N 1099 Printable Form Colorado DR 0084 Substitute Colorado W2 Form DR 0810 Employees Election Regarding Medical Savings Account DR 0811 Employees Election Regarding Catastrophic Health Insurance DR 1059 Exemption from Withholding for a Qualifying Spouse of a U S Armed Forces Servicemember Gaming Withholding Forms DR 1091 Backup Withholding Tax Return Gaming DR 1101

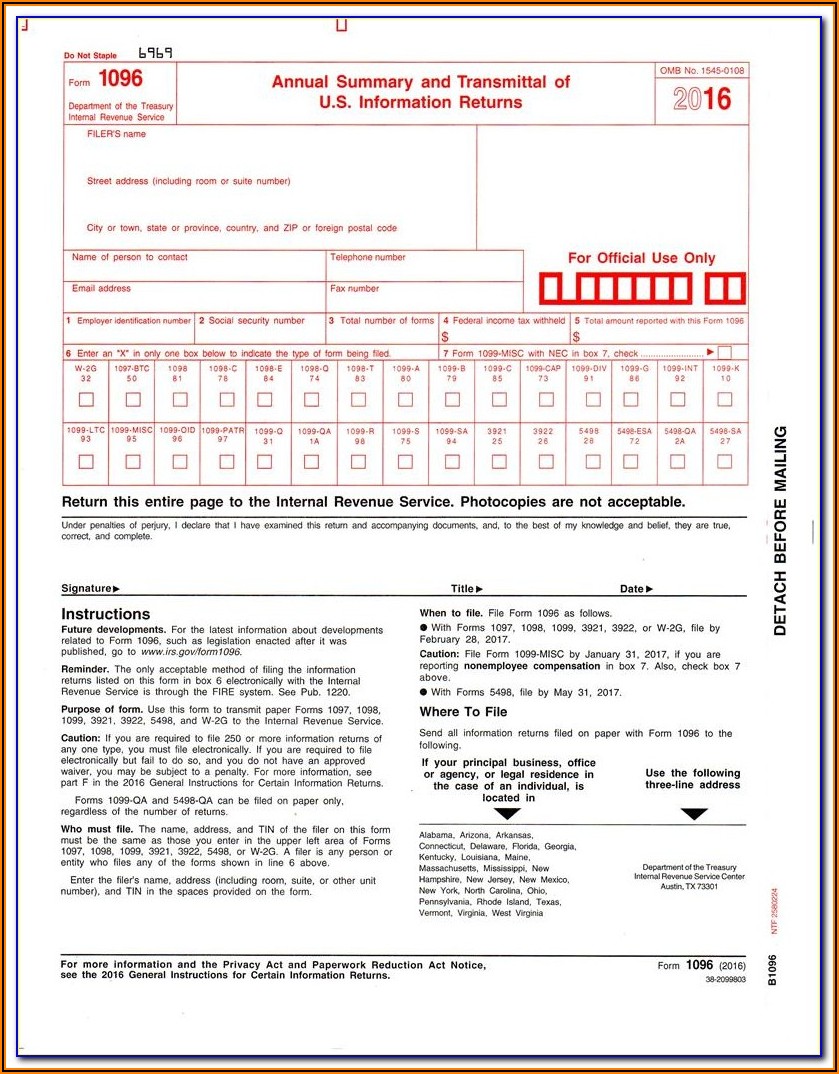

Instructions for Annual Transmittal of State 1099 Forms The DR 1106 Annual Transmittal of State 1099s should be filed in January for withholding taxes reported on Federal form 1099 If you are filing an amended return you are required to mark the amended return box To prevent being billed by the department when no taxes were withheld during the filing period file a completed paper form 1099 Income Withholding Tax return DR 1107 Instructions for Amending Withholding Taxes If you overpaid for a period you may take a credit on a return in the current calendar year

N 1099 Printable Form Colorado

N 1099 Printable Form Colorado

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Colorado 1099 Form Form Resume Examples edV1pPlBYq

https://www.contrapositionmagazine.com/wp-content/uploads/2021/05/colorado-1099-transmittal-form.jpg

N 1099 Printable Form Colorado Printable Forms Free Online

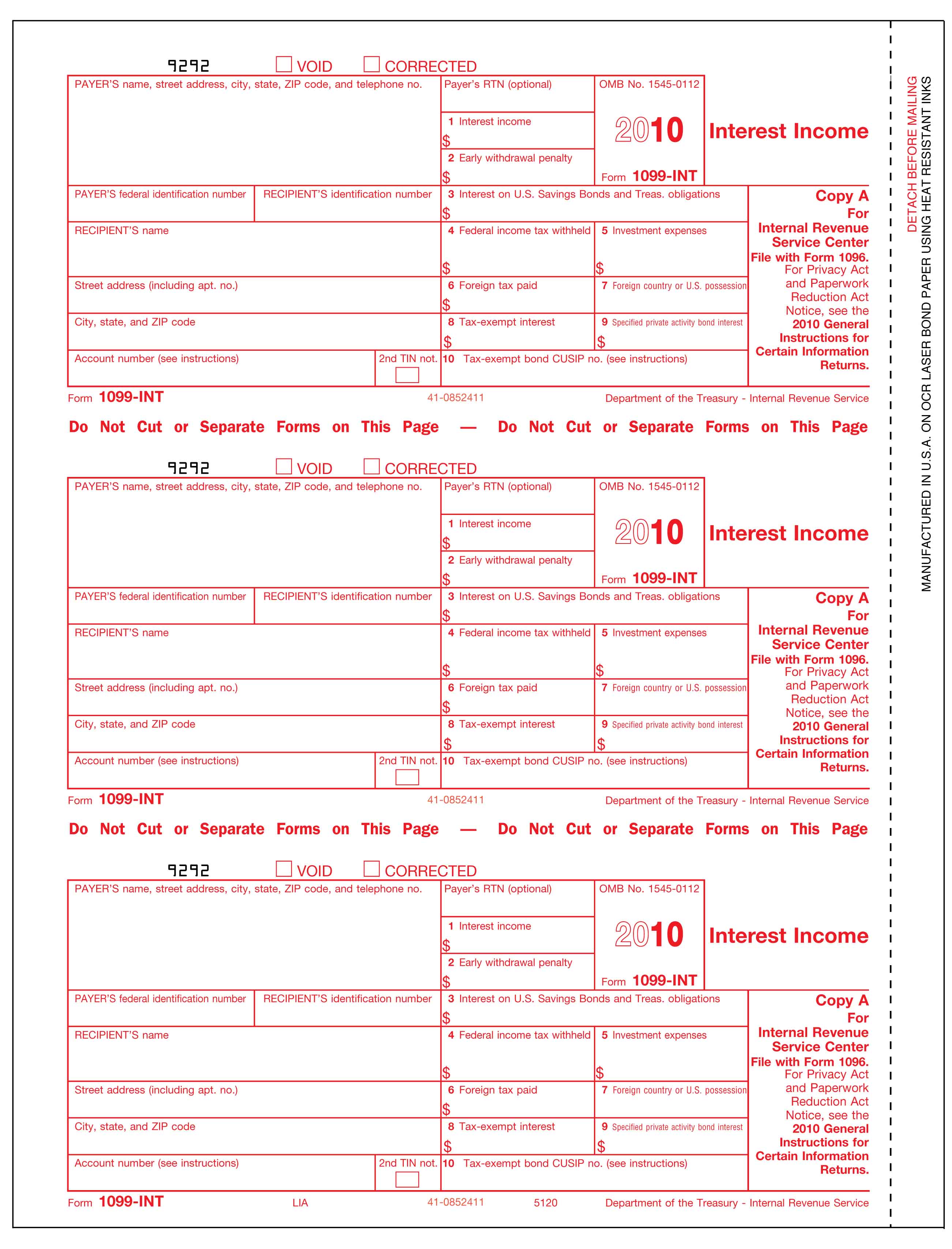

https://cotaxaide.org/forms/Form 1099-INT.png

To view your 1099 G form if available log into your MyUI account then select View Correspondences from the left hand navigation menu or in the hamburger menu at the top if you re on mobile Taxpayers who withhold amounts paid and reported on a form 1099 or form W 2G must set up a tax account with the Colorado Department of Revenue separate from their W 2 wage withholding account to pay the withholding Below are options to open a 1099 or W 2G withholding tax account There are no fees for opening a withholding account Paper

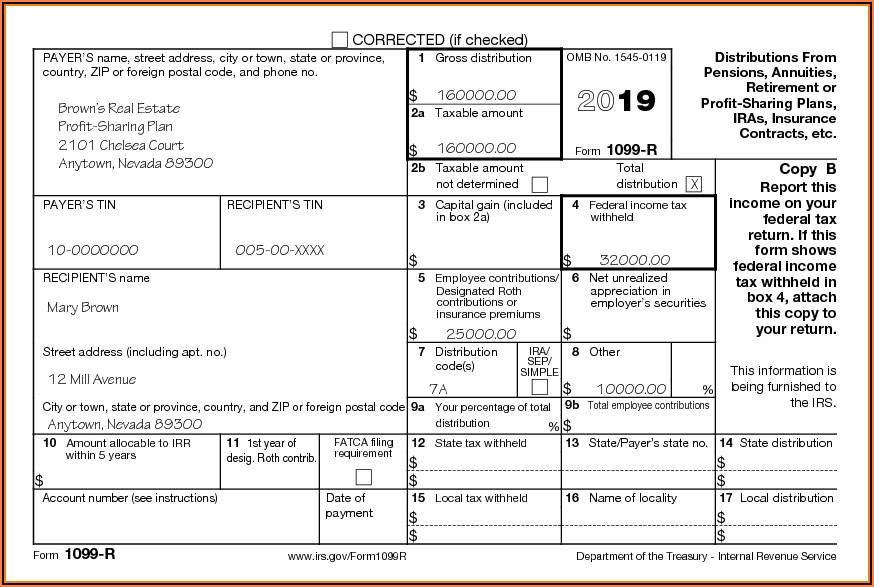

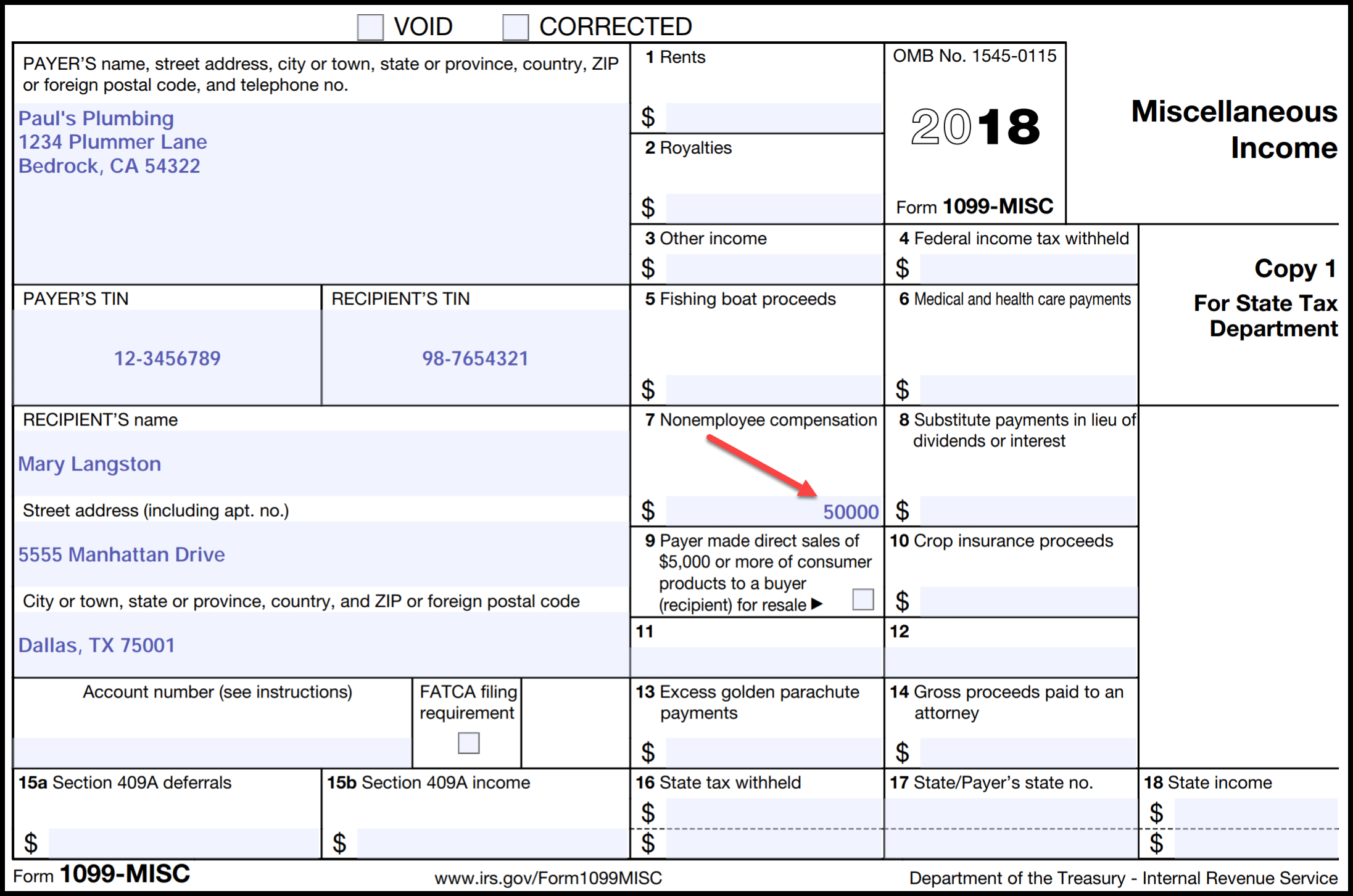

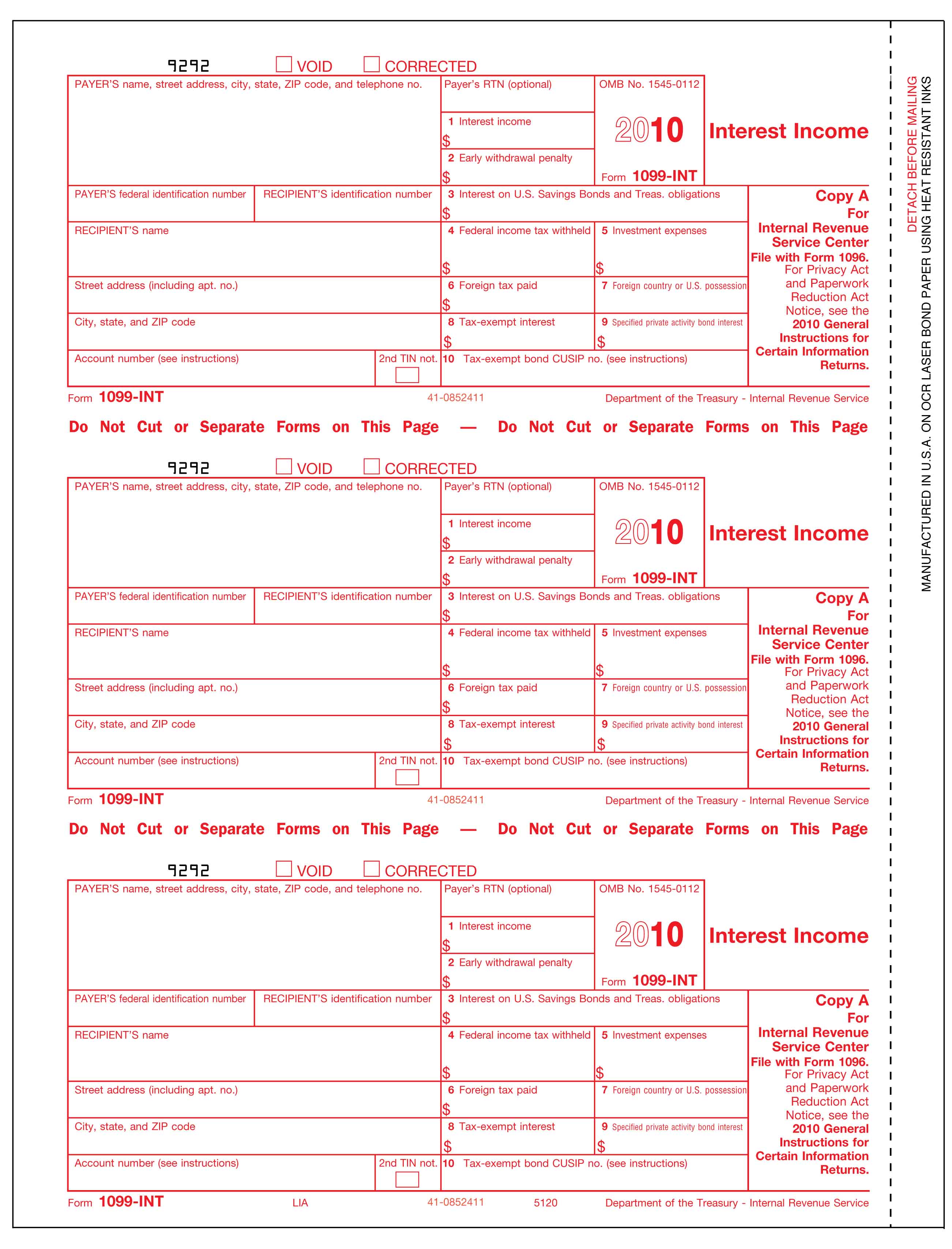

1 Does Colorado require W 2 filing for TY 2023 2 When is the W 2 Form Due Date for Colorado 3 Do you require any additional forms to submit along W 2 form with Colorado 4 Does Colorado require filing of 1099 Form for TY 2023 5 What Type of 1099 Forms Does Colorado Require 6 When is the 1099 Form Due Date for Colorado 7 Download 1099 E File Software File the following forms with the state of Colorado 1099 MISC 1099 NEC and 1099 R Filing due dates File the state copy of form 1099 with the Colorado taxation agency by March 31 2021 Reporting threshold If you file 250 or more 1099 forms with Colorado you must file electronically

More picture related to N 1099 Printable Form Colorado

1099 Forms Printable Printable Forms Free Online

https://www.pdffiller.com/preview/421/116/421116584/big.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New E filing returns Itching to get your 800 TABOR refund or 1 600 if you re married You re closer than ever now that the Colorado Department of Revenue has begun processing tax forms for the 2023 tax year due

Paying someone with a 1099 does not make them a contractor Our statute outlines the minimum criteria to consider when establishing a working relationship If you have additional questions about independent contractors contact Customer Service at 303 318 8700 or toll free at 1 888 390 7936 Rejection of Coverage Corporations and LLCs The IRS has reinstated Form 1099 NEC Nonemployee Compensation effective for tax year 2020 and forward This form will report nonemployee compensation formerly reported on line 7 of Form 1099 MISC Miscellaneous Income

1099 Form Colorado 2019 Form Resume Examples AjYdX7GoYl

http://www.contrapositionmagazine.com/wp-content/uploads/2021/05/1099-form-colorado-2019.jpg

1099 Form Colorado 2019 Form Resume Examples AjYdX7GoYl

https://www.contrapositionmagazine.com/wp-content/uploads/2020/07/irs.gov-1099-form-2019.jpg

https://tax.colorado.gov/withholding-forms

DR 0084 Substitute Colorado W2 Form DR 0810 Employees Election Regarding Medical Savings Account DR 0811 Employees Election Regarding Catastrophic Health Insurance DR 1059 Exemption from Withholding for a Qualifying Spouse of a U S Armed Forces Servicemember Gaming Withholding Forms DR 1091 Backup Withholding Tax Return Gaming DR 1101

https://tax.colorado.gov/sites/tax/files/DR1106_2020.pdf

Instructions for Annual Transmittal of State 1099 Forms The DR 1106 Annual Transmittal of State 1099s should be filed in January for withholding taxes reported on Federal form 1099 If you are filing an amended return you are required to mark the amended return box

Irs Printable 1099 Form Printable Form 2023

1099 Form Colorado 2019 Form Resume Examples AjYdX7GoYl

Printable 1099 Misc Tax Form Template Printable Templates

Free 1099 Fillable Form Printable Forms Free Online

1099 S Fillable Form Printable Forms Free Online

1099 Format 1099 Forms 1099 Tax Forms Print Forms

1099 Format 1099 Forms 1099 Tax Forms Print Forms

1099 Form Fillable Pdf Printable Forms Free Online

2009 Form IRS 1099 MISCFill Online Printable Fillable Blank PdfFiller

1099 nec Excel Template Free Printable Word Searches

N 1099 Printable Form Colorado - You may request a duplicate 1099 R by calling PERA s Customer Service Center at 800 759 7372 Duplicates are printed overnight and mailed daily from February 1 through April 15 You may also view and print your past 1099 R forms by logging in to your account Duplicates are available for the current tax year and the previous five years