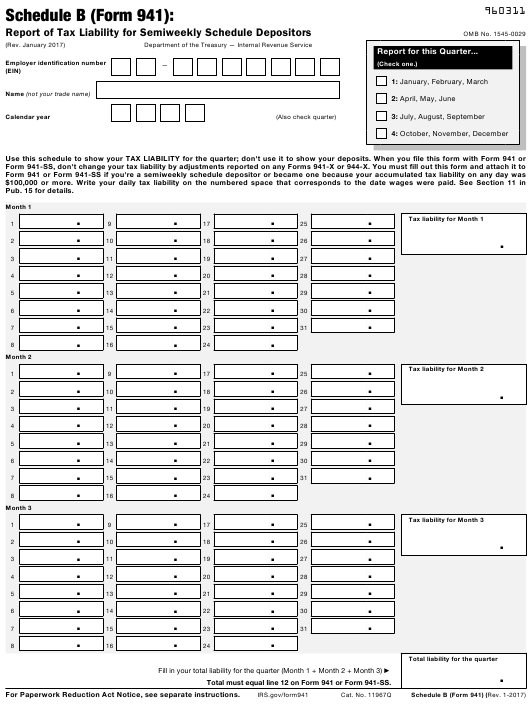

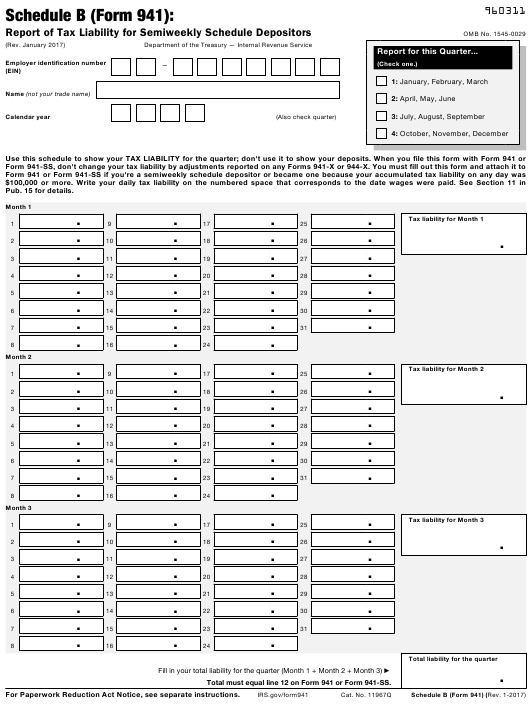

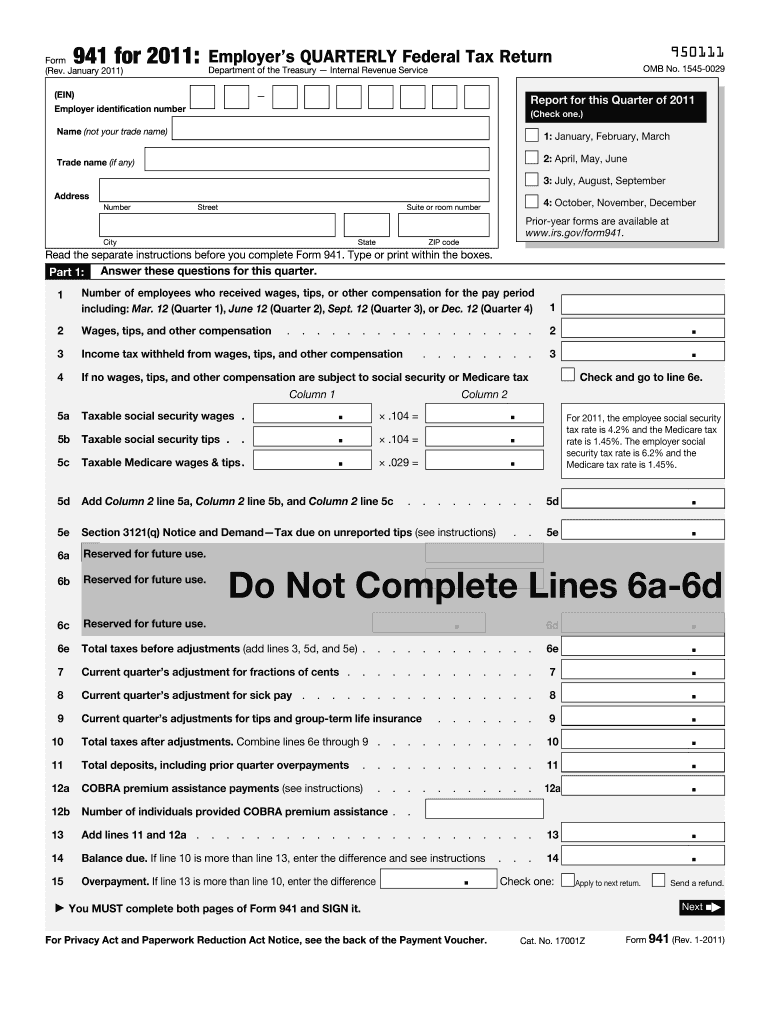

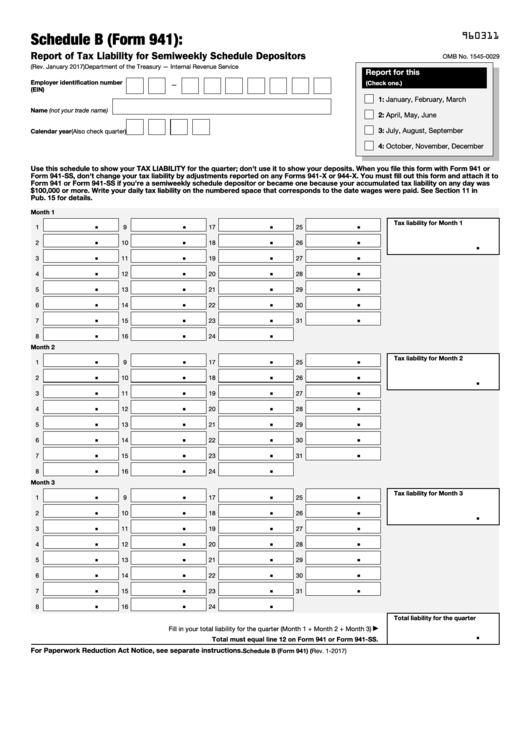

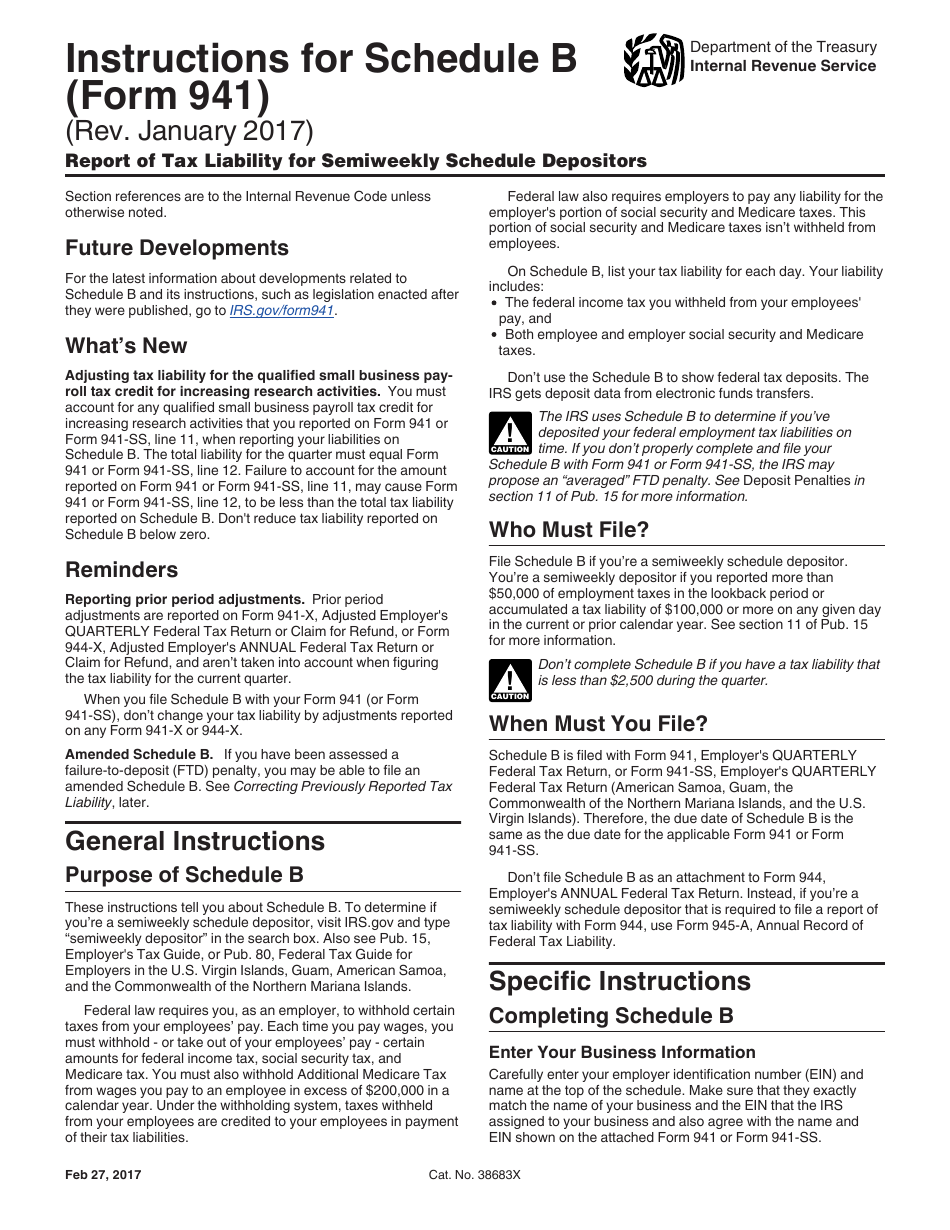

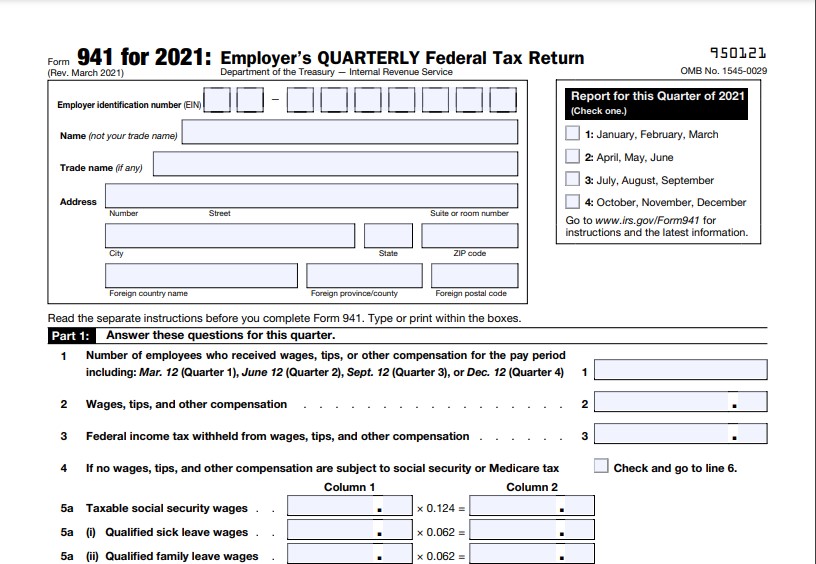

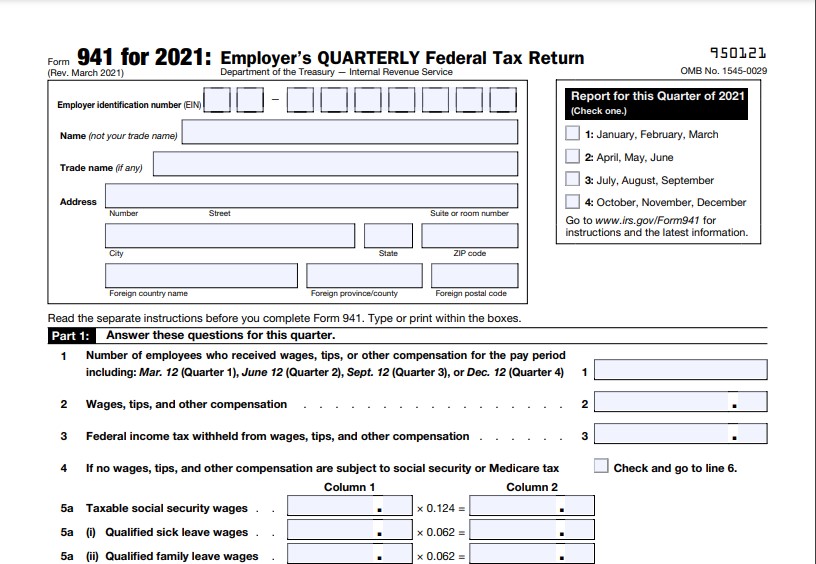

Irs Form 941schedule B Printable Schedule B is filed with Form 941 or Form 941 SS References to Form 941 Employer s QUARTERLY Federal Tax Return in these instructions also apply to Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of Feb 22 2023 the Northern Mariana Islands and the U S Virgin Islands unless otherwise noted

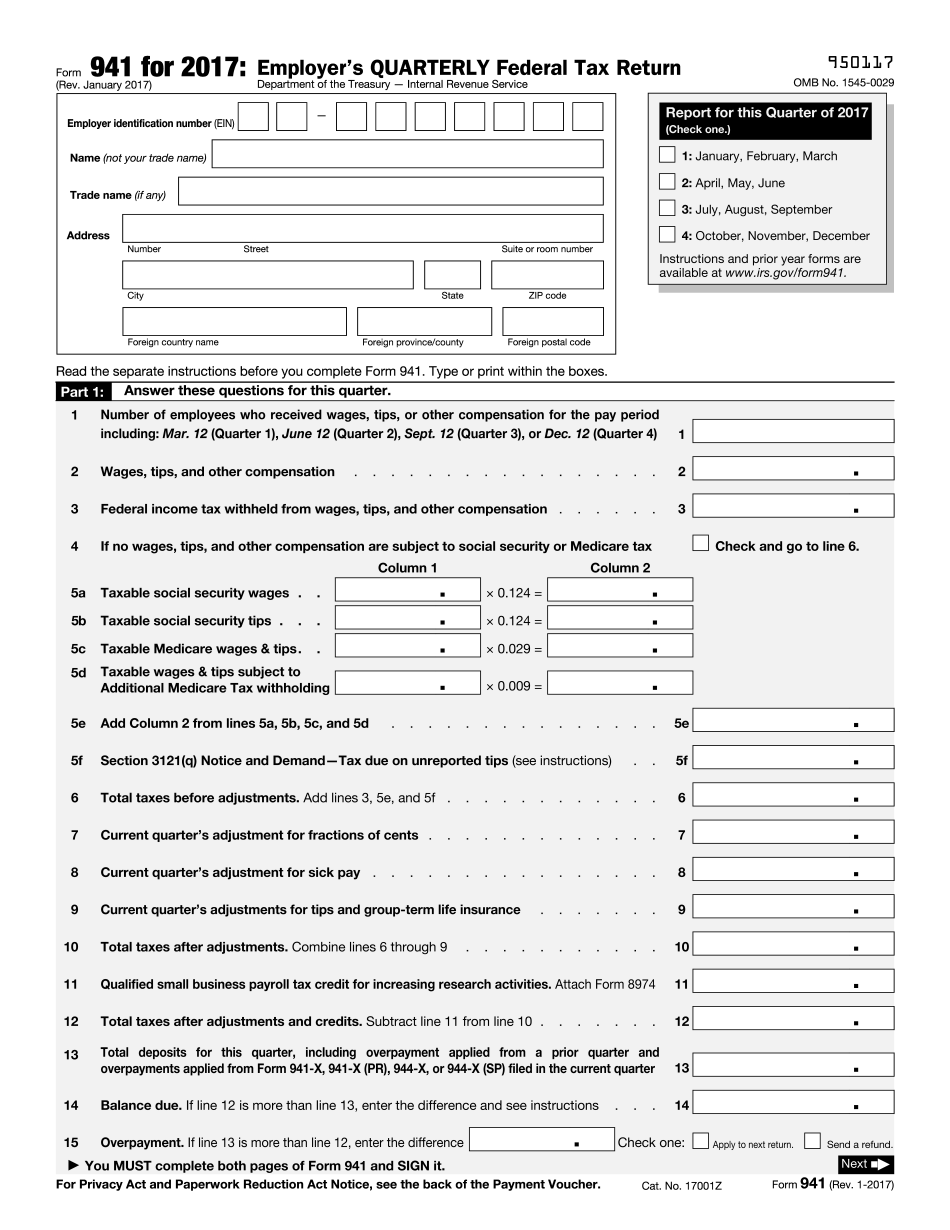

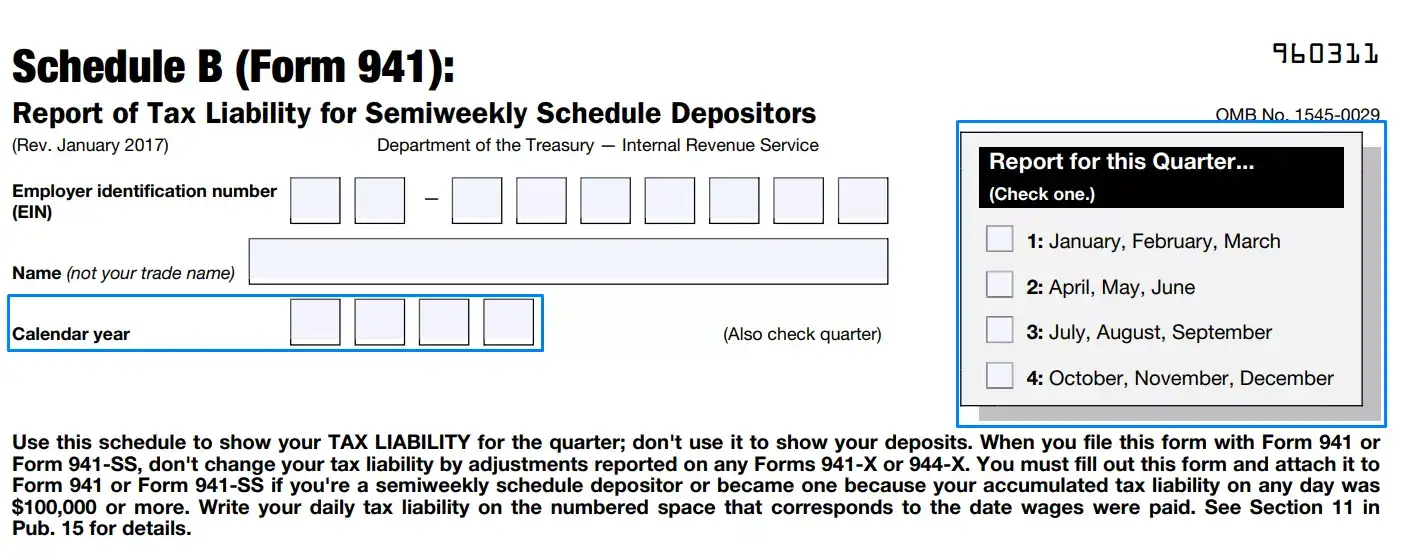

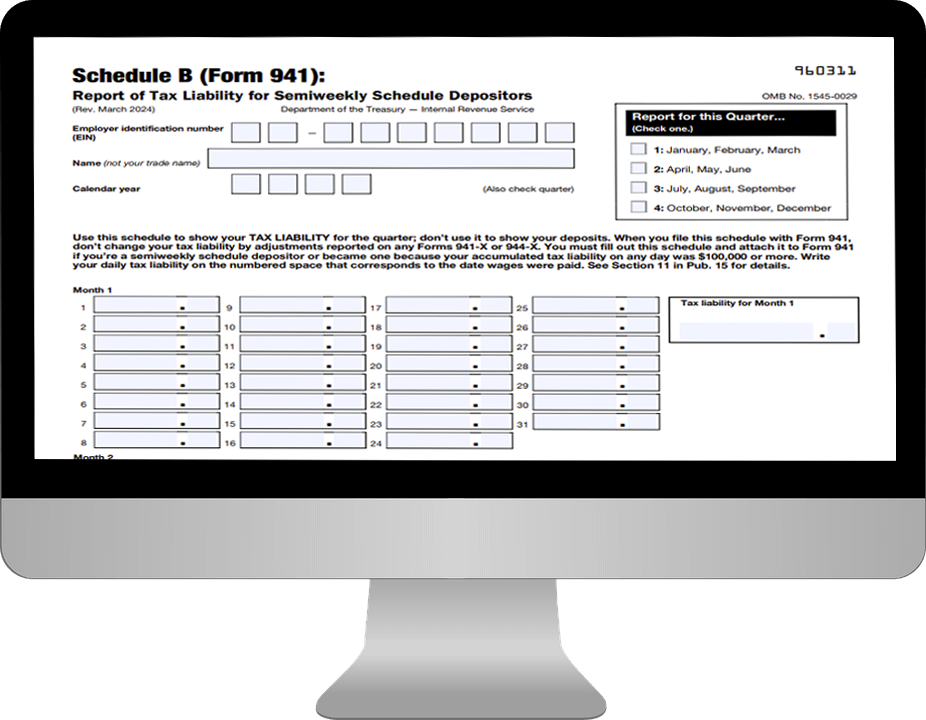

Purpose of Schedule B These instructions tell you about Schedule B To determine if you re a semiweekly schedule depositor see section 11 of Pub 15 Employer s Tax Guide or section 8 of Pub 80 Federal Tax Guide for Employers in the U S Jun 22 2020 Virgin Islands Guam American Samoa and the Commonwealth of the Northern Mariana Islands Draft instructions for Schedule B for Form 941 were released Feb 22 by the Internal Revenue Service The draft makes changes to the revised guidance for Schedule B Report of Tax Liability for Semiweekly Schedule Depositors which was released in September 2020 to update the guidance from January 2017 The instructions have a March 2021

Irs Form 941schedule B Printable

Irs Form 941schedule B Printable

https://fillableforms.net/wp-content/uploads/2022/09/printable-schedule-b-form-941.png

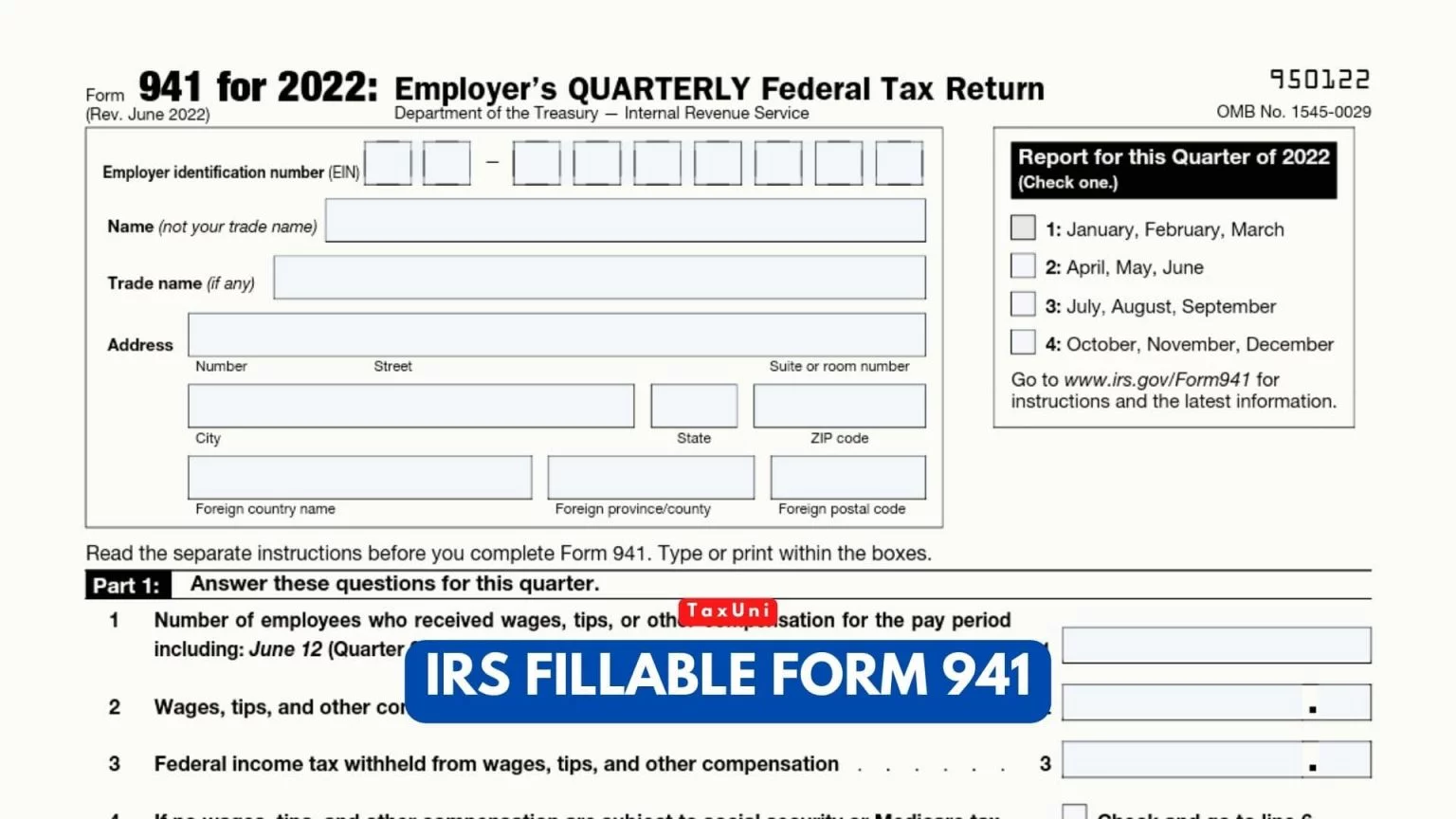

Schedule B Form 941 2022

https://www.taxbandits.com/Content/Images/frm941-schr2021.jpg

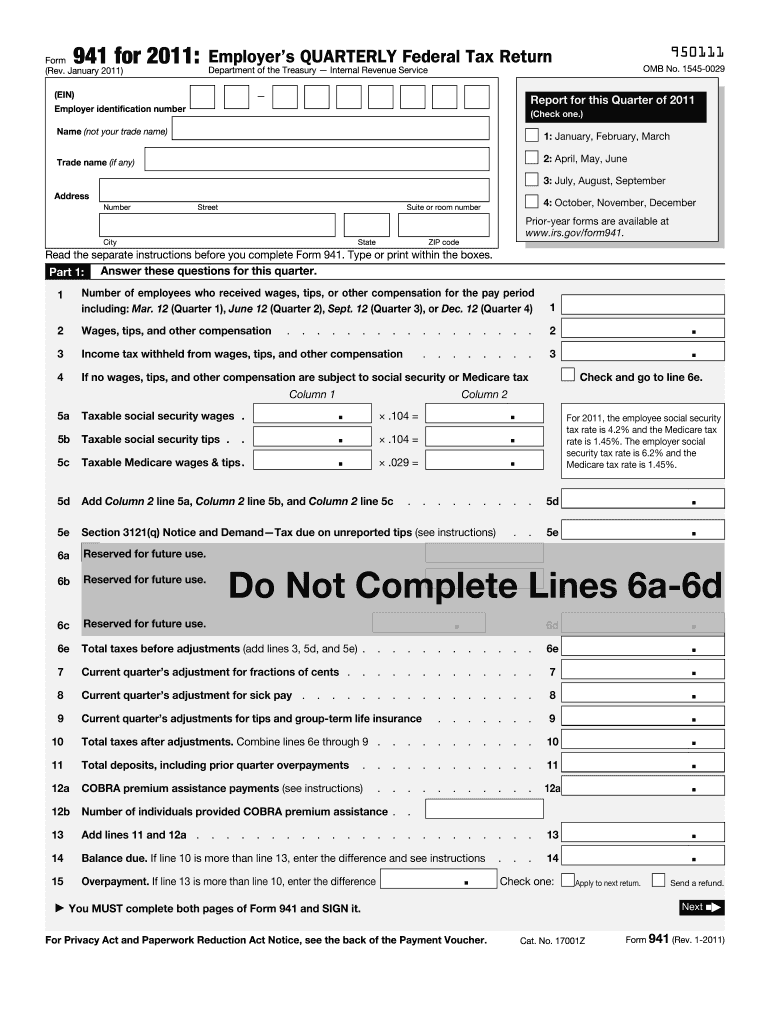

Form 941 Schedule B Report Of Tax Liability For Semiweekly Schedul 2012 Form Irs 1040 Schedule

https://images.sampletemplates.com/wp-content/uploads/2016/11/14151754/Schedule-B-Form-941.jpg

Visit To complete your Schedule B report you are required to enter your tax liability in the numbered space that corresponds to the date that wages were paid Know IRS Form 941 Schedule B instructions for 2023 with TaxBandits and Semiweekly schedule depositors can file to the IRS at 5 95 form Most businesses must report and file tax returns quarterly using the IRS Form 941 This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations

You were assessed an FTD penalty File your amended Schedule B with Form 941 X The total liability for the quarter reported on your amended Schedule B must equal the corrected amount of tax reported on Form 941 X If your penalty is decreased the IRS will include the penalty decrease with your tax decrease Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2023 2nd Quarter 2023 3rd Quarter 2023 or 4th Quarter 2023 on your check or money order

More picture related to Irs Form 941schedule B Printable

IRS Fillable Form 941 2023

https://www.taxuni.com/wp-content/uploads/2022/12/IRS-Fillable-Form-941-TaxUni-Cover-1-1536x864.jpg

2023 Schedule B Form 941 Printable Forms Free Online

https://www.pdffiller.com/preview/570/917/570917598/large.png

Form 941b 2023 Printable Forms Free Online

https://blog.taxbandits.com/wp-content/uploads/2023/01/Semi-weekly-depositors-and-filing-Form-941-Schedule-B-1024x538.png

A Schedule B Form 941 is used by the Internal Revenue Service for tax filing and reporting purposes This form must be completed by a semiweekly schedule depositor who reported more than 50 000 in employment taxes or acquired more than 100 000 in liabilities in a single day in the tax year This form requires information that will show your File Now with TurboTax We last updated Federal 941 Schedule B in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government

Form 941 is an information form in the payroll form series which deals with employee pay reports such as salaries wages tips and taxes Schedule B specifically deals with reporting federal income tax social security tax and Medicare tax withheld from the employee s pay The federal laws require all employers to file Schedule B Form 941 Draft instructions for Schedule B of the 2022 Form 941 Employer s Quarterly Federal Tax Return were released Feb 3 by the Internal Revenue Service The instructions for Schedule B Report of Tax Liability for Semiweekly Schedule Depositors were revised to remove guidance pertaining to the expired employee retention credit Employers were

Printable Form 941 For 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/0/56/56554/large.png

Get IRS 941 Schedule B 2017 2023 US Legal Forms Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/400/414/400414967/big.png

https://www.irs.gov/pub/irs-pdf/i941sb.pdf

Schedule B is filed with Form 941 or Form 941 SS References to Form 941 Employer s QUARTERLY Federal Tax Return in these instructions also apply to Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of Feb 22 2023 the Northern Mariana Islands and the U S Virgin Islands unless otherwise noted

https://www.reginfo.gov/public/do/DownloadDocument?objectID=103448201

Purpose of Schedule B These instructions tell you about Schedule B To determine if you re a semiweekly schedule depositor see section 11 of Pub 15 Employer s Tax Guide or section 8 of Pub 80 Federal Tax Guide for Employers in the U S Jun 22 2020 Virgin Islands Guam American Samoa and the Commonwealth of the Northern Mariana Islands

941 Form 2023 Schedule B Fill Online Printable Fillable Blank Form Example Download

Printable Form 941 For 2023 Printable Forms Free Online

Fillable Schedule B Form 941 Report Of Tax Liability For Semiweekly Schedule Depositors

Form 941 Schedule B 2022

Irs Form 941 Schedule B 2024 Kore Shaine

Form 941 Printable Fillable Per Diem Rates 2021

Form 941 Printable Fillable Per Diem Rates 2021

Schedule B Form 941 For 2023 Printable Forms Free Online

IRS Form 941 Schedule B 2024

Fillable Form 941 Schedule B 2020 Download Printable 941 For Free

Irs Form 941schedule B Printable - Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2021 2nd Quarter 2021 3rd Quarter 2021 or 4th Quarter 2021 on your check or money order