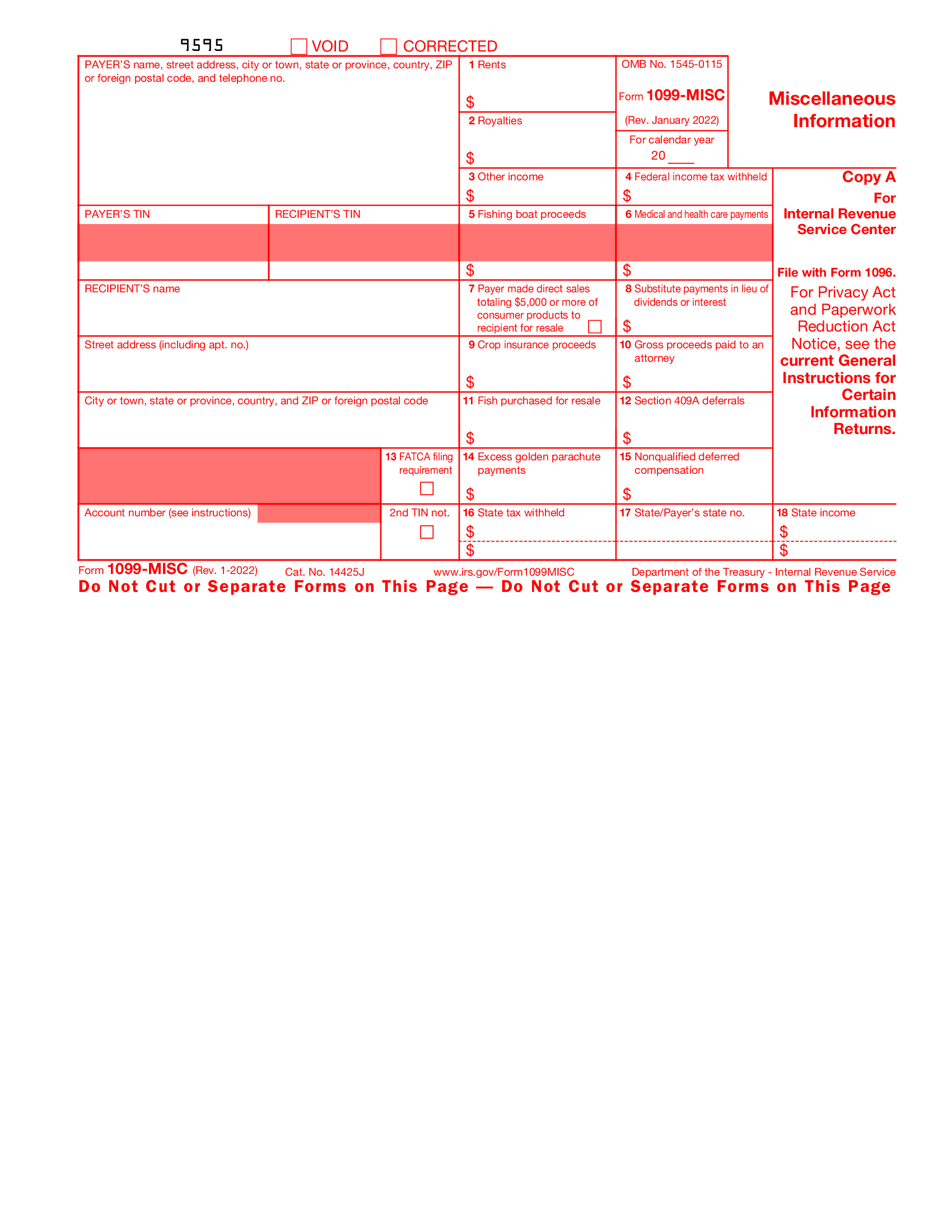

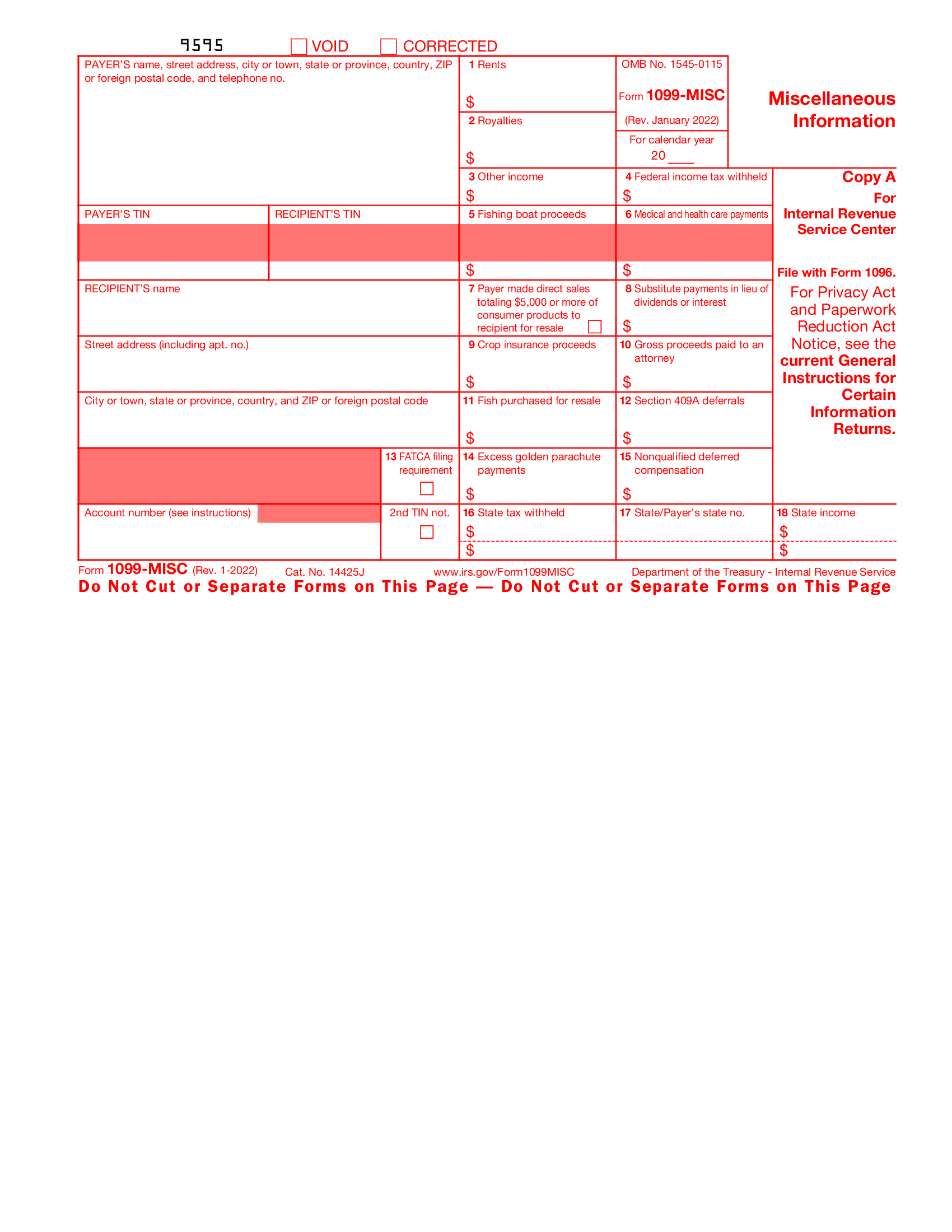

Irs Gov Printable 1099 Form Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use Copy 1 For State Tax Department www irs gov Form1099NEC if checked For calendar year Federal income tax withheld Copy B For Recipient This is important tax information and is being furnished to the IRS

Irs Gov Printable 1099 Form

Irs Gov Printable 1099 Form

https://www.pdffiller.com/preview/488/370/488370241/large.png

Fillable 1099 Misc Irs 2022 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/09/fillable-1099-misc-irs-2022.png

IRS Form 1099 Reporting For Small Businesses In 2023

https://fitsmallbusiness.com/wp-content/uploads/2022/05/FeatureImage_Form_1099.jpg

You can e file any Form 1099 for tax year 2022 and later with the Information Returns Intake System IRIS The system also lets you file corrections and request automatic extensions for Forms 1099 For system availability check IRIS status There are 2 ways to e file with IRIS E file through the IRIS Taxpayer Portal IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs What to do if your W 2 form is incorrect stolen or you never received it W 2 forms show the income you earned the previous year and what taxes were withheld

More picture related to Irs Gov Printable 1099 Form

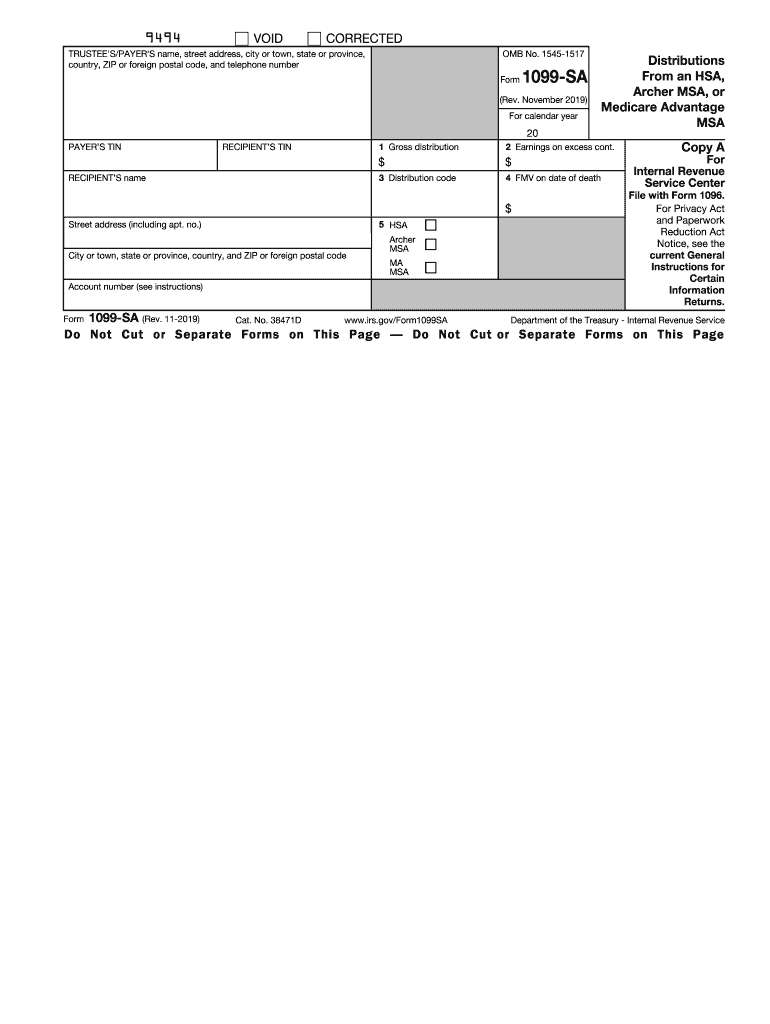

IRS 1099 SA 2019 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/458/73/458073368/large.png

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

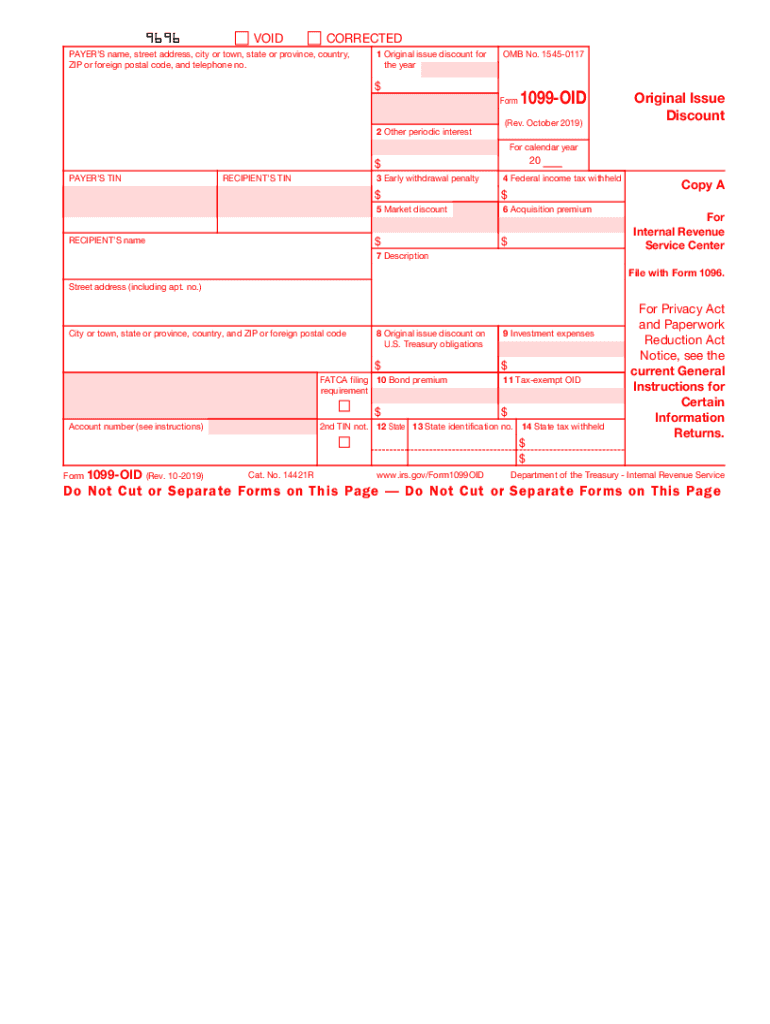

IRS 1099 OID 2019 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/492/756/492756716/large.png

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to Anyone who received income from investments retirement accounts Social Security benefits government payments or those who took withdrawals from 529 college savings plans or health savings

IR 2024 33 Feb 6 2024 WASHINGTON In an effort to provide more resources for taxpayers during this filing season the Internal Revenue Service today revised frequently asked questions FAQs for Form 1099 K Payment Card and Third Party Network Transactions in Fact Sheet 2024 03 PDF Form 1099 INT for each of the other owners showing the income allocable to each File Copy A of the form with the IRS Furnish Copy B to each owner List yourself as the payer and the other owner s as the recipient File Form s 1099 INT with Form 1096 with the Internal Revenue Service Center for your area On Form 1096 list

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

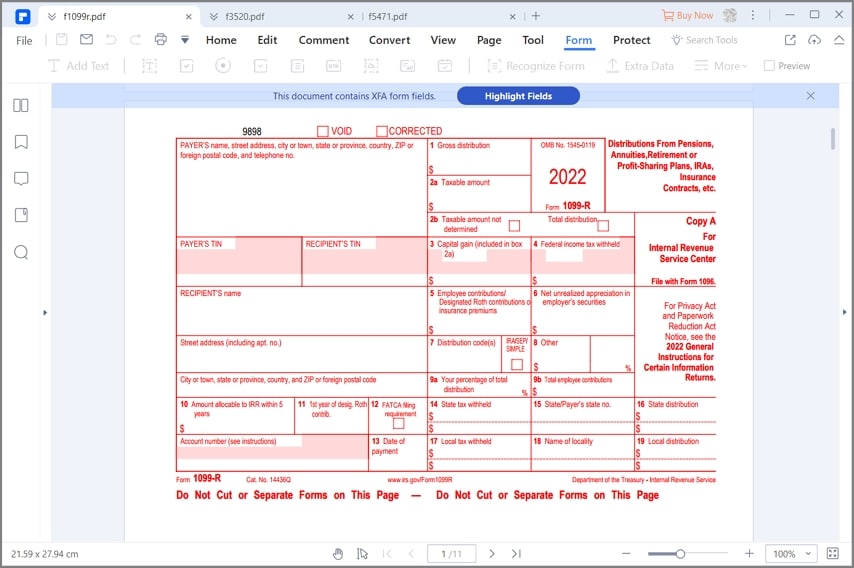

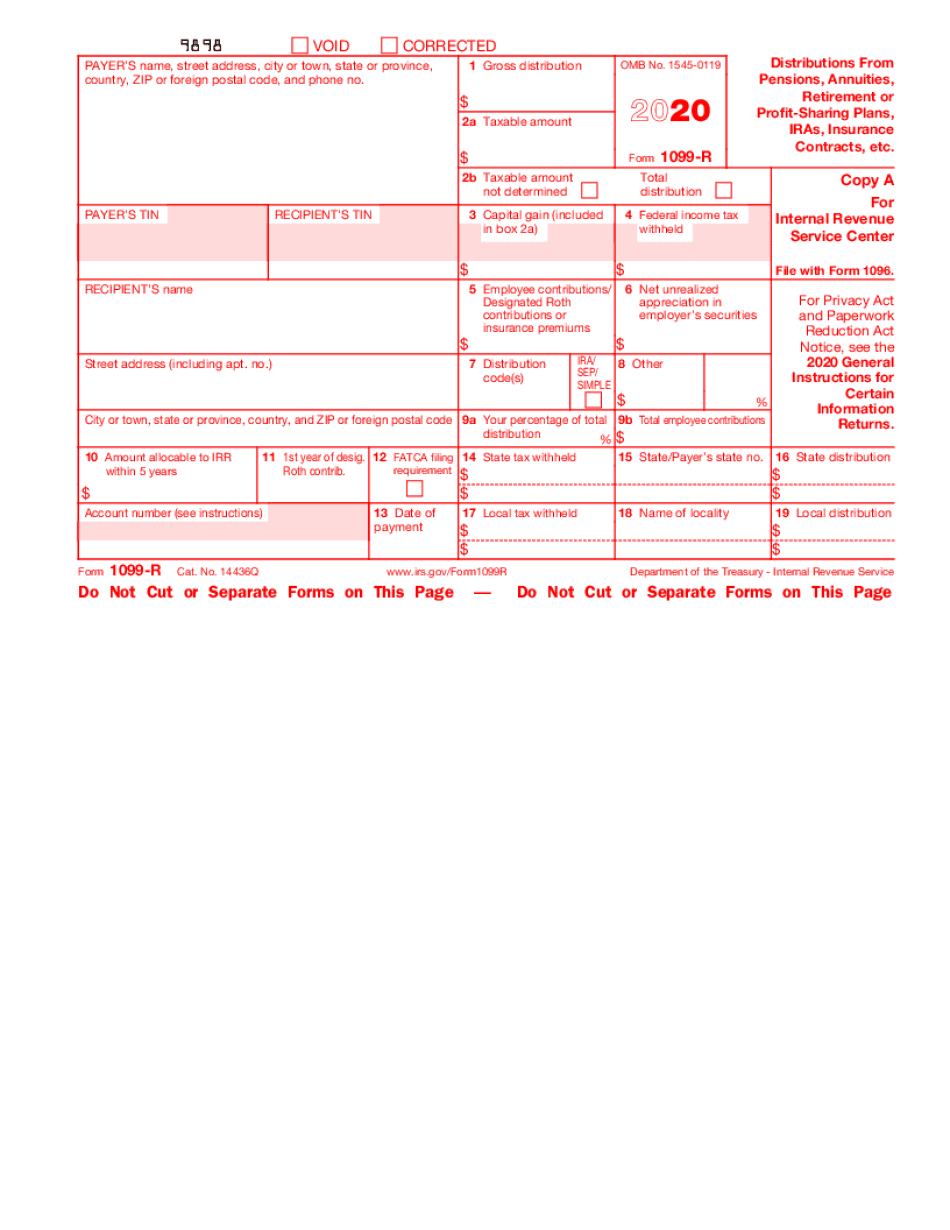

Formulario 1099 R Del IRS C mo Rellenarlo Bien Y F cilmente

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1099r-01.jpg

https://www.irs.gov/forms-pubs/about-form-1099-misc

Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

IRS Form 1099 R How To Fill It Right And Easily

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

2021 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

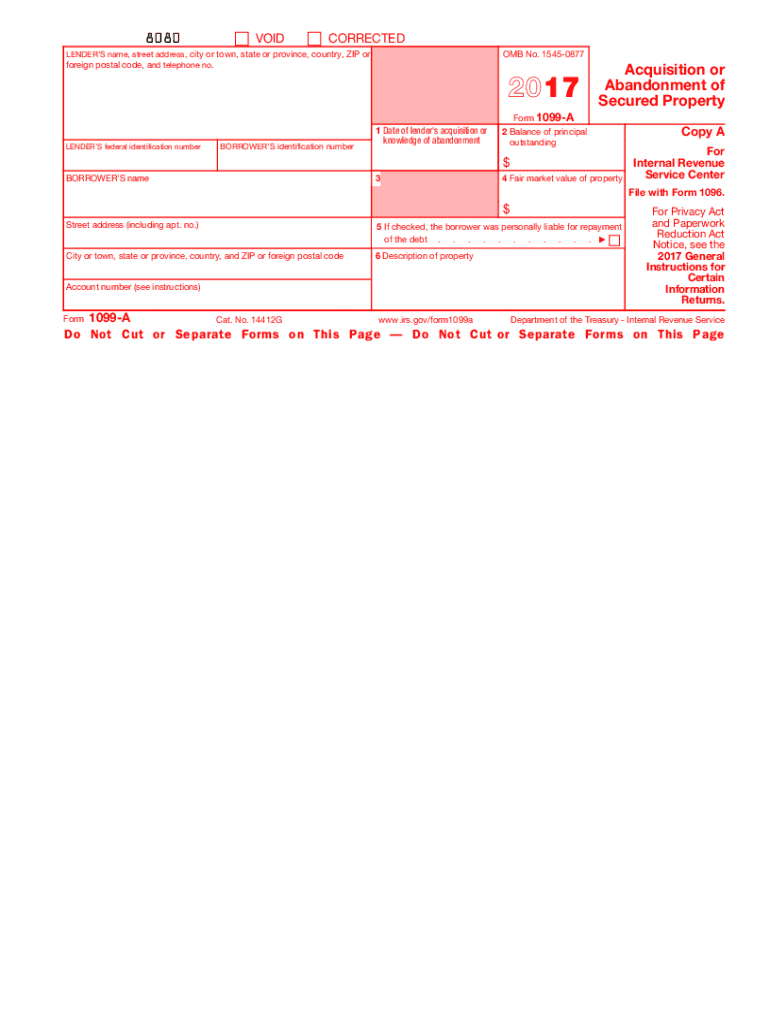

2017 Form IRS 1099 A Fill Online Printable Fillable Blank PdfFiller

Free Irs Form 1099 Printable Printable Templates

IRS 1099 MISC 2023 Form Printable Blank PDF Online

IRS 1099 MISC 2023 Form Printable Blank PDF Online

How To Fill Out 1099 MISC IRS Red Forms

2009 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

IRS 1099R Form Best Templates To Fill Out And Sign Online In PDF

Irs Gov Printable 1099 Form - IR 2023 14 January 25 2023 The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS