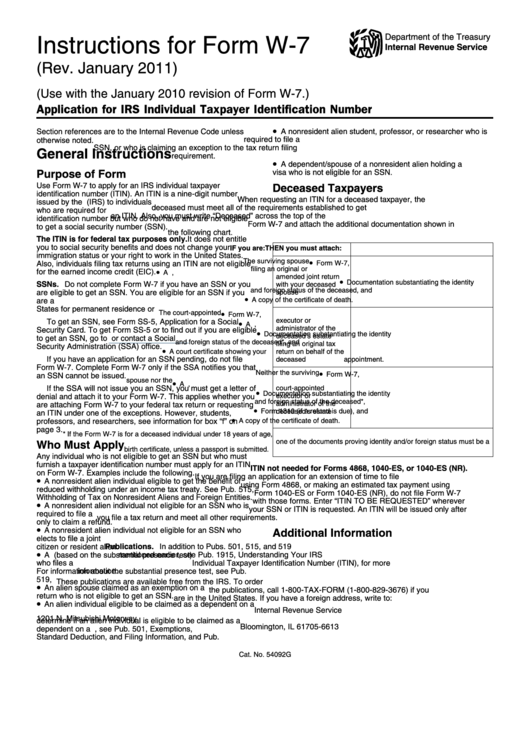

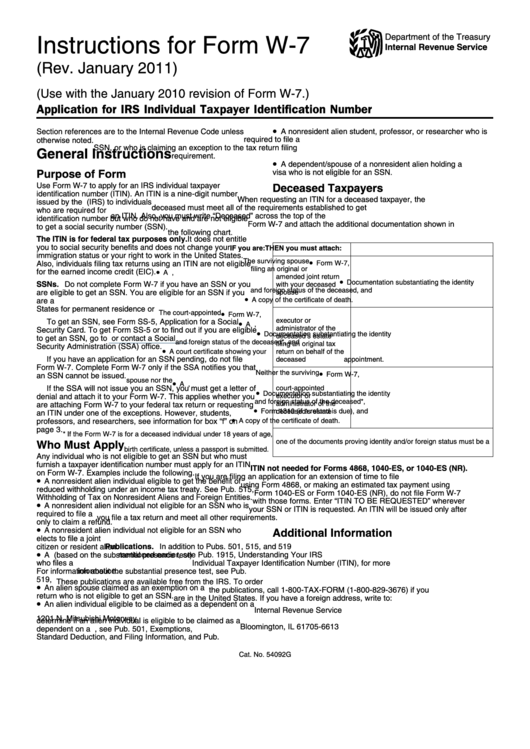

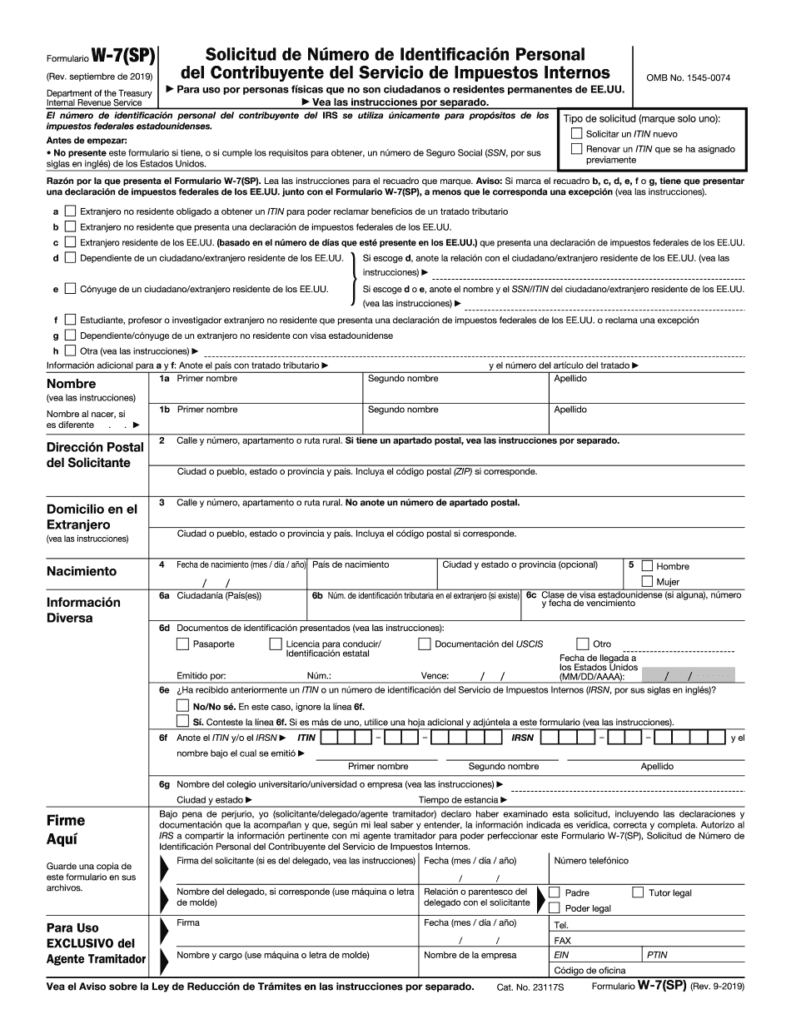

Irs Form W 7 Printable An ITIN is a 9 digit number issued by the U S Internal Revenue Service IRS to individuals who are required for U S federal tax purposes to have a U S taxpayer identification number but who do not have and are not eligible to get a Social Security number SSN Current revision Form W 7 PDF Instructions for Form W 7 Print version PDF

All Form W 7 renewal applications must include a U S federal tax return unless you meet an exception to the requirement See Exceptions Tables later for more information Expanded discussion of allowable tax benefit A W 7 Form is used to apply for an individual taxpayer identification number or ITIN for non citizens who aren t eligible to receive a Social Security number but need to file a federal tax return with the IRS for income from US sources TABLE OF CONTENTS ITINs Why ITINs are necessary About form W 7 Click to expand ITINs

Irs Form W 7 Printable

Irs Form W 7 Printable

https://www.fillhq.com/wp-content/uploads/2023/02/form-w7.jpg

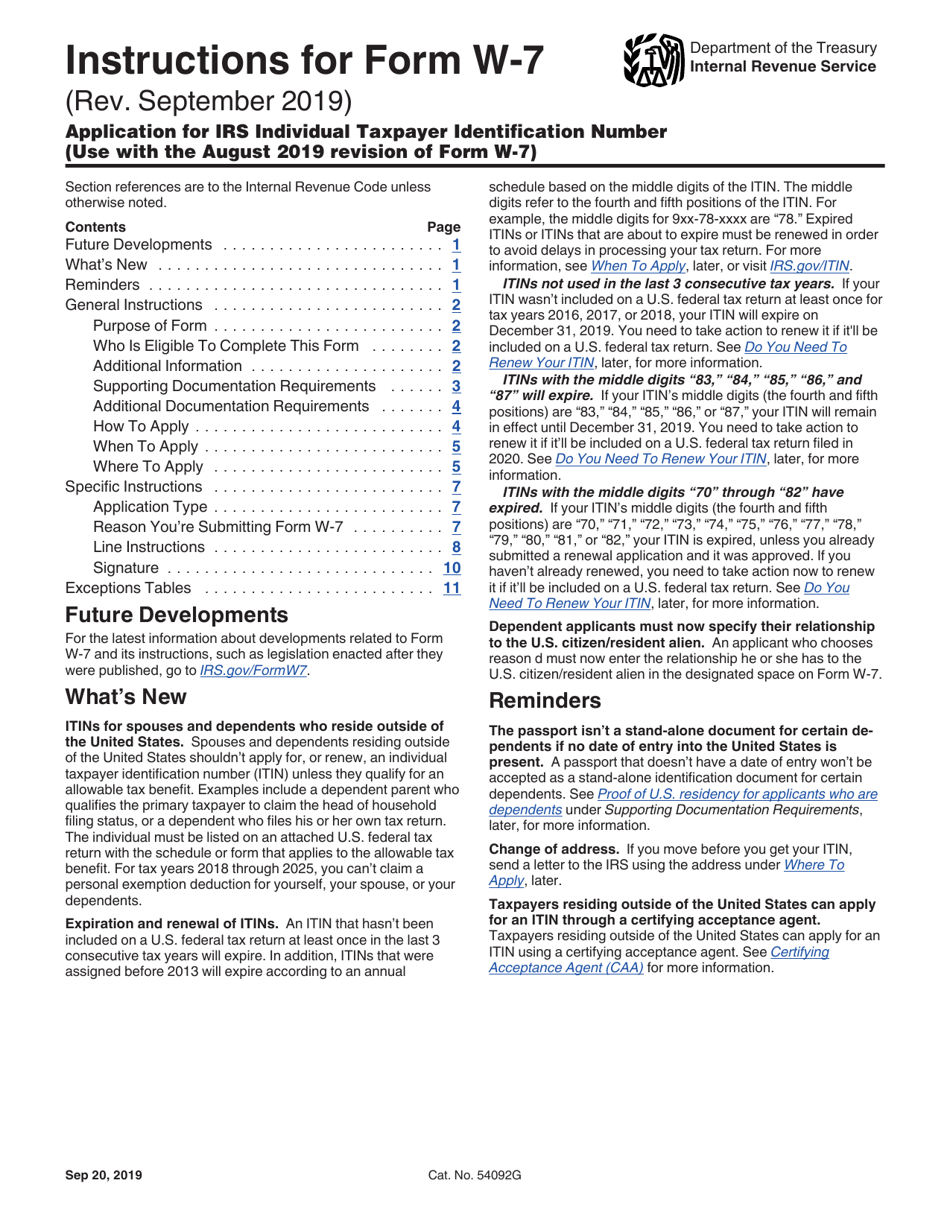

Instructions For Form W 7 Application For Irs Individual Taxpayer Identification Number

https://data.formsbank.com/pdf_docs_html/239/2393/239348/page_1_thumb_big.png

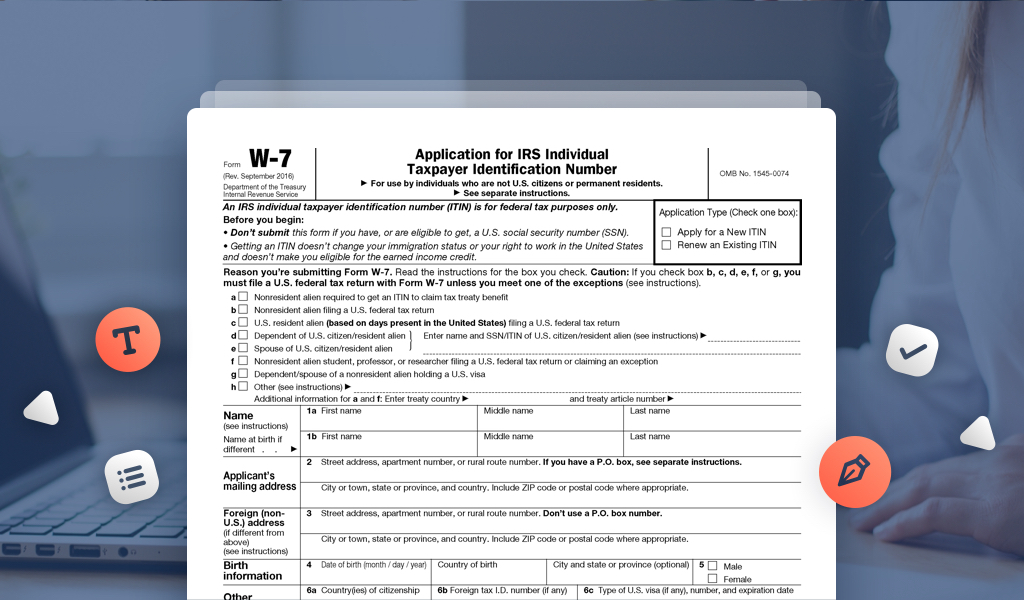

IRS Form W7 Applying For Individual Taxpayer Identification Number Community Tax

https://www.communitytax.com/wp-content/uploads/2019/06/W7-5.png.jpg

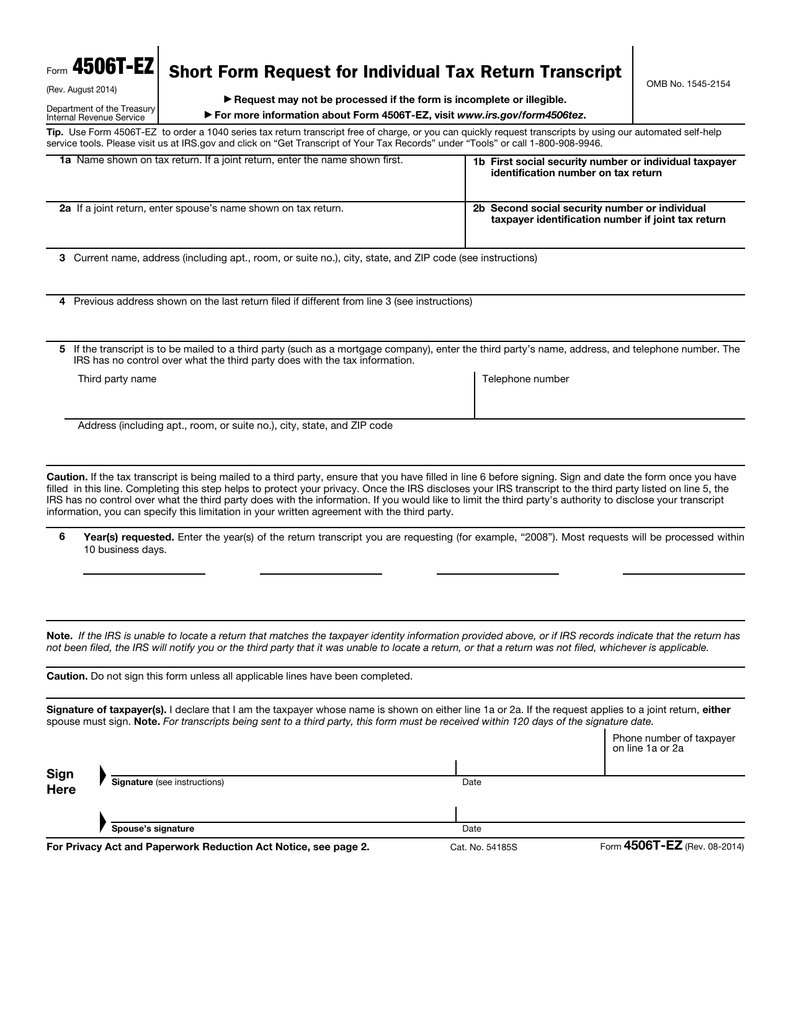

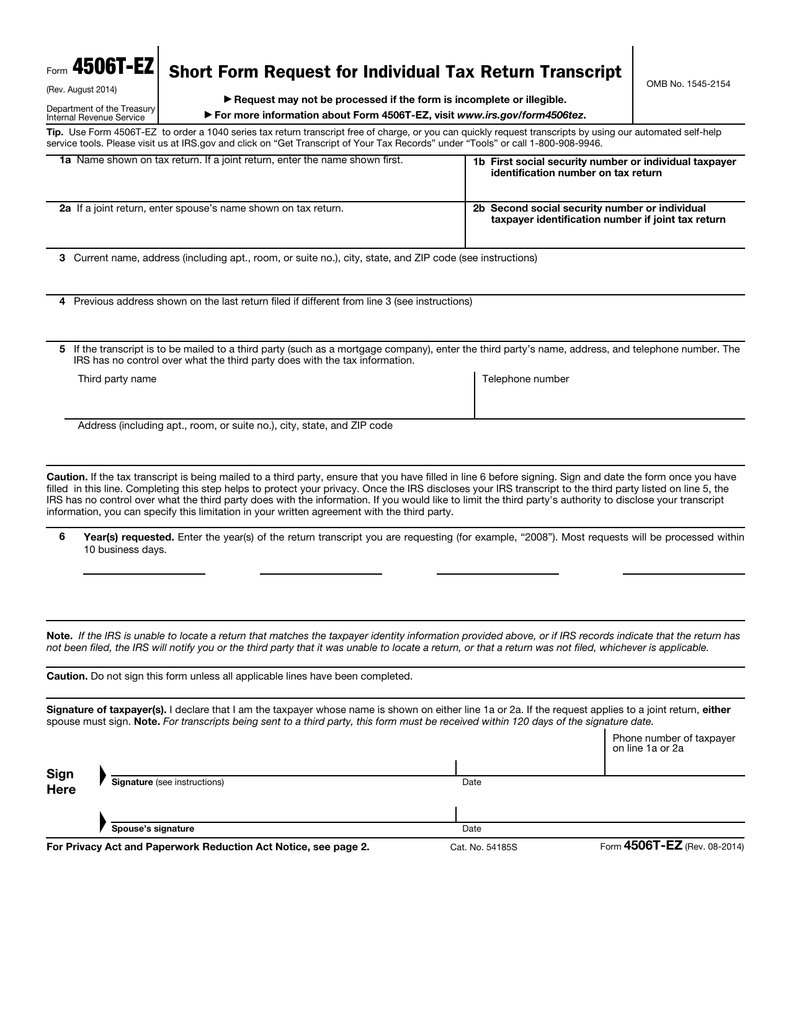

TurboTax doesn t support Form W 7 so there are a few steps you ll have to take to file your return You ll need to use TurboTax Desktop If you ve already begun your return in TurboTax Online go here to transfer your tax data Download Form W 7 directly from the IRS fill it in and print it out See the IRS instructions FORM 8379 INJURED SPOUSE FORM 4506 REQUEST FOR TAX TRANSCRIPT FORM 8822 CHANGE OF ADDRESS FORM W 4 EMPLOYEE S WITHHOLDING ALLOWANCE CERTIFICATE FORM W 7 ITIN APPLICATION Publication 1 YOUR RIGHTS AS A TAXPAYER Visit the Taxpayer Advocate Service s Get Help section for more in depth details on these and many other

Free File Prepare and file your federal income tax online at no cost to you if you qualify using guided tax preparation at an IRS trusted partner site or using Free File Fillable Forms Direct File pilot The pilot is being rolled out in phases during the 2024 filing season ITIN and Form W 7 work hand in hand In fact a Form W 7 is the document to apply for an ITIN The Form W 7 asks for In addition you will need two of the following unexpired documents or certified copies to support the information you provide on Form W 7 National ID card with name address photo date of birth and expiration date

More picture related to Irs Form W 7 Printable

Renew Your ITIN With IRS Form W 7 And Avoid Refund Delays

https://blog.pdffiller.com/app/uploads/2018/01/Form-w-7-Schedule-A-blog-featured.jpg

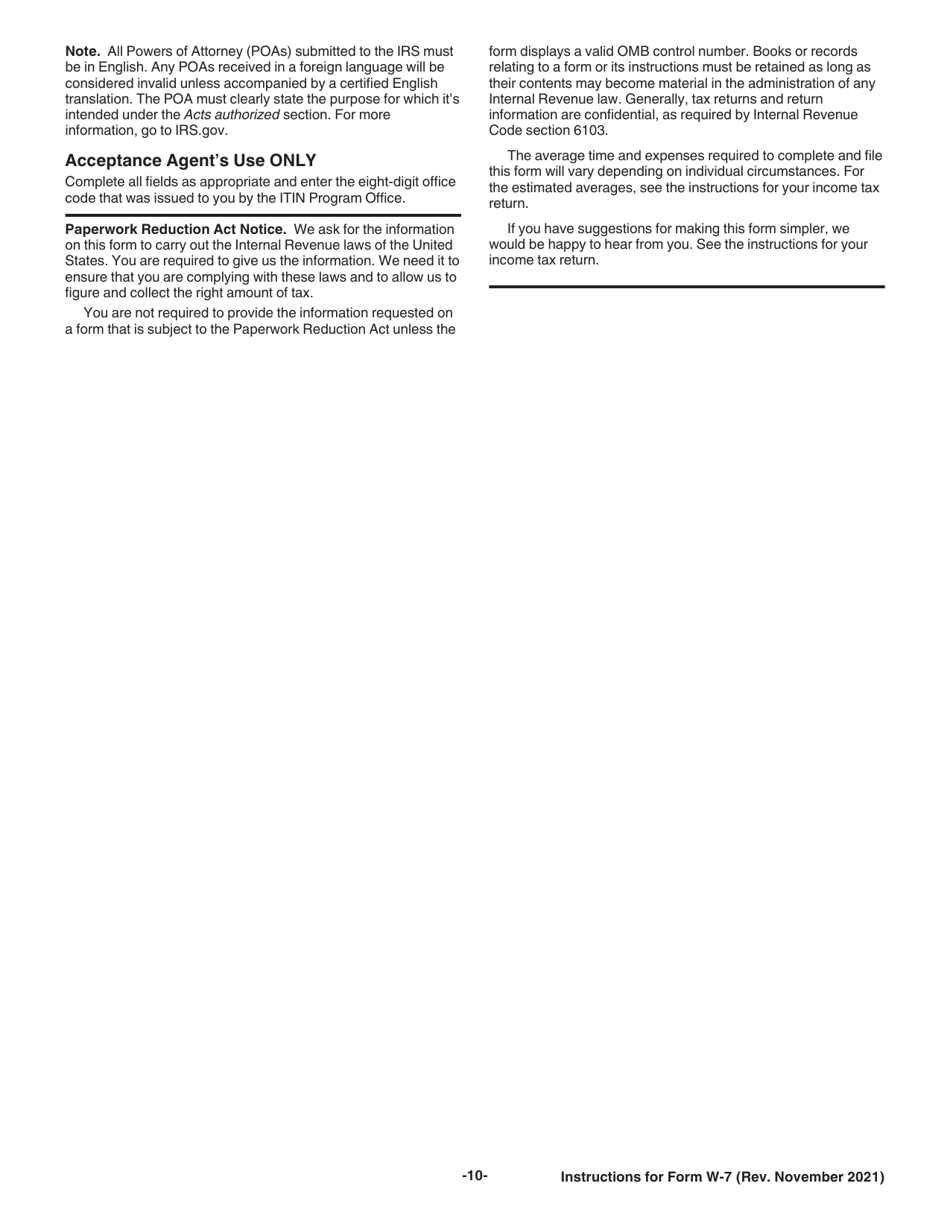

Download Instructions For IRS Form W 7 Application For IRS Individual Taxpayer Identification

https://data.templateroller.com/pdf_docs_html/2464/24642/2464254/page_10_thumb_950.png

2022 Form W 4 IRS Tax Forms W4 Form 2022 Printable

https://w4formprintable.com/wp-content/uploads/2022/01/irs-w-4-form-w4-form-2021.jpg

An IRS Form W 7 also called an Application for IRS Individual Taxpayer Identification Number is a form used by individuals who are ineligible for a Social Security Number but still need to file taxes in the United States W 2 forms show the income you earned the previous year and what taxes were withheld Learn how to replace incorrect stolen or lost W 2s or how to file one if you are an employer Find out how to get and where to mail paper federal and state tax forms Learn what to do if you don t get your W 2 form from your employer or it s wrong

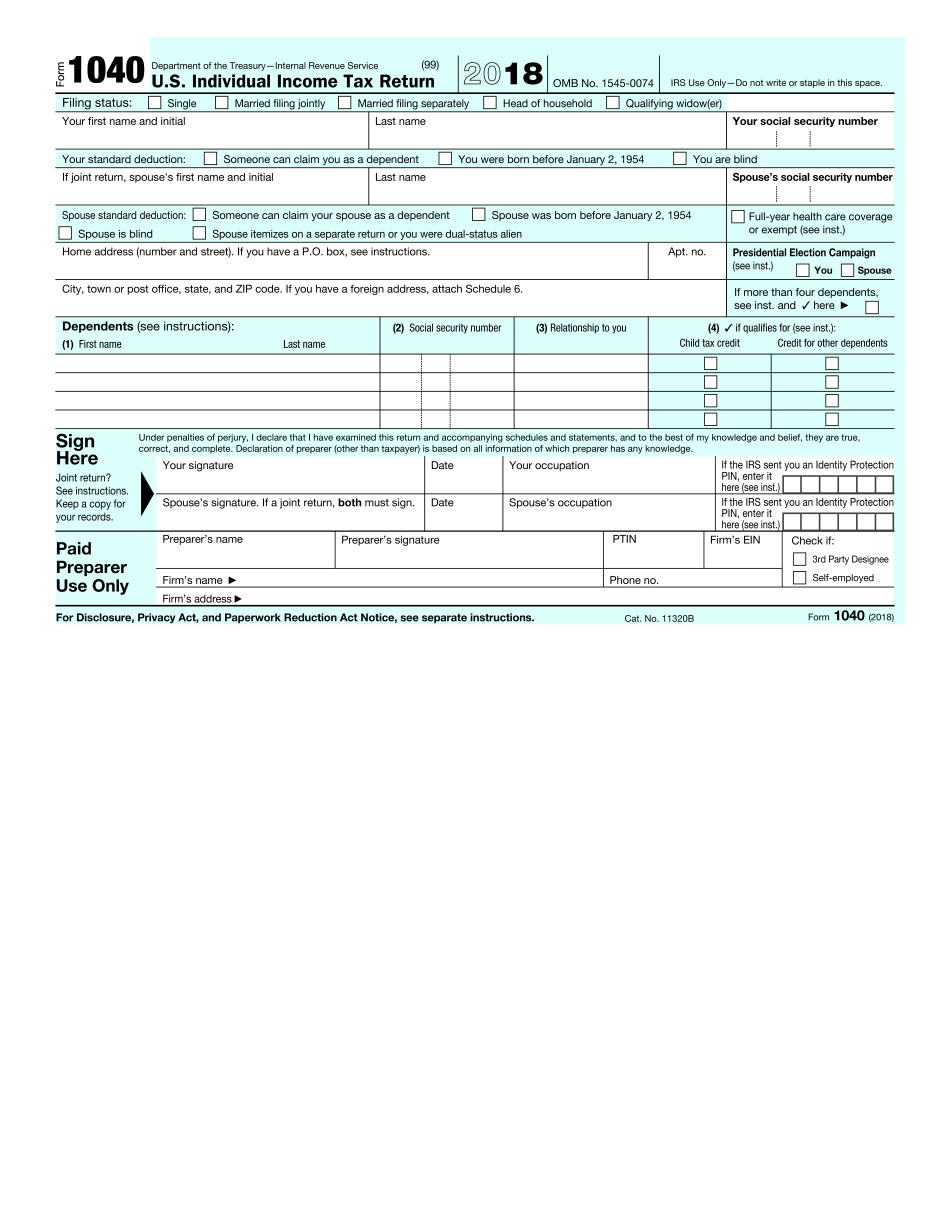

Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form W 7 Apply for an ITIN Circular 230 Rules Governing Practice before IRS Search IRS gov Submit Search to IRS gov News English Charities Nonprofits Tax Pros An IRS individual taxpayer identification number ITIN is for federal tax purposes only this form if you have or are eligible to get a U S social security number SSN and does not make you eligible for the earned income credit Reason you are submitting Form W 7 Read the instructions for the box you check

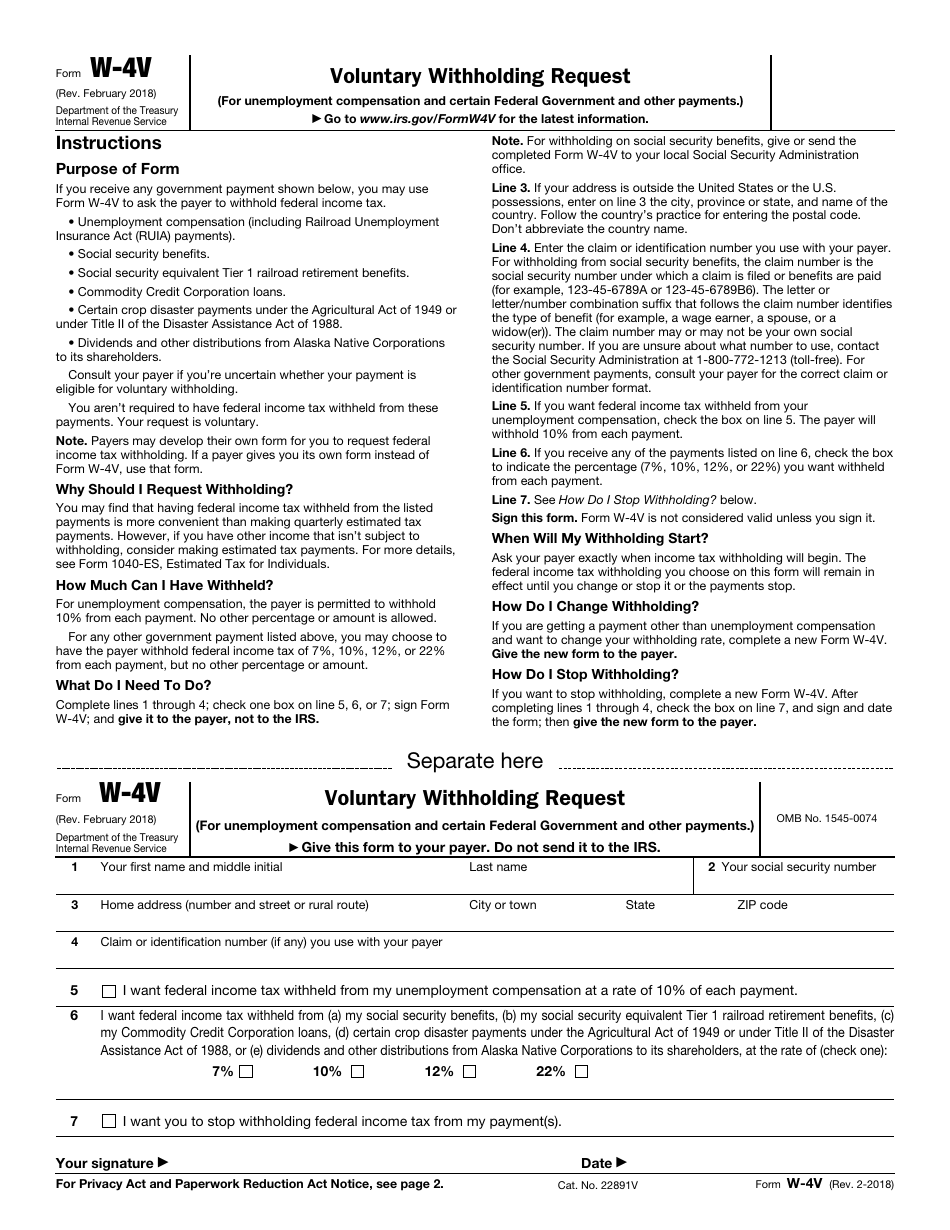

Irs Form W 4v Printable Irs Form W 4v Printable Rating Yodler Images And Photos Finder

https://s1.manualzz.com/store/data/009721380_1-cdc25fa479112544f351fb7dd9ccdf7e.png

Form W 7 Application For IRS Individual Taxpayer Identification Number 2013 Free Download

https://www.formsbirds.com/formimg/tax-support-document/8181/form-w-7-application-for-irs-individual-taxpayer-identification-number-2013-l1.png

https://www.irs.gov/forms-pubs/about-form-w-7

An ITIN is a 9 digit number issued by the U S Internal Revenue Service IRS to individuals who are required for U S federal tax purposes to have a U S taxpayer identification number but who do not have and are not eligible to get a Social Security number SSN Current revision Form W 7 PDF Instructions for Form W 7 Print version PDF

https://www.irs.gov/instructions/iw7

All Form W 7 renewal applications must include a U S federal tax return unless you meet an exception to the requirement See Exceptions Tables later for more information Expanded discussion of allowable tax benefit

Fill Free Fillable Form W 7 Application For Irs Individual Taxpayer Identification Number PDF Form

Irs Form W 4v Printable Irs Form W 4v Printable Rating Yodler Images And Photos Finder

IRS Form W 7 SP 2019 2020 Fill Out And Edit Online Printable Form 2021

Download Instructions For IRS Form W 7 Application For IRS Individual Taxpayer Identification

Printable W 4v Form 2022 Printable World Holiday

Irs Form W 4V Printable Form W 7 Application For Irs Individual Taxpayer Identification Number

Irs Form W 4V Printable Form W 7 Application For Irs Individual Taxpayer Identification Number

Irs 1040 Form Printable

W7 Pdf 2020 2022 Fill And Sign Printable Template Online US Legal Forms

How To Fill Out Form W 7 Step By Step Aenten US

Irs Form W 7 Printable - The Form 2441 must be attached to Form W 7 along with the U S federal tax return See Pub 503 for more information Reminders Expired ITINs If your ITIN wasn t included on a U S federal tax return at least once for tax years 2018 2019 and 2020 your ITIN will expire on December 31 2021