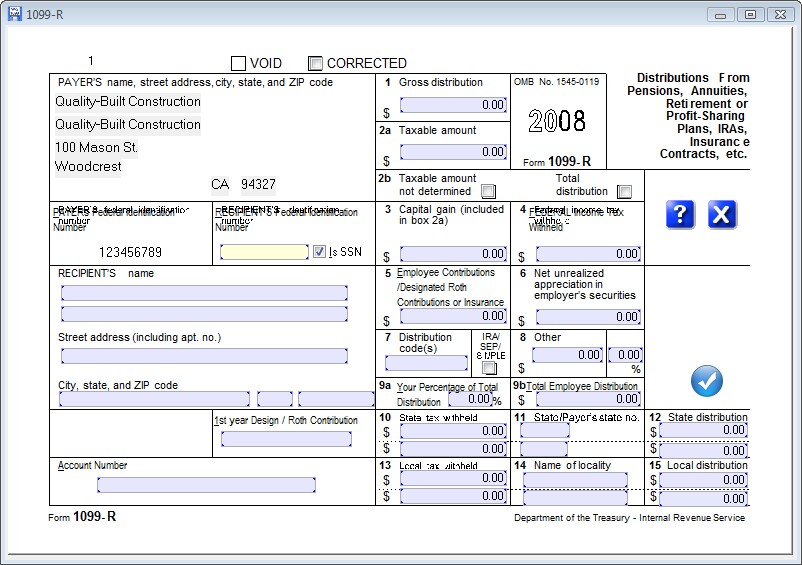

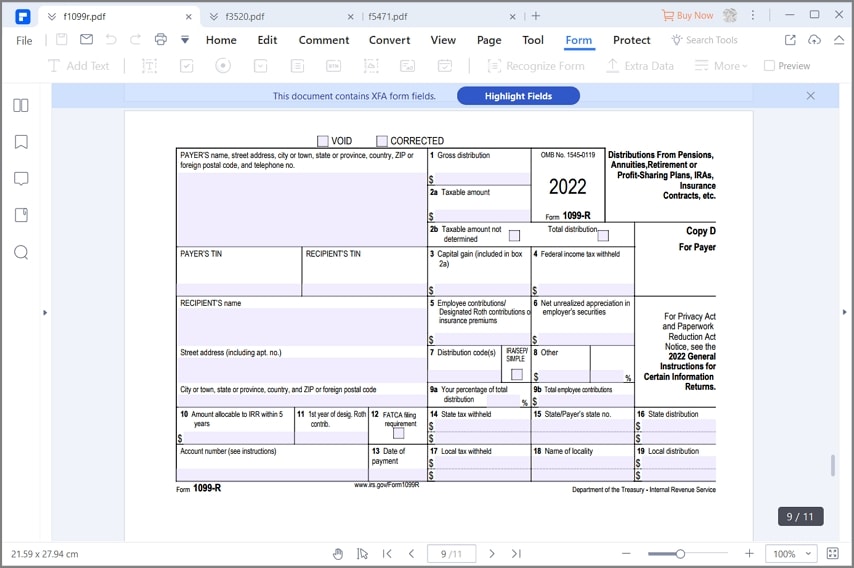

It 1099 R Printable Form File Form IT 1099 R as an entire page See instructions on the back Name s as shown on return Identifying number as shown on return 1099 R Record 1 Recipient s identification number for this 1099 R Corrected 1099 R Box 11 1st year of desig Roth contrib Box A Payer s name and full address State

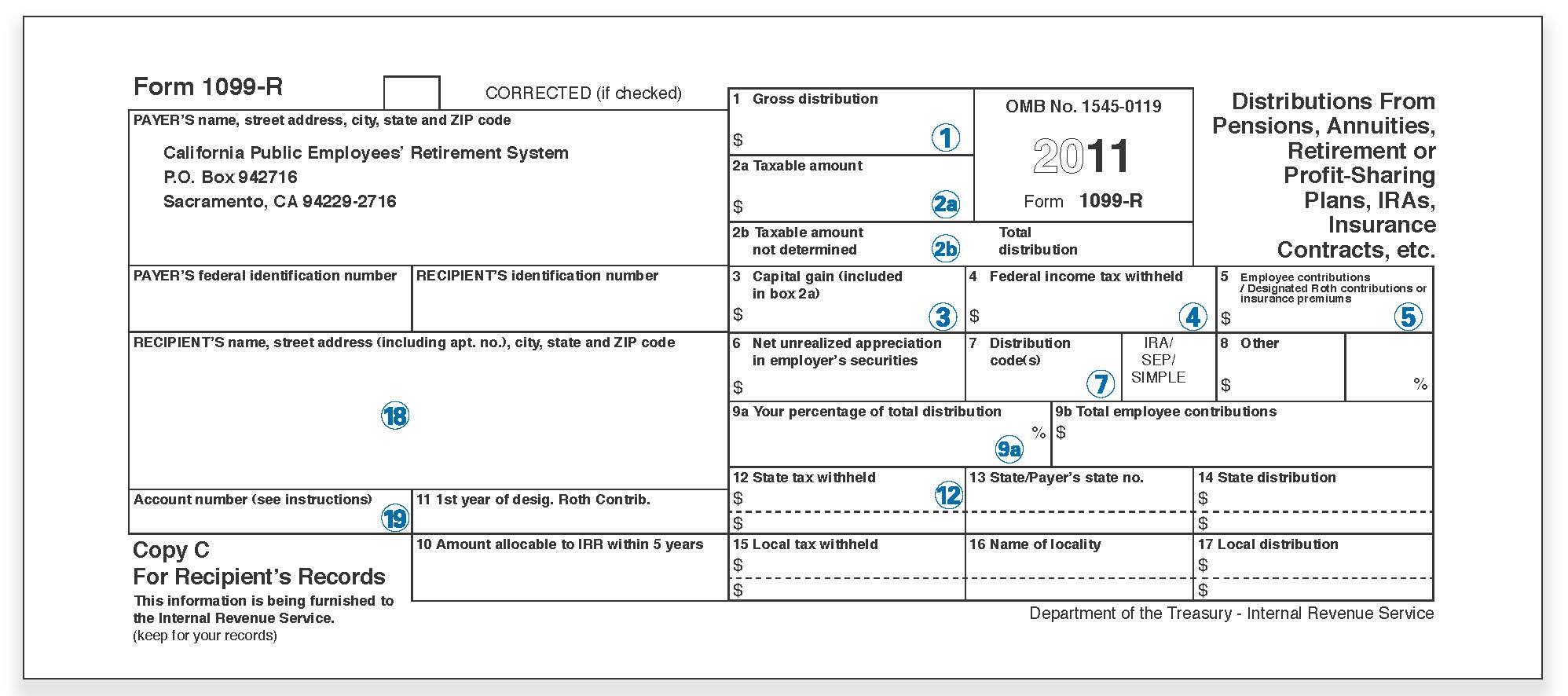

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution How to request your 1099 R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099 R tile We ll send your tax form to the address we have on file You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab Was this helpful Yes No

It 1099 R Printable Form

It 1099 R Printable Form

https://legaldocfinder.com/images/jumbotron/1099-r-sample.png

Free Printable 1099 R Form Printable Templates

http://www.magtax.com/help/form1099r.jpg

2020 Form NY DTF IT 1099 R Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/541/595/541595143/large.png

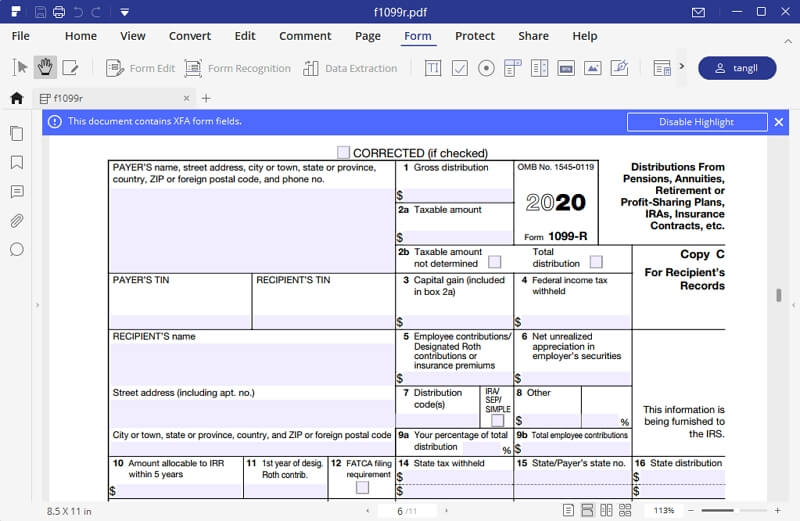

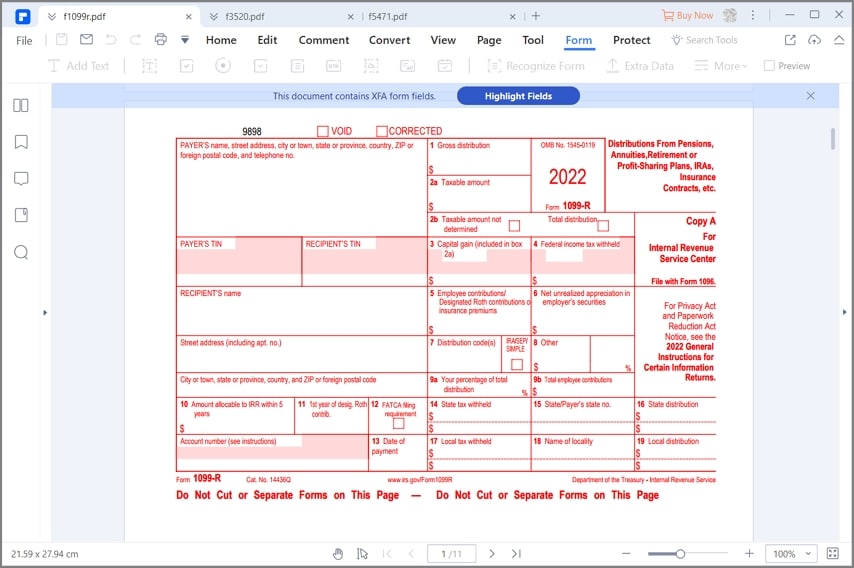

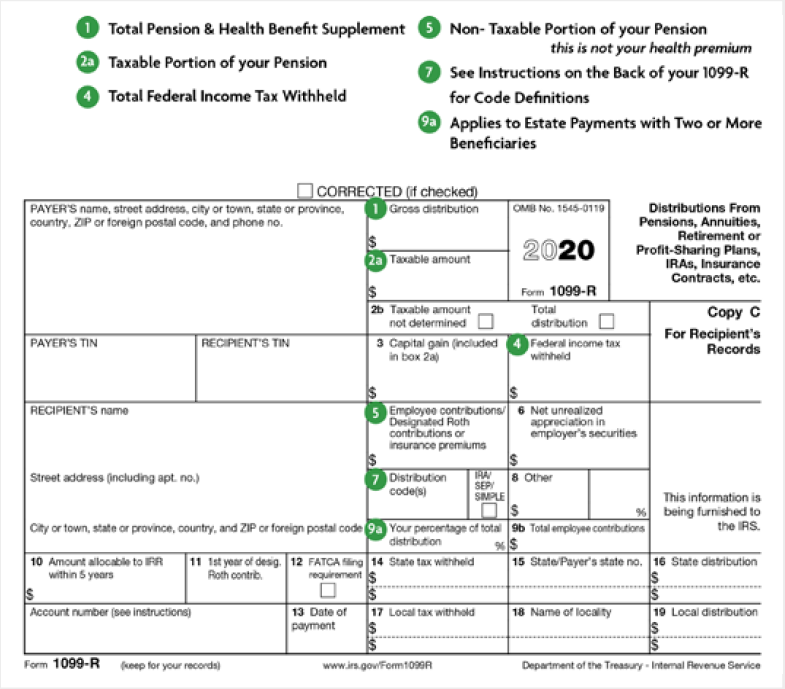

Electronic filing is the fastest safest way to file but if you must file a paper Summary of Federal Form 1099 R Statements use our enhanced fill in Form IT 1099 R with 2D barcodes Benefits include no more handwriting type your entries directly into our form Form 1099 R is an Internal Revenue Service IRS form with which an individual reports his or her distributions from annuities profit sharing plans retirement plans individual retirement

Form 1099 R Form 1099 R is used to report the distribution of retirement benefits such as pensions annuities or other retirement plans Additional variations of Form 1099 R include Form CSA 1099R Form CSF 1099R and Form RRB 1099 R Most public and private pension plans that aren t part of the Civil Service system use the standard Form 1099 R A 1099 R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts You ll generally receive one for distributions of 10 or more The plan or account custodian completing the 1099 R must fill out three copies of every 1099 R they issue One for the IRS

More picture related to It 1099 R Printable Form

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-03.jpg

IRS Form 1099 R 2023 Forms Docs 2023

https://blanker.org/files/images/form-1099r.png

What Is A 1099 R Form Distributions From Pensions Annuities

https://www.taxbandits.com/content/images/form/form1099r-1.png

Select option 1 to request a 1099 R 24 hours a day seven days a week without waiting to speak to a customer service representative Enter your Social Security Number using your touch tone keypad when prompted You should receive your 1099 R in 7 to 10 business days Questions and answers How do I get a copy of my 1099R Use Services Online Retirement Services to start change or stop Federal and State income tax withholdings request a duplicate tax filing statement 1099R change your Personal Identification Number PIN for accessing our automated systems

Military retirees and annuitants receive a 1099 R tax statement either electronically via myPay or as a paper copy in the mail each year Members can also request additional copies of their 1099 R tax statements in several different ways Click on any of the following links to learn more about your options on requesting a 1099 R Mutual Fund Year End Tax Forms Annuities Year End Tax Forms Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc Why you may receive this form Because you received a distribution of 10 or more from a tax advantaged account If you have more than one annuity with a taxable

How To Print And File 1099 R

http://www.halfpricesoft.com/1099s_software/images/fill-1099-r-form.jpg

2023 Form 1099 R Printable Forms Free Online

https://www.communitytax.com/wp-content/uploads/2016/04/Tax-Form-1099-R.jpg

https://www.tax.ny.gov/pdf/current_forms/it/it1099r_fill_in.pdf

File Form IT 1099 R as an entire page See instructions on the back Name s as shown on return Identifying number as shown on return 1099 R Record 1 Recipient s identification number for this 1099 R Corrected 1099 R Box 11 1st year of desig Roth contrib Box A Payer s name and full address State

https://eforms.com/irs/form-1099/r/

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

Understanding Your Form 1099 R MSRB Mass gov

How To Print And File 1099 R

Formulario 1099 R Del IRS C mo Rellenarlo Bien Y F cilmente

Understanding Your 1099 R Dallaserf

Formulaire IRS 1099 R Comment Le Remplir Correctement Et Facilement

SDCERS Form 1099 R Explained

SDCERS Form 1099 R Explained

Form 1099 R Wikipedia

IRS Form 1099 R What Every Retirement Saver Should Know

Understanding Your 1099 R Tax Form CalPERS

It 1099 R Printable Form - Form 1099 R Form 1099 R is used to report the distribution of retirement benefits such as pensions annuities or other retirement plans Additional variations of Form 1099 R include Form CSA 1099R Form CSF 1099R and Form RRB 1099 R Most public and private pension plans that aren t part of the Civil Service system use the standard Form 1099 R