Printable 1099 Form For Contractors Report payments of 10 or more made in the course of a business in royalties or broker payments in lieu of dividends or tax exempt interest Form 1099 MISC Report payments of 600 or more made in the course of a business in rents prizes and awards other income and for other specified purposes including gross proceeds paid to an attorney

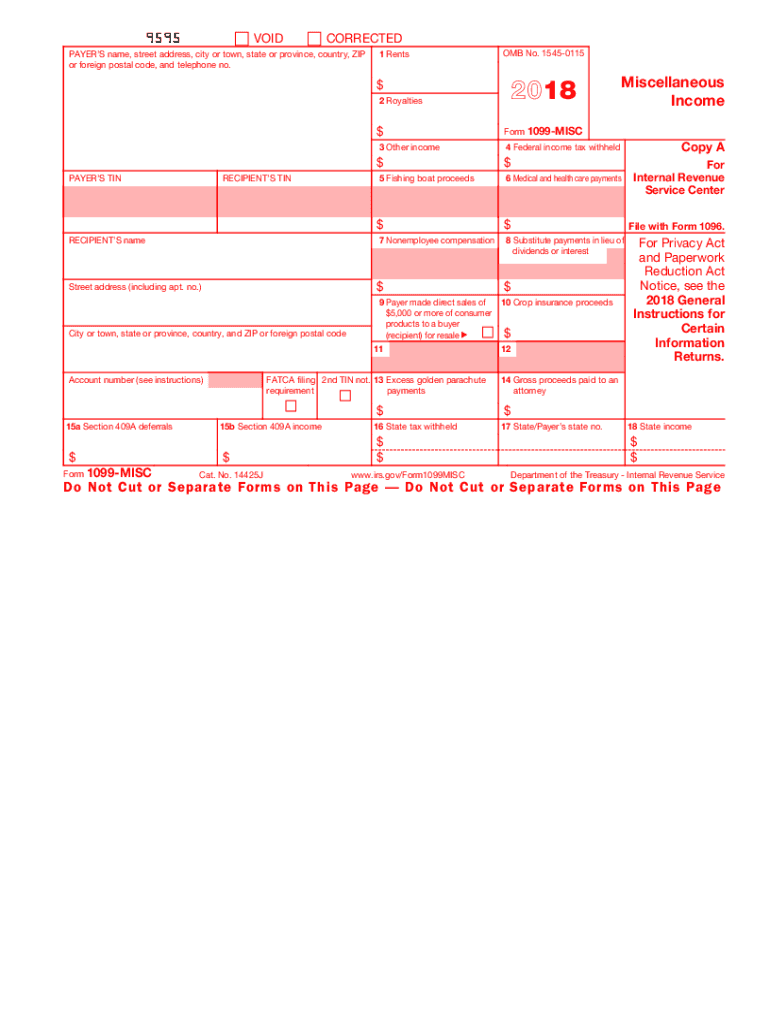

Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Printable 1099 Form For Contractors

Printable 1099 Form For Contractors

https://www.pdffiller.com/preview/421/116/421116584/large.png

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://s30311.pcdn.co/wp-content/uploads/2020/03/form-1099-misc-fold.png

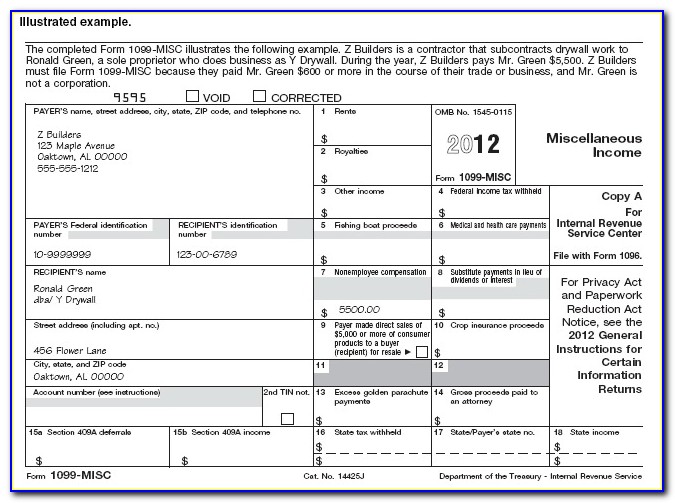

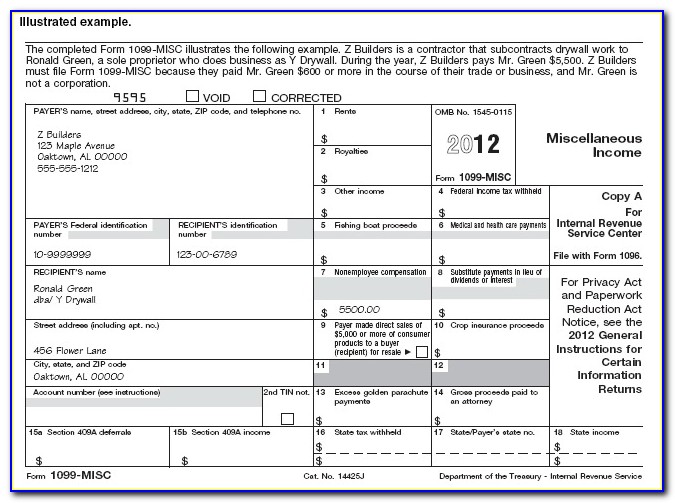

Can You Print 1099 Forms From a Regular Printer Everything You Need to Know How To Print 1099 Forms on Your Regular Printer by Soo Lee CPA Updated March 29 2023 Reviewed by Isaiah McCoy CPA If you hired a contractor or freelancer and paid them more than 600 in a year directly you have to send them a 1099 NEC Here are the instructions for how to complete a 1099 NEC line by line Box 1 Nonemployee compensation Post the nonemployee compensation and Payer s TIN List your company s taxpayer identification number TIN as Payer s TIN Payer s information List your business s name and address in the top left section of the form

Form 1099 is an IRS document that reports payments received from non employee compensation or other income sources to independent contractors vendors subcontractors and freelancers This form also reports payments made in exchange for services that exceed 600 during the tax year A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

More picture related to Printable 1099 Form For Contractors

1099 Printable Forms

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Free Form 1099 MISC PDF Word

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more What is an Independent Contractor 1099 Form Self employed people and those who perform contract work for others must use IRS Form 1099 to report income and other details More than twenty distinct 1099 forms are in use today Formerly known as the 1099 MISC the 1099 NEC is now the standard form for reporting payments to independent contractors

Updated November 27 2023 A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes Form 1099 NEC Independent Contractors Question What s the difference between a Form W 2 and a Form 1099 MISC or Form 1099 NEC Answer Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors

Report payments of 10 or more made in the course of a business in royalties or broker payments in lieu of dividends or tax exempt interest Form 1099 MISC Report payments of 600 or more made in the course of a business in rents prizes and awards other income and for other specified purposes including gross proceeds paid to an attorney

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

How To Fill Out And Print 1099 NEC Forms

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

Form 1099 For Independent Contractors A Guide For Recipients

How To File A 1099 Form Independent Contractor Universal Network

Irs 1099 Forms For Independent Contractors Form Resume Examples

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

What Is A 1099 Misc Form Financial Strategy Center

Irs Printable 1099 Form Printable Form 2023

Printable 1099 Form For Contractors - STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms Fill in your Federal Tax ID number SSN or EIN and contractor s information SSN or EIN accurately Fill out Form 1099 MISC accurately using the information you ve gathered