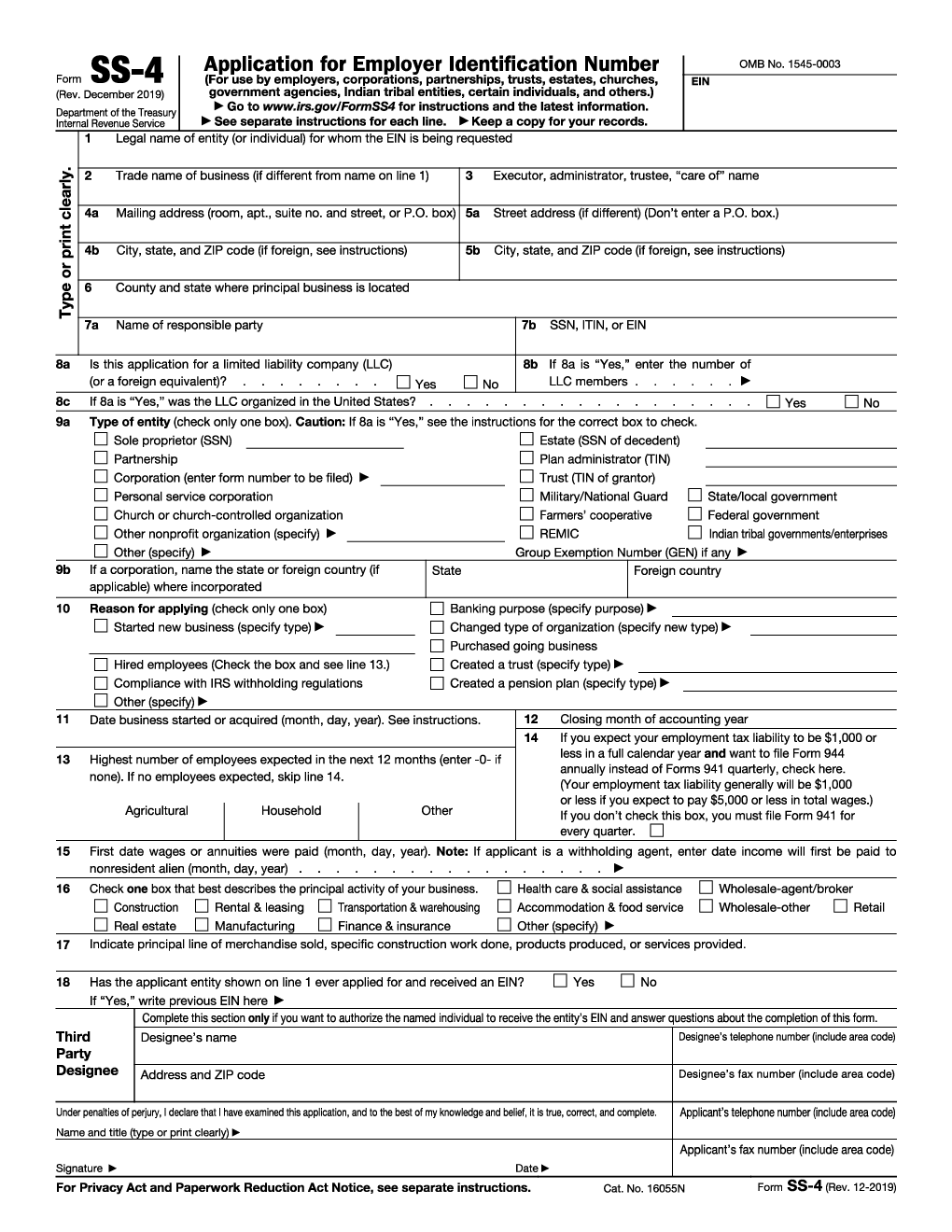

Printable Application For A Federal Tax Id Number Form Form SS 4 Rev December 2023 9a Type of entity check only one box Caution If 8a is Yes see the instructions for the correct box to check

The Internet EIN application is the preferred method for customers to apply for and obtain an EIN Once the application is completed the information is validated during the online session and an EIN is issued immediately File your 2023 federal tax return online for free directly with the IRS Direct File pilot if you re eligible Get your EIN online without calling mailing or faxing a paper Form SS 4 Application for Employer Identification Number Online Tax Calendar Track important business tax dates and deadlines right from your desktop

Printable Application For A Federal Tax Id Number Form

Printable Application For A Federal Tax Id Number Form

https://i.pinimg.com/originals/ce/76/b8/ce76b82a32c3c76e945647c14d6a93b2.jpg

How Can I Find My Itin Number Locate Copies Of Previous Years Tax Returns Srkuwszirzkpv

https://tax-expatriation.com/wp-content/uploads/2015/05/irs-form-w-7-highlighted.png

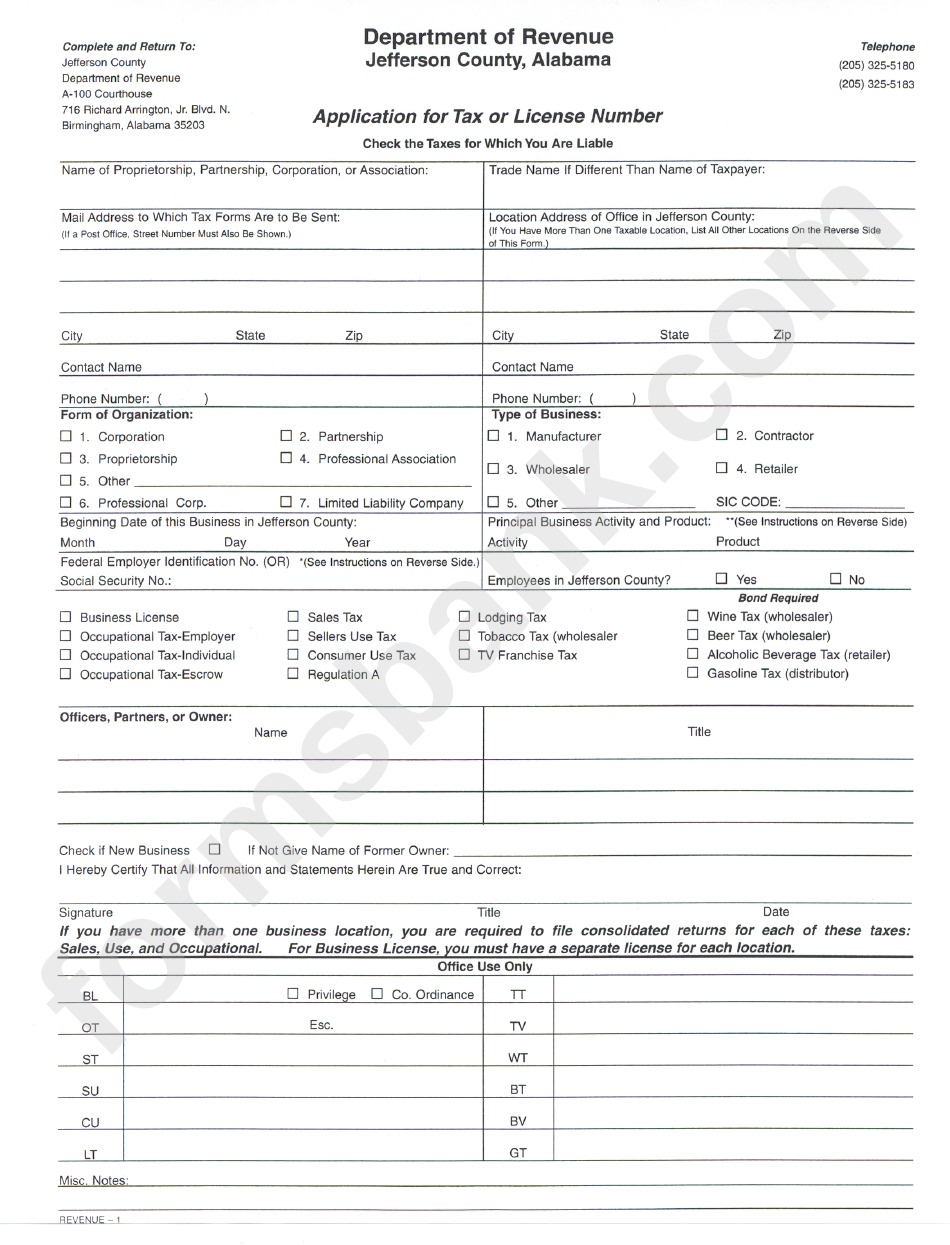

Application For Tax Of License Number Form 2001 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/245/2454/245476/page_1_bg.png

When you form a business entity such as an LLC you may need to apply for a federal tax ID number also known as an employer identification number EIN to hire employees file taxes pay taxes open a business bank account and complete other business tasks This nine digit number is similar to a Social Security number and is issued by the Call 267 941 1099 not a toll free number from 6 00 a m to 11 00 p m ET Monday through Friday The person calling must be authorized to receive the EIN and can answer the questions on IRS Form SS 4 Application for Employer Identification Number It s helpful to fill out the form before calling because the IRS employee will need that

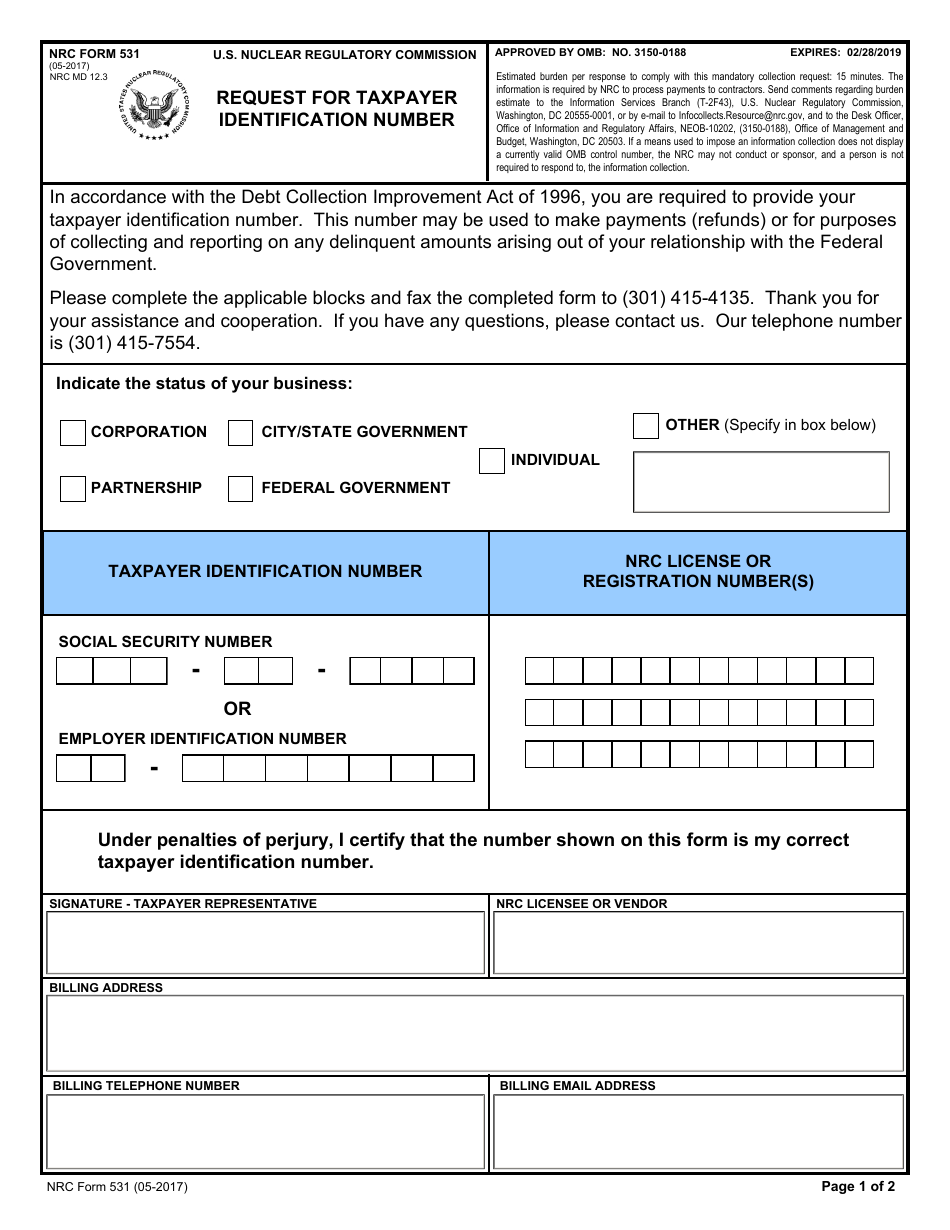

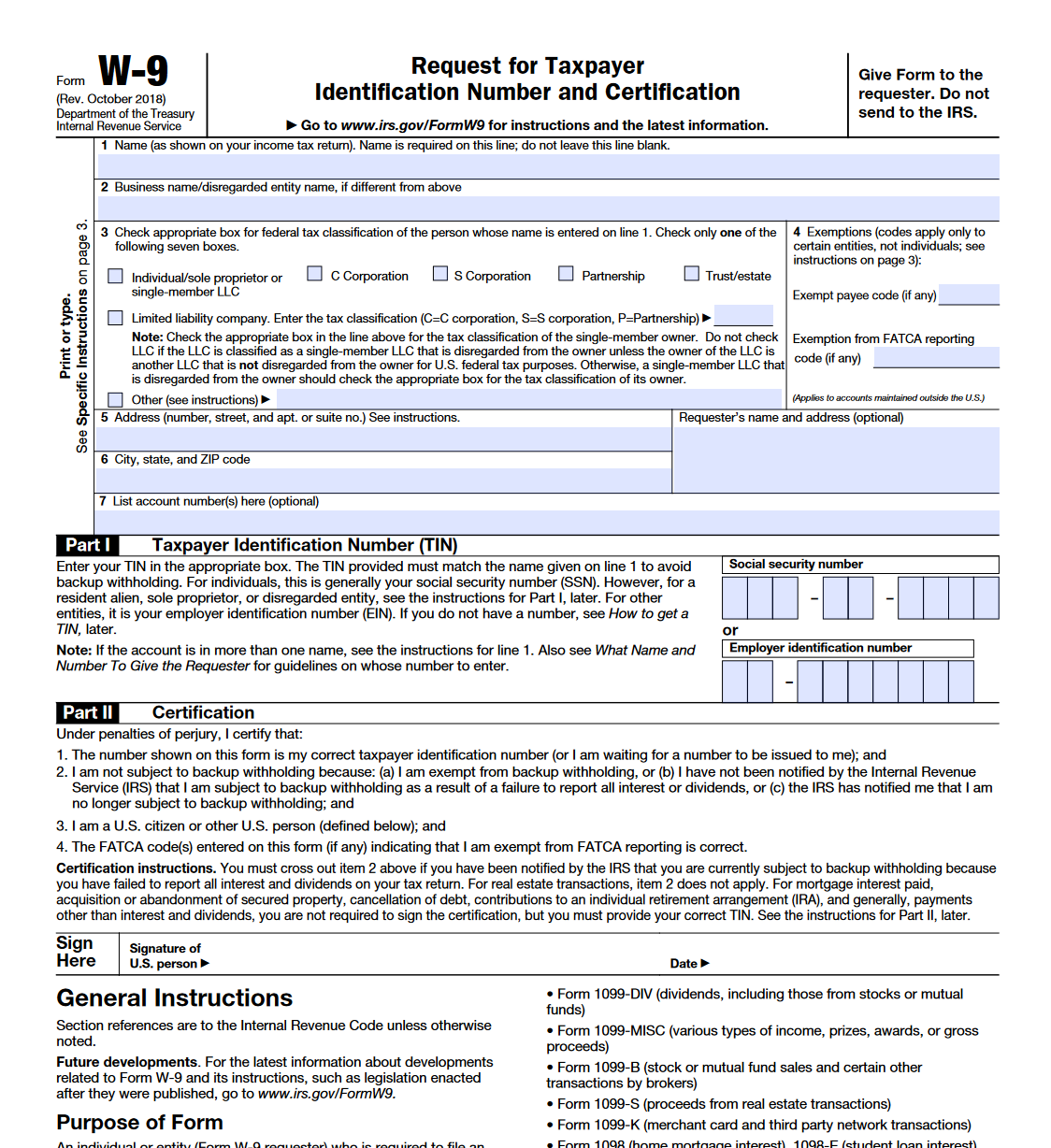

Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return Form W 4 Employee s Withholding Certificate Form 941 Employer s Quarterly Federal Tax Return Form W 2 Employers engaged in a trade or business who pay compensation You or your spouse must have a 2023 Form W2 Wage and Foreign issuers that do not have a tax or federal identification number should enter 00 0000000 After you have saved the application print the Form ID by selecting the PRINT icon at the top of the Form ID page You can verify that all information is accurate through the print preview screen

More picture related to Printable Application For A Federal Tax Id Number Form

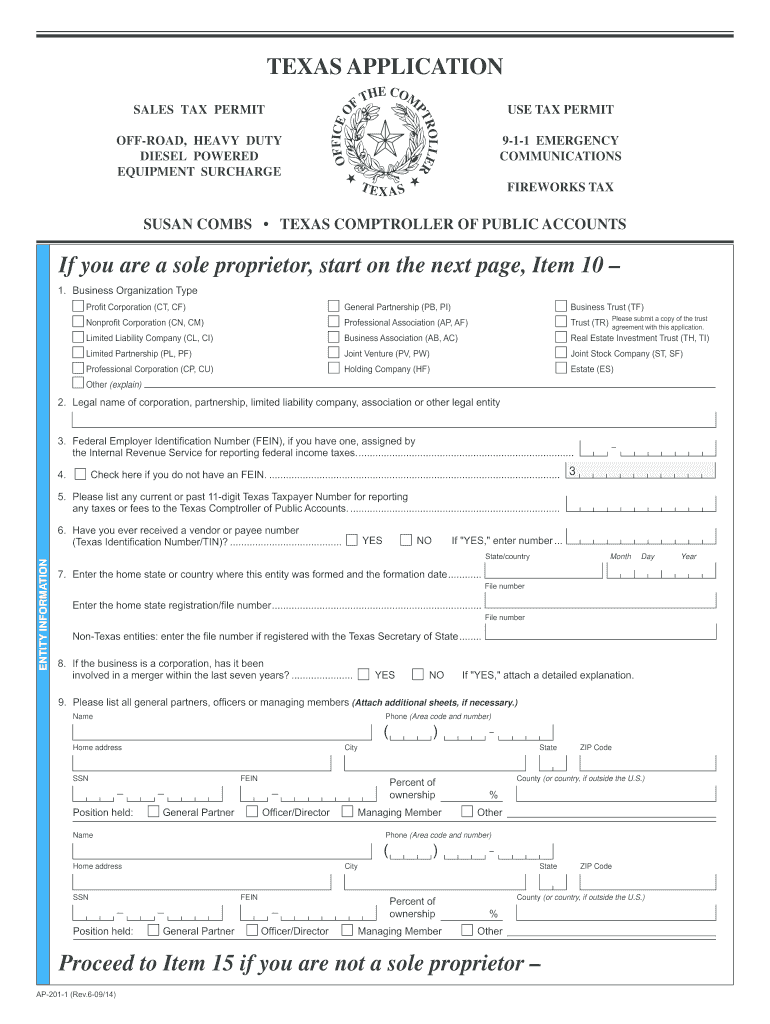

Tax Id Number Texas Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/42/816/42816067/large.png

Free Printable State Tax Forms Printable Templates

https://www.pdffiller.com/preview/100/101/100101112/large.png

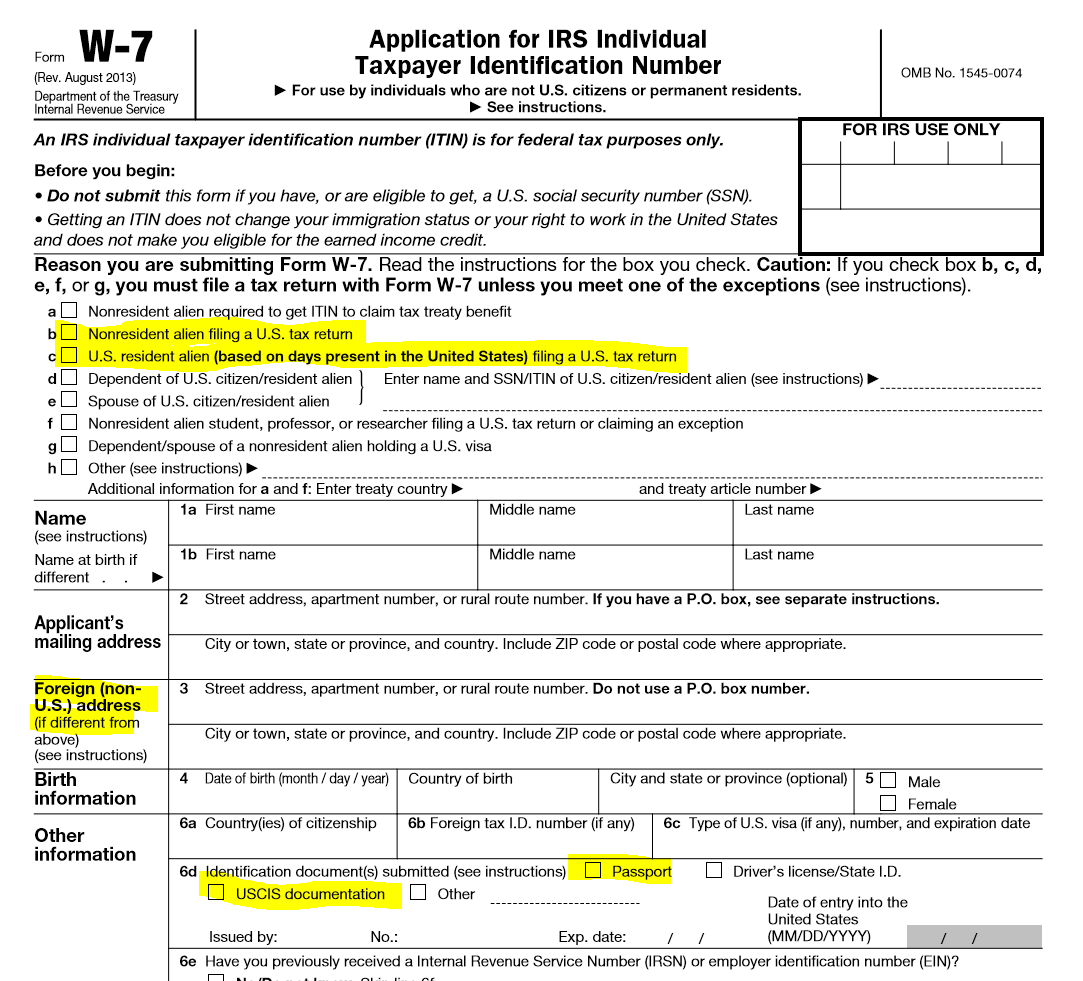

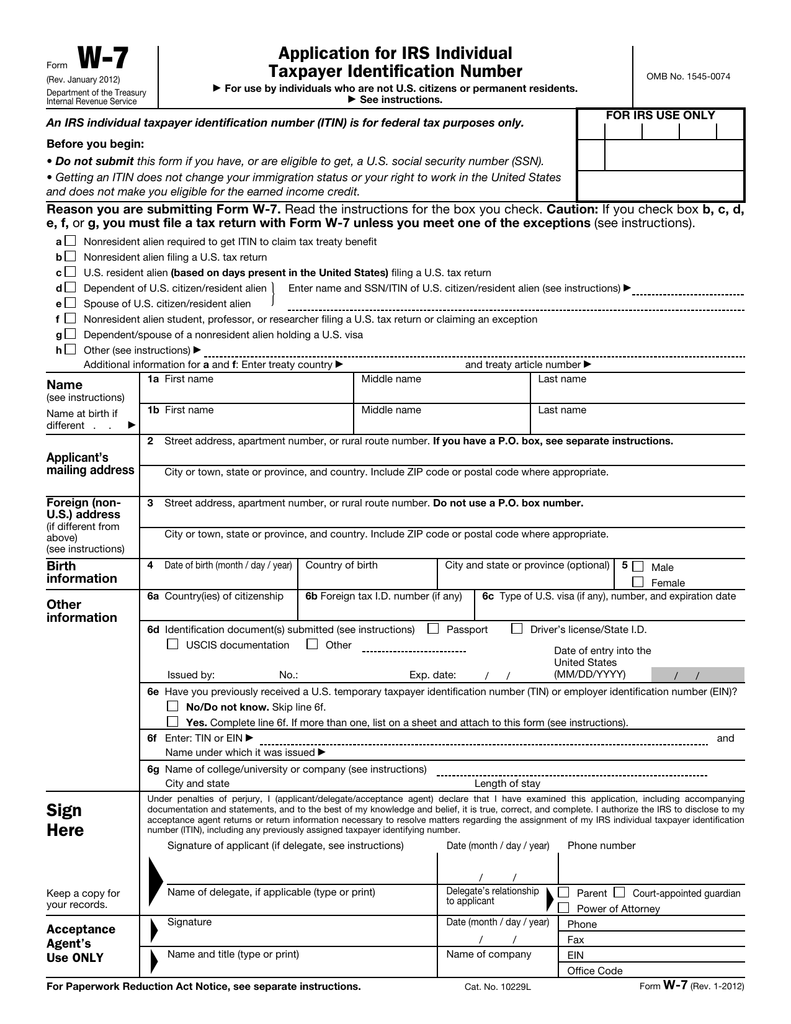

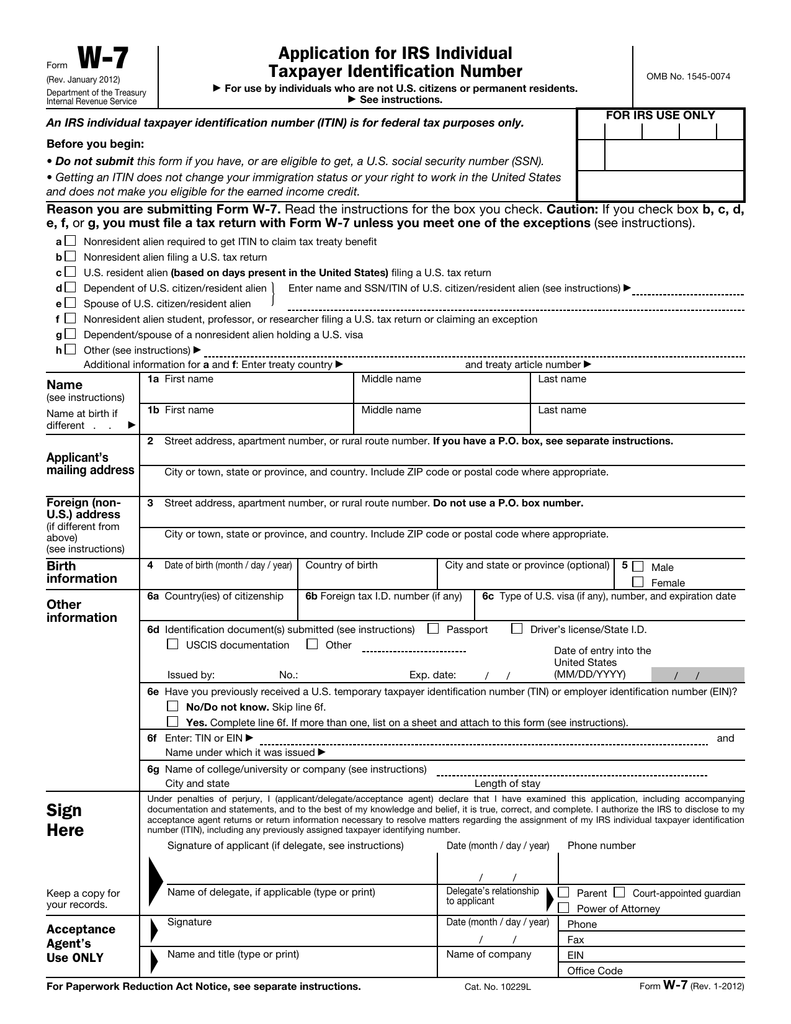

Form W 7 Application For IRS Individual Taxpayer Identification Number

http://image.slidesharecdn.com/1271391/95/form-w7application-for-irs-individual-taxpayer-identification-number-1-728.jpg?cb=1239338217

The Federal Employer Identification Number EIN Application otherwise known as IRS Form SS 4 is an official document used to request a Federal EIN Essentially you apply through Form SS 4 to obtain a unique nine digit number that can be considered the Social Security number for your business entity Purpose of the SS 4 Form Your Employer Identification Number EIN is your federal tax ID You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits It s free to apply for an EIN and you should do it right after you register your business Your business needs a federal tax ID number if it does any of the following

The number of members in the LLC changes from a single member to more than one member A sole proprietor files papers to become a state recognized entity organizes as an LLC and will file Form 8832 or Form 2553 to elect to be treated as a disregarded entity or taxed as a corporation or small business corporation Application for IRS Individual Taxpayer Identification Number Form W 7 Rev August 2019 W 7 Application for IRS Individual Taxpayer Identification Number Form Rev August 2019 Department of the Treasury Internal Revenue Service OMB No 1545 0074 For use by individuals who are not U S citizens or permanent residents See separate instructions

Form W 7 Application For IRS Individual Taxpayer Identification Number 2013 Free Download

https://www.formsbirds.com/formimg/tax-support-document/8181/form-w-7-application-for-irs-individual-taxpayer-identification-number-2013-l1.png

NRC Form 531 Download Fillable PDF Or Fill Online Request For Taxpayer Identification Number

https://data.templateroller.com/pdf_docs_html/1742/17423/1742314/nrc-form-531-request-taxpayer-identification-number_print_big.png

https://www.irs.gov/pub/irs-pdf/fss4.pdf

Form SS 4 Rev December 2023 9a Type of entity check only one box Caution If 8a is Yes see the instructions for the correct box to check

https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

The Internet EIN application is the preferred method for customers to apply for and obtain an EIN Once the application is completed the information is validated during the online session and an EIN is issued immediately

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Form W 7 Application For IRS Individual Taxpayer Identification Number 2013 Free Download

Business Federal Tax Id Number Employer Identification Number Non Profit Organization Tax Id

Form SS 4 Application For Employer Identification Number 2010 Free Download

Cara Mendapatkan Tax Identification Number

W 7 Application For IRS Individual Taxpayer Identification Number

W 7 Application For IRS Individual Taxpayer Identification Number

IRS Form W 9 Request For Taxpayer Identification Number And Certification Forms Docs 2023

IRS Form SS 4 Application For Employer Identification Number EIN Forms Docs 2023

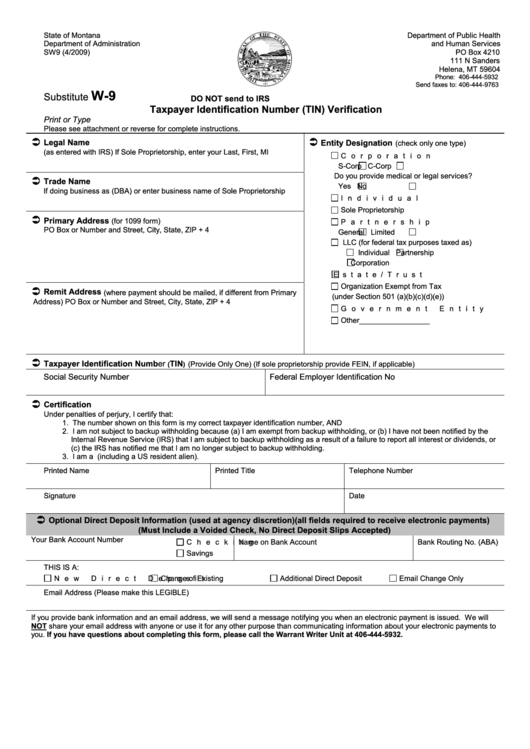

Fillable Taxpayer Identification Number Tin Verification Printable Pdf Download

Printable Application For A Federal Tax Id Number Form - 1 Apply for an EIN if you need one to report estate income on IRS Form 1041 This is the most common reason to apply for an EIN for an estate