Printable 1099 Tax Form Free IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

Printable 1099 Tax Form Free

Printable 1099 Tax Form Free

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to

1099 MISC forms for all purposes are due to the IRS by February 28 2024 or March 31 2024 if you re filing electronically You must issue the form to the recipient by February 15 2024 for gross proceeds paid to attorneys substitute dividends or tax exempt interest payments You should issue all other payments to the recipient by A 1099 form is a tax record that an entity or person not your employer gave or paid you money See how various types of IRS Form 1099 work Hassle free tax filing is 50 for all tax

More picture related to Printable 1099 Tax Form Free

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

IRS 1099 NEC Form 2021 2024 A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report File your 1099 with the IRS for free Free support for self employed income independent contractor freelance and other small business income All Years 2016 2022 File 2022 Tax Return File 2021 Tax Return File 2020 Tax Return View My Prior Year Return s After You File

1099 INT reports interest income typically of 10 or more from your bank credit union or other financial institution The form reports the interest income you received any federal income taxes From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099 G section select the year you want in the NYS 1099 G drop down menu box with an arrow and then select the Get Your NYS 1099 G button If you get a file titled null after you click the 1099 G button click on that file You may see

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/509/836/509836879/big.png

1099 S Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2019/01/1099-s-fillable-form.jpg

https://eforms.com/irs/form-1099/

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

https://eforms.com/irs/form-1099/misc/

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

IRS 1099 S 2020 Fill And Sign Printable Template Online US Legal Forms

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

What Is A 1099 Misc Form Financial Strategy Center

Free 1099 Fillable Form Printable Forms Free Online

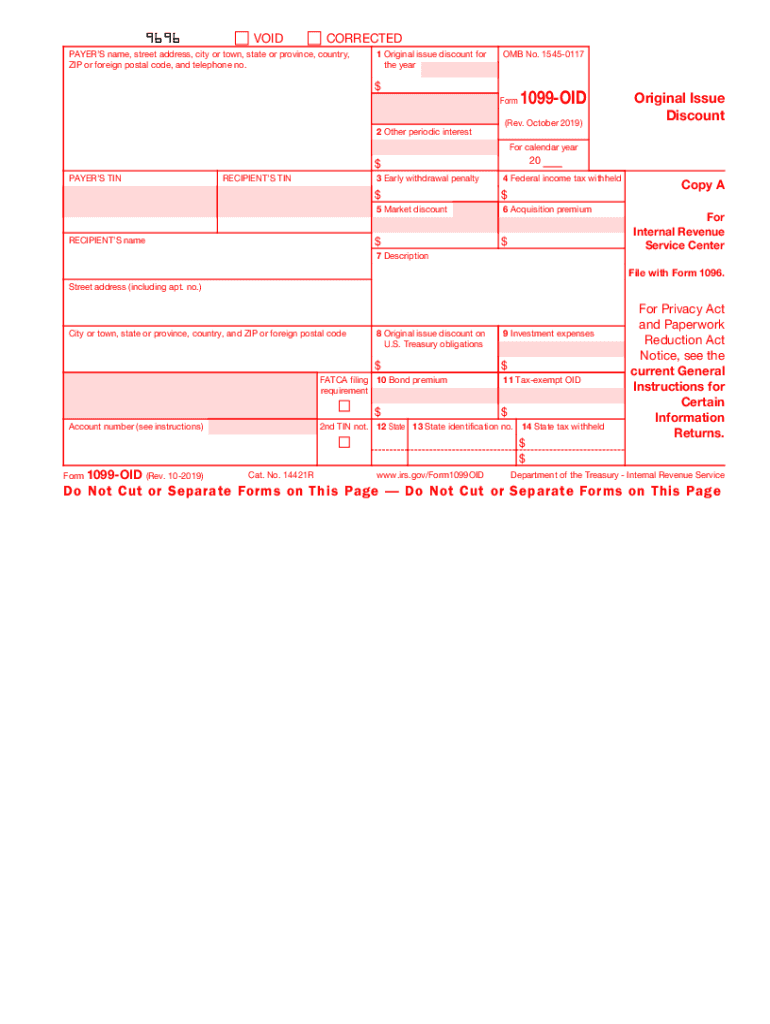

2019 2024 Form IRS 1099 OID Fill Online Printable Fillable Blank PdfFiller

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

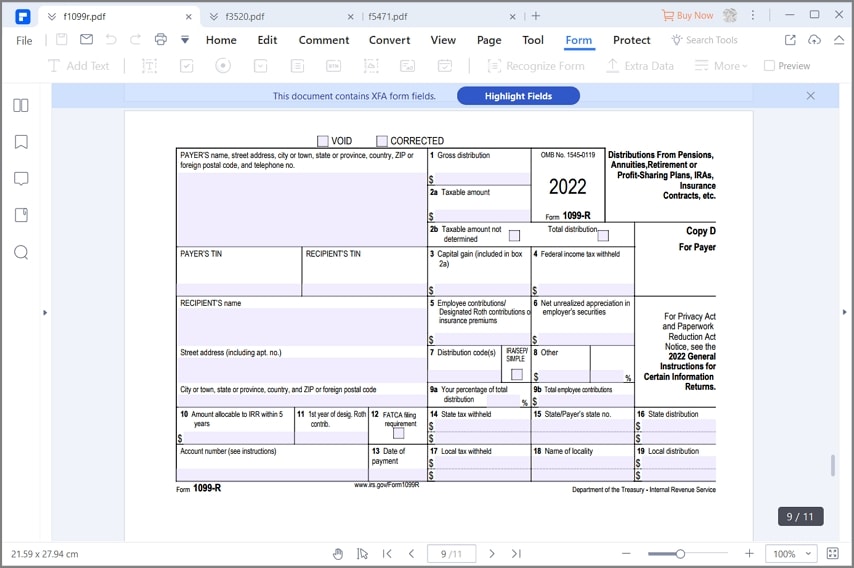

Free Printable 1099 R Form Printable Templates

E file 2022 Form 1099 R Report The Distributions From Pensions

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Types Of 1099 Form 2023 Printable Forms Free Online

Printable 1099 Tax Form Free - Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services