Irs Printabl E W 2 Forms The entries on Form W 2 must be based on wages paid during the calendar year Use Form W 2 for the correct tax year For example if the employee worked from December 15 2024 through December 28 2024 and the wages for that period were paid on January 3 2025 include those wages on the 2025 Form W 2

Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media W 2 forms show the income you earned the previous year and what taxes were withheld Learn how to replace incorrect stolen or lost W 2s or how to file one if you are an employer Find out how to get and where to mail paper federal and state tax forms Learn what to do if you don t get your W 2 form from your employer or it s wrong

Irs Printabl E W 2 Forms

Irs Printabl E W 2 Forms

https://www.pdffiller.com/preview/539/18/539018563/large.png

What Is IRS Form W2 Federal W2 Form For 2021 Tax Year

https://www.taxbandits.com/Content/Images/form/formw2online.jpg

IRS W 2 2021 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/539/448/539448884/large.png

Get federal tax forms for current and prior years Get the current filing year s forms instructions and publications for free from the IRS Download them from IRS gov Order online and have them delivered by U S mail Order by phone at 1 800 TAX FORM 1 800 829 3676 Updated December 15 2023 A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck Forms are submitted to the SSA Social Security Administration and the information is shared with the IRS Employees use the information in the W2 to file their

Publication 4012 Rev 01 2021 If a Form W 2 can t be obtained from the employer select the box to indicate this is a substitute W 2 TaxSlayer will generate a Form 4852 Substitute for Form W 2 Wage and Tax Statement The taxpayer will need to provide total income and withholding from their year end pay stub Indicate if W 2 is for Taxpayer Form W 2 reports an employee s annual wages as well as the amount of taxes withheld from their pay by their employer Employees use the information on the W 2 to complete their personal income tax return Employers must file a copy of each employee s W 2 with the Social Security Administration SSA and the Internal Revenue Service IRS

More picture related to Irs Printabl E W 2 Forms

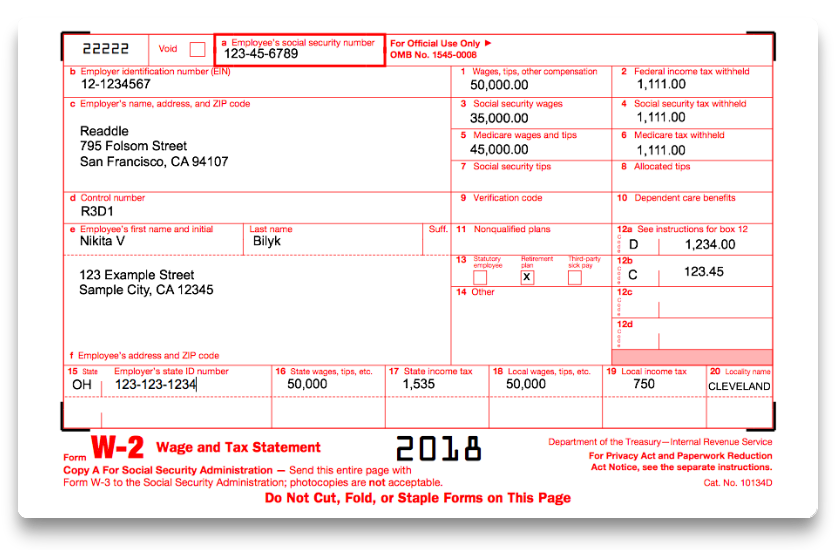

How To Fill Out IRS Form W 2 2017 2018 PDF Expert

https://pdfexpert.com/img/howto/fill-w2-form/how-to-fill-w2-filledform.png

How To Fill Out Form W 2 Detailed Guide For Employers

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

W 2 Form Filing Deadline And FAQs Square

https://jumbotron-production-f.squarecdn.com/assets/1041514e5e807e8ee1ec7.png

Register to Use Business Services Online You must register to use Business Services Online Social Security s suite of services that allows you to file W 2 W 2Cs online and verify your employees names and Social Security numbers against our records Form W 2c W 3c Instructions Social Security accepts laser printed Forms W 2 W 3 as well as the standard red drop out ink forms Both the laser forms and the red drop out ink forms must comply with Internal Revenue Service s Publication 1141 and require pre approval from Social Security Free File Up to 50 W 2s Using W 2 Online

The W 2 form is a crucial document for U S taxpayers as it reports their income and taxes withheld from their wages or salary during the tax year Employers must provide employees with an IRS W2 form for the 2023 tax year by January 31st of each year and employees must use this information to file their annual tax returns Instead you can create and submit them online See E filing later Due dates By January 31 2024 furnish Copies B C and 2 to each person who was your employee during 2023 Mail or electronically file Copy A of Form s W 2 and W 3 with the SSA by January 31 2024 See the separate instructions

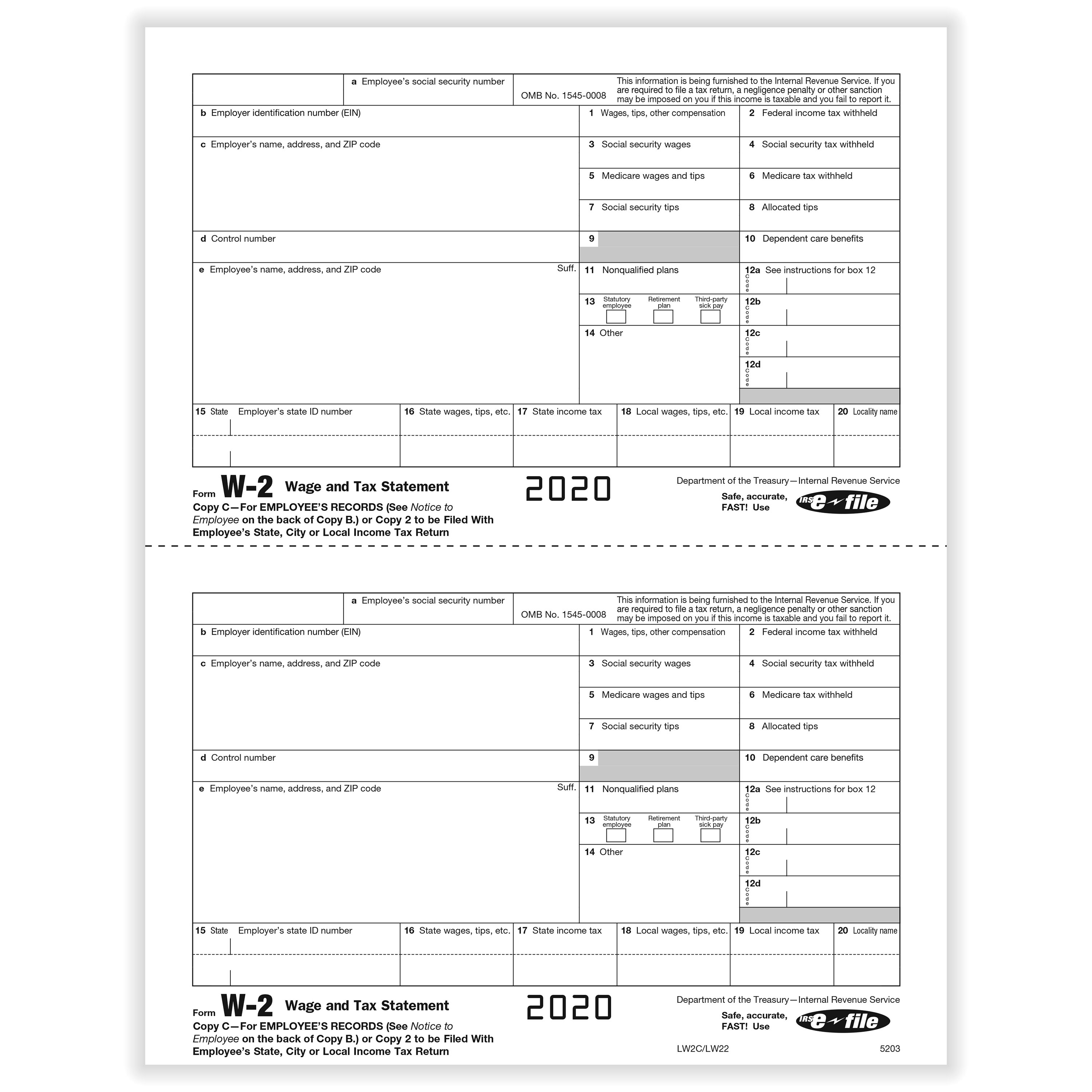

W 2 IRS Approved W 2 Laser Tax Form Copy C W 2 Forms Formstax

https://cdn.formstax.com/Images/Products/L0760-5203-2020-W2-Laser-Employee-Copy-2-C_xl.jpg

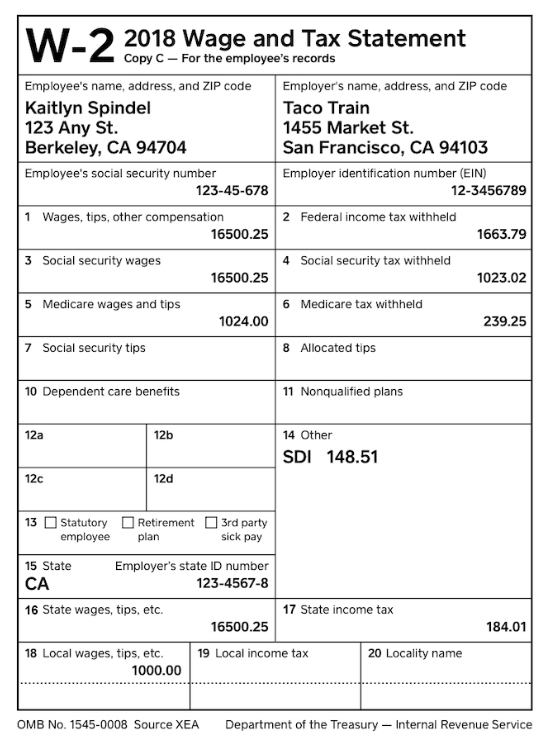

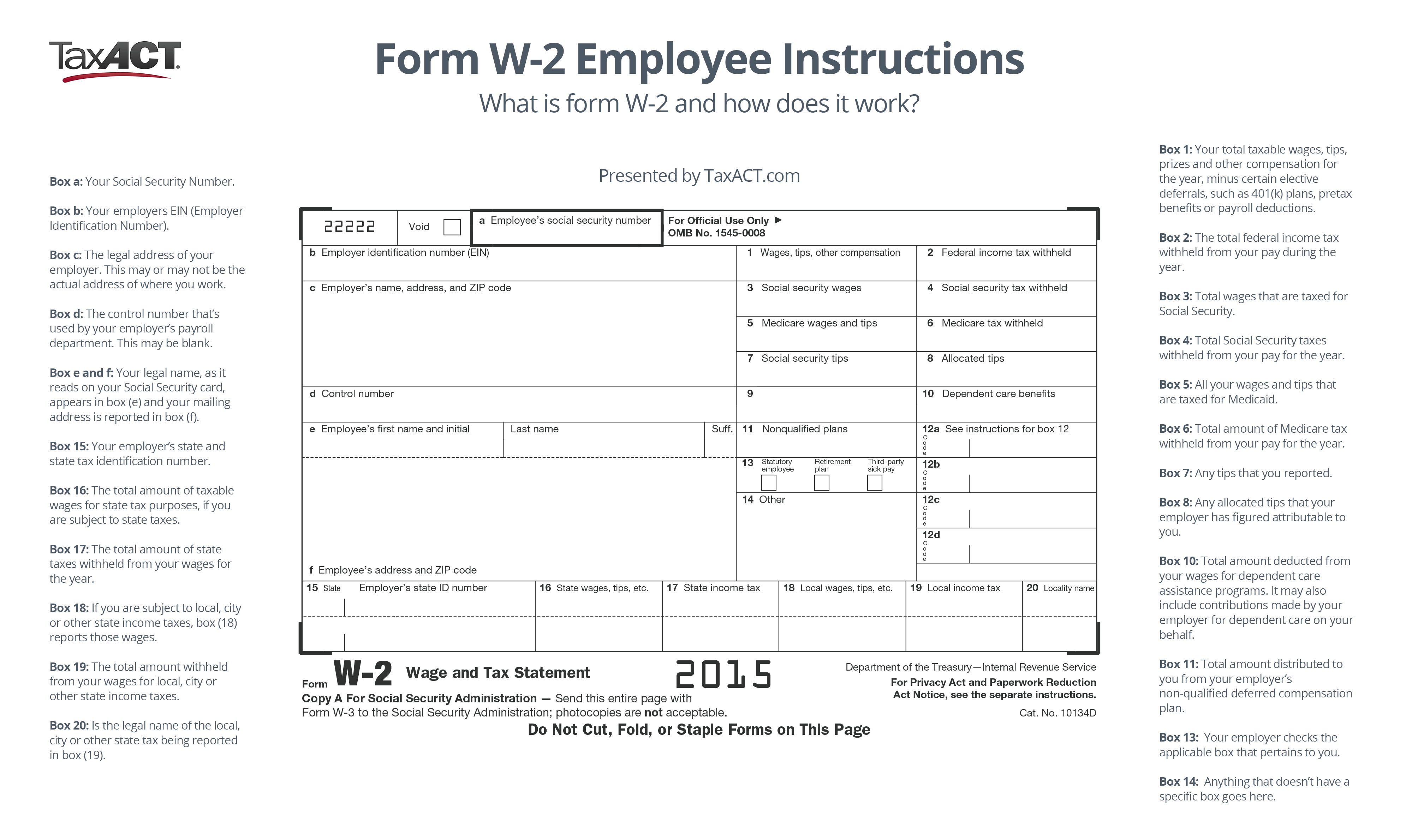

What Is Form W 2 And How Does It Work TaxAct Blog

http://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions.png

https://www.irs.gov/instructions/iw2w3

The entries on Form W 2 must be based on wages paid during the calendar year Use Form W 2 for the correct tax year For example if the employee worked from December 15 2024 through December 28 2024 and the wages for that period were paid on January 3 2025 include those wages on the 2025 Form W 2

https://www.irs.gov/forms-instructions

Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media

W 2 Reporting Requirements W 2 Changes For 2020 Forms

W 2 IRS Approved W 2 Laser Tax Form Copy C W 2 Forms Formstax

W2 Form IRS 2023 Fillable PDF With Print And Clear Buttons Generate W2 Quickly Digital Download

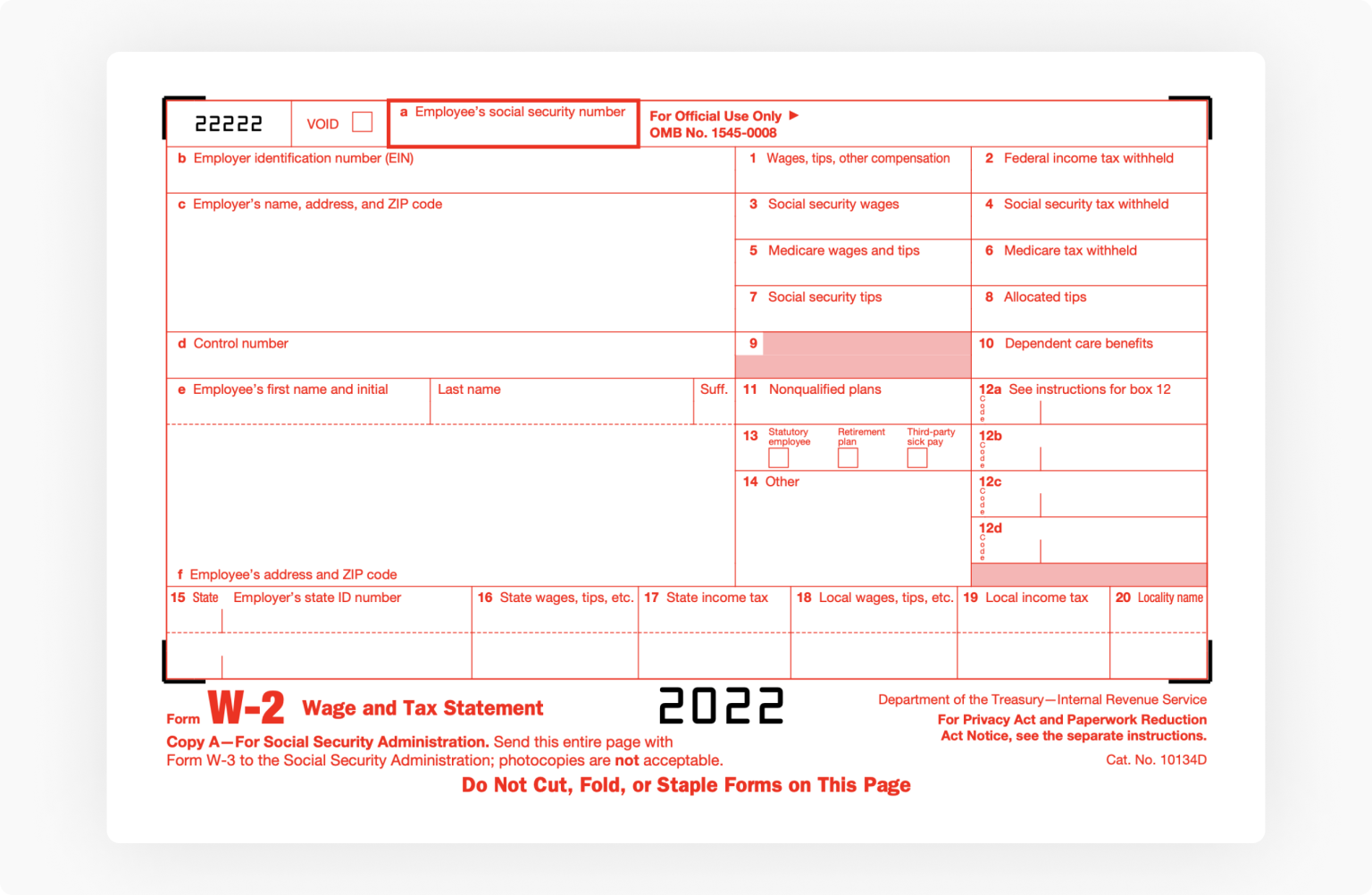

2022 Irs W 2 Fillable Form Fillable Form 2023

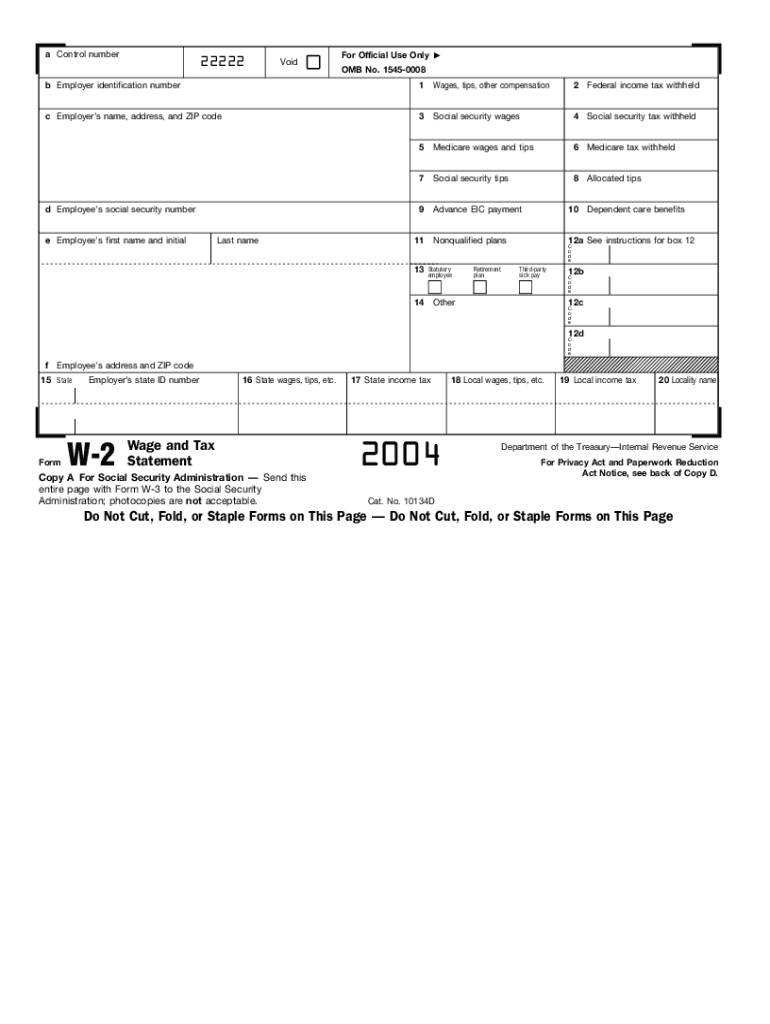

2004 Form IRS W 2 Fill Online Printable Fillable Blank PdfFiller

Printable W2 Forms

Printable W2 Forms

Fillable W2 Form 2020 Fill Online Printable Fillable Blank Form w 3pr

How To Print W2 Forms On White Paper

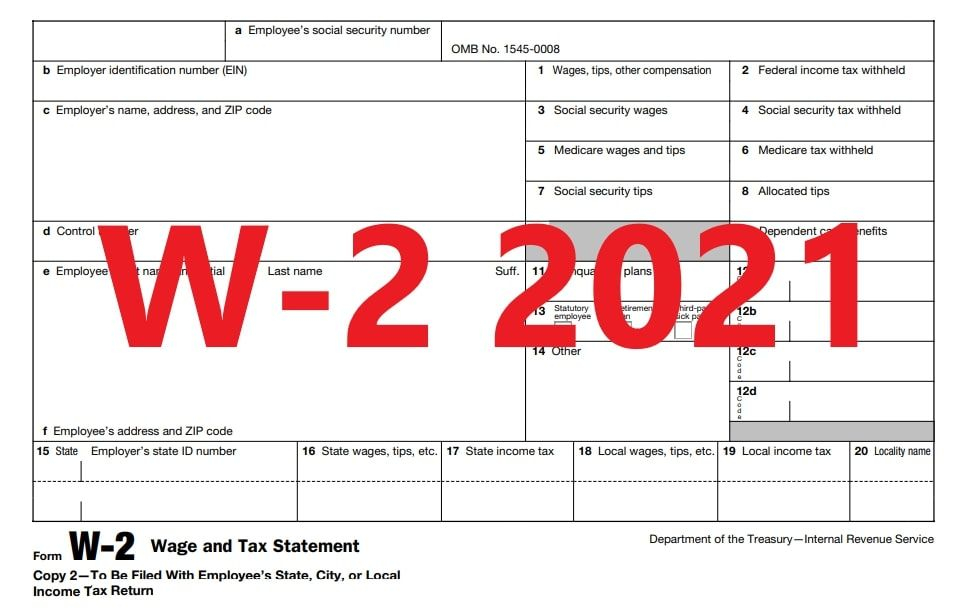

W 2 Form 2021 Printable Form 2021

Irs Printabl E W 2 Forms - Publication 4012 Rev 01 2021 If a Form W 2 can t be obtained from the employer select the box to indicate this is a substitute W 2 TaxSlayer will generate a Form 4852 Substitute for Form W 2 Wage and Tax Statement The taxpayer will need to provide total income and withholding from their year end pay stub Indicate if W 2 is for Taxpayer