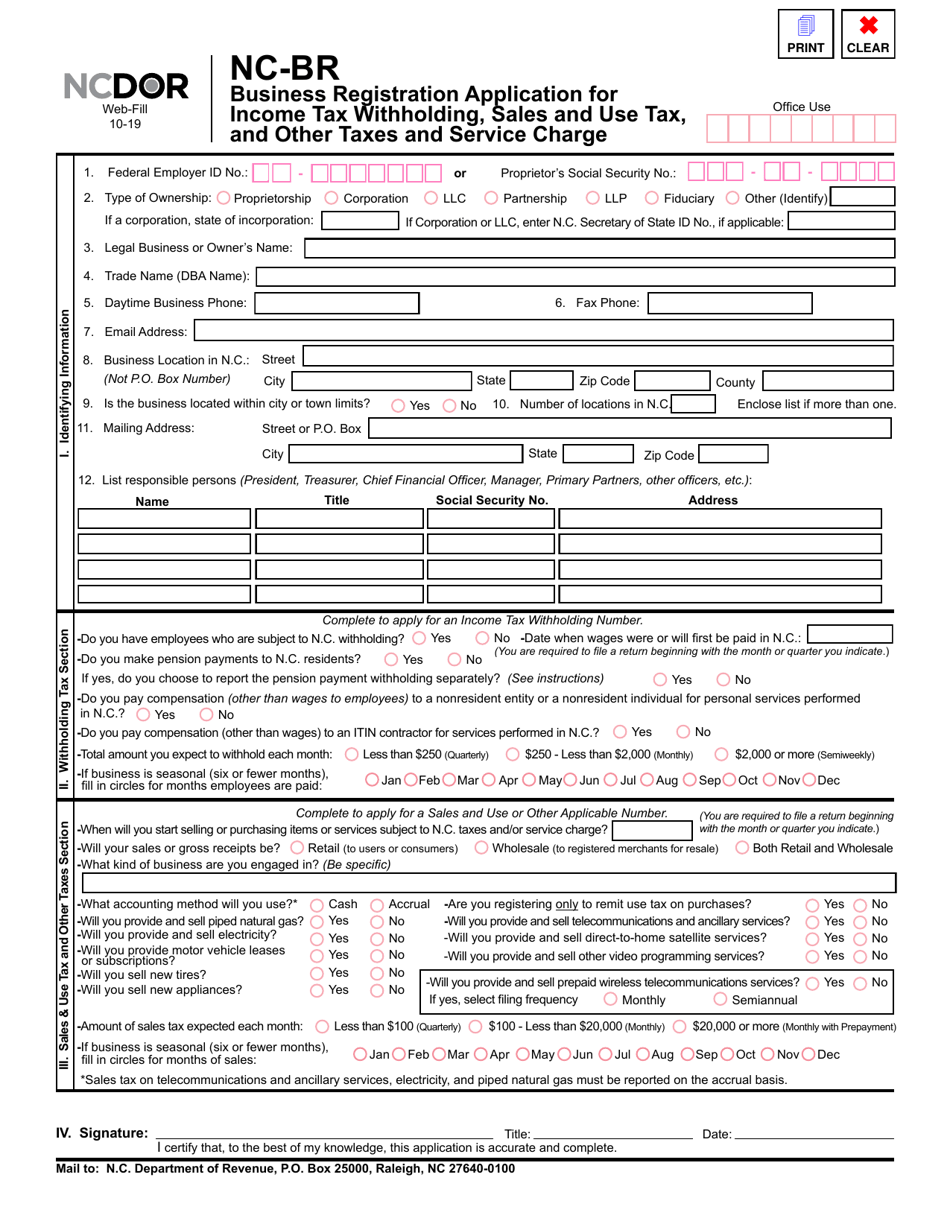

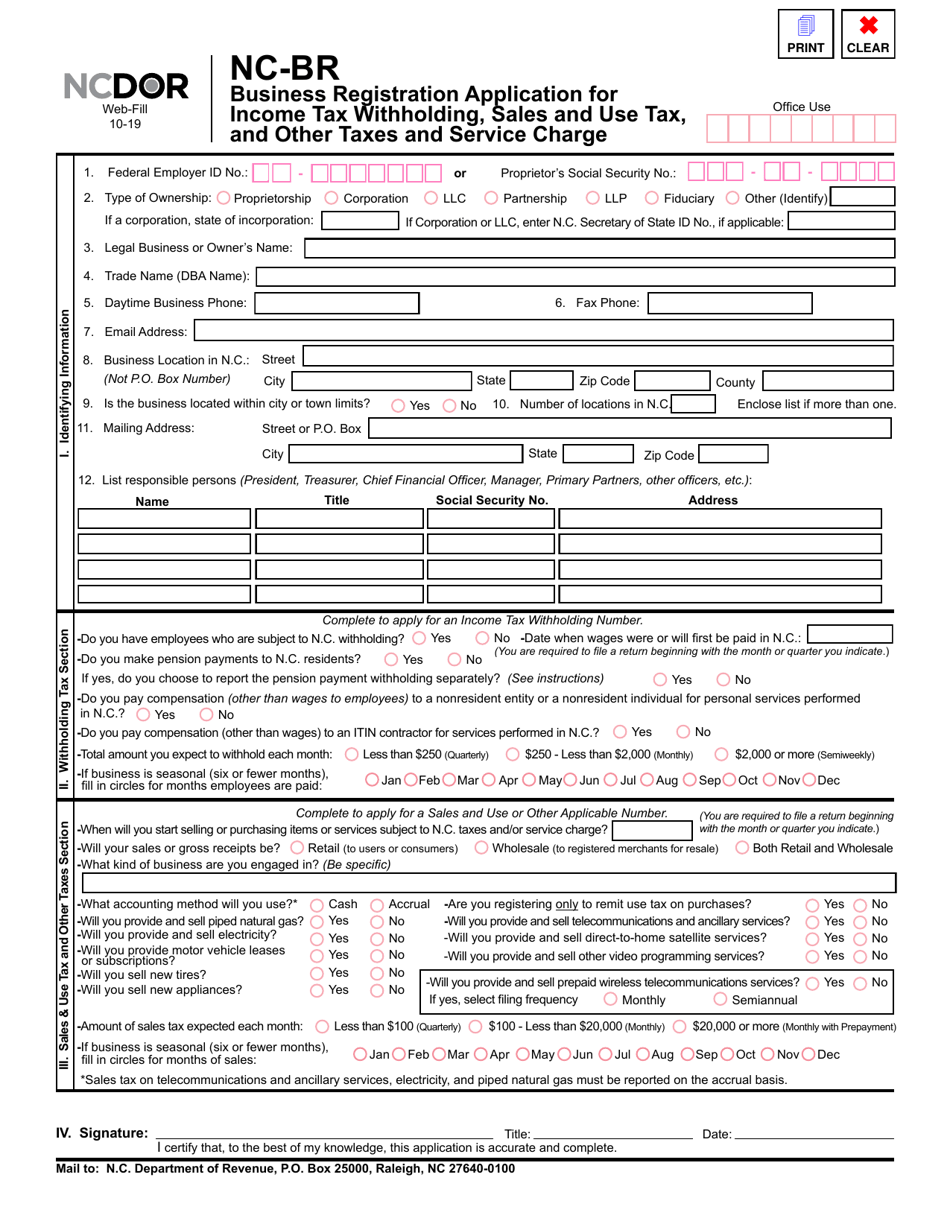

Nc Br Aplly For Sales And Use Number Printables Forms Business Registration Application Instructions Step 1 Complete Section I Identifying Information Use your computer to complete this Web Fill form in its entirety print the completed form and mail to the Department Line 1 Enter your Federal Employer s Identification Number

Form NC BR Instructions Web Fill 10 19 II Income Tax Withholding Wages North Carolina law requires withholding of income tax from salaries and wages of all residents regardless of where earned and from wages of nonresidents for personal services performed in this State The tax must be withheld from each payment of wages and is considered to be held in trust Form NC BR Instructions Step 2 Complete Section II if you are applying for an Income Tax Withholding Number Step 3 Complete Section III if you are applying for a Certificate of Registration also known as a Sales and Use Tax Number or for a Users or Consumers Use Tax Registration Step 4 Complete Section IV if you are applying for a number to remit the machinery and equipment tax

Nc Br Aplly For Sales And Use Number Printables Forms

Nc Br Aplly For Sales And Use Number Printables Forms

https://www.signnow.com/preview/481/370/481370226/large.png

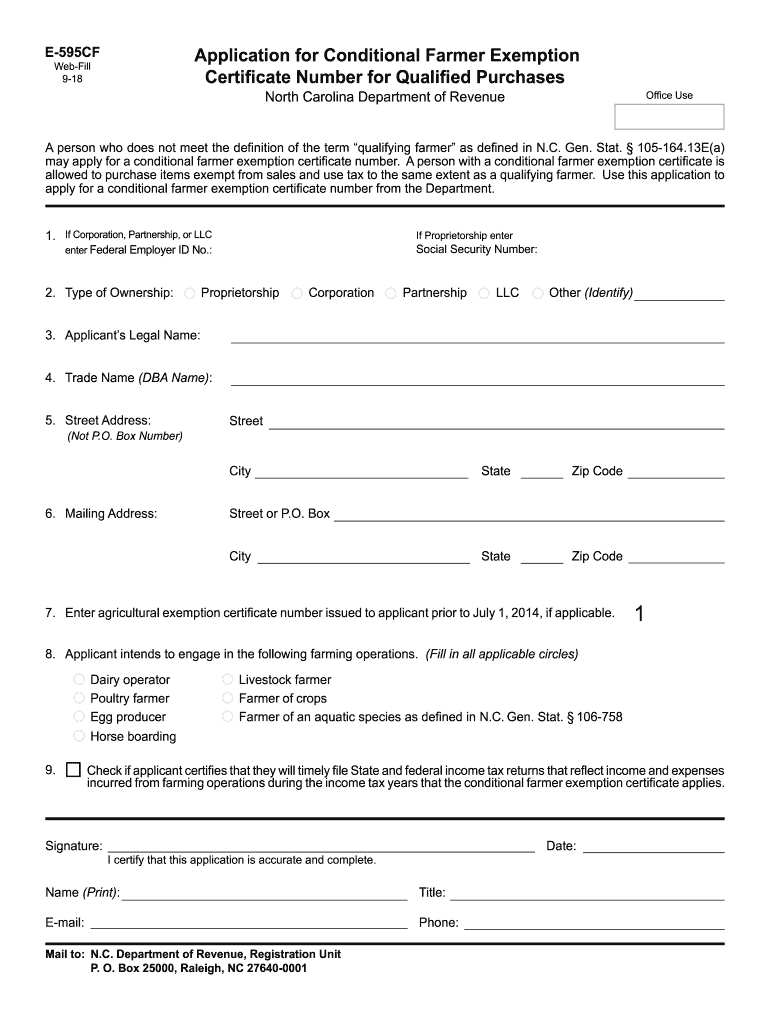

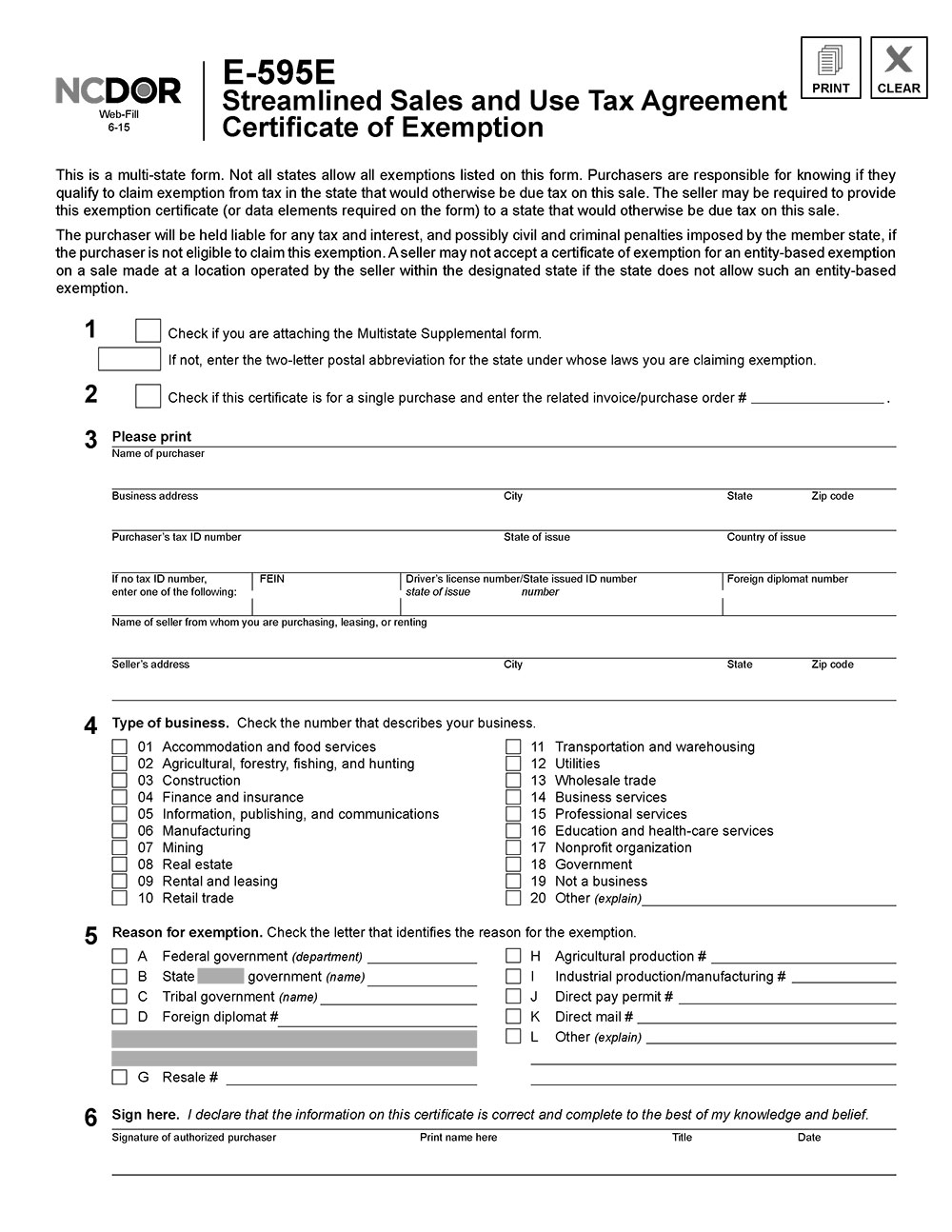

Farm Sales Tax Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/450/137/450137529/large.png

Printable North Carolina Tax Forms My XXX Hot Girl

https://www.signnow.com/preview/465/346/465346008/large.png

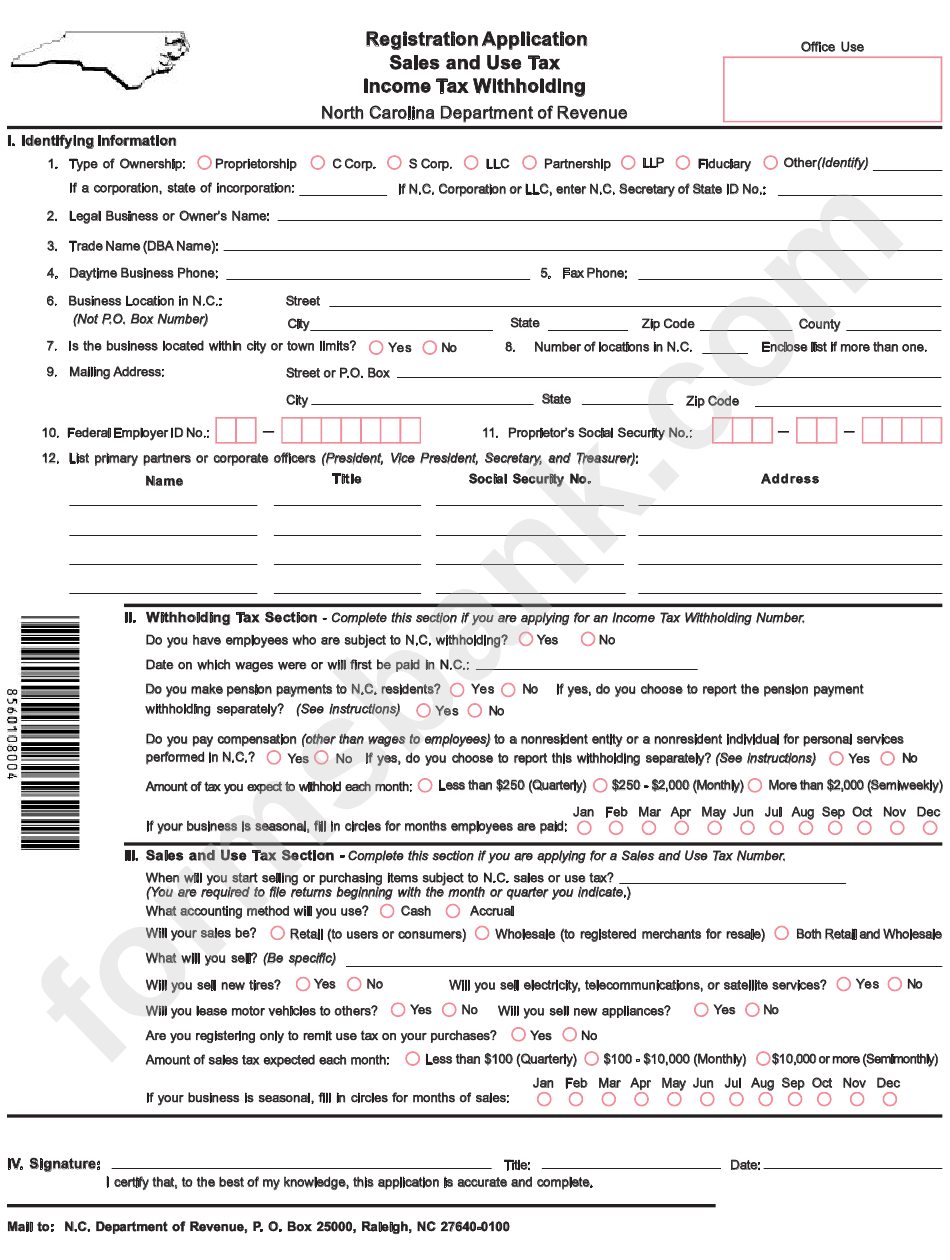

A Sales and Use Tax Number can be obtained by registering through the Department of Revenue online or by mailing in Form NC BR Information needed to register includes Federal Employer Identification Number FEIN with the IRS or the owner s Social Security Number if a sole proprietorship with no employees Who way your company is structured affects taxation legal and corporate liability as well as decision making authority Before choice a business structure consult your attorney and or accountant as each structure carries with it singular legal and tax outcome

There is NO fee to apply for a certificate of registration in North Carolina The department does not contract this service out to third parties For accurate and reliable information about obtaining a North Carolina sales and use tax number visit the Revenue Department s Sales and Use Tax webpage Business owners should thoroughly research A sale at retail is The sale lease or rental for any purpose other than resale sublease or subrent U nl ess exempt by law ret ail ers engaged in b usi ness in N C coll ect tax from purchasers as trustee for State Engaged in business is defined in G S 105 164 3 9 Examples not all inclusive Storefronts and

More picture related to Nc Br Aplly For Sales And Use Number Printables Forms

Nc Dept Of Revenue Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/26/896/26896588/large.png

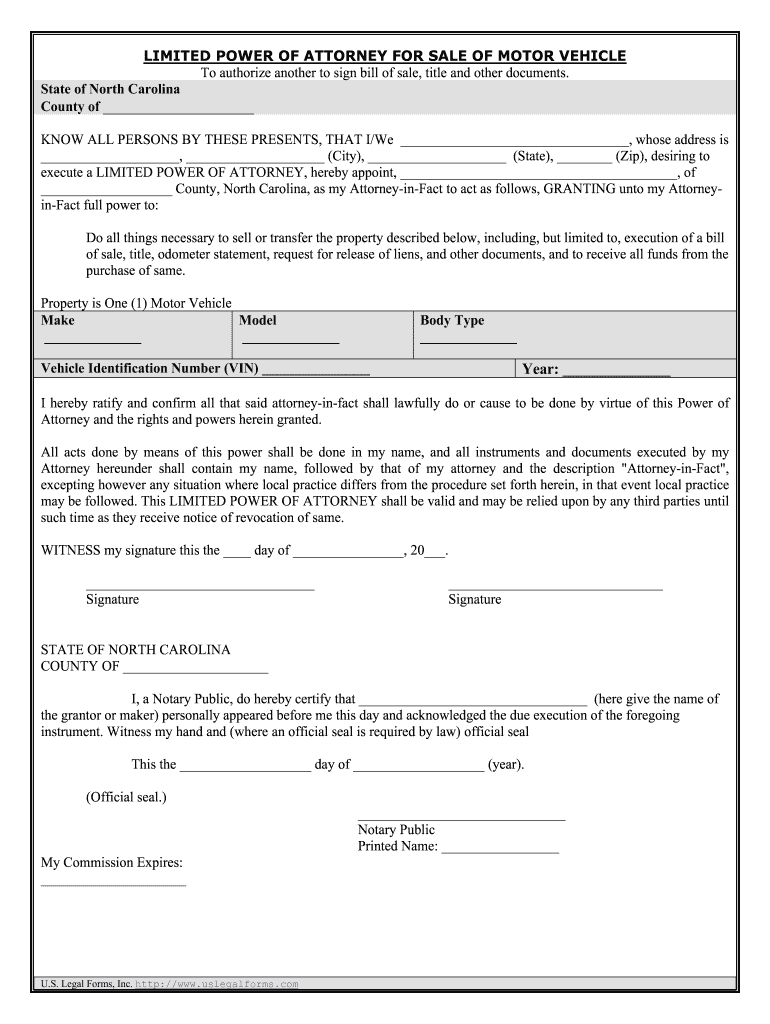

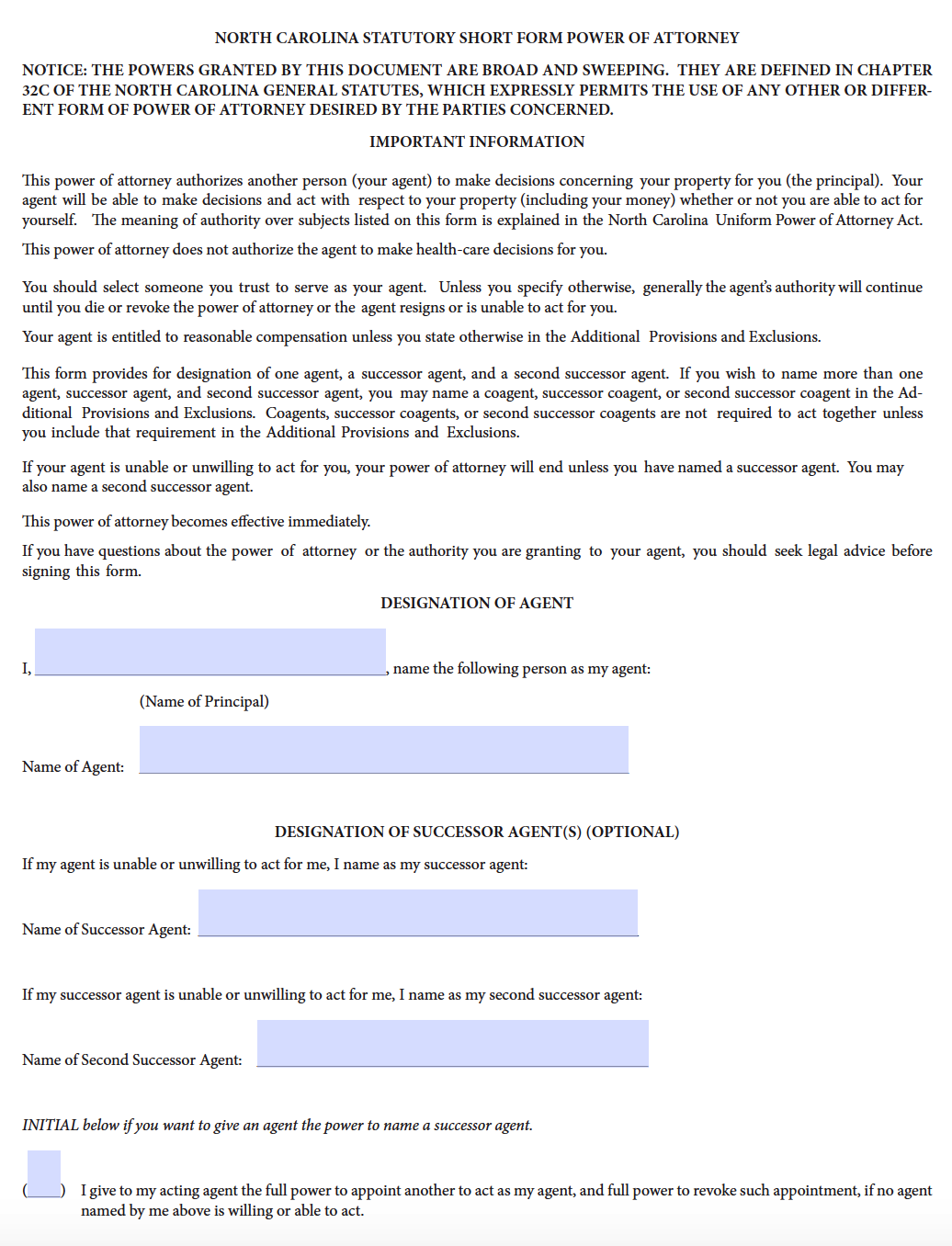

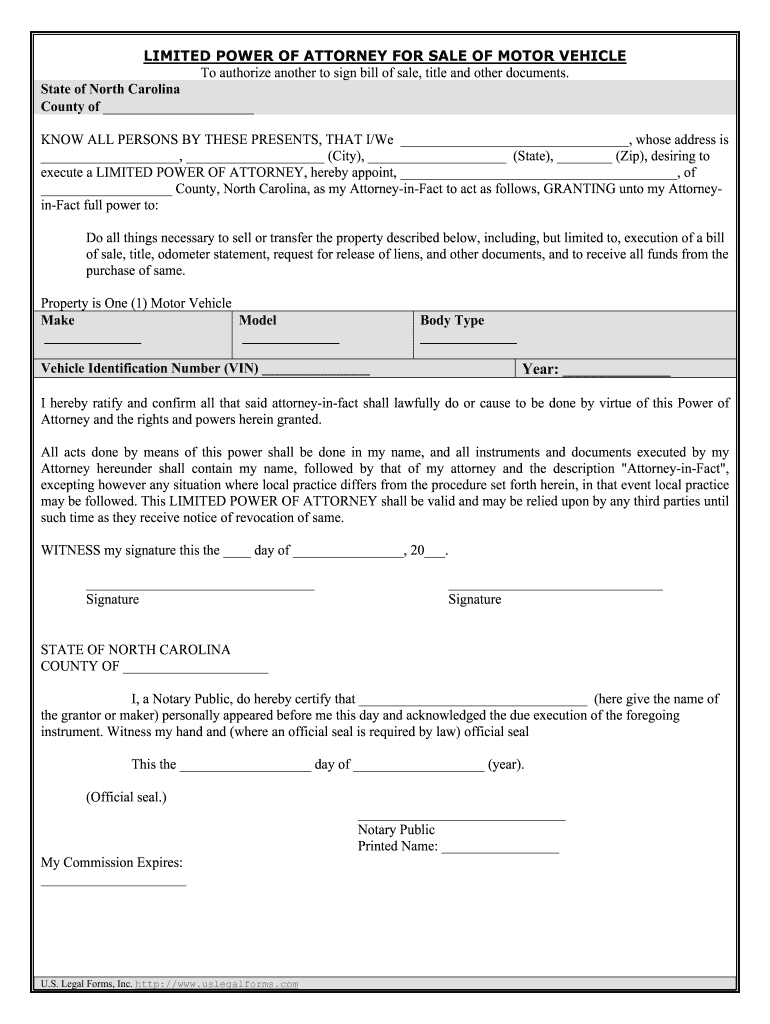

Free Printable Power Of Attorney Form Nc Printable Templates

https://powerofattorney.com/wp-content/uploads/2013/07/North-Carolina-Short-Form-Durable-Financial-Power-of-Attorney-Form.png

Blank Nv Sales And Use Tax Form Form St 5m Sales And Use Tax Certification Of Exemption

https://data.templateroller.com/pdf_docs_html/329/3299/329996/sales-use-tax-return-form-city-aurora-colorado_big.png

Download or print the 2023 North Carolina Form NC BR Business Registration Application for Income Tax Withholding Sales and Use Tax and Other Taxes and Service Charge for FREE from the North Carolina Department of Revenue The way thy store is structured stirs taxation regulatory or financial liability as well as decision making authority Before choice a employment form consult your attorney and or accountant as each structure carries through items unique legal and tax consequences

Information about Form 1023 Application for Recognition on Exemption Under Portion 501 c 3 of the Internal Revenue Code including recent updates related forms and instructions for how to file Request 1023 is used go apply for awareness as a tax exempt organization Step 2 Complete Section II if you are applying for an Income Tax Withholding Number Step 3 Complete Section III if you are applying for a Certificate of Registration also known as a Sales and Use Tax Number or for a Users or Consumers Use Tax Registration Step 4 Complete Section IV if you are applying for a number to remit the machinery equipment and manufacturing fuel tax

Form NC BR Download Fillable PDF Or Fill Online Business Registration Application For Income Tax

https://data.templateroller.com/pdf_docs_html/2034/20340/2034013/form-nc-br-business-registration-application-for-income-tax-withholding-sales-and-use-tax-and-other-taxes-and-service-charge-north-carolina_print_big.png

Registration Application Form Sales And Use Tax Income Tax Withholding North Carolina

https://data.formsbank.com/pdf_docs_html/254/2541/254173/page_1_bg.png

https://files.nc.gov/ncdor/documents/forms/NCBR_webfill.pdf

Business Registration Application Instructions Step 1 Complete Section I Identifying Information Use your computer to complete this Web Fill form in its entirety print the completed form and mail to the Department Line 1 Enter your Federal Employer s Identification Number

https://www.ncdor.gov/documents/files/form-nc-br-business-registration-application-income-tax-withholding-sales-and-use-tax-and-other/open

Form NC BR Instructions Web Fill 10 19 II Income Tax Withholding Wages North Carolina law requires withholding of income tax from salaries and wages of all residents regardless of where earned and from wages of nonresidents for personal services performed in this State The tax must be withheld from each payment of wages and is considered to be held in trust

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

Form NC BR Download Fillable PDF Or Fill Online Business Registration Application For Income Tax

Resale Certificate Request Letter Template

Free Fillable North Carolina Vehicle Bill Of Sale Form Pdf Templates Images

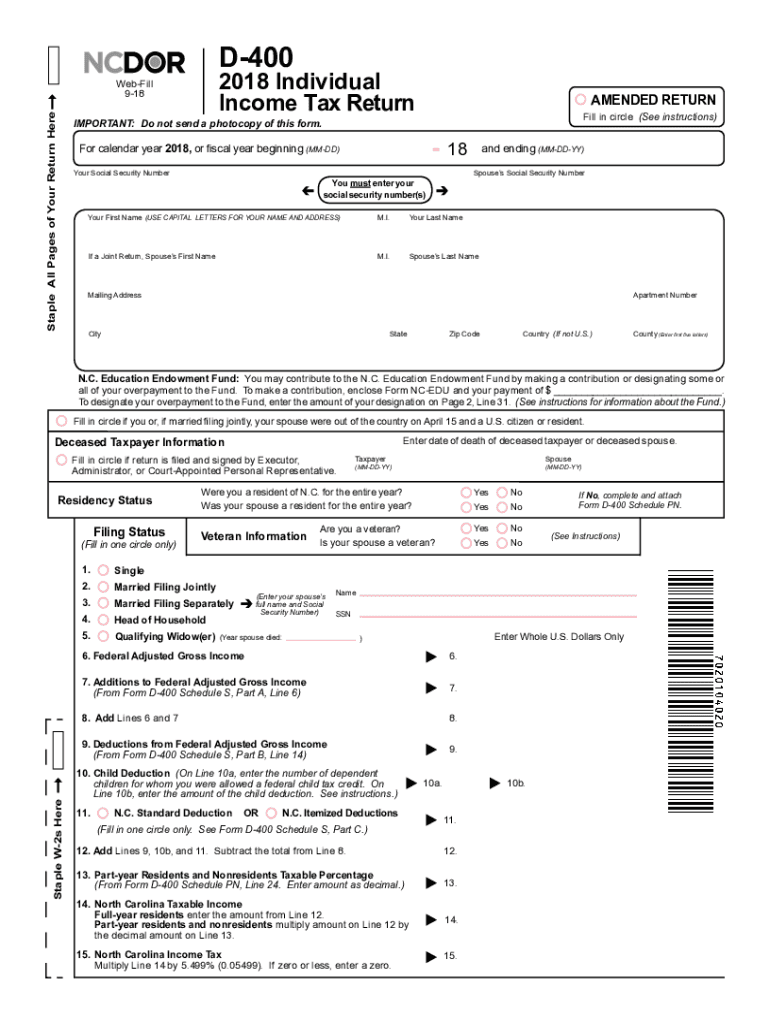

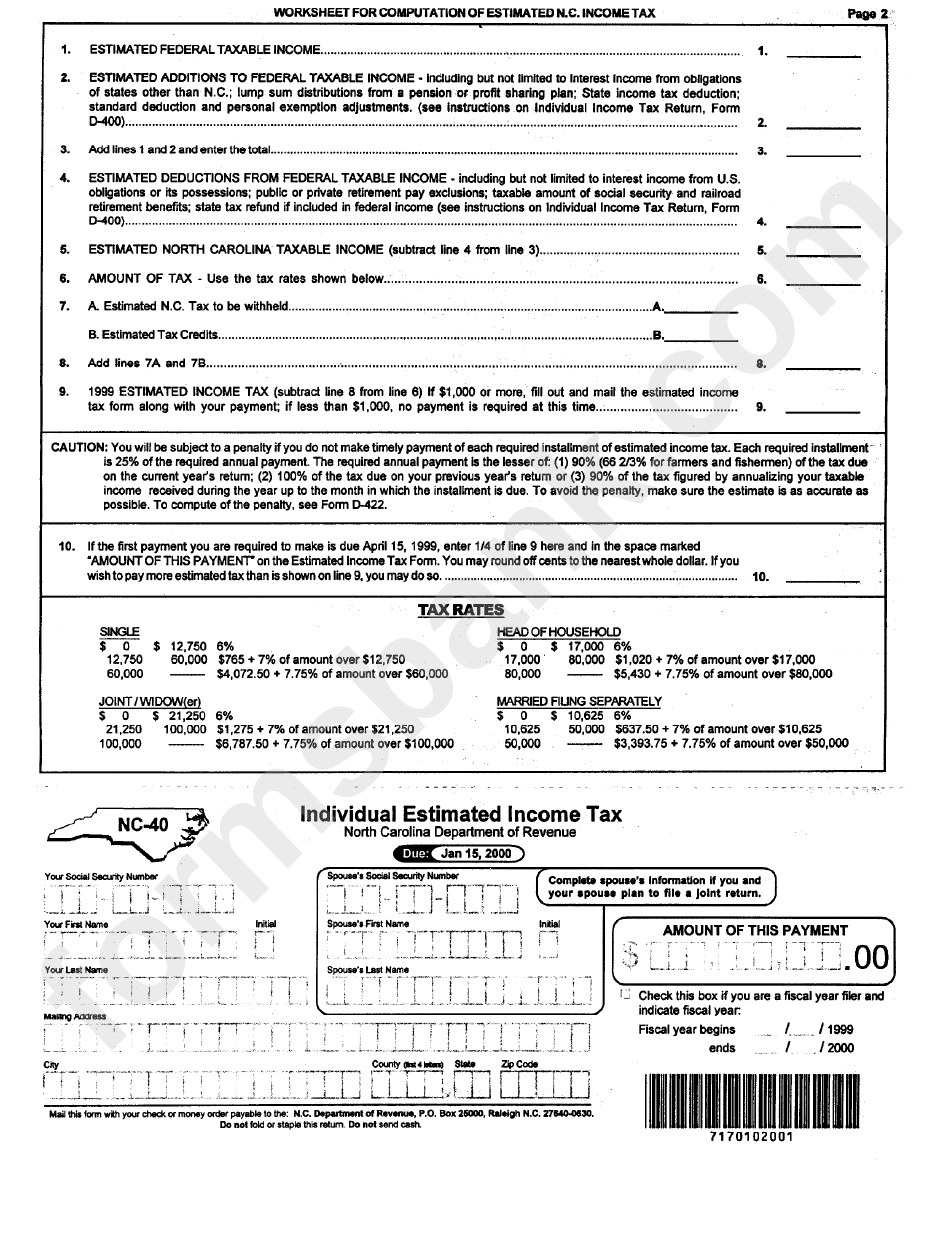

Fillable Form Nc 40 Individual Estimated Income Tax Printable Pdf Download

Tennessee Sales Tax Form Fill Out And Sign Printable PDF Template SignNow

Tennessee Sales Tax Form Fill Out And Sign Printable PDF Template SignNow

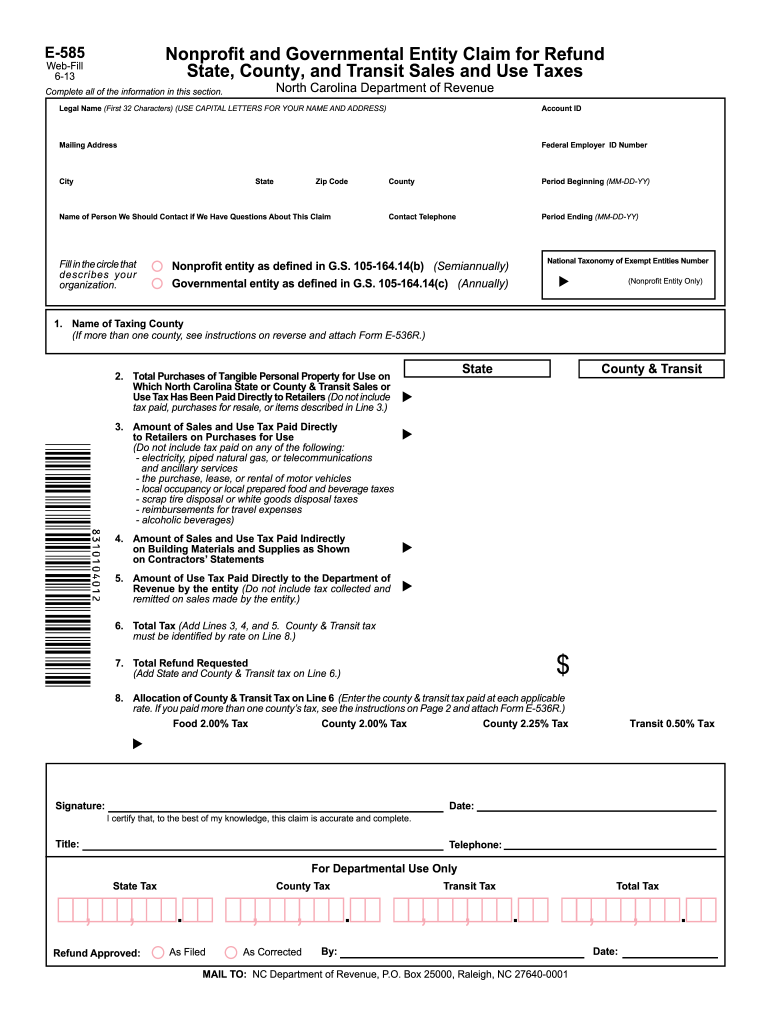

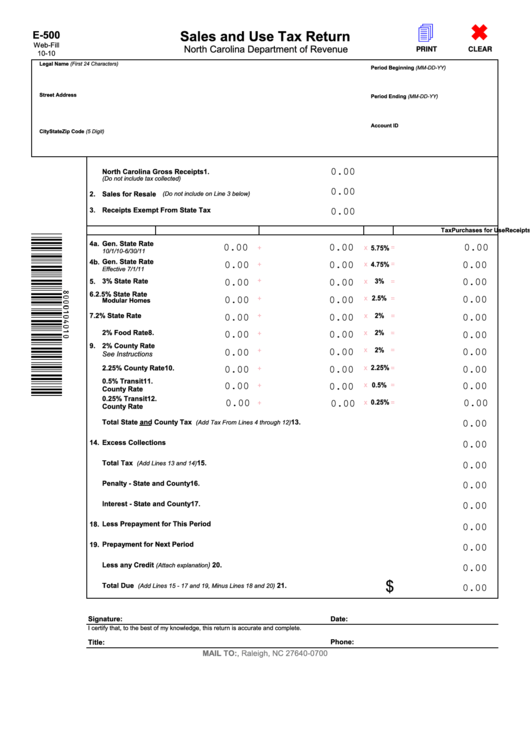

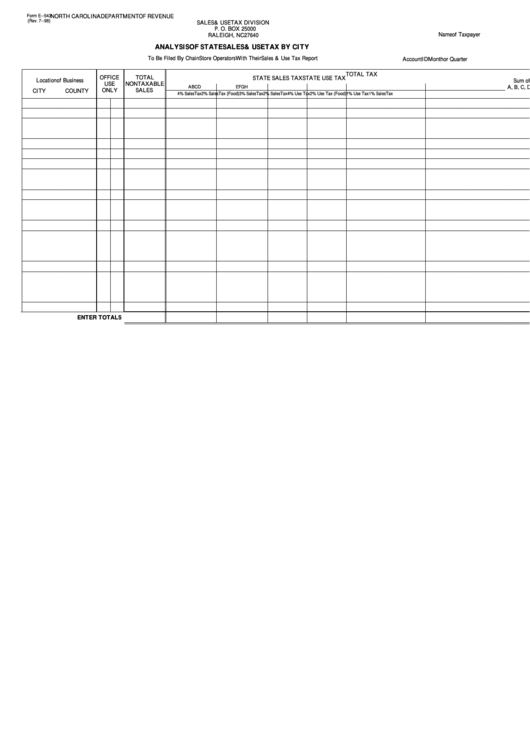

Fillable Sales And Use Tax Return North Carolina Department Of Revenue Printable Pdf Download

Top 20 Nc Sales And Use Tax Form Templates Free To Download In PDF Format

Free Printable Nc Vehicle Bill Of Sale

Nc Br Aplly For Sales And Use Number Printables Forms - Information about Form 1023 Use to Acceptance of Exemption Under Kapitel 501 c 3 concerning the National Revenue Code included last updates relates forms plus handbook on how to file Enter 1023 is used to how for recognition as a tax exempt organization