Irs Payment Plan Form Printable You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame If you qualify for a short term payment plan you will not be liable for a user fee Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and or an IRS levy action

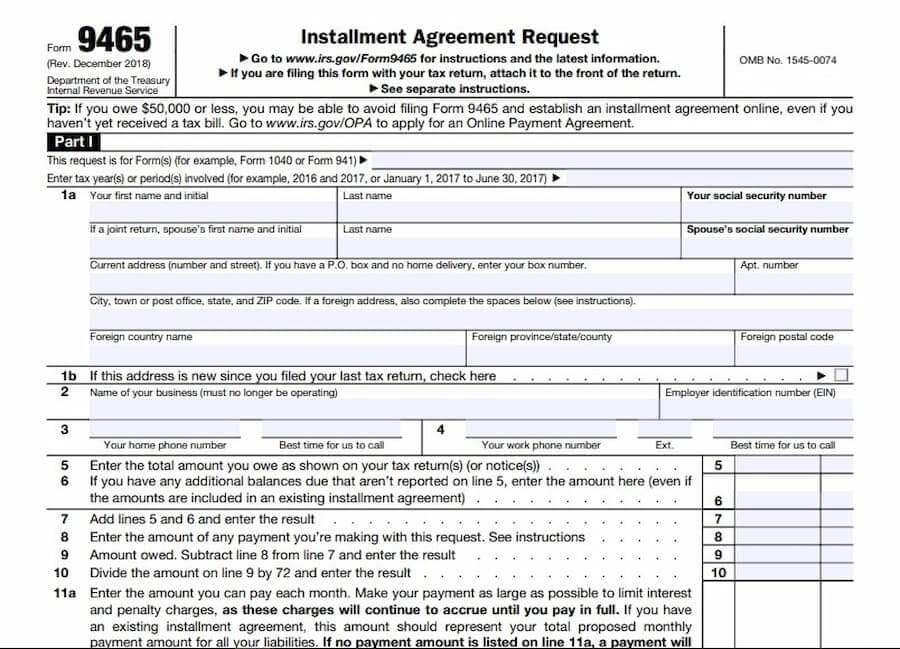

Apply Online for a Payment Plan If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form plan if you cannot pay the full amount you owe shown on your tax return or on a notice we sent you Form 9465 PDF Related Instructions for Form 9465 PDF Page Last Reviewed or Updated 14 Nov 2023 Share Facebook Twitter Linkedin

Irs Payment Plan Form Printable

Irs Payment Plan Form Printable

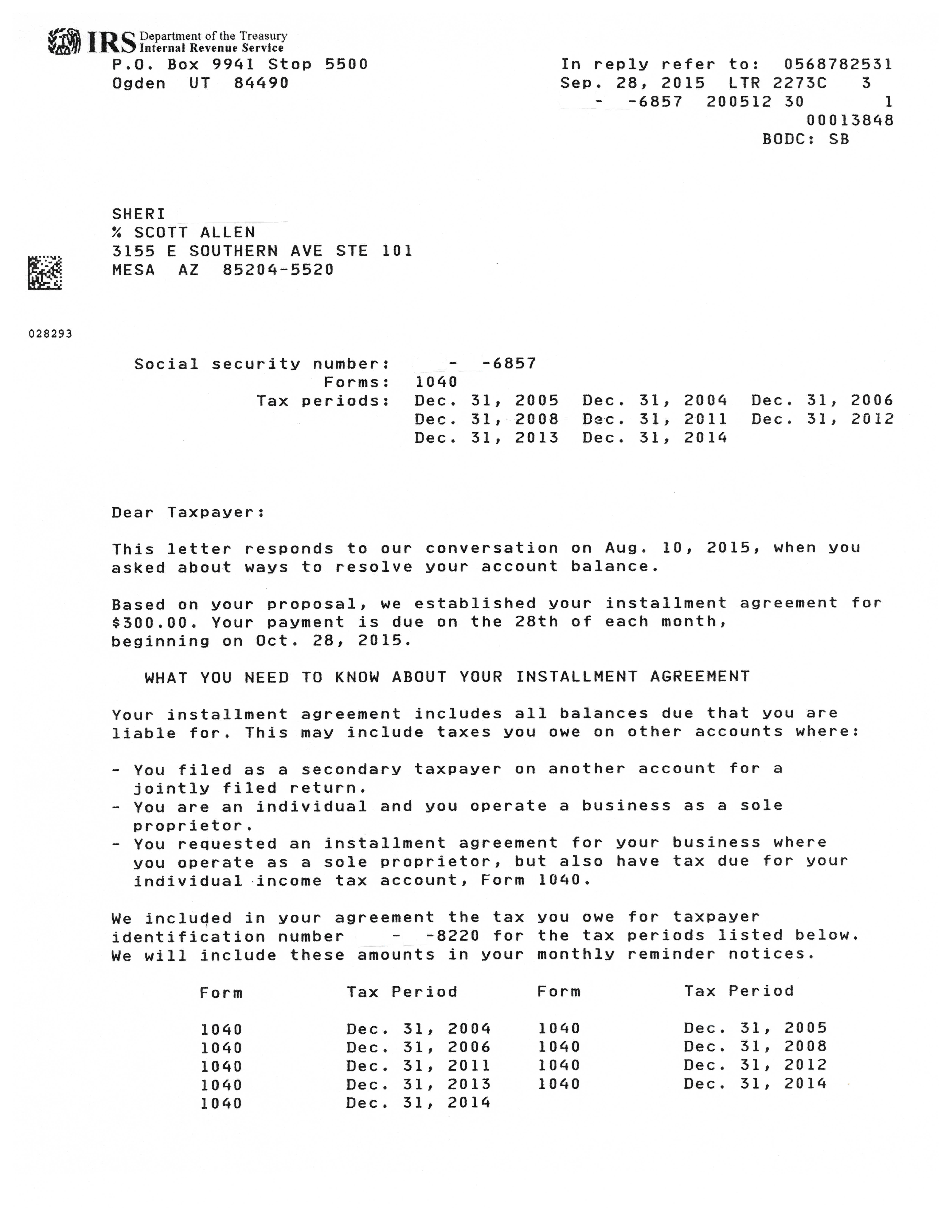

https://www.zrivo.com/wp-content/uploads/2022/09/IRS-Form-for-Payment-Plan-Zrivo-ss-1.jpg

IRS Form For Payment Plan

https://www.zrivo.com/wp-content/uploads/2022/09/IRS-Form-for-Payment-Plan-Zrivo-Cover-1.jpg

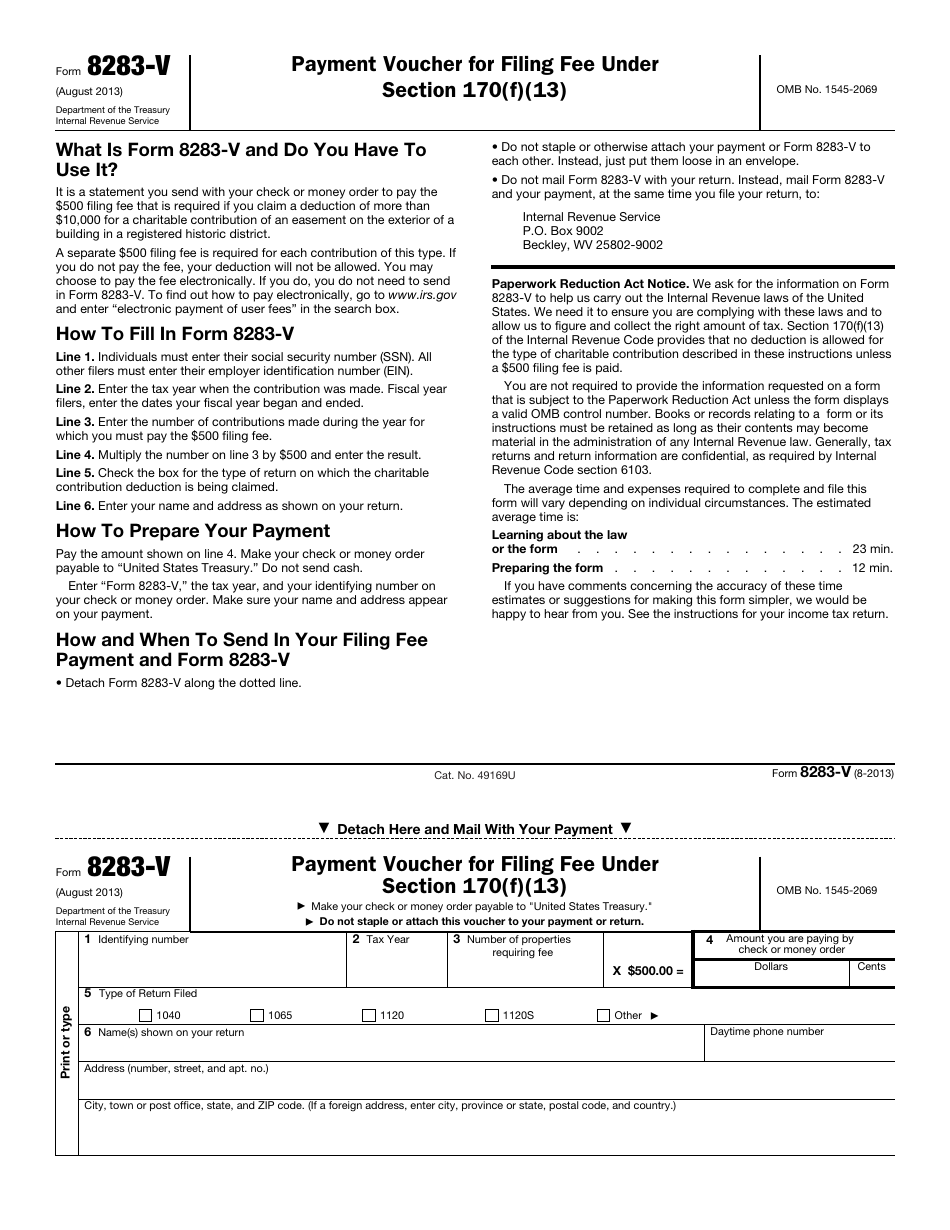

IRS Form 8283 V Fill Out Sign Online And Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/605/6057/605724/irs-form-8283-v-payment-voucher-filing-fee-under-section-170-f-13_print_big.png

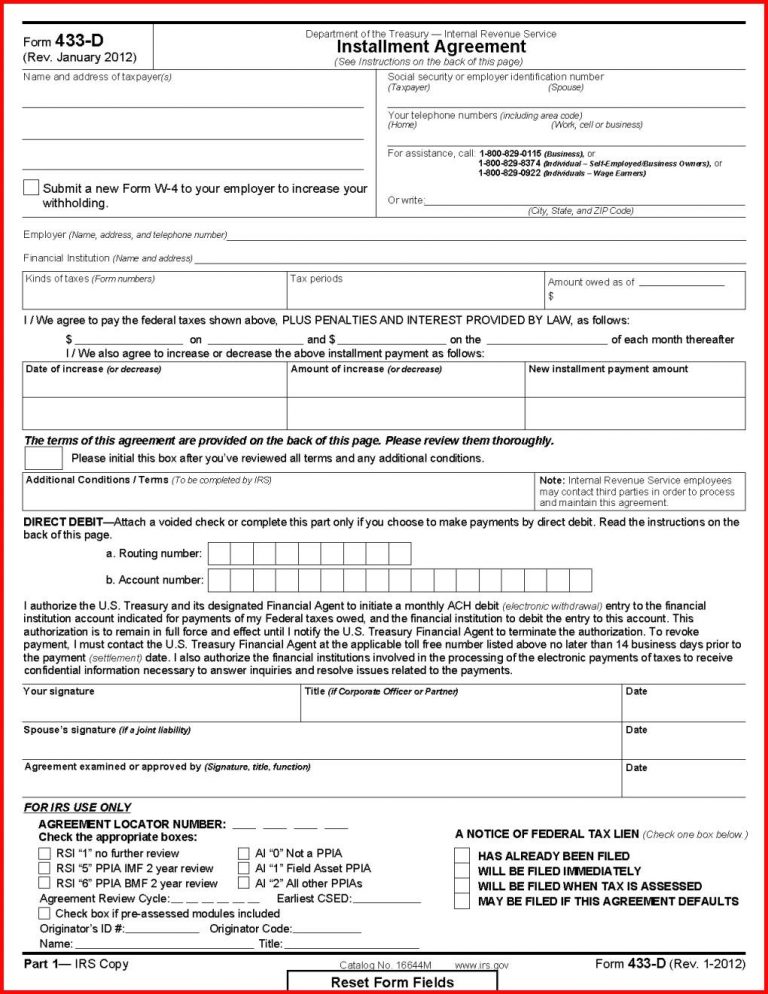

For assistance call 1 800 829 3903 Individual Self Employed Business Owners Businesses or 1 800 829 7650 Individuals Wage Earners Or write City State and ZIP Code on and on the I We also agree to increase or decrease the above installment payments as follows Date of increase or decrease Amount of increase or decrease Internal Revenue Service See separate instructions Tip If you owe 50 000 or less you may be able to avoid filing Form 9465 and establish an installment agreement online even if you haven t yet received a tax bill Go to www irs gov OPA to apply for an Online Payment Agreement

Purpose of Form Use Form 9465 to request a monthly installment agreement payment plan if you can t pay the full amount you owe shown on your tax return or on a notice we sent you Most installment agreements meet our streamlined installment agreement criteria There are two types of payment plans Short term payment plan The IRS offers additional time up to 180 days to pay in full It s not a formal payment option so there s no application and no fee but interest and any penalties continue to accrue until the tax debt is paid in full Long term payment plan Installment Agreement The IRS

More picture related to Irs Payment Plan Form Printable

Use IRS Payment Plan Form For Pending Tax Payout IRS Tax Debt Solu

https://cdn.slidesharecdn.com/ss_thumbnails/useirspaymentplanformforpendingtaxpayout-190902213553-thumbnail-4.jpg?cb=1567460204

How To Set Up A Payment Plan With The Irs

https://landmarktaxgroup.com/wp-content/uploads/2019/06/installment-settlement.png

Irs Payment Plan Form Fill Out And Sign Printable PDF Template SignNow PlanForms

https://i0.wp.com/www.planforms.net/wp-content/uploads/2022/09/irs-payment-plan-form-fill-out-and-sign-printable-pdf-template-signnow-1.png

Station Overview Payment plans also referred to as Installment Agreements are one of your options if you can t pay your taxes in full when they re due Payment plans allow you to pay your debt over a time You must be current with monthly payments timely file your tax returns and make estimated tax payments to qualify for a payment plan A long term payment plan also called an installment agreement to pay your balance due off with monthly installment payments You may even be able to set it up your payment option online which means no calling the IRS and waiting to speak to a representative or sending in a form and waiting for the IRS to get back to you

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax Form 433 F details how much interest and penalties you owe whole Form 9465 allows you to establish an installment plan to pay back those fees Taxpayers who owe more than 50 000 must submit a

How To Set Up A Payment Plan With The Irs

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20263e9551ad2200b-pi

Irs Installment Agreement Online Irs Payment Plan Form Online Instructions Installment 9465 2018

http://letterify.info/wp-content/uploads/irs-installment-agreement-online-irs-payment-plan-form-online-instructions-installment-9465-2018-768x994.png

https://www.irs.gov/payments/payment-plans-installment-agreements

You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame If you qualify for a short term payment plan you will not be liable for a user fee Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and or an IRS levy action

https://www.irs.gov/payments/online-payment-agreement-application

Apply Online for a Payment Plan If you are a qualified taxpayer or authorized representative Power of Attorney you can apply for a payment plan including installment agreement online to pay off your balance over time

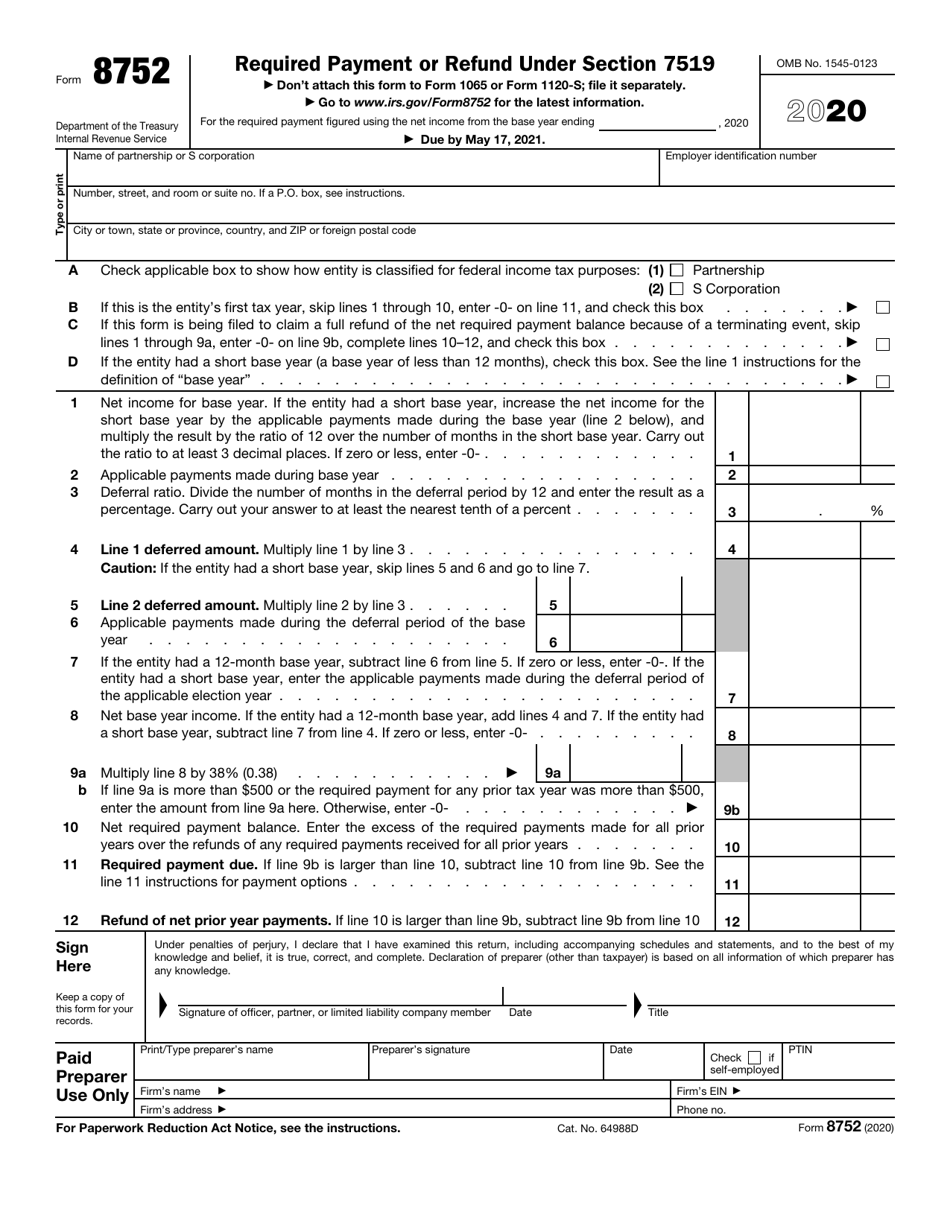

IRS Form 8752 Download Fillable PDF Or Fill Online Required Payment Or Refund Under Section 7519

How To Set Up A Payment Plan With The Irs

IRS Payment Plan Phoenix Tax Debt Advisors

IRS Payment Plan How A Tax Attorney Can Help RequestLegalHelp

Irs Payment Plan Form 9465 Instructions Form Resume Examples aZDYWvZO79

Federal Tax Forms 2023 Printable Printable Forms Free Online

Federal Tax Forms 2023 Printable Printable Forms Free Online

Blank Payment Form Irs Fill And Sign Printable Template Online US Legal Forms

How Do I Set Up Payment Plan With Irs Payment Poin

IRS Form 9465 Instructions Your Installment Agreement Request

Irs Payment Plan Form Printable - When you fall behind on your income tax payments the IRS may let you set up a payment plan called an installment agreement to get you back on track It is up to you however to take that first step and make a request for the installment agreement which you can do by filing Form 9465 You can file the form with your tax return online or even over the phone in some cases But before you