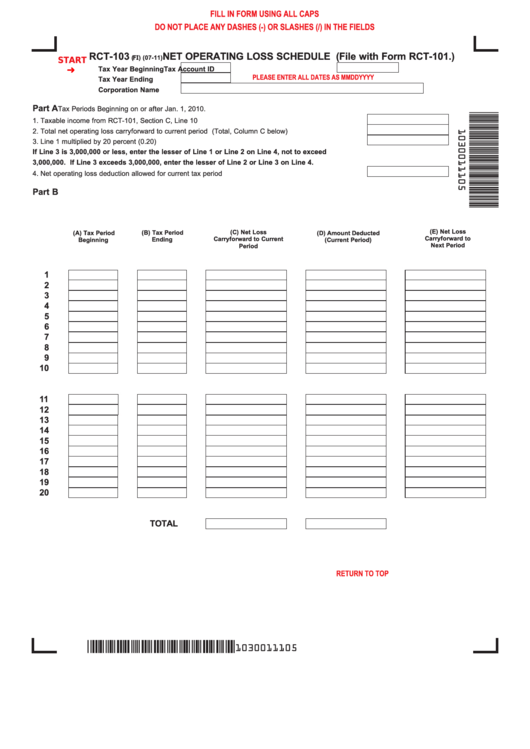

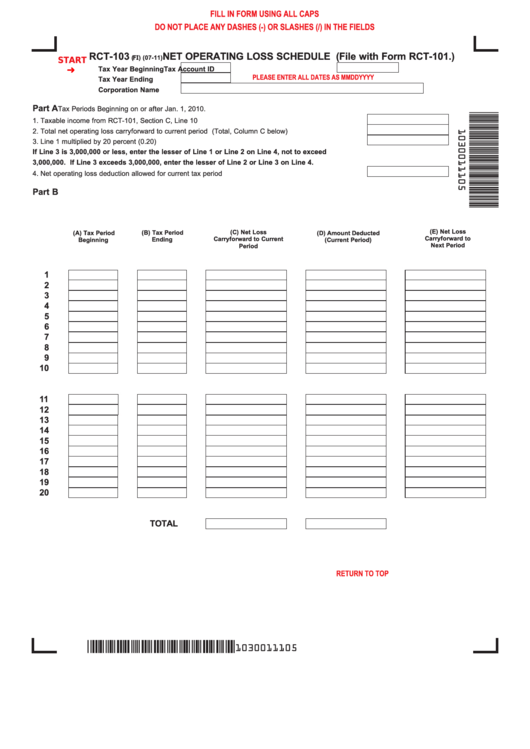

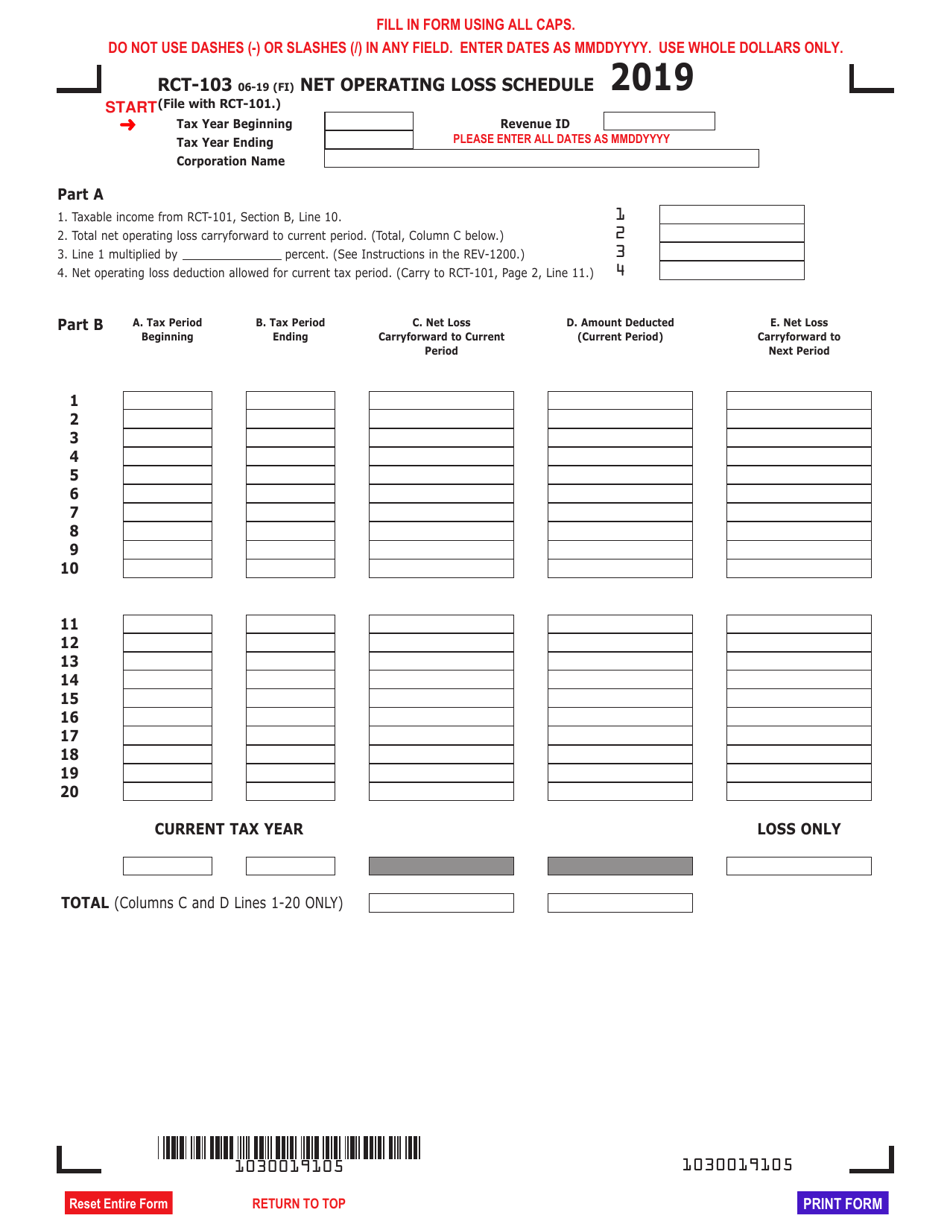

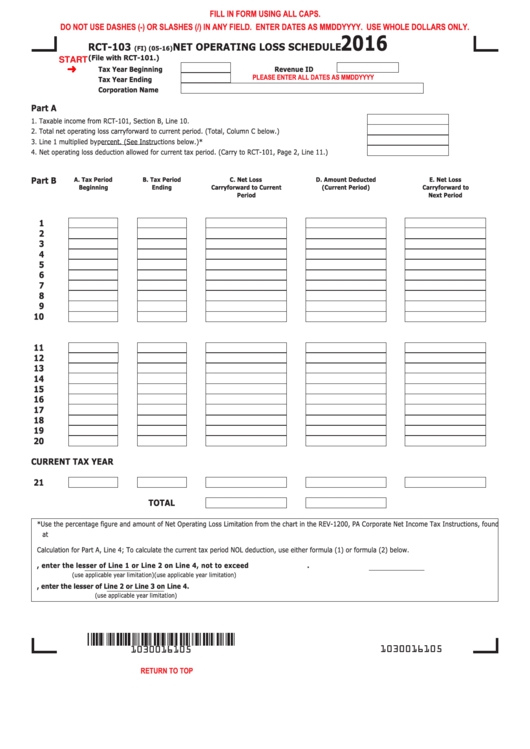

Pa Form Rct 103 Printable Net Operating Loss Schedule RCT 103 RCT 103 FI 06 15 NET OPERATING LOSS SCHEDULE File with Form RCT 101 Tax Year Beginning Revenue ID Tax Year Ending Corporation Name Part A Taxable income from RCT 101 Section C Line 10 Total net operating loss carryforward to current period Total Column C below Line 1 multiplied by

Part A Taxable income from RCT 101 Section C Line 10 Total net operating loss carryforward to current period Total Column C below Line 1 multiplied by percent See Instructions in the REV 1200 Net operating loss deduction allowed for current tax period Carry to RCT 101 Page 2 Line 11 Part B Tax Period Beginning Tax Period Ending To support the net operating loss carryforward allowed for the current tax period taxpayers are required to complete Part A of RCT 103 as follows LINE 1 Enter the taxable income from RCT 101 Section C Line 10 LINE 2 Enter total net operating loss carryforward to current period from RCT 103 Part B Column C LINE 3

Pa Form Rct 103 Printable

Pa Form Rct 103 Printable

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/acdaec94b2bcc9962432e06c9e/bg1.png

Indiana St 103 Pdf Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/458/100458191/large.png

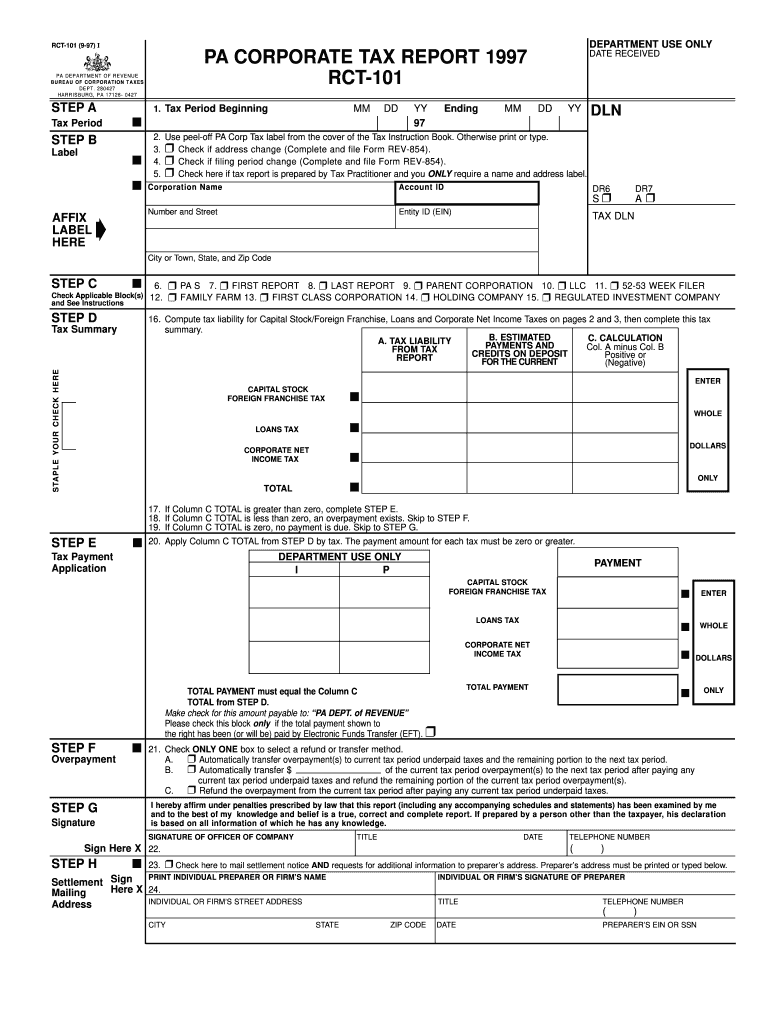

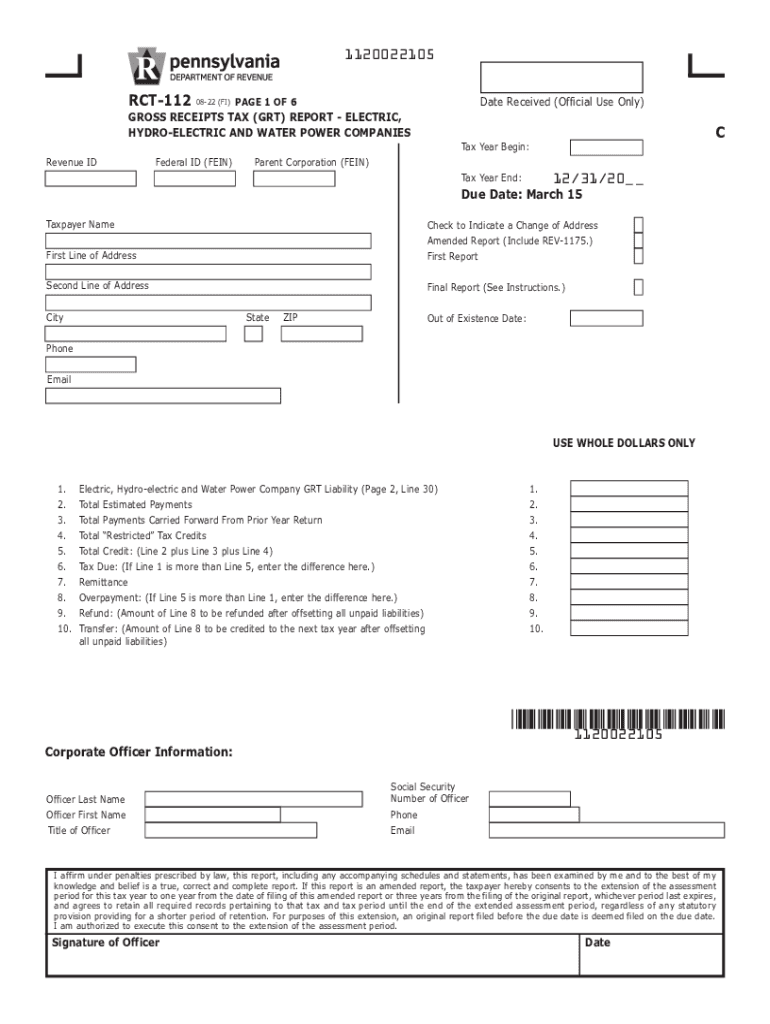

PA Corporate Tax Report ACT 101 Votes PA Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/13/853/13853280/large.png

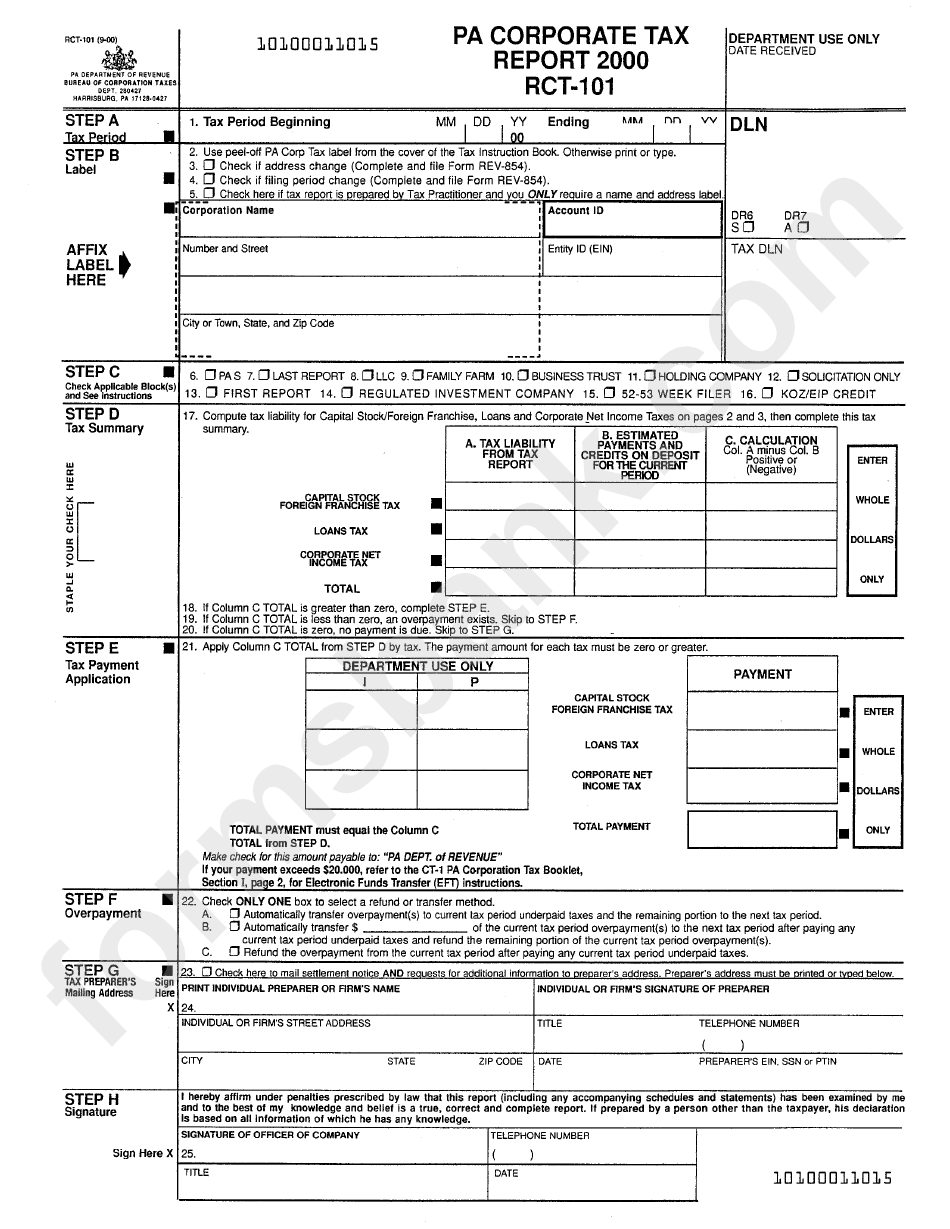

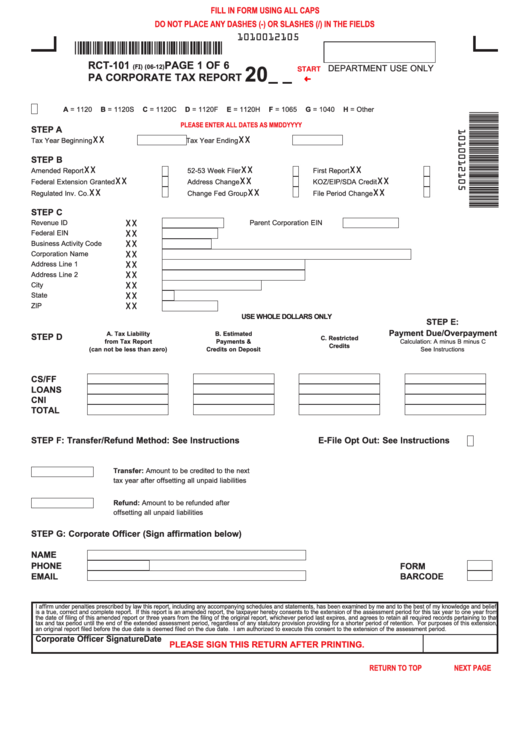

You can download or print current or past year PDFs of Form RCT 103 directly from TaxFormFinder You can print other Pennsylvania tax forms here eFile your Pennsylvania tax return now eFiling is easier faster and safer than filling out paper tax forms File your Pennsylvania and Federal tax returns online with TurboTax in minutes RCT 101 PA Corporate Tax Report Print Only Version RCT 101 Fillin PA Corporate Tax Report Net Operating Loss Schedule Print Only Version RCT 103 Fillin Net Operating Loss Schedule RCT 105 Three Factor Capital Stock Foreign Franchise Tax Manufacturing Exemption Schedule RCT 106 Insert Sheet File with form RCT 101

2023 PA Corporate Net Income Report RCT 101 DEPARTMENT USE ONLY RCT 101 12 23 FI pa CoRpoRaTe NeT INCoMe Tax RepoRT 2023 page 1 oF 4 STep a Tax Year Beginning STep B Economic Nexus Revenue ID Federal EIN NAICS code Corporation Name Address Line 1 Address Line 2 City State ZIP Province Country Code Foreign Postal Code Address Change File Now with TurboTax We last updated Pennsylvania Form RCT 103 in January 2024 from the Pennsylvania Department of Revenue This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Pennsylvania government

More picture related to Pa Form Rct 103 Printable

2014 Form PA DoR RCT 101 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/6/962/6962530/large.png

Form Rct 101 Pa Corporate Tax Report 2000 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/312/3125/312518/page_1_bg.png

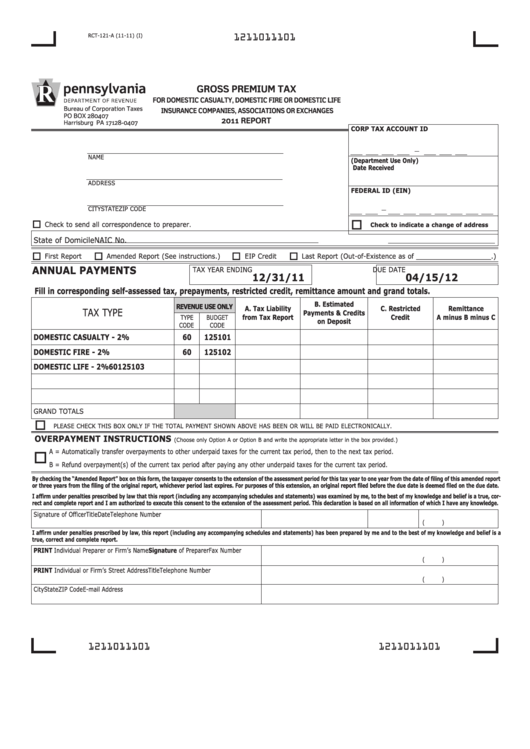

Form Rct 121 A Gross Premium Tax 2011 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/344/3440/344069/page_1_thumb_big.png

The instruction book for the PA Corporate Tax Report is the REV 1200 and can be found on the departments webpage under Corporation Tax Forms Then select the appropriate tax year below Was this answer helpful Answers others found helpful Where do I mail the RCT 101 PA Corporate Tax Report How do I update the beginning dates on Form RCT 103 Part B for state Pennsylvania in a 1120 return using worksheet view Article Type How To Last Modified 11 05 2022 To populate the beginning dates on Form RCT 103 Part B do the following Go to Federal Income Deductions worksheet Email Print Attachments Solution Id 000161104

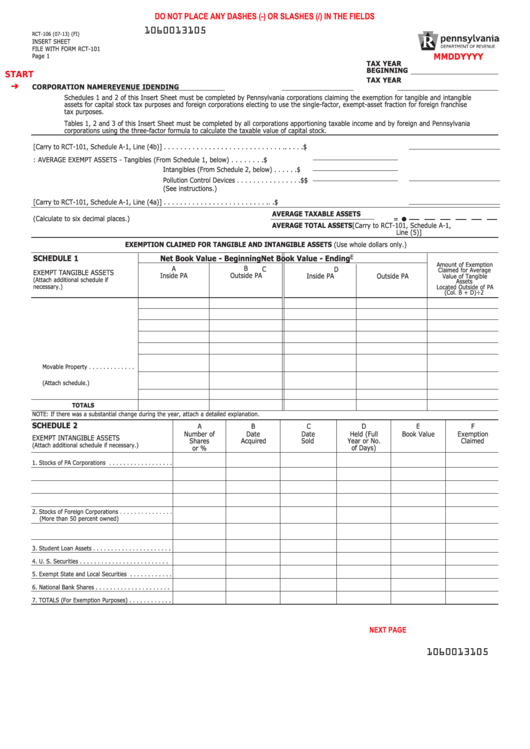

View download and print fillable Rct 103 Net Operating Loss Schedule file With Rct 101 in PDF format online Browse 2085 Pennsylvania Tax Forms And Templates collected for any of your needs Form RCT 103 Net Operating Loss Schedule Form RCT 105 Three Factor Capital Stock Foreign Franchise Tax Manufacturing Exemption Schedule Form RCT 106 Insert Sheet for Form RCT 101 Form CT V Fed State Payment Voucher Form PA 8453 C Pennsylvania Corporation Tax Declaration for a State E File Report Form PA 8879 C Pennsylvania E File

Fillable Form Rct 103 Net Operating Loss Schedule Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/354/3545/354562/page_1_thumb_big.png

Fillable Form Rct 106 Insert Sheet File With Form Rct 101 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/350/3508/350845/page_1_thumb_big.png

https://www.revenue.pa.gov/FormsandPublications/FormsforBusinesses/CorporationTax/Documents/rct-103_fillin.pdf

Net Operating Loss Schedule RCT 103 RCT 103 FI 06 15 NET OPERATING LOSS SCHEDULE File with Form RCT 101 Tax Year Beginning Revenue ID Tax Year Ending Corporation Name Part A Taxable income from RCT 101 Section C Line 10 Total net operating loss carryforward to current period Total Column C below Line 1 multiplied by

https://www.revenue.pa.gov/FormsandPublications/FormsforBusinesses/CorporationTax/Documents/2023/2023_rct-103.pdf

Part A Taxable income from RCT 101 Section C Line 10 Total net operating loss carryforward to current period Total Column C below Line 1 multiplied by percent See Instructions in the REV 1200 Net operating loss deduction allowed for current tax period Carry to RCT 101 Page 2 Line 11 Part B Tax Period Beginning Tax Period Ending

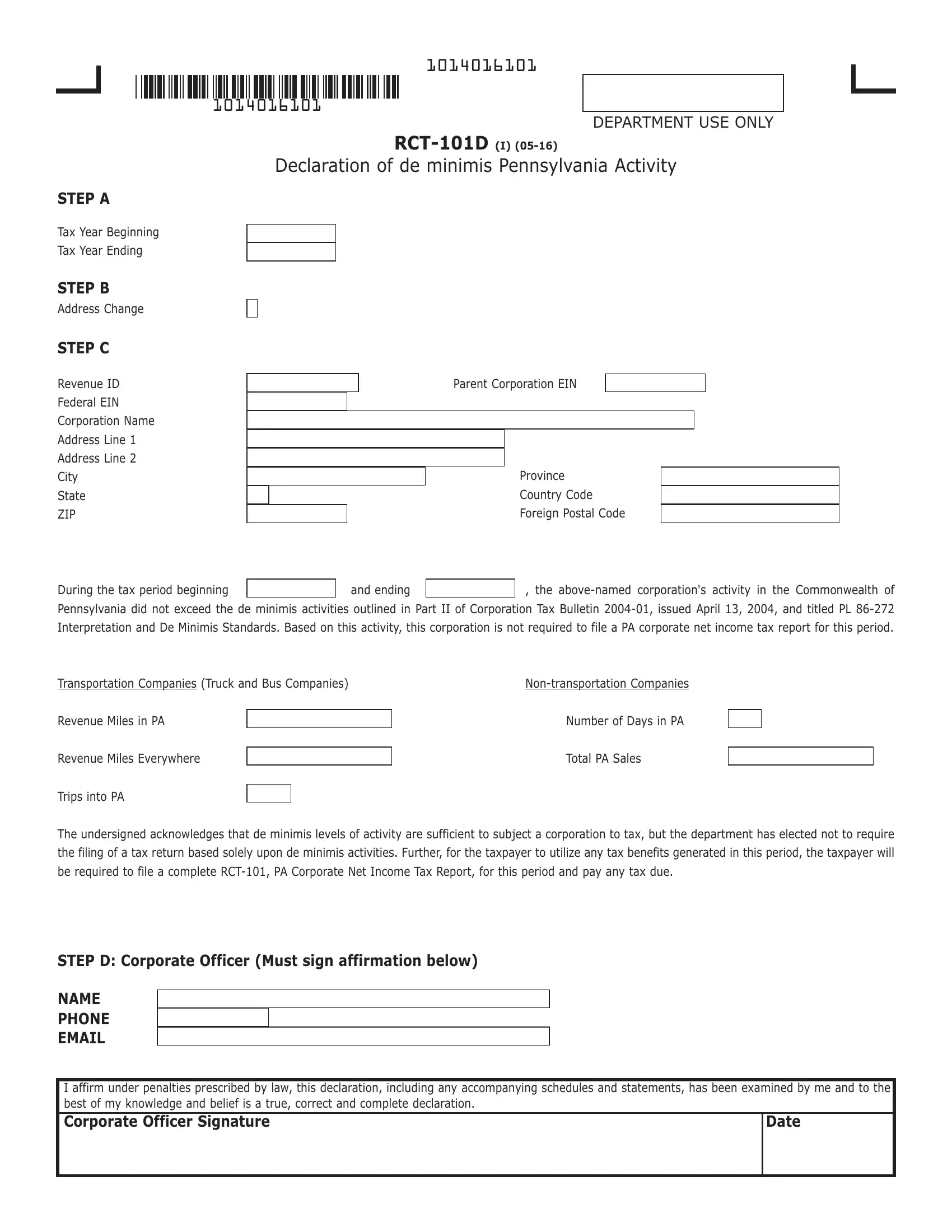

Form Rct 101D Fill Out Printable PDF Forms Online

Fillable Form Rct 103 Net Operating Loss Schedule Printable Pdf Download

Fillable Form Rct 101 Pa Corporate Tax Report Printable Pdf Download

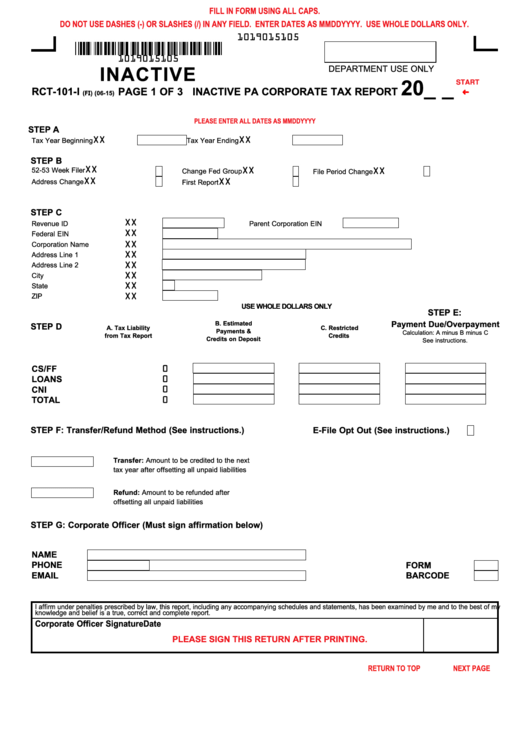

Fillable Form Rct 101 I Inactive Pa Corporate Tax Report Printable Pdf Download

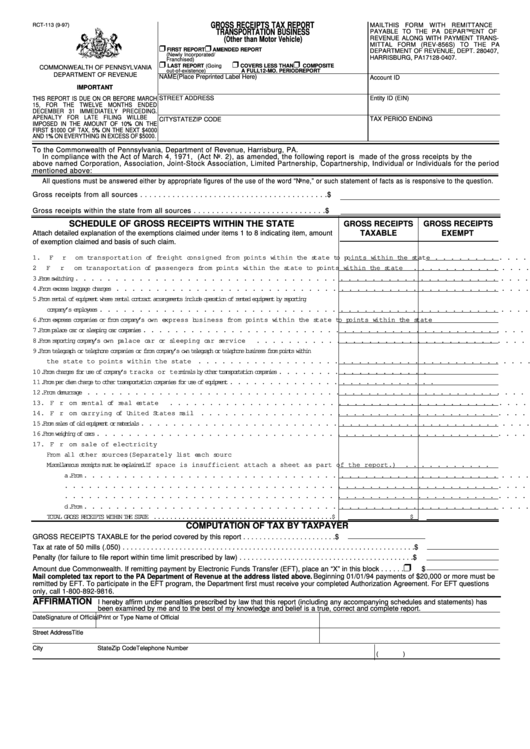

Fillable Form Rct 113 Gross Receipts Tax Report Transportation Business Commonwealth Of

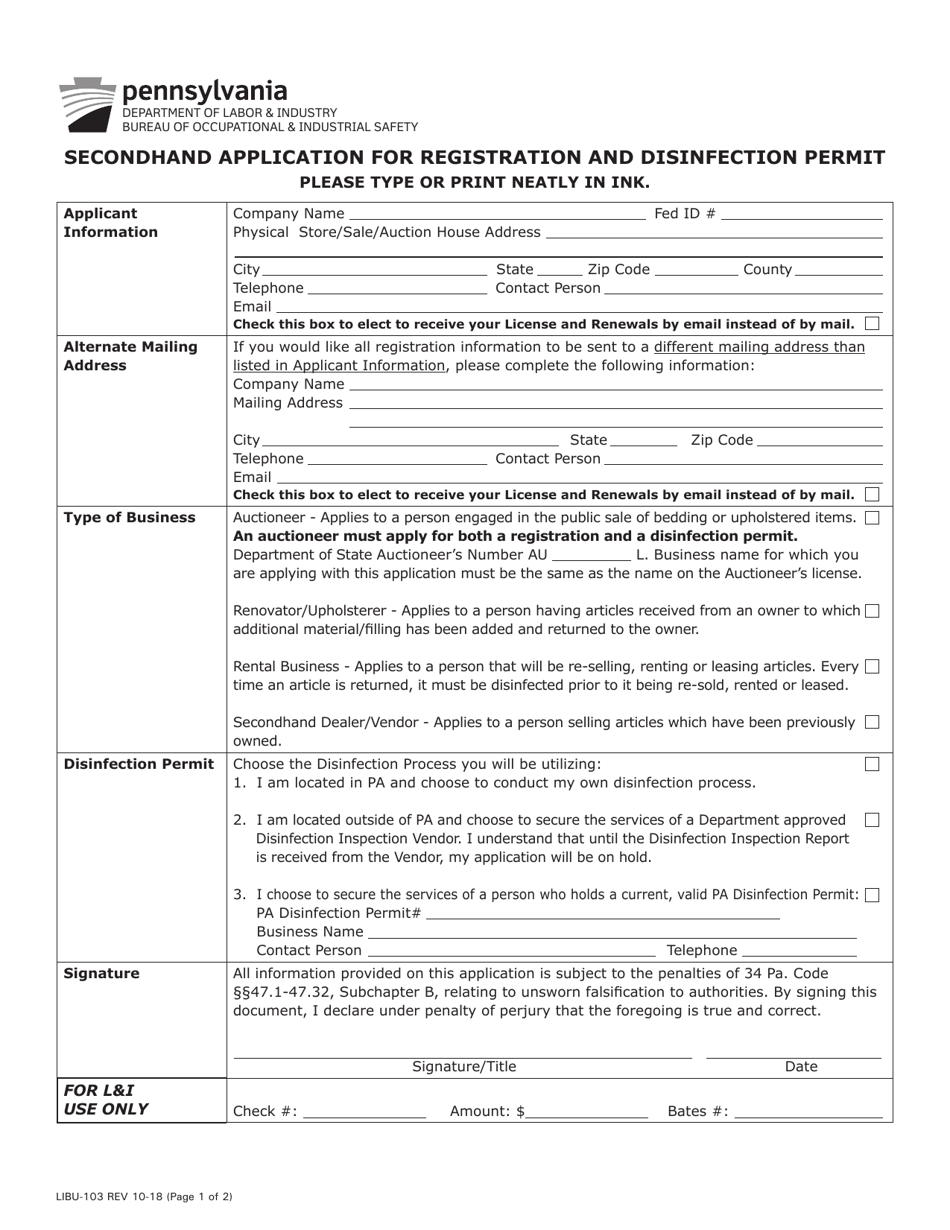

Form LIBU 103 Fill Out Sign Online And Download Fillable PDF Pennsylvania Templateroller

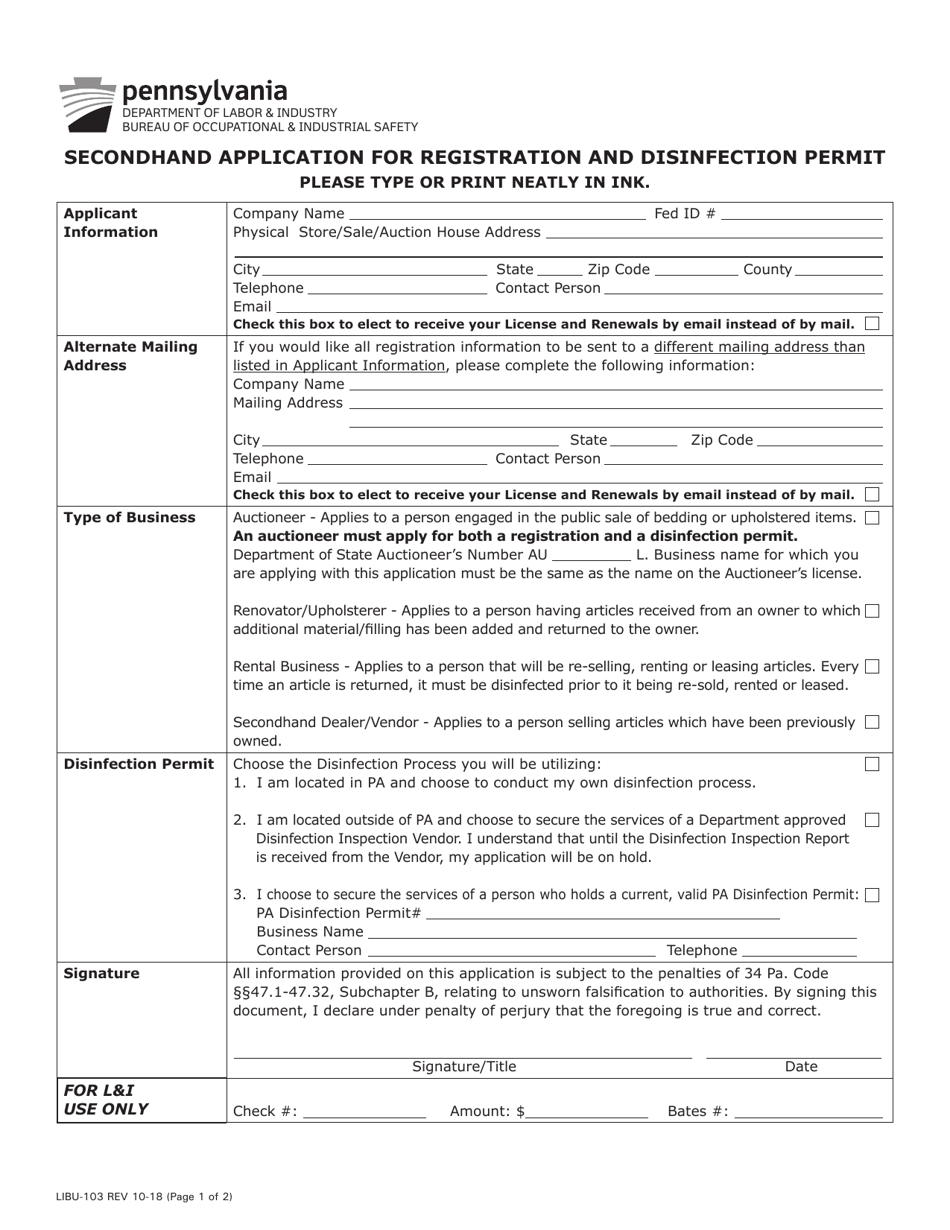

Form LIBU 103 Fill Out Sign Online And Download Fillable PDF Pennsylvania Templateroller

Schedule RCT 103 Download Fillable PDF Or Fill Online Net Operating Loss Schedule 2019

Fillable Form Rct 103 Net Operating Loss Schedule 2016 Printable Pdf Download

Fillable Online 2022 Form PA DoR RCT 101 Fill Online Printable Fillable Fax Email Print

Pa Form Rct 103 Printable - You can print other Pennsylvania tax forms here eFile your Pennsylvania tax return now eFiling is easier faster and safer than filling out paper tax forms File your Pennsylvania and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax