Printable Copy Of Schedule 2 1040 Form Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file

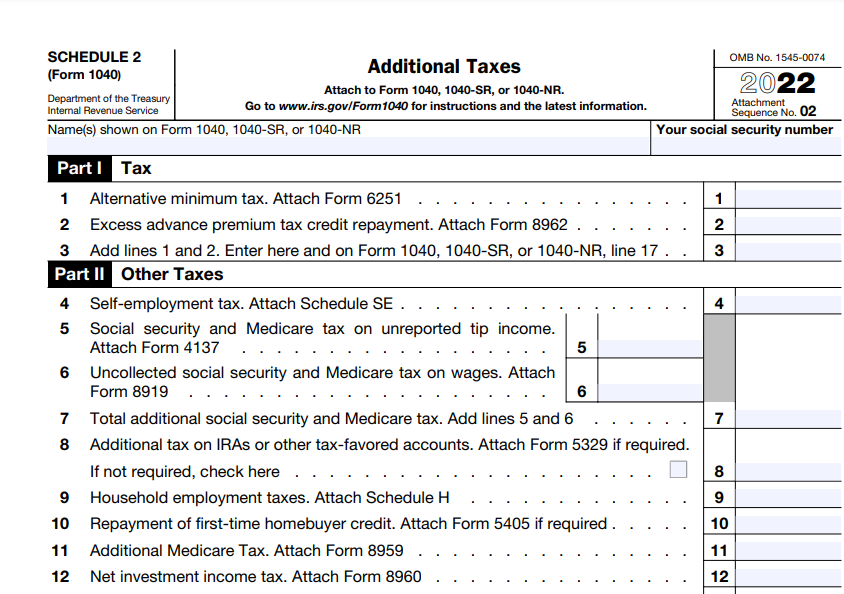

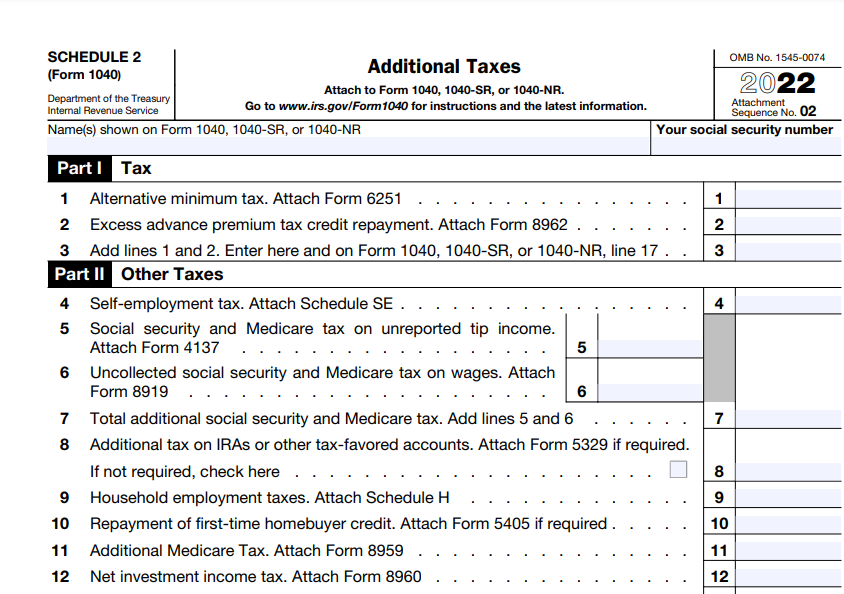

Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media What Is Form 1040 Schedule 2 Form 1040 Schedule 2 Additional Taxes asks that you report any additional taxes that can t be entered directly onto Form 1040 The 2023 Schedule 2 Instructions are not published as a separate booklet

Printable Copy Of Schedule 2 1040 Form

Printable Copy Of Schedule 2 1040 Form

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)

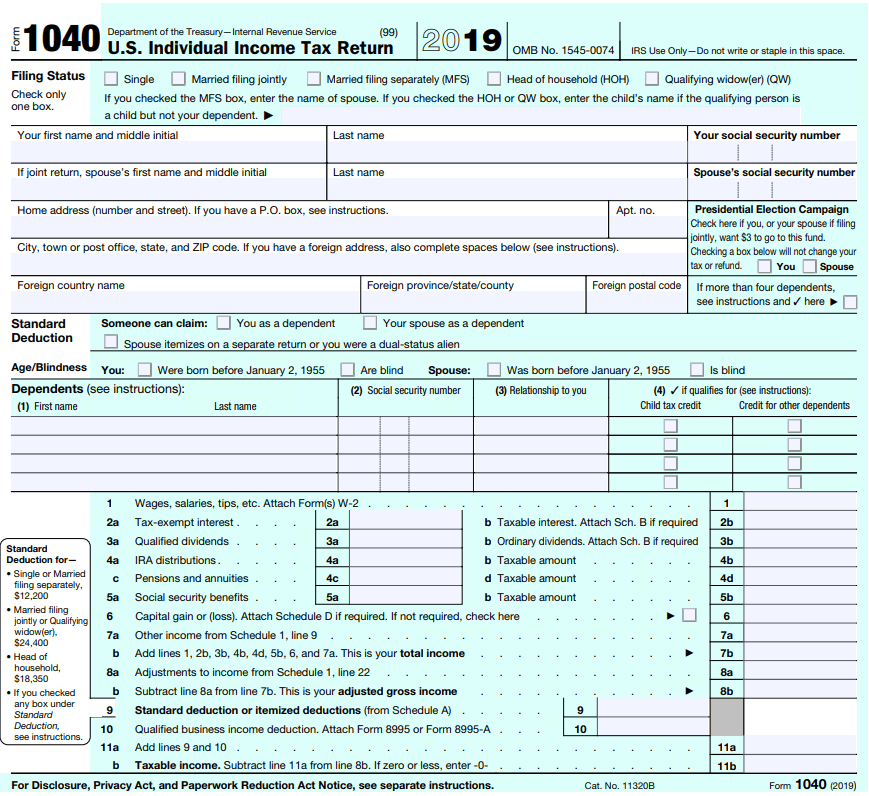

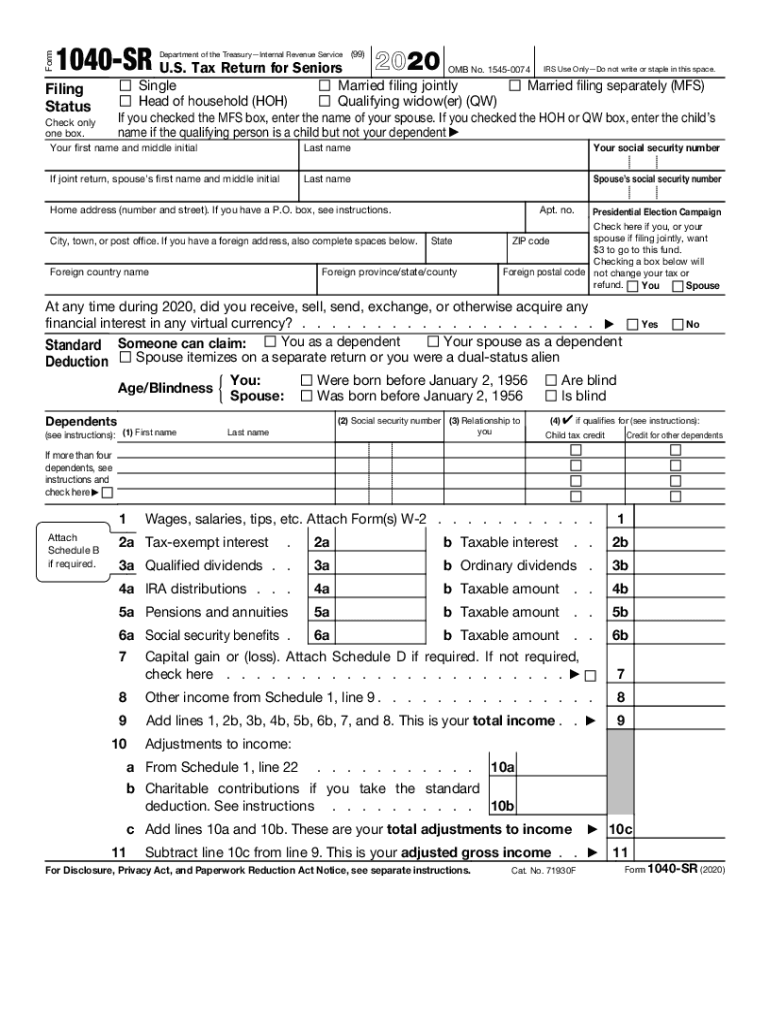

Formulaire 1040 SR Les Personnes g es Re oivent Un Nouveau Formulaire Fiscal Simplifi

https://www.investopedia.com/thmb/zbJjzYaZ7NOhDjEqqr_Sy9Ho_fI=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png

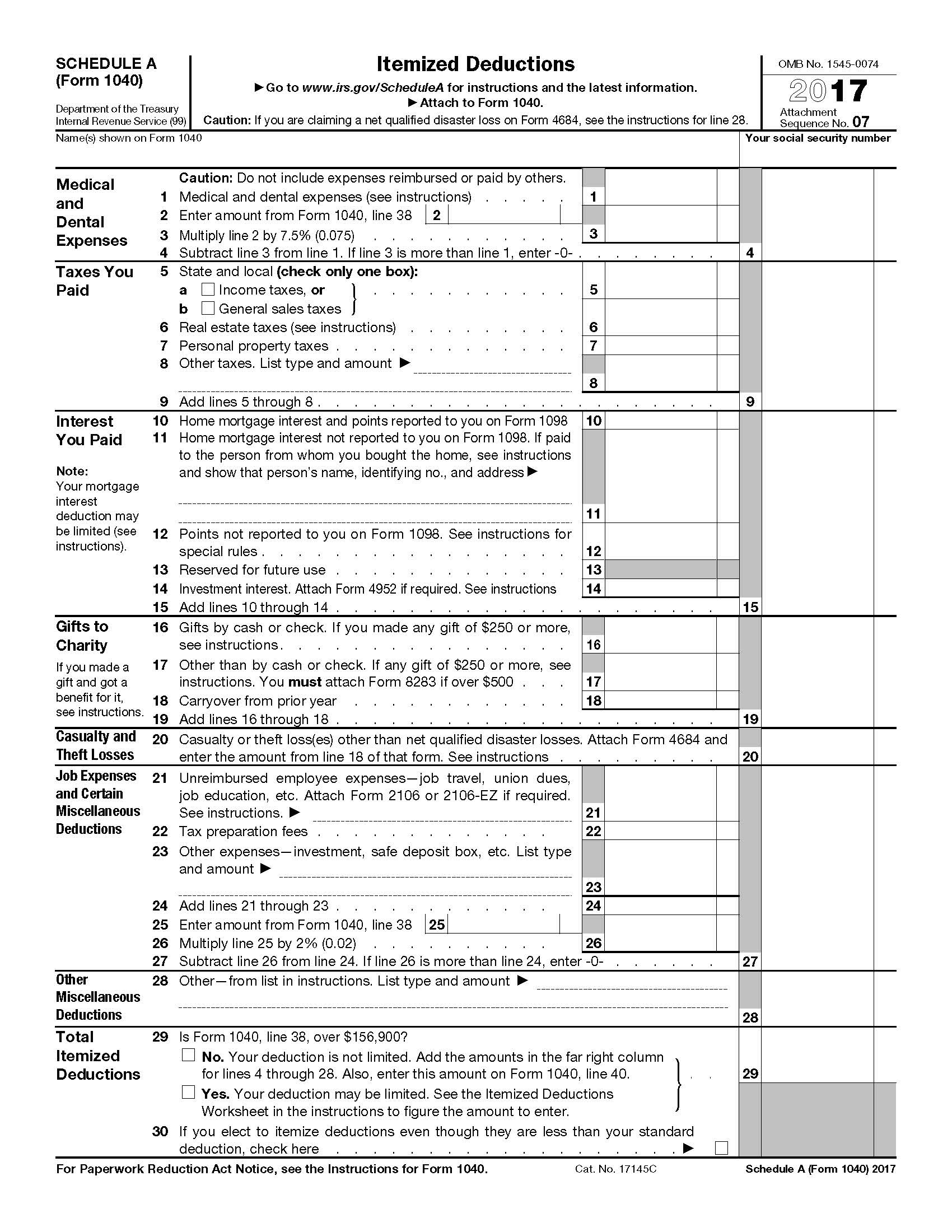

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/2017-irs-tax-forms-1040-schedule-a-itemized-deductions-53.jpg

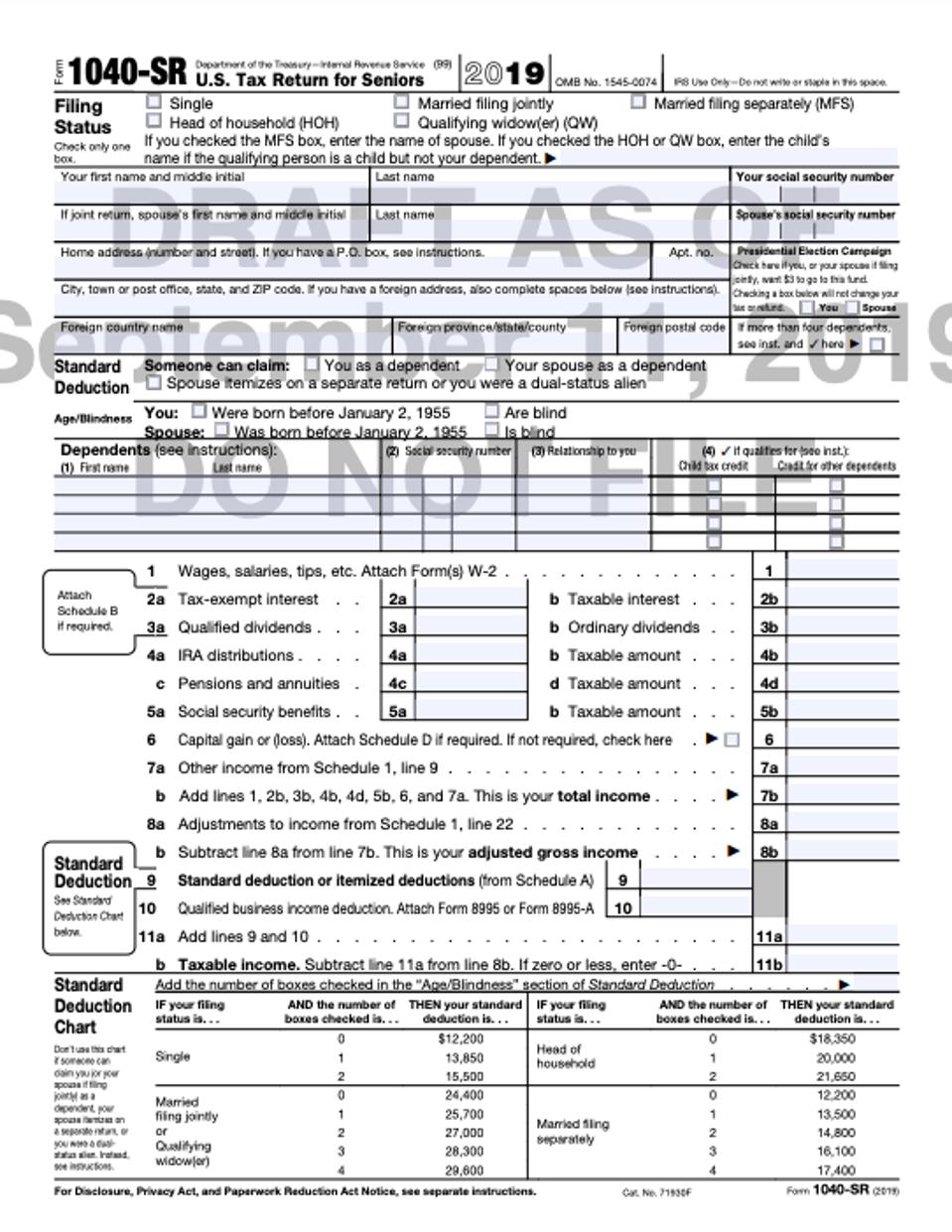

New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Key Takeaways You should file Form 1040 Schedule 2 along with Form 1040 Form 1040 SR or Form 1040 NR to report taxes not included in the basic tax forms If you owe alternative minimum tax AMT use Form 1040 Schedule 2 to report the amount You ll also need to complete and include Form 6251 File Form 1040 Schedule 2 if you need to repay any excess amount received for the

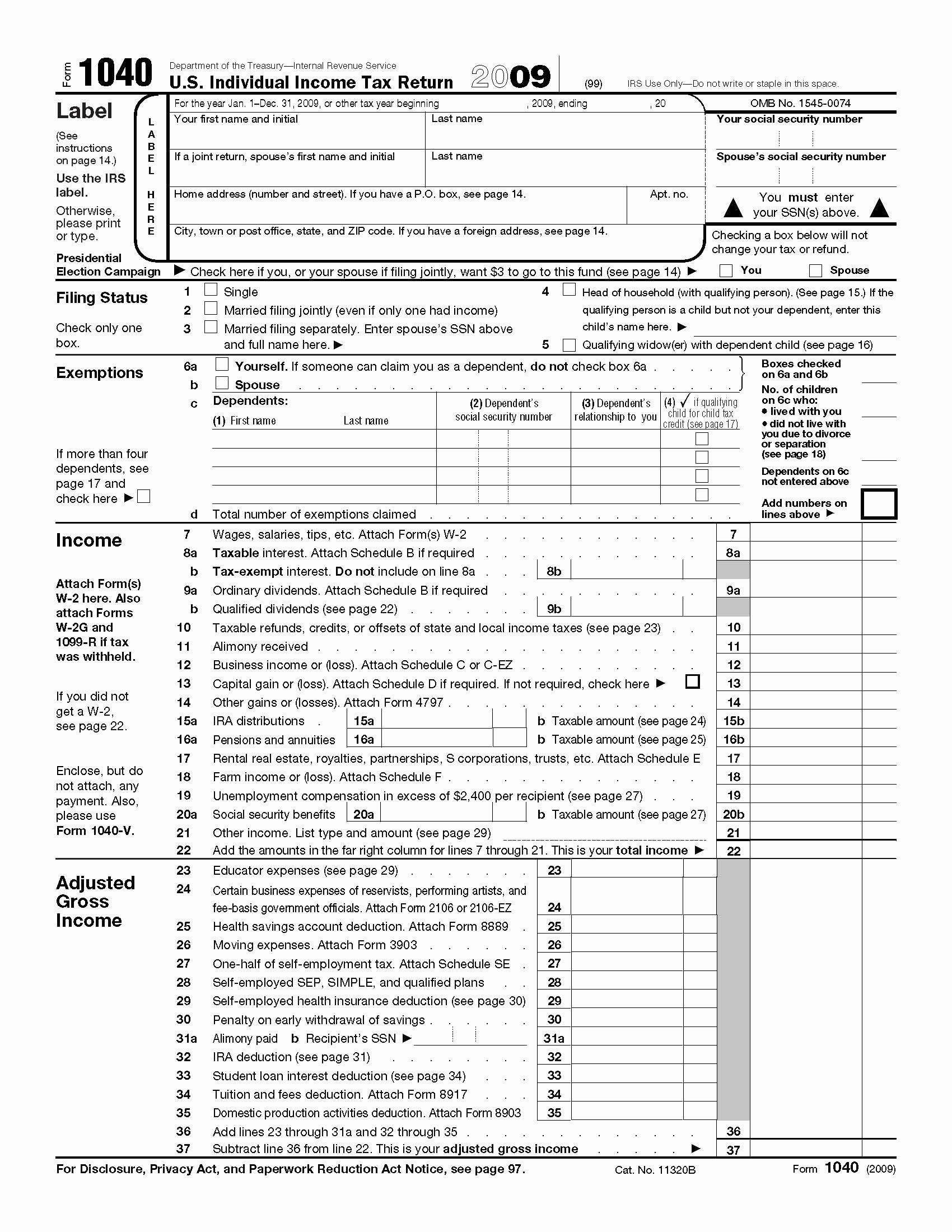

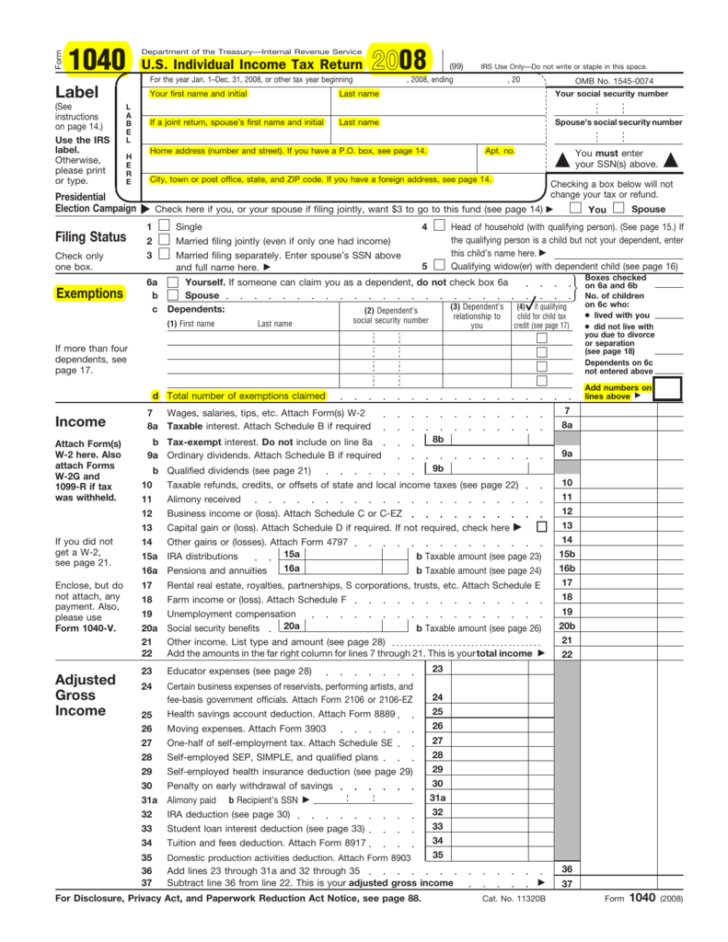

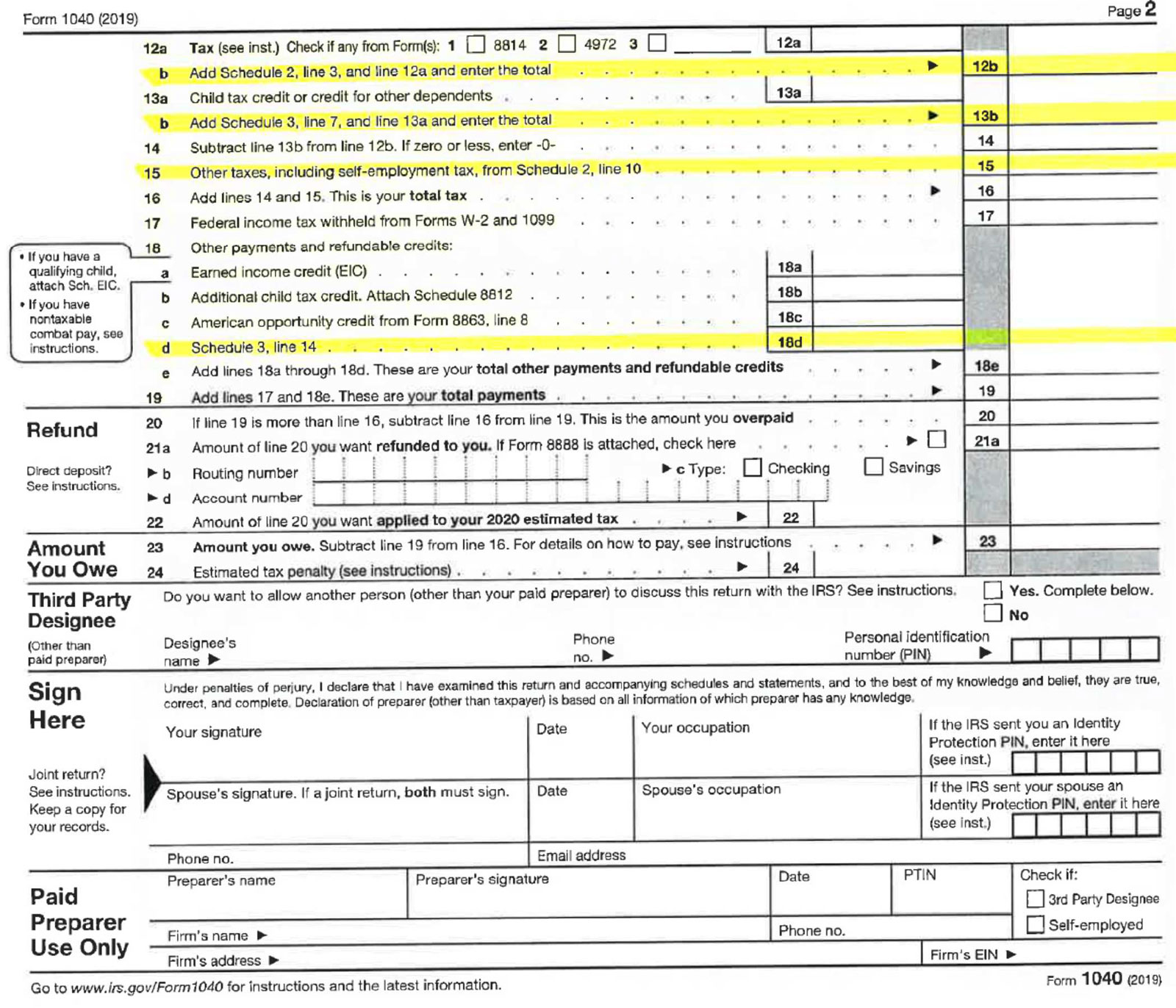

Form 1040 formally known as the U S Individual Income Tax Return is the form people use to report income to the IRS claim tax deductions and credits and calculate their tax refund or W 2 forms show the income you earned the previous year and what taxes were withheld Learn how to replace incorrect stolen or lost W 2s or how to file one if you are an employer Find out how to get and where to mail paper federal and state tax forms Learn what to do if you don t get your W 2 form from your employer or it s wrong

More picture related to Printable Copy Of Schedule 2 1040 Form

1040 Form 2020 PDF 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/irs-form-1040-pdf-2020-refund-schedule-2020-9.png

1040 Sr Form Printable Printable Forms Free Online

https://www.signnow.com/preview/535/781/535781037/large.png

2018 Form 1040 Schedule 2 Fill Online Printable Fillable Blank Form 1040 schedule h

https://www.pdffiller.com/preview/458/73/458073479/big.png

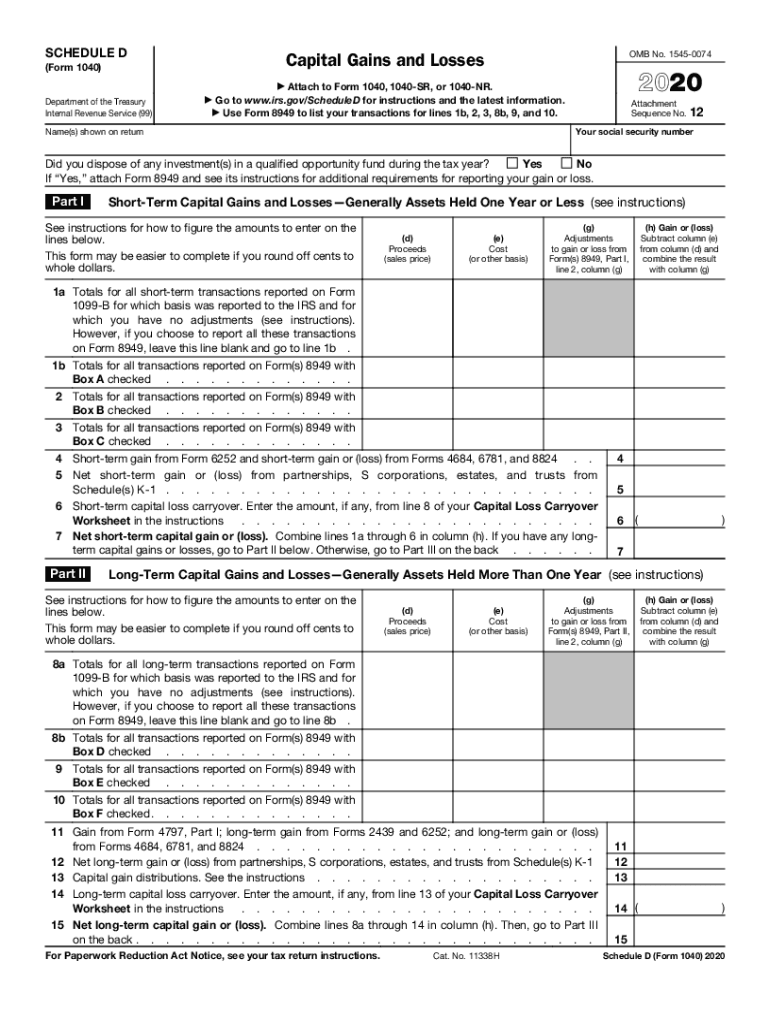

Printable 2022 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2022 tax tables and instructions for easy one page access For most US individual tax payers your 2022 federal income tax forms due on April 18 2023 for income earned January 1 2022 through December 31 2022 The H R Block online program supports most federal forms Form 1040 US Individual Income Tax Schedule 8812 Child Tax Credit Schedule A Itemized Deductions Schedule B Interest and Dividends Schedule C Profit or Loss from Business Schedule C EZ Net Profit from Business Schedule D Capital Gains and Losses

Schedule A is a place to tally various itemized deductions you want to claim You then enter the total deductions on your Form 1040 Stuff you ll need if you want to claim any of the most For the 2023 tax year federal tax form 1040 US Individual Income Tax Return must be postmarked by April 15 2024 Federal income taxes due are based on the calendar year January 1 2023 through December 31 2023 Prior year federal tax forms instructions and schedules are also available and should be mailed as soon as possible if late

IRS Releases Draft Form 1040 Here s What s New For 2020

https://specials-images.forbesimg.com/imageserve/5f3ed50b6c322baa3b67a319/960x0.jpg?fit=scale

Form 1040 Schedule 2 A Comprehensive Guide For Taxpayers Eso Events 2023

https://i0.wp.com/pastorswallet.com/wp-content/uploads/2019/01/schedule-1.png?resize=750%2C646&ssl=1

https://www.irs.gov/forms-pubs/schedules-for-form-1040

Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png?w=186)

https://www.irs.gov/forms-instructions

Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media

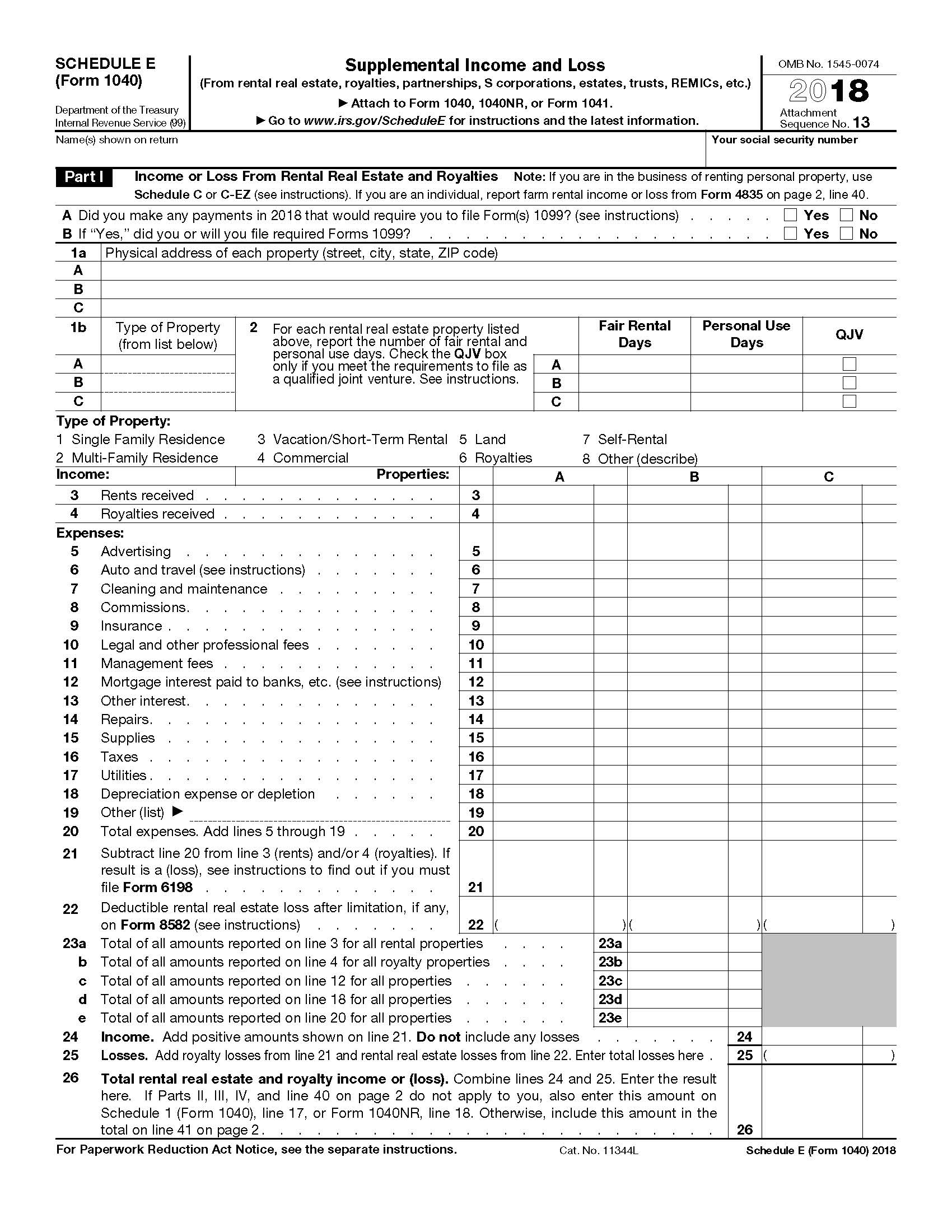

2018 IRS Tax Forms 1040 Schedule E Supplement Income And Loss U S Government Bookstore

IRS Releases Draft Form 1040 Here s What s New For 2020

Irs Printable Form 1040

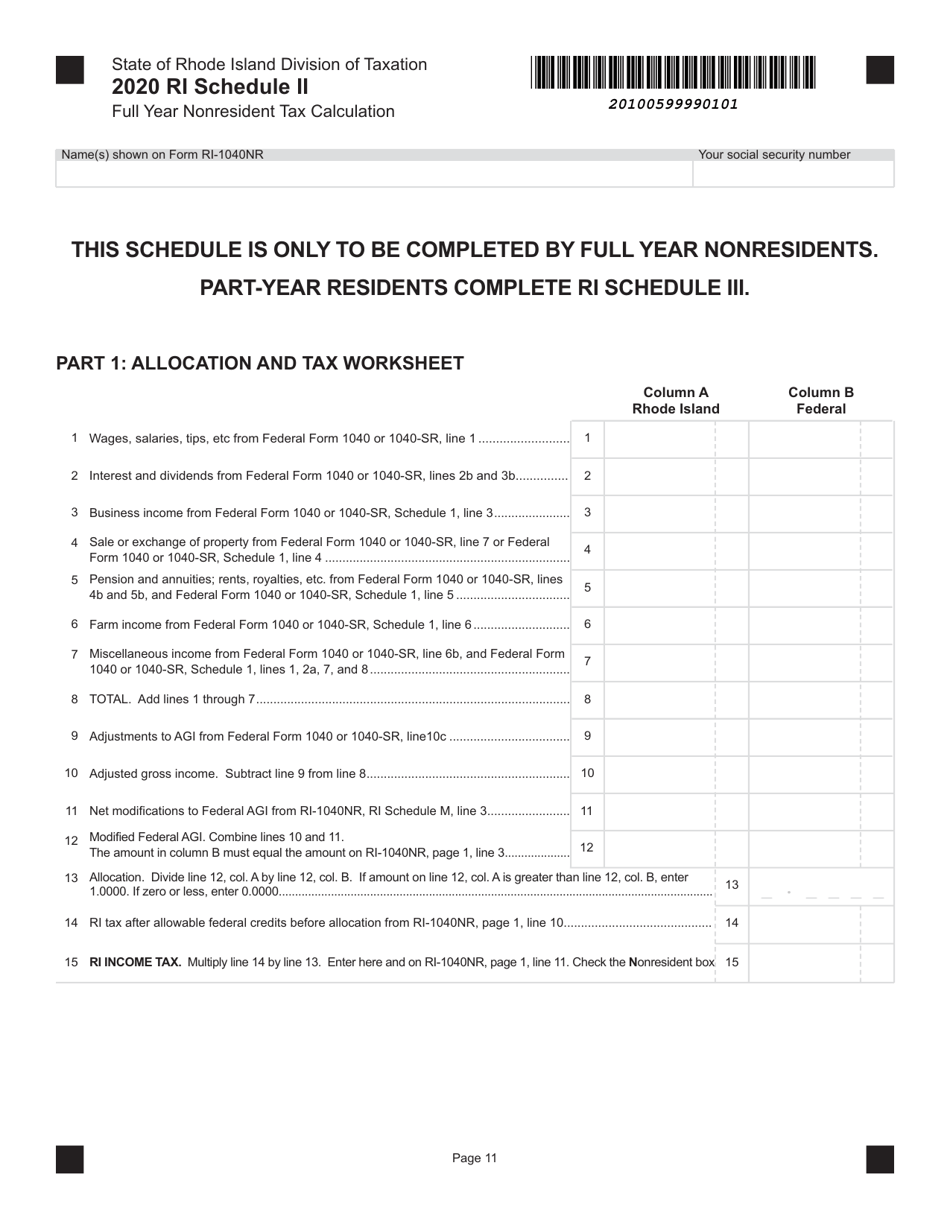

Form RI 1040NR Schedule II Download Fillable PDF Or Fill Online Full Year Nonresident Tax

2020 Form IRS 1040 Schedule D Fill Online Printable Fillable Blank PdfFiller

IRS Form 1040 Schedule 2 Additional Taxes Forms Docs 2023

IRS Form 1040 Schedule 2 Additional Taxes Forms Docs 2023

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

1040 U S Individual Income Tax Return Filing Status 2021 Tax Forms 1040 Printable

2019 Schedule Example Student Financial Aid

Printable Copy Of Schedule 2 1040 Form - Form 1040 formally known as the U S Individual Income Tax Return is the form people use to report income to the IRS claim tax deductions and credits and calculate their tax refund or