Printable 1099 Hand Written Form Dec 11 2019 Can you handwrite a 1099 or a W2 is one of our most common questions surrounding tax preparation The short answer is yes you can fill out a 1099 by hand but there s a little more to it than that Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines

Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Printable 1099 Hand Written Form

Printable 1099 Hand Written Form

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

1099 MISC Form Printable And Fillable PDF Template

https://www.pdffiller.com/preview/456/108/456108087/big.png

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

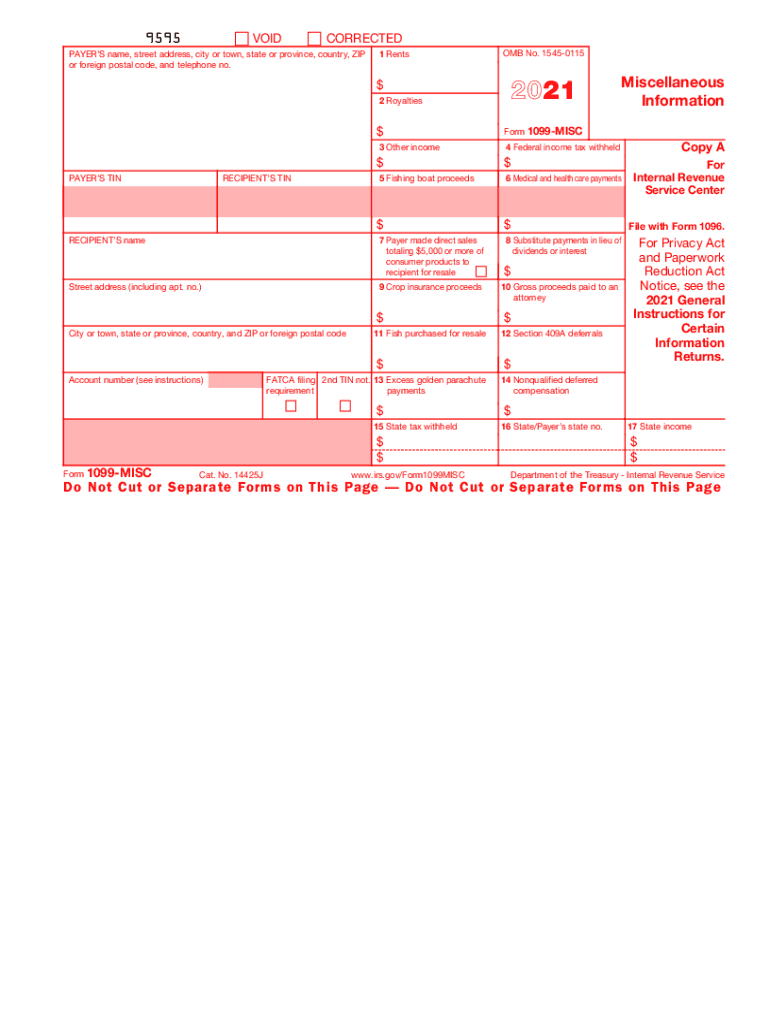

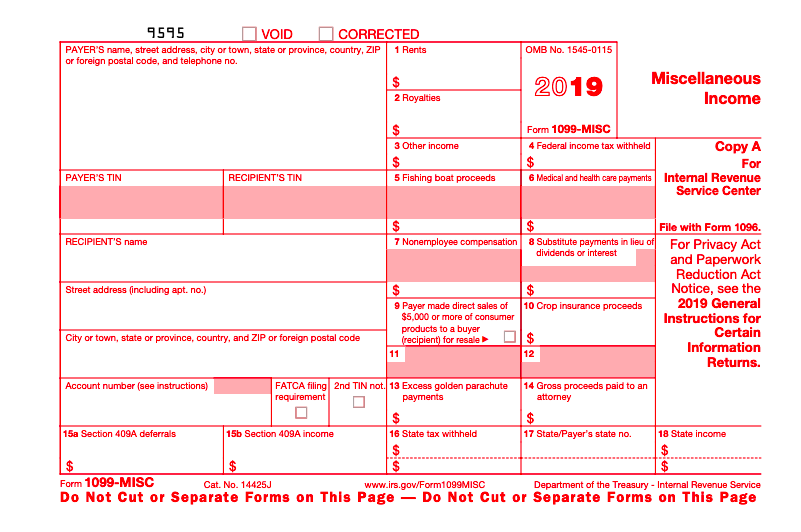

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

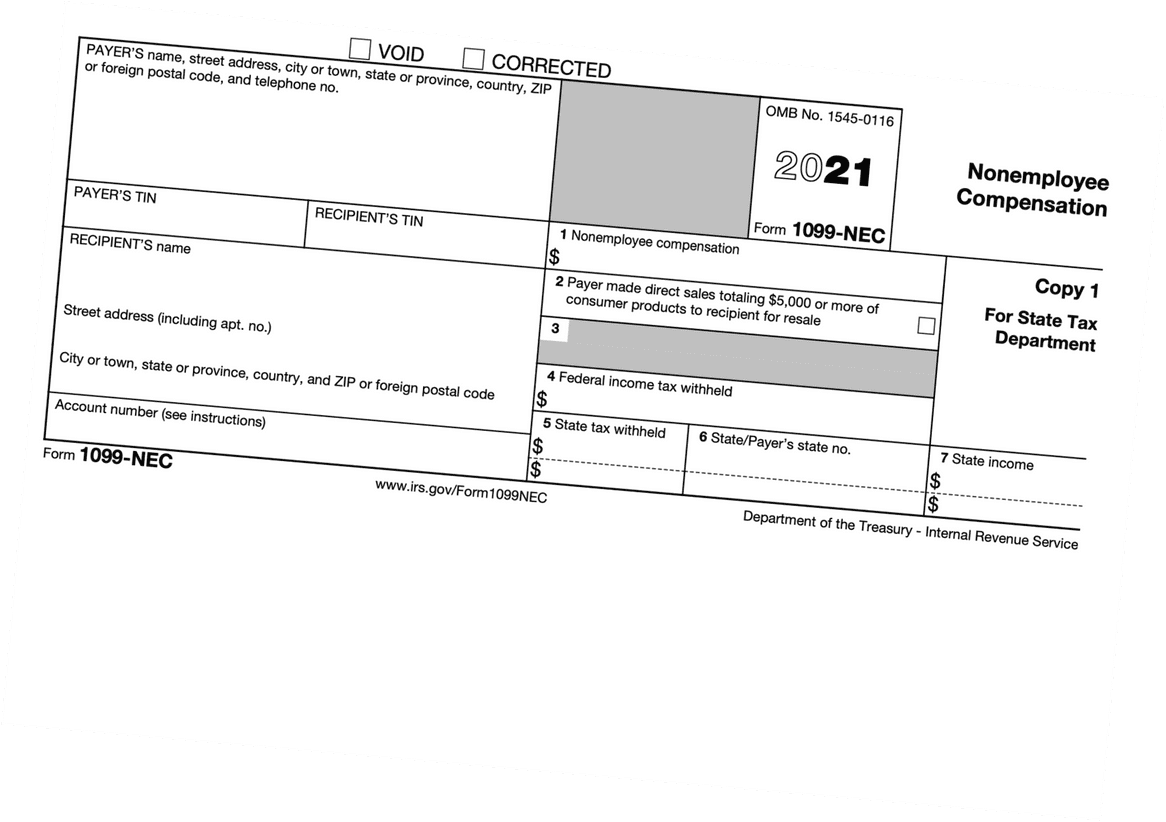

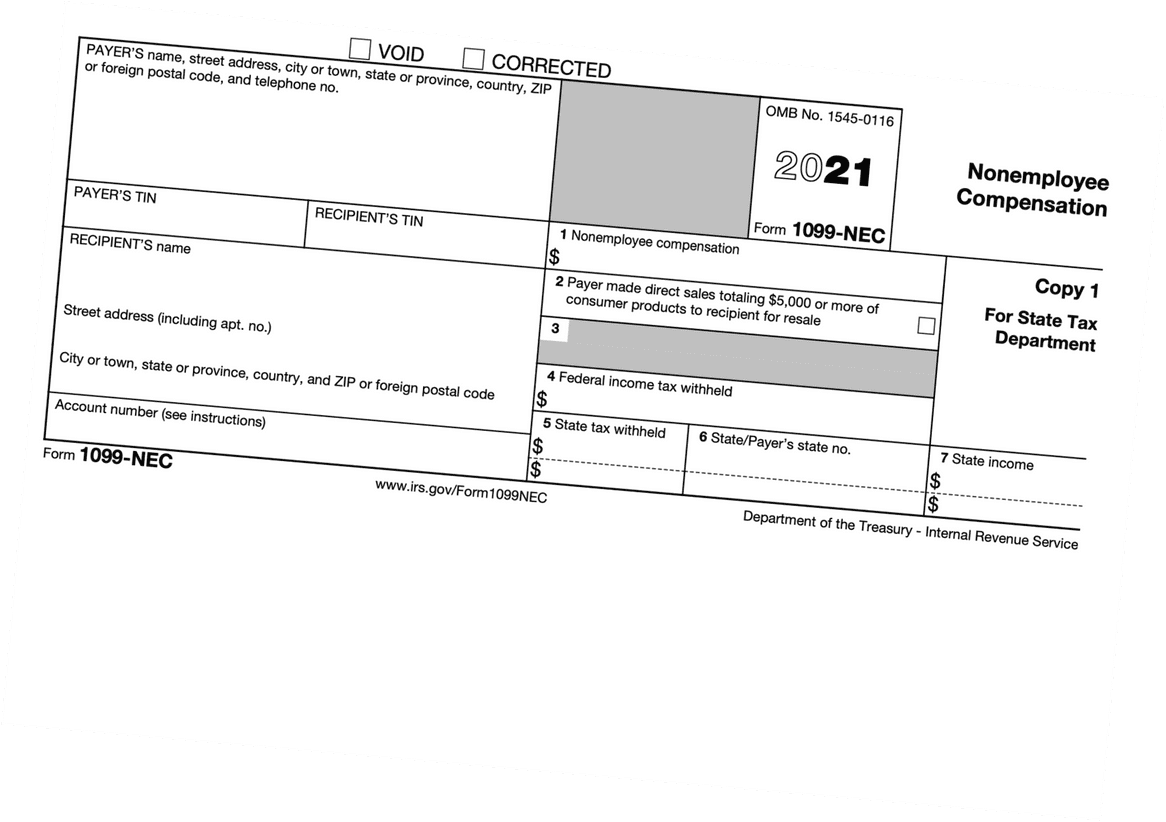

You can print the following number of copies for these 1099 forms on 1 page 1098 2 copies 1098 C 1 copy 1098 E 3 copies 1098 T 3 copies 1099 A 3 copies 1099 B 2 copies 1099 C 3 copies 1099 DIV 2 copies 1099 G 3 copies 1099 INT 2 copies 1099 MISC 2 copies 1099 NEC 3 copies 1099 OID 2 copies 1099 PATR 3 copies 1099 R 2 copies A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted

More picture related to Printable 1099 Hand Written Form

1099 Form Template Create A Free 1099 Form Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/17227/sample_IRS_1099_MISC_2014_1_.545a6b837de3b.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments Download and Print a 1099 MISC Form 2023 For filling out taxes on income earned from 1 1 2023 to 12 31 2023 DOWNLOAD PDF Fill Out Form 2022 Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN For Form 1099s Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor All other parts of Form 1099 can be printed on plain white paper Additionally you must use perforated paper for some copies of forms that you re sending to employees Handwritten Tax Forms Guidelines

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

https://www.bluesummitsupplies.com/blogs/tax-resources/can-you-handwrite-a-1099

Dec 11 2019 Can you handwrite a 1099 or a W2 is one of our most common questions surrounding tax preparation The short answer is yes you can fill out a 1099 by hand but there s a little more to it than that Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines

https://www.irs.gov/instructions/i1099mec

Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

Print Blank 1099 Form Printable Form Templates And Letter

Printable 1099 Tax Forms Free Printable Form 2024

1099 Filing Electronically 2021 2023 Form Fill Out And Sign Printable PDF Template SignNow

1099 NEC Form Print Template For Word Or PDF 2021 Tax Year 1096 Transmittal Summary Form

1099 Fillable Form Free Printable Form Templates And Letter

Free Printable 1099 NEC File Online 1099FormTemplate

Free Printable 1099 NEC File Online 1099FormTemplate

1099 MISC Form The Ultimate Guide For Business Owners

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

1099 S Fillable Form Printable Forms Free Online

Printable 1099 Hand Written Form - A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form