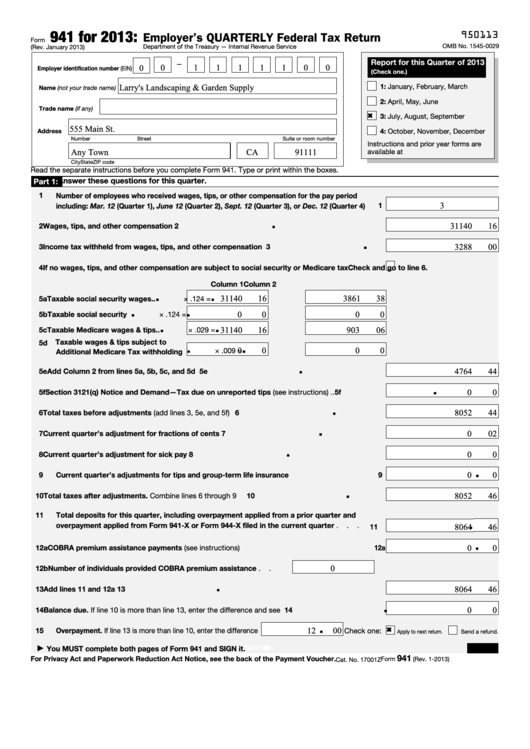

Irs Printable Estimated Tax Forms Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

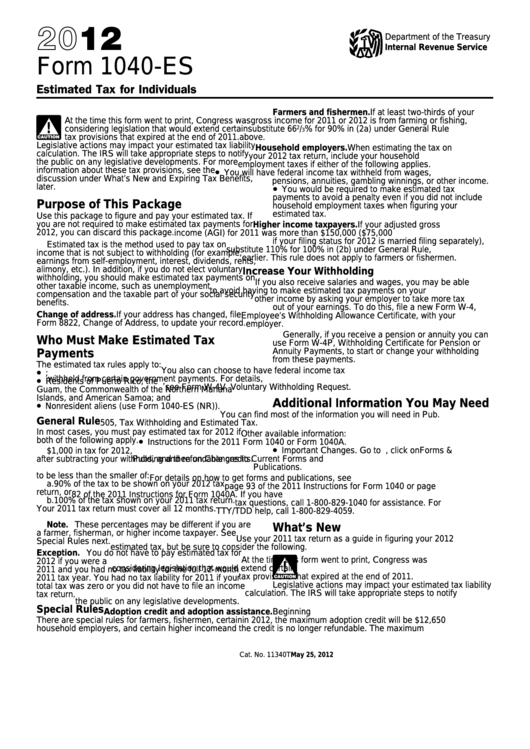

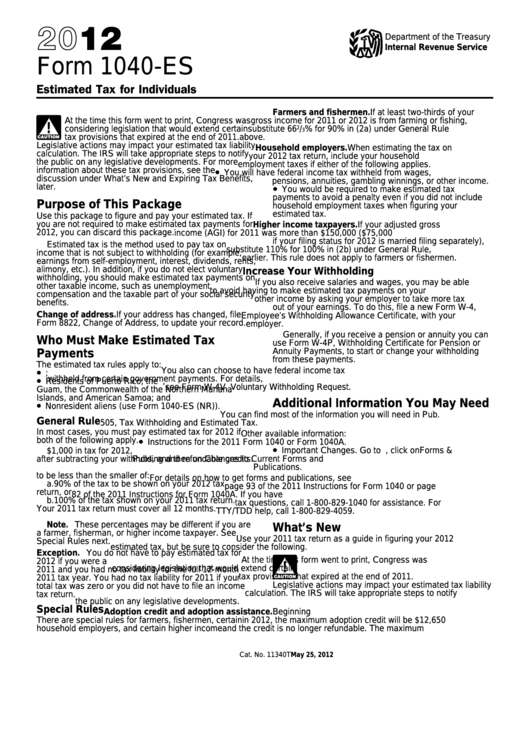

Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self employment interest dividends rents alimony etc Department of the Treasury Internal Revenue Service Purpose of This Package Use Form 1040 ES to figure and pay your estimated tax for 2023 Estimated tax is the method used to pay tax on income that isn t subject to withholding for example earnings from self employment interest dividends rents alimony etc

Irs Printable Estimated Tax Forms

Irs Printable Estimated Tax Forms

https://i1.wp.com/bookkeeperla.com/wp-content/uploads/1040ESNo2.jpg?fit=1200%2C564&ssl=1

Fillable Form 1040 Es Estimated Tax For Individuals 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/fillable-form-1040-es-estimated-tax-for-individuals.png

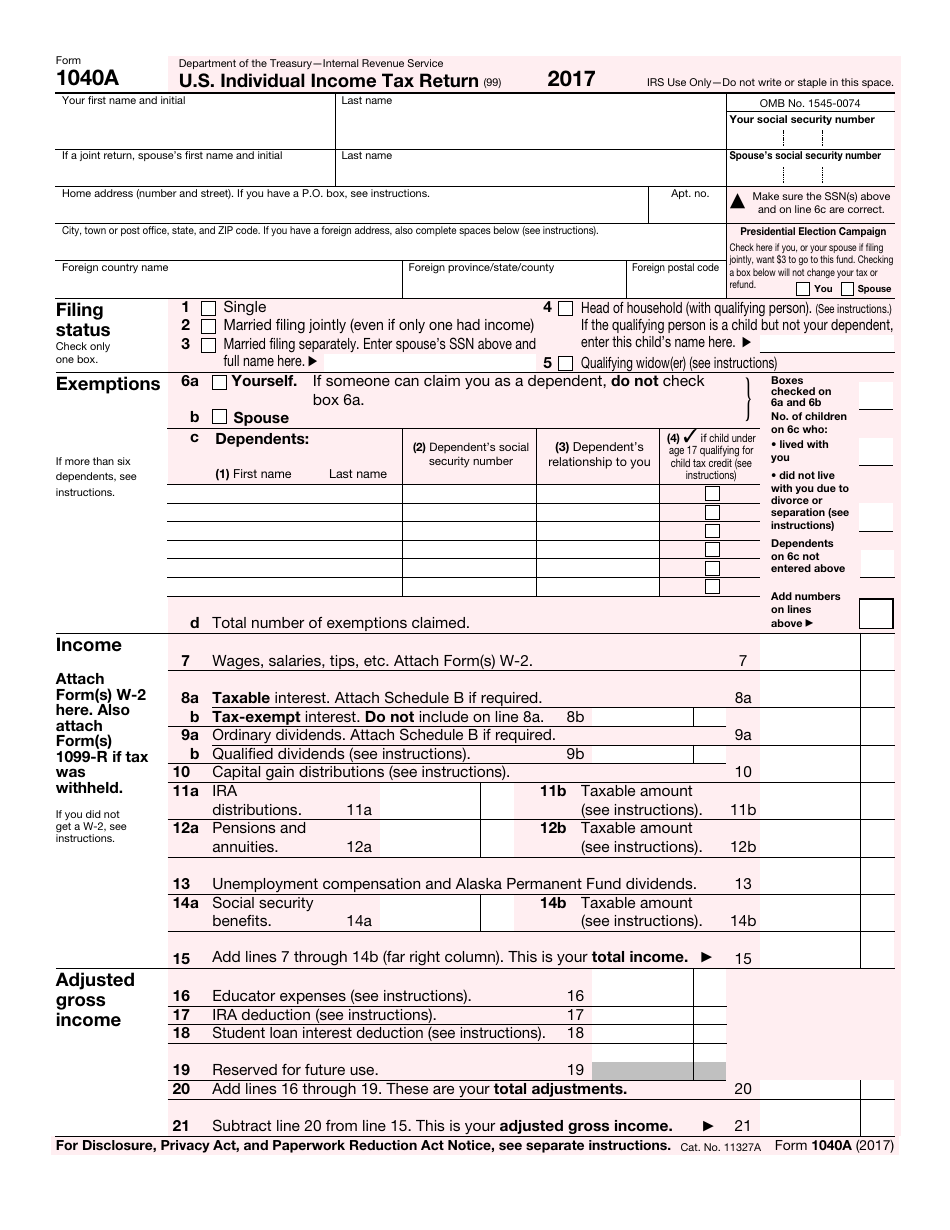

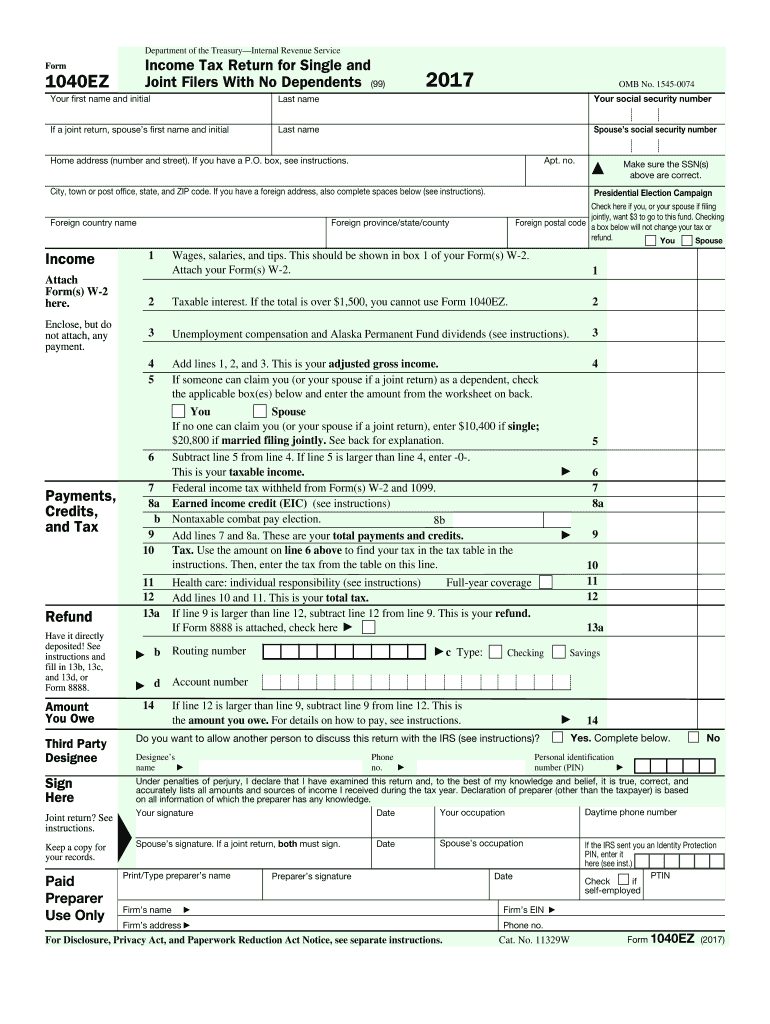

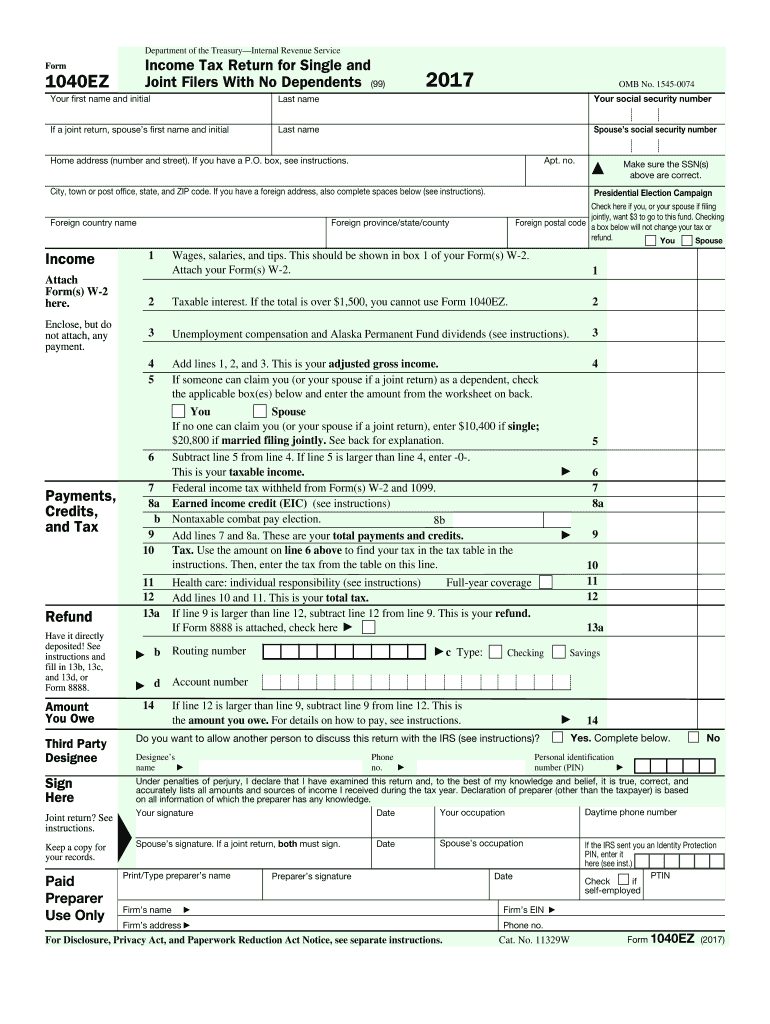

IRS Form 1040A 2017 Fill Out Sign Online And Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/1352/13527/1352746/irs-form-1040a-2017-u-s-individual-income-tax-return_print_big.png

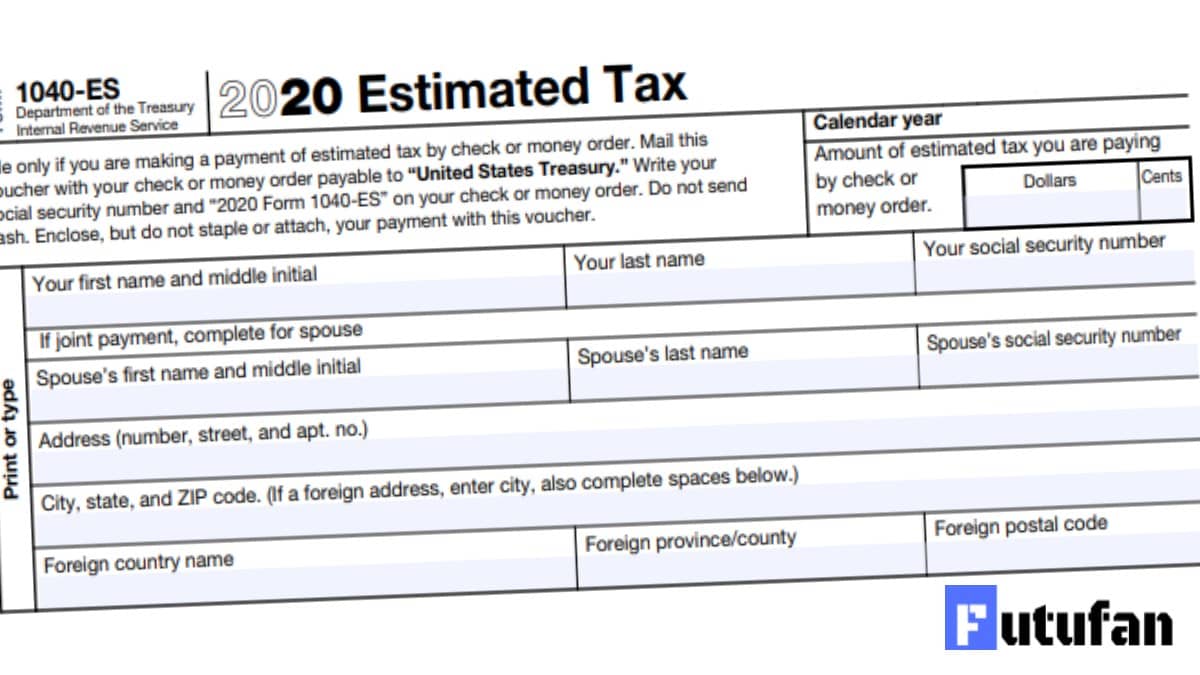

Department of the Treasury Internal Revenue Service Purpose of This Package Use Form 1040 ES to figure and pay your estimated tax for 2020 Estimated tax is the method used to pay tax on income that isn t subject to withholding for example earnings from self employment interest dividends rents alimony etc The IRS provides Form 1040 ES for you to calculate and pay estimated taxes for the current year While the 1040 relates to the previous year the estimated tax form calculates taxes for the current year You use Form 1040 ES to pay income tax self employment tax and any other tax you may be liable for TABLE OF CONTENTS Who pays estimated tax

Order by phone at 1 800 TAX FORM 1 800 829 3676 You can also find printed versions of many forms instructions and publications in your community for free at Libraries IRS Taxpayer Assistance Centers If you are searching for federal tax forms from previous years look them up by form number or year New 1040 form for older adults The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

More picture related to Irs Printable Estimated Tax Forms

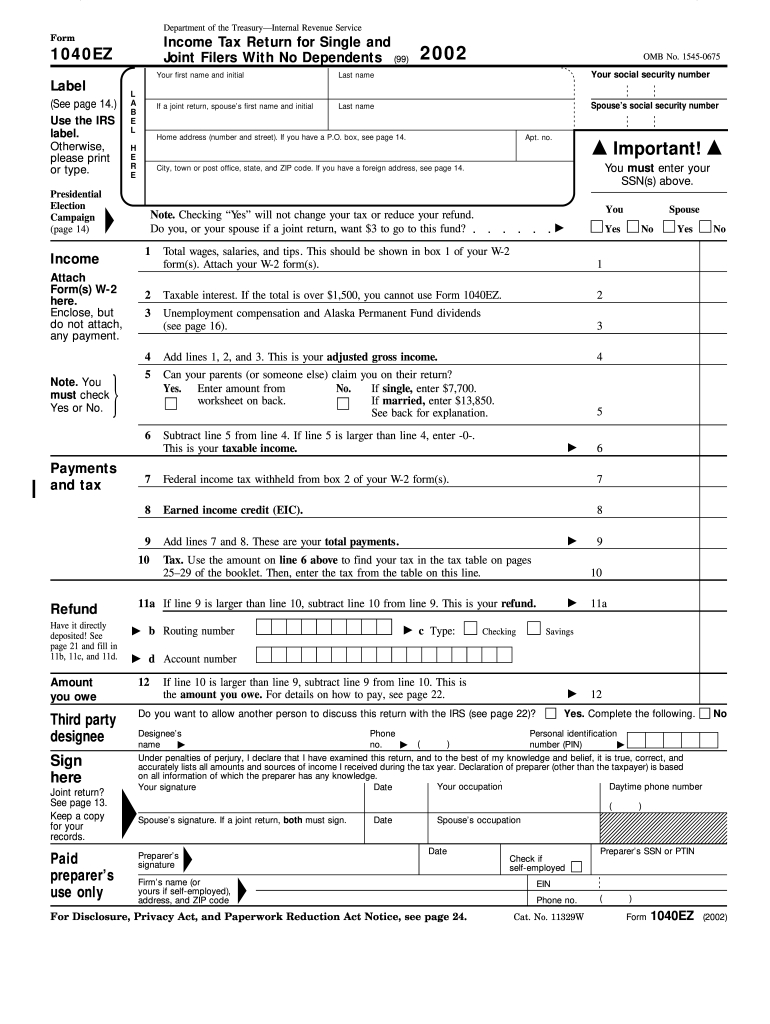

2002 Form IRS 1040 EZ Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/44/44600/large.png

2023 Form 1040 Es Printable Forms Free Online

https://www.taxuni.com/wp-content/uploads/2020/09/1040-ES-Form.jpg

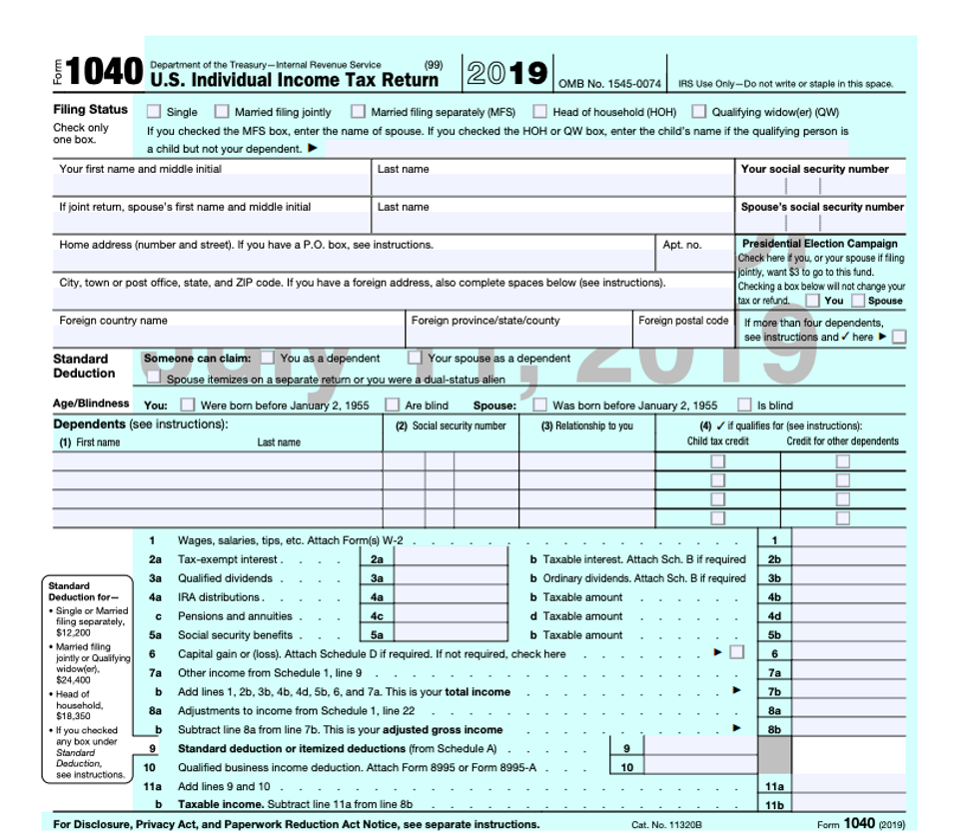

2019 IRS Tax Forms 1040 Printable 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/everything-old-is-new-again-as-irs-releases-form-1040-3.png

You can print next year s estimated tax vouchers Form 1040 ES in your 2023 program Sign in to your TurboTax account then open your return by selecting Continue or Pick up where you left off in the progress tracker When your return is open search for 1040 es be sure to include the hyphen and select the Jump to link in the search results Quantity Limits Maximum Item Quantities 20 Forms 5 Instructions 5 Publications 20 copies for each Form one copy of the corresponding instructions is automatically included 5 copies for each Instruction or Publication If you need more than the quantity limits above please call 800 829 3676 to order

Jan 15 2024 You can make estimated tax payments using any of these methods Apply your 2023 refund to your 2024 estimated tax Mail a check or money order with Form 1040 ES Estimated Tax for Individuals Use the Electronic Federal Tax Payment System EFTPS to submit payments electronically Visit www eftps gov or call 1 800 555 4477 W 2 forms show the income you earned the previous year and what taxes were withheld Learn how to replace incorrect stolen or lost W 2s or how to file one if you are an employer Find out how to get and where to mail paper federal and state tax forms Learn what to do if you don t get your W 2 form from your employer or it s wrong

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/429/961/429961581/large.png

IRS Estimated Taxes Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/irs-1040-estimated-tax-form-1040-form-printable.png

https://www.irs.gov/forms-instructions

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

https://www.irs.gov/forms-pubs/about-form-1040-es

Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self employment interest dividends rents alimony etc

IRS 1120 W 2021 Fill Out Tax Template Online US Legal Forms

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill And Sign Printable Template Online

IRS 1041 ES 2020 2022 Fill Out Tax Template Online US Legal Forms

Irs Forms 2021 Printable Quarterly Estimate Taxes Calendar Template Printable

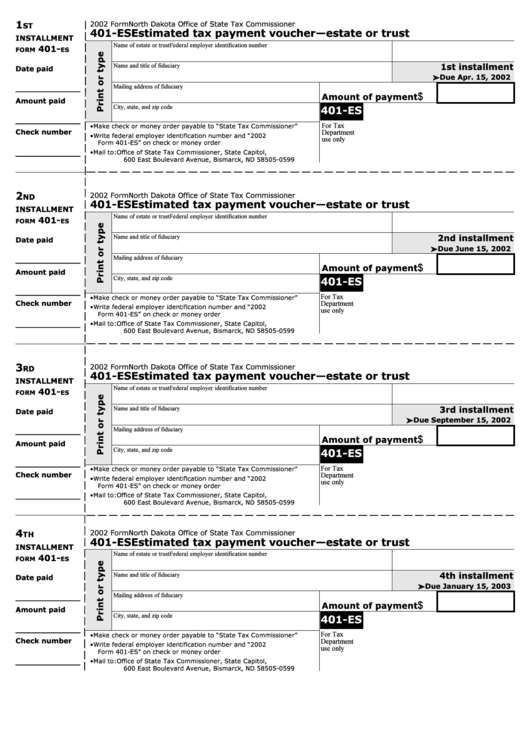

Form 401 Es Estimated Tax Payment Voucher 2002 Printable Pdf Download

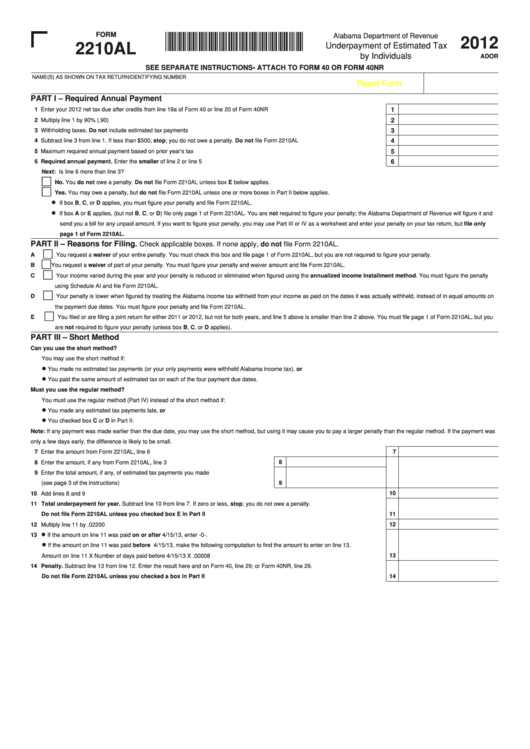

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals 2012 Printable Pdf Download

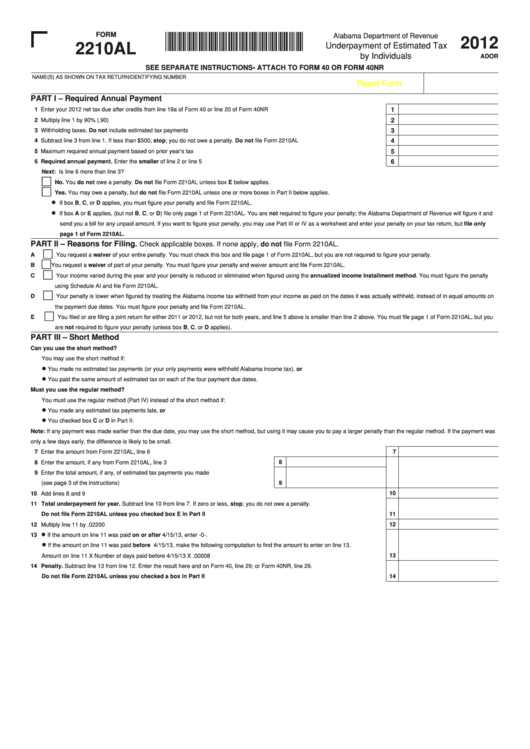

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals 2012 Printable Pdf Download

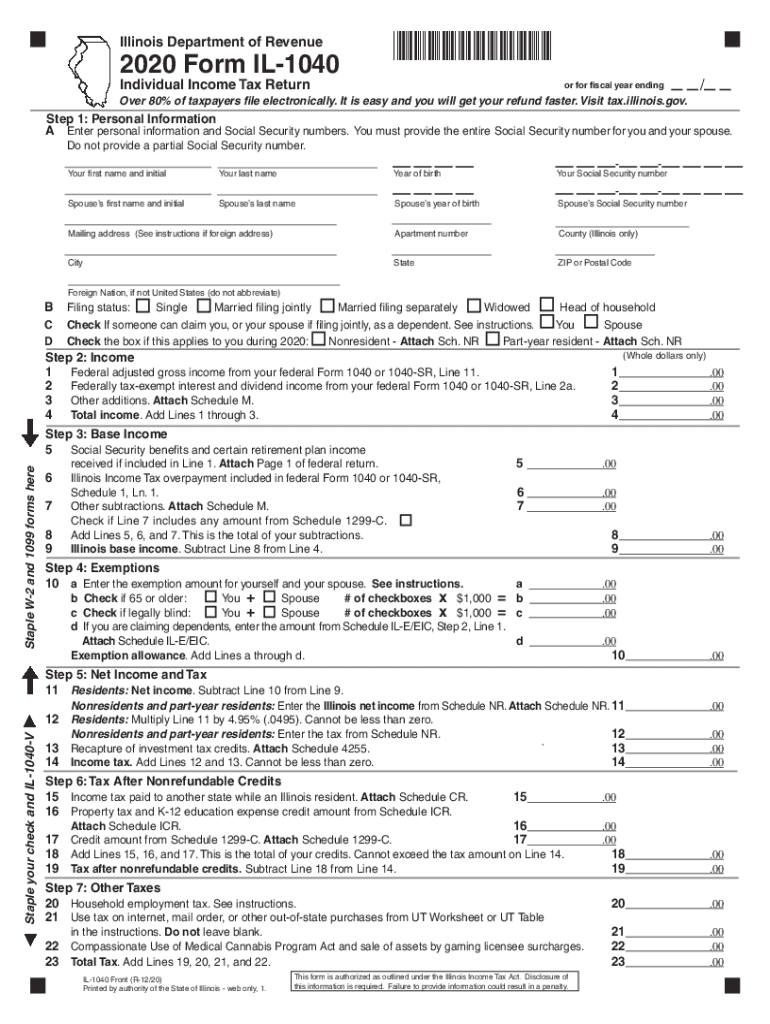

IL DoR IL 1040 2020 Fill Out Tax Template Online US Legal Forms

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting

2015 Form 1040ES Estimated Tax For Individual Free Download Worksheet Template Tips And Reviews

Irs Printable Estimated Tax Forms - Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services