Printable Directions To Fill Out Form 8962 Form 8962 must be completed if you received advance payments of the premium tax credit APTC or if you want to claim the credit on your tax return In today s post I m giving you step by step instructions to correctly complete and file Form 8962 What is the Premium Tax Credit

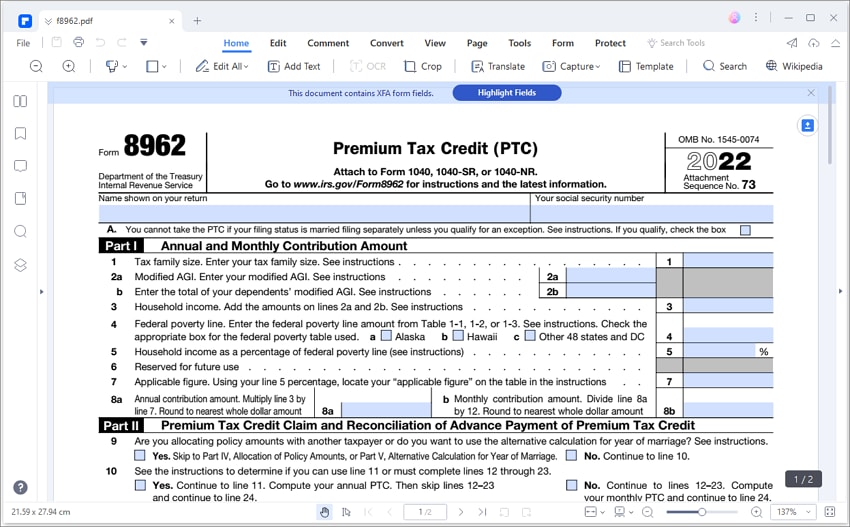

Use Form 8962 to Figure the amount of your premium tax credit PTC Reconcile it with any advance payments of the premium tax credit APTC Current Revision Form 8962 PDF Instructions for Form 8962 Print Version PDF Recent Developments Updates to the Instructions for Form 8962 regarding filing status exceptions 02 FEB 2023 Form 8962 will generate but will not be filed with the return The repayment amount on Form 8962 line 29 will not flow to Schedule 2 line 2 The IRS won t correspond for a missing Form 8962 or ask for more information about the excess APTC For clients who can claim a net premium tax credit PTC Form 8962 will still be attached to the return

Printable Directions To Fill Out Form 8962

Printable Directions To Fill Out Form 8962

https://www.signnow.com/preview/536/160/536160325/large.png

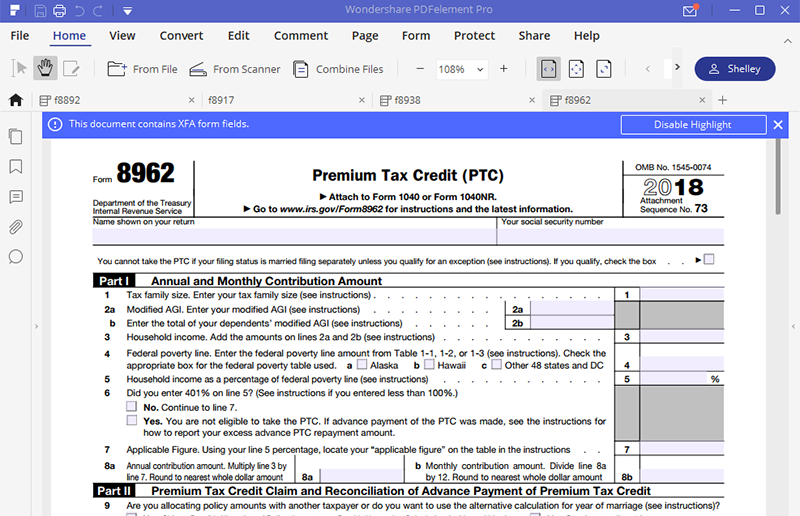

How To Fill Out IRS Form 8962 Correctly

https://images.wondershare.com/pdfelement/forms-templates/article/fill-f8962.png

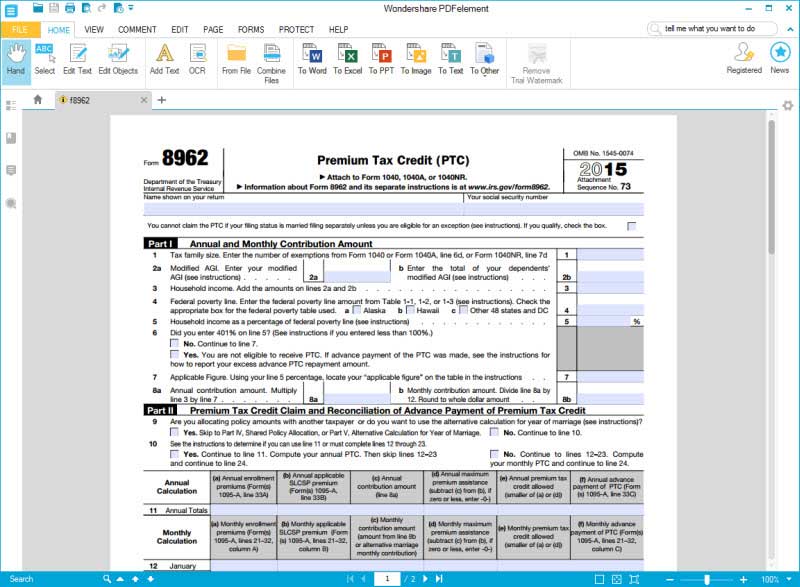

IRS Form 8962 Instruction For How To Fill It Right

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-8962.png

For instructions and the latest information OMB No 1545 0074 2023 Attachment Sequence No 73 Name shown on your return Your social security number A 2023 Form 8962 Author SE W CAR MP Subject Premium Tax Credit PTC Keywords Fillable Created Date Method 1 Reviewing Your Form 1095 A 1 Wait to receive your Form 1095 A in the mail If you purchased health insurance through the Marketplace and opted for advance payment of your tax credit to lower your premiums you ll get a Form 1095 A from the Marketplace

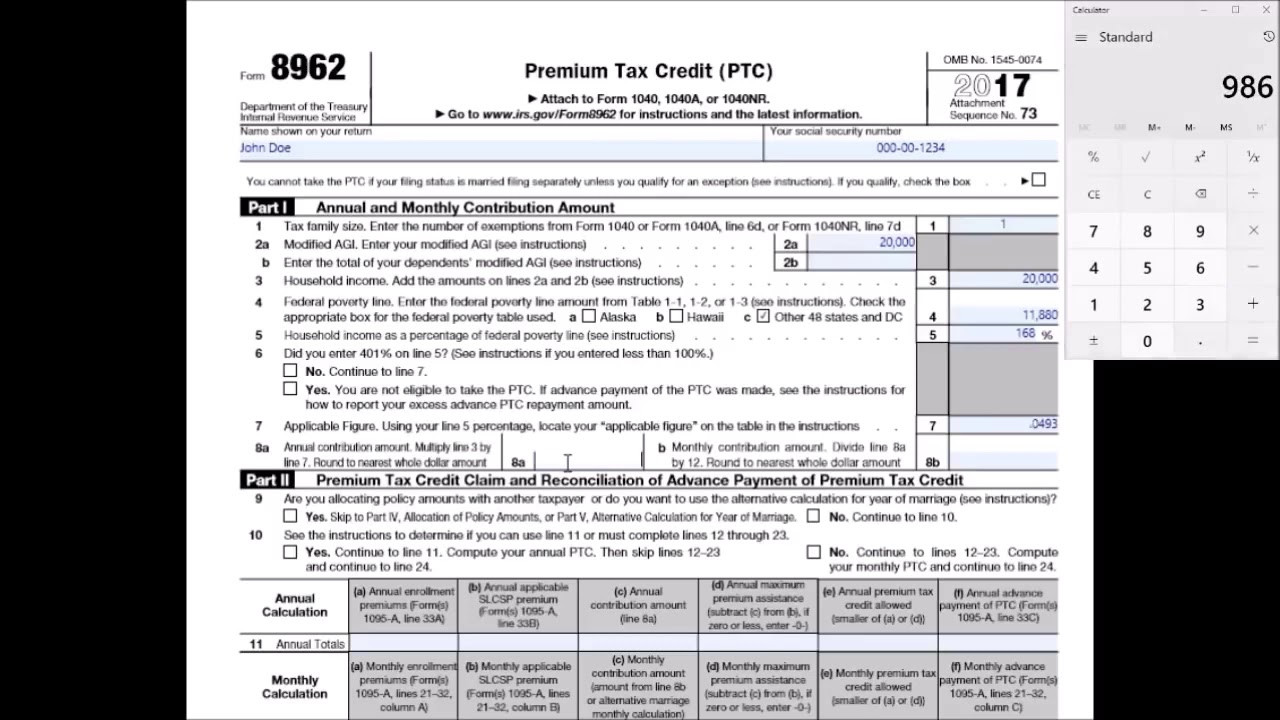

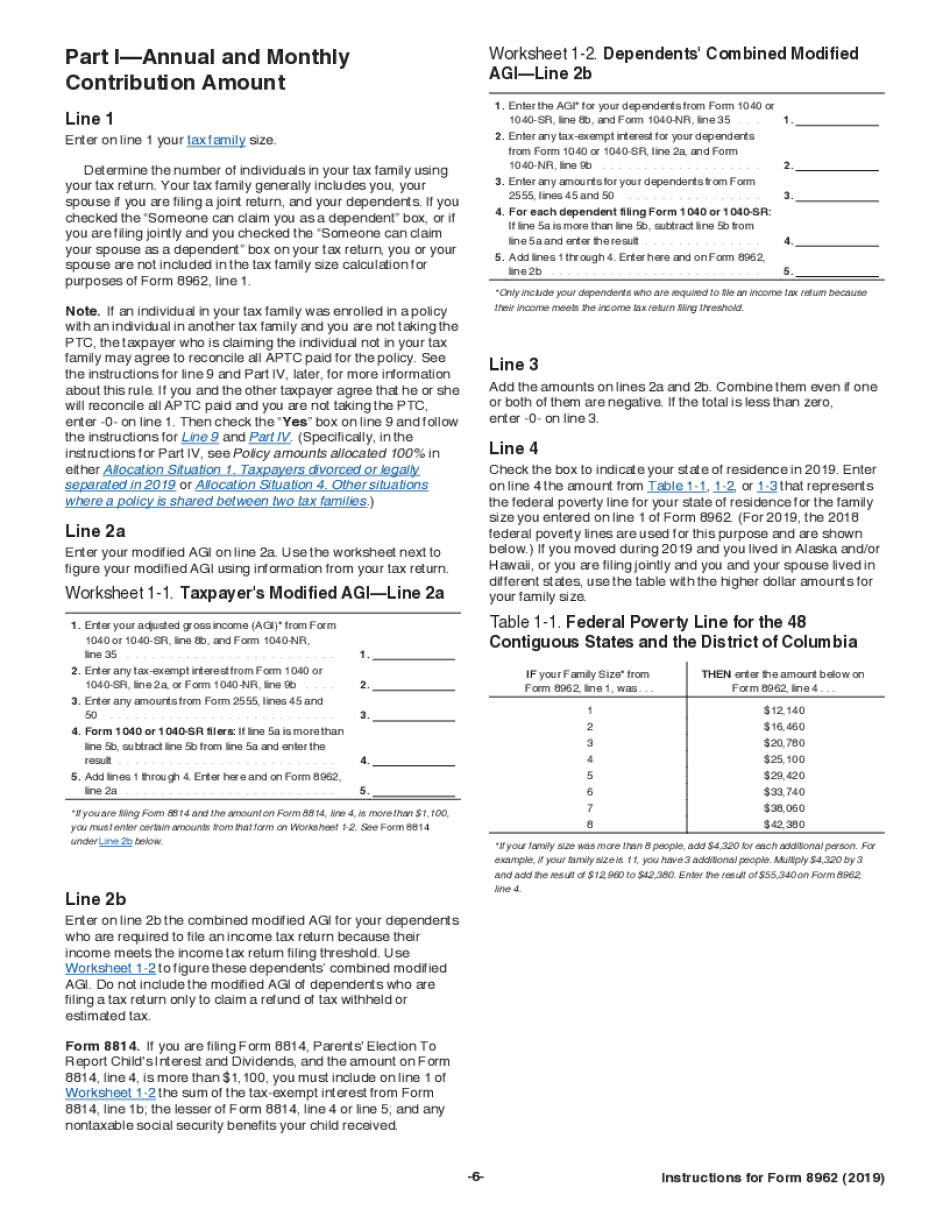

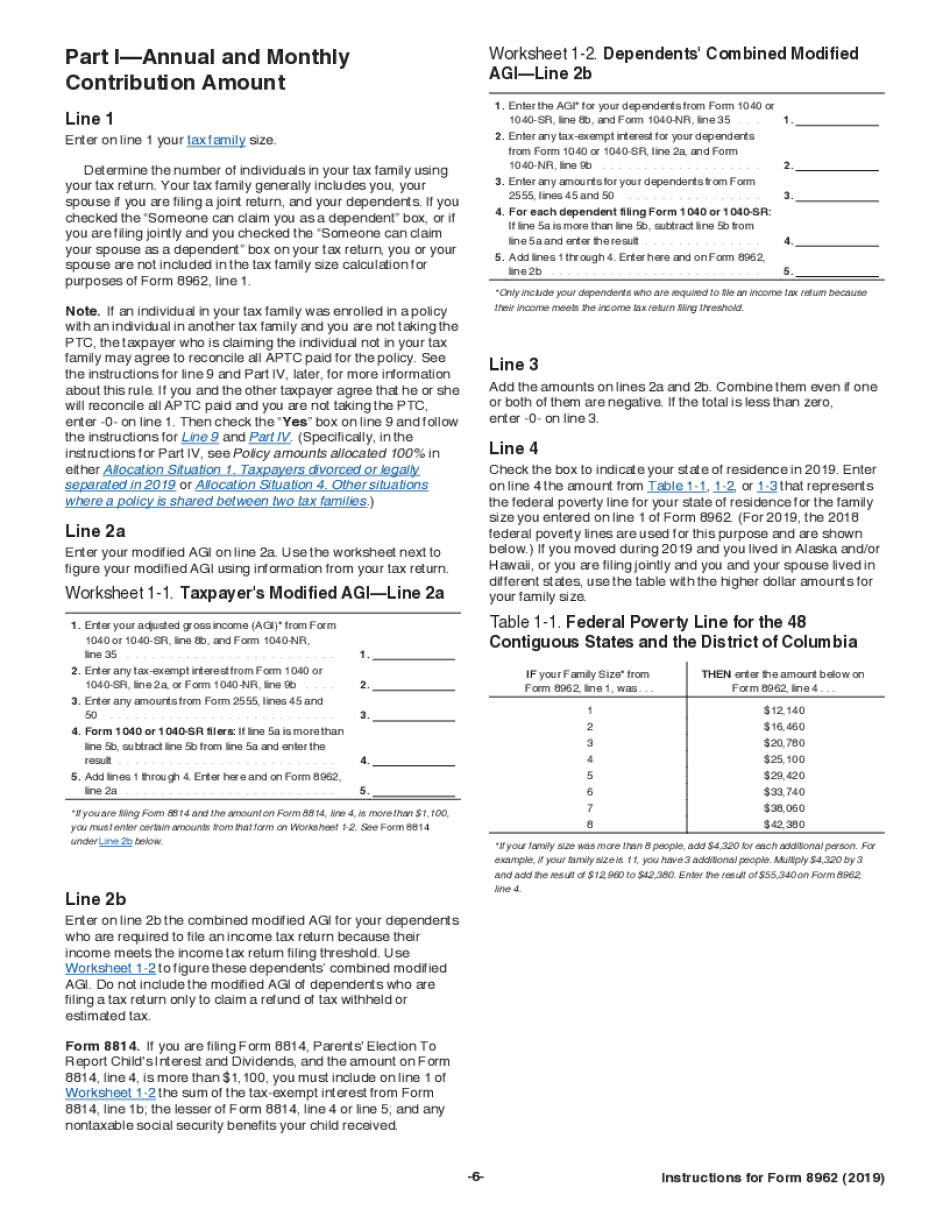

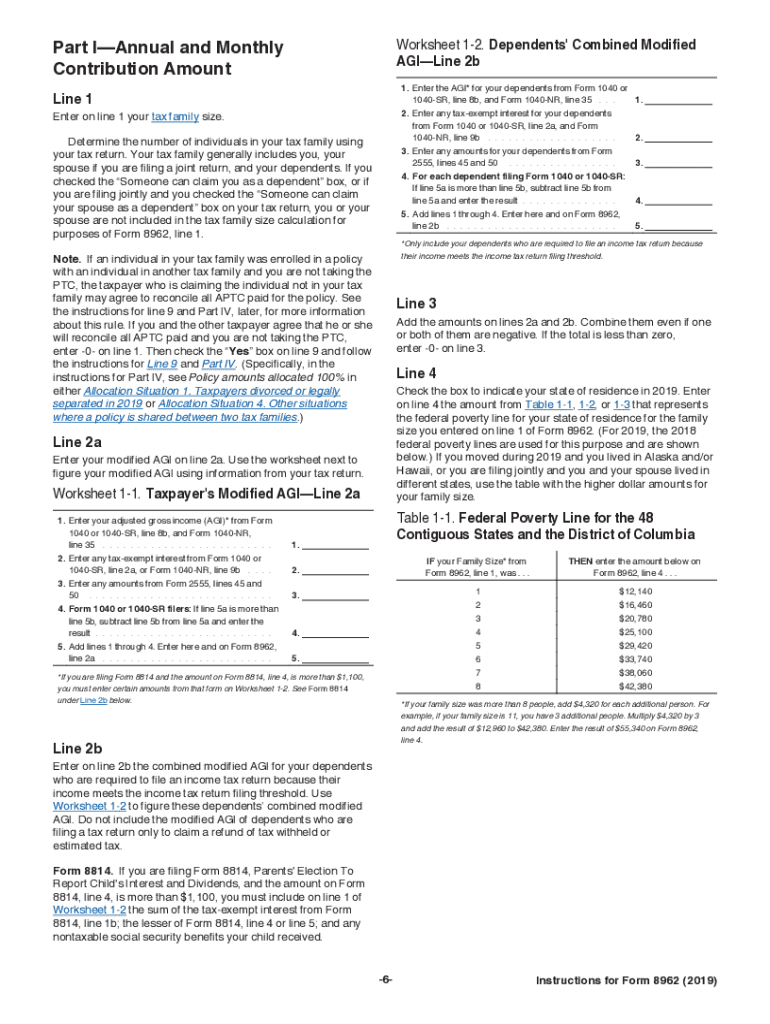

If you received a Form 1095 B from your insurance company or a Form 1095 C from your employer you don t file Form 8962 Customarily you must fill out and file Form 8962 if How to Fill Out Form 8962 Form 8962 is divided into five parts Before you dive into Part I write your name and Social Security number at the top of the form Part I is where you enter your annual and monthly contribution amounts You ll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR

More picture related to Printable Directions To Fill Out Form 8962

IRS Form 8962 Instruction For How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-8962.jpg

How To Fill Out Form 8962 Step By Step Premium Tax Credit PTC Sample Example Completed YouTube

https://i.ytimg.com/vi/eLBQngMVv1Y/maxresdefault.jpg

How To Fill Out IRS Form 8962 Correctly

https://images.wondershare.com/pdfelement/pdf-forms/tax-form/8962-part2-2.jpg

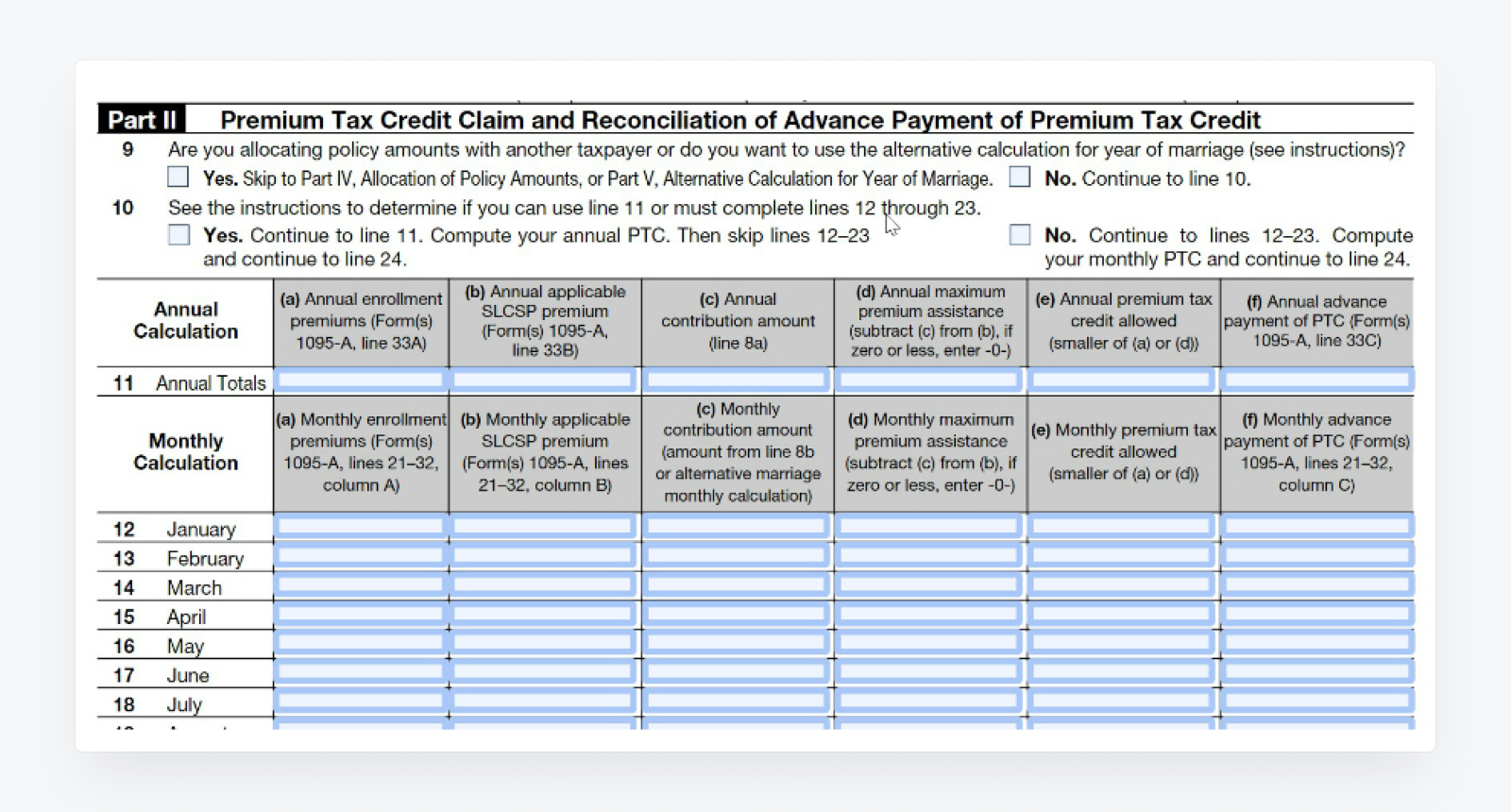

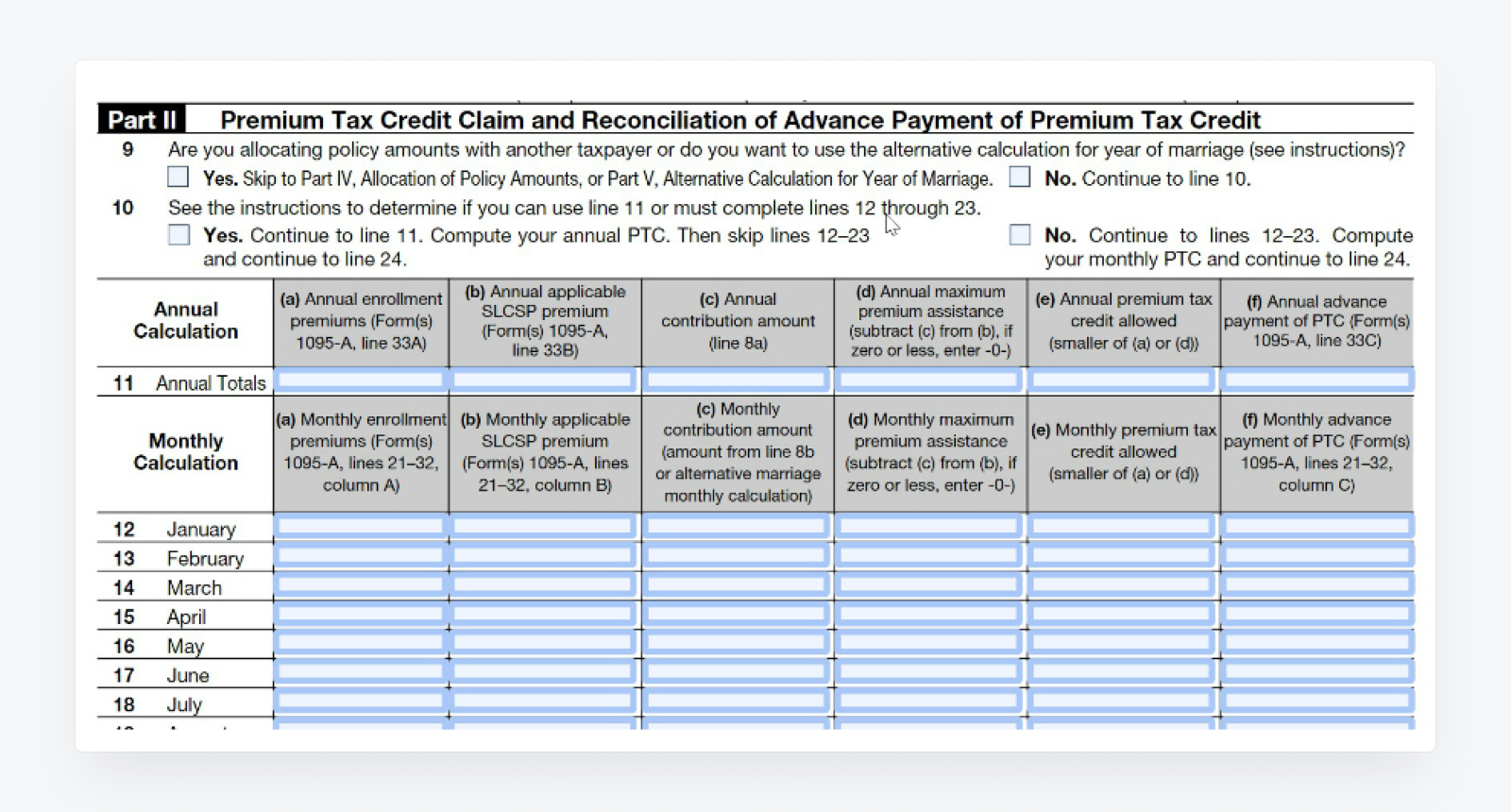

Form 8962 is a two page document with five sections Part I is where you enter the annual and monthly payment amounts based on the size of your family modified adjusted gross income and household income Part II is where you balance the amount of your advanced premium tax credit with the amount of your monthly premiums You must reconcile your premium tax credit when you file your tax return if you were enrolled in Health Insurance Marketplace plan

The instructions for IRS Form 8962 refer to a guide found on the IRS website that assists you in filling out the Form These instructions take you through the process line by line and even contain a glossary This glossary provides the user with correct definitions for terms used in Form 8962 that may be difficult to understand otherwise This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB

How To Fill Out Form 8962 Step By Step Fill Online Printable Fillable Blank Form 8962

https://www.pdffiller.com/preview/489/187/489187822/big.png

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

https://www.pdffiller.com/preview/459/416/459416023/big.png

https://amynorthardcpa.com/form-8962/

Form 8962 must be completed if you received advance payments of the premium tax credit APTC or if you want to claim the credit on your tax return In today s post I m giving you step by step instructions to correctly complete and file Form 8962 What is the Premium Tax Credit

https://www.irs.gov/forms-pubs/about-form-8962

Use Form 8962 to Figure the amount of your premium tax credit PTC Reconcile it with any advance payments of the premium tax credit APTC Current Revision Form 8962 PDF Instructions for Form 8962 Print Version PDF Recent Developments Updates to the Instructions for Form 8962 regarding filing status exceptions 02 FEB 2023

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

How To Fill Out Form 8962 Step By Step Fill Online Printable Fillable Blank Form 8962

How To Fill Out Form 8962 Or Premium Tax Credit PTC PDFRun YouTube

3 Easy Ways To Fill Out Form 8962 WikiHow

8962 Form Fill Out And Sign Printable PDF Template SignNow

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

Irs Form 8962 Instructions Fill Online Printable Fillable Blank

3 Easy Ways To Fill Out Form 8962 WikiHow

How To Fill Out Form 8962 Correctly In 2022 EaseUS

Printable Directions To Fill Out Form 8962 - Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC