Printable Employee Mileage Reimbursement Form What Does It Cover The IRS mileage rate covers Depreciation Fuel gas electricity etc Oil changes Vehicle expenses insurance registration etc and Common maintenance due to wear and tear It Does NOT Cover Food Lodging Parking Fees Tolls and Minor accidents or repairs

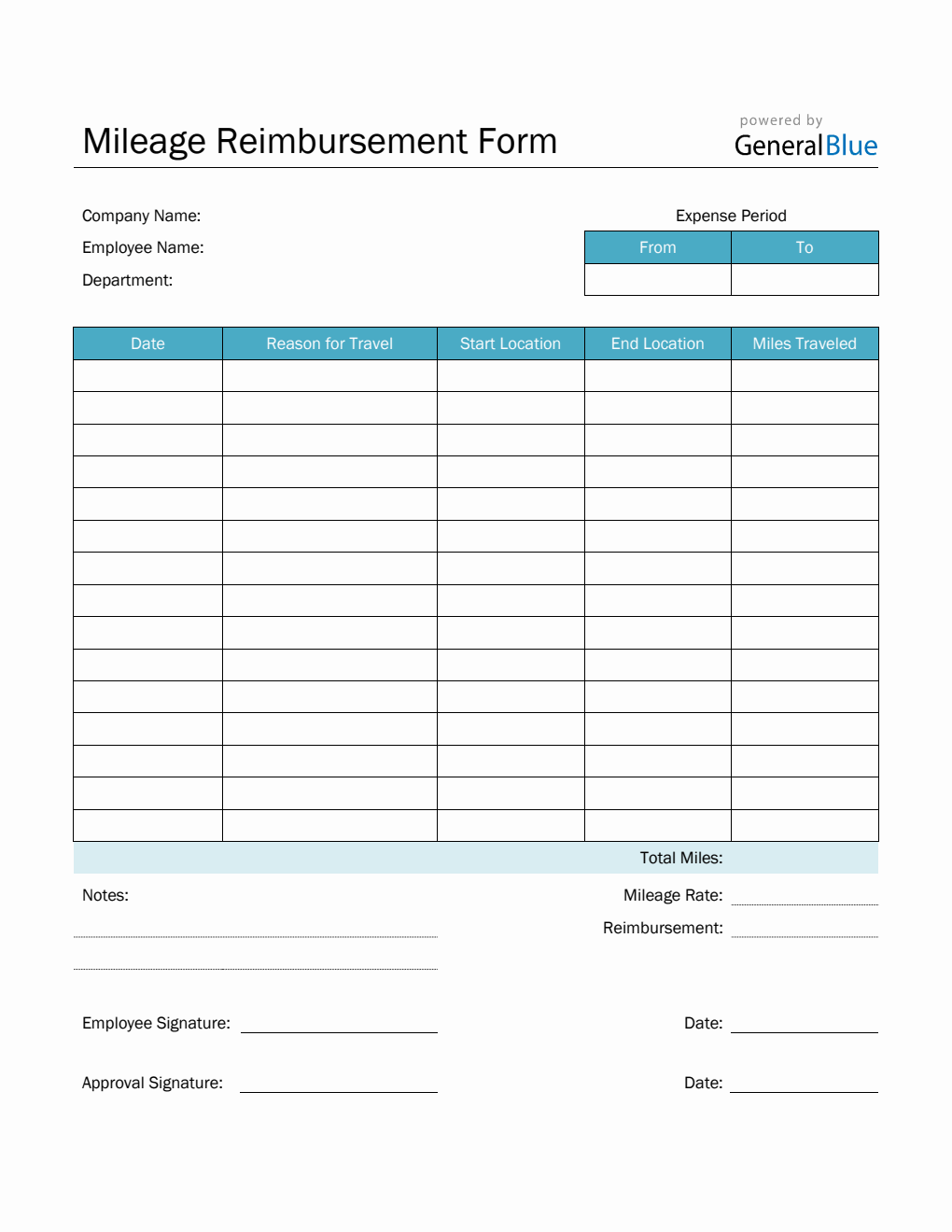

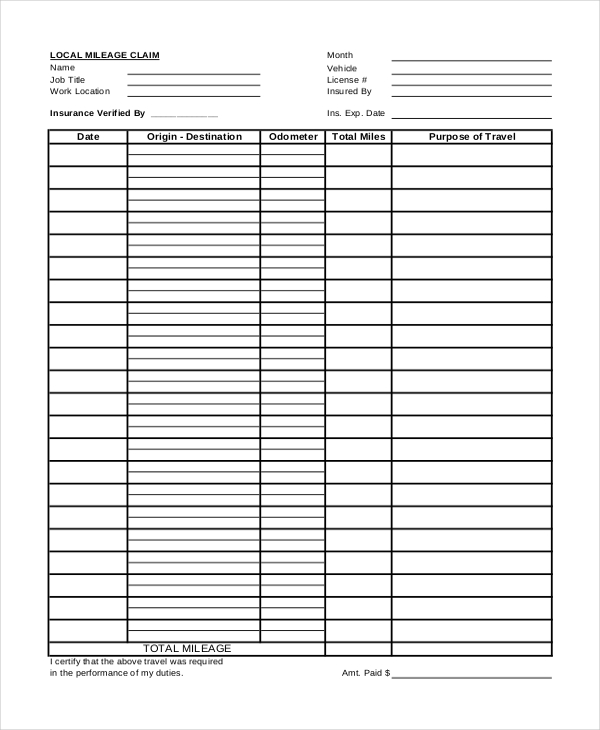

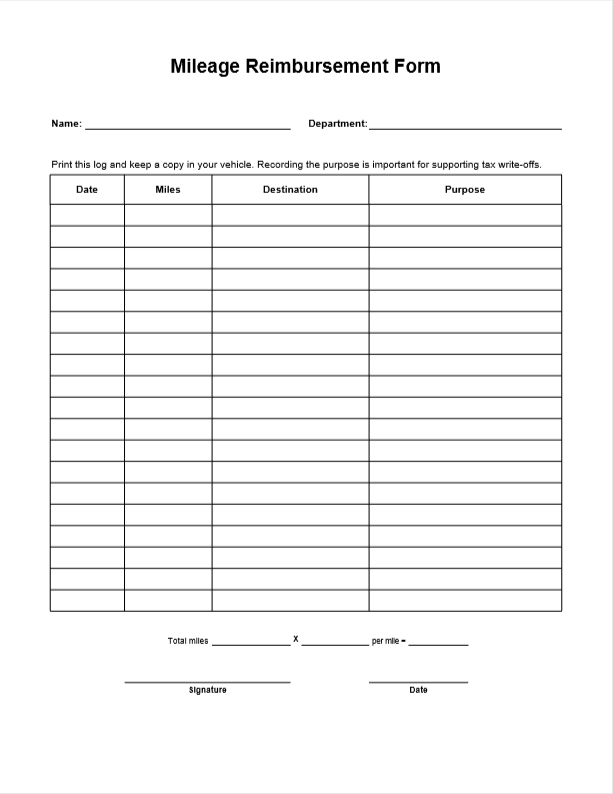

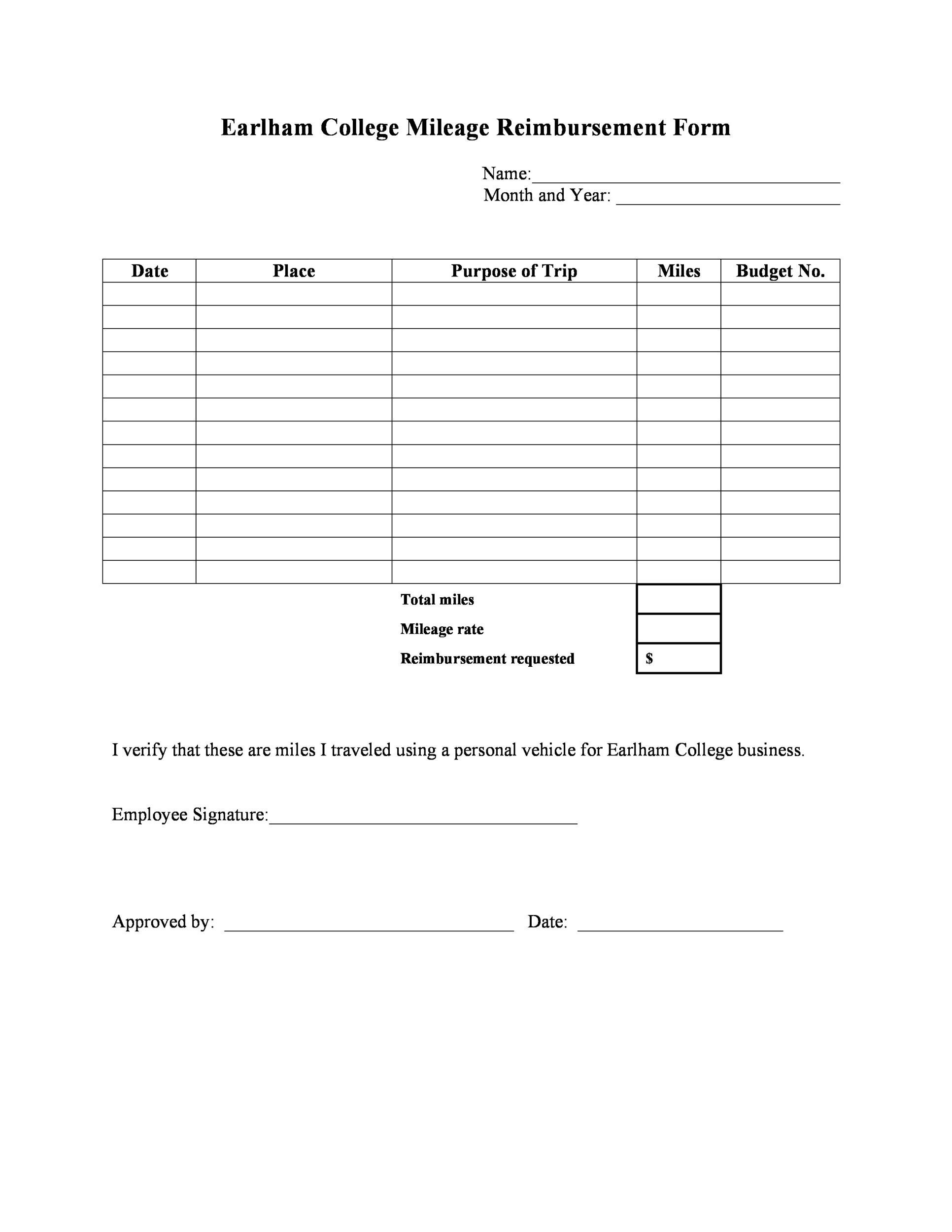

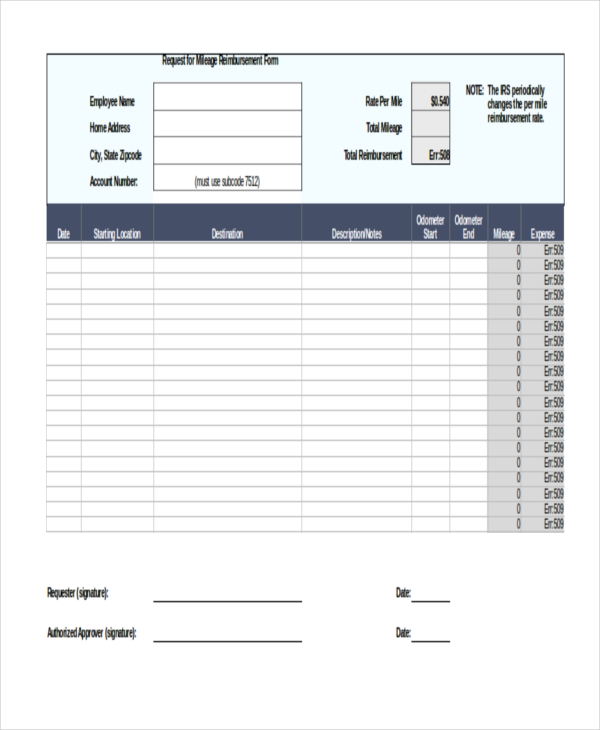

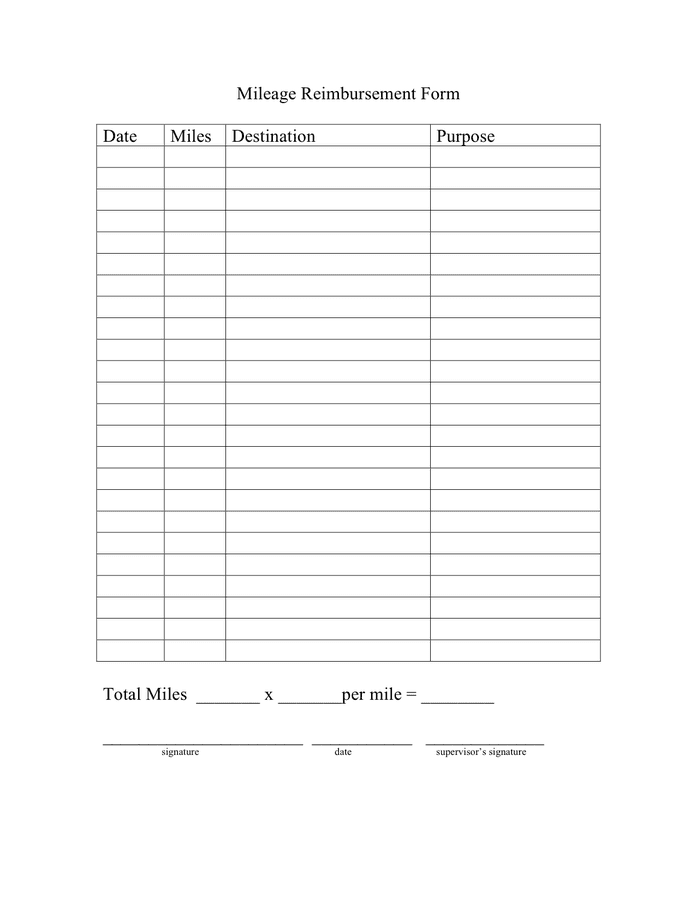

You can download the printable mileage log template which uses the standard IRS mileage rate for 2024 67 cents per mile for business related driving See an overview of previous mileage rates Important note If you choose to use the Google Sheets version you need to copy the sheet onto your own sheet This mileage reimbursement form can be used to calculate your mileage expenses on a specific period It s printable customizable and downloadable in PDF Download PDF Template Free for personal or commercial use General Blue This mileage claim form can be used to request for reimbursement for mileage expenses from your company

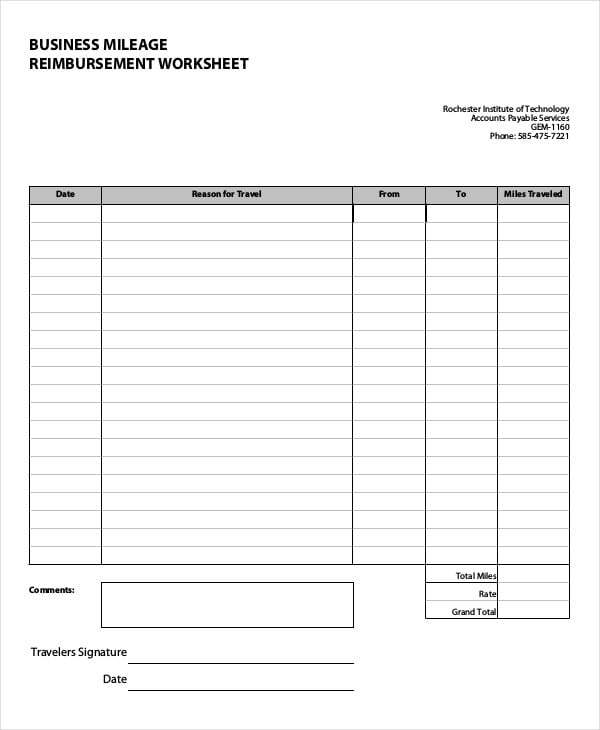

Printable Employee Mileage Reimbursement Form

Printable Employee Mileage Reimbursement Form

https://images.sampletemplates.com/wp-content/uploads/2016/11/25164404/Mileage-Log-for-Employee-Reimbursement-Form.jpg

Mileage Reimbursement Form In Word Basic

https://www.generalblue.com/mileage-reimbursement-form/p/tgh4jt2v2/f/basic-mileage-reimbursement-form-in-word-md.png?v=5b4b7d0371aad301b5653aedb5b309e2

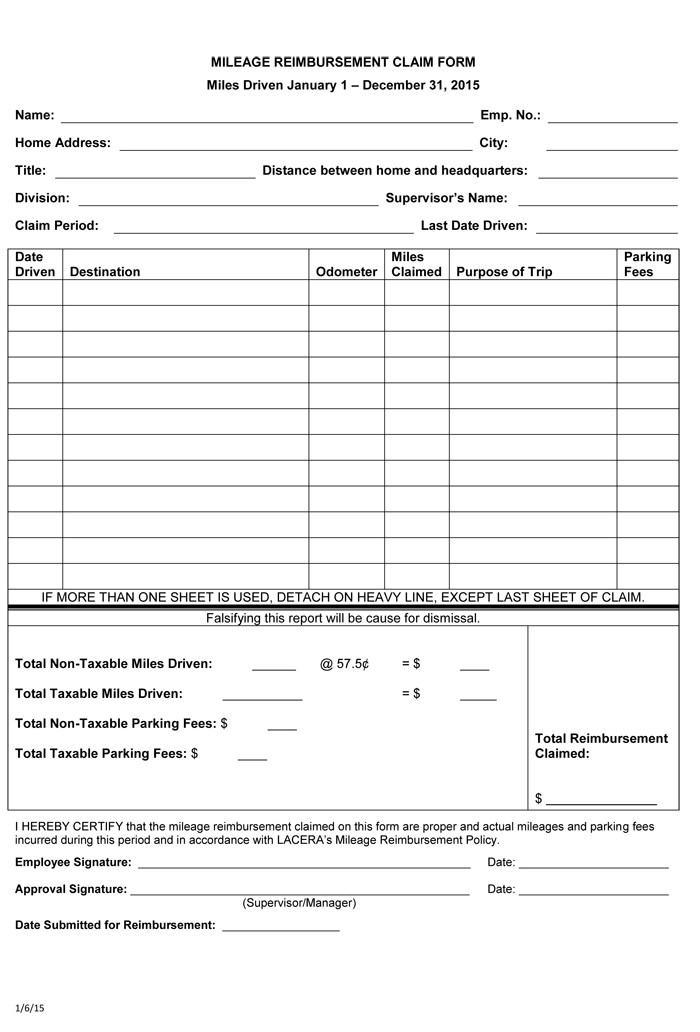

FREE 9 Sample Mileage Reimbursement Forms In PDF Word Excel

https://images.sampleforms.com/wp-content/uploads/2016/08/blank-mileage-reimbursement-form.jpg

This monthly mileage report template can be used as a mileage calculator and reimbursement form Template features include sections to list starting and ending locations daily and total miles driven employee information and approval signatures No email required Sample Employee Mileage Reimbursement Template Download our free mileage reimbursement for employees template in PDF format Download Template Instant download No email required Mileage Reimbursement Software Best Overall TriNet Zenefits 5 0 out of 5 overall One time reimbursements Recurring reimbursements too

Statutory employees Reimbursement for personal expenses Income producing property Standard mileage rate For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Ordering tax forms instructions and publications Go to IRS gov OrderForms to order current forms A mileage reimbursement form helps employees track mileage for reimbursement per mile While some companies establish a mileage reimbursement rate based on their calculations many base their rates on the standard Internal Revenue Service IRS mileage rate which is updated annually

More picture related to Printable Employee Mileage Reimbursement Form

Mileage Claim Form Template

https://minasinternational.org/wp-content/uploads/2021/03/costum-mileage-claim-form-template-word-sample.png

Mileage Reimbursement Form Edit Forms Online PDFFormPro

https://pdfformpro.com/assets/images/form_thumb/96565-mileage-reimbursement-form-front-page.png

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word EForms

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

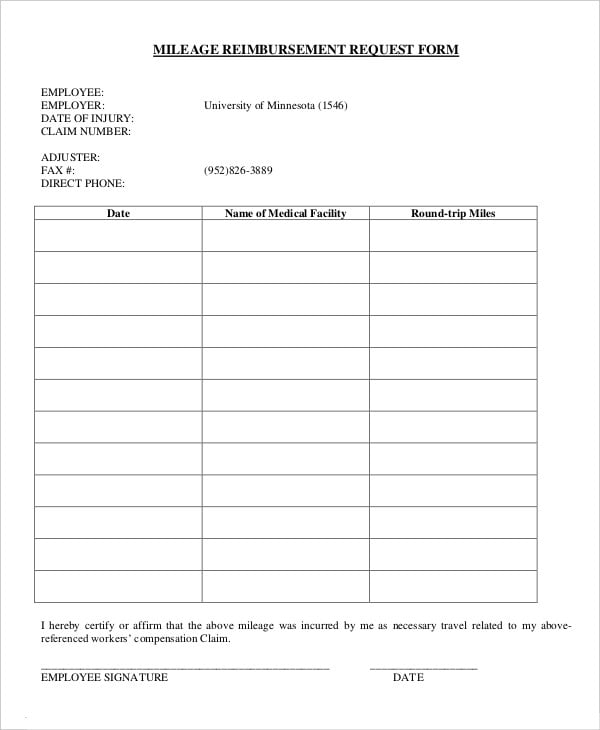

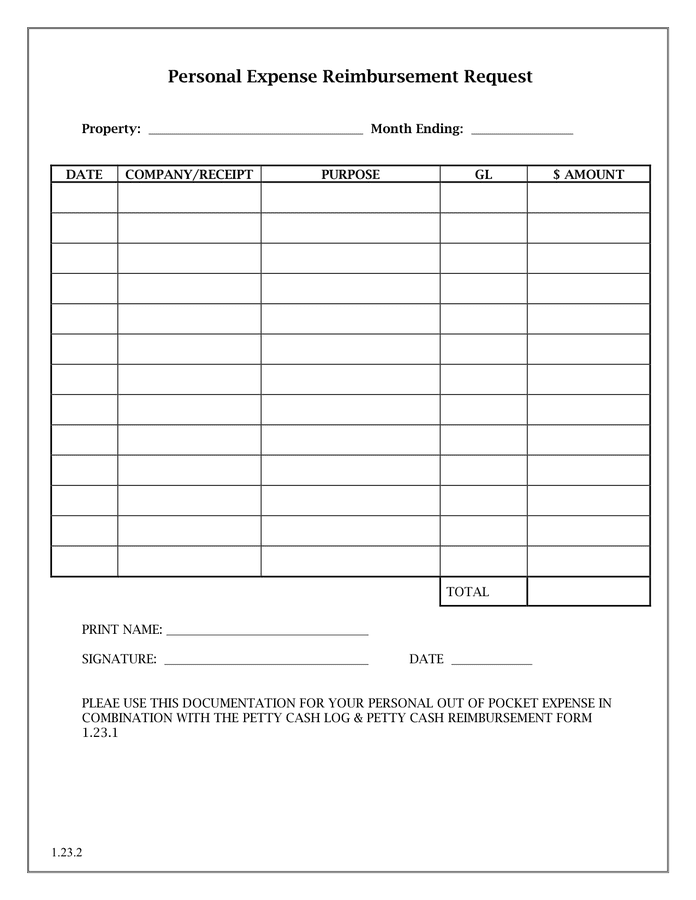

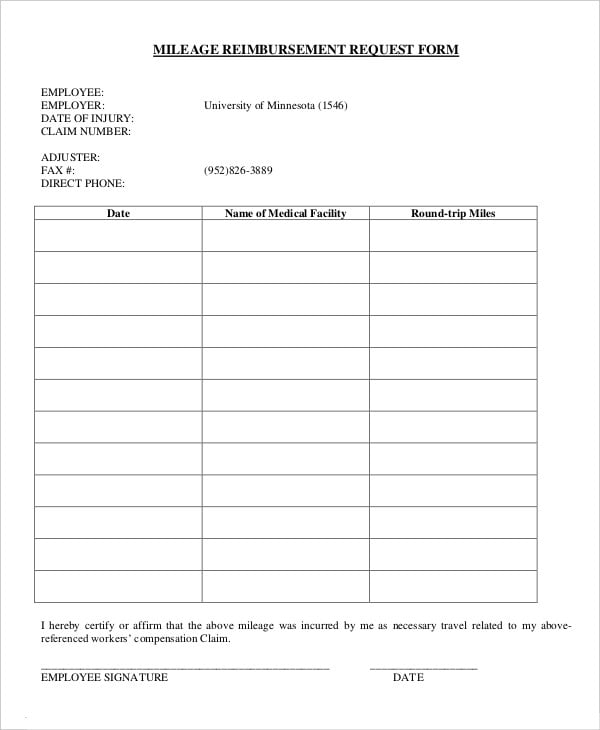

A sample form for an employee to request mileage reimbursement for business related travel A Mileage Reimbursement Form acts as a report of expenses incurred and provides proof of the expense Details of the Reimbursement Form include the purpose of a trip the trip destination and the date the trip was taken If you have been given authorization to use your personal vehicle for business medical events or charitable services this

This form allows employees to report the details of their trips including the starting and ending locations the purpose of the trip and the total number of miles driven The information provided in the printable mileage reimbursement form calculates the reimbursement amount based on the company s predetermined reimbursement rate per mile Download a free mileage reimbursement and tracking log for Microsoft Excel Whether you re an employee or a business owner it s important to keep good business mileage records so that you have the information you need for either completing your company s mileage reimbursement form or for determining the mileage deduction on your tax return

Mileage Reimbursement Form 10 Free Sample Example Format

https://images.template.net/wp-content/uploads/2016/12/20051854/Mileage-Reimbursement-Request-Form.jpg

MILEAGE REIMBURSEMENT Form In Word And Pdf Formats

https://static.dexform.com/media/docs/4842/mileage-reimbursement-form-1_1.png

https://eforms.com/employee/mileage-reimbursement-irs/

What Does It Cover The IRS mileage rate covers Depreciation Fuel gas electricity etc Oil changes Vehicle expenses insurance registration etc and Common maintenance due to wear and tear It Does NOT Cover Food Lodging Parking Fees Tolls and Minor accidents or repairs

https://www.driversnote.com/blog/irs-mileage-log-template-free-excel-pdf-versions

You can download the printable mileage log template which uses the standard IRS mileage rate for 2024 67 cents per mile for business related driving See an overview of previous mileage rates Important note If you choose to use the Google Sheets version you need to copy the sheet onto your own sheet

47 Reimbursement Form Templates Mileage Expense VSP

Mileage Reimbursement Form 10 Free Sample Example Format

FREE 9 Sample Employee Reimbursement Forms In MS Excel PDF Word

Mileage Reimbursement Form 10 Free Sample Example Format

Free Mileage Reimbursement Forms Templates Word Excel

FREE 8 Sample Mileage Reimbursement Forms In PDF MS Word

FREE 8 Sample Mileage Reimbursement Forms In PDF MS Word

Mileage Reimbursement Form Download Free Documents For PDF Word And Excel

Mileage Reimbursement Form In Word And Pdf Formats

FREE 11 Sample Mileage Reimbursement Forms In MS Word PDF Excel

Printable Employee Mileage Reimbursement Form - I declare under penalty of perjury under the laws of the United States of America that the foregoing is true and correct Signature Print Name Page 1 of 2 IRS CURRENT AND PAST RATES 2020 IRS MILEAGE RATES