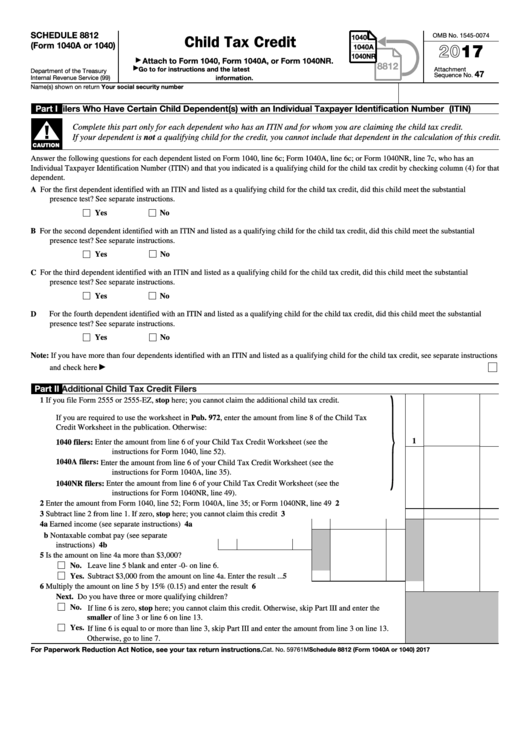

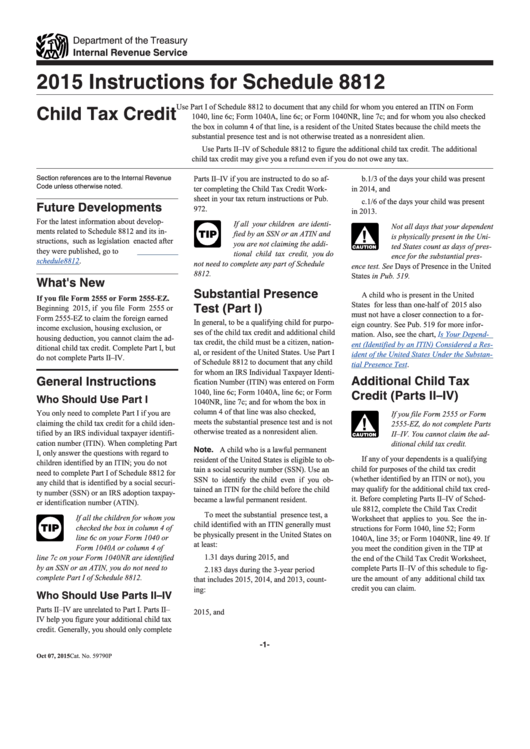

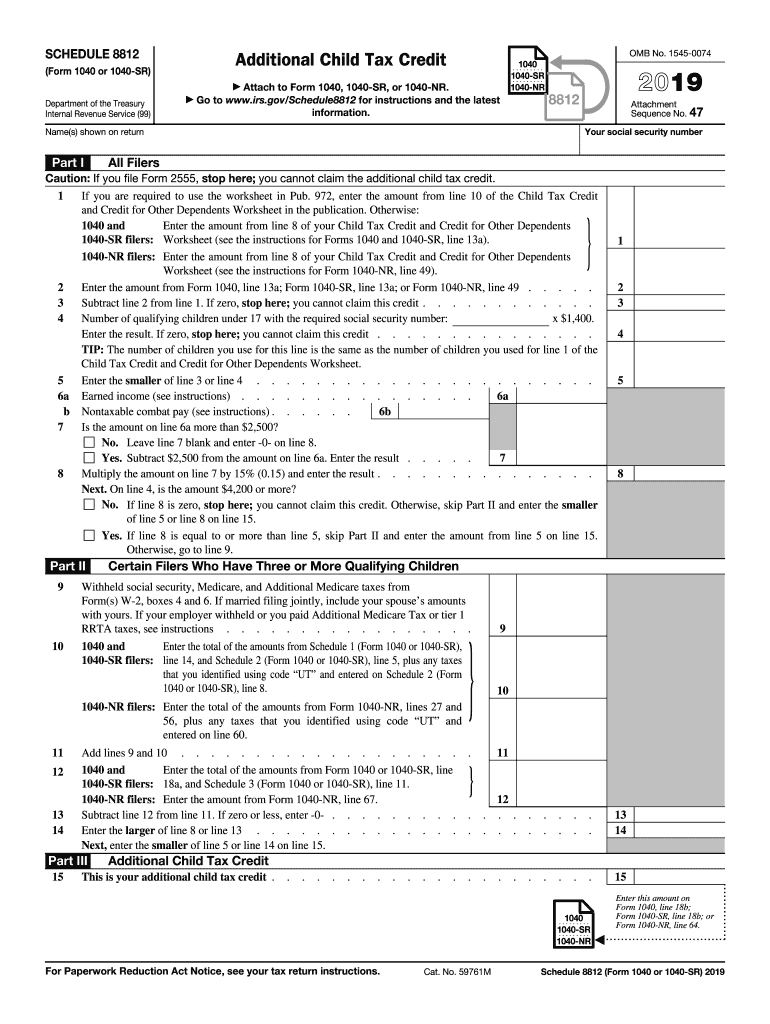

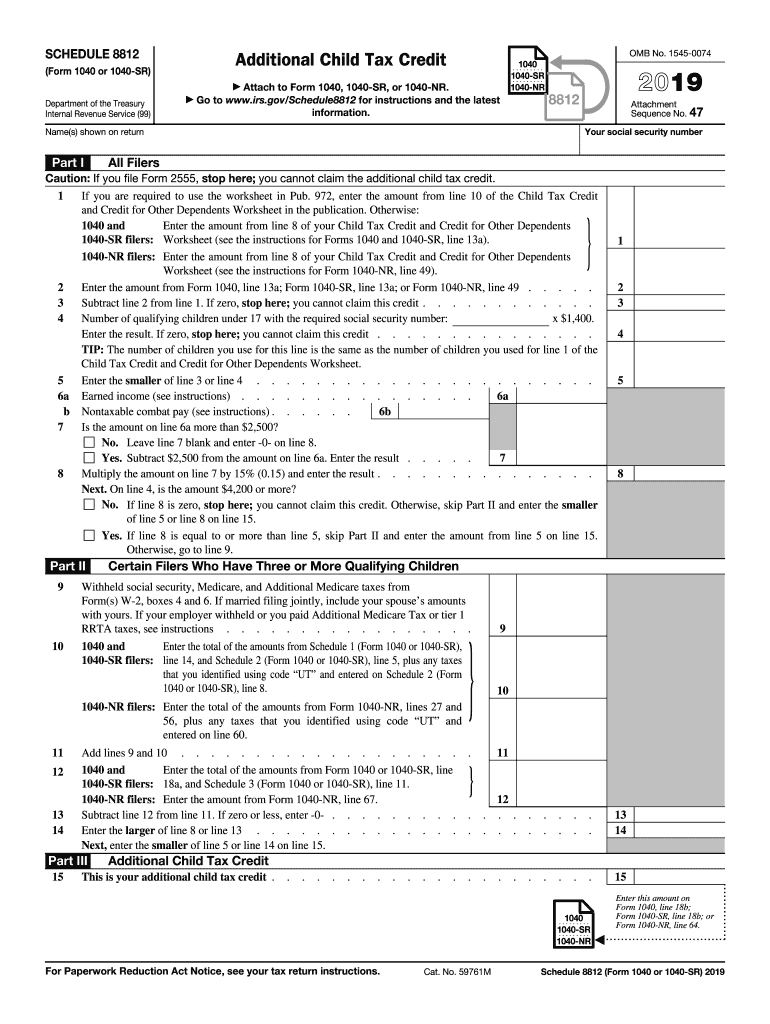

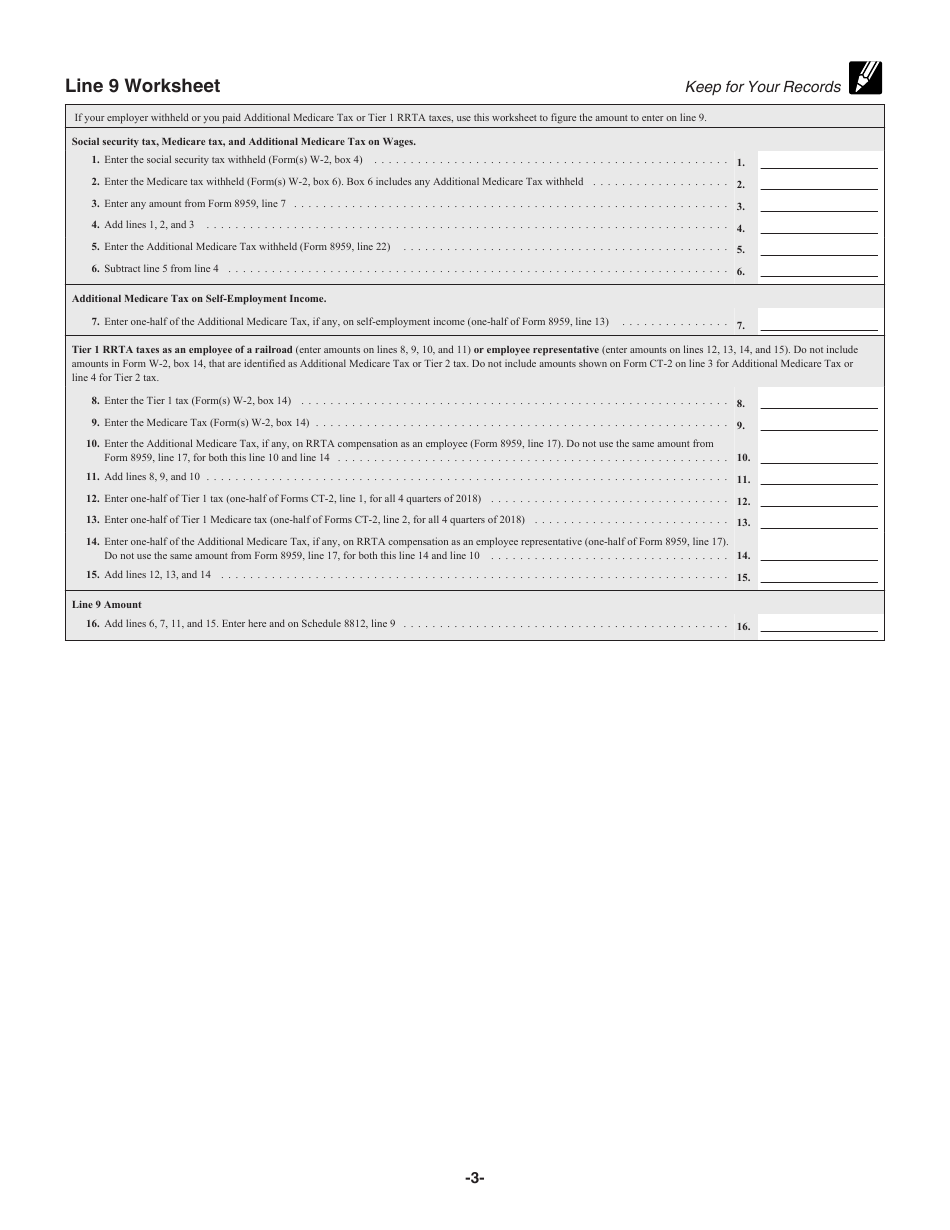

Irs Printable Tax Form 8812 With Instructions 2020 Instructions for Schedule 8812 Rev January 2021 Additional Child Use Schedule 8812 Form 1040 to figure the additional child tax credit ACTC The ACTC may give you a refund even if you do not owe any tax Tax Credit Section references are to the Internal Revenue Code unless otherwise noted Future Developments

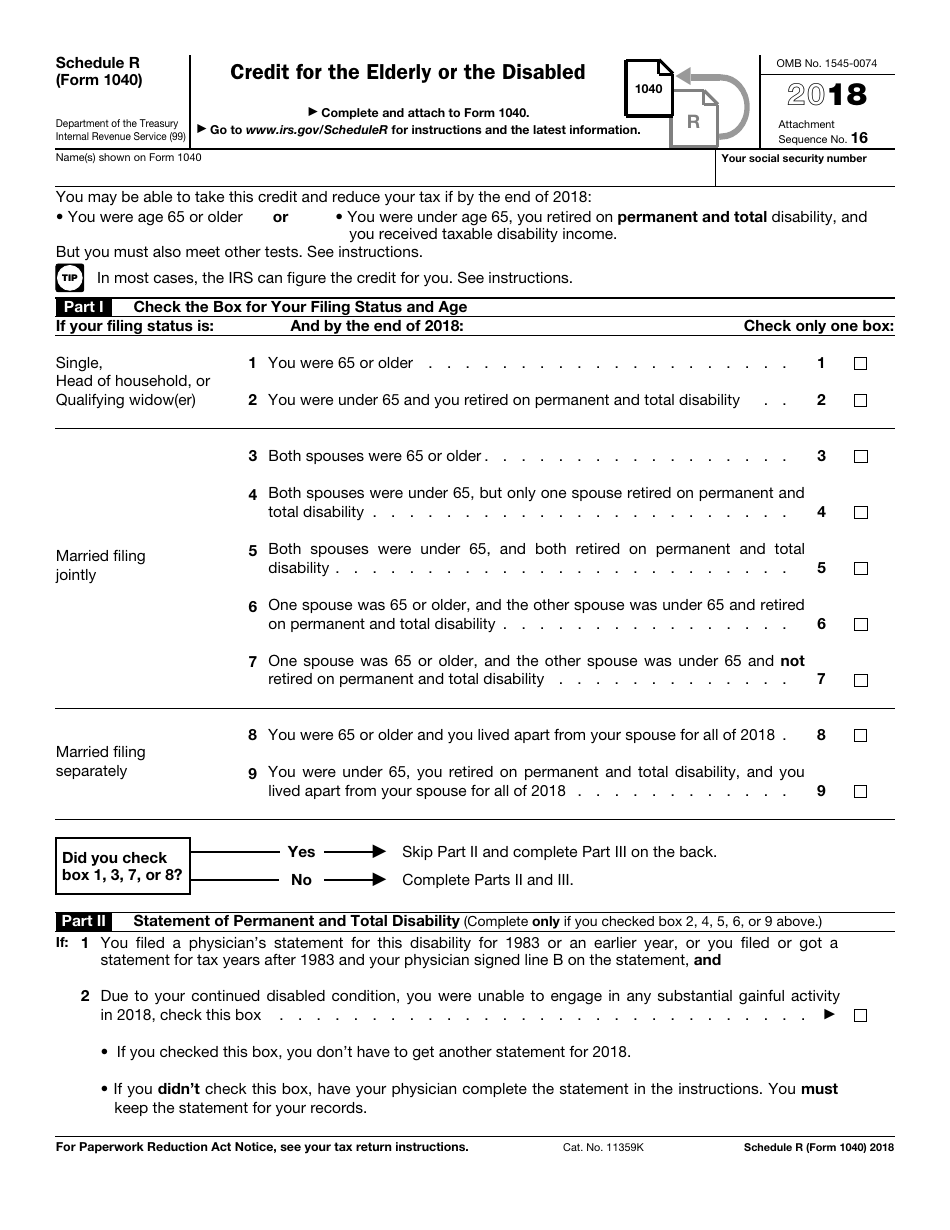

Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Schedule8812 for instructions and the latest information OMB No 1545 0074 Attachment Sequence No 47 1040 1040 SR 1040 NR 8812 Name s shown on return Your social security number What Is Form 1040 Schedule 8812 Up until a few years ago the title of Schedule 8812 was the Additional Child Tax Credit The maximum amount of the Additional Child Tax Credit has increased to 1 600 per qualifying child The Enhanced Child Tax Credit available a few years ago has expired

Irs Printable Tax Form 8812 With Instructions

Irs Printable Tax Form 8812 With Instructions

https://www.pdffiller.com/preview/6/895/6895661/large.png

8812 Instructions Tax 2021 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/590/432/590432562/large.png

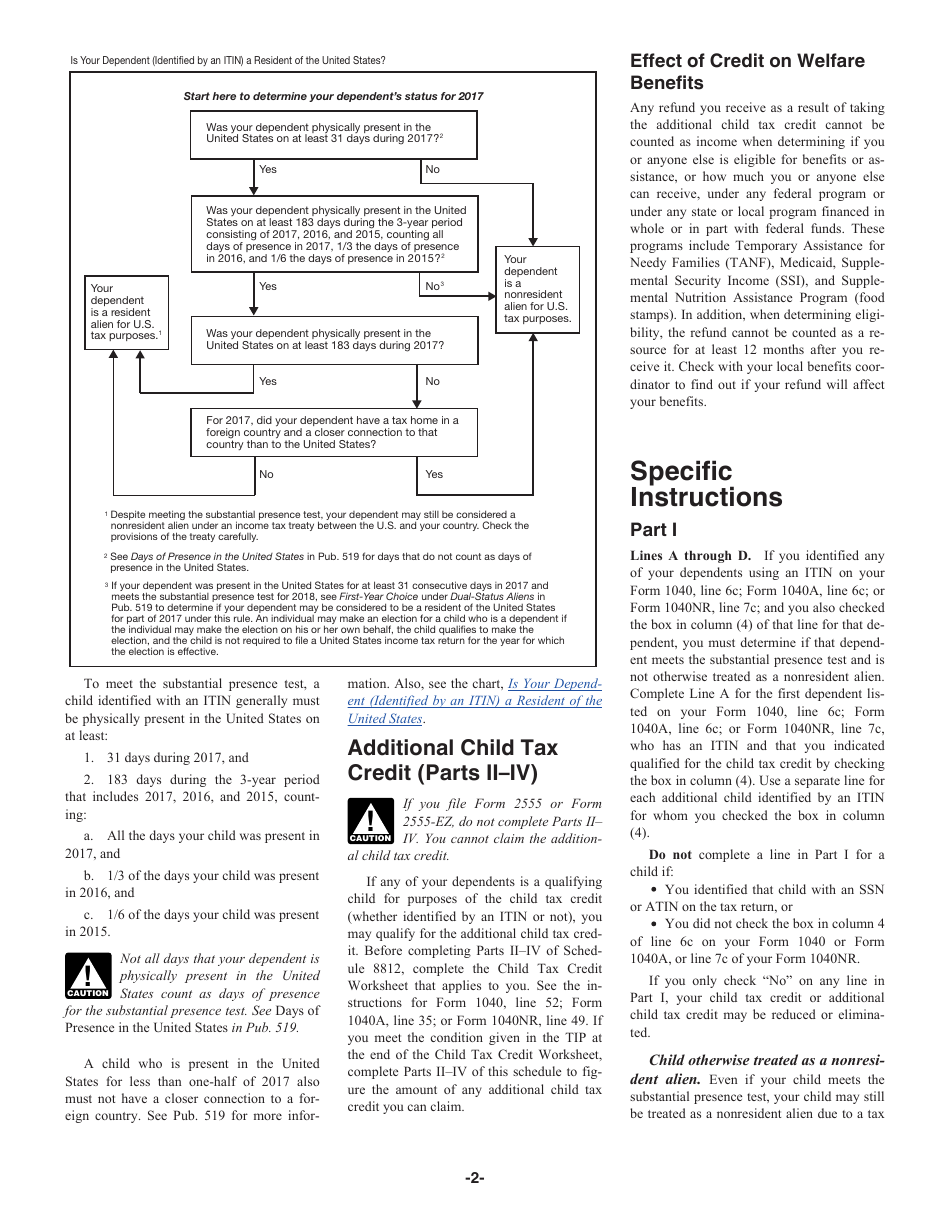

Irs Child Tax Credit Download Instructions For IRS Form 1040 Schedule 8812 Regardless Of

https://data.formsbank.com/pdf_docs_html/362/3627/362752/page_1_thumb_big.png

Form 8812 Changes to the Additional Child Tax Credit Qualifying children requirement Click to expand Key Takeaways The Child Tax Credit CTC is worth up to 2 000 per qualifying child tax year 2023 What is the child tax credit The child tax credit is a nonrefundable credit that allows taxpayers to claim a tax credit of up to 2 000 per qualifying child which reduces their tax liability What do I need Form 13614 C Publication 4012 Publication 17 Schedule 8812 Optional Form 1040 Instructions Schedule 8812 Instructions

What is Form 8812 The Schedule 8812 Form is found on Form 1040 and it s used to calculate the alternative refundable credit known as the additional child tax credit For example if the amount you owe in taxes is either zero or less than the credit you cannot claim the full child tax credit of 2 000 In an effort to provide financial relief to families Schedule 8812 is an IRS form designed to help taxpayers maximize their tax benefits for qualifying children through the additional child tax credit When filing a federal income tax return Schedule 8812 is attached to Form 1040 Alongside Form 2441 which is used to claim the child and

More picture related to Irs Printable Tax Form 8812 With Instructions

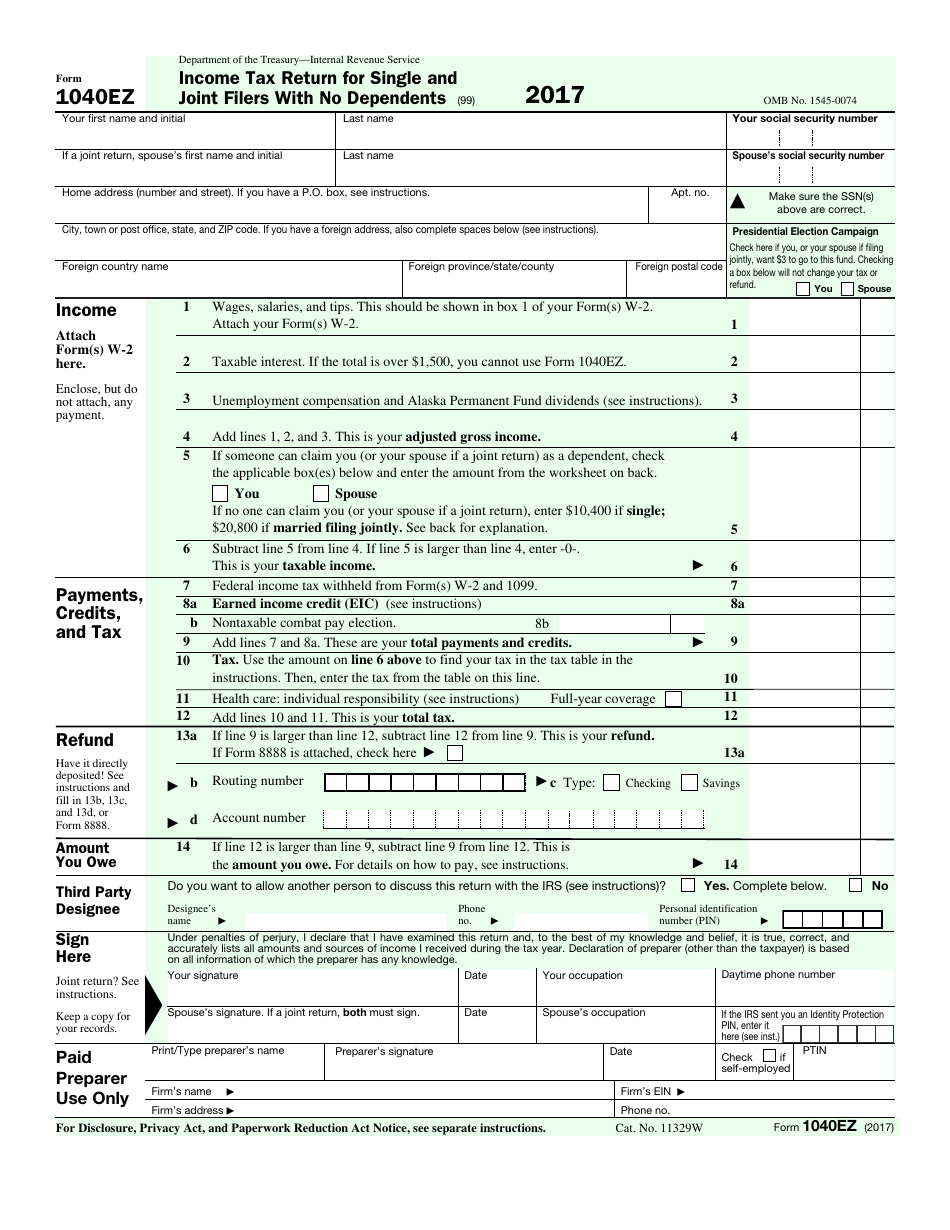

Irs Tax Forms Printable

https://data.templateroller.com/pdf_docs_html/1352/13527/1352744/irs-form-1040ez-2017-income-tax-return-single-and-joint-filers-with-no-dependents_print_big.png

Ir s Form 8812 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/954/6954950/large.png

Download Instructions For IRS Form 1040 Schedule 8812 Child Tax Credit PDF Templateroller

https://data.templateroller.com/pdf_docs_html/1352/13529/1352945/page_2_thumb_950.png

Schedule 8812 Schedule 8812 Credits for Qualifying Children and Other Dependents will now be used as a single source replacing Publication 972 Child Tax Credit and the child tax credit worksheet in the Form 1040 Instructions Schedule 8812 will be used to claim the Child Tax Credit CTC Credit for Other Dependents and the Additional Instructions Comments fillable forms The federal government provides numerous tax breaks to parents raising children in the form of tax credits One of the important tax credits is the child tax credit which taxpayers calculate on Schedule 8812 of their Form 1040 1040 SR or 1040 NR In this article we ll walk through Schedule 8812 including

1040 Schedule 8812 is a Federal Individual Income Tax form States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar for dollar reduction of tax liability Some common tax credits apply to many taxpayers while others only apply to extremely specific situations Before starting Schedule 8812 be sure to complete lines 1 through 15 on your Form 1040 If applicable you may also need to complete Form 2555 Foreign Earned Income and or Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa

Instructions For Schedule 8812 Child Tax Credit 2015 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/270/2703/270395/page_1_thumb_big.png

Irs Fillable Form 1040 Irs 1040 Schedule 8812 2020 Fill Out Tax Free Download Nude Photo Gallery

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

https://www.irs.gov/pub/irs-prior/i1040s8--2020.pdf

2020 Instructions for Schedule 8812 Rev January 2021 Additional Child Use Schedule 8812 Form 1040 to figure the additional child tax credit ACTC The ACTC may give you a refund even if you do not owe any tax Tax Credit Section references are to the Internal Revenue Code unless otherwise noted Future Developments

https://www.irs.gov/pub/irs-prior/f1040s8--2021.pdf

Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Schedule8812 for instructions and the latest information OMB No 1545 0074 Attachment Sequence No 47 1040 1040 SR 1040 NR 8812 Name s shown on return Your social security number

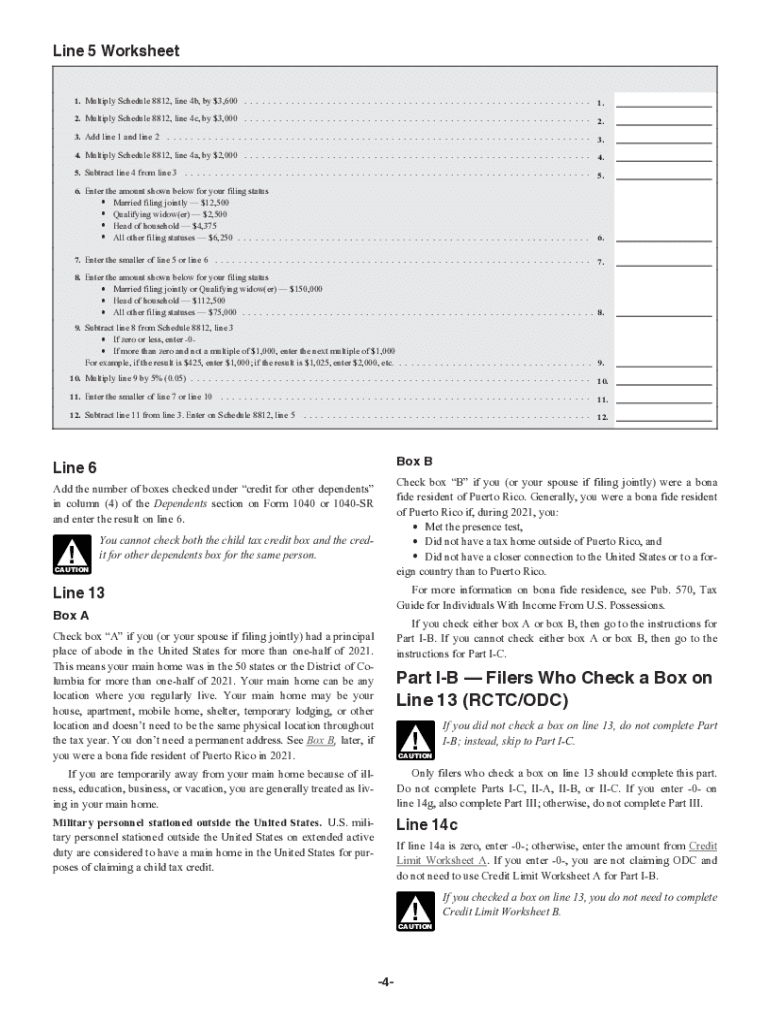

Form 8812 Worksheets

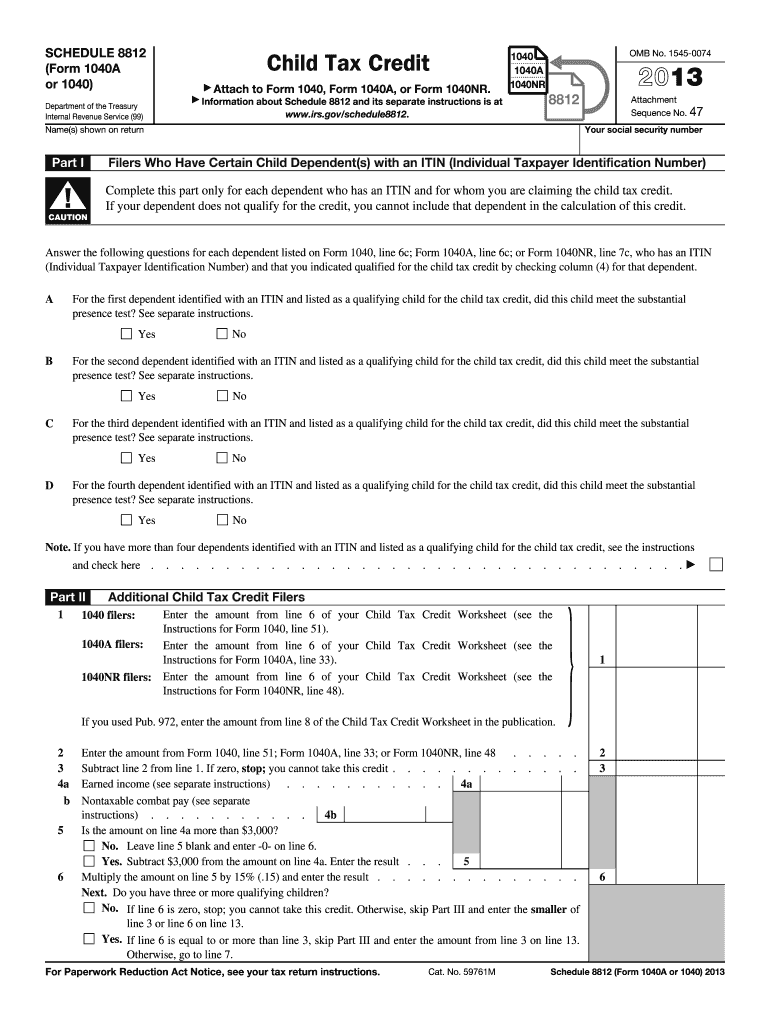

Instructions For Schedule 8812 Child Tax Credit 2015 Printable Pdf Download

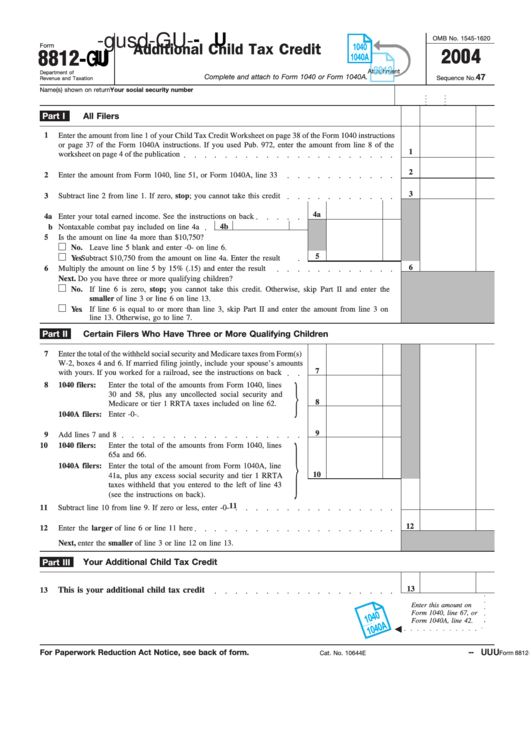

Fillable Form 8812 Gu Additional Child Tax Credit Printable Pdf Download

Irs Fillable Form 1040 IRS 1040 Schedule 8812 2020 Fill Out Tax Template Online US Legal

Schedule 8812 What Is IRS Form Schedule 8812 Filing Instructions

2019 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable Blank PdfFiller

2019 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable Blank PdfFiller

Download Instructions For IRS Form 1040 Schedule 8812 Additional Child Tax Credit PDF 2018

Download Instructions For IRS Form 1040 Schedule 8812 Additional Child Tax Credit PDF 2020

Form 8812 Ir s Fill Out And Sign Printable PDF Template SignNow

Irs Printable Tax Form 8812 With Instructions - What is Form 8812 The Schedule 8812 Form is found on Form 1040 and it s used to calculate the alternative refundable credit known as the additional child tax credit For example if the amount you owe in taxes is either zero or less than the credit you cannot claim the full child tax credit of 2 000