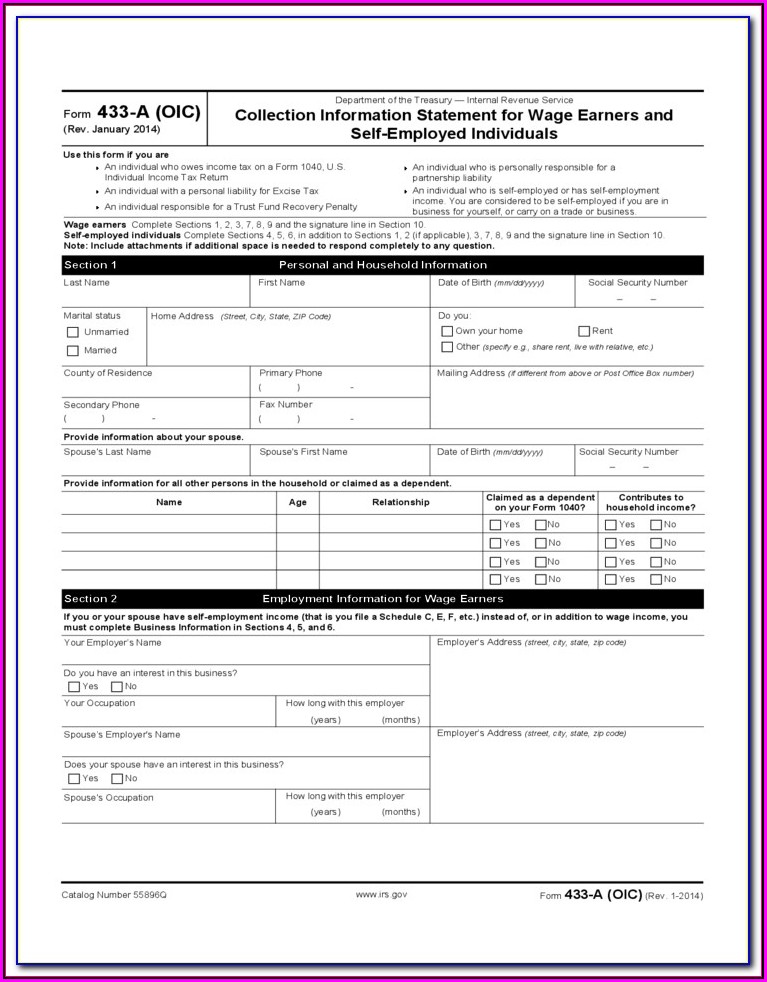

Form Rev 5 2012 Page 3 of 7 Real Estate Enter information about any house condo co op time share etc that you own or are buying Vehicles Enter information about any cars boats motorcycles etc that you own or lease Catalog Number 55896Q www irs gov Form 433 A OIC Rev 5 2012 Form 433 A is used to obtain current financial information necessary for determining how a wage earner or self employed individual can satisfy an outstanding tax liability You may need to complete Form 433 A If you are an individual who owes income tax on Form 1040

Irs Form 433 A Printable

Irs Form 433 A Printable

https://www.pdffiller.com/preview/5/451/5451971/large.png

How To Fill Out Form 433 A OIC 2021 Version Detailed Instructions From IRS 656 Booklet

https://trp.tax/wp-content/uploads/2015/03/IRS_433-A_OIC-1.png

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

https://trp.tax/wp-content/uploads/2015/03/OIC_Sec-3-Form-433-A-OIC-Cash-and-Investments.jpg

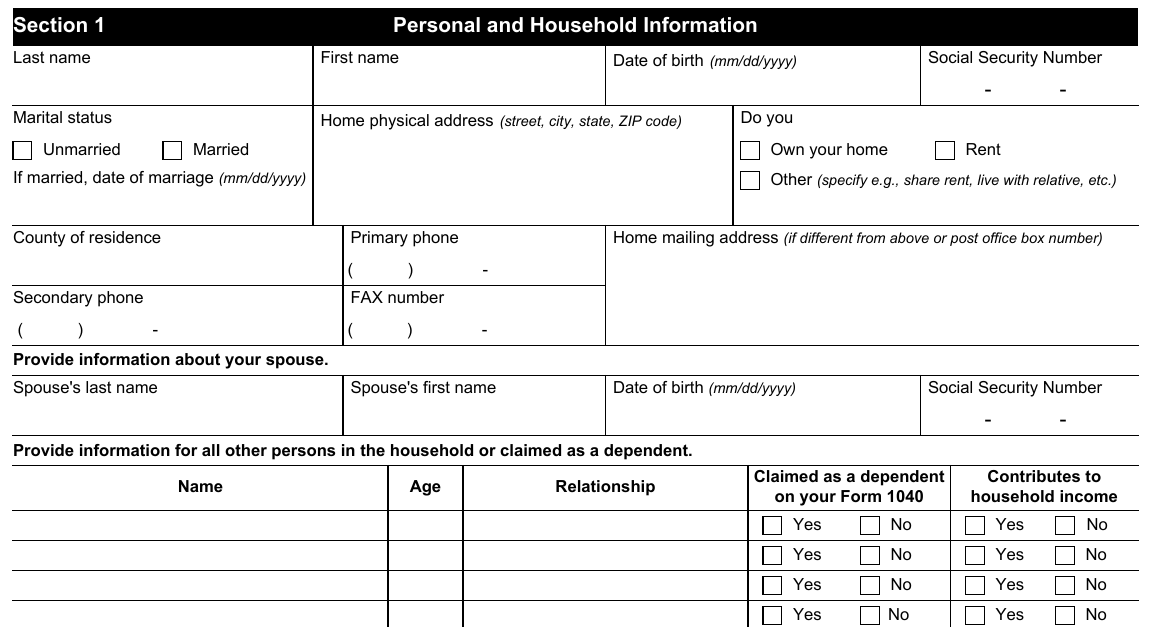

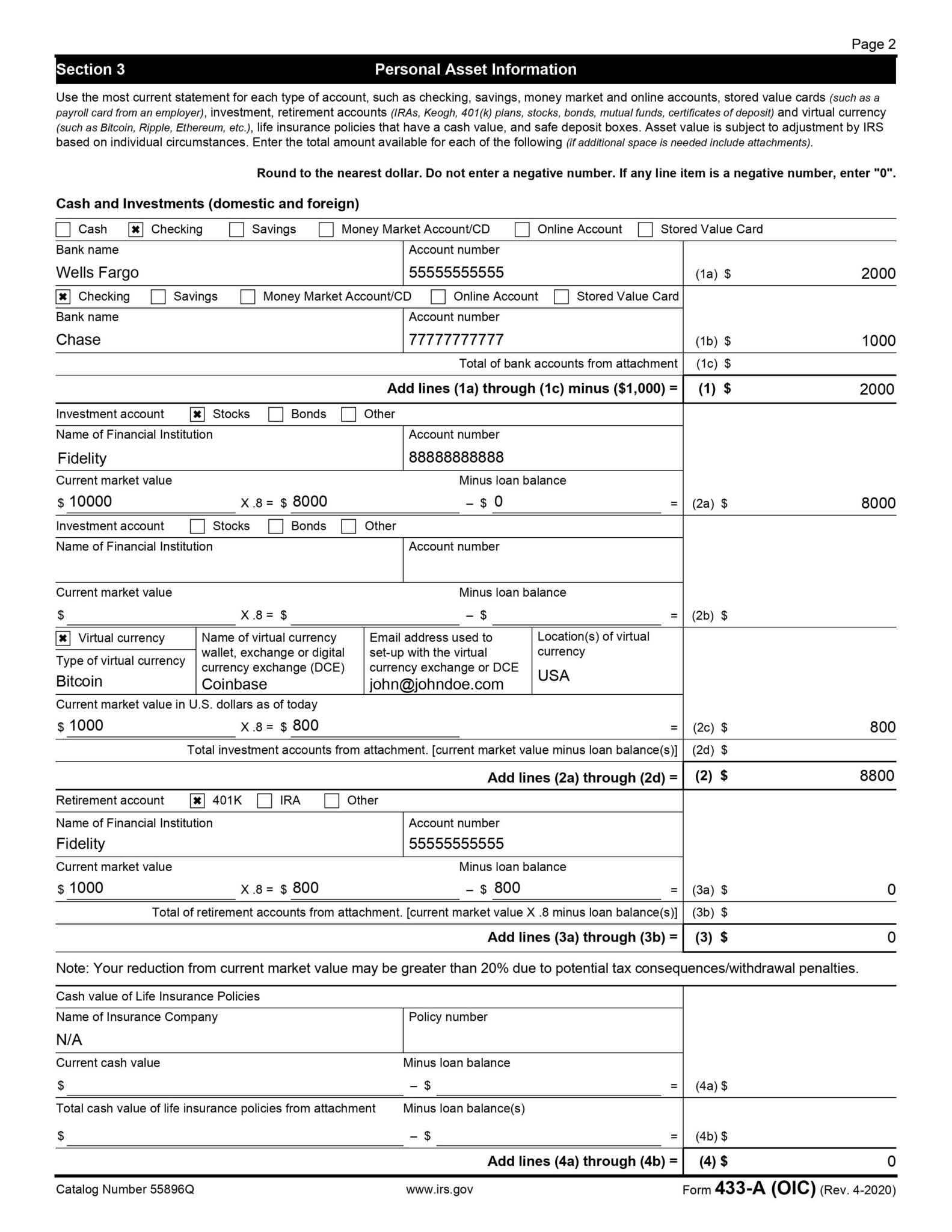

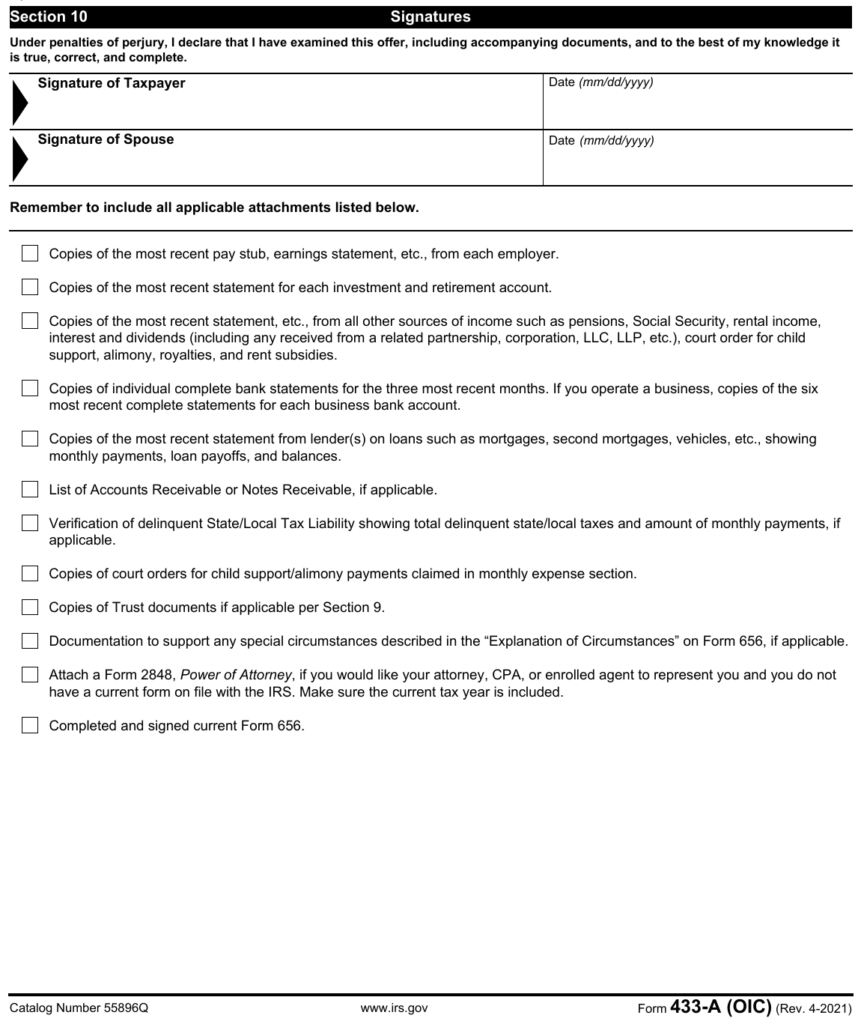

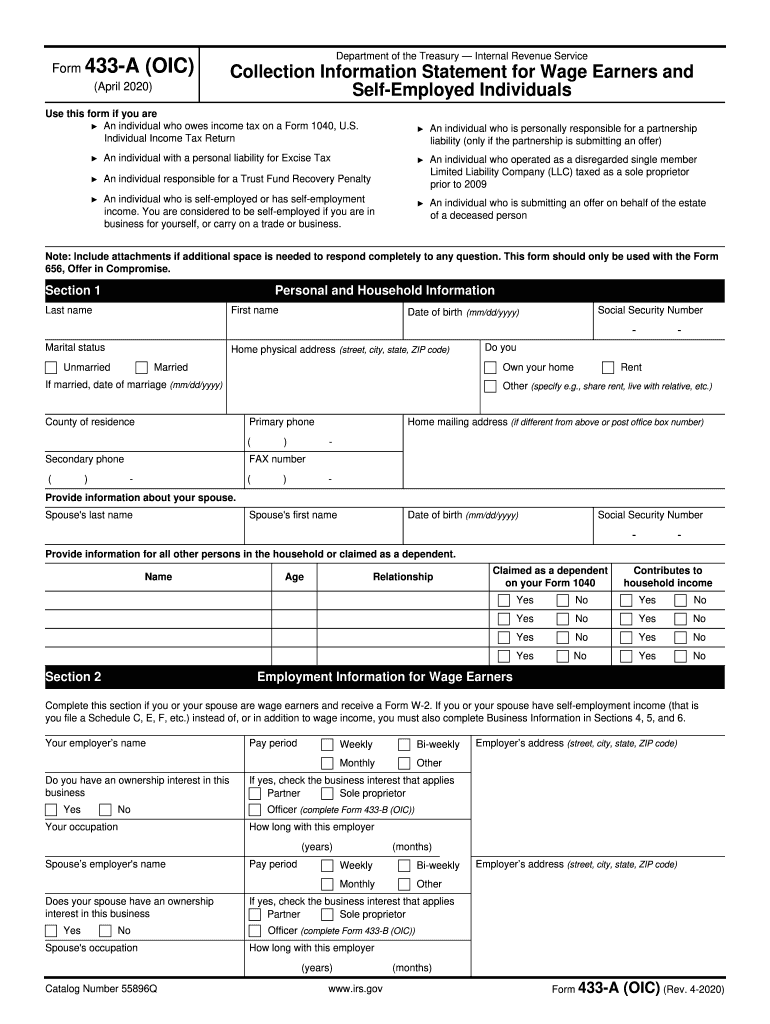

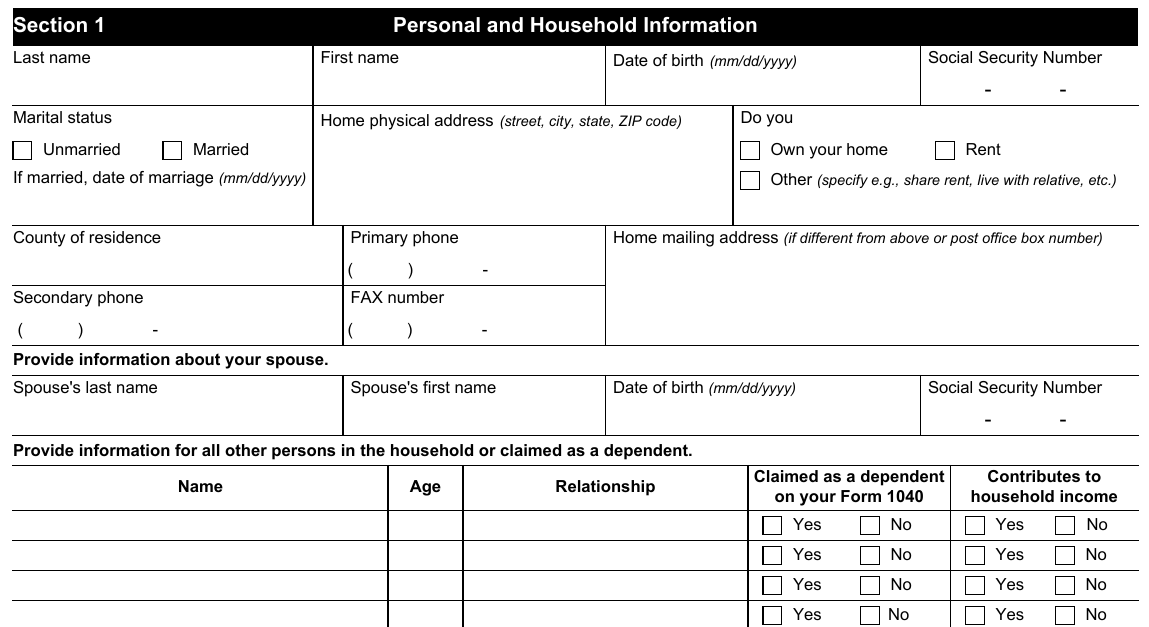

How to Complete Form 433 A OIC Offer In Compromise Personal and Household Information 2 12 Wage Earners Employment Information Section 2 0 43 Personal Assets Information Section 3 0 46 Personal Assets Checking Section 3 1 39 Personal Assets Investments Retirement and Insurance Section 3 2 00 Personal Assets Real Estate Section 3 If you re requesting an installment agreement or similar tax debt management solution from the Internal Revenue Service IRS you ll need to submit Form 433 A Collection Information Statement for Wage Earners and Self Employed Individuals This six page form provides the IRS with detailed information about your financial situation

IRS Form 433 A is a tax form that collects information about your finances including any debts and assets you have The IRS uses this form to determine whether you re able to satisfy an outstanding tax liability Key Takeaways Form 433 A is required for individuals and self employed people who are seeking an offer in compromise with the IRS Form 433 A is a collection information statement for wage earners and self employed individuals This form provides the IRS with a complete overview of your financial situation by gathering details about your assets liabilities income and expenses This information allows the IRS to assess if you qualify for certain tax relief programs If

More picture related to Irs Form 433 A Printable

1995 Form IRS 433 A Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/668/1668891/large.png

How To Fill Out Form 433 A OIC 2021 Version Detailed Instructions From IRS 656 Booklet

https://trp.tax/wp-content/uploads/2015/03/IRS_433-A_OIC-10-861x1024.png

Form 433 How The IRS Assesses The Ability To Pay Tax Debt Traxion Tax

https://traxiontax.com/wp-content/uploads/2022/06/form-433-irs-assesses-ability-pay-tax-debt-1024x683.png

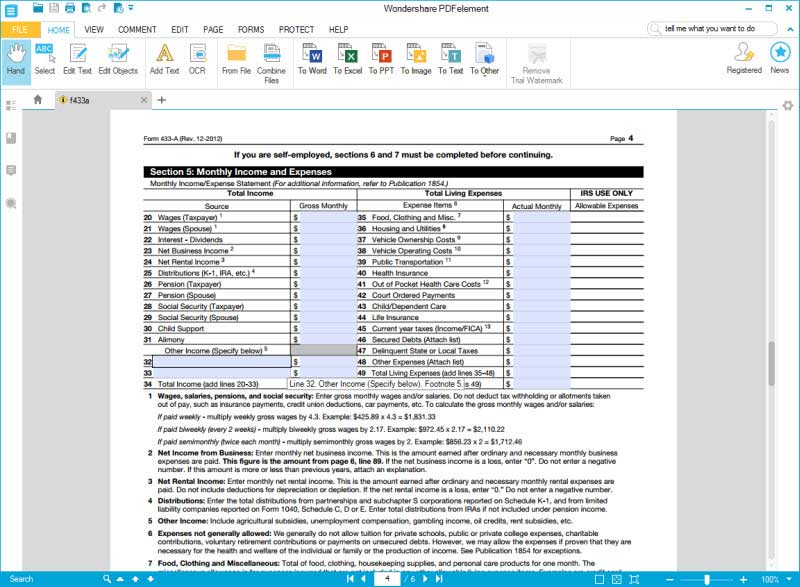

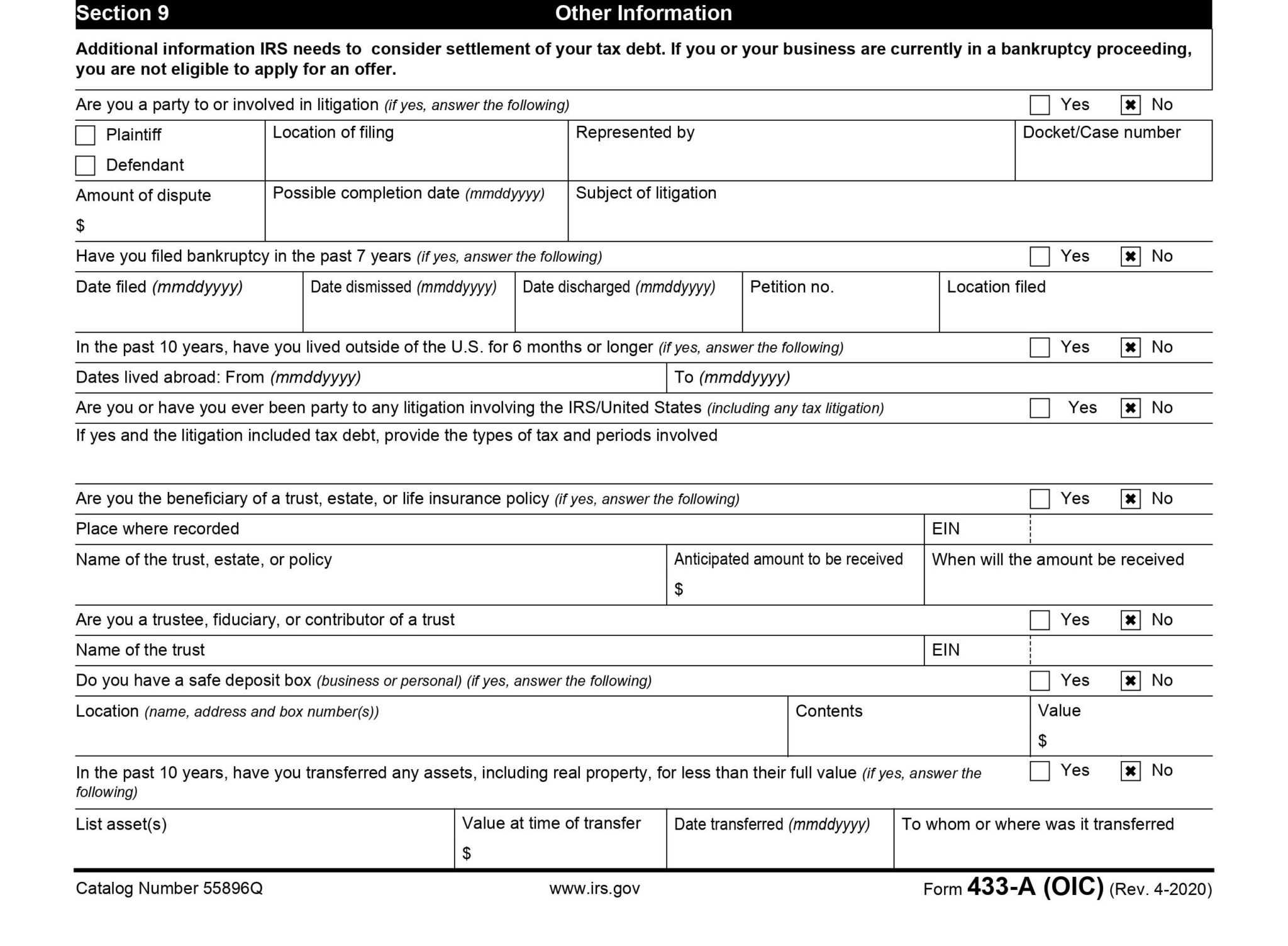

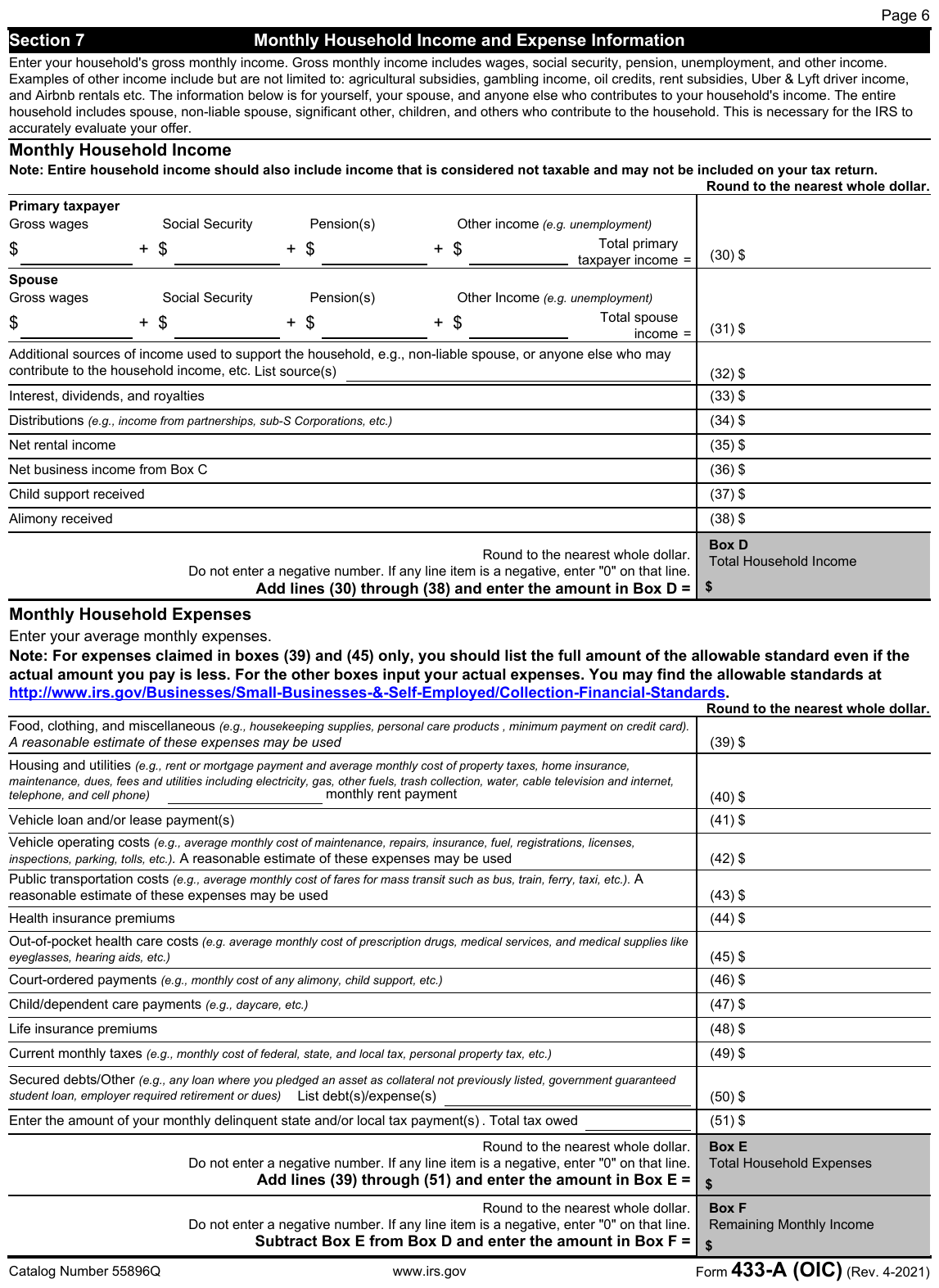

Catalog Number 20312N www irs gov Form 433 A Rev 5 2020 Form 433 A Rev 2 2019 Page 4 If you are self employed sections 6 and 7 must be completed before continuing Section 5 Monthly Income and Expenses Monthly Income Expense Statement For additional information refer to Publication 1854 Total Income The regular tax form 433 A is the long version of the form that allows the IRS to determine how much of a person s tax liability they can reasonably afford to pay Form 433 A OIC is the version of the Collection Information Statement that is used to specifically request an offer in compromise The seven sections of form 433 A include personal

The IRS can use this version of the form to determine how much of a person s tax liability they can afford to pay This form is significantly longer than Form 433 F Form 433 A OIC The tax form 433 A OIC is the Collection Information Statement that specifically relates to an offer in compromise While this version of the form collects Form 433A OIC Guide Filling It Out Completely Updated 4 4 2016 to include the updated IRS Collection Financial Standards Updated 6 17 2016 to include updated 2016 Version of Form 433 A OIC Updated 5 21 2017 to include updated 2017 Version of Form 433 A OIC Updated 06 06 2018 to include updated 2018 Version of Form 433 A OIC Updated 4 3 2019 to include updated 2019 Version of Form 433 A

2020 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/512/562/512562277/large.png

IRS Form 433 A How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-433a-section-5.jpg

https://www.irs.gov/pub/irs-pdf/f433aoi.pdf

Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

https://www.irs.gov/pub/irs-access/f433aoi_accessible.pdf

Form Rev 5 2012 Page 3 of 7 Real Estate Enter information about any house condo co op time share etc that you own or are buying Vehicles Enter information about any cars boats motorcycles etc that you own or lease Catalog Number 55896Q www irs gov Form 433 A OIC Rev 5 2012

IRS Form 433 A How To Fill It Right

2020 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

Form 433 A Collection Information Statement For Wage Earners And Individuals 2013 Free Download

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

Download Form 433 A For Free Page 6 FormTemplate

IRS Form 433 A Collection Information Statement For Wage Earners And Self Employed Individuals

IRS Form 433 A Collection Information Statement For Wage Earners And Self Employed Individuals

2014 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

Irs Form 433 A Printable Printable Forms Free Online

How To Fill Out Form 433 A OIC 2021 Version Detailed Instructions From IRS 656 Booklet

Irs Form 433 A Printable - How to Complete Form 433 A OIC Offer In Compromise Personal and Household Information 2 12 Wage Earners Employment Information Section 2 0 43 Personal Assets Information Section 3 0 46 Personal Assets Checking Section 3 1 39 Personal Assets Investments Retirement and Insurance Section 3 2 00 Personal Assets Real Estate Section 3