Irs Printable Forms Eftps Diredt Worksheet Short Form How to enroll in EFTPS New enrollments for EFTPS can take up to five business days to process Enroll at EFTPS or request an enrollment from EFTPS Customer Service 800 555 4477 877 333 8292 Federal Agencies 800 733 4829 TDD Hearing Impaired 800 244 4829 Espa ol

For Business Individual Taxpayers Publication 4990 Rev 4 2022 Catalog Number 59402S Department of the Treasury Internal Revenue Service www irs gov This EFTPS tax payment service Web site supports Microsoft EDGE for Windows Google Chrome for Windows and Mozilla Firefox for Windows You may use this Web site and our voice response system 1 800 555 3453 interchangeably to make payments If you are required to make deposits electronically but do not wish to use the EFTPS tax payment

Irs Printable Forms Eftps Diredt Worksheet Short Form

Irs Printable Forms Eftps Diredt Worksheet Short Form

https://data.formsbank.com/pdf_docs_html/259/2595/259575/page_1_thumb_big.png

Eftps Direct Payment Worksheet Short Form Photos Cantik

https://www.irs.gov/pub/xml_bc/33875028.gif

IRS Forms Fillable Printable Free

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

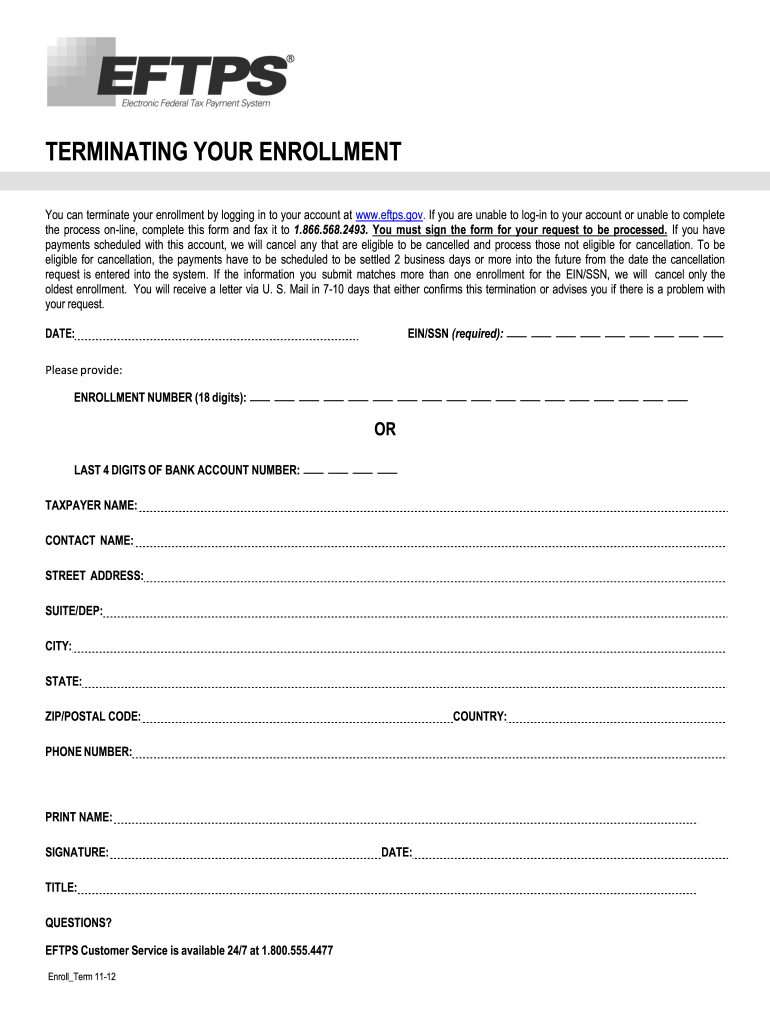

Gather your information including your EIN for business or SSN for individual PIN and tax form number Call the EFTPS Tax Payment toll free number available 24 hours a day 7 days a week 1 800 555 3453 Follow the voice prompts to select the tax form payment type period and amount and subcategory information if applicable EFTPS Financial Institution Handbook This handbook is designed to help you assist business and individual customers with their federal tax payments It contains information related to customer initiated payments ACH credit for businesses and more EFTPS Financial Institution Handbook Same Day Payment Worksheet

For assistance call Customer service at 1 800 555 8778 Upon logging in to this site you may be redirected to a separate page and prompted to register and or authenticate with a Credential Service Provider ID me or Login gov Federal Agency users have the option to utilize PIV CAC to authenticate Upon completion of this step you will be Gather your information including your EIN for business or SSN for individual PIN and tax form number Call the EFTPS Tax Payment toll free number available 24 hours a day 7 days a week 1 800 555 3453 Follow the voice prompts to select the tax form payment type tax period and amount and subcategory information if applicable

More picture related to Irs Printable Forms Eftps Diredt Worksheet Short Form

Fillable Online Ikafig Bounceme Eftps Direct Payment Bworksheetb Short Form Fax Email Print

https://www.pdffiller.com/preview/350/771/350771198/large.png

Adams And Hook Cheat Sheet Fill Online Printable Db excel

https://db-excel.com/wp-content/uploads/2019/09/adams-and-hook-cheat-sheet-fill-online-printable.jpg

Eftps Direct Payment Worksheet Long Form

https://i2.wp.com/data.formsbank.com/pdf_docs_html/294/2947/294774/page_1_thumb_big.png

Step 1 Click the Get Form button in the top area of this webpage to open our PDF tool Step 2 With the help of this online PDF tool you could do more than just complete blank form fields Try each of the features and make your forms seem professional with custom text incorporated or fine tune the file s original input to perfection all Stick to these simple instructions to get EFTPS Direct Payments Short Form completely ready for submitting Find the sample you require in our collection of legal forms Open the document in the online editing tool Go through the guidelines to learn which info you will need to give Select the fillable fields and include the required details

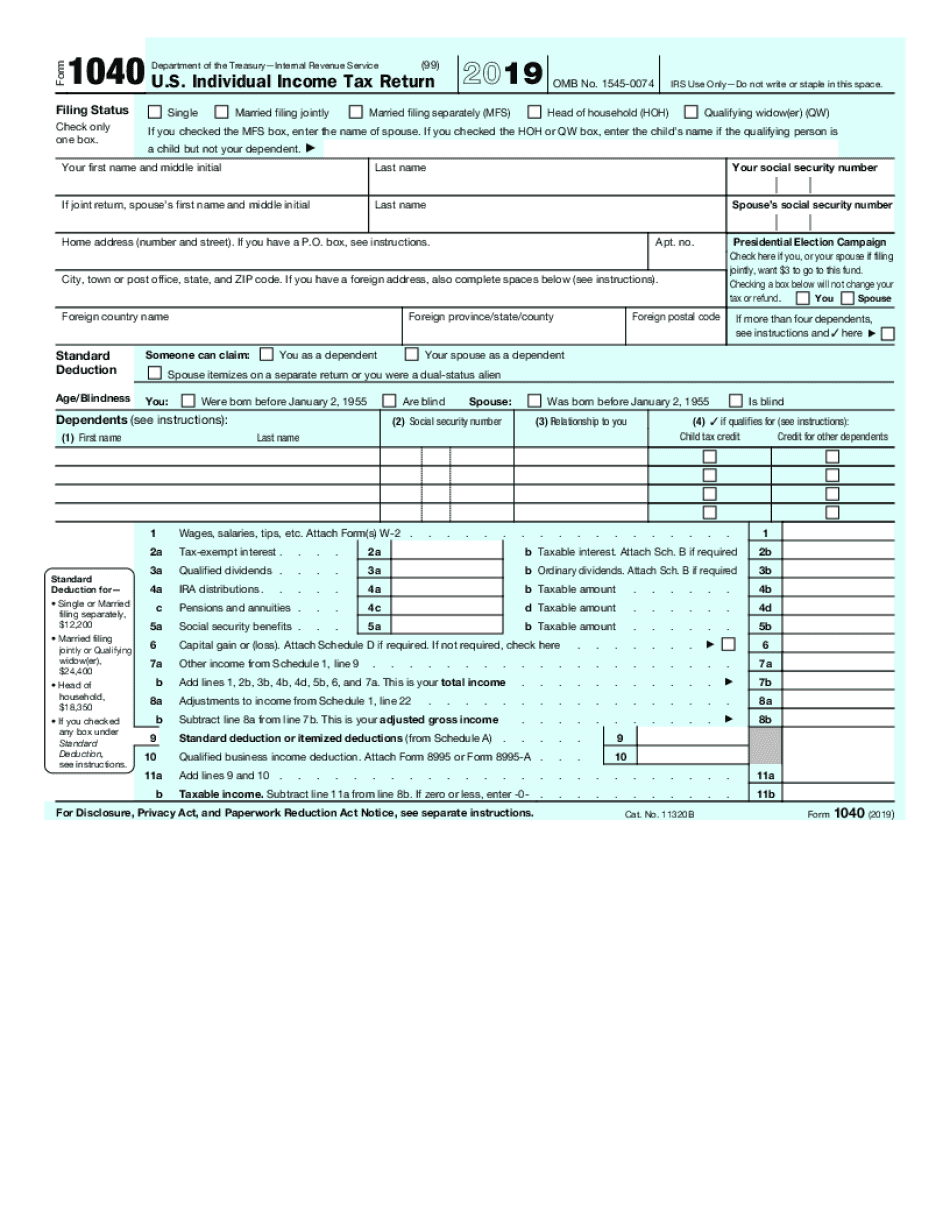

The latest versions of IRS forms instructions and publications View more information about Using IRS Forms Instructions Publications and Other Item Files Click on a column heading to sort the list by the contents of that column Enter a term in the Find box Click the Search button Fill out Printable Eftps Form Direct Payment Worksheet within several minutes by using the instructions listed below Find the document template you need from our library of legal forms Choose the Get form button to open the document and begin editing Fill in all the required boxes they will be yellowish

Eftps Direct Worksheet TUTORE ORG Master Of Documents

https://www.irs.gov/pub/xml_bc/33928027.gif

940 Eftps Printable Worksheet Form Printable Worksheets And ReportForm

https://www.reportform.net/wp-content/uploads/2022/09/35-pdf-blank-eftps-worksheet-printable-zip-docx-download.gif

https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system

How to enroll in EFTPS New enrollments for EFTPS can take up to five business days to process Enroll at EFTPS or request an enrollment from EFTPS Customer Service 800 555 4477 877 333 8292 Federal Agencies 800 733 4829 TDD Hearing Impaired 800 244 4829 Espa ol

https://www.irs.gov/pub/irs-pdf/p4990.pdf

For Business Individual Taxpayers Publication 4990 Rev 4 2022 Catalog Number 59402S Department of the Treasury Internal Revenue Service www irs gov

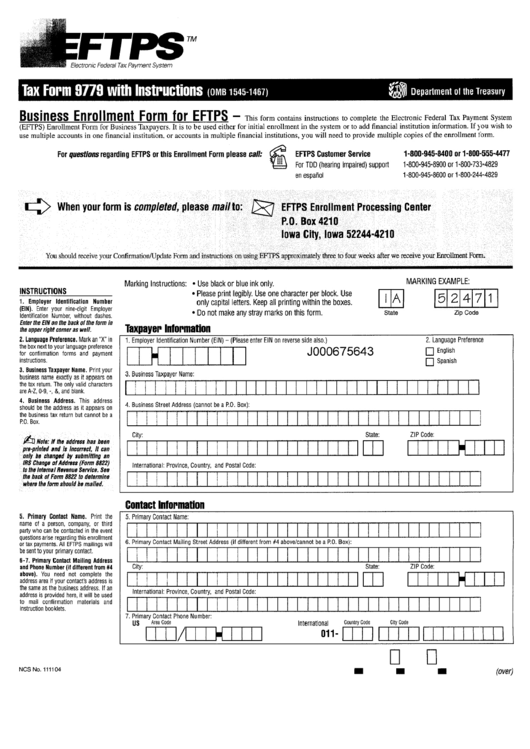

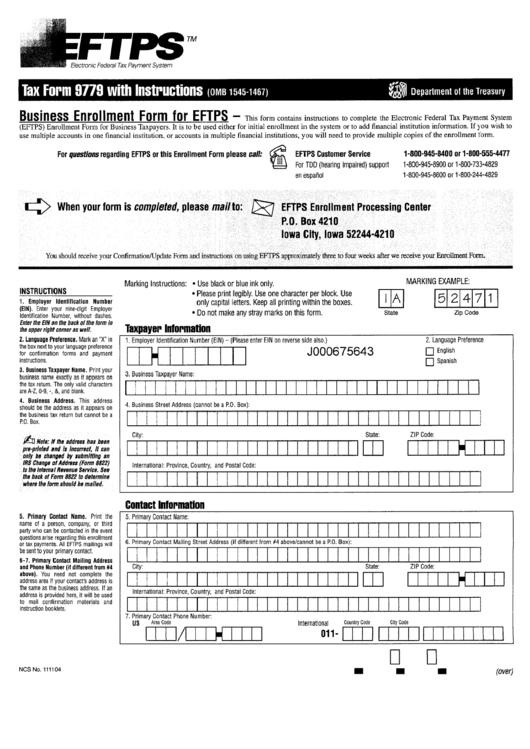

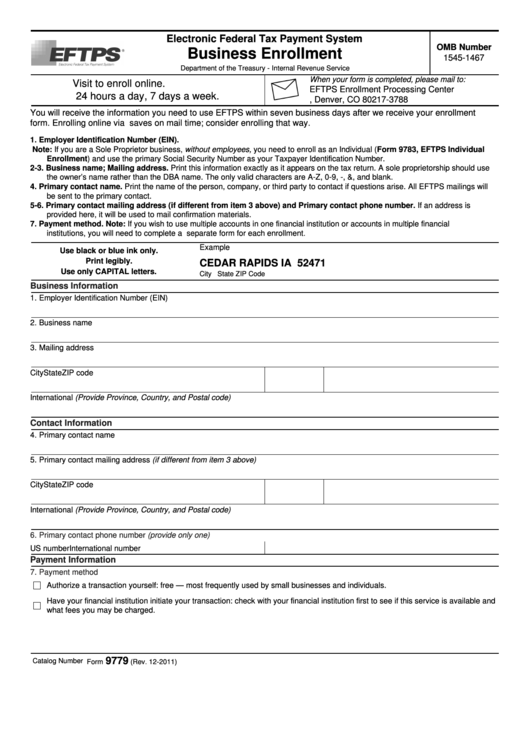

Fillable Form 9779 Eftps Business Enrollment Printable Pdf Download

Eftps Direct Worksheet TUTORE ORG Master Of Documents

Tax Payment Report Worksheet Eftps Voice Response System Short Form ReportForm

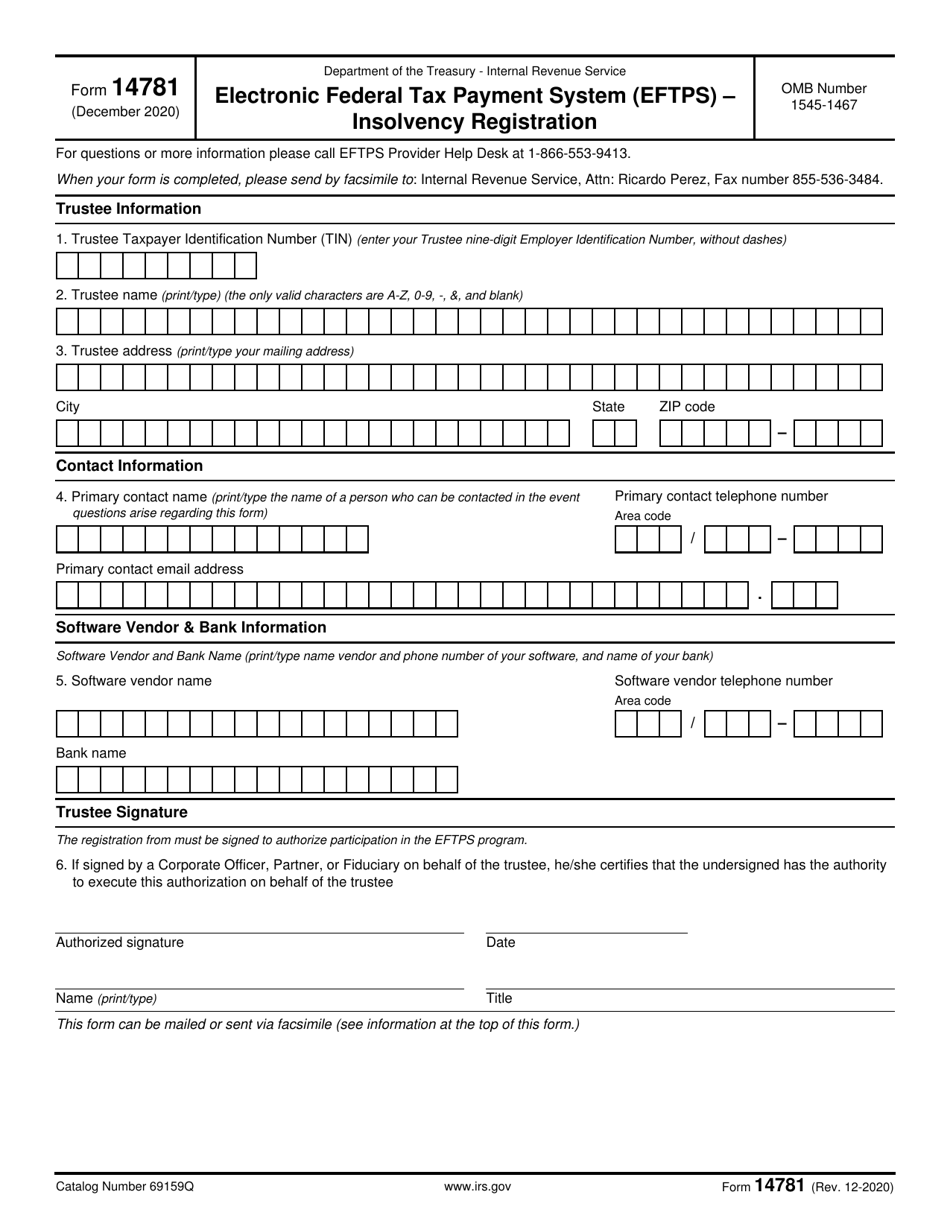

IRS Form 14781 Download Fillable PDF Or Fill Online Electronic Federal Tax Payment System Eftps

Irs Gov Printable Forms

Fillable Online Nufgs Loginto Eftps Direct Payment Worksheet Short Form Eftps Direct Payment

Fillable Online Nufgs Loginto Eftps Direct Payment Worksheet Short Form Eftps Direct Payment

Eftps Direct Payment Worksheet

Eftps Letter 2012 2024 Form Fill Out And Sign Printable PDF Template SignNow

Eftps Direct Payment Worksheet Short Form Photos Cantik

Irs Printable Forms Eftps Diredt Worksheet Short Form - Instructions in Form 2290 Introductory Material Future Developments Reminders