Printable 1099 Tax Forms Free IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

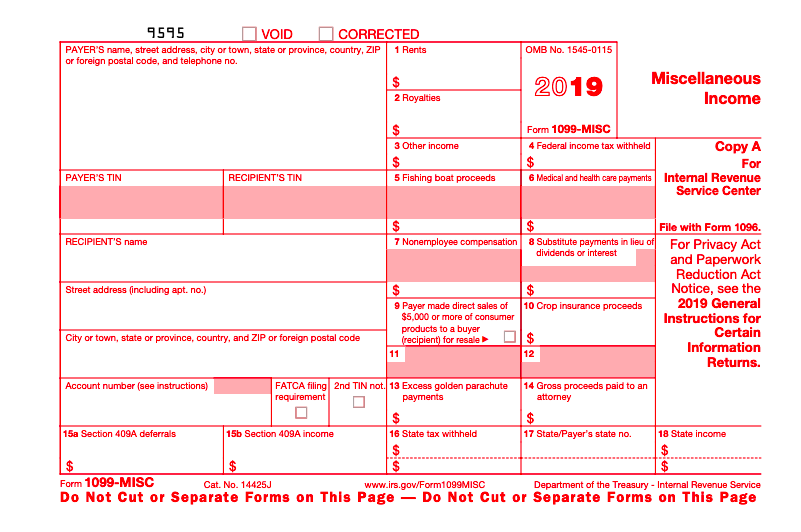

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form 2020 Form 1099 MISC Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

Printable 1099 Tax Forms Free

Printable 1099 Tax Forms Free

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below IR 2023 14 January 25 2023 WASHINGTON The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

More picture related to Printable 1099 Tax Forms Free

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 S Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2019/01/1099-s-fillable-form.jpg

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to Use federal 1099 NEC tax forms to report payments of 600 or more to non employees contractors These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you Learn more about the IRS e filing changes Each kit contains 2023 1099 NEC forms three tax forms per page four free 1096 forms

1099 MISC forms for all purposes are due to the IRS by February 28 2024 or March 31 2024 if you re filing electronically You must issue the form to the recipient by February 15 2024 for gross proceeds paid to attorneys substitute dividends or tax exempt interest payments You should issue all other payments to the recipient by As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

IRS 1099 S 2020 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/456/257/456257951/large.png

https://eforms.com/irs/form-1099/

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

https://eforms.com/irs/form-1099/misc/

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Free 1099 Fillable Form Printable Forms Free Online

What Is A 1099 Misc Form Financial Strategy Center

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Printable 1099 Tax Forms

1099 MISC Form The Ultimate Guide For Business Owners

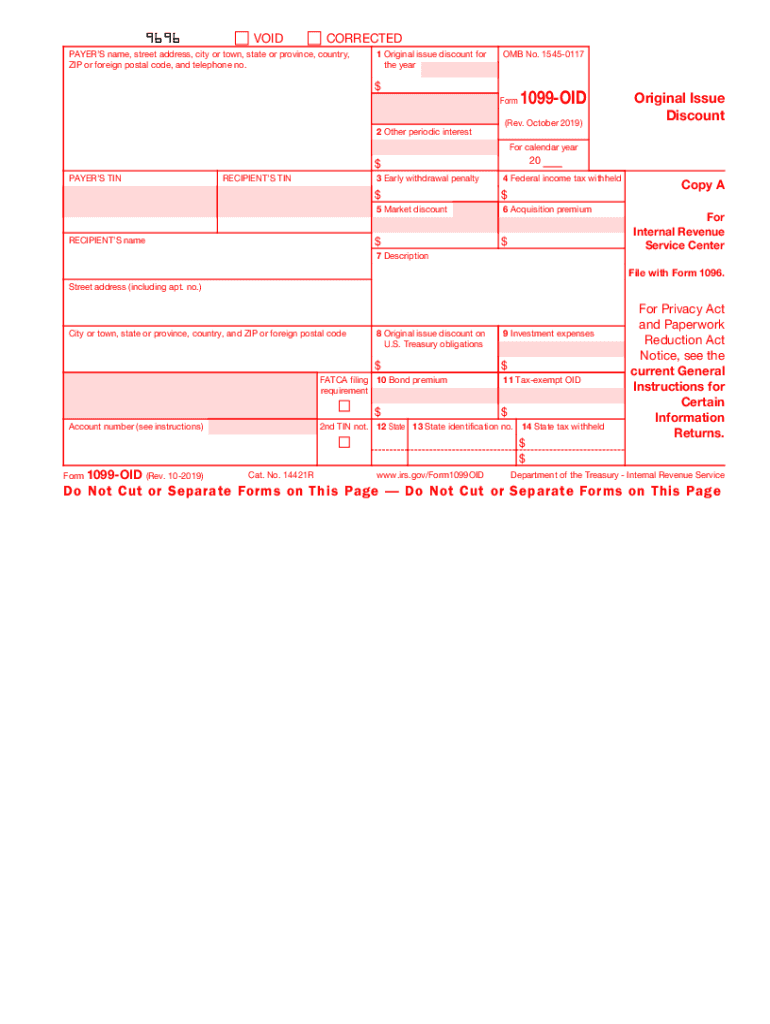

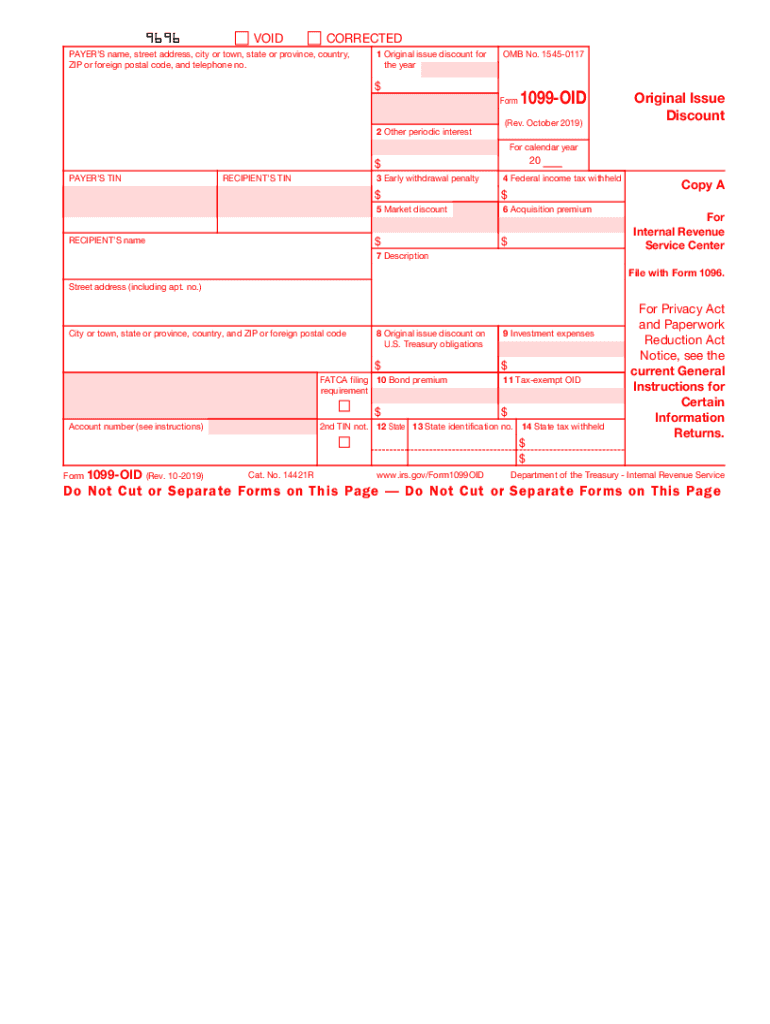

2019 2024 Form IRS 1099 OID Fill Online Printable Fillable Blank PdfFiller

2019 2024 Form IRS 1099 OID Fill Online Printable Fillable Blank PdfFiller

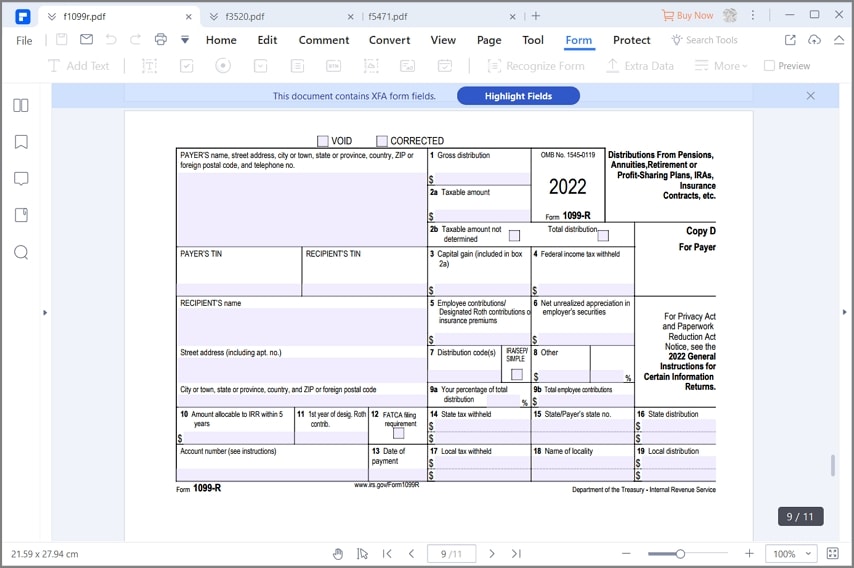

Free Printable 1099 R Form Printable Templates

Printable 1099 Forms Free Download Printable Templates

Fillable Forms Tax Form 1099 Printable Forms Free Online

Printable 1099 Tax Forms Free - Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like