Printable Business Irs Extension Form English Espa ol Now you can select and download multiple small business and self employed forms and publications or you can call 800 829 3676 to order forms and publications through the mail

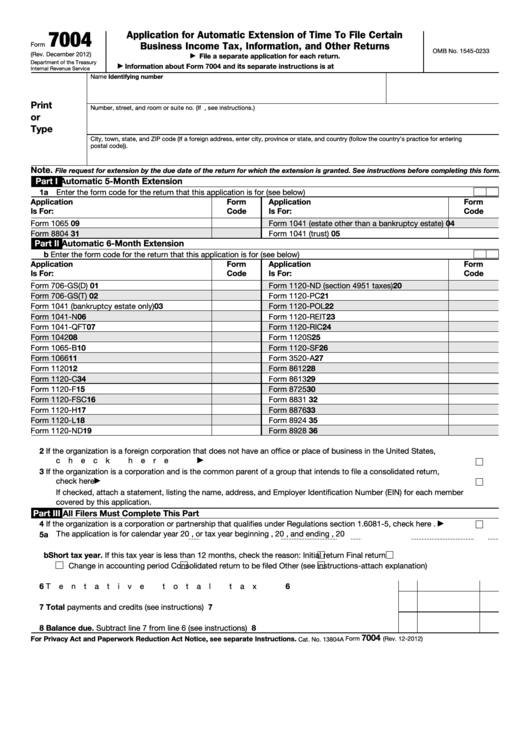

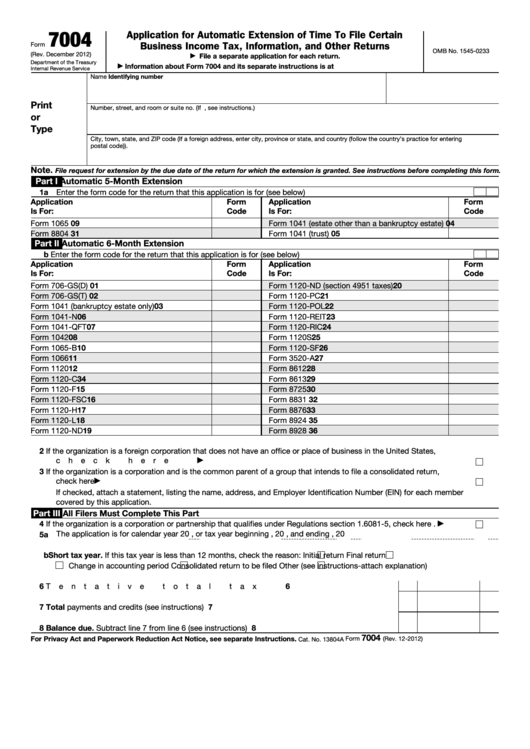

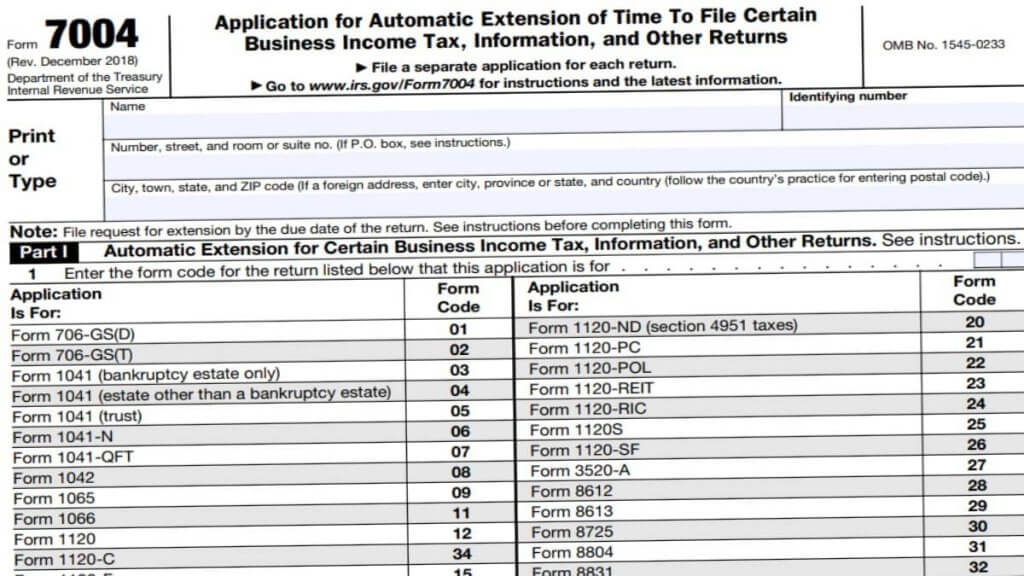

Form 7004 Rev December 2018 7004 Note File request for extension by the due date of the return See instructions before completing this form 2 If the organization is a foreign corporation that does not have an office or place of business in the United States check here Form 8809 Rev August 2020 Application for Extension of Time Form 8809 To File Information Returns Rev August 2020 For Forms W 2 W 2G 1042 S 1094 C 1095 1097 1098 1099 3921 3922 5498 and 8027 OMB No 1545 1081 This form may be filled out online See How to file below

Printable Business Irs Extension Form

Printable Business Irs Extension Form

https://data.formsbank.com/pdf_docs_html/332/3320/332073/page_1_thumb_big.png

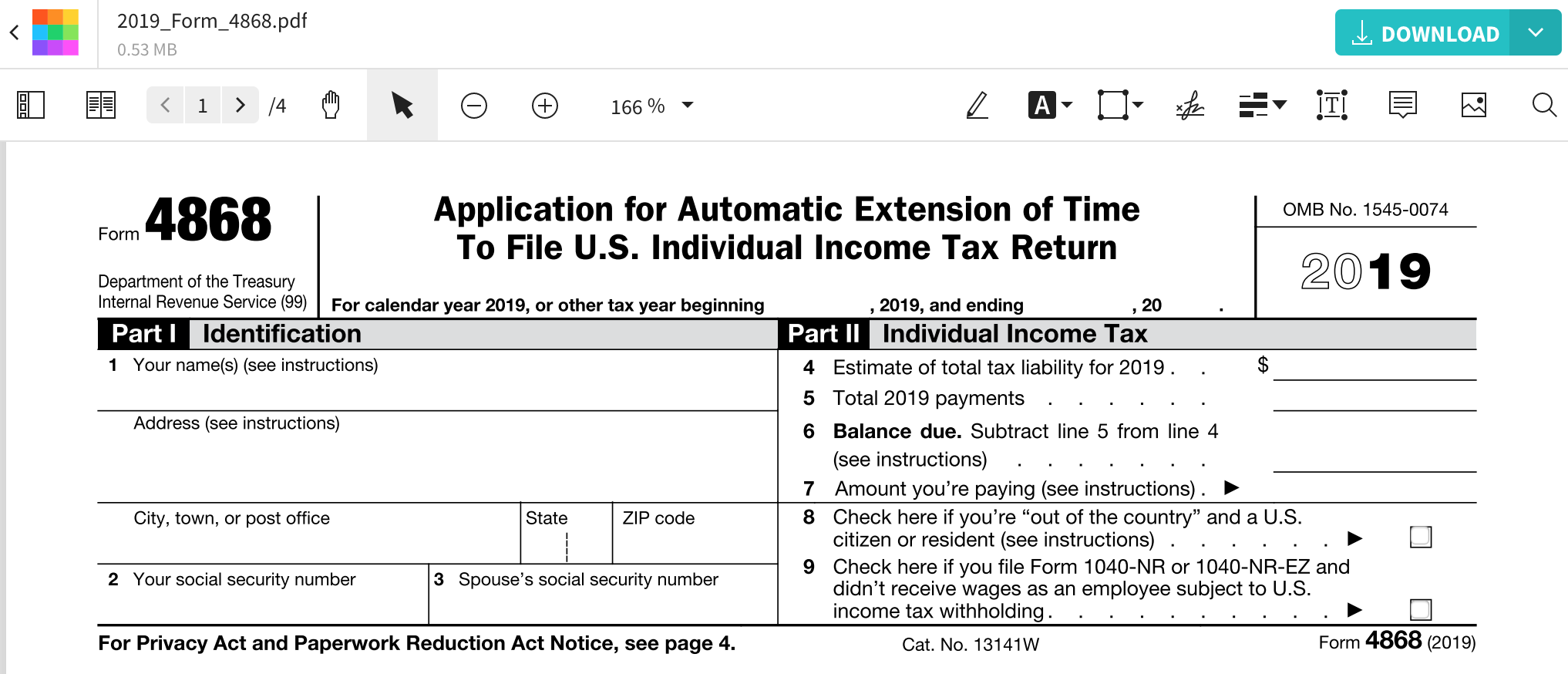

IRS Form 4868 Extension Printable 4868 Form 2023

https://irstax-forms.com/wp-content/uploads/2023/04/IRS-Form-4868-Extension-Printable1024_3-768x994.jpg

4868 Form Form 4868 Application For Automatic Extension Of Time To File U S Individual

https://www.universalnetworkcable.com/wp-content/uploads/2019/02/irs-gov-form-4868-e-file.jpg

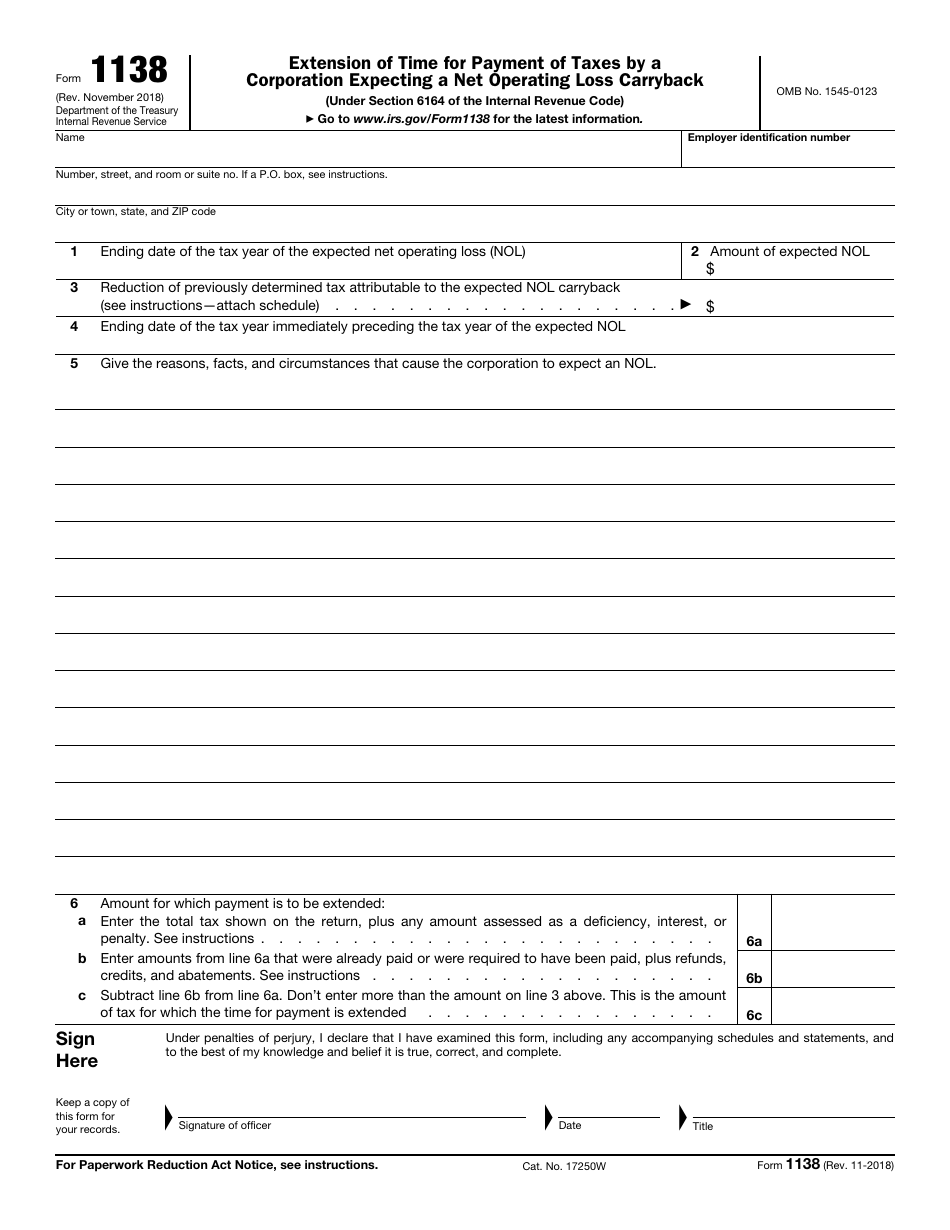

To file a business tax extension use Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns As the name implies IRS Form 7004 is used by various types of businesses to extend the filing deadline on their taxes Form 8725 Excise Tax on Greenmail Form 8831 Excise Taxes on Excess Inclusions of REMIC Residual Interests Form 8876 Excise Tax on Structured Settlement Factoring Transactions Due Dates for Form 7004 Generally Form 7004 must be filed on or before the due date of the applicable tax return

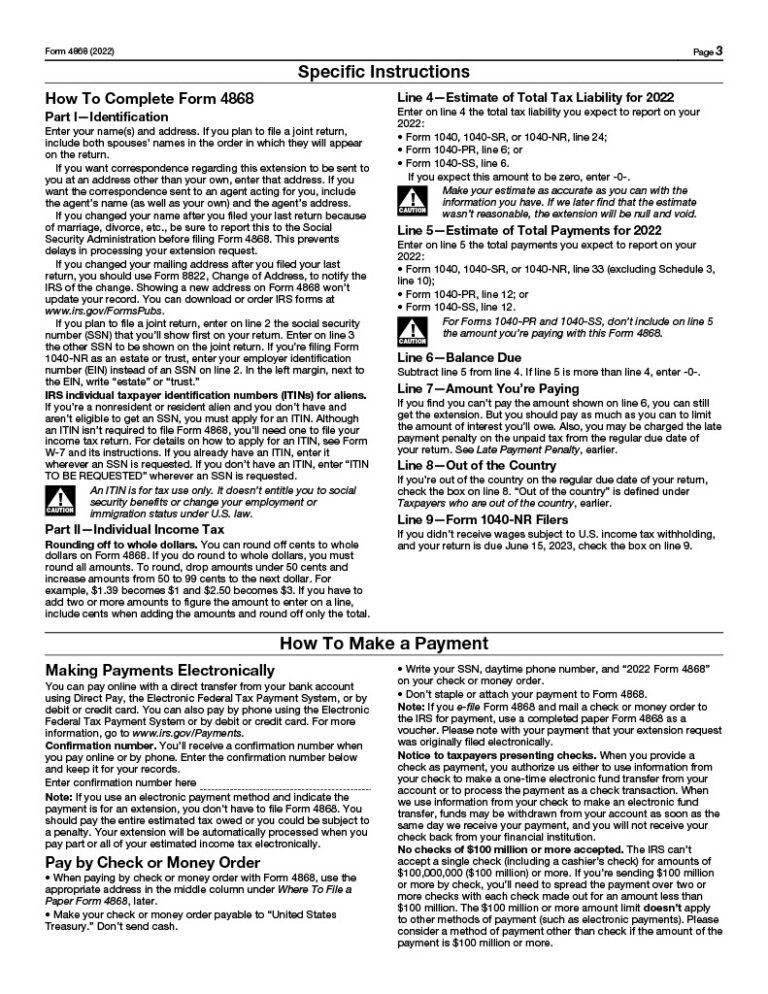

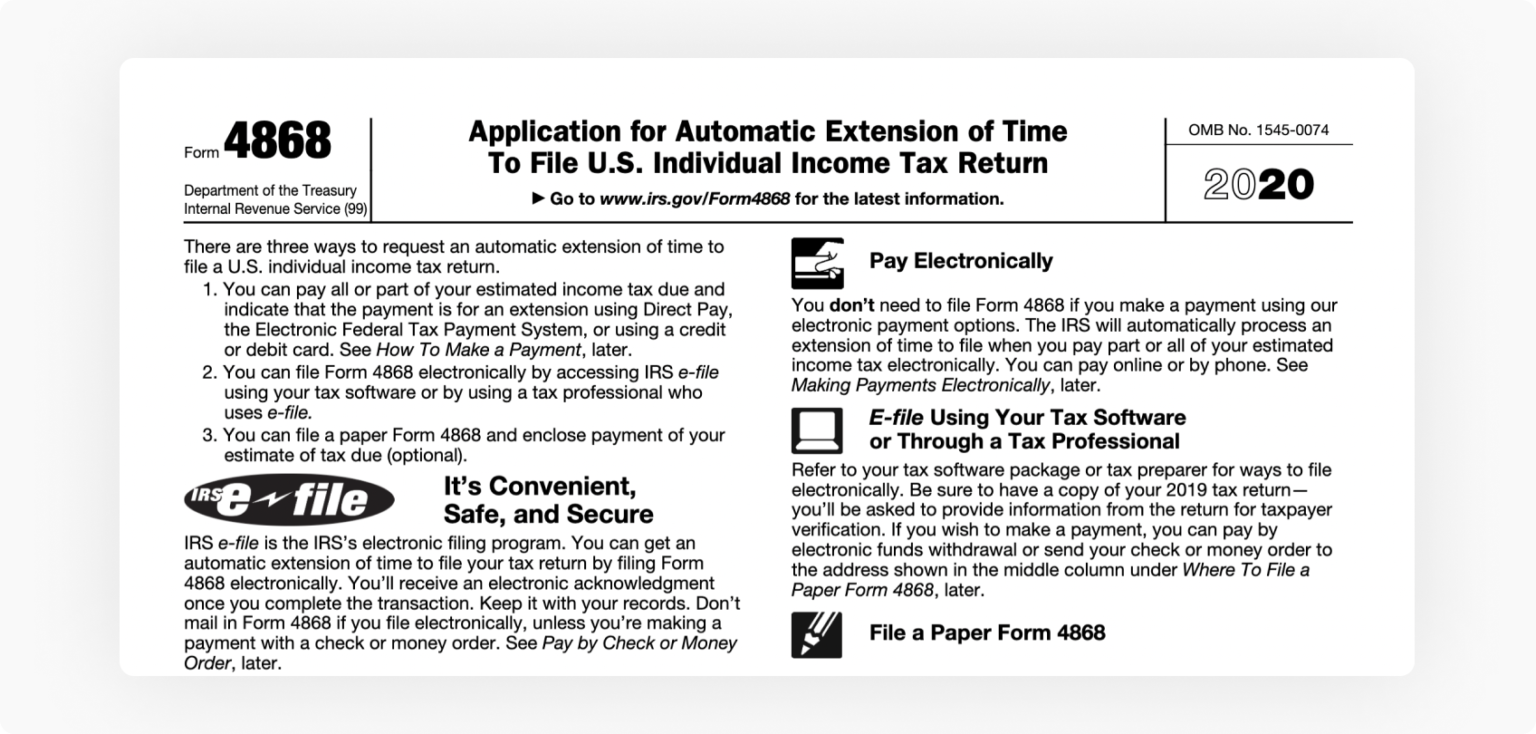

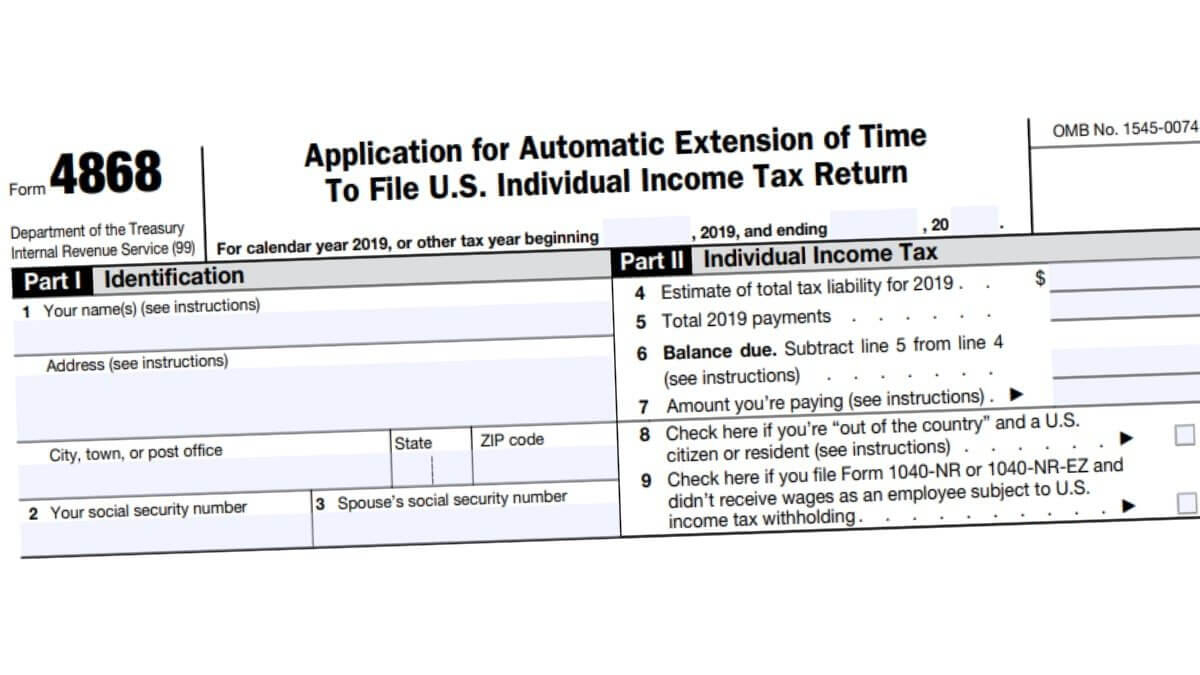

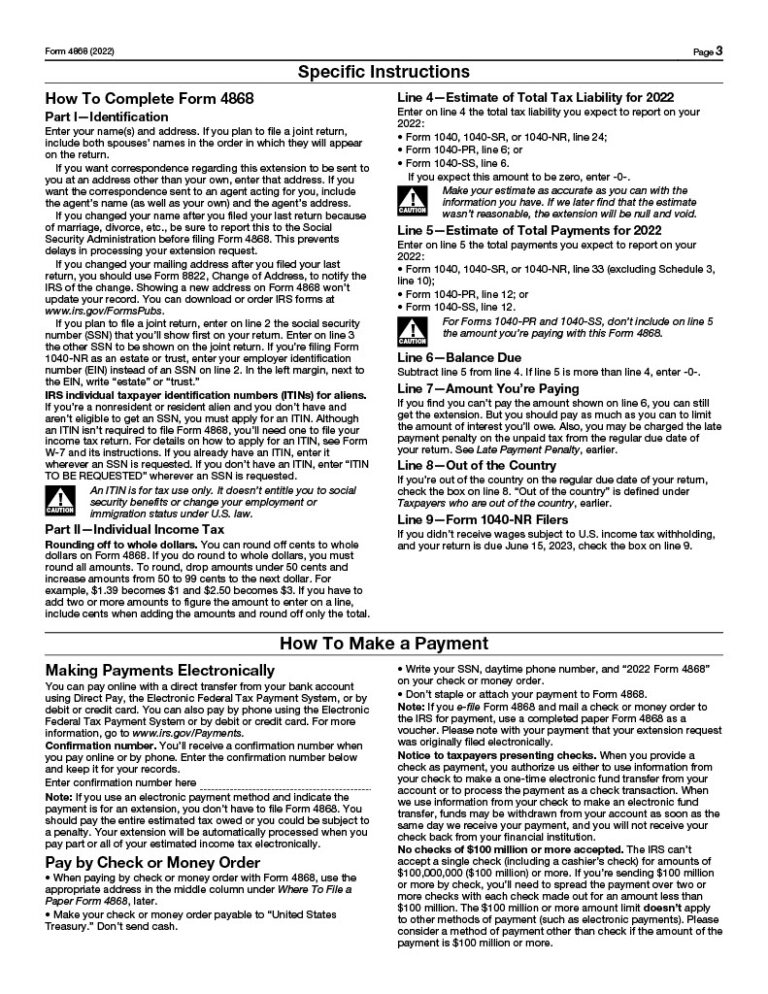

There are three ways to request an automatic extension of time to file a U S individual income tax return 1 You can pay all or part of your estimated income tax due and indicate that the payment is for an extension using your bank account a digital wallet such as Click to Pay PayPal and Venmo cash or a credit or debit card In plain terms Form 7004 is a tax form most business owners can use to request more time to file their business income tax returns To successfully use Form 7004 you ll have to Complete Form 7004 Estimate and pay the taxes you owe File Form 7004 before or on the deadline of the appropriate tax form Make sure you calculate your tax bill

More picture related to Printable Business Irs Extension Form

Irs form 4868 application for automatic extension of time to file individual income tax return

https://blog.pdffiller.com/app/uploads/2021/12/irs-form-4868-application-for-automatic-extension-of-time-to-file-individual-income-tax-return-1536x734.png

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

https://calendargraphicdesign.com/wp-content/uploads/2021/01/4868-form-2021-irs-forms-zrivo.jpg

Form 4868 Fill IRS Extension Form Online For Free Smallpdf

https://images.ctfassets.net/l3l0sjr15nav/3xHaeRZdlL2gHjCebhiefv/a96b2713223cdd3fd72c5ea34b764212/Fill_Form_4868_Smallpdf.png

IRS Form 7004 is the Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns It s used to request more time to file business tax returns for partnerships multiple member LLCs filing as partnerships corporations or S corporations As the name suggests you re guaranteed an extension The form lists the returns that can apply for automatic extensions The IRS grants an automatic five month extension to some businesses such as partnerships and trusts and a six month extension for many more including corporations and S corporations You can file an IRS Form 7004 electronically for most returns

IRS Form 4868 also known as an Application for Automatic Extension of Time to File is a form that taxpayers can submit to the IRS if they need more time to file their tax returns A Whether you need a first time business tax extension or have filed Form 7004 before this article has you covered Introduction to Form 7004 Understanding Business Tax Extensions Print Form 7004 from IRS gov Go to IRS gov forms and search for Form 7004 Select the latest revision and download the printable PDF

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

Irs Extension Form For 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/gQBvYiXclCkiIcOq2ojiOVZGtiU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png

Printable Business Irs Extension Form Printable Forms Free Online

https://image.slidesharecdn.com/irsform7004-130312051912-phpapp01/95/irs-form-7004-automatic-extension-for-business-tax-returns-1-638.jpg?cb=1363065700

https://www.irs.gov/businesses/small-businesses-self-employed/small-business-forms-and-publications

English Espa ol Now you can select and download multiple small business and self employed forms and publications or you can call 800 829 3676 to order forms and publications through the mail

https://www.irs.gov/pub/irs-pdf/f7004.pdf

Form 7004 Rev December 2018 7004 Note File request for extension by the due date of the return See instructions before completing this form 2 If the organization is a foreign corporation that does not have an office or place of business in the United States check here

IRS Income Tax Extension E file Federal Extension

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

Irs Extension Form For 2023 Printable Forms Free Online

Irs Extension Form 2023 Online Printable Forms Free Online

Printable Irs Form 3911 Form Fill Out Sign Online Dochub Images

2016 Extension Form Irs Kopreference

Irs Printable Form For 2016 Extension Form Aslbank

Irs Printable Form For 2016 Extension Form Aslbank

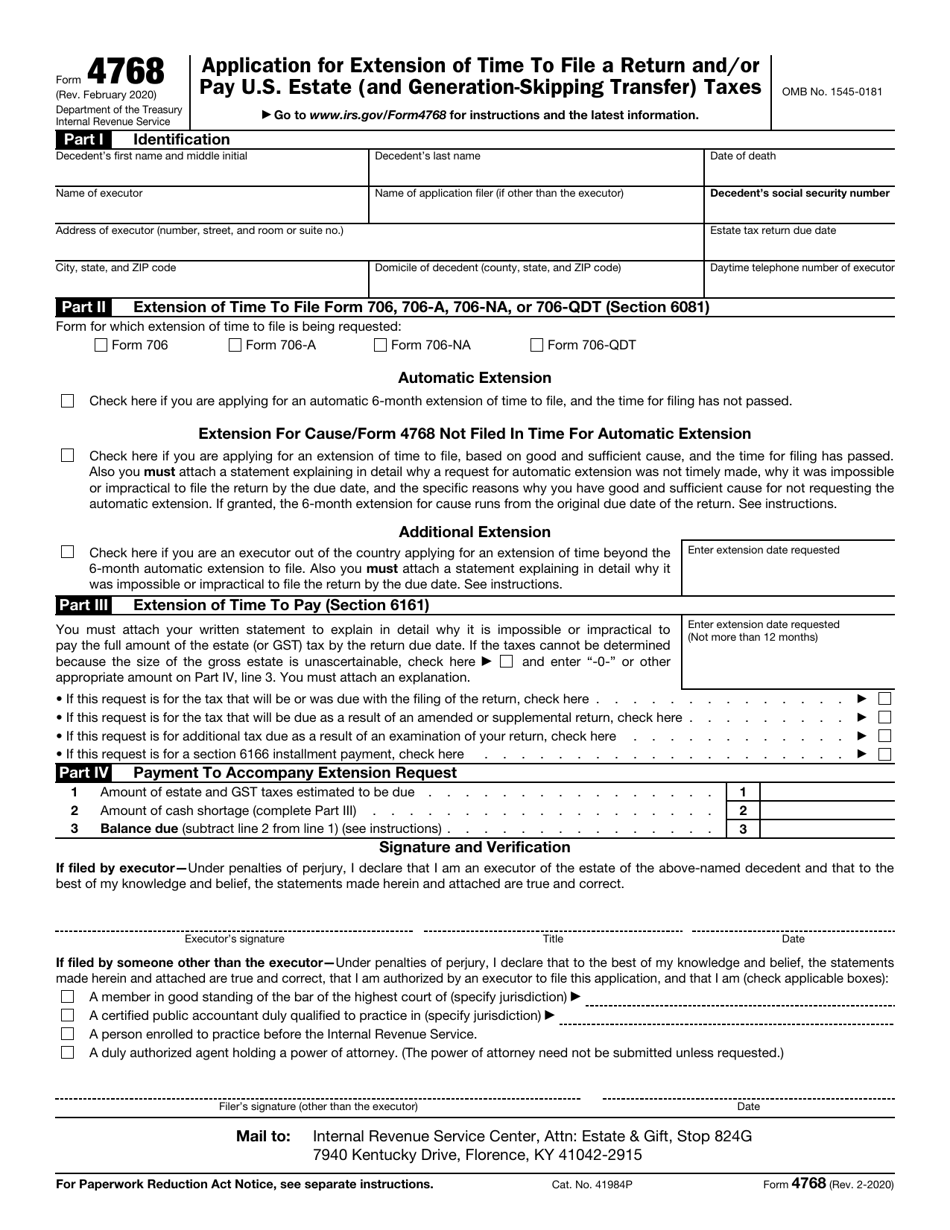

IRS Form 4768 Download Fillable PDF Or Fill Online Application For Extension Of Time To File A

Business Tax Extension 7004 Form 2024

What Is IRS Form 7004

Printable Business Irs Extension Form - If your business is organized as an S corporation or partnership and is a calendar year taxpayer the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year usually March 15th