Printable 1099 Forms For Independent Contractors Report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit commission or other commission basis for resale Form 1099 MISC or Form 1099 NEC Payers file Forms 1099 MISC and 1099 NEC with the IRS and provide them to the person or business that received the payment

Answer Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee Report the employee s income Social Security and Medicare taxes withheld and other information An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee Paying Taxes

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

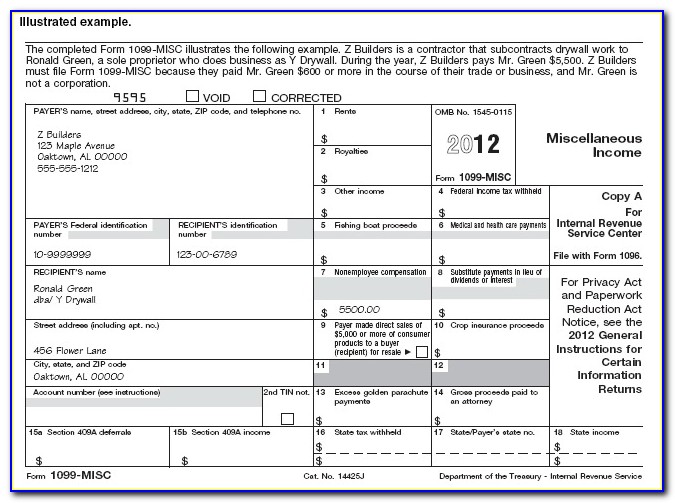

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

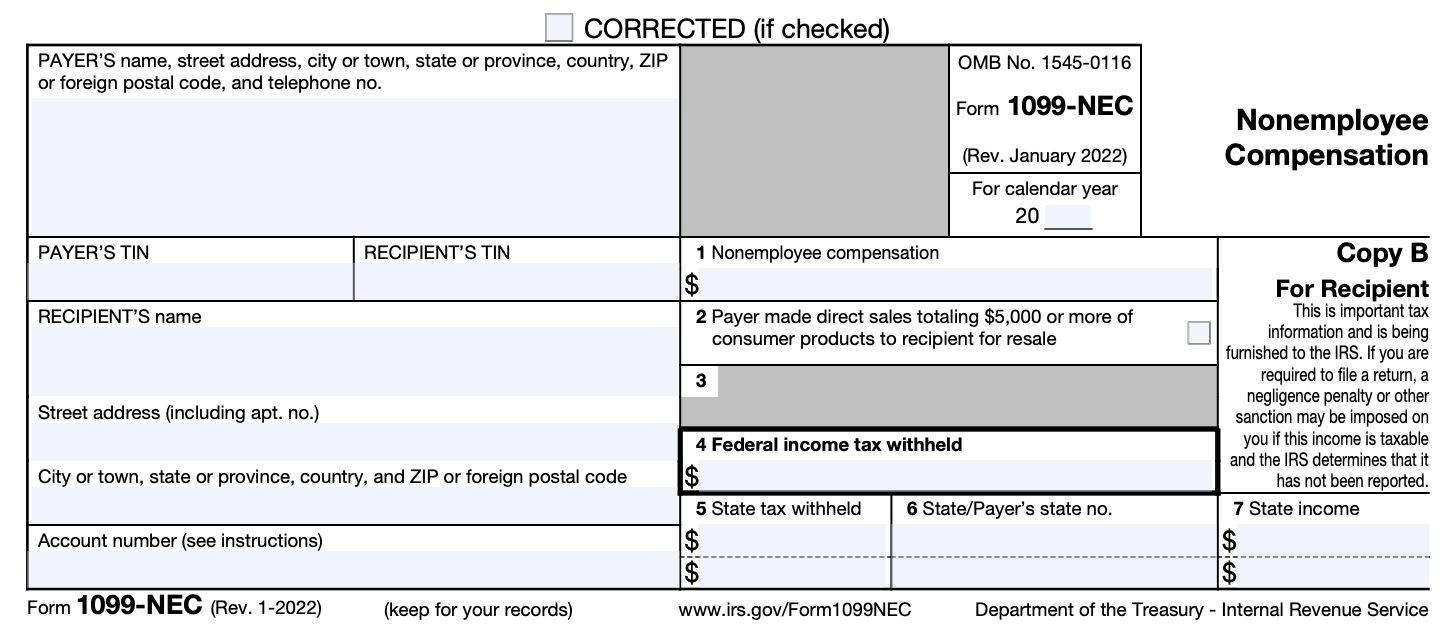

What is an Independent Contractor 1099 Form Self employed people and those who perform contract work for others must use IRS Form 1099 to report income and other details More than twenty distinct 1099 forms are in use today Formerly known as the 1099 MISC the 1099 NEC is now the standard form for reporting payments to independent contractors A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

1099 payroll payroll for independent contractors Want to pay freelancers with greater speed and accuracy Learn More Want more exclusive business insights like this delivered to your inbox Subscribe now The number of people who work as freelancers or independent contractors is increasing How contractors use Form 1099 NEC Most freelancers and independent contractors use Schedule C Profit or Loss From Business to report self employment income on their personal tax returns Here is the process for reporting income earned on a Form 1099 NEC Part 1 of Schedule C reports income earned by the contractor

More picture related to Printable 1099 Forms For Independent Contractors

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://s30311.pcdn.co/wp-content/uploads/2020/03/form-1099-misc-fold.png

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2018/12/1099-form-independent-contractor-2018.jpg

Remember 1099 forms are printable and having a physical copy can often be helpful While businesses are required to send 1099 forms to any independent contractor they pay 600 or more mistakes can happen If you don t receive your 1099 form reach out to the business promptly Remember even without a 1099 form you must report all There are three independent contractor tax forms that businesses must file to avoid penalties Learn about what tax forms to give contractors from Paychex

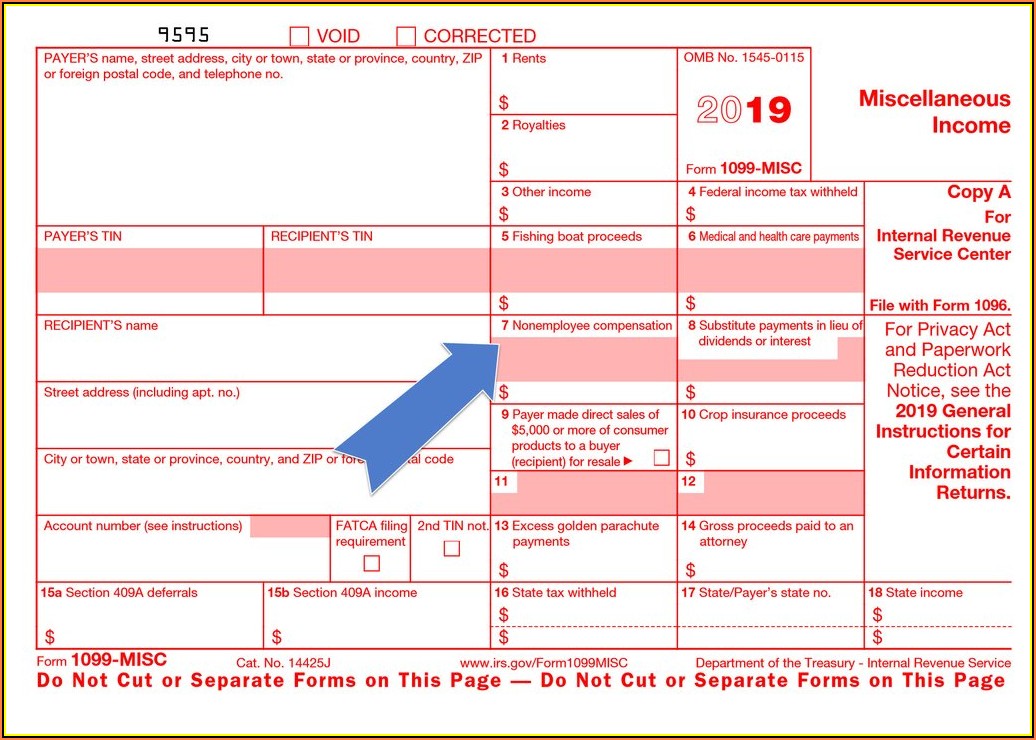

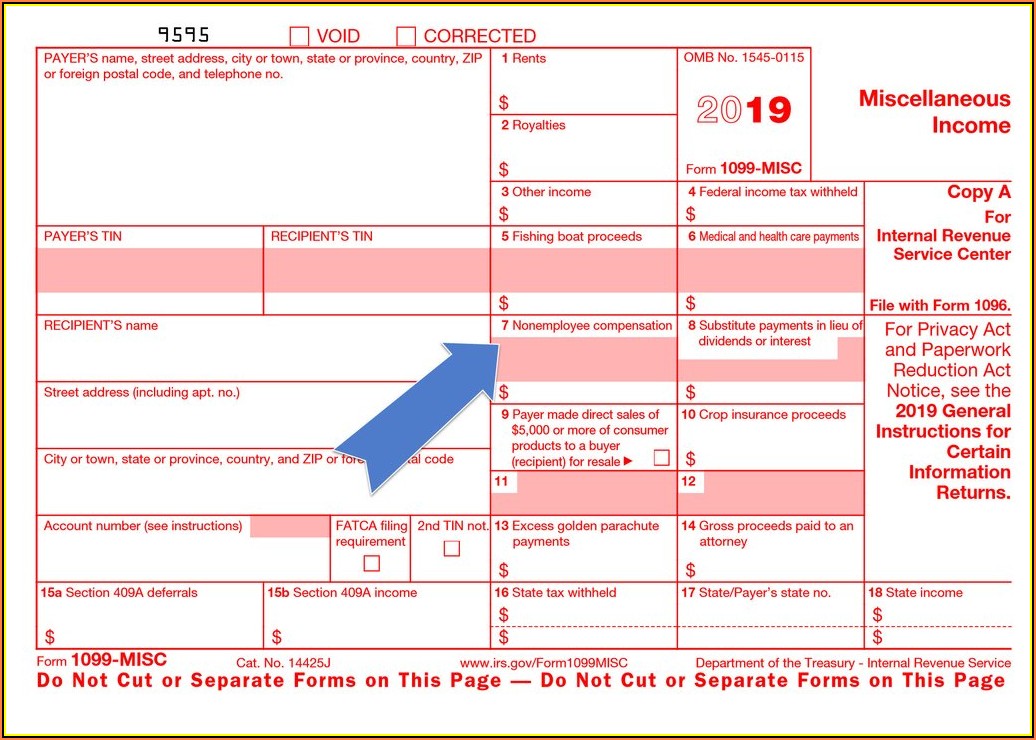

STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms Fill in your Federal Tax ID number SSN or EIN and contractor s information SSN or EIN accurately Fill out Form 1099 MISC accurately using the information you ve gathered Before you can submit a 1099 form independent contractors need to fill out a W 9 form The W 9 form collects information for tax purposes including Social Security Number or Individual Taxpayer ID

Irs 1099 Forms For Independent Contractors Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor.jpg

Form 1099 For Independent Contractors A Guide For Recipients

https://mycountsolutions.com/wp-content/uploads/2019/07/Form-1099-for-Independent-Contractors-2048x1365.jpg

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors

Report sales totaling 5 000 or more of consumer products to a person on a buy sell a deposit commission or other commission basis for resale Form 1099 MISC or Form 1099 NEC Payers file Forms 1099 MISC and 1099 NEC with the IRS and provide them to the person or business that received the payment

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors/form-1099-nec-independent-contractors

Answer Although these forms are called information returns they serve different functions Employers use Form W 2 Wage and Tax Statement to Report wages tips or other compensation paid to an employee Report the employee s income Social Security and Medicare taxes withheld and other information

1099 Form Independent Contractor Pdf Free Independent Contractor Agreement Templates Pdf Word

Irs 1099 Forms For Independent Contractors Form Resume Examples

How To File A 1099 Form Independent Contractor Universal Network

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Printable 1099 Forms For Independent Contractors

1099 Form Independent Contractor Pdf Fillable Independent Contractor Agreement Fill Online

1099 Form Independent Contractor Pdf Fillable Independent Contractor Agreement Fill Online

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Tax Form Independent Contractor Printable 1099 Forms Independent Contractors Lifecoach

Printable 1099 Form Independent Contractor Form Resume Examples

Printable 1099 Forms For Independent Contractors - What is an Independent Contractor 1099 Form Self employed people and those who perform contract work for others must use IRS Form 1099 to report income and other details More than twenty distinct 1099 forms are in use today Formerly known as the 1099 MISC the 1099 NEC is now the standard form for reporting payments to independent contractors