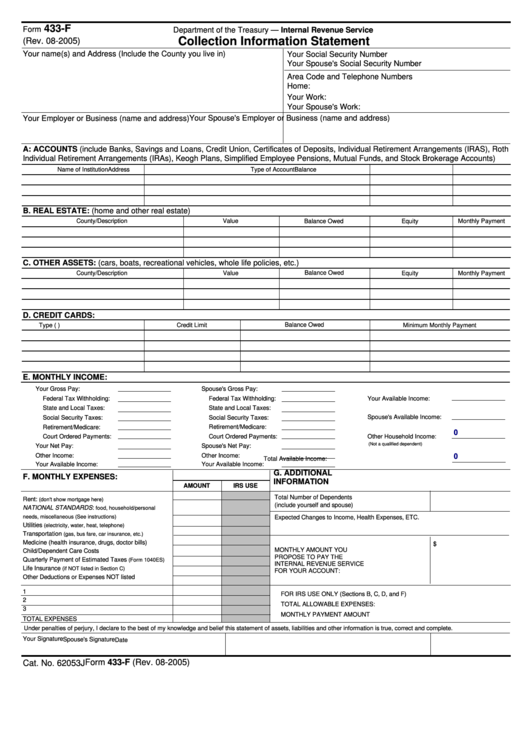

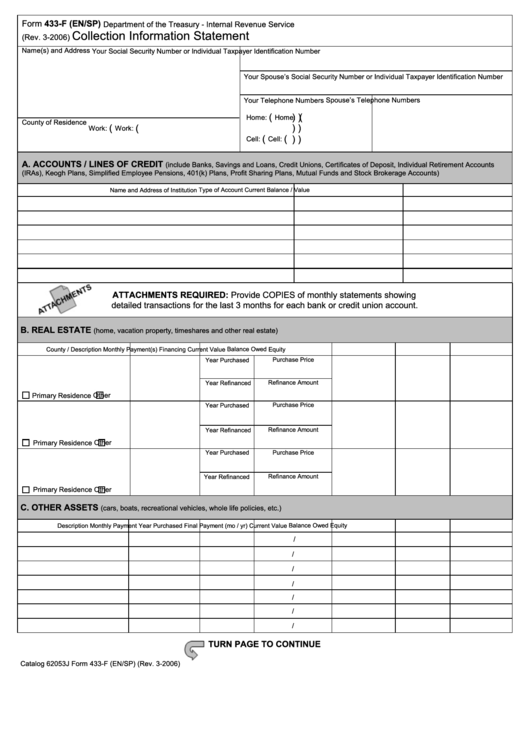

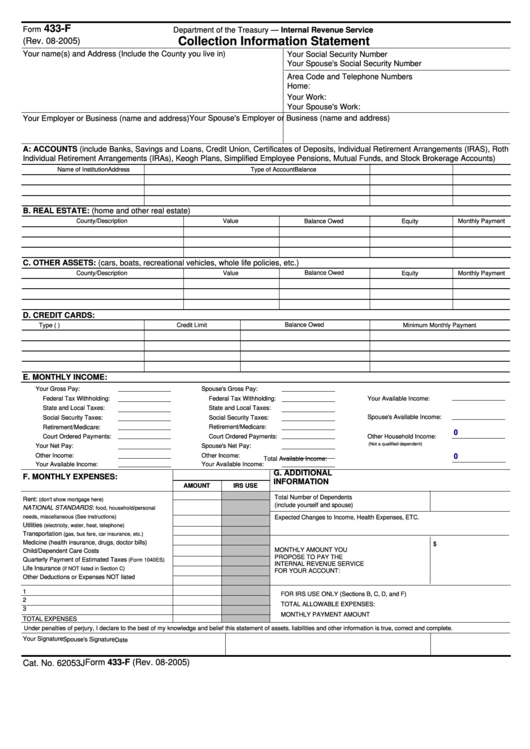

Irs Form 433 F Printable Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

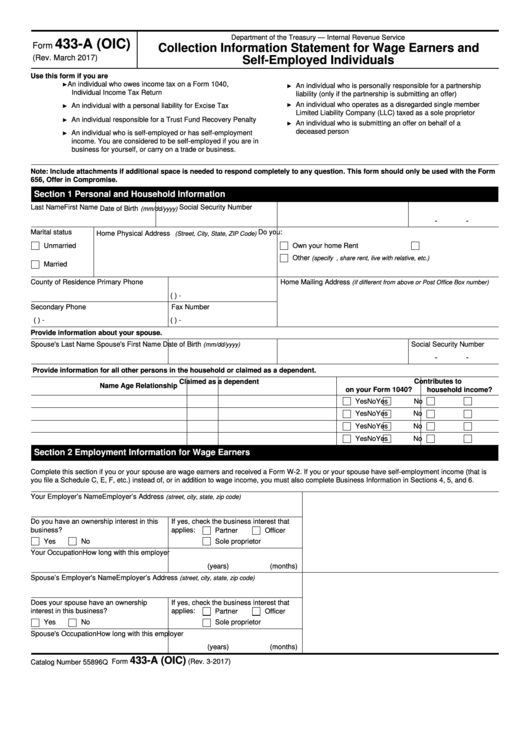

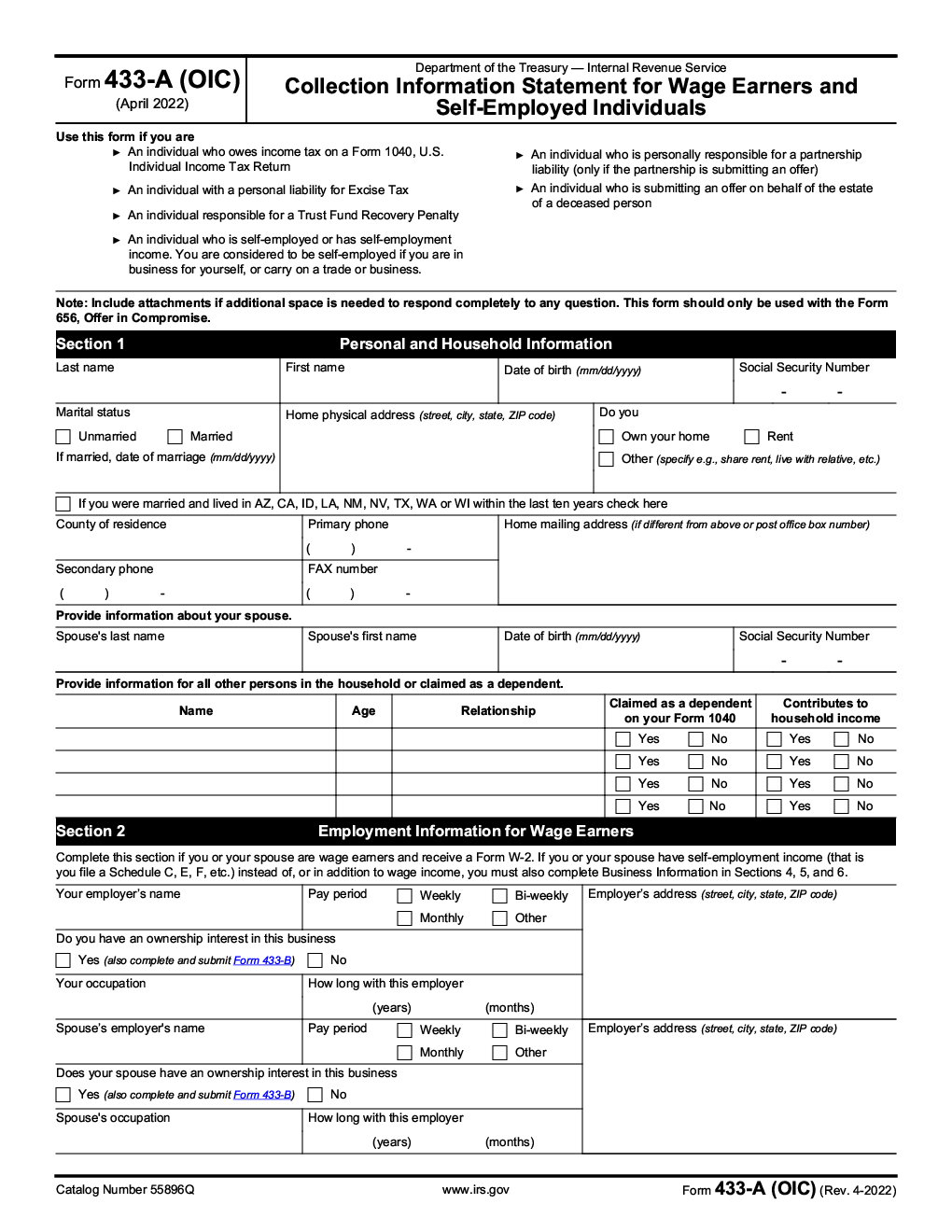

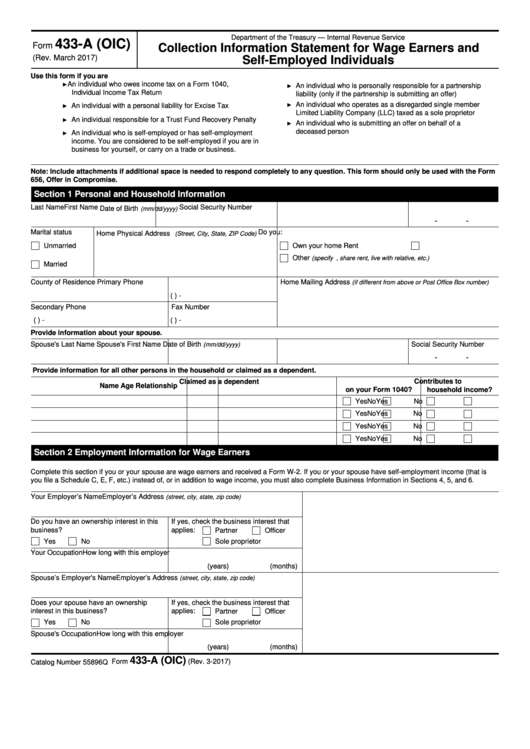

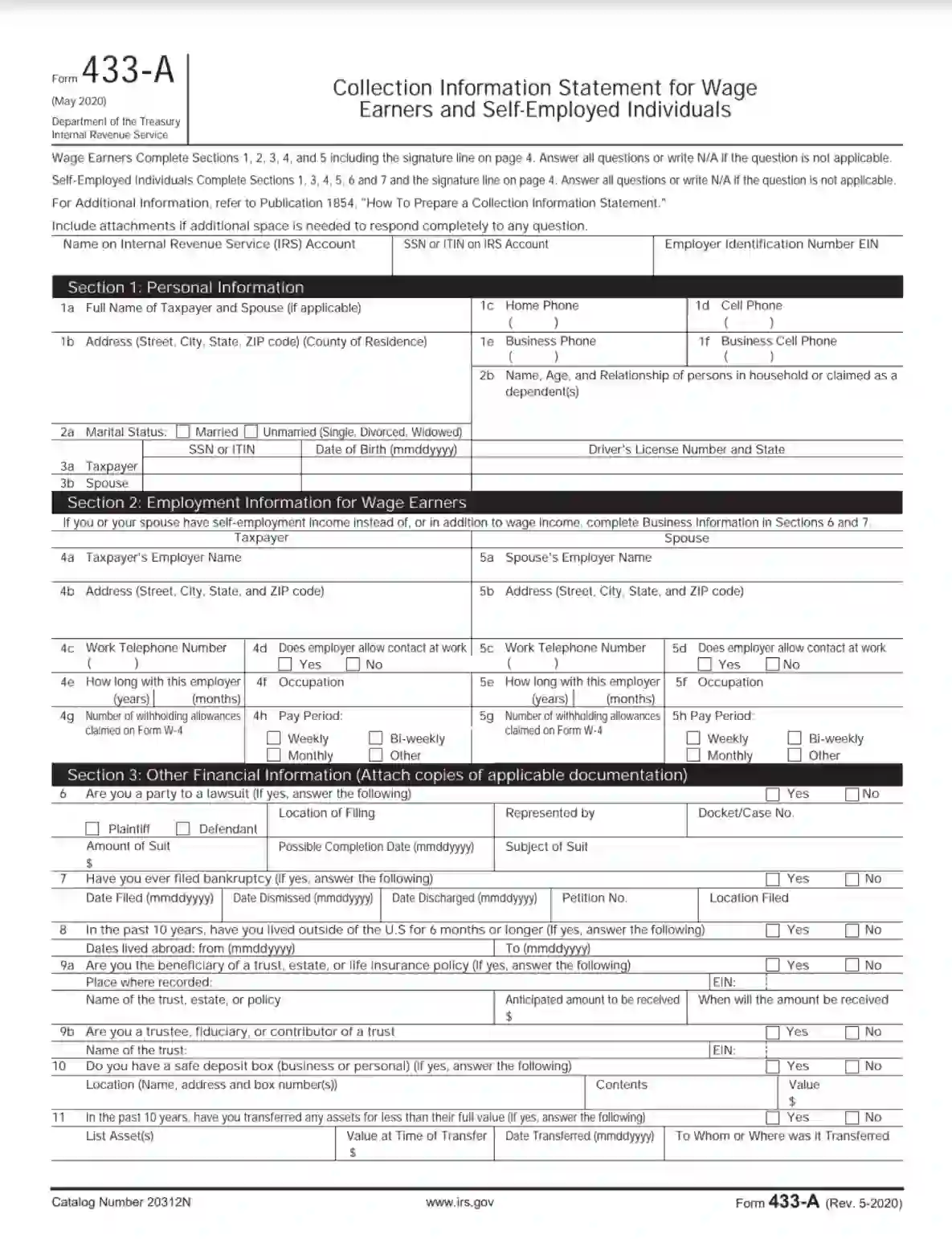

Collection Information Statement for Wage July 2022 Department of the Treasury Earners and Self Employed Individuals Internal Revenue Service Wage Earners Complete Sections 1 2 3 4 and 5 including the signature line on page 4 Answer all questions or write N A if the question is not applicable You can use Form 433 F Collection Information Statement to provide your financial information to the IRS Your Collection Information Statement is needed to determine your eligibility for certain installment agreements currently not collectible status and other tax resolution options that the IRS has available based on your ability to pay

Irs Form 433 F Printable

Irs Form 433 F Printable

https://data.formsbank.com/pdf_docs_html/249/2499/249903/page_1_thumb_big.png

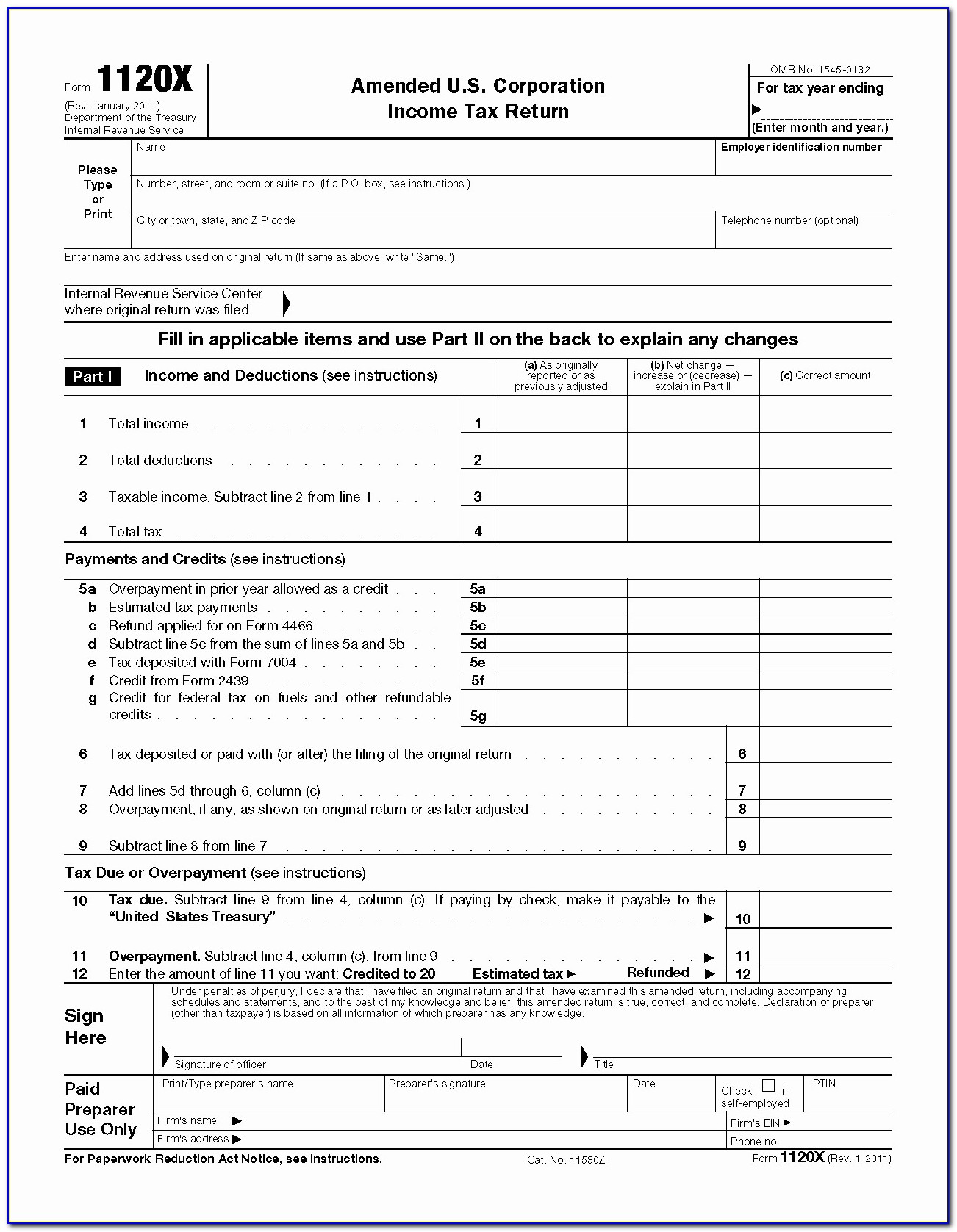

Irs Form 433 A Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/286/2862/286295/page_1_thumb_big.png

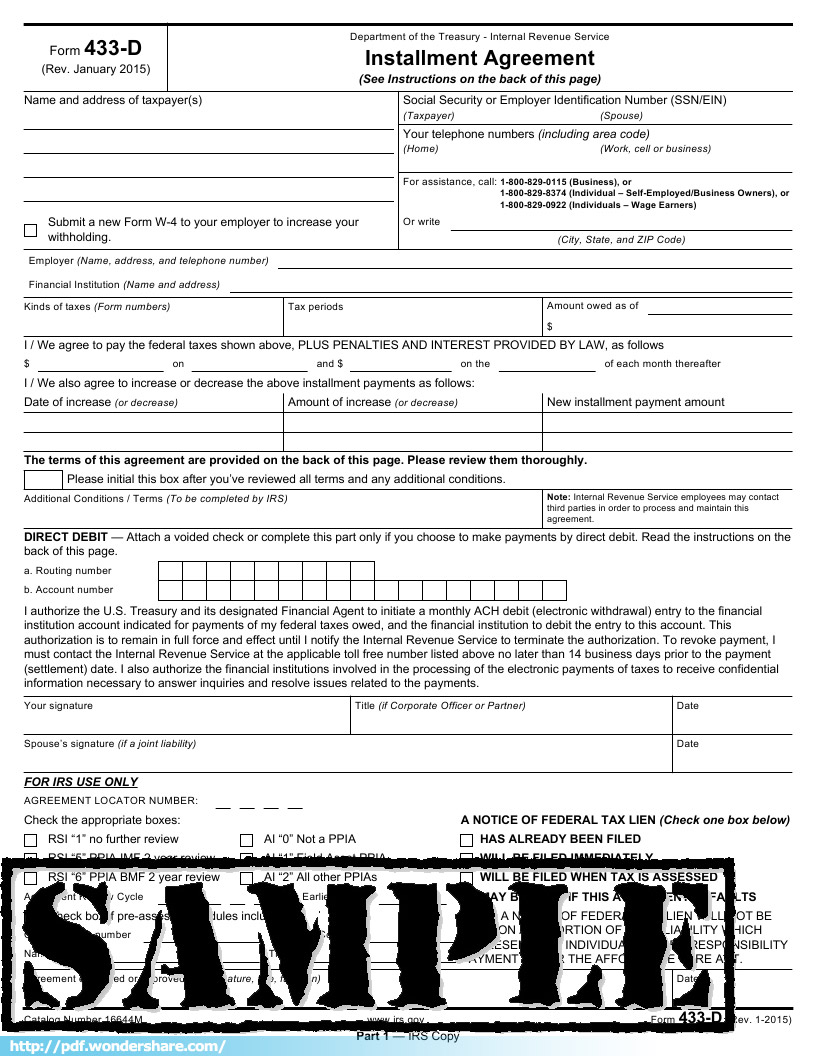

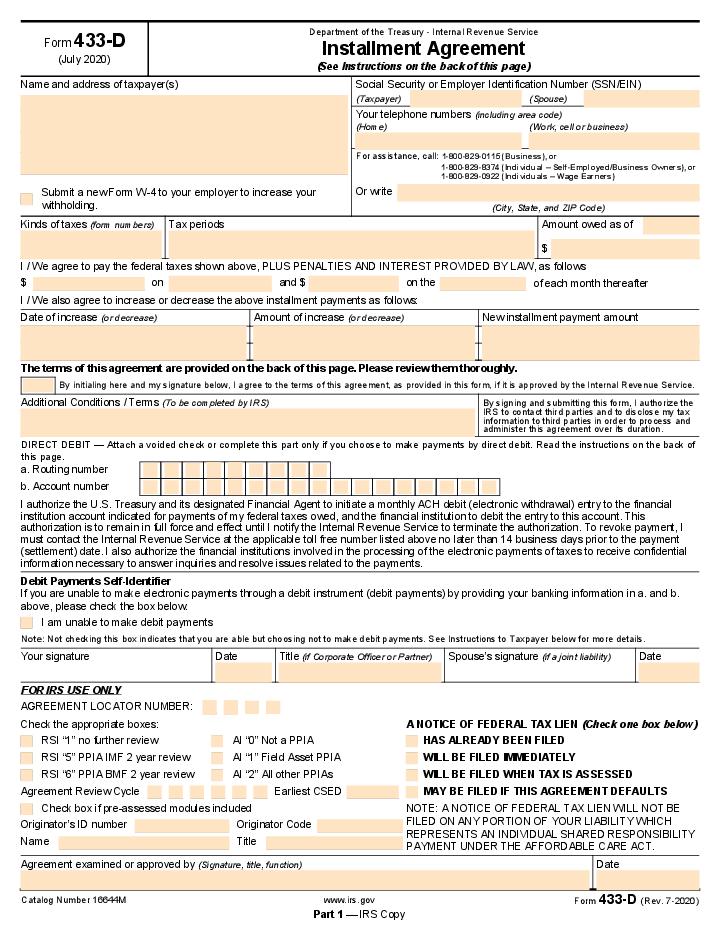

Irs Form 433 D Printable Read iesanfelipe edu pe

https://data.formsbank.com/pdf_docs_html/291/2917/291734/page_1_thumb_big.png

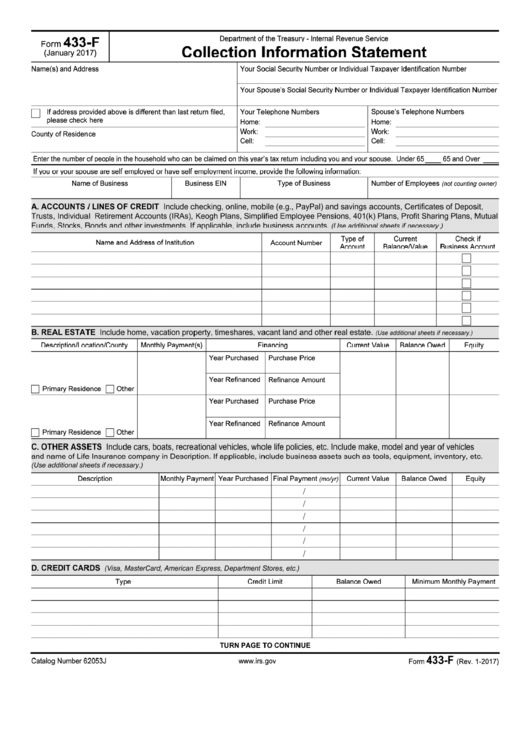

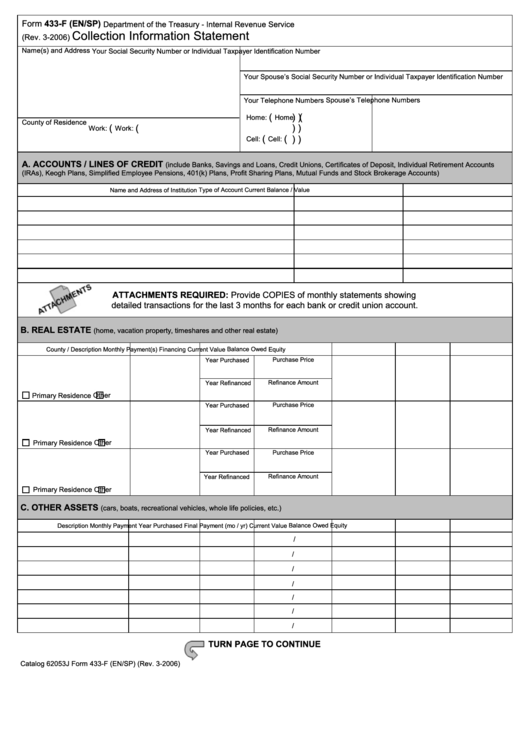

You may also have to file Form 433 F if your tax liability exceeds the 50 000 mark and you want to avoid making payments from your bank account However filing this form is optional if the initial downpayment pushes you below the 50 000 threshold Sometimes taxpayers with tax liabilities ranging from 25 000 to 50 000 must fill out this Form 433 F Collection Information Statement is one of the forms the IRS uses to collect financial information from people with taxes owed It shows the IRS the taxpayer s ability to pay monthly cash flow The IRS uses the information on this form to determine eligibility for payment plans and uncollectible status among other resolutions

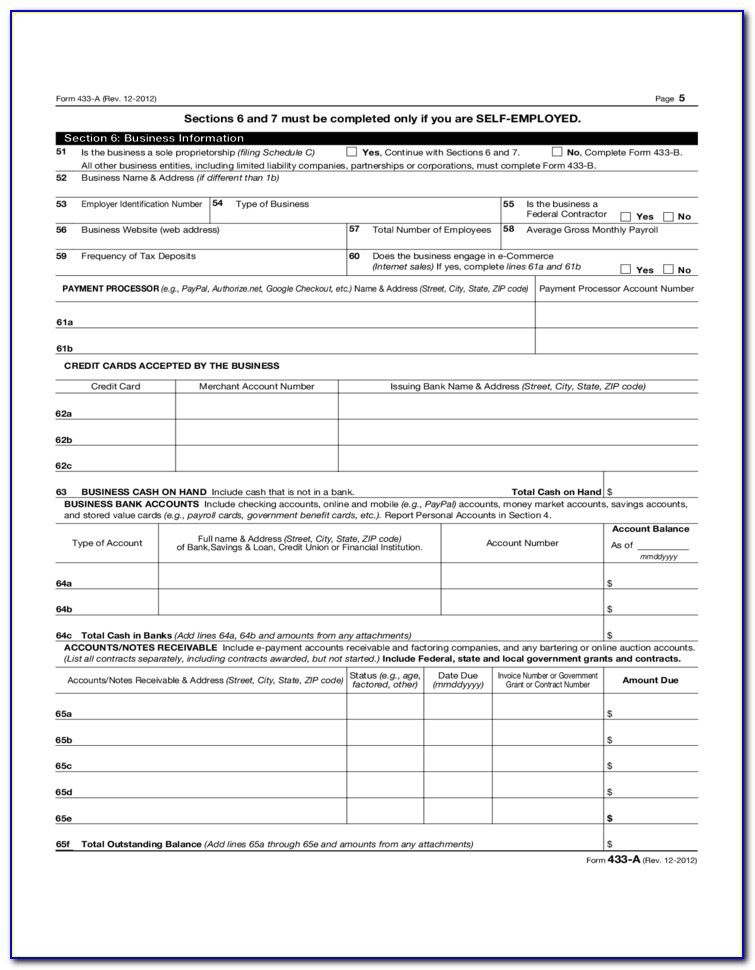

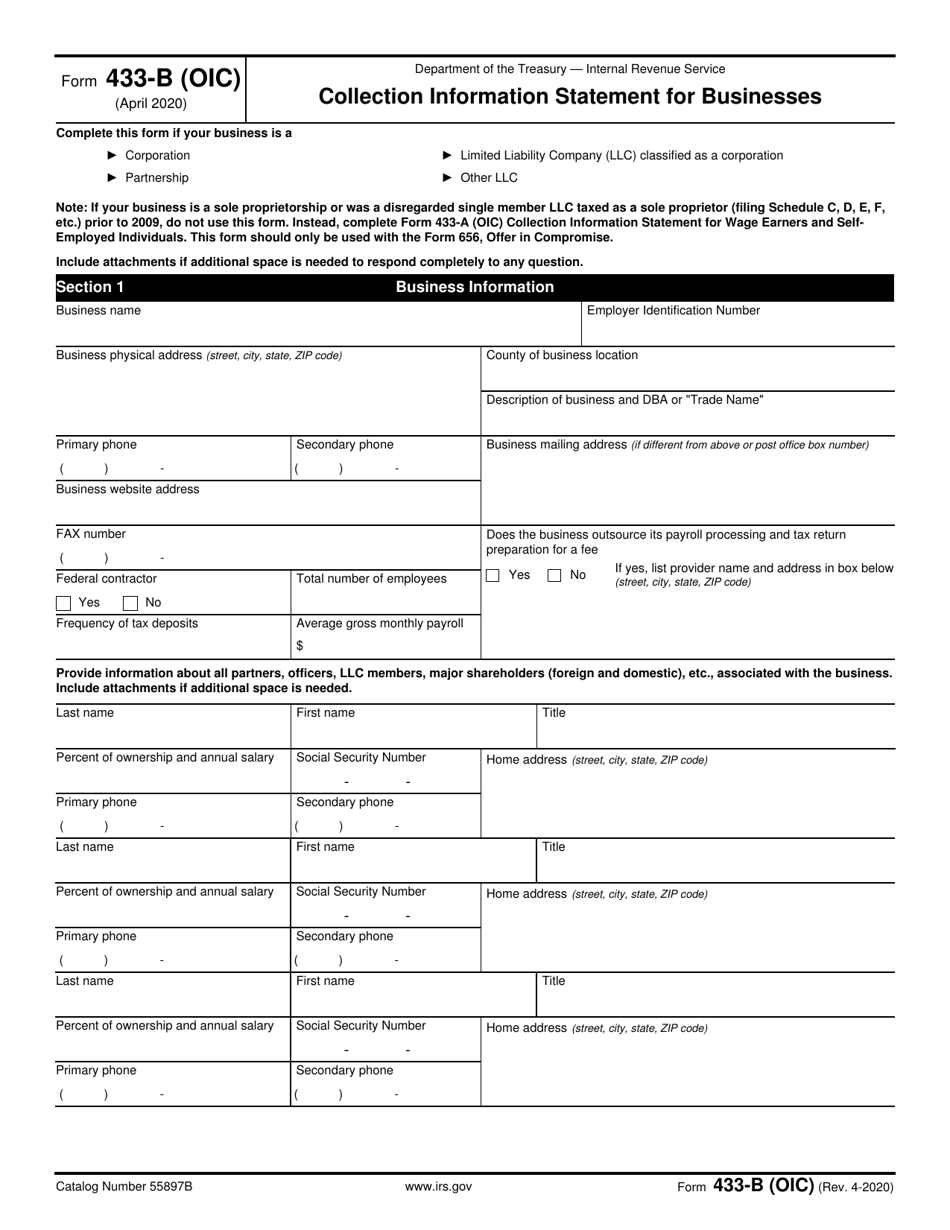

The IRS may ask you to file any past due returns The IRS may ask you to complete Form 433 A Collection Information Statement for Wage Earners and Self Employed Individuals or Form 433 F Collection Information Statement and or Form 433 B Collection Information Statement for Businesses before making any collection decision Form 433 F Collection Information Statement to develop an in depth understanding of a taxpayer s financial situation This form helps the IRS to determine your eligibility for different types of To obtain the best terms possible for your payment plan you need to ensure that you fill out this form correctly

More picture related to Irs Form 433 F Printable

Irs Form 433 D Printable

https://pdfimages.wondershare.com/images/templates/241-form-433-d-f433d.jpg

IRS Form 433 A Collection Information Statement For Wage Earners And Self Employed Individuals

https://blanker.org/files/images/form-433aoi.png

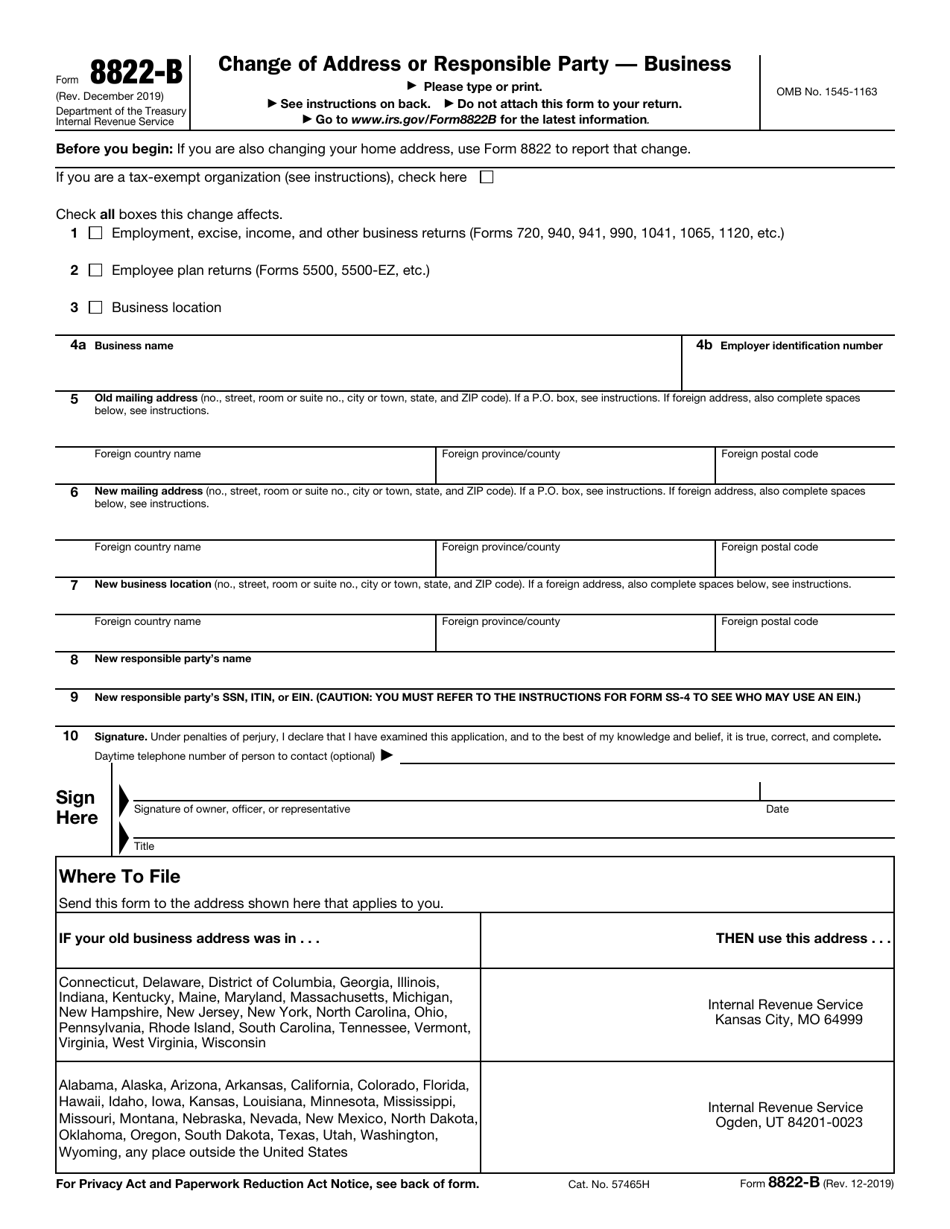

Printable Irs Form 8822 B Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2084/20840/2084068/irs-form-8822-b-change-of-address-or-responsible-party-business_print_big.png

Form 433 F Rev 6 2012 Department of the Treasury Internal Revenue Service Collection Information Statement Enter the number of people in the household who can be claimed on this year s tax return including you and your spouse under 65 65 and over Catalog 62053J TURN PAGE TO CONTINUE Form 433 F Rev 6 2012 Catalog Number 55896Q www irs gov Form 433 A OIC Rev 4 2023 Form 433 A OIC April 2023 Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

IRS Form 433 F Collection Information Statement is used to determine taxpayer s ability to pay the IRS Learn more from the tax experts at H R Block In most cases you can file Form 433 F but in certain circumstances the IRS may request that you complete Form 433 A which asks for more detailed information than the 433 F The IRS Form 433 F also known as the Collection Information Statement plays a pivotal role in IRS collections If you re swimming in tax debt or have been contacted by IRS revenue officers this form is your lifeline

Form 433 F Pdf Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/179/1792/179279/page_1_thumb_big.png

Irs Form 433 F Instructions Form Resume Examples qlkmd3rOaj

https://www.viralcovert.com/wp-content/uploads/2018/11/irs-form-433-f-instructions.jpg

https://www.irs.gov/pub/irs-utl/f433f.pdf

Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

https://www.irs.gov/pub/irs-pdf/f433a.pdf

Collection Information Statement for Wage July 2022 Department of the Treasury Earners and Self Employed Individuals Internal Revenue Service Wage Earners Complete Sections 1 2 3 4 and 5 including the signature line on page 4 Answer all questions or write N A if the question is not applicable

Irs Form 433 D Improve Tax Return Accuracy AirSlate

Form 433 F Pdf Printable Printable Forms Free Online

Irs Form 3911 Printable

Aia Document G704 Form Form Resume Examples VX5JqbLDjv

IRS Form 433 A Fill Out Printable PDF Forms Online

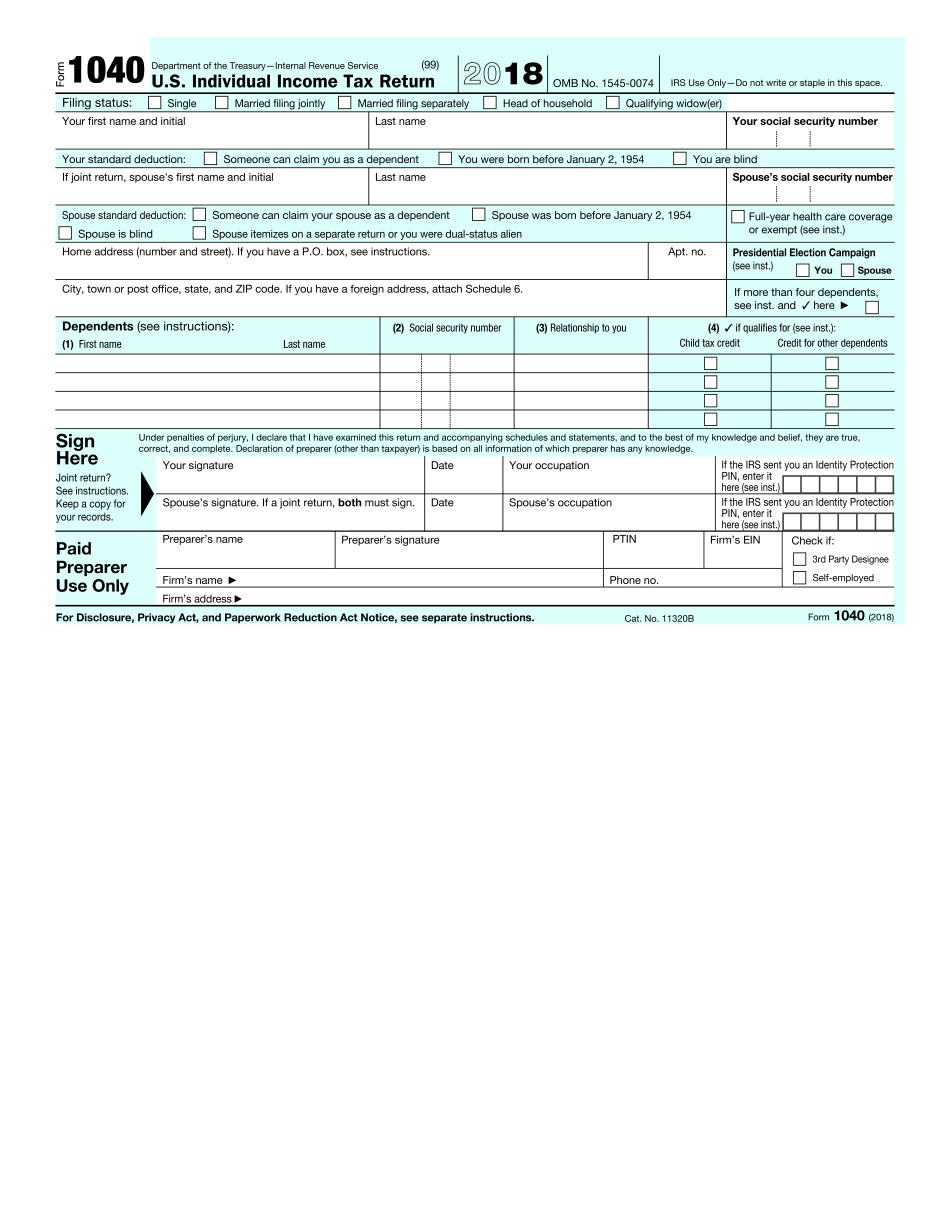

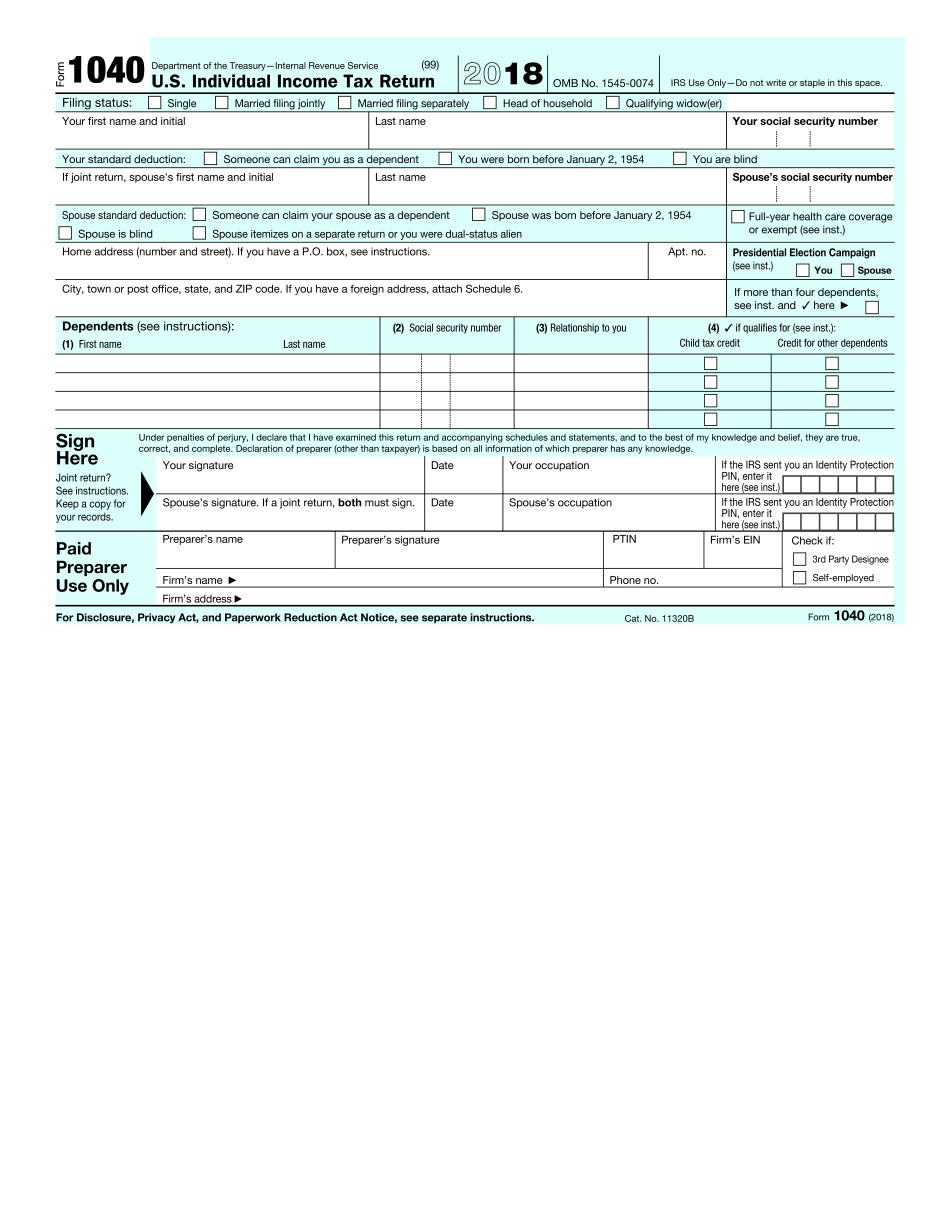

Irs 1040 Form Printable

Irs 1040 Form Printable

Form 433 F Pdf Printable Printable Forms Free Online

Form 433 F Printable Printable World Holiday

Fillable 433 Irs Form Printable Forms Free Online

Irs Form 433 F Printable - You may also have to file Form 433 F if your tax liability exceeds the 50 000 mark and you want to avoid making payments from your bank account However filing this form is optional if the initial downpayment pushes you below the 50 000 threshold Sometimes taxpayers with tax liabilities ranging from 25 000 to 50 000 must fill out this