Printable 1099 Miscellaneous Income Form What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

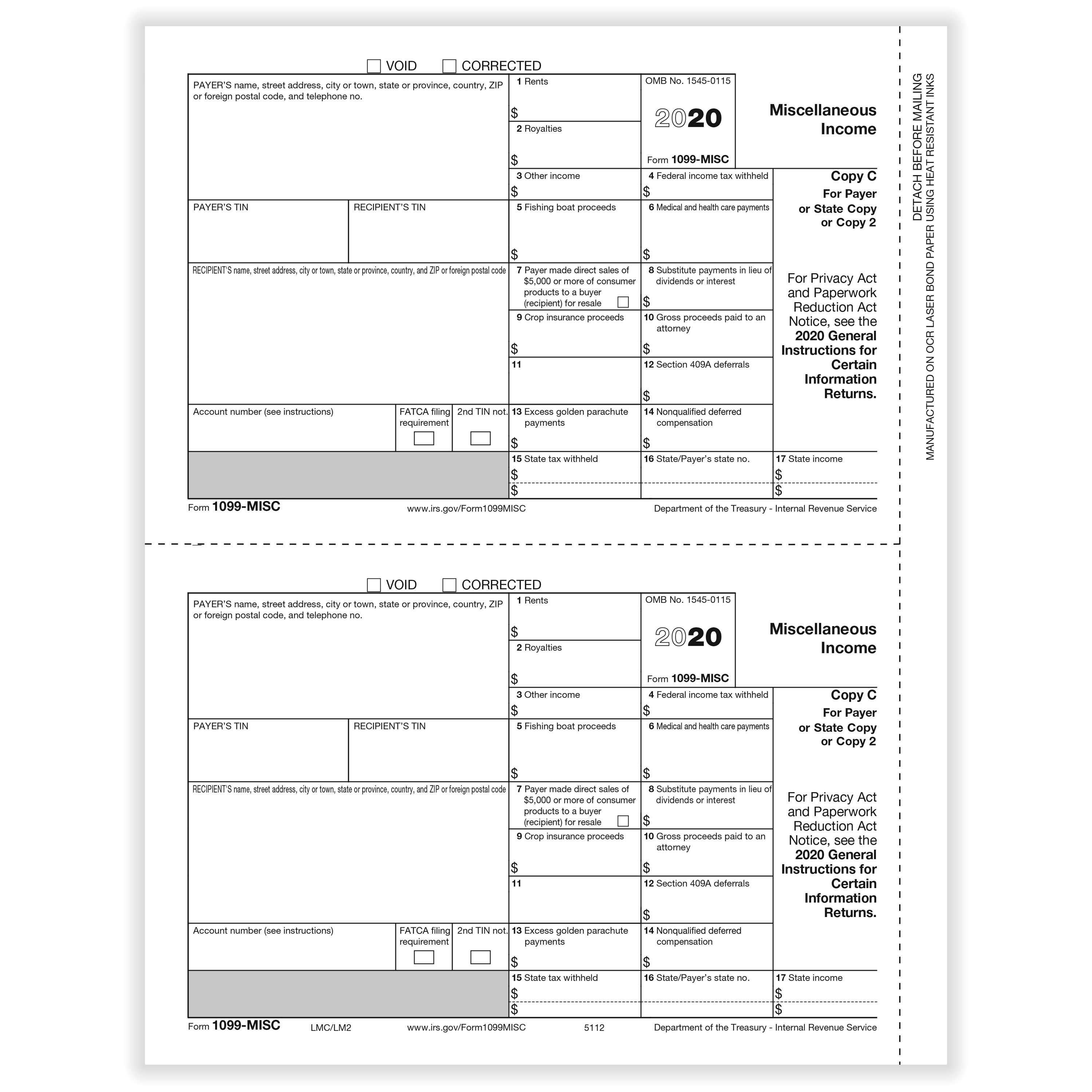

2020 Form 1099 MISC Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

Printable 1099 Miscellaneous Income Form

Printable 1099 Miscellaneous Income Form

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

Form 1099 MISC For Independent Consultants 6 Step Guide

https://global-uploads.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

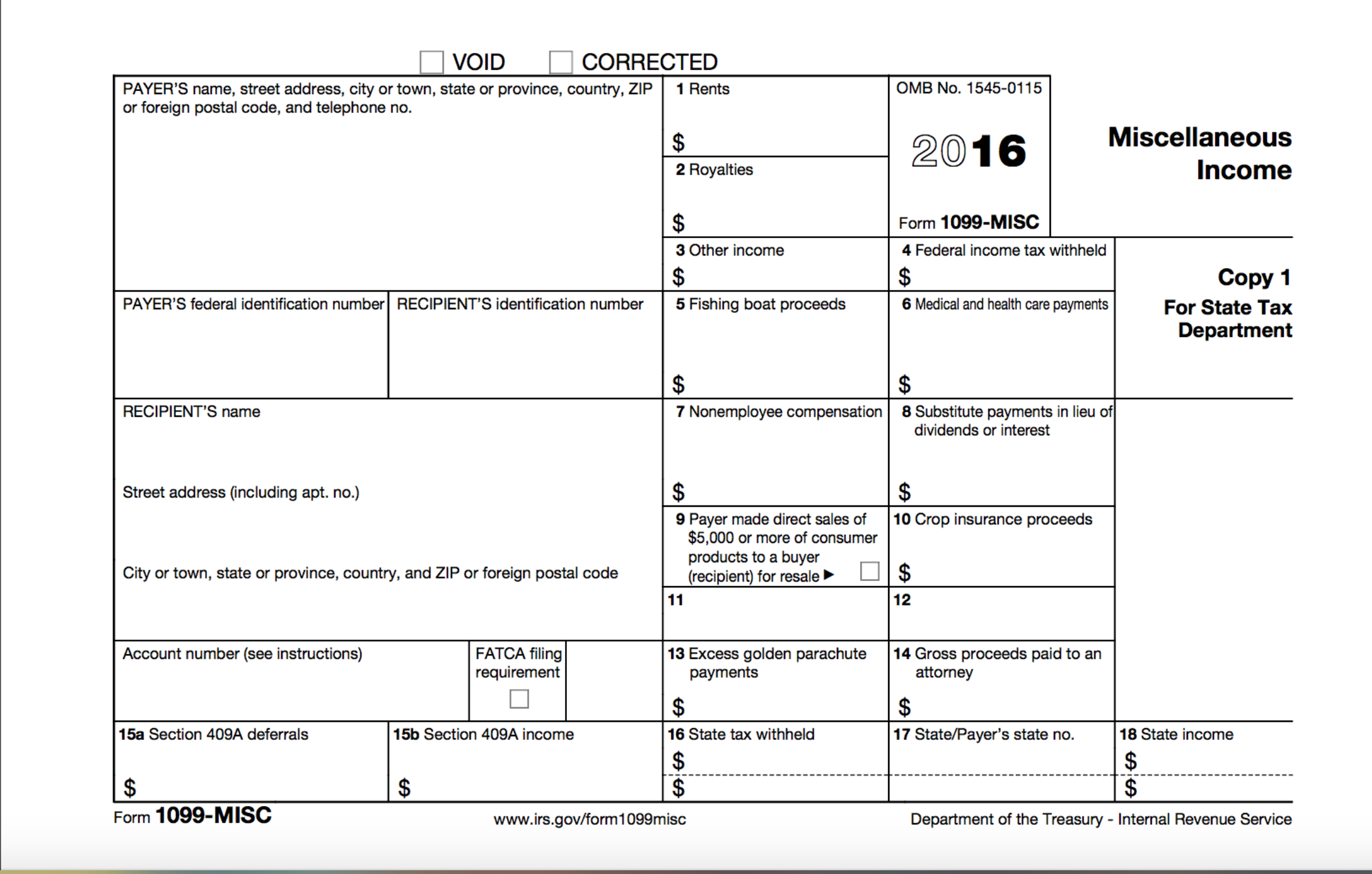

What is Form 1099 MISC used for A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments You should also receive Form 1099 MISC from any business or person that withheld any federal income tax on your behalf under backup withholding rules regardless of amount withheld or the amount paid Direct sales made of 5 000 or more will be reported on either Form 1099 MISC or Form 1099 NEC

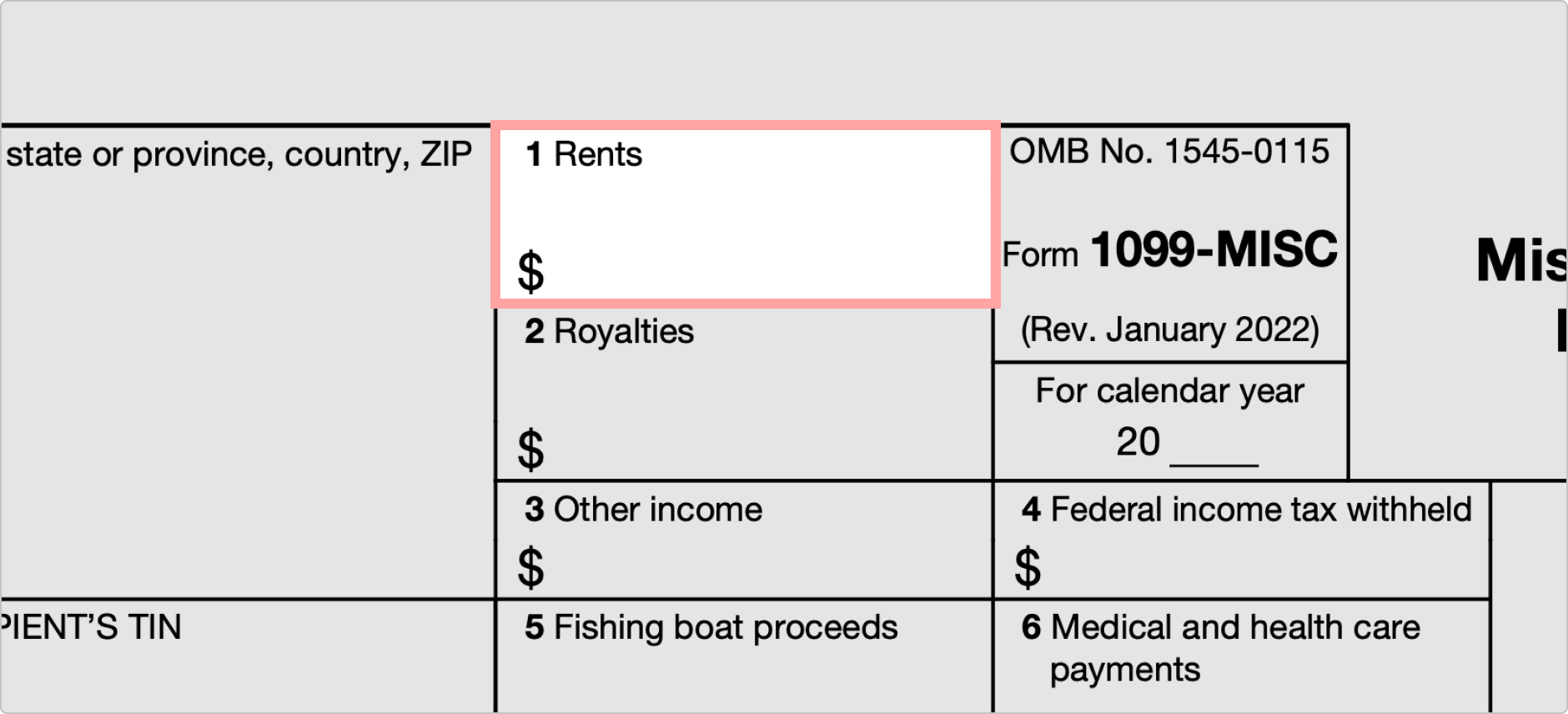

This guide will provide the 1099 MISC instructions you ll need when preparing your tax return or reporting payments made to others as well as insight into the key pieces of information reported on the new 1099 MISC Box 1 Rents If someone pays you rent for office space machinery farmland or pasture you would report that figure in Box 1 Form 1099 MISC Miscellaneous Income or Miscellaneous Information as it s now called is an Internal Revenue Service IRS form used to report certain types of miscellaneous

More picture related to Printable 1099 Miscellaneous Income Form

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

https://cdn.formstax.com/Images/Products/L0759-5112-2020-1099MISC-Laser-Copy-C_xl.jpg

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/17227/sample_IRS_1099_MISC_2014_1_.545a6b837de3b.png

1099 MISC Form Fillable Printable Download Free 2021 Instructions

https://formswift.com/seo-pages-assets/images/1099-forms/image-7-box2-2x.png

Form 1099 MISC Miscellaneous Information is an information return businesses use to report payments and miscellaneous payments File Form 1099 MISC for each person you have given the following types of payments in the course of your business during the tax year IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted Form 1099 MISC is a government form businesses use to show miscellaneous payments they distribute and taxpayers report them on their annual tax returns In the past the Internal Revenue Service IRS referred to this document as Form 1099 MISC Miscellaneous Income but now they refer to it as Form 1099 MISC Miscellaneous Information

1099 Printable Forms

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Form 1099 MISC Miscellaneous Income IRS Copy A

https://www.phoenixphive.com/images/products/detail/1099MFEDA.4.jpg

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

2020 Form 1099 MISC Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

Form 1099 MISC Miscellaneous Income IRS Copy A

1099 Printable Forms

Form 1099 MISC Miscellaneous Income IRS Copy A

1099 MISC Tax Form DIY Guide ZipBooks

1099 MISC Form Fillable Printable Download 2023 Instructions

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To Fill Out And Print 1099 MISC Forms

Free Irs Form 1099 Printable Printable Templates

Printable 1099 Miscellaneous Income Form - Form 1099 MISC Miscellaneous Income or Miscellaneous Information as it s now called is an Internal Revenue Service IRS form used to report certain types of miscellaneous