Irs Printable First B Notice Form Access IRS forms instructions and Use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return or on a notice we sent you Form 9465 PDF Related Instructions for Form 9465 PDF Page Last Reviewed or Updated 14 Nov 2023 Share Facebook Twitter Linkedin Print Footer

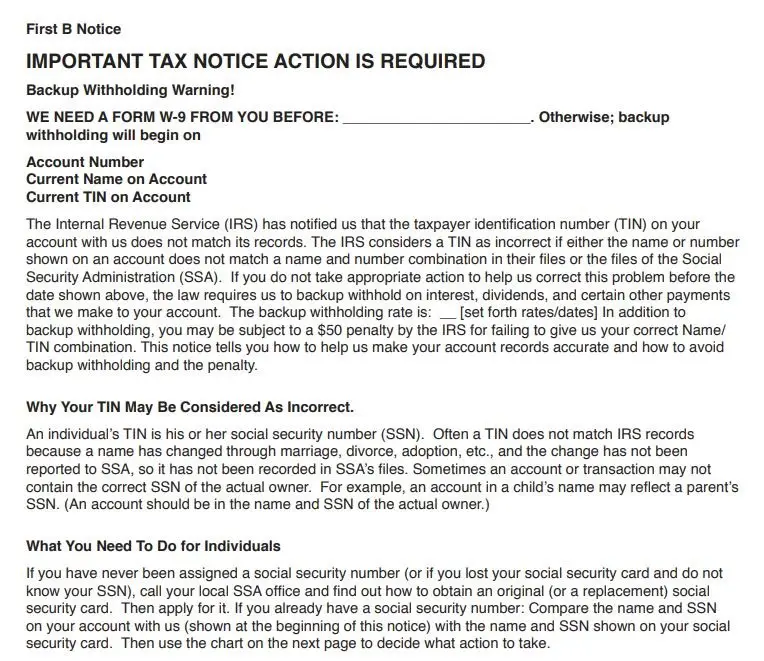

What You Need To Do for Individuals If you have never been assigned a social security number or if you lost your social security card and do not know your SSN call your local SSA ofice and find out how to obtain an original or a replacement social security card Then apply for it Step 1 Identify Which IRS Notice You Received The IRS will send you a CP2100 Notice or a CP2100A Notice if your tax documents contain Missing TINs or Incorrect Name TIN Combinations A Taxpayer Identification Number TIN can be a Social Security Number SSN for an individual Employer Identification Number EIN for a business

Irs Printable First B Notice Form

Irs Printable First B Notice Form

https://lh3.googleusercontent.com/proxy/swconOy_ADpN5dfq6dI7kNuj64IOS_cDv8Rev3slZniPu2S3FT3YNSTShS-xur8gb-pN-_K_-s7w57wtq0XomkzZK_OZkSbOQm4jOVC6=w1200-h630-p-k-no-nu

Irs B Notice Template

http://www.irs.gov/file_source/image/cp259b_pg4.jpg

Irs First B Notice Form Template Free

https://i.pinimg.com/736x/ad/e4/f9/ade4f9b08d1b9fd08f1e51232f35459d.jpg

This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income This is known as Backup Withholding BWH and may be required Under the BWH B program because you failed to provide a correct taxpayer identification number TIN to the payer for reporting on the required information return A TIN can A backup withholding notice sometimes called a B notice states that the nonemployee s taxpayer ID number is either missing or incorrect When you receive the first IRS notice you should follow these steps Send a copy of the B notice to the individual within 15 business days of receiving the first notice and ask them to sign a new W 9 form

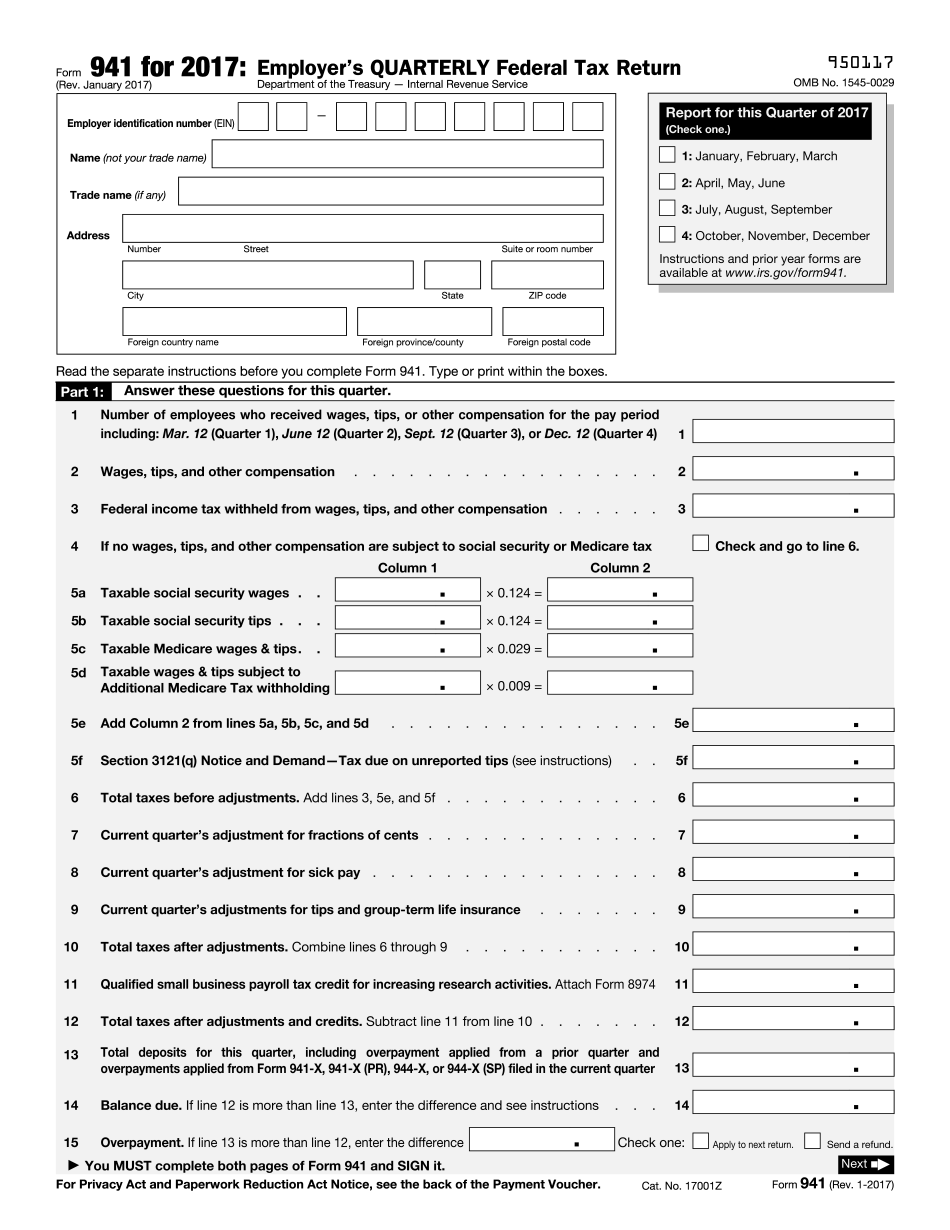

Updated 11 14 2023 The IRS has resumed sending collection notices in limited circumstances The notices will resume for individual taxpayers with tax debts for tax periods ending Dec 31 2022 or later for business taxpayers with tax debts for tax periods Aug 31 2023 or later and tax debts connected to Form 941 Employer s Quarterly Federal Tax Return for tax periods Sept 30 2023 or Send the payee the first B Notice and a Form W 9 within 15 business days The vendor must complete sign and return the W 9 to you They certify under penalties of perjury that the name and number is correct

More picture related to Irs Printable First B Notice Form

Printable I R S Forms Schedule B Printable Forms Free Online

https://www.pdffiller.com/preview/400/414/400414967/big.png

First B Notice Fillable Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/first-b-notice-fillable/first-b-notice-fillable-preview.webp

Free Printable Irs Tax Forms Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/how-to-fill-out-irs-form-1040-with-form-wikihow-free-2.jpg

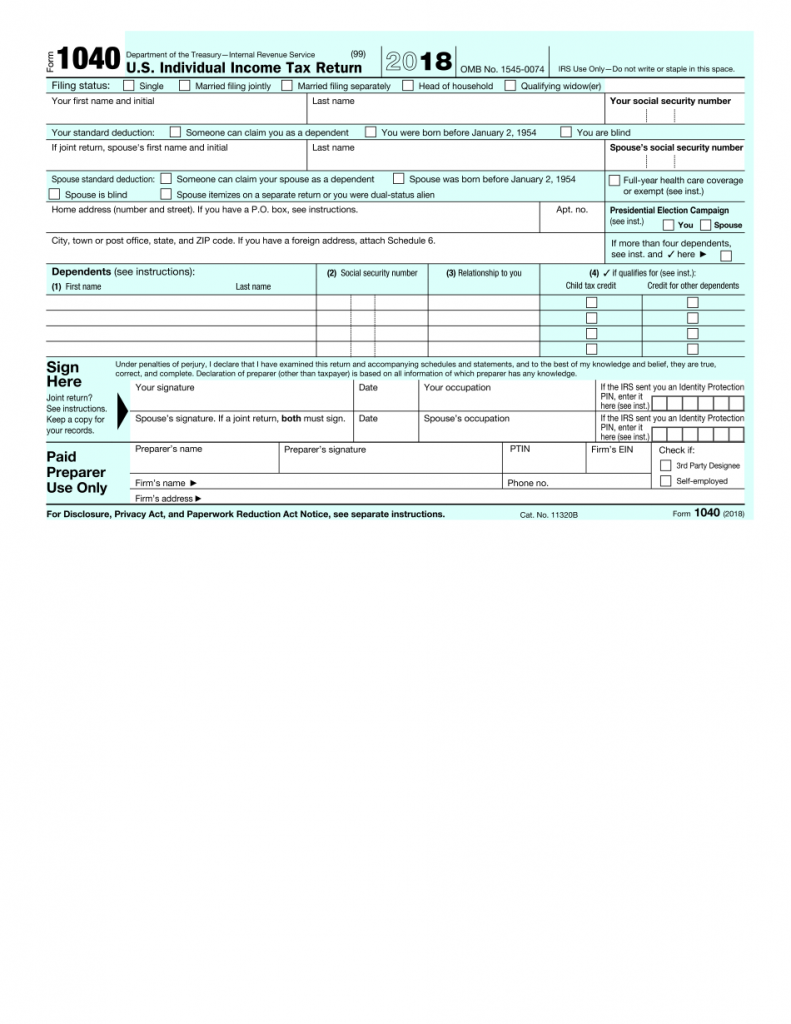

Department of the Treasury Internal Revenue Service Go to Interest and Ordinary Dividends Attach to Form 1040 or 1040 SR OMB No 1545 0074 Attachment 2023 www irs gov ScheduleB Name s shown on return for instructions and the latest information Sequence No 08 Your social security number on that form The B Notice creates potential backup withholding exposure incorrect filing penalties and potentially an IRS Form 1099 audit B Notices are sent to IRS Form 1099 filers who ve submitted a name and taxpayer identification number TIN combination that doesn t match the IRS database Filers have a 15 day window to take action on the notices

An IRS B Notice is an annual IRS notification to payers that IRS Forms 1099 have been filed with either missing or incorrect name TIN combinations A first B Notice mailing is used when there is a mismatch between the IRS registration and the tax reporting information that was supplied via IRS Form 1099 Follow the simple instructions below Choosing a authorized specialist making a scheduled appointment and going to the workplace for a private conference makes completing a First B Notice from beginning to end stressful US Legal Forms lets you quickly produce legally valid papers based on pre constructed web based samples

Printable First B Notice Template Printable Templates

https://i.pinimg.com/originals/57/32/da/5732da7e44155acc689e76491717b360.jpg

Irs First B Notice Form Template Free Printable Word Searches

https://i2.wp.com/data.templateroller.com/pdf_docs_html/2017/20173/2017334/irs-form-1094-b-transmittal-of-health-coverage-information-returns_print_big.png

https://www.irs.gov/forms-instructions

Access IRS forms instructions and Use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return or on a notice we sent you Form 9465 PDF Related Instructions for Form 9465 PDF Page Last Reviewed or Updated 14 Nov 2023 Share Facebook Twitter Linkedin Print Footer

https://www.businessasap.com/wp-content/uploads/IRS-First-B-Notice.pdf

What You Need To Do for Individuals If you have never been assigned a social security number or if you lost your social security card and do not know your SSN call your local SSA ofice and find out how to obtain an original or a replacement social security card Then apply for it

Irs First B Notice Form Template Free

Printable First B Notice Template Printable Templates

First B Notice Template

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

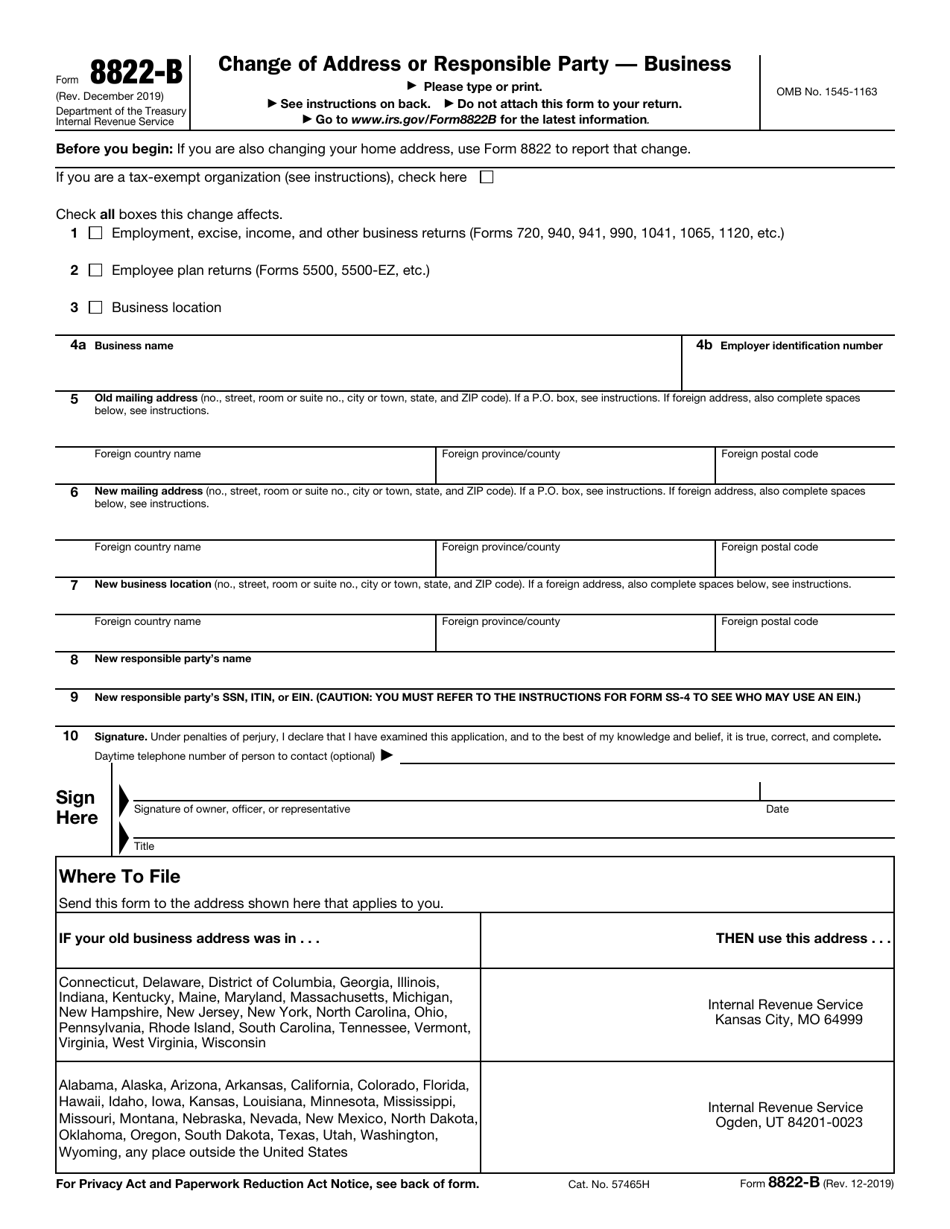

IRS Form 8822 B Fill Out Sign Online And Download Fillable PDF Templateroller

Printable First B Notice Template Printable Templates

Printable First B Notice Template Printable Templates

Printable First B Notice Template Printable Templates

First B Notice Template

First B Notice Template

Irs Printable First B Notice Form - A backup withholding notice sometimes called a B notice states that the nonemployee s taxpayer ID number is either missing or incorrect When you receive the first IRS notice you should follow these steps Send a copy of the B notice to the individual within 15 business days of receiving the first notice and ask them to sign a new W 9 form