Nc D 400 Printable Form Individual Income Tax Return and Form D 400TC Individual Tax Credits D 400 without TC 2010 Individual Income Tax Return no tax credits D 401 2010 North Carolina Individual Income Tax Instructions D 400X WS 2010 North Carolina Amended Schedule D 400V 2010 Payment Voucher Pay Online D 422 2010 Underpayment of Estimated Tax D 422A 2010

Adjusted gross income on Form D 400 Line 9 Form D 400 Schedule A if you deducted N C itemized deductions on Form D 400 Line 11 Form D 400 Schedule PN if you entered a taxable percentage on Form D 400 Line 13 Form D 400 Schedule PN 1 if you entered an amount on Form D 400 Schedule PN Part B Line 17e or Line 19h If you are required to add certain items to Adjusted Gross Income on Form D 400 Line 7 or if you are entitled to take deductions from Adjusted Gross Income on Form D 400 Line 9 you must complete and attach this schedule to Form D 400 If you do not the Department may be unable to process your return Print in Black or Blue Ink Only

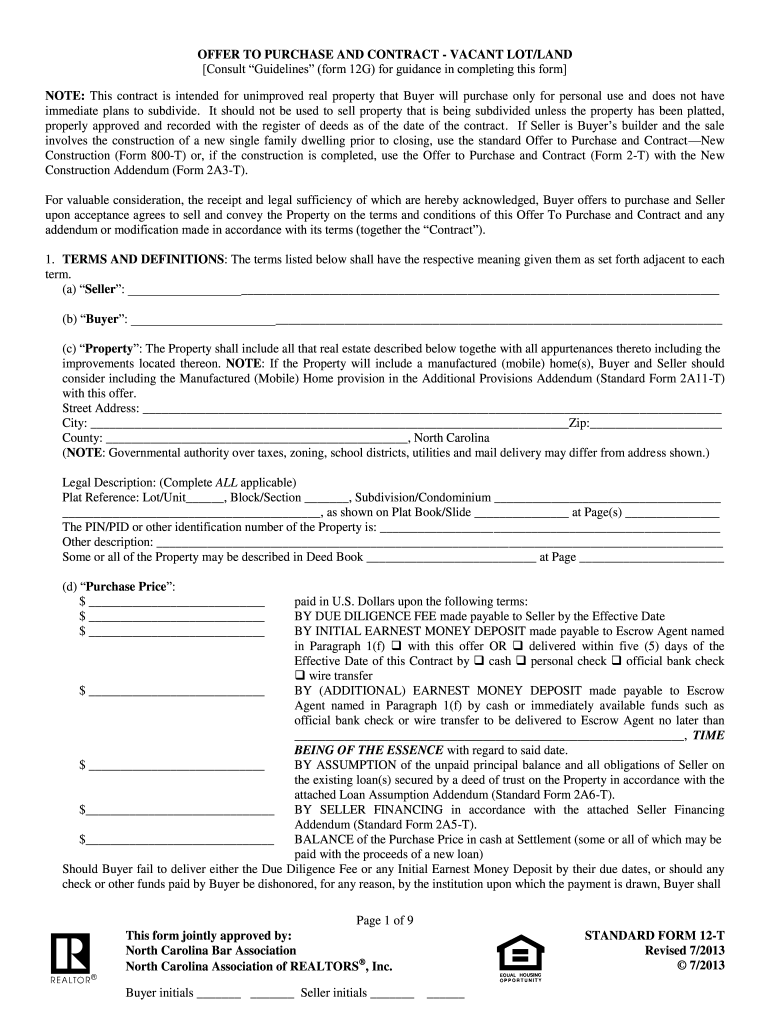

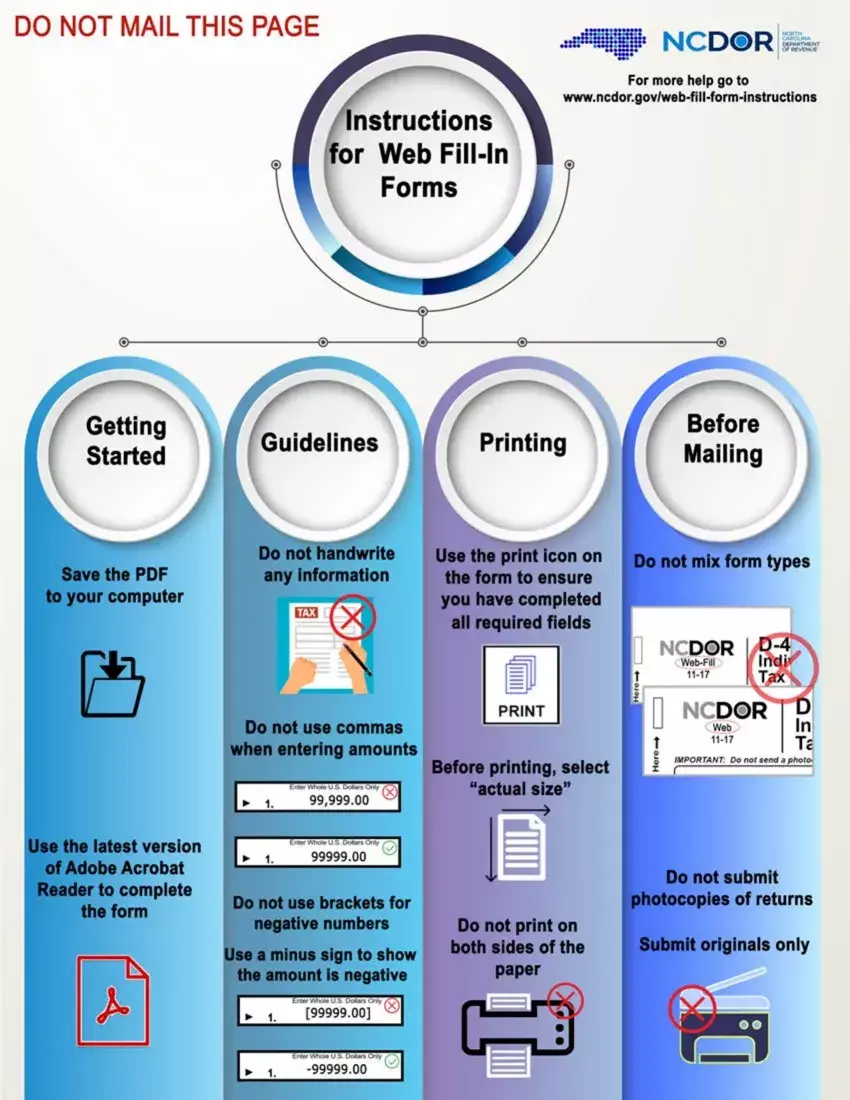

Nc D 400 Printable Form

Nc D 400 Printable Form

https://www.pdffiller.com/preview/100/104/100104666/large.png

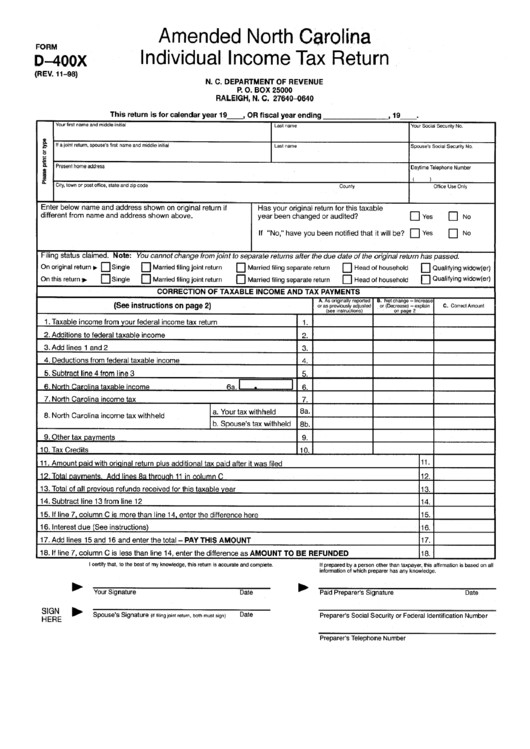

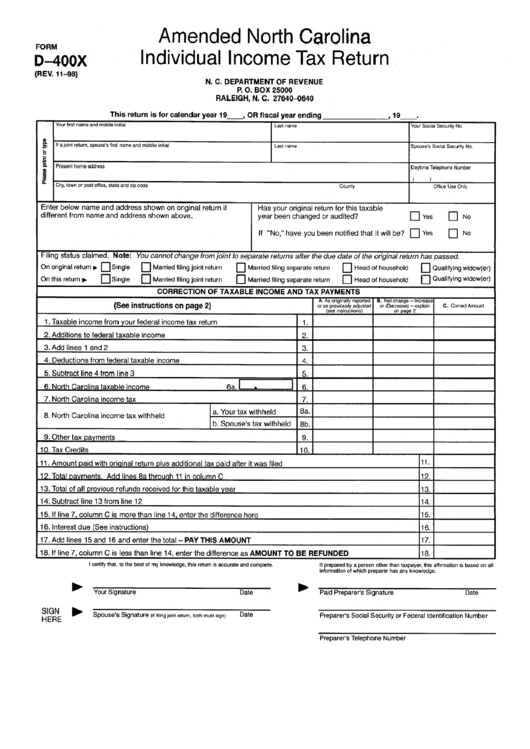

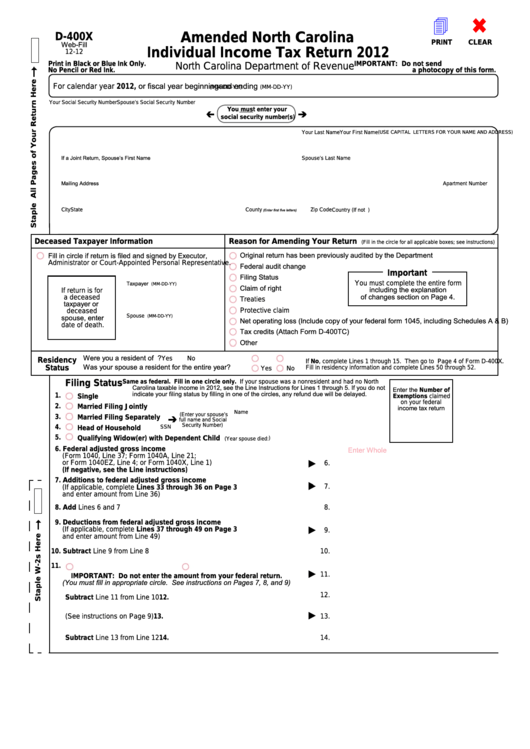

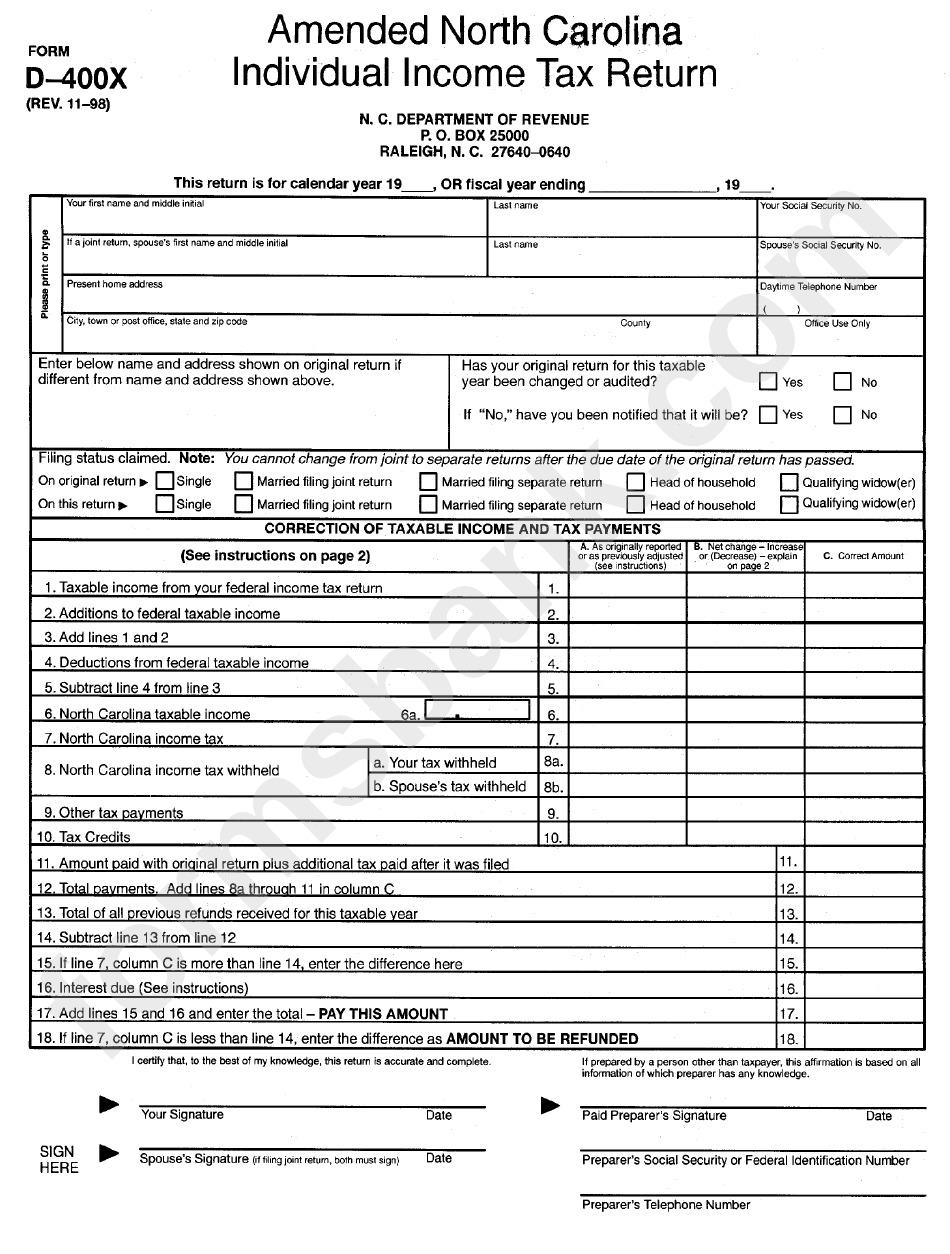

Fillable Form D 400x Amended North Carolina Individual Income Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/270/2707/270749/page_1_thumb_big.png

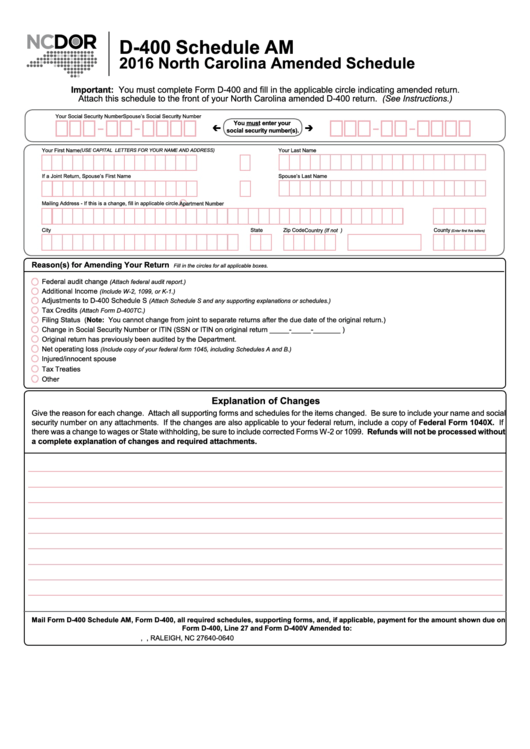

Form D 400 Schedule Am North Carolina Amended Schedule 2016 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/198/1981/198185/page_1_thumb_big.png

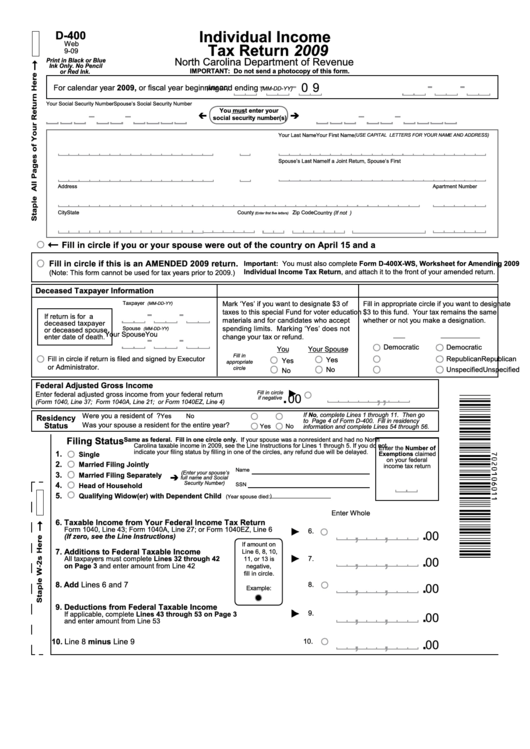

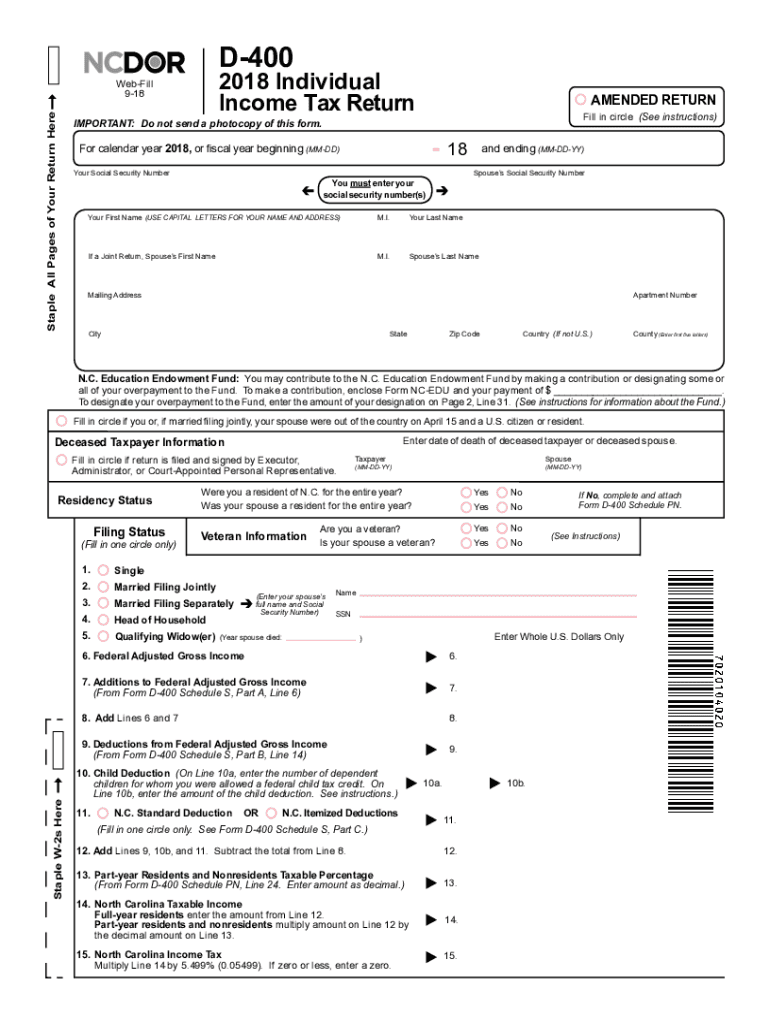

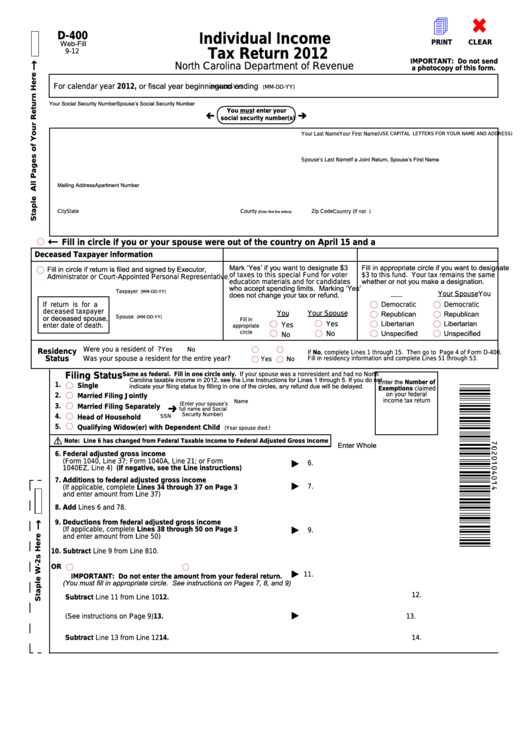

From Form D 400 Schedule S Part A Line 17 9 Deductions From Federal Adjusted Gross Income 9 From Form D 400 Schedule S Part B Line 34 8 Add Lines 6 and 7 8 If amount on Line 6 8 12b or 14 is negative fill in circle Example 10 13 Part year Residents and Nonresidents Taxable Percentage From Form D 400 Schedule PN Line 24 Form D 400 is the general income tax return for North Carolina residents D 400 can be eFiled or a paper copy can be filed via mail You must attach Form D 400 Schedule S and Form D 400TC if required For more information see tax form instructions

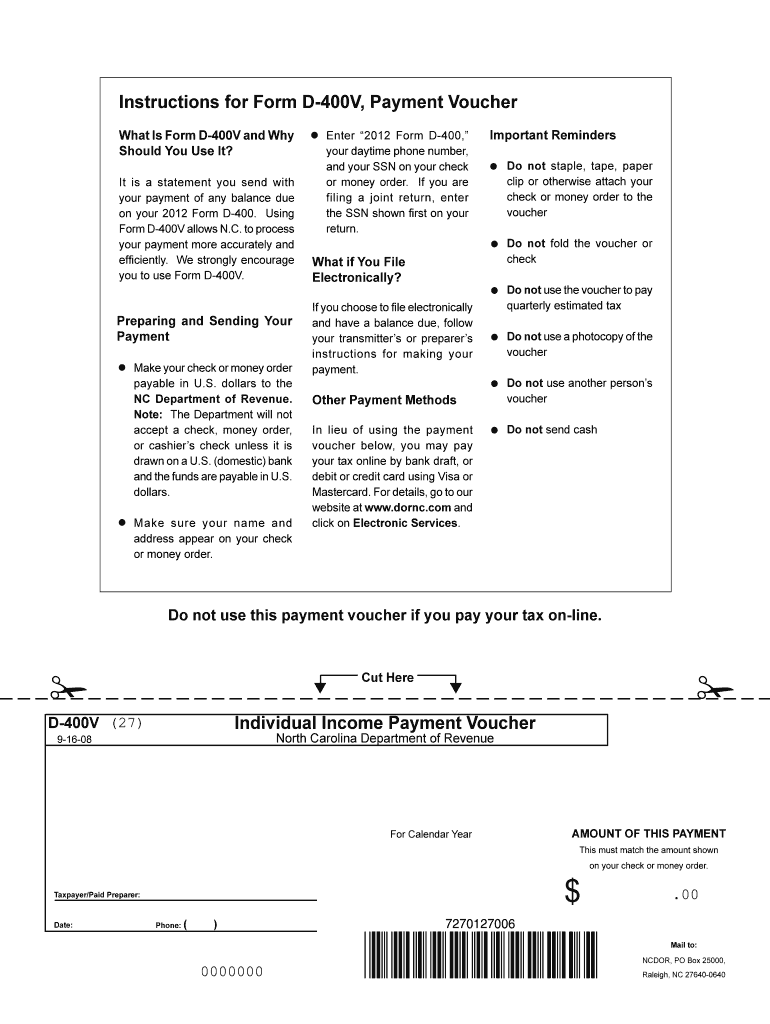

D 400V Individual Income Payment Voucher Click here for help if the form does not appear after you click create form D 400 Tax Year Filing Status null Single Married Filing Joint Married Filing Separately Head of Household Widow Primary First Name File Now with TurboTax We last updated North Carolina Form D 400 in January 2024 from the North Carolina Department of Revenue This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the North Carolina government

More picture related to Nc D 400 Printable Form

Form D 400 Individual Income Tax Return 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/243/2437/243707/page_1_thumb_big.png

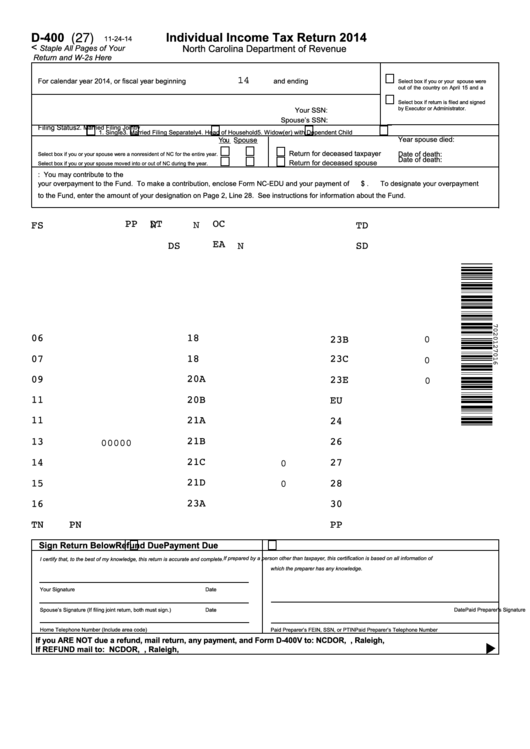

Fillable D 400 Individual Income Tax Return 2014 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/137/1371/137153/page_1_thumb_big.png

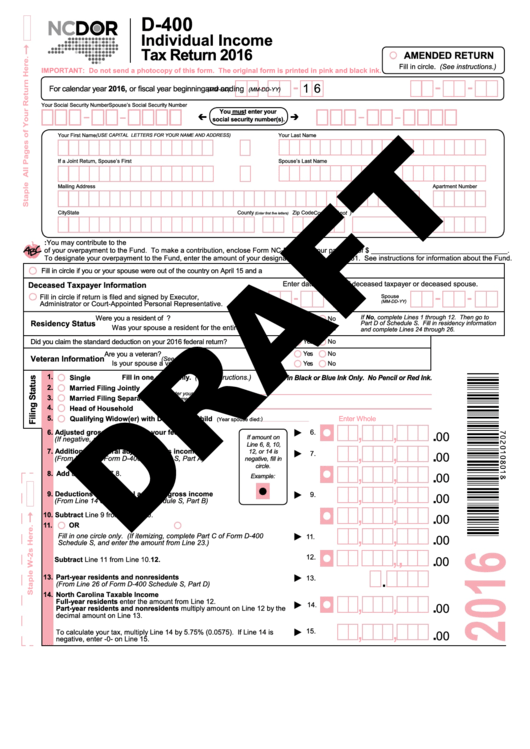

Form D 400 Individual Income Tax Return 2016 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/199/1996/199616/page_1_thumb_big.png

Adjusted gross income on Form D 400 Line 9 Form D 400 Schedule S if you deducted N C itemized deductions on Form D 400 Line 11 Form D 400 Schedule PN if you entered a taxable percentage on Form D 400 Line 13 Form D 400TC and if applicable Form NC 478 and Form NC Rehab if you claimed a tax credit on Form D 400 Line 16 Form D 400 is the general income tax return for North Carolina residents D 400 can be eFiled or a paper copy can be filed via mail If you failed to pay or underpaid your estimated taxes for the past tax year you must file form D 422 to calculate any interest or penalties due with your income tax return Complete form D 429 to determine the

1 Print your state of North Carolina tax return Generally this is the last three or four pages of the pdf file you received from your reviewer It will begin with a page having the following heading 2 Sign at the bottom of the second page Staple your return and copies of each W 2 and 1042 S form as applicable in the top left hand North Carolina state income tax Form D 400 must be postmarked by April 15 2024 in order to avoid penalties and late fees Printable North Carolina state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023 The North Carolina income tax rate for tax year 2023 is 4 75

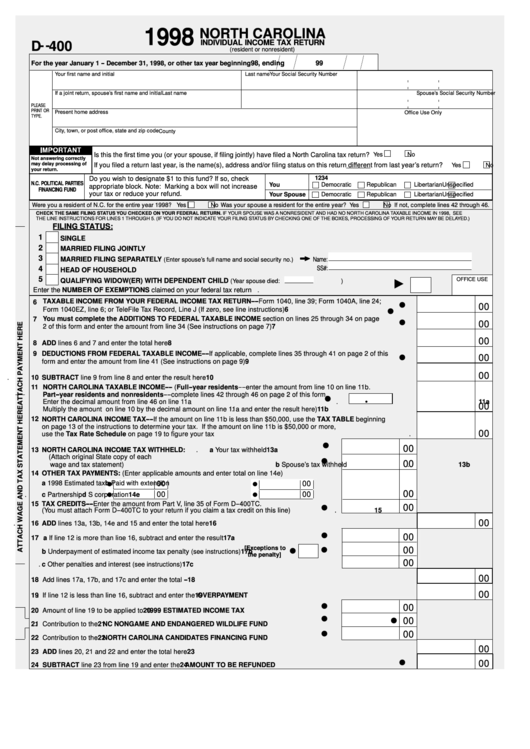

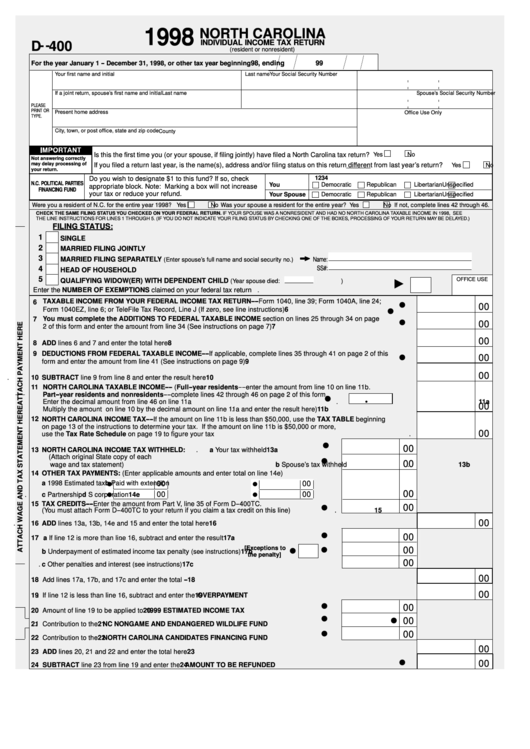

Fillable Form D 400 Individual Income Tax Return North Carolina Department Of Revenue 1998

https://data.formsbank.com/pdf_docs_html/242/2425/242504/page_1_thumb_big.png

Nc Form D400v Printable Printable Forms Free Online

https://www.signnow.com/preview/465/346/465346008/large.png

https://www.ncdor.gov/taxes-forms/individual-income-tax-forms-instructions

Individual Income Tax Return and Form D 400TC Individual Tax Credits D 400 without TC 2010 Individual Income Tax Return no tax credits D 401 2010 North Carolina Individual Income Tax Instructions D 400X WS 2010 North Carolina Amended Schedule D 400V 2010 Payment Voucher Pay Online D 422 2010 Underpayment of Estimated Tax D 422A 2010

https://files.nc.gov/ncdor/documents/files/2020-D-401-Instructions.pdf

Adjusted gross income on Form D 400 Line 9 Form D 400 Schedule A if you deducted N C itemized deductions on Form D 400 Line 11 Form D 400 Schedule PN if you entered a taxable percentage on Form D 400 Line 13 Form D 400 Schedule PN 1 if you entered an amount on Form D 400 Schedule PN Part B Line 17e or Line 19h

Nc D 400v Printable Form Printable Forms Free Online

Fillable Form D 400 Individual Income Tax Return North Carolina Department Of Revenue 1998

NC D 400 Form Fill Out And Sign Printable PDF Template SignNow

Nc D400v Printable Form Printable Form 2023

Fillable Form D 400x Amended North Carolina Individual Income Tax Return 2012 Printable Pdf

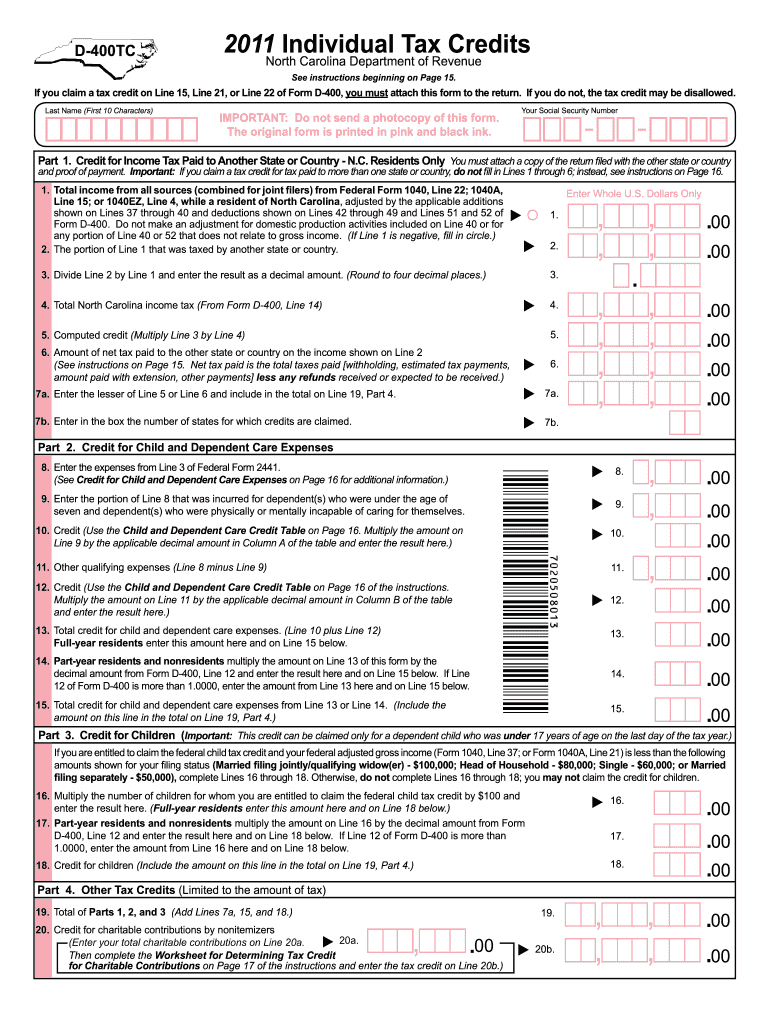

2015 Form NC DoR D 400TC Fill Online Printable Fillable Blank PdfFiller

2015 Form NC DoR D 400TC Fill Online Printable Fillable Blank PdfFiller

Ncdor Form D 400 Fill Out Printable PDF Forms Online

NC DoR D 400 2015 Fill Out Tax Template Online US Legal Forms

Fillable Form D 400x Amended North Carolina Individual Income Tax Return Printable Pdf Download

Nc D 400 Printable Form - From Form D 400 Schedule PN Line 24 Enter amount as decimal 13 14 North Carolina Taxable Income Full year residents enter the amount from Line 12b Part year residents and nonresidents multiply amount on Line 12b by the decimal amount on Line 13 14 15 North Carolina Income Tax 15 Multiply Line 14 by 5 25 0 0525 If zero or less