Printable 1099 Form For Conrtactors Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee Report the employee s income Social Security and Medicare taxes withheld and other information

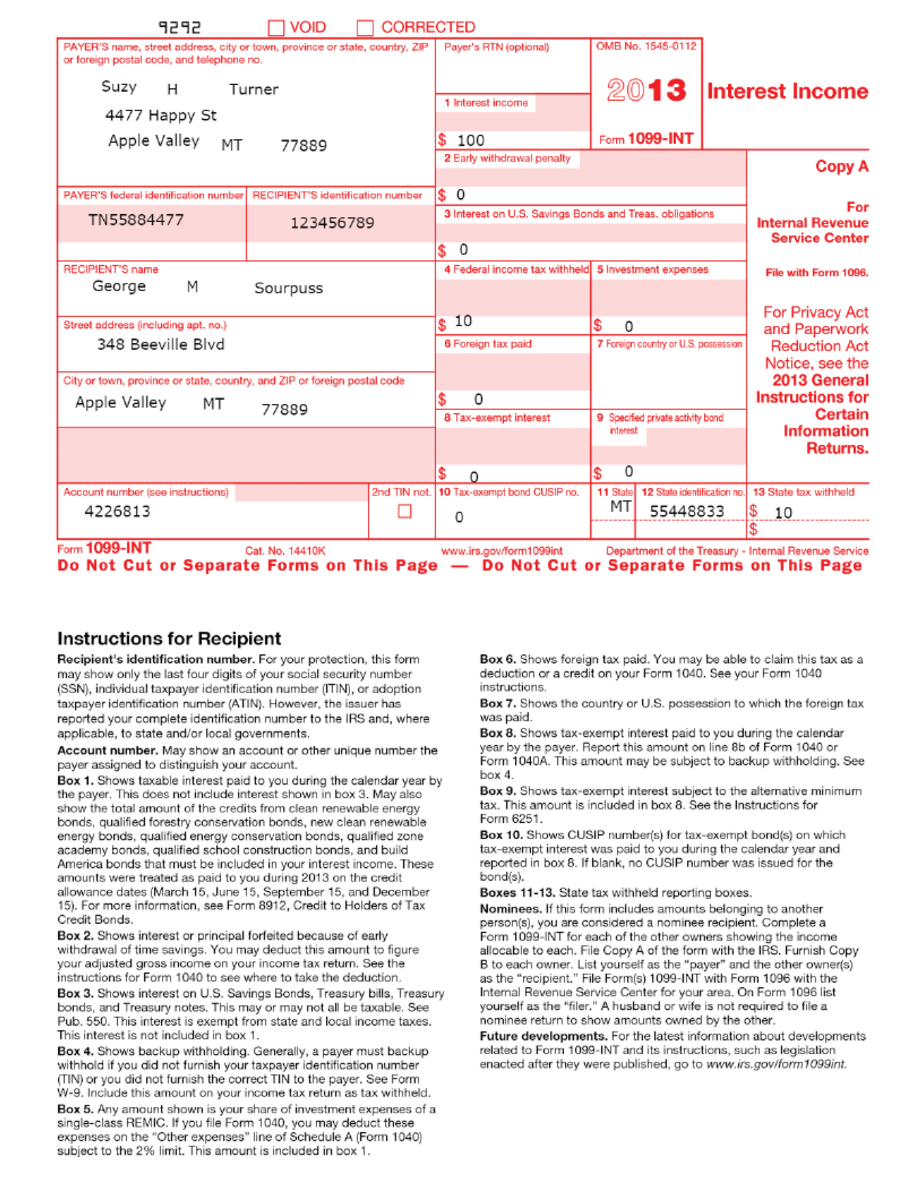

IRS 1099 Form IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification This form can be used to request the correct name and Taxpayer Identification Number or TIN of the payee The W 9 should be kept in your files for four years for future

Printable 1099 Form For Conrtactors

Printable 1099 Form For Conrtactors

https://www.pdffiller.com/preview/421/116/421116584/large.png

1099 Printable Forms

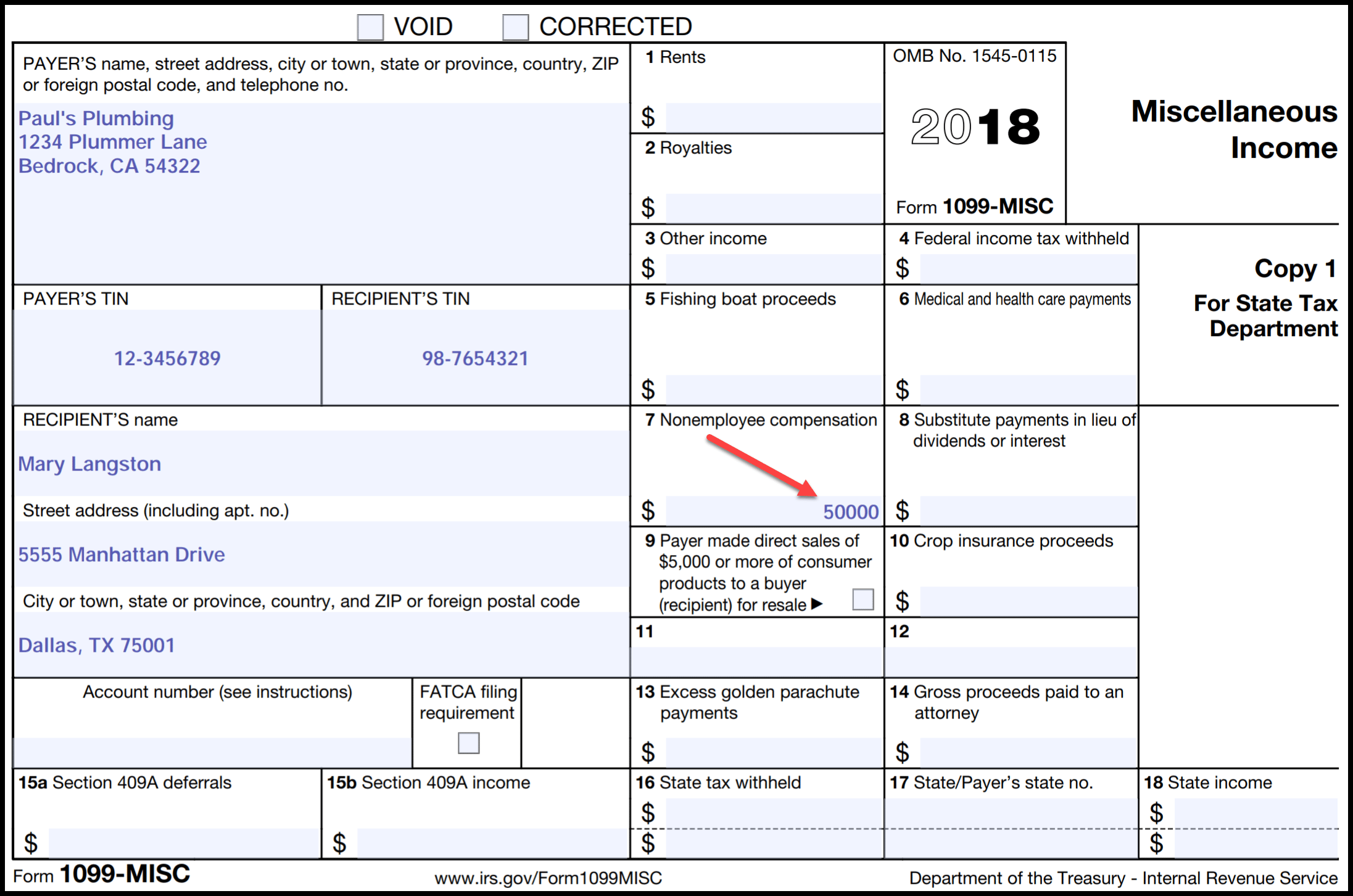

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

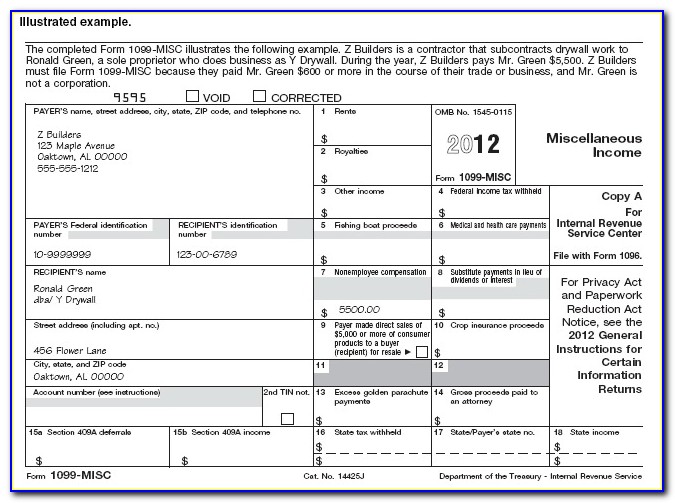

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

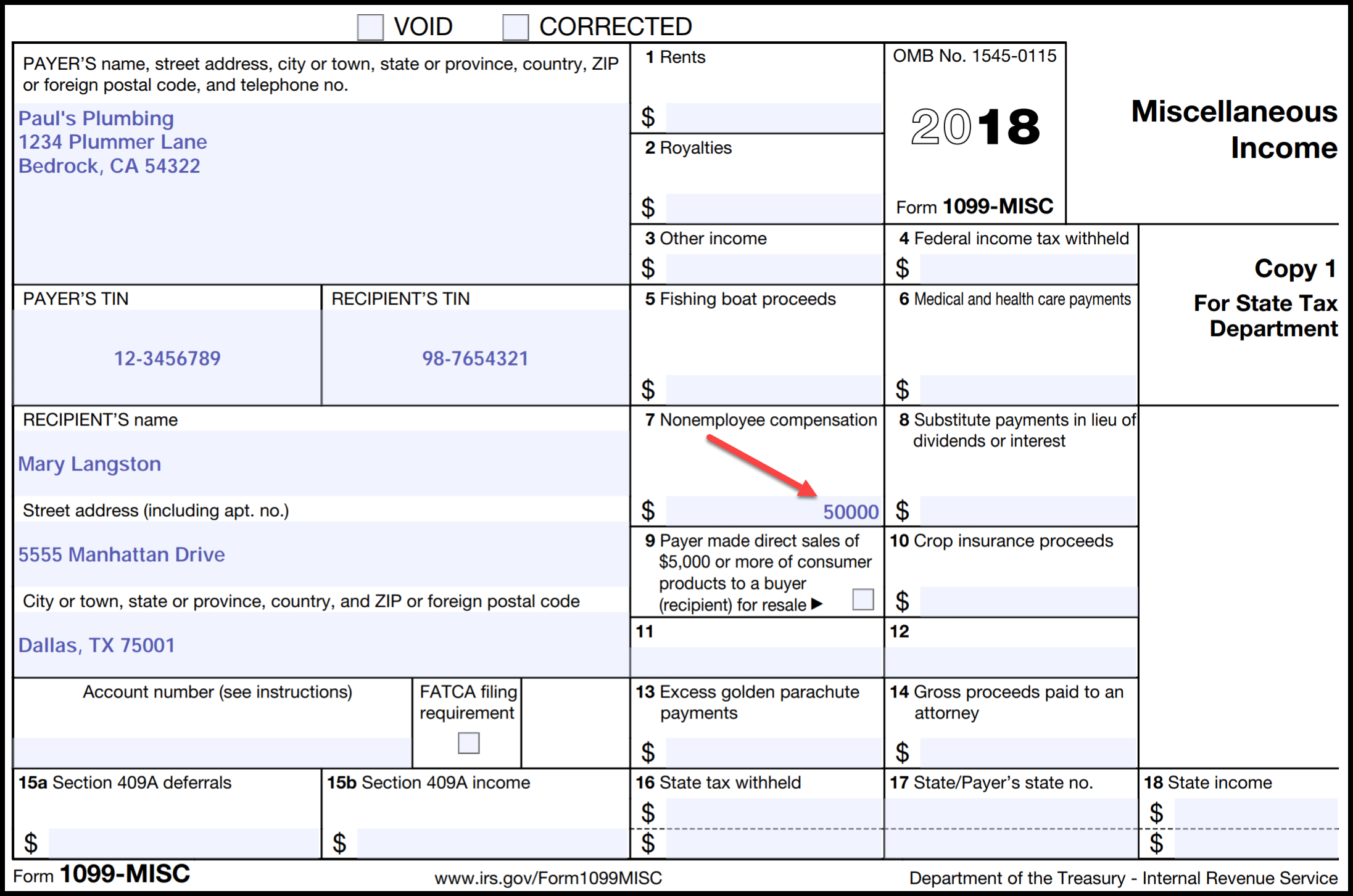

From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer Once that s done add up all payments made in a financial year and fill in the amount in Boxes as applicable 5 Print And Mail The 1099 Form Now that you have entered all relevant information for your contractor attach a Copy B version of their 1099 to Form 1096 the summary report and mail it to them

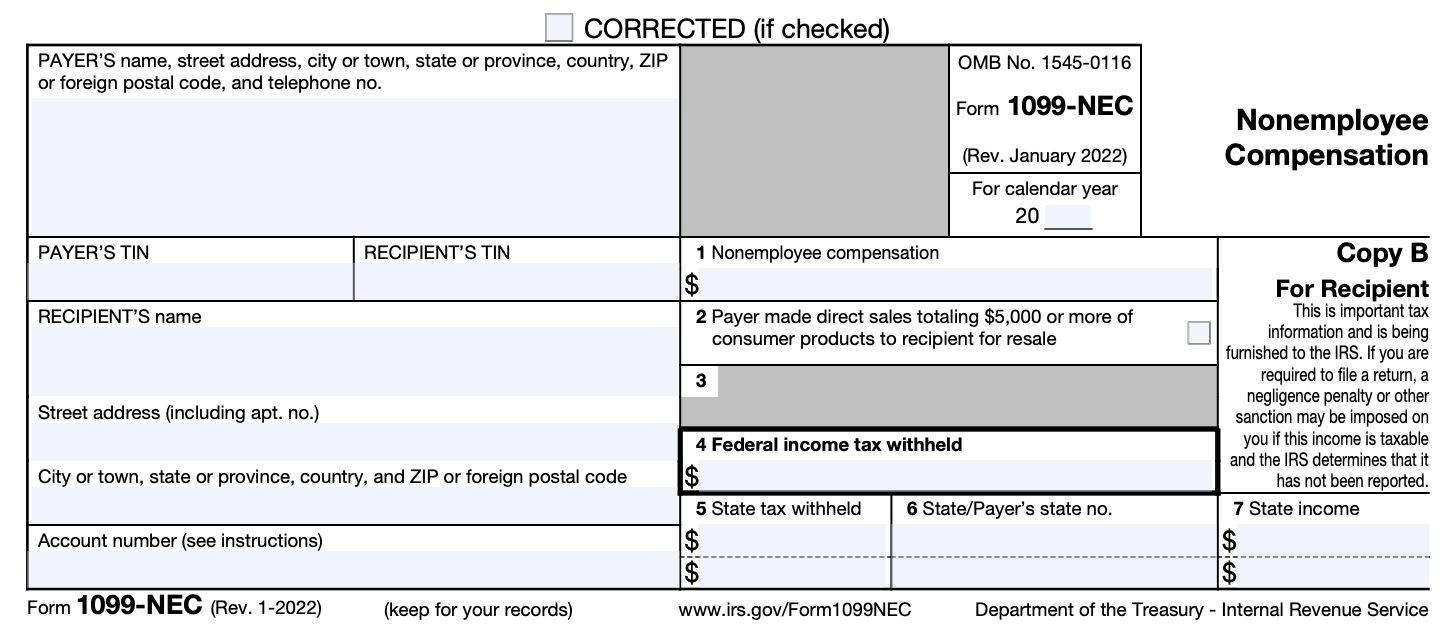

Step 4 Provide Form 1099 to Independent Contractors File With IRS Provide one copy of Form 1099 NEC to each contractor or vendor and file all Forms 1099 NEC with the IRS You will also have a copy you can send to your state tax department if required Send out these 1099 forms after you review them for accuracy and completeness The 1099 form is an Internal Revenue Service IRS tax form that is used to report income that is not subject to withholding Form 1099 NEC must be filed for independent contractors or freelancers paid 600 or more The IRS requires your organization to prepare and return this document to a non employee independent contractor

More picture related to Printable 1099 Form For Conrtactors

Form 1099 For Independent Contractors A Guide For Recipients

https://mycountsolutions.com/wp-content/uploads/2019/07/Form-1099-for-Independent-Contractors-2048x1365.jpg

How To Fill Out And Print 1099 NEC Forms

https://www.halfpricesoft.com/1099-nec-software/images/1099-nec-3-per-page-big.jpg

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

https://www.investopedia.com/thmb/4vQCJv3iU7vUQ9wYIpztsxRnjrM=/837x587/filters:no_upscale():max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg

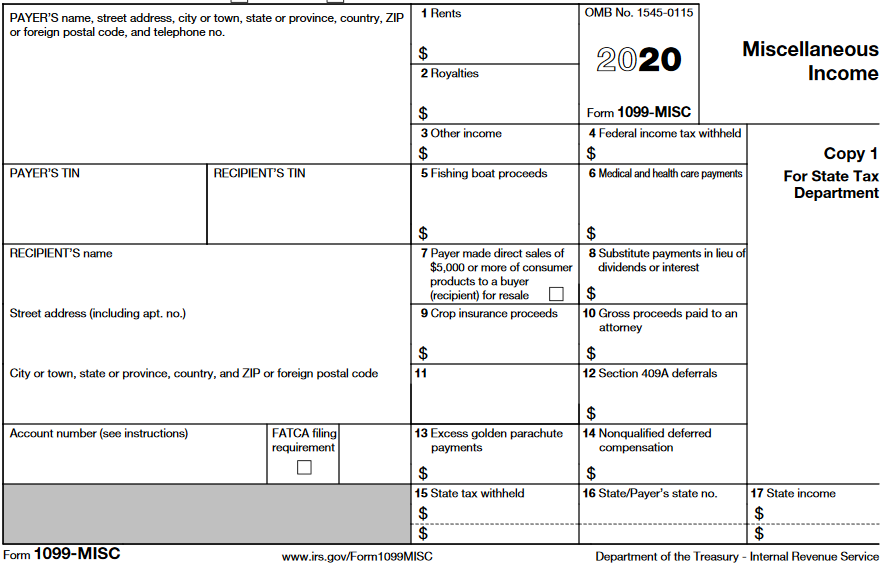

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted Complete the Form Accurately Enter Contractor Details Input the contractor s name address TIN or SSN and other relevant details accurately to avoid discrepancies Report Compensation Enter the total amount paid to the contractor during the tax year in the designated box for non employee compensation or other relevant categories on the form

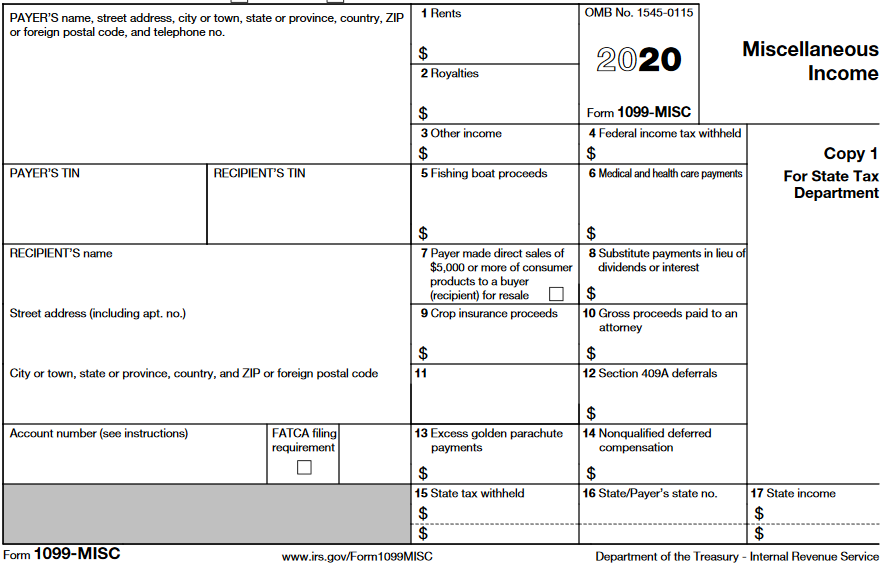

IRS 1099 NEC Form 2021 2024 A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Microsoft Word 1099 Tax Form Printable Template Printable Templates

https://www.troutcpa.com/hubfs/1099.png

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors

Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee Report the employee s income Social Security and Medicare taxes withheld and other information

https://eforms.com/irs/form-1099/

IRS 1099 Form IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Irs 1099 Forms For Independent Contractors Form Resume Examples

1099 Form Template Create A Free 1099 Form Form

1099 Contract Template HQ Printable Documents

1099 Form Independent Contractor Pdf 14 Printable 1099 Form Independent Contractor Templates

1099 Form Independent Contractor Pdf 14 Printable 1099 Form Independent Contractor Templates

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

1099 S Fillable Form Printable Forms Free Online

Printable 1099 Form For Conrtactors - Reporting Payments to Independent Contractors If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in