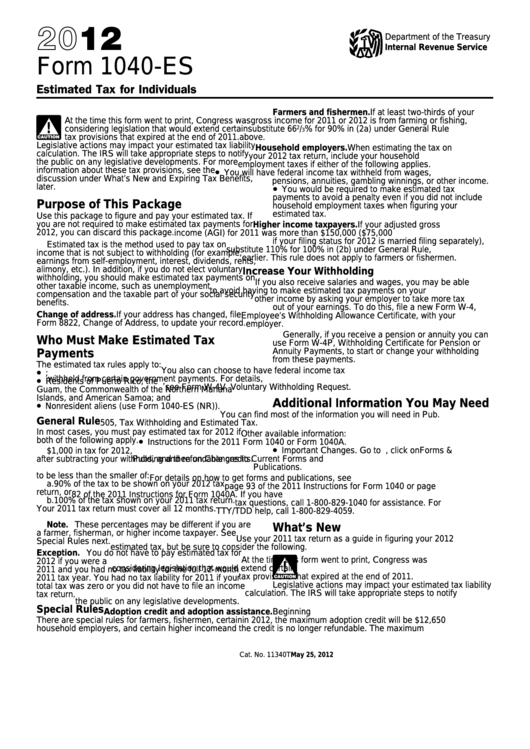

Printable 1040 Estimated Tax Form OVERVIEW The IRS provides Form 1040 ES for you to calculate and pay estimated taxes for the current year While the 1040 relates to the previous year the estimated tax form calculates taxes for the current year You use Form 1040 ES to pay income tax self employment tax and any other tax you may be liable for

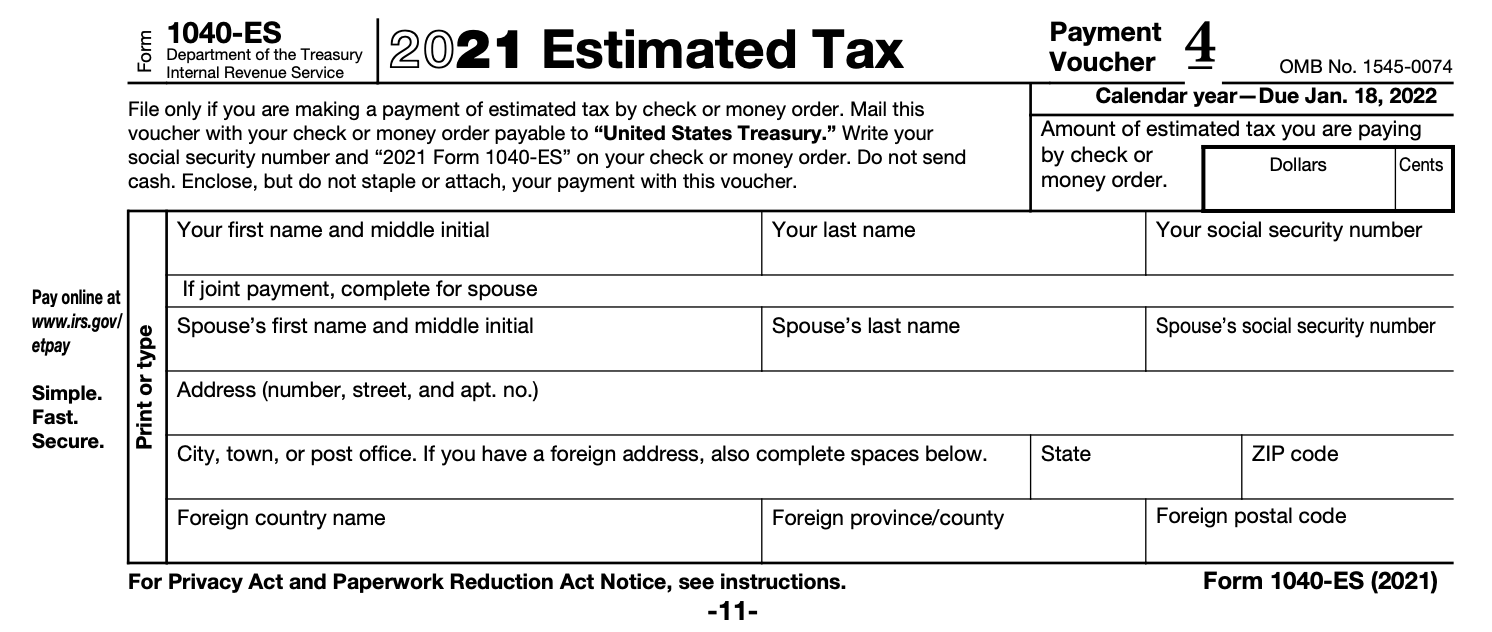

Jan 15 2024 You can make estimated tax payments using any of these methods Apply your 2023 refund to your 2024 estimated tax Mail a check or money order with Form 1040 ES Estimated Tax for Individuals Use the Electronic Federal Tax Payment System EFTPS to submit payments electronically Visit www eftps gov or call 1 800 555 4477 The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms Accessible

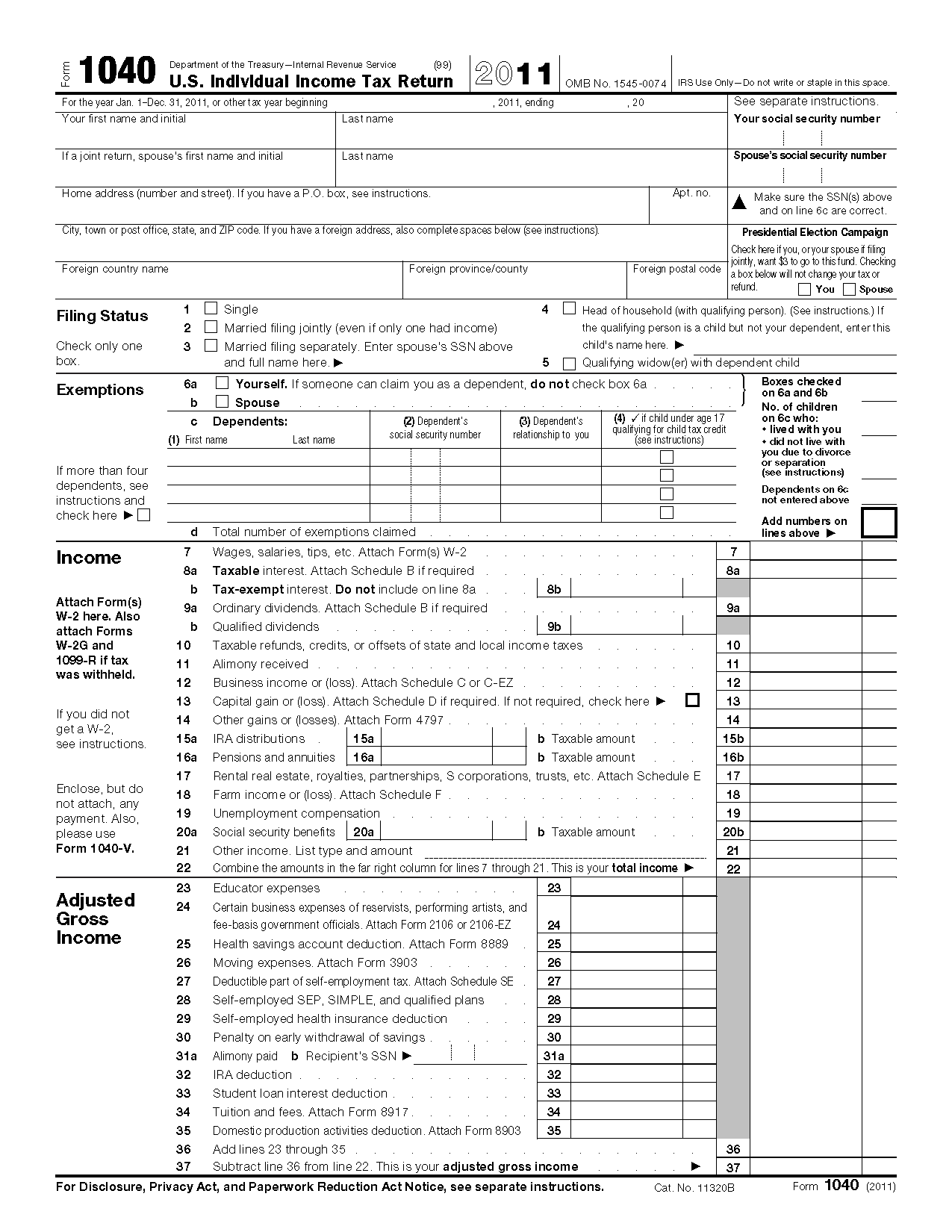

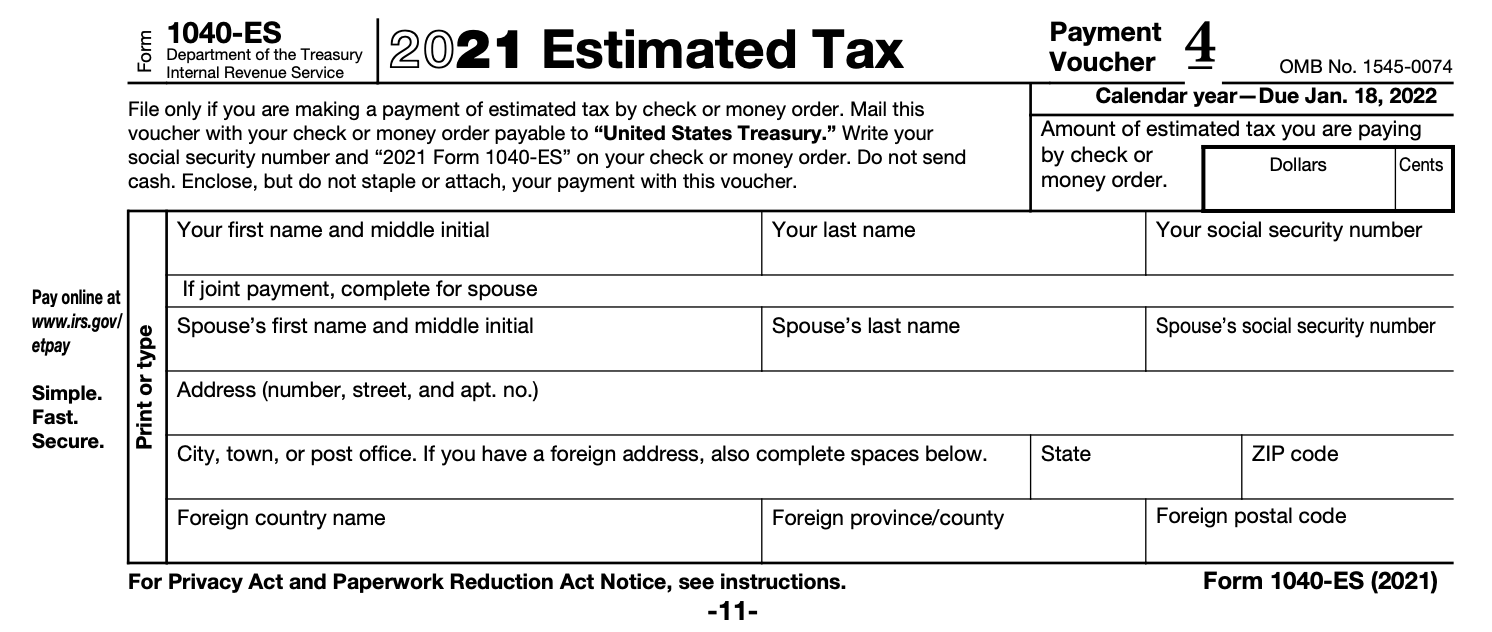

Printable 1040 Estimated Tax Form

Printable 1040 Estimated Tax Form

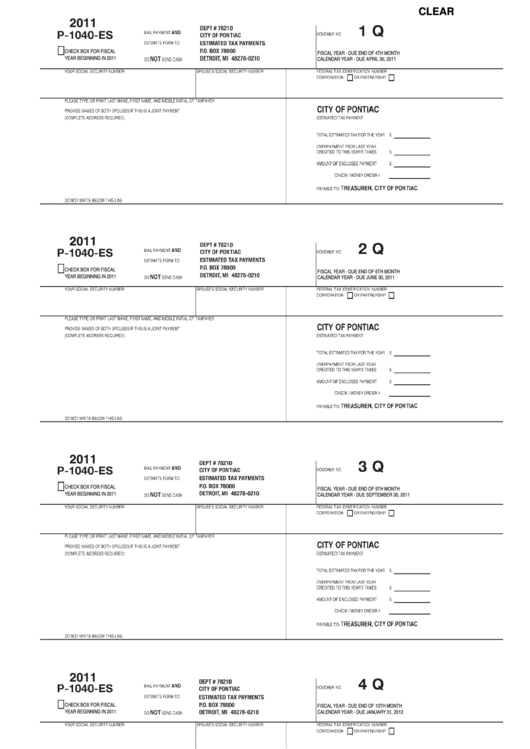

https://1044form.com/wp-content/uploads/2020/08/fillable-form-p-1040-es-estimated-tax-for-individuals.png

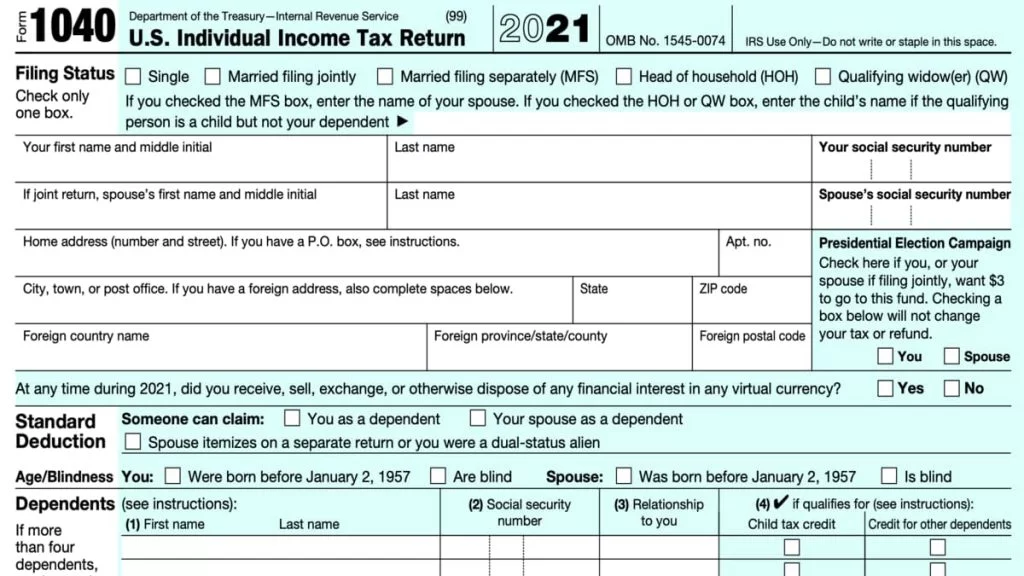

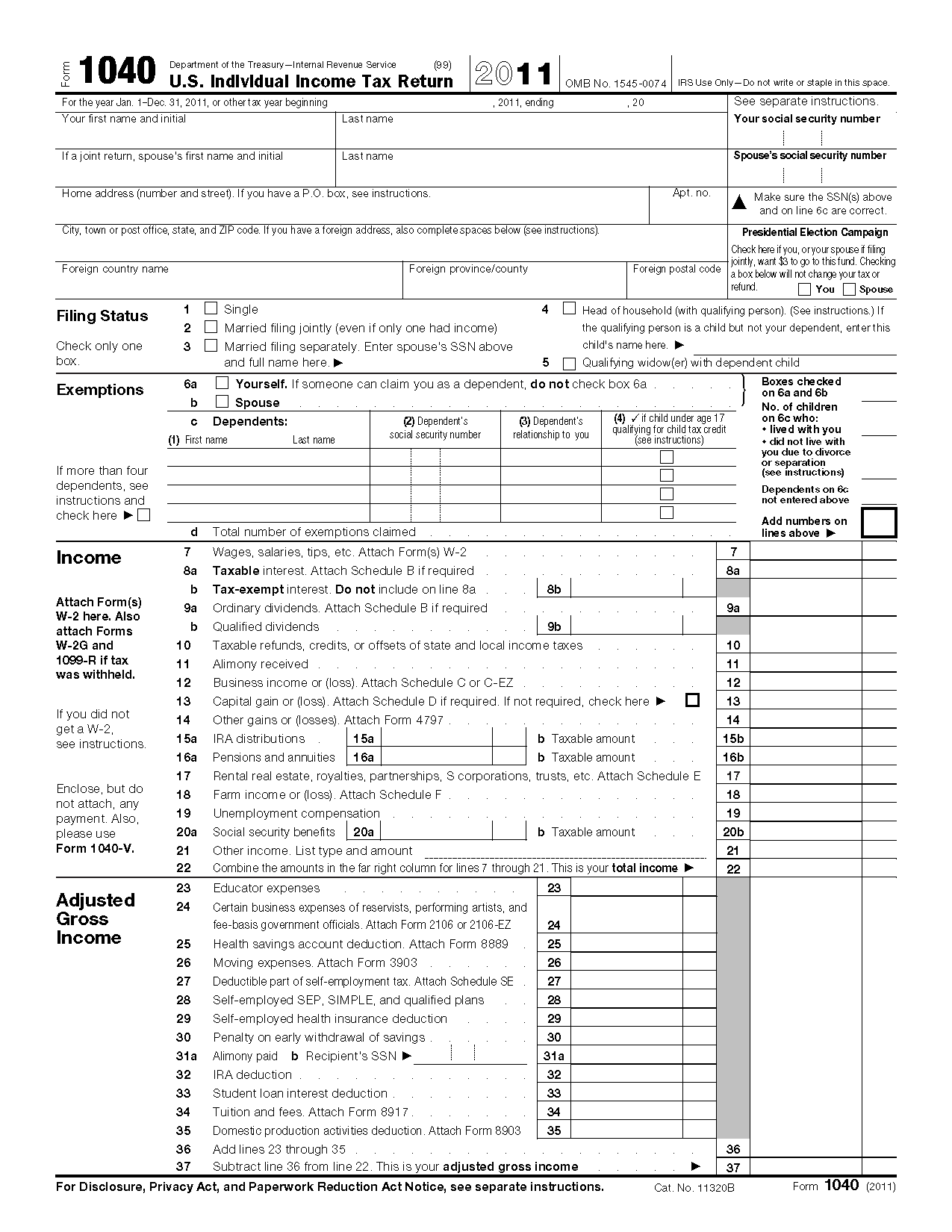

Form 1040 U S Individual Income Tax Return 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/form-1040-u-s-individual-income-tax-return.png

Form 1040 ES Estimated Tax For Individuals Internal Revenue Service Internal Revenue

https://i.pinimg.com/736x/1f/11/10/1f1110553810fcded1158572460f25a0.jpg

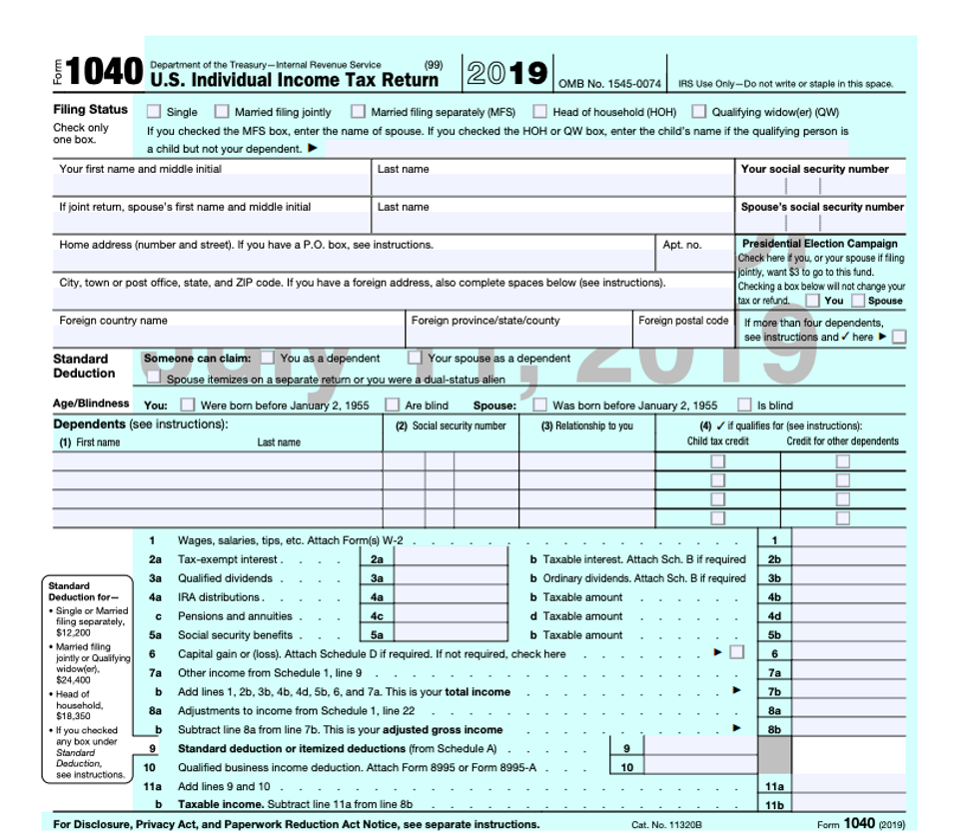

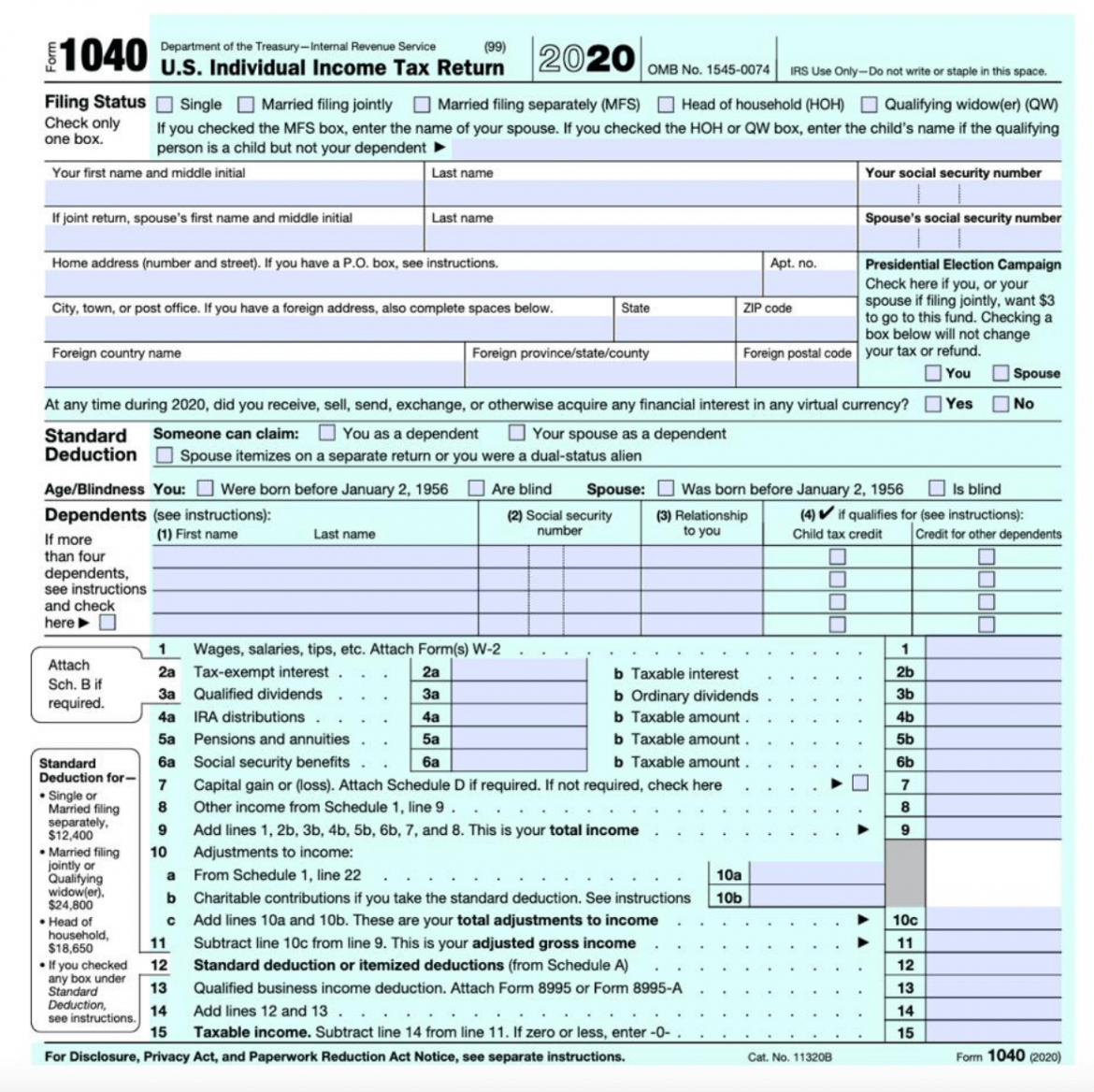

The 2024 Form 1040 ES instructions discuss when a penalty is applied and how to amend estimated tax payments In practical terms if you are late paying your estimated taxes catch up as soon as you can If you missed the first second third or fourth payment by two days 20 days or more don t skip it OMB 1545 0074 Form 1040 U S Individual Income Tax Return 2020 Filing Status Check only one box 99 Department of the Treasury Internal Revenue Service Single Married filing jointly OMB No 1545 0074 Married filing separately MFS IRS Use Only Do not write or staple in this space Head of household HOH Qualifying widow er QW If

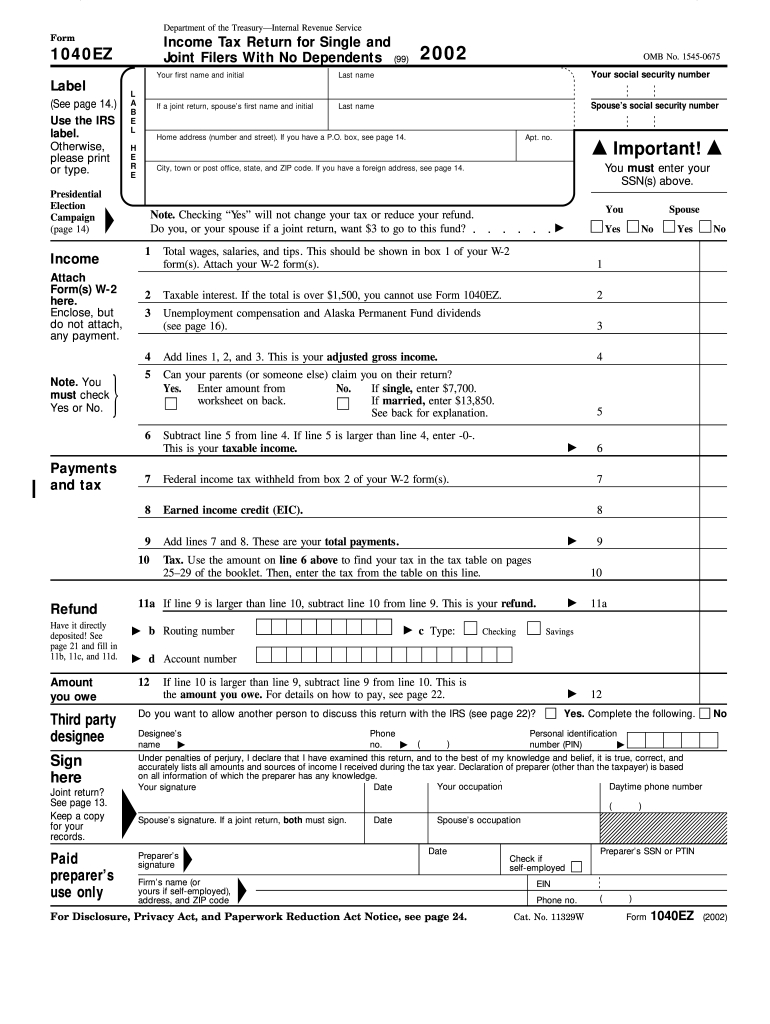

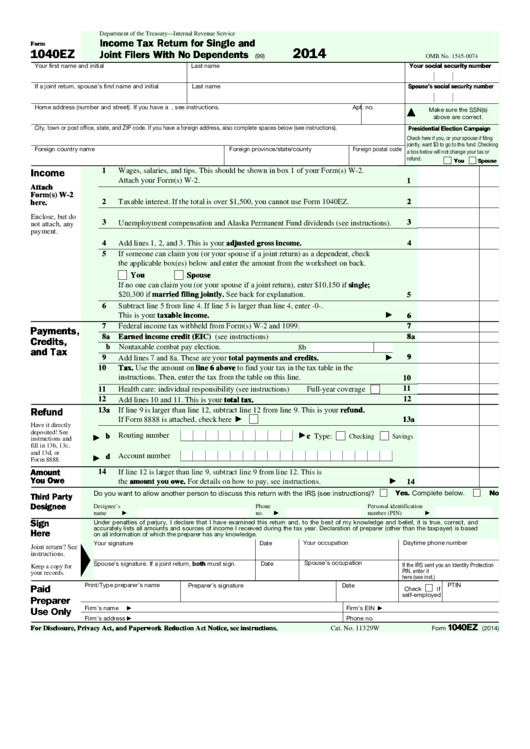

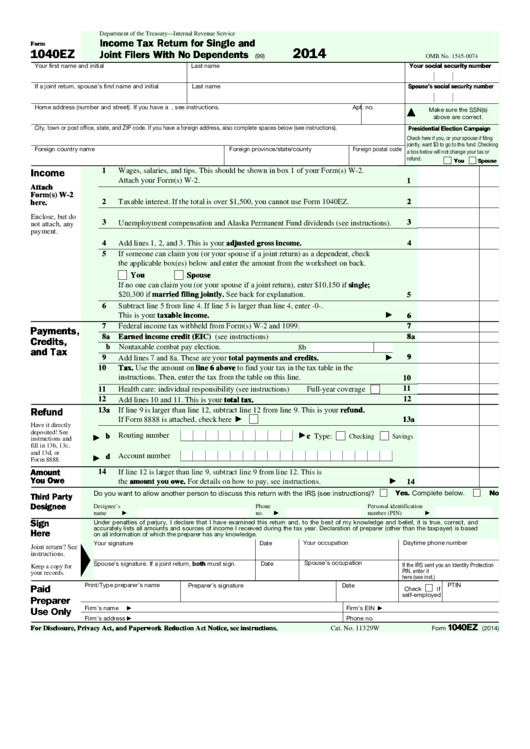

The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form Simply select your tax filing status and enter a few other details to estimate your total taxes Your outstanding tax bill is estimated at 4 121 00 This puts you in the 12 tax bracket Definitions Federal Form 1040 SR is a large print version of Form 1040 that is designed for taxpayers who fill out their tax return by hand rather than online A standard deduction table is printed right on the form for easy reference You need to be 65 or older to use Form 1040 SR

More picture related to Printable 1040 Estimated Tax Form

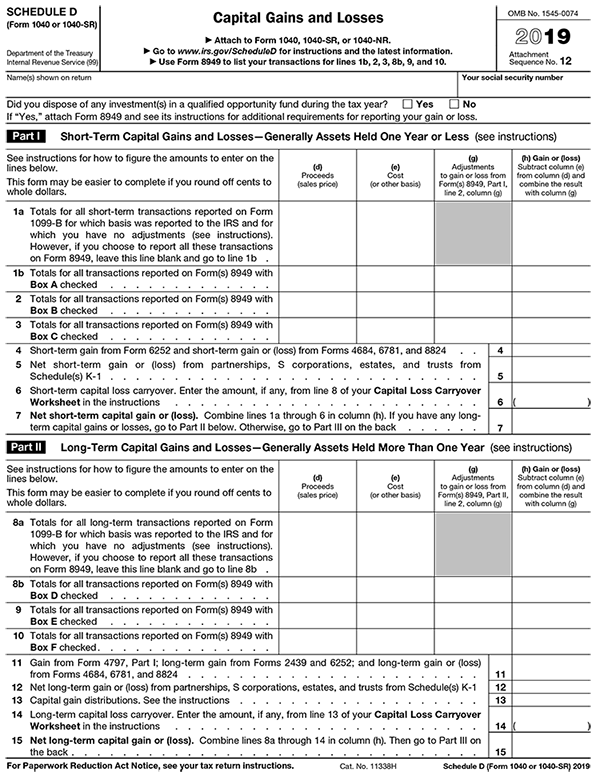

2019 IRS Tax Form 1040 Schedule D Capital Gains And 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/2019-irs-tax-form-1040-schedule-d-capital-gains-and-5.png

1040 Tax Form Instructions 2022 2023 1040 Forms

https://www.taxuni.com/wp-content/uploads/2022/01/1040-form-2022-instructionst-o-file--1024x576.jpg

Form 1040 Ez 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/0/44/44600/large.png

File Now with TurboTax We last updated Federal Form 1040 ES in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government 01 01 2023 2022 Download Download 01 01 2022 Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment a partnership or S corporation mailing a voluntary estimated payment on behalf of its nonresident individual partners shareholders participating in the filing of a composite return

Income Tax Film and Digital Media Tax Credit GIT DEP Income Tax Depreciation Adjustment Worksheet NJ 1040 O E File Opt Out Request Form NJ 2440 Statement in Support of Exclusion for Amounts Received Under Accident and Health Insurance Plan For Personal Injuries or Sickness NJ 2450 You must file a Declaration of Estimated Tax if you expect to owe an Income Tax liability of 100 or more with the filing of your SC1040 Individual Income Tax Return Use the Estimated Tax Worksheet to compute your Estimated Tax If you are a resident of South Carolina use your 2021 SC1040 as a basis for figuring your Estimated Tax

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/4dfj2UqJI2eWJhtTsXLqpU/57cfe16bee91066142087cbc8743317f/Voucher_4.png

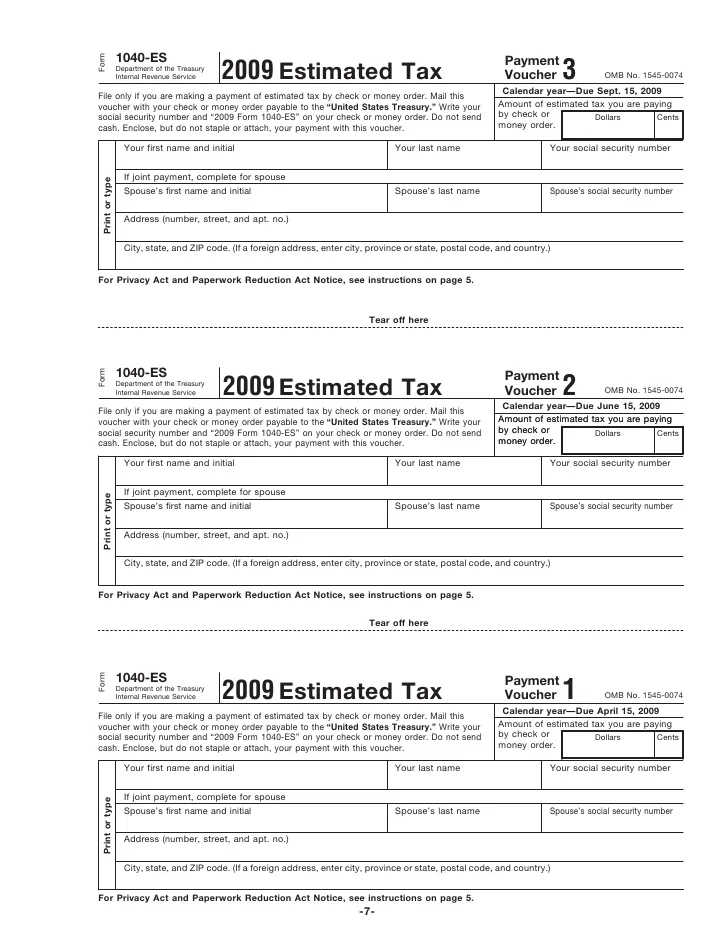

Form 1040ES Estimated Tax For Individuals

https://image.slidesharecdn.com/1273185/95/form-1040esestimated-tax-for-individuals-8-728.jpg?cb=1239369230

https://turbotax.intuit.com/tax-tips/irs-tax-forms/what-is-irs-form-1040-es-estimated-tax-for-individuals/L384qHYFm

OVERVIEW The IRS provides Form 1040 ES for you to calculate and pay estimated taxes for the current year While the 1040 relates to the previous year the estimated tax form calculates taxes for the current year You use Form 1040 ES to pay income tax self employment tax and any other tax you may be liable for

https://www.hrblock.com/tax-center/irs/forms/estimated-tax-1040es/

Jan 15 2024 You can make estimated tax payments using any of these methods Apply your 2023 refund to your 2024 estimated tax Mail a check or money order with Form 1040 ES Estimated Tax for Individuals Use the Electronic Federal Tax Payment System EFTPS to submit payments electronically Visit www eftps gov or call 1 800 555 4477

Fillable Form 1040 Es Estimated Tax For Individuals 1040 Form Printable

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting

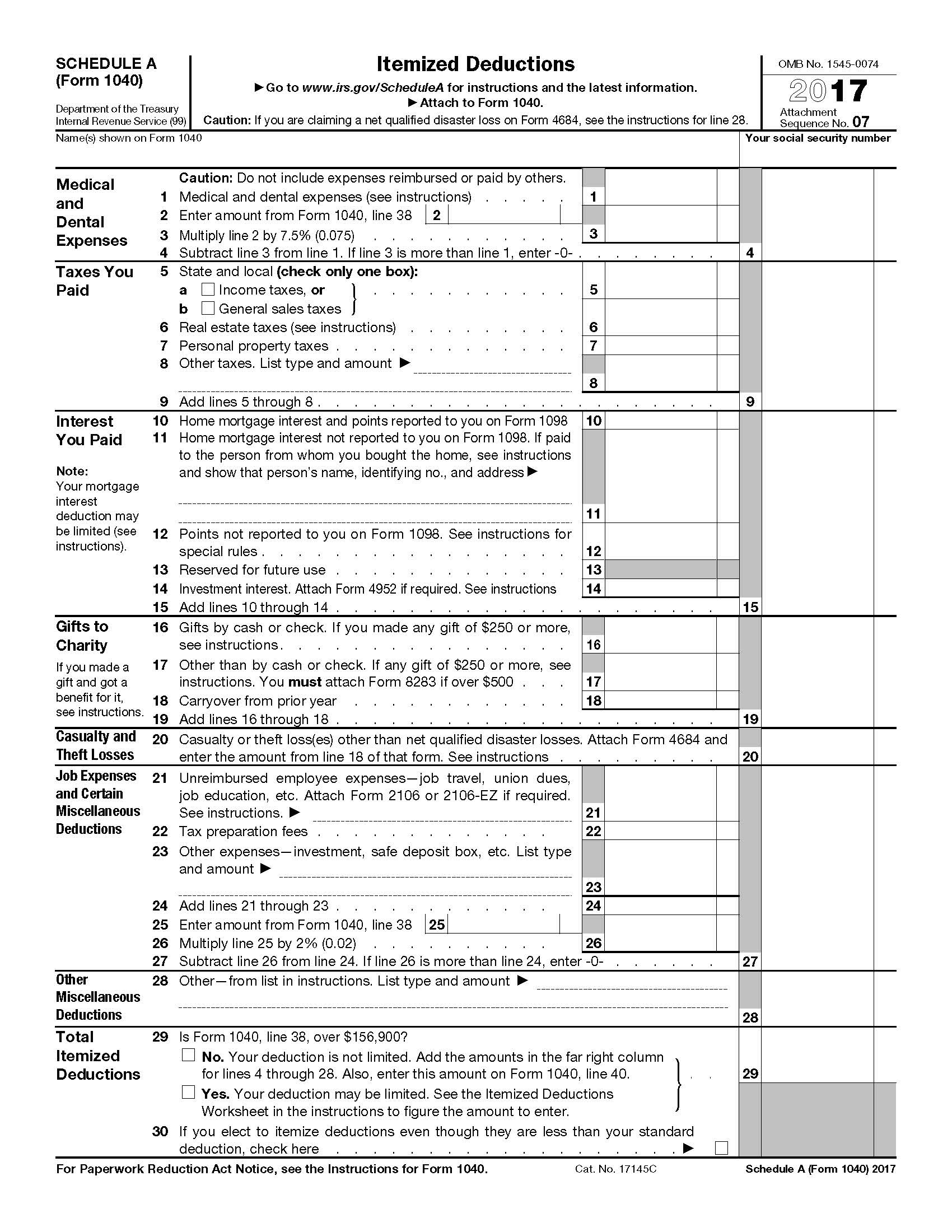

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions 1040 Form Printable

2020 Form OH IT 1040ES Fill Online Printable Fillable Blank PdfFiller

2019 IRS Tax Forms 1040 Printable 2021 Tax Forms 1040 Printable

Free Printable Tax Forms 1040ez Printable Templates

Free Printable Tax Forms 1040ez Printable Templates

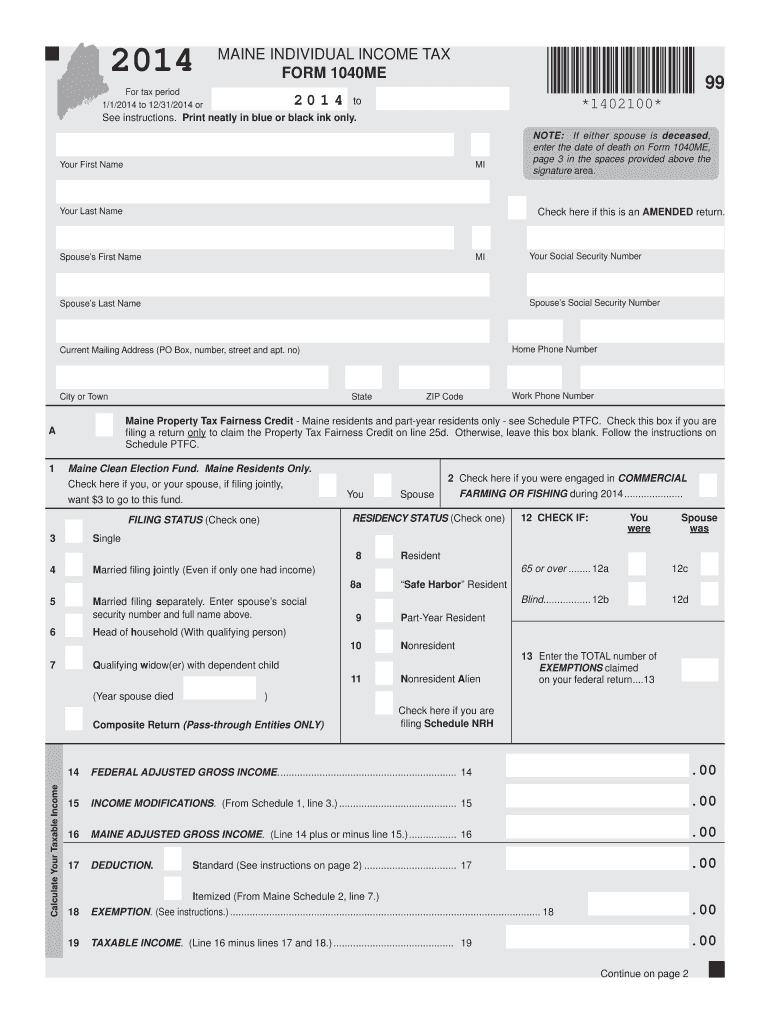

MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine Gov Fill Out And Sign Printable PDF

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

2015 Form 1040ES Estimated Tax For Individual Free Download Worksheet Template Tips And Reviews

Printable 1040 Estimated Tax Form - Divide Line 1 by 4 Amount of estimated payments made with 2024 Forms IL 1040 ES including any prior year overpayment applied to tax year 2024 Multiply Line 2 by the number of previously due estimated payments Subtract Line 3 from Line 4 This amount may be negative