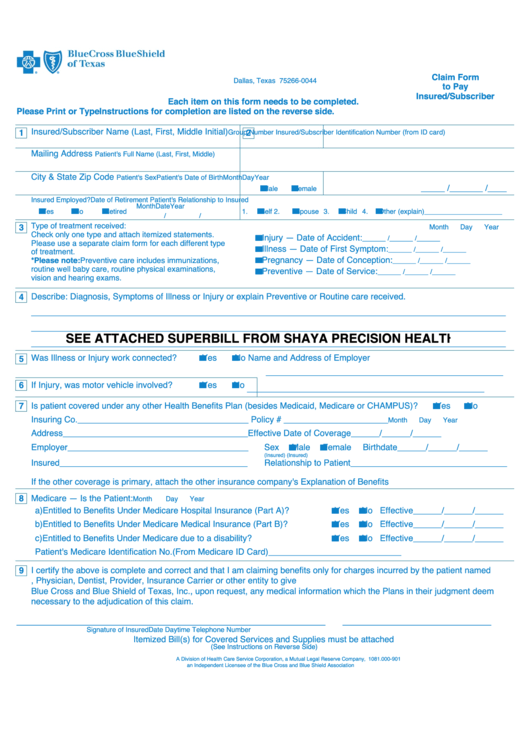

Oklahoma Injured Spouse Form Printable If Injured Spouse check here When Do You File Form 505 After you have been notified that your refund is going to be applied to a debt other than your own file Form 505 and mail to Oklahoma Tax Commission Account Maintenance Division Post Office Box 26800 Oklahoma City OK 73126 0800 Note Include copies of all W 2 forms of both spouses

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability Download Fillable Form 505 In Pdf The Latest Version Applicable For 2023 Fill Out The Injured Spouse Claim And Allocation Oklahoma Online And Print It Out For Free Form 505 Is Often Used In Oklahoma Tax Commission Oklahoma Legal Forms And United States Legal Forms

Oklahoma Injured Spouse Form Printable

Oklahoma Injured Spouse Form Printable

https://data.formsbank.com/pdf_docs_html/10/108/10836/page_1_thumb_big.png

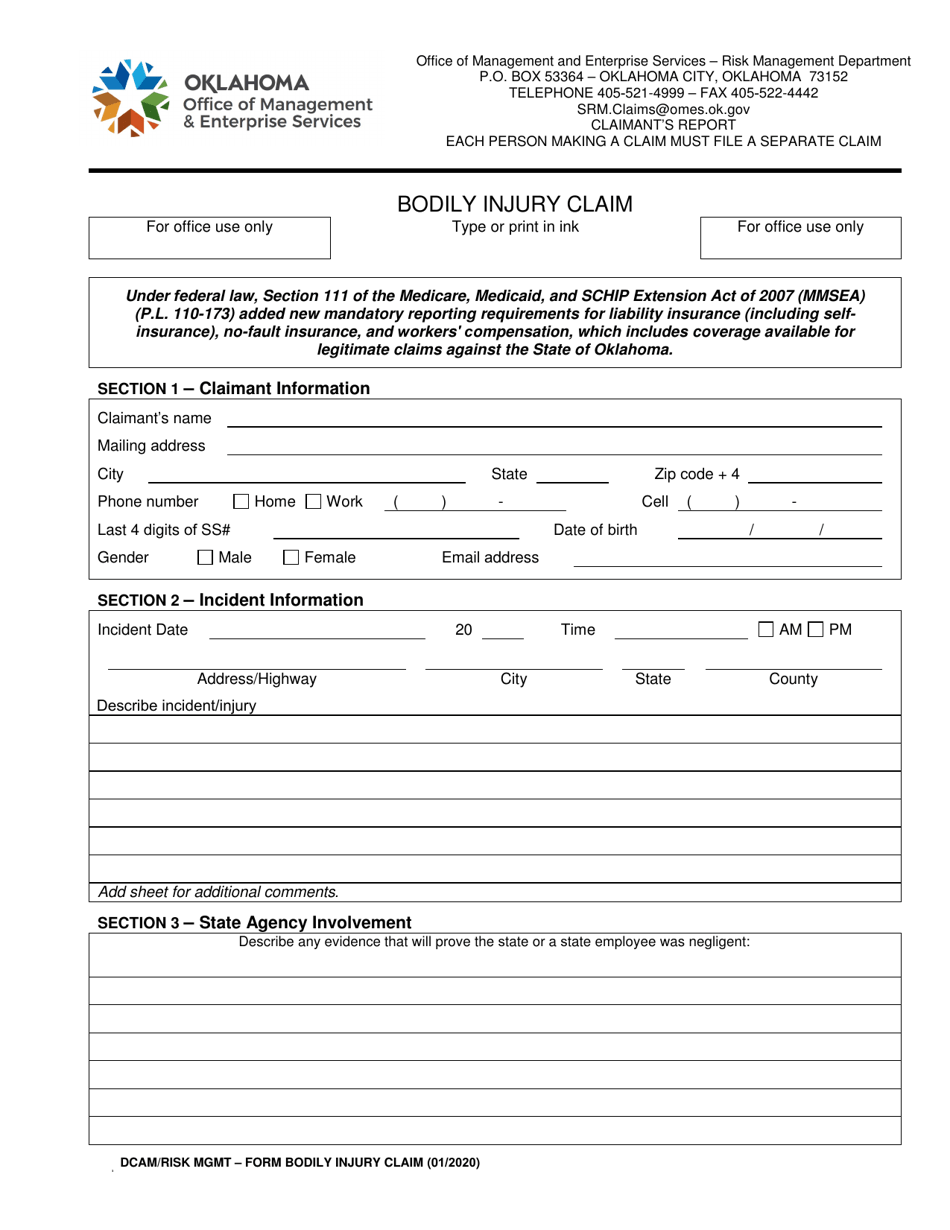

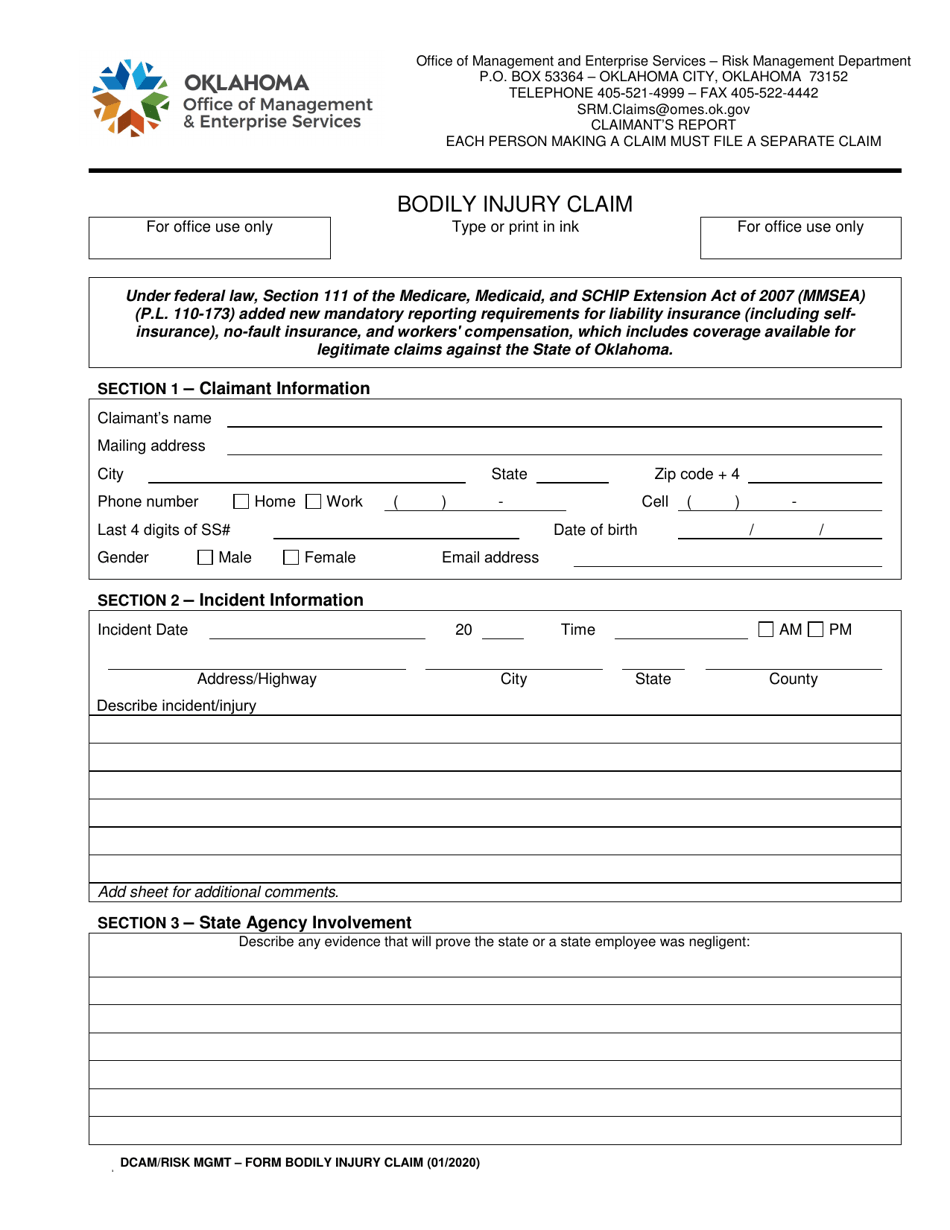

Oklahoma Bodily Injury Claim Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2183/21833/2183380/bodily-injury-claim-oklahoma_print_big.png

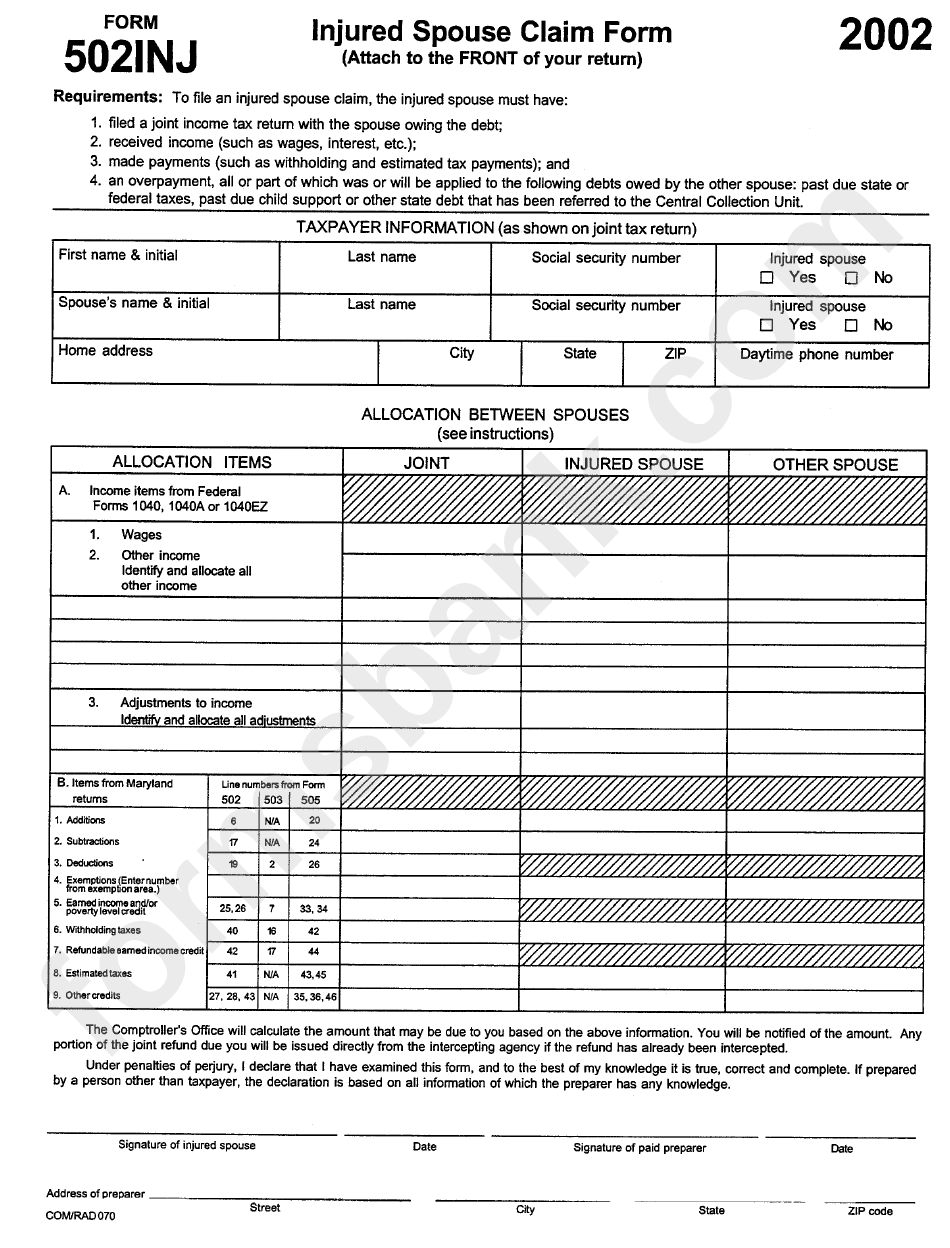

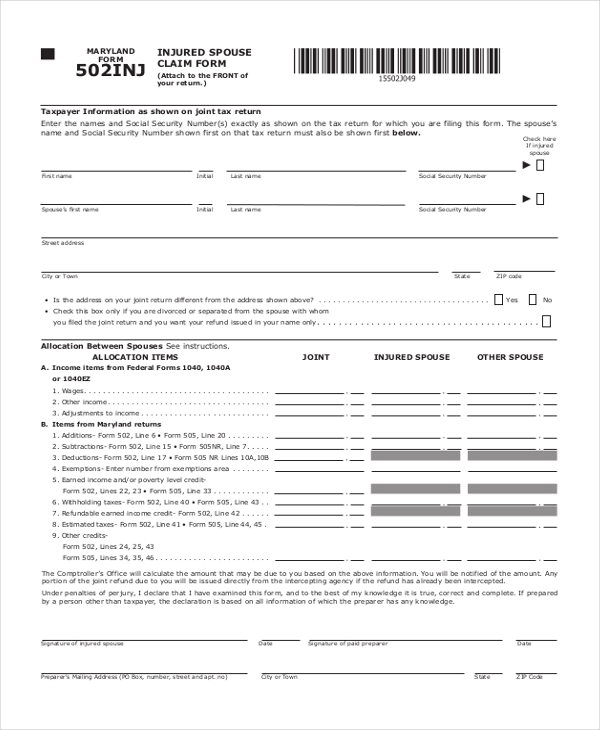

Form 502inj Injured Spouse Claim Form 2002 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/292/2923/292377/page_1_bg.png

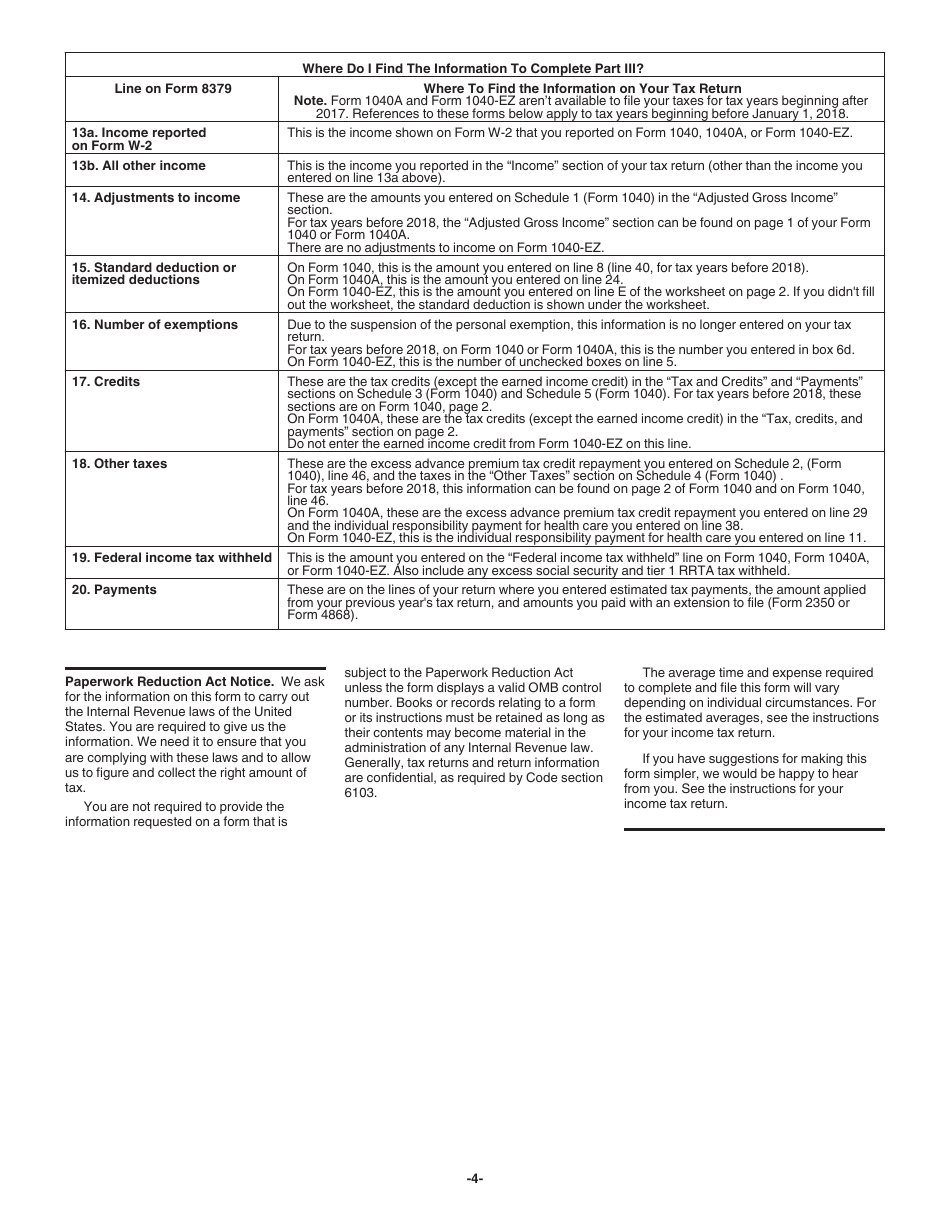

Form 505 Oklahoma Injured Spouse Claim and Allocation not to be filed with the return Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 oklahoma form 505 pdf and you can print it directly from your computer More about the Oklahoma Form 505 Download Fillable Otc Form 505 In Pdf The Latest Version Applicable For 2024 Fill Out The Injured Spouse Claim And Allocation Oklahoma Online And Print It Out For Free Otc Form 505 Is Often Used In Injured Spouse Claim Injured Spouse Tax Allocation Tax Claims Oklahoma Tax Commission Oklahoma Legal Forms Tax Return Template And United States Legal Forms

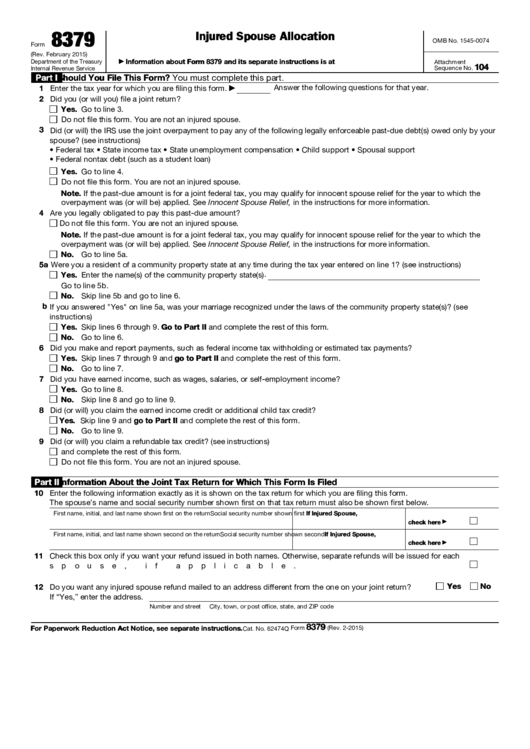

Screen OK505 Oklahoma Injured Spouse 1040 Screens Screen OK505 Oklahoma Injured Spouse 1040 Show all hidden content Overview Use this screen to complete Form 505 Injured Spouse Claim and Allocation Information is automatically used from federal Form 8379 Use this screen if the state information differs from the federal data Form 505 is for Oklahoma Tax Commission use only If you answered yes you may file this form to claim your part of the refund if all three of the following apply You are not required to pay your spouse s Oklahoma Tax Commission liability You received and reported income such as wages taxable interest etc on the joint return

More picture related to Oklahoma Injured Spouse Form Printable

Injured Spouse Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/12/100012342/large.png

IRS Form 8857 Instructions Innocent Spouse Relief

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/irs_form_8857_featured_image.png

Code 971 Injured Spouse Claim Received

https://data.formsbank.com/pdf_docs_html/192/1928/192848/page_1_thumb_big.png

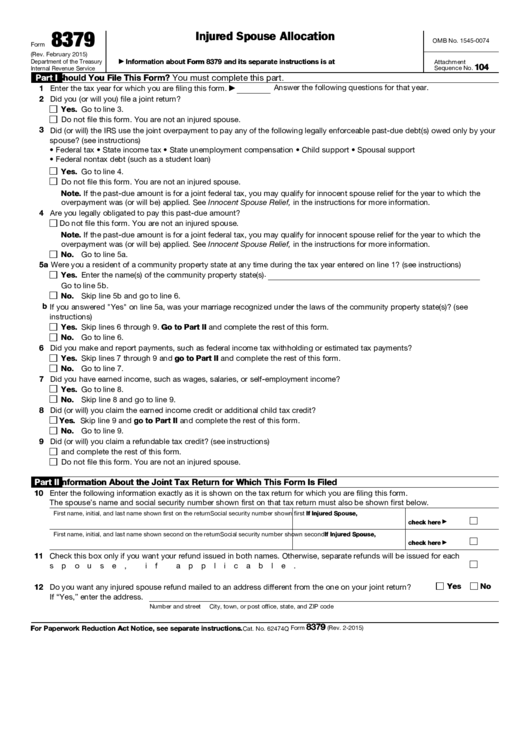

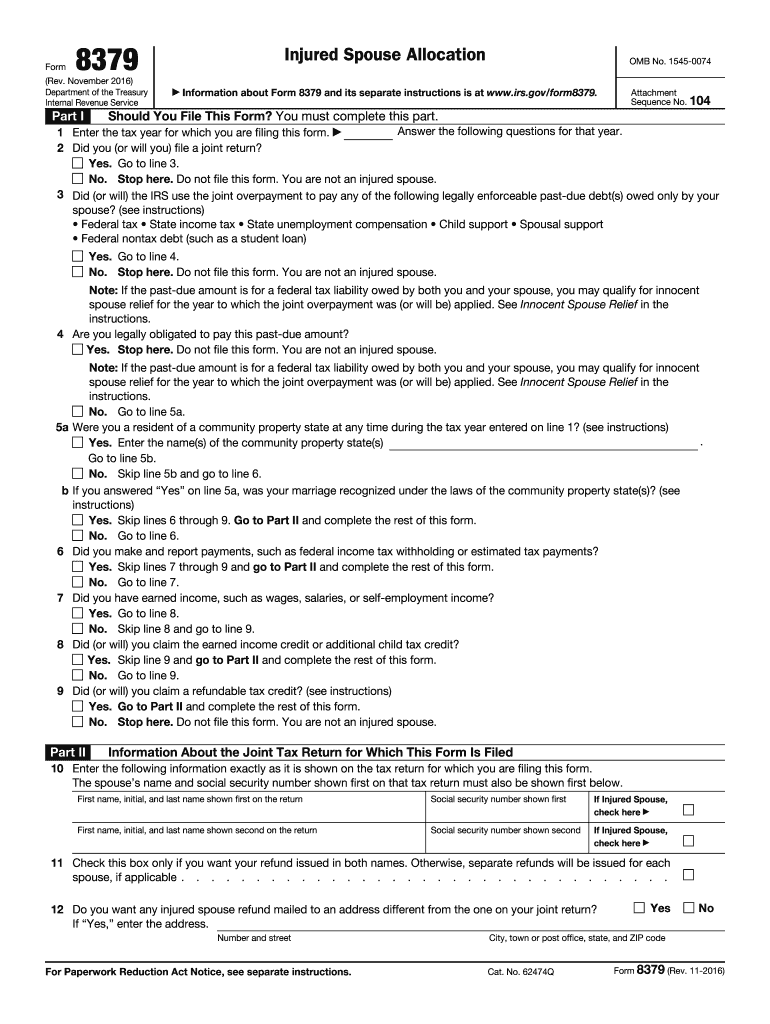

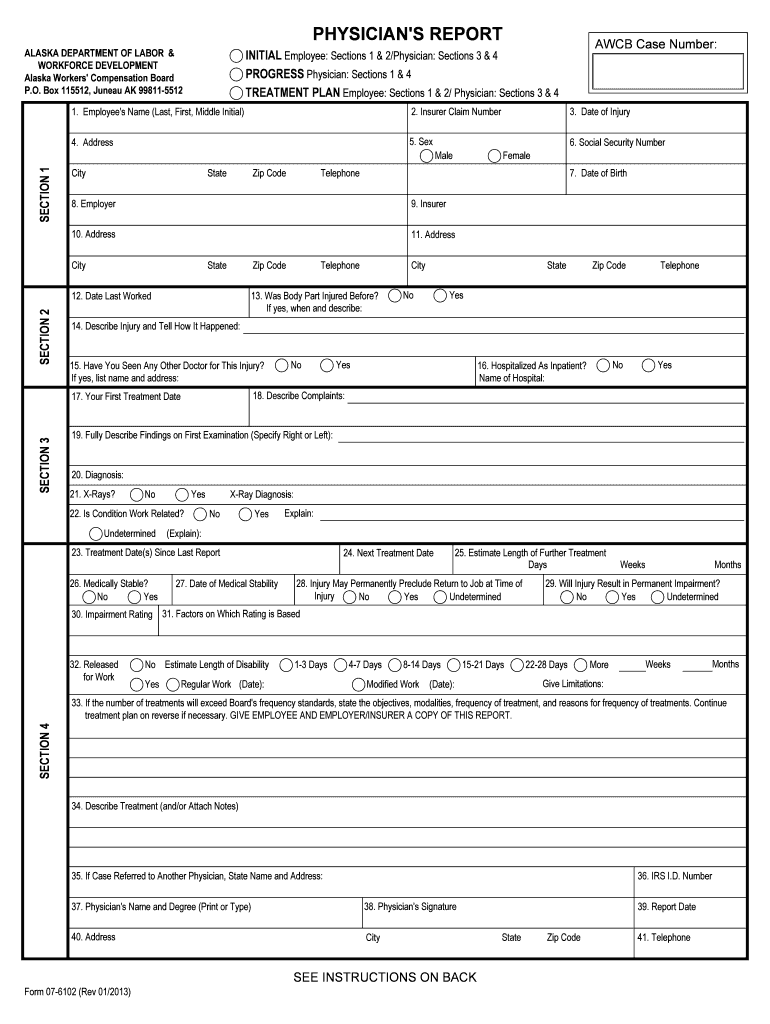

This form is used in what s commonly called an uncontested or waiver or default divorce action Generally used for one spouse to respond to the Petition for Dissolution of Marriage by entering an appearance signing the Agreed Decree of Divorce and waiving all further notices from the court CAREFULLY read and only sign this form on page 2 if Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Which Revision To Use

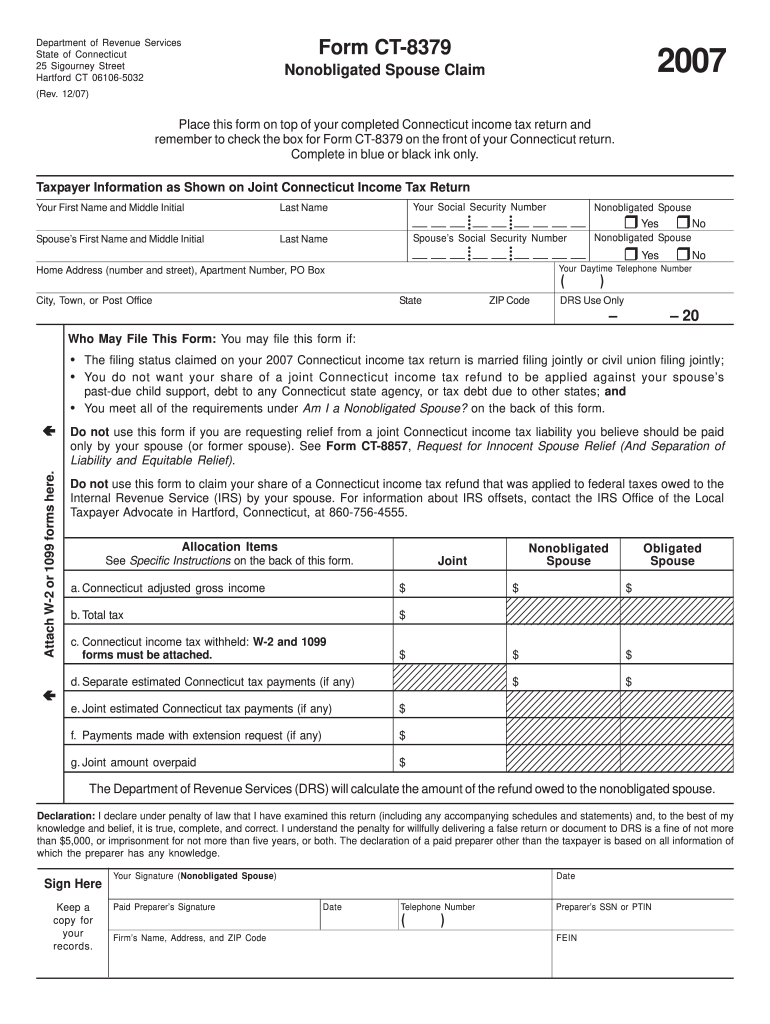

Exclusion for Spouse Coverage An employee may elect to cover all eligible dependent children and elect not to cover their spouse This election shall be made at one of these times 1 when the employee enrolls in the plan or makes changes during the annual Option Period or 2 when the employee experiences a qualifying event An employee who View download and print 505 Injured Spouse Claim And Allocation pdf template or form online 891 Oklahoma Tax Forms And Templates are collected for any of your needs Form 505 Oklahoma Injured Spouse Claim And Allocation Financial Form Pa 8379 Injured Spouse Claim And Allocation Financial Pa 8379

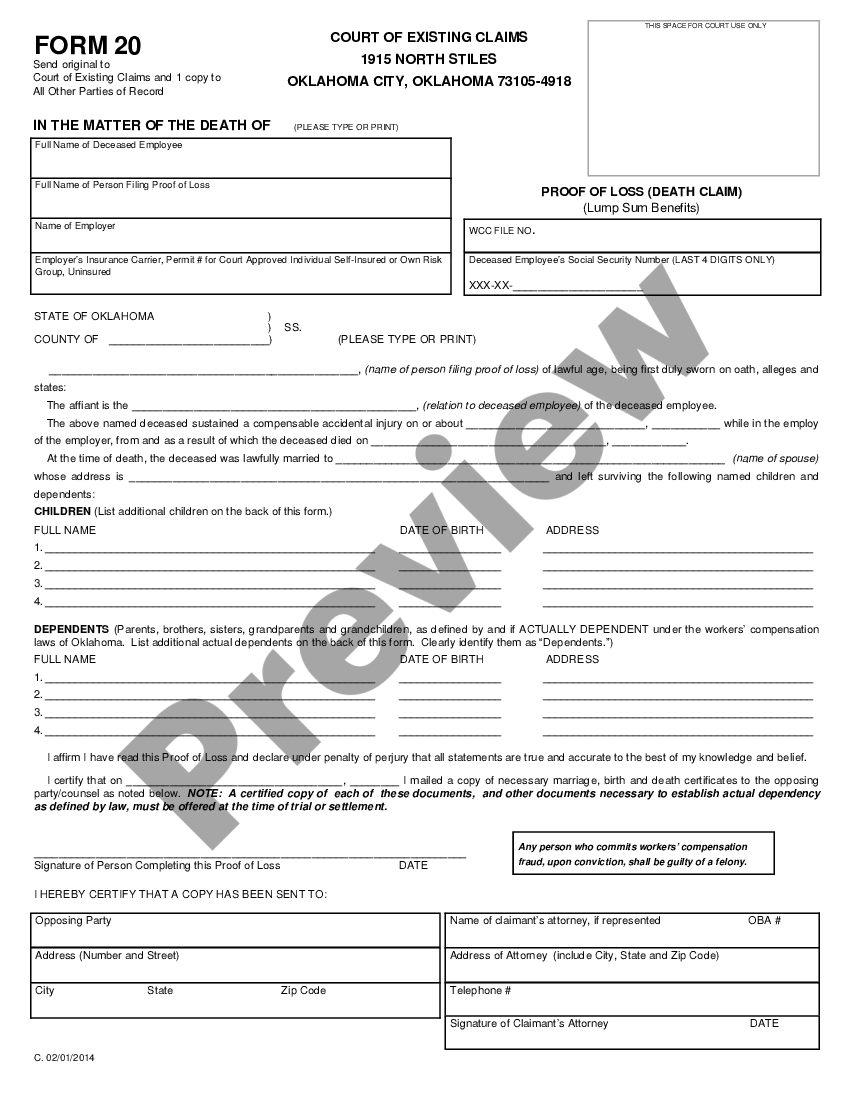

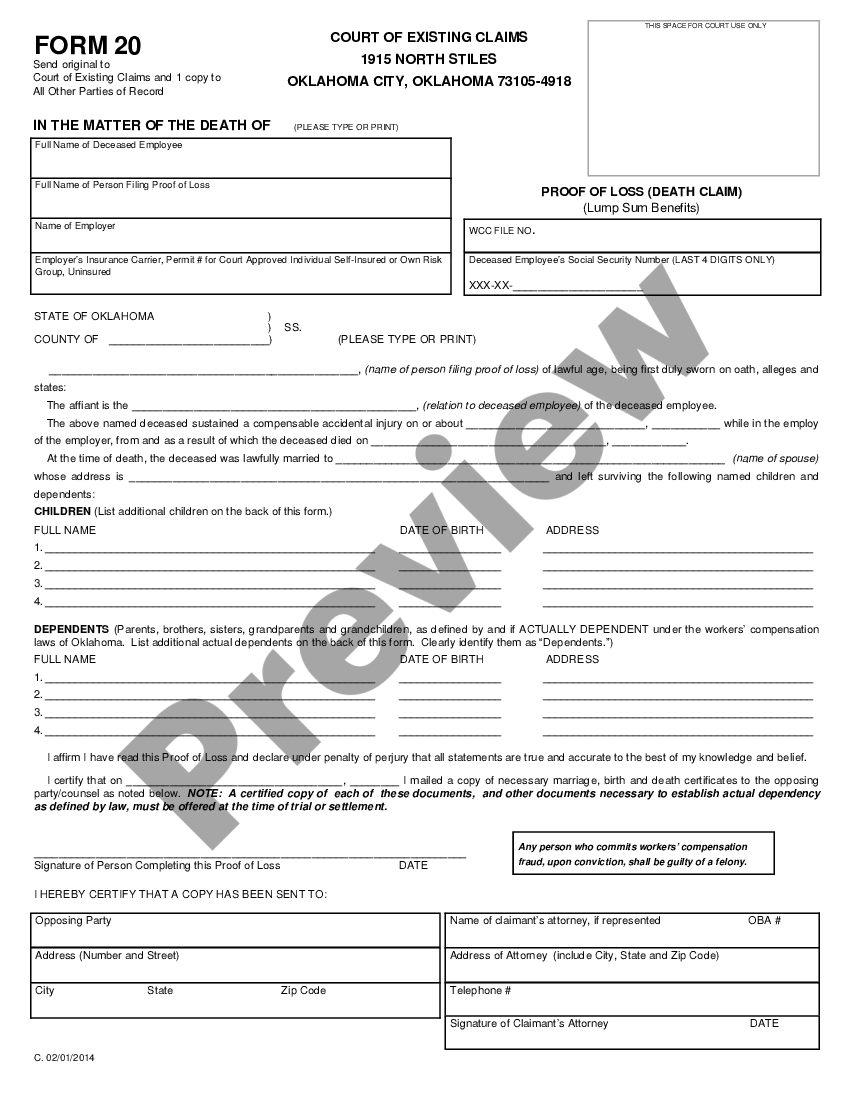

Oklahoma Proof Of Loss For Spouse And Children Lump Sum Benefits US Legal Forms

https://cdn.uslegal.com/uslegal-preview/OK/OK-20-WC/1.png

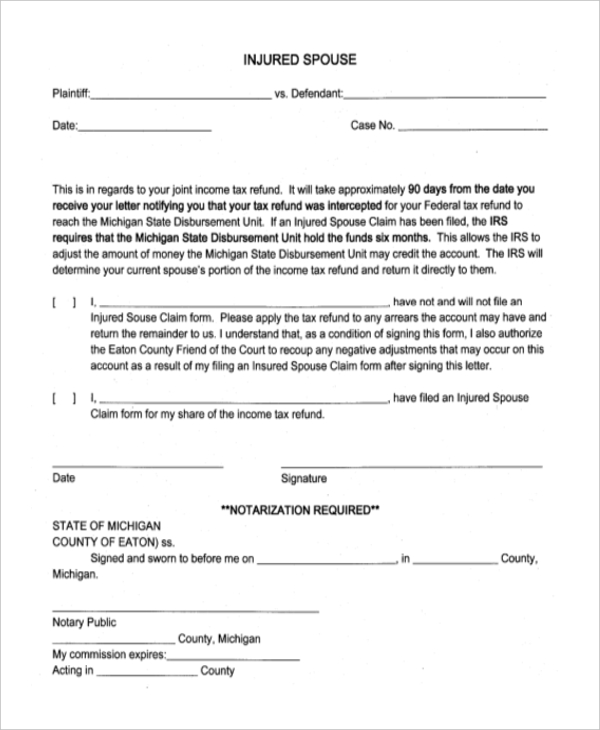

FREE 7 Sample Injured Spouse Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2016/10/25143415/Sample-Injured-Spouse-Form.jpg

https://digitalprairie.ok.gov/digital/collection/forms/id/2711

If Injured Spouse check here When Do You File Form 505 After you have been notified that your refund is going to be applied to a debt other than your own file Form 505 and mail to Oklahoma Tax Commission Account Maintenance Division Post Office Box 26800 Oklahoma City OK 73126 0800 Note Include copies of all W 2 forms of both spouses

https://www.taxformfinder.org/oklahoma/form-505

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability

8379 Form Fill Out Sign Online DocHub

Oklahoma Proof Of Loss For Spouse And Children Lump Sum Benefits US Legal Forms

FREE 9 Sample Injured Spouse Forms In PDF

Injured Spouse Allocation Free Download

Download Instructions For IRS Form 8379 Injured Spouse Allocation PDF Templateroller

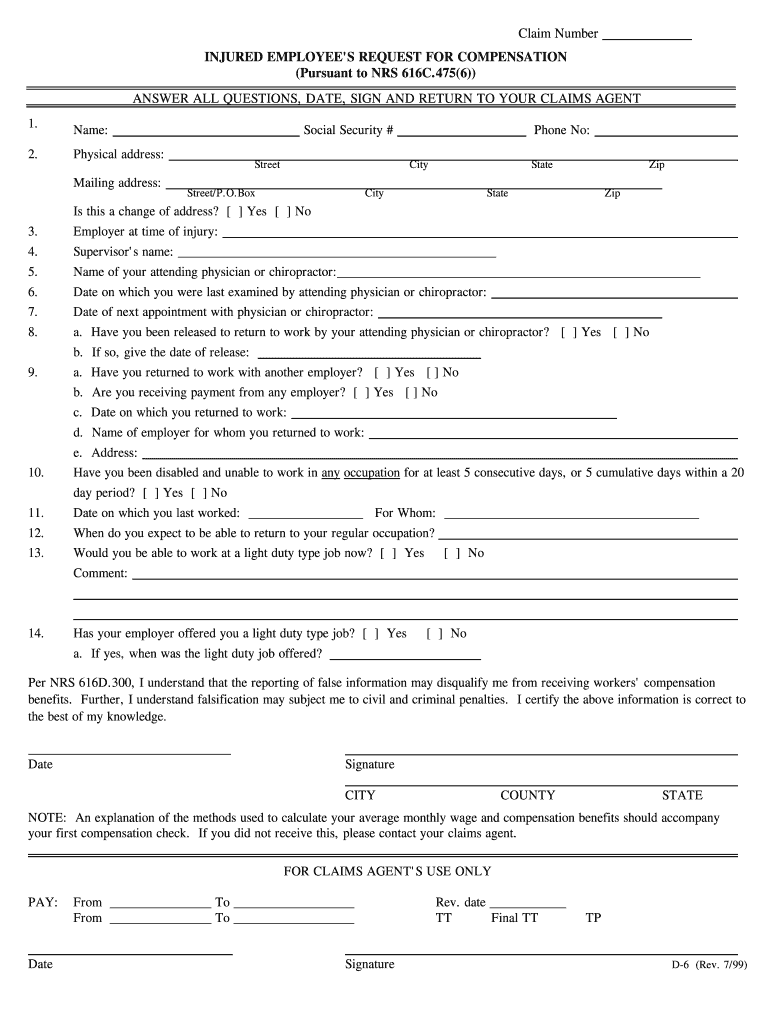

INJURED EMPLOYEE S REQUEST For COMPENSATION Form Fill Out And Sign Printable PDF Template

INJURED EMPLOYEE S REQUEST For COMPENSATION Form Fill Out And Sign Printable PDF Template

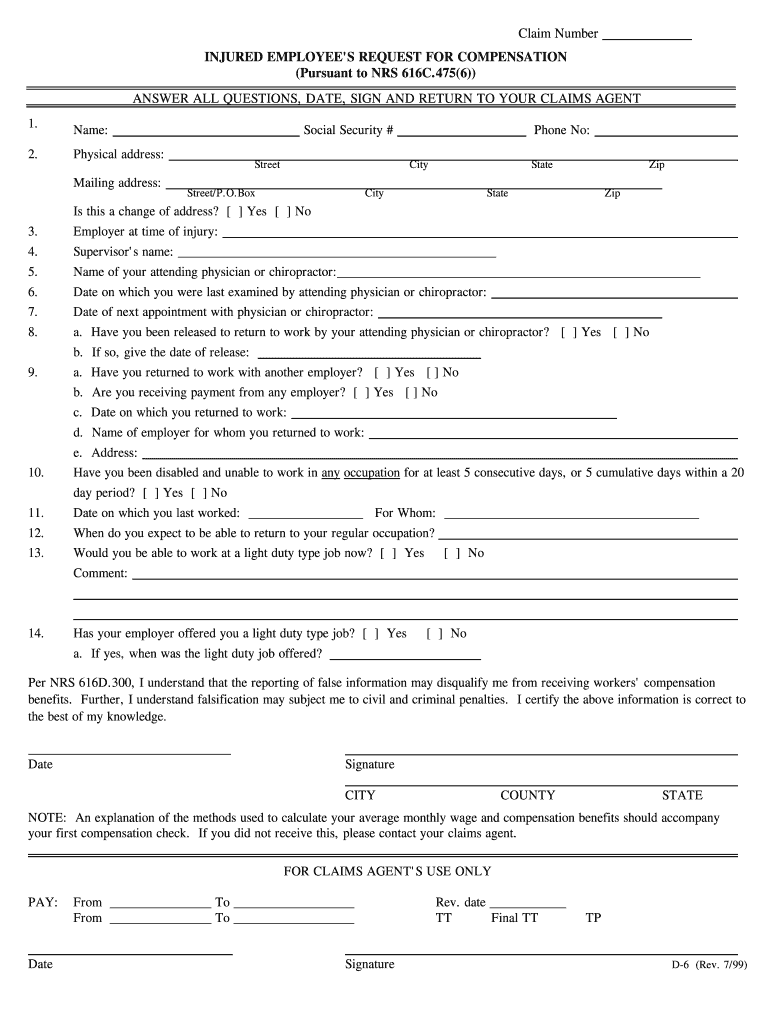

Was Body Part Injured Before Form Fill Out And Sign Printable PDF Template SignNow

FREE 7 Sample Injured Spouse Forms In PDF

FREE 9 Sample Injured Spouse Forms In PDF

Oklahoma Injured Spouse Form Printable - To request injured spouse relief file Form 8379 Injured Spouse Allocation You can file it with your tax return by mail or electronically You can also mail it separately when you receive notice that your refund was applied to an outstanding debt