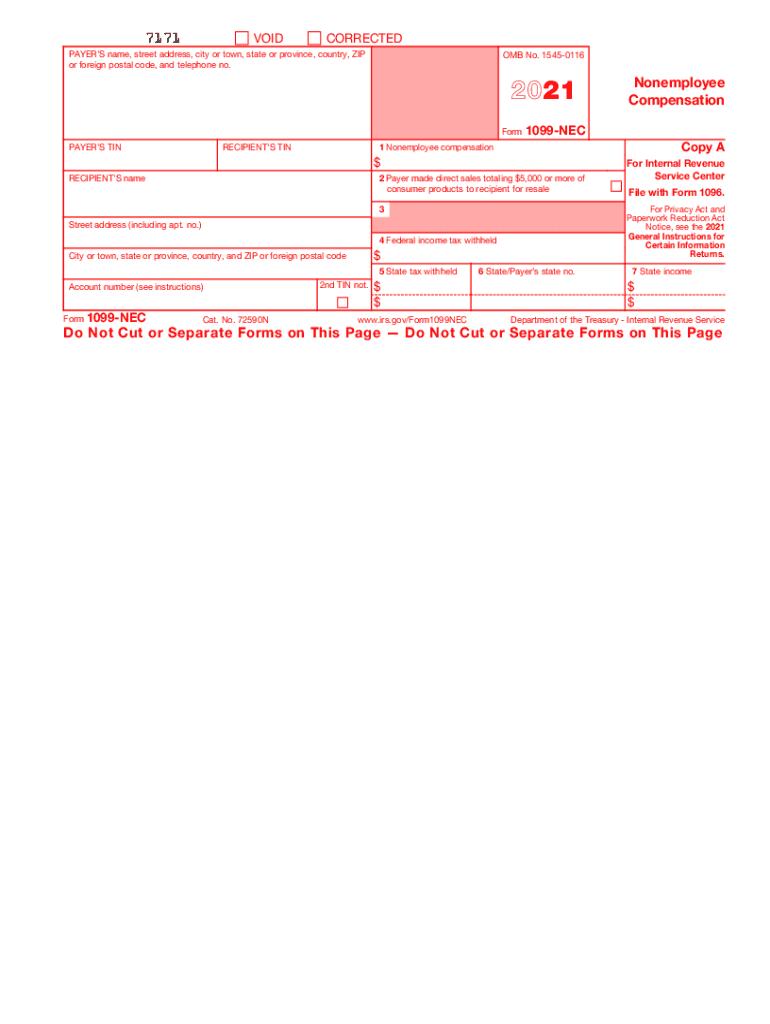

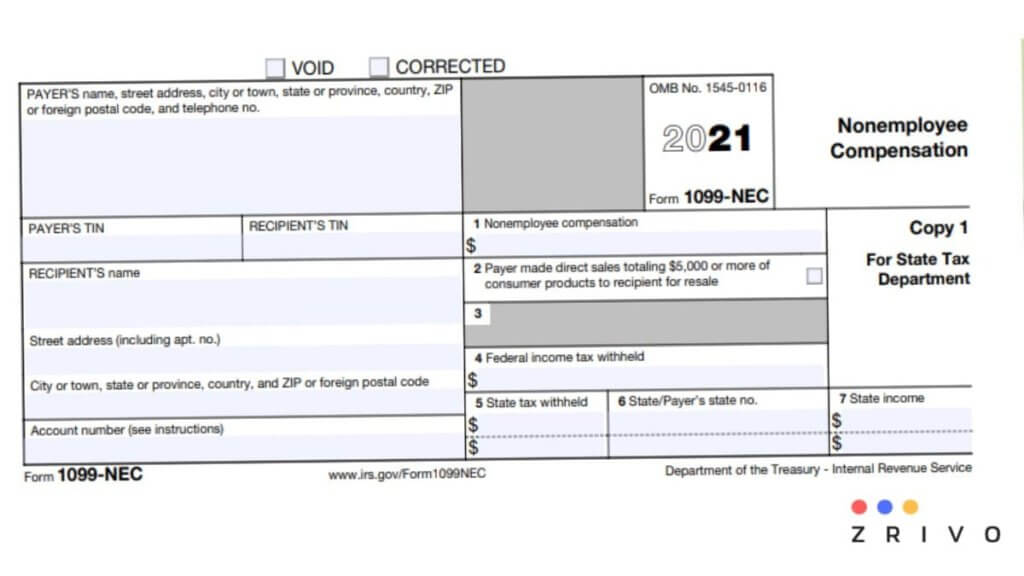

Printable Blank 1099 Nec Form A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

1099 3921 or 5498 that you print from the IRS website Due dates Furnish Copy B of this form to the recipient by January 31 2022 File Copy A of this form with the Form 1099 NEC call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free Persons with a hearing or speech Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding

Printable Blank 1099 Nec Form

Printable Blank 1099 Nec Form

https://www.pdffiller.com/preview/533/156/533156765/large.png

Printable Form 1099 Nec

https://www.chortek.com/wp-content/uploads/2019/08/1099-nec-2020-draft.png

1099 NEC Editable PDF Fillable Template 2022 With Print And Clear Buttons Courier Font Etsy

https://i.etsystatic.com/25616924/r/il/53e8da/4486482592/il_1080xN.4486482592_n0gk.jpg

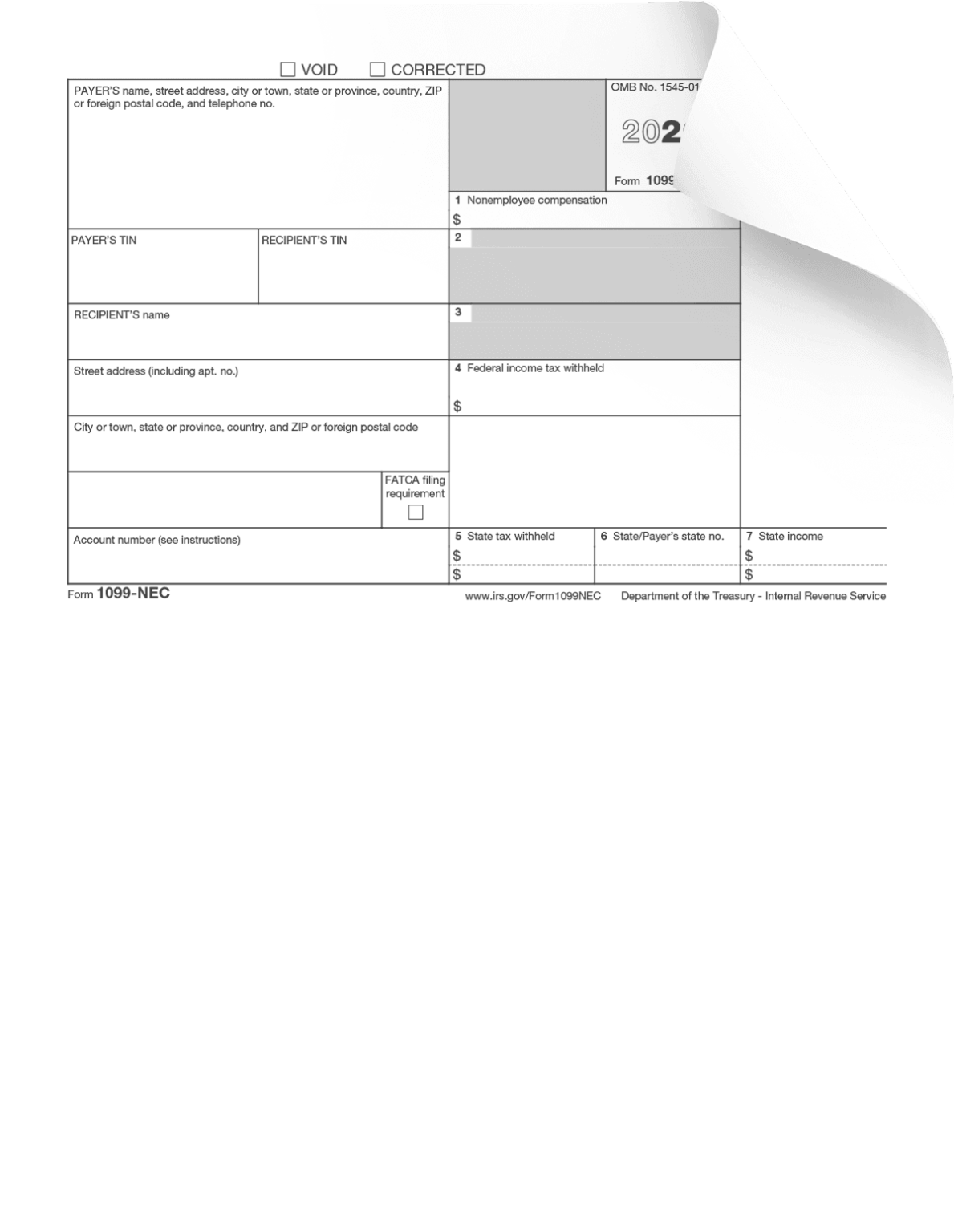

What is Form 1099 NEC This tax season millions of independent workers will receive Form 1099 NEC in the mail for the first time The 1099 NEC is the new form to report nonemployee compensation that is pay from independent contractor jobs also sometimes referred to as self employment income Use Form 1099 NEC solely to report nonemployee compensation payments of 600 or more you make in the course of your business to individuals who aren t employees Report payments for Services performed by a nonemployee including parts and materials Fish purchased in cash from someone engaged in the trade or business of catching fish

There are a few ways to file 1099 NEC forms including Online You can e file your 1099 NEC Form with the IRS through the Information Returns Intake System IRIS Taxpayer Portal This is a free filing method that allows you to electronically file your 1099 NEC Form as well as apply for extensions make amendments and more The nonemployee compensation reported in Box 1 of Form 1099 NEC is generally reported as self employment income and is usually subject to self employment tax Payments from your trade or business to individuals that aren t reportable on the 1099 NEC form would typically be reported on Form 1099 MISC The IRS provides a more comprehensive list

More picture related to Printable Blank 1099 Nec Form

IRS 1099 NEC 2020 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/488/370/488370241/large.png

Fill Out A 1099 NEC

https://assets.website-files.com/5fbc22d336f673712db66095/5fbc25f076bd933980bbf983_progress-1099nec-img-2x-p-1080.png

Printable Blank 1099 Nec Form Printable World Holiday

https://cdn.hrdirect.com/Images/Products/L0205-1099-NEC-rec-copy-b-sheet_xl.jpg

2023 Pre Printed 1099 MISC Kits Starting at 58 99 Use federal 1099 MISC tax forms to report payments of 600 or more for rents royalties medical and health care payments and gross proceeds paid to attorneys These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you IRS Form 1099 NEC is a document individuals or businesses use to disclose the payments they made to self employed individuals including sole proprietors freelancers and independent contractors for the current tax year Important Considerations Threshold Amount Businesses fill out this form for each individual to whom they pay 600 or more

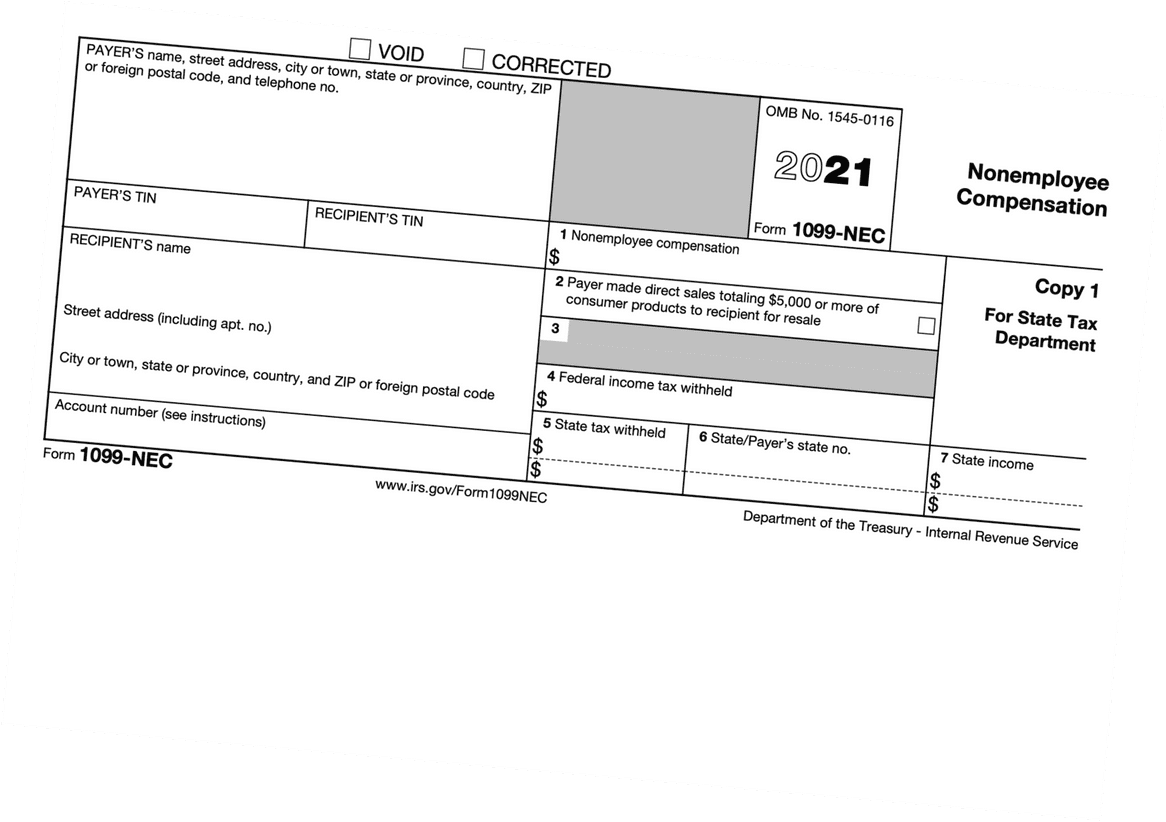

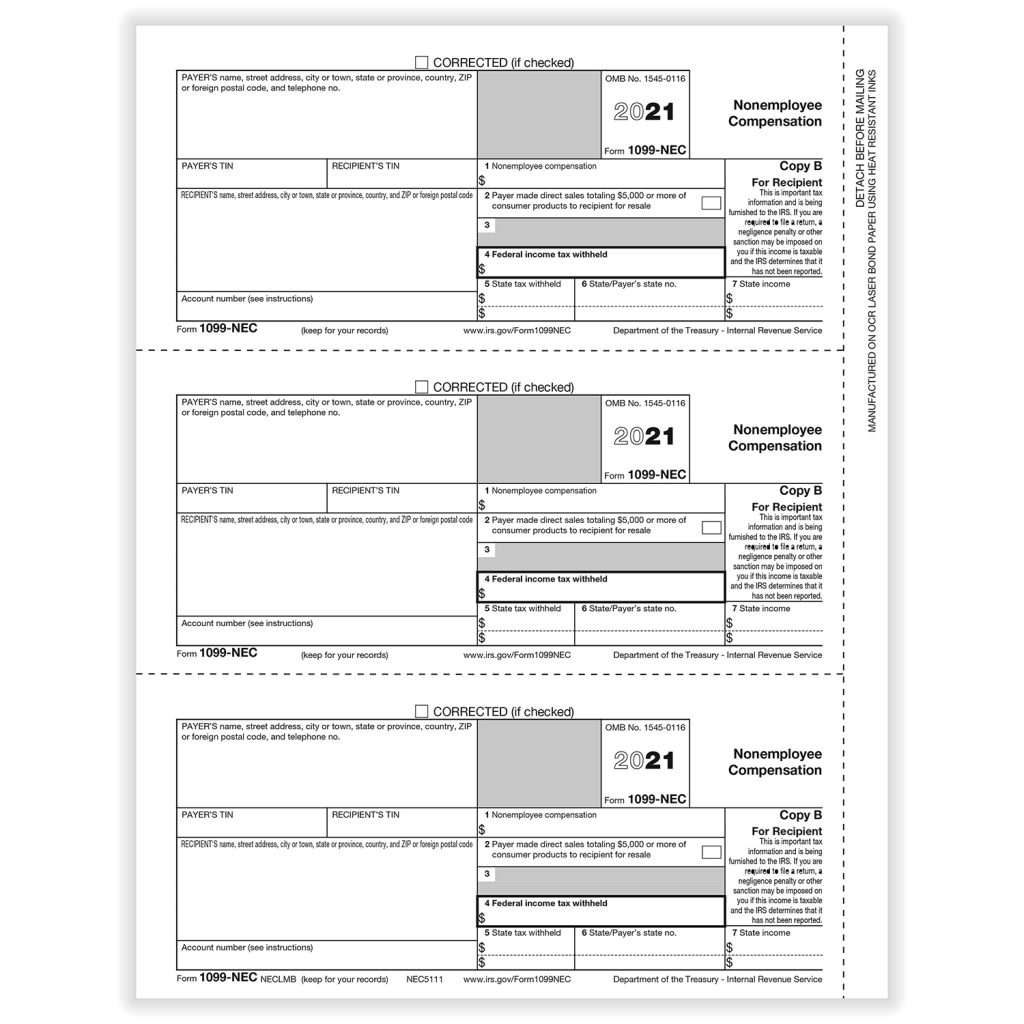

Businesses are required to send copies of Form 1099 NEC to the IRS and contractors if they pay 600 or more in compensation Search for Menu HR Form 1099 NEC is due Jan 31 2024 to report 2023 calendar year payments You can print blank 1099 NEC form copies from the web or fully completed forms from your payroll software many offer Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

How To File Your Taxes If You Received A Form 1099 NEC

https://forst.tax/wp-content/uploads/2020/01/1099-nec.jpg

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://lh5.googleusercontent.com/yfJqNRzKg7JnBlldtckvQFvy5qVRsIS3JJXdwN399u-d9tKmqelmVgCn3xLWUUcMx4jdv8P-xmtjqP9nn5I1cjh5RCpNVbpl5wtQCIu7TiJbknR6nbICGdVDiATvNc1cejqGsiuL

https://eforms.com/irs/form-1099/nec/

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

https://www.irs.gov/pub/irs-prior/f1099nec--2021.pdf

1099 3921 or 5498 that you print from the IRS website Due dates Furnish Copy B of this form to the recipient by January 31 2022 File Copy A of this form with the Form 1099 NEC call the information reporting customer service site toll free at 866 455 7438 or 304 263 8700 not toll free Persons with a hearing or speech

Free Printable 1099 NEC File Online 1099FormTemplate

How To File Your Taxes If You Received A Form 1099 NEC

Fillable 1099 nec Form 2023 Fillable Form 2023

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

Fillable 1099 nec Form 2023 Fillable Form 2023

Printable 1099 Nec Form

Printable 1099 Nec Form

How To Fill Out And Print 1099 NEC Forms

IRS 1099 NEC Income Blank Set 4 part

1099 Nec Form 2021 Printable Get Your Hands On Amazing Free Printables

Printable Blank 1099 Nec Form - In the Choose a filing method window select the Print 1099 NEC or Print 1099 MISC button Specify the date range for the forms then choose OK Select all vendors you wish to print 1099s for Press on the Print 1099 button Select Print 1096s instead if printing form 1096