Printable 1099 Form For Pastors Form 1099 NEC is the most commonly used for contractors Nonemployee compensation is defined as payments made to Sole proprietor and single member LLC businesses and or individuals who are not church employees for services Some examples of independent contractors include Repair workers Cleaning services Lawncare services Pulpit Supply

Members of the Clergy Members of the Clergy For services in the exercise of the ministry members of the clergy receive a Form W 2 but do not have social security or Medicare taxes withheld They must pay social security and Medicare by filing Schedule SE Form 1040 Self Employment Tax Your church or nonprofit organization should send an IRS Form 1099 NEC to independent contractors that you paid amounts 600 or more in payments for service to your organization See below for comments from an IRS agent regarding this subject

Printable 1099 Form For Pastors

Printable 1099 Form For Pastors

https://www.pdffiller.com/preview/608/781/608781885/big.png

1099 Form Template Create A Free 1099 Form Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

1099 Misc Printable Template Free

https://www.pdffiller.com/preview/421/116/421116584/big.png

Some churches give their pastors a Form W 2while others provide their pastors with a Form 1099 MISC So which tax form is correct In short pastors who are on staff at a church either full time or part time should receive a Form W 2 If this is so then why do some churches give their minister s a Form 1099 MISC Whether you re a small or large church you can benefit from online e filing with Clergy Financial Resources We have designed an easy online service and support for filing W 2 and 1099 form Our service is simple cost effective efficient and secure Because your information is securely saved every year your filing gets quicker and easier

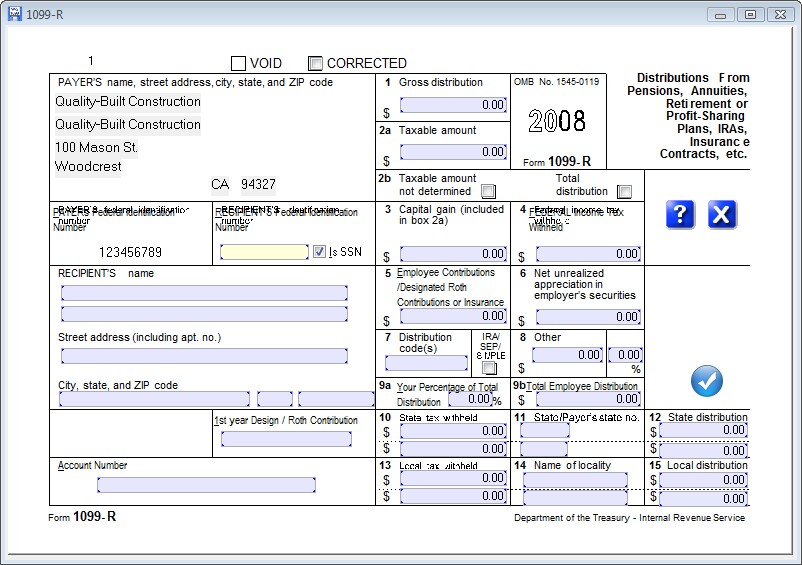

IRS Form 1099 reports to the Federal government various types of taxable income paid to contractors and vendors There are versions of the 1099 to report payments for services as well as interest dividends and real estate sale proceeds This form is issued by churches to guest speakers pulpit supply etc who provide services in excess of 600 Form 1099 R from GuideStone 62 Form 1040 63 Schedule 1 65 Schedule 2 67 Schedule C 69 to several forms and schedules and the sections of each form most relevant to ministers The companion resource and Part 5 in this guide the 2024 Federal Reporting Requirements

More picture related to Printable 1099 Form For Pastors

1099 Fillable Form Free Printable Form Templates And Letter

https://formswift.com/seo-pages-assets/images/1099-forms/image-7-box2-2x.png

1099 S Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2019/01/1099-s-fillable-form.jpg

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Reported as taxable income on the minister s Form W 2 and Form 1040 For example reimbursing the travel costs associated with the minister s spouse to travel with the minister is a nonbusiness expense even if the church requires the spouse to accompany the minister for accountability purposes The reimbursement of the Churches issue a 1099 form to self employed persons who are paid at least 600 during the year The 1099 form reports compensation paid 941 forms Churches that are subject to income tax withholding FICA social security taxes or both must file Form 941 quarterly Form 941 reports the number of employees and amount of FICA taxes and

Form 990 It is important to know that churches are exempt from filing Form 990 but all other tax exempt organizations must file Form 990 There are three different 990 forms which you need to be familiar with Form 990 Long File this form if your gross income is 200 000 00 or more or your assets are 500 000 00 or more IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

https://www.clergyfinancial.com/when-should-use-form-1099-nec/

Form 1099 NEC is the most commonly used for contractors Nonemployee compensation is defined as payments made to Sole proprietor and single member LLC businesses and or individuals who are not church employees for services Some examples of independent contractors include Repair workers Cleaning services Lawncare services Pulpit Supply

https://www.irs.gov/businesses/small-businesses-self-employed/members-of-the-clergy

Members of the Clergy Members of the Clergy For services in the exercise of the ministry members of the clergy receive a Form W 2 but do not have social security or Medicare taxes withheld They must pay social security and Medicare by filing Schedule SE Form 1040 Self Employment Tax

What Is Form 1099 NEC And Who Needs To File 123PayStubs Blog

1099 S Fillable Form Printable Forms Free Online

Printable 1099 Tax Forms Free Printable Form 2024

Fillable 1099 Misc Fill Out Sign Online DocHub

Free Printable 1099 R Form Printable Templates

1099 Form Fillable 1099 Misc Software Includes Electronic Filing Printing Fillable Forms Irs

1099 Form Fillable 1099 Misc Software Includes Electronic Filing Printing Fillable Forms Irs

IRS Form 1099 R 2023 Forms Docs 2023

1099 MISC 3 Part Continuous 1 Wide Formstax

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

Printable 1099 Form For Pastors - Beginning with the 2020 tax year the IRS will require churches to report nonemployee compensation on the new Form 1099 NEC instead of on Form 1099 MISC Churches will need to use this form if they made payments totaling 600 or more to a non employee such as an independent contractor Most ministers are treated as dual status employees and