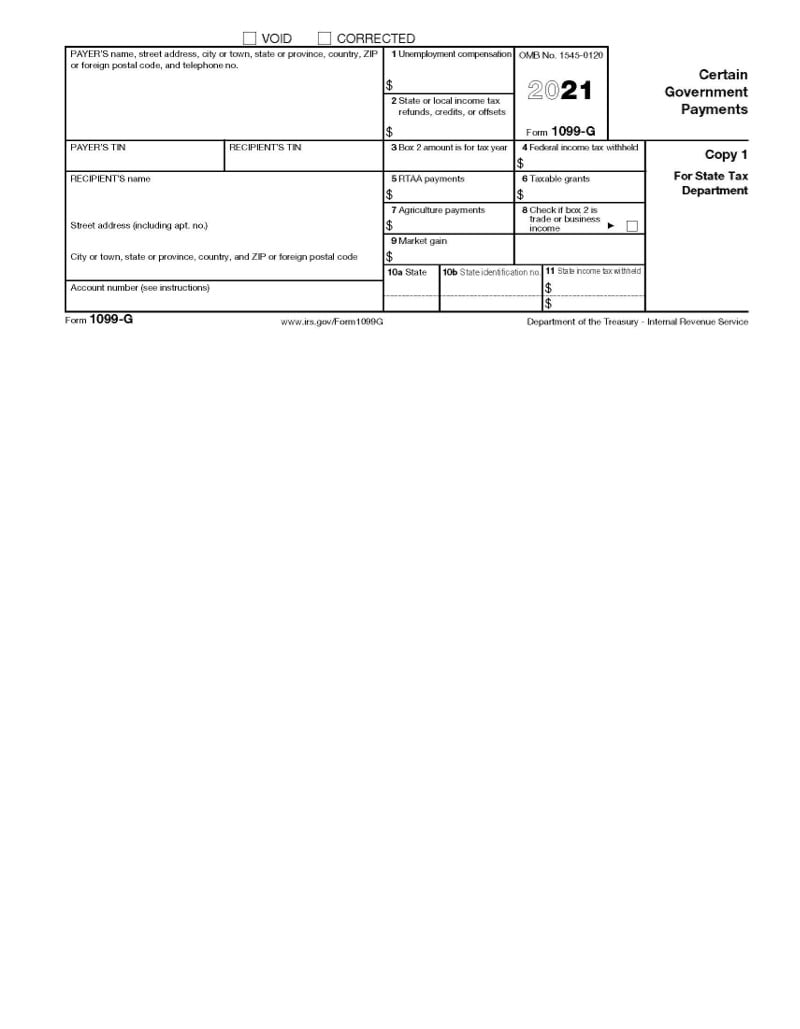

Printable 1099 G Form Pennsylvania Form 1099 G Rev January 2022 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

Instructions for Form 1099 G Print Version PDF Recent Developments Exclusion of up to 10 200 of Unemployment Compensation for Tax Year 2020 Only 21 DEC 2022 IRS offers guidance to taxpayers on identity theft involving unemployment benefits Identity theft guidance regarding unemployment compensation reporting 29 DEC 2020 Form 1099 G is a federal form that the Internal Revenue Service requires to be sent to taxpayers to remind them of the Pennsylvania Income Tax refund or credit they received during the previous year You may have received this refund or credit six to eight months ago This does not affect the filing of your Pennsylvania Income Tax Return

Printable 1099 G Form Pennsylvania

Printable 1099 G Form Pennsylvania

https://wicu.images.worldnow.com/images/20262260_G.png?lastEditedDate=1610966863000

Understanding Form 1099 G Jackson Hewitt

https://www.jacksonhewitt.com/siteassets/tax-help-main/blogs/form-images/irs-notice_1099g.jpg

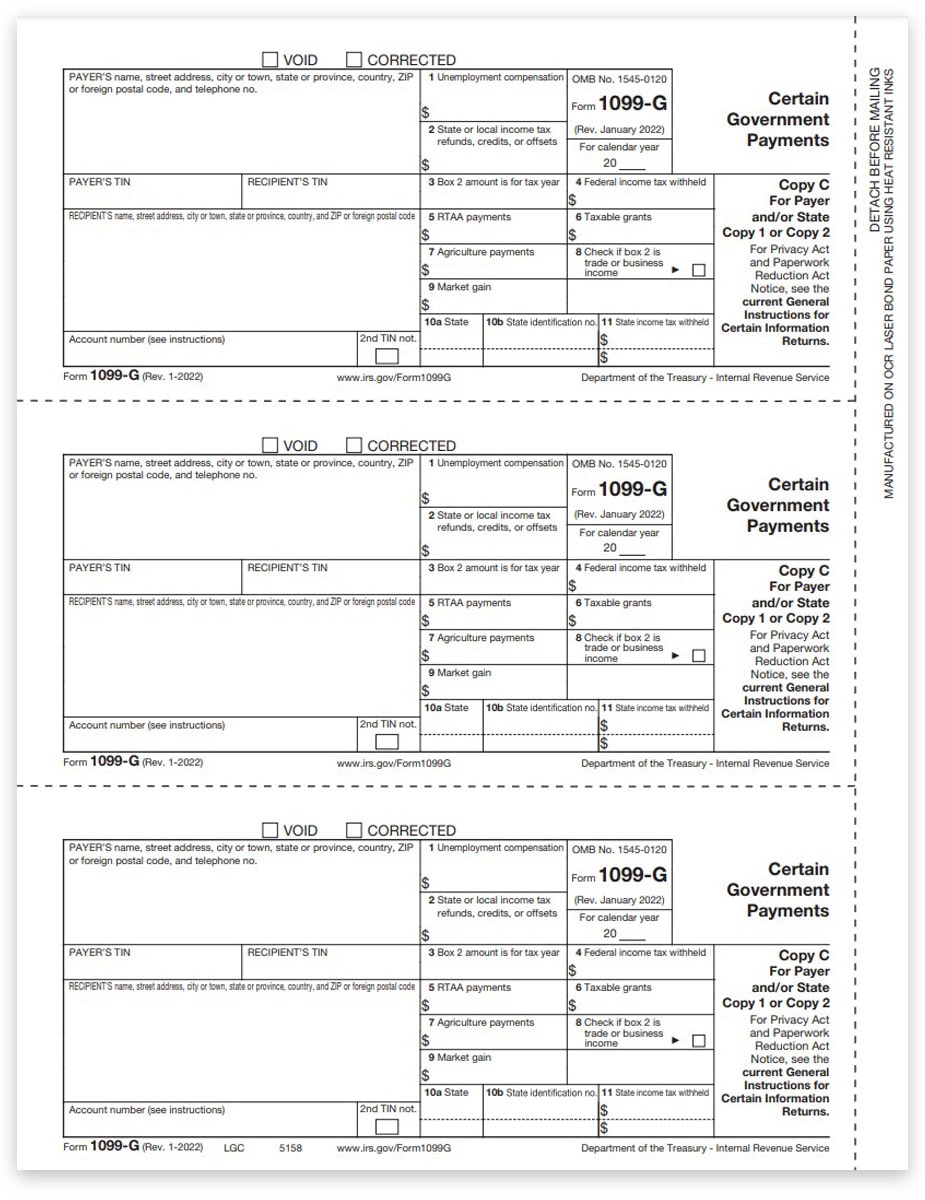

1099G Tax Forms For Government Payments Payer Copy C ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-C-1-2-Payer-State-LGC-FINAL-min.jpg

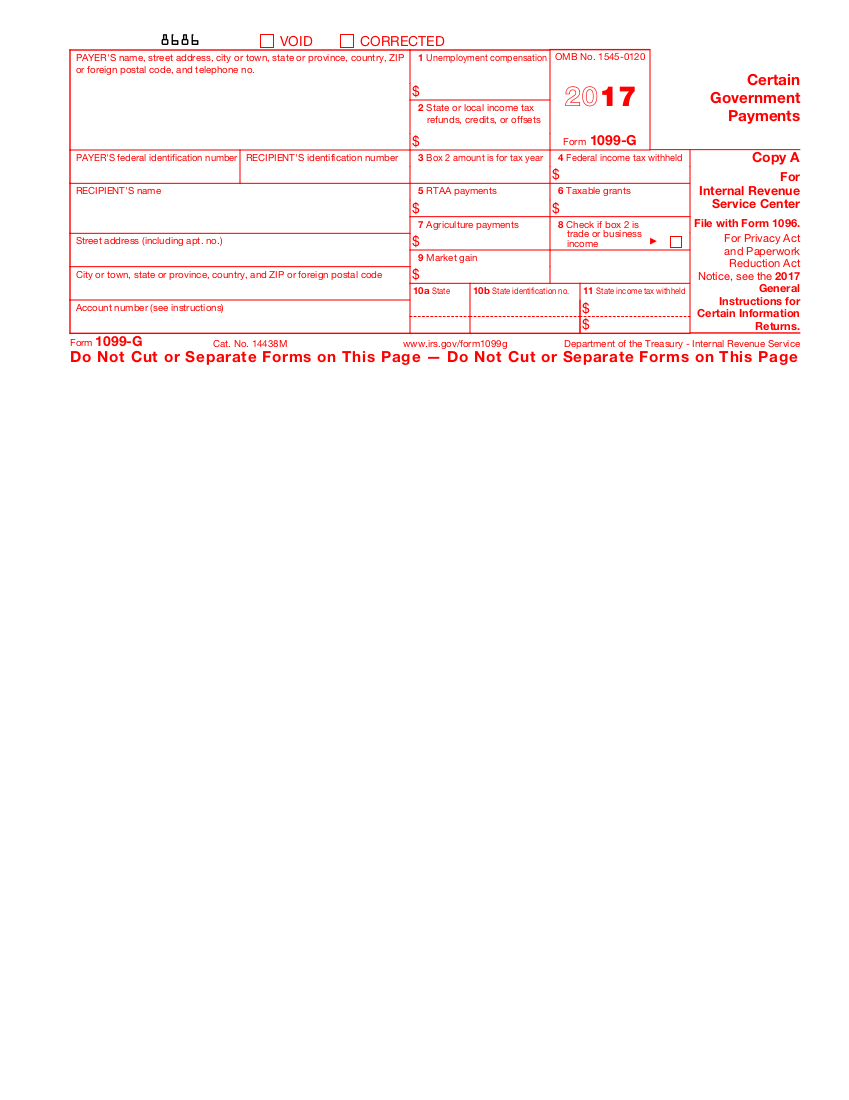

Form 1099 G is a federal form that the Internal Revenue Service requires to be sent to taxpayers to remind them of the Pennsylvania Income Tax refund or credit they received during the previous year You may have received this refund or credit six to eight months ago 2021 Form 1099 G Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

File Your 2023 PA 40 Pennsylvania Department of Revenue Forms and Publications Forms and Publications Note Please know that all fill in PDF forms should be downloaded and saved to your computer or device before you start entering information Simply click on the Download Forms W 2G hyperlink on the Additional Resources panel From there you will be prompted to enter in the tax year social security number and indicate if you are a business or an individual then hit search You will then be able to view and or print a copy of the W 2G form

More picture related to Printable 1099 G Form Pennsylvania

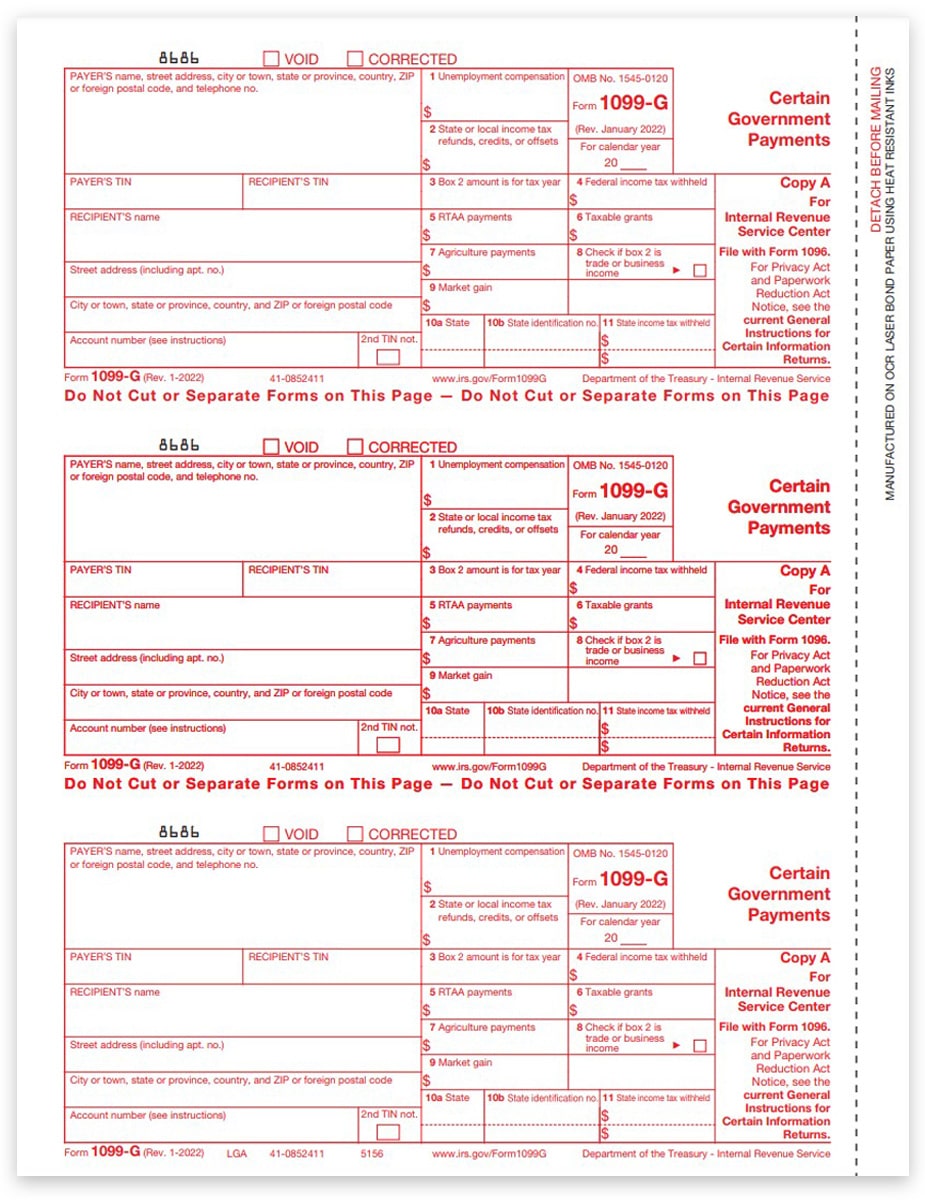

1099G Tax Forms For Government Payments IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-A-Federal-Red-LGA-FINAL-min.jpg

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

https://www.taxoutreach.org/wp-content/uploads/Form-1099G-1-1.png

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

1099 Estimated Tax Form Printable Printable Forms Free Online

https://www.investopedia.com/thmb/veZGCPP20-x4eAgYy80ukMcmgyU=/1566x765/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png

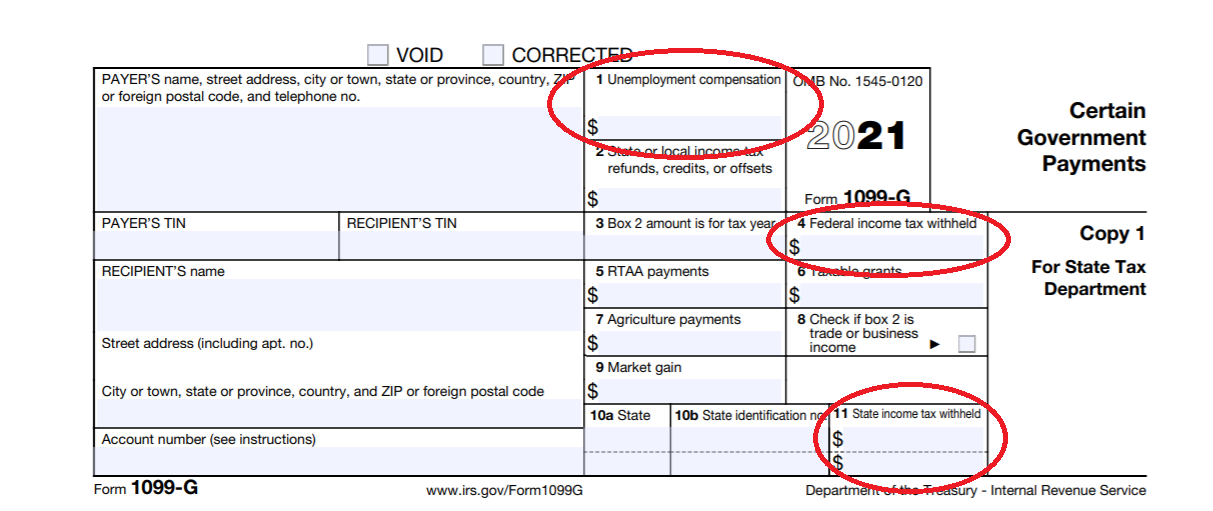

Taxable unemployment compensation Generally you must include in federal taxable income any unemployment compensation from a state government Box 1 of the 1099 G Form shows your total unemployment compensation payments for the year Schedule 1 for Form 1040 includes a separate line for unemployment compensation in the income section 1099 G Form for state tax refunds credits or offsets If the state issues you a refund credit or offset of state or local income that amount will be shown in Box 2 of your 1099 G form The most common reason for receiving a refund is because of an overpayment of state taxes as explained in the example below

File Form 1099 G Certain Government Payments if as a unit of a federal state or local government you made payments of unemployment compensation state or local income tax refunds credits or offsets Reemployment Trade Adjustment Assistance RTAA payments taxable grants or agricultural payments This site provides legal information and referrals to free and low cost legal service providers in Pennsylvania Answers to frequently asked questions from the Pennsylvania Department of Labor Industry about Form UC 1099G related to unemployment compensation and Pandemic Unemployment Assistance PUA Link www uc pa gov

1099 G Form 2023 2024

https://www.zrivo.com/wp-content/uploads/2020/09/1099-G-Form-2021-1280x787.png

Printable Tax Form 1099 G Copy B Free Shipping

https://www.printez.com/image/cache/Printable-Tax-Form-1099-G-Copy-B-TF5157-large.jpg

https://www.irs.gov/pub/irs-pdf/f1099g.pdf

Form 1099 G Rev January 2022 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

https://www.irs.gov/forms-pubs/about-form-1099-g

Instructions for Form 1099 G Print Version PDF Recent Developments Exclusion of up to 10 200 of Unemployment Compensation for Tax Year 2020 Only 21 DEC 2022 IRS offers guidance to taxpayers on identity theft involving unemployment benefits Identity theft guidance regarding unemployment compensation reporting 29 DEC 2020

1099 G 2017 Edit Forms Online PDFFormPro

1099 G Form 2023 2024

1099 G FAQs

1099 Printable Form

Form 1099 G Certain Government Payments

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax Preparation Bookkeeping And

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax Preparation Bookkeeping And

Free Printable 1099 Form Free Printable

Can You Print 1099 Forms From A Regular Printer Everything You Need To Know

How Do I Get A 1099 G Form Patricia Wheatley s Templates

Printable 1099 G Form Pennsylvania - Simply click on the Download Forms W 2G hyperlink on the Additional Resources panel From there you will be prompted to enter in the tax year social security number and indicate if you are a business or an individual then hit search You will then be able to view and or print a copy of the W 2G form