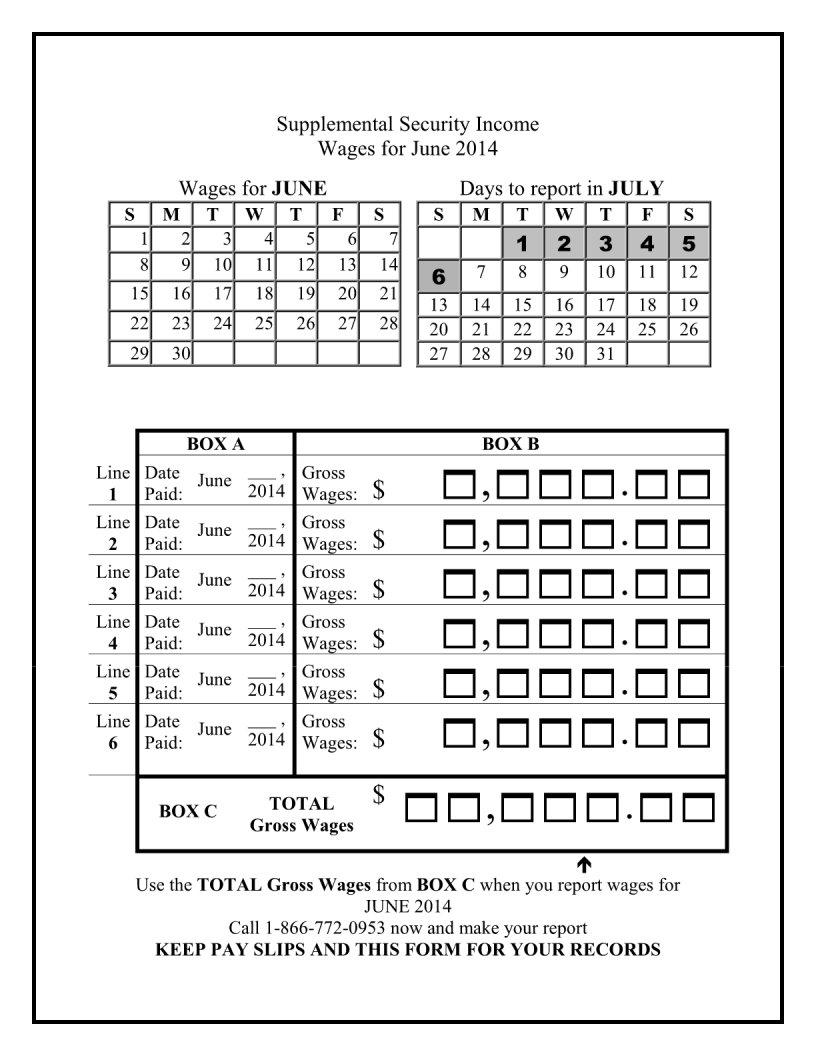

Online Printable Supplemental Security Income Wages Form Supplemental Security Income SSI Your reporting responsibilities Report monthly wages and other income while on SSI Report monthly wages and other income You must report your monthly wages and changes in income from other sources to get accurate monthly SSI payments If you live with your spouse you must also report their income

The Supplemental Security Income SSI program provides monthly payments to adults and children who have a disability are blind or age 65 or older The amount you can receive is based in part on your income and resources the things you own To make sure you get timely and accurate payments you should participate in monthly wage reporting You will need to have all pay stubs for wages paid in the report month You will need to know the pay period start and end dates gross amount paid and the pay date before you can report your wages online If you are receiving SSDI only you may report wages up to 2 years prior to the current date

Online Printable Supplemental Security Income Wages Form

Online Printable Supplemental Security Income Wages Form

https://www.formsbirds.com/formimg/supplemental-security-income-application-form/1281/supplemental-security-income-application-sample-l2.png

Supplemental Security Income Application Sample Free Download

http://www.formsbirds.com/formimg/supplemental-security-income-application-form/1281/supplemental-security-income-application-sample-l3.png

Supplemental Security Income Application Sample Free Download

http://www.formsbirds.com/formimg/supplemental-security-income-application-form/1281/supplemental-security-income-application-sample-l5.png

The Benefit Statement is also known as the SSA 1099 or the SSA 1042S Now you can get a copy of your 1099 anytime and anywhere you want using our online services A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from After you report your wages online you can save or print a copy of your receipt This service will be available for Supplemental Security Income SSI recipients in the future SSI recipients should continue to report wages through SSA Mobile Wage Reporting SSI Telephone Wage Reporting or by visiting a local field office

How SSI Works To get SSI you must have limited income and resources The table below shows the maximum income and resources you can have to qualify for SSI Note Exclusions may apply to the income and resource limits in each of the columns below 2023 SSI Income and Resource Eligibility Table More Details about SSI and How It Works Supplemental Security Income SSI is a federal program funded by U S Treasury general funds The U S Social Security Administration SSA administers the program but SSI is not paid for by Social Security taxes SSI provides monthly payments to adults age 65 and older who have limited income and resources and to other adults and children

More picture related to Online Printable Supplemental Security Income Wages Form

FREE Printable Statement Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2017/03/Social-Security-Earnings-Statement-Form.jpg

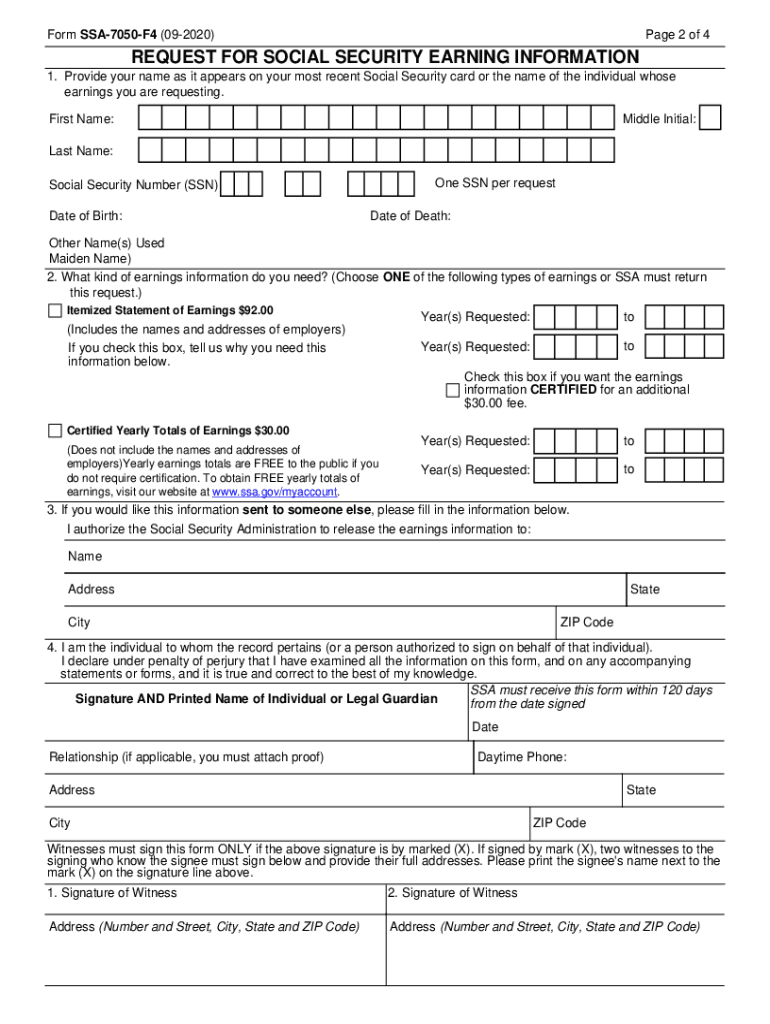

2020 Form SSA 7050 F4 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/524/571/524571142/large.png

Social Security Wage Form Fill Out Printable PDF Forms Online

https://formspal.com/data/LandingPageImages/Image/1/169/169598.JPEG

You can apply online if you Are between the ages of 18 and 65 Have never been married Are a U S citizen residing in one of the fifty states District of Columbia or the Northern Mariana Islands Haven t applied for or received disability or SSI benefits in the past Print If I get Supplemental Security Income SSI and work do I have to report my earnings to Social Security Views Yes the law requires you to report your wages when you get SSI See Reporting Wages When You Receive Supplemental Security Income for more information Comments 0 Give us Feedback Did this answer your question

Download your 1099 or 1042S tax form in your Social Security account Sign in Create account If you live outside the United States and can t access your form online contact a Federal Benefits Unit for help If you get SSI payments Supplemental Security Income SSI payments aren t taxed Supplemental Security Income SSI is for people who have little to no income You must also either Have a disability or Be 65 or older Use the Benefit Eligibility Screening Tool to see if you are eligible for SSI You have options to apply online by phone or in person To apply for SSI for a child you can start the process online

Application For Supplemental Security Income Form Free Download

http://www.formsbirds.com/formimg/supplemental-security-income-application-form/1287/application-for-supplemental-security-income-form-l4.png

Supplemental Security Income Application Sample Free Download

https://www.formsbirds.com/formimg/supplemental-security-income-application-form/1281/supplemental-security-income-application-sample-l14.png

https://www.ssa.gov/ssi/reporting/wages

Supplemental Security Income SSI Your reporting responsibilities Report monthly wages and other income while on SSI Report monthly wages and other income You must report your monthly wages and changes in income from other sources to get accurate monthly SSI payments If you live with your spouse you must also report their income

https://www.ssa.gov/pubs/EN-05-10503.pdf

The Supplemental Security Income SSI program provides monthly payments to adults and children who have a disability are blind or age 65 or older The amount you can receive is based in part on your income and resources the things you own To make sure you get timely and accurate payments you should participate in monthly wage reporting

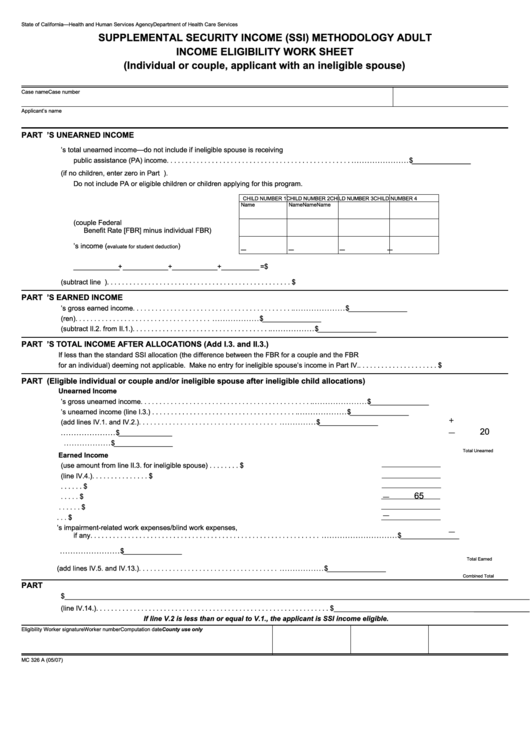

Form Mc 326 A Supplemental Security Income Ssi Methodology Adult Income Eligibility Work

Application For Supplemental Security Income Form Free Download

Supplemental Security Income Application Sample Free Download

Supplemental Security Income Application Sample Free Download

Supplemental Security Income Application Sample Free Download

Download Application For Supplemental Security Income For Free Page 3 FormTemplate

Download Application For Supplemental Security Income For Free Page 3 FormTemplate

Supplemental Security Income Application Form 2 Free Templates In PDF Word Excel Download

Supplemental Security Income Application Sample Free Download

Supplemental Security Income Application Sample Free Download

Online Printable Supplemental Security Income Wages Form - Supplemental Security Income Smartphone Wage Reporting Application Instructions Beneficiaries deemors and representative payees reporting a change in wages can report their monthly wages via the SSI Mobile Wage Reporting Application available in the Android Play and Apple iTunes Markets