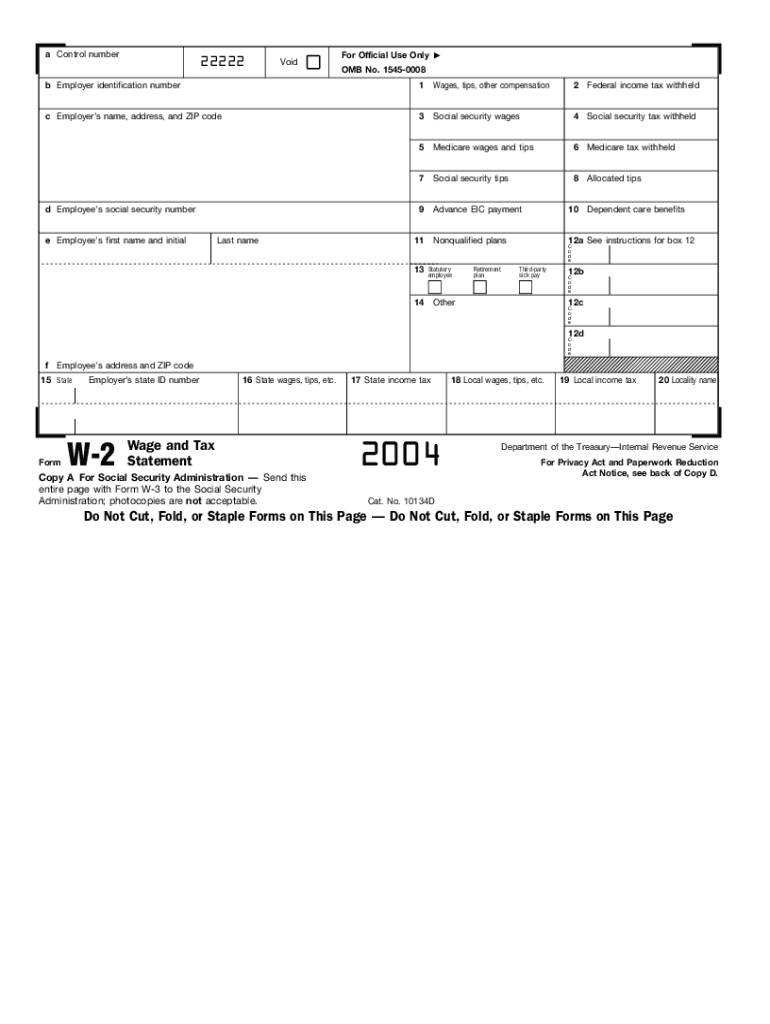

Printable Enrollment W2 Form For Employees Employment Tax Forms Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return

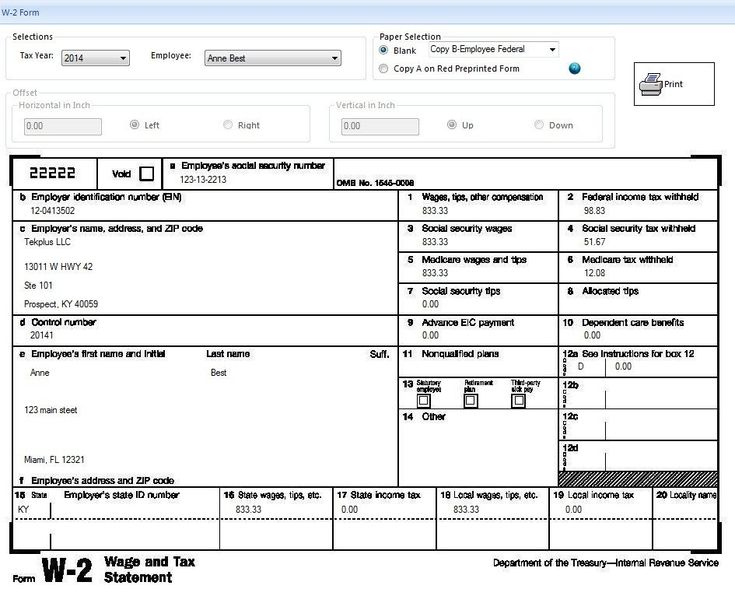

Step 1 Set up your W 2 E filing The first step to electronically file your W 2s is to set it up Open QuickBooks Go to Employees then Payroll Center Open the QuickBooks Desktop Payroll Setup To order official IRS information returns such as Forms W 2 and W 3 which include a scannable Copy A for filing go to IRS Online Ordering for Information Returns and Employer Returns page or visit www irs gov orderforms and click on Employer and Information returns We ll mail you the scannable forms and any other products you order

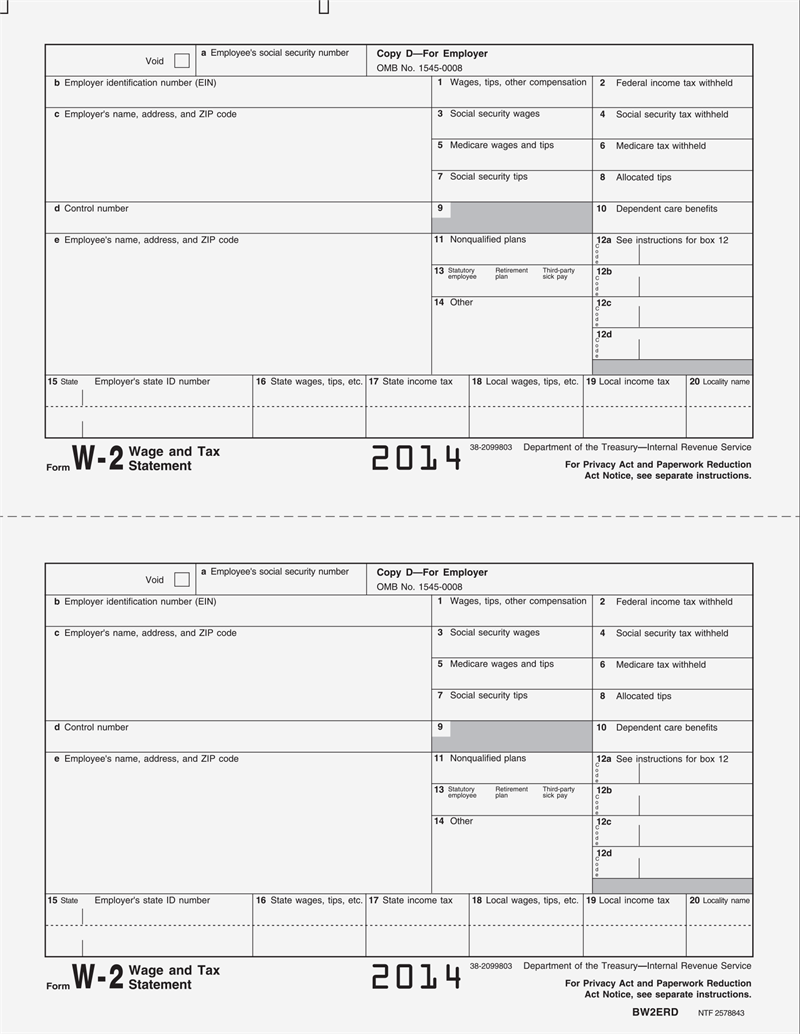

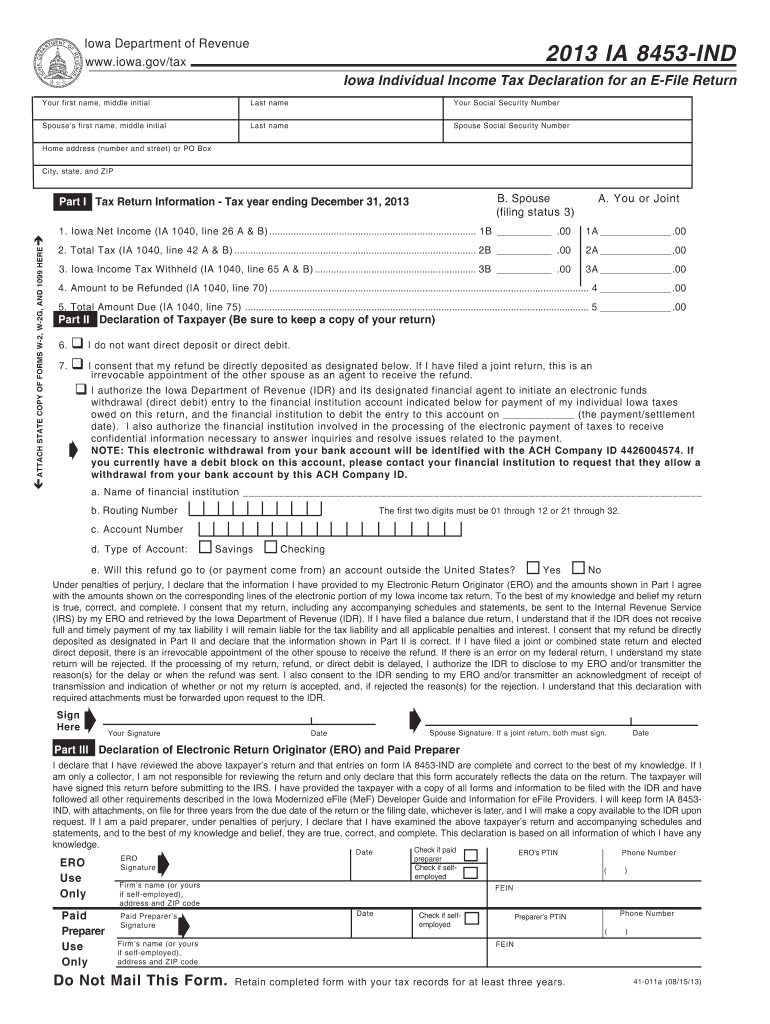

Printable Enrollment W2 Form For Employees

Printable Enrollment W2 Form For Employees

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

Printable W2 Form For New Employee

http://www.phoenixphive.com/images/products/detail/BW2ERD05.1.png

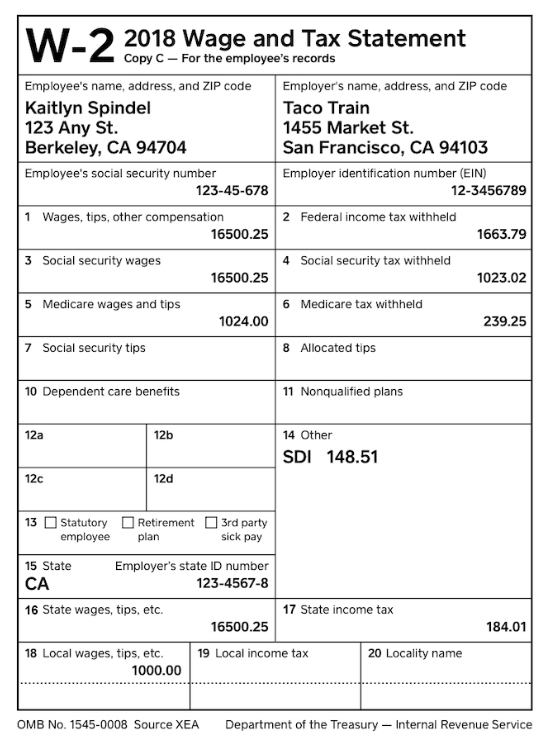

Understanding 2018 W 2 Forms

https://jumbotron-production-f.squarecdn.com/assets/1041514e5e807e8ee1ec7.png

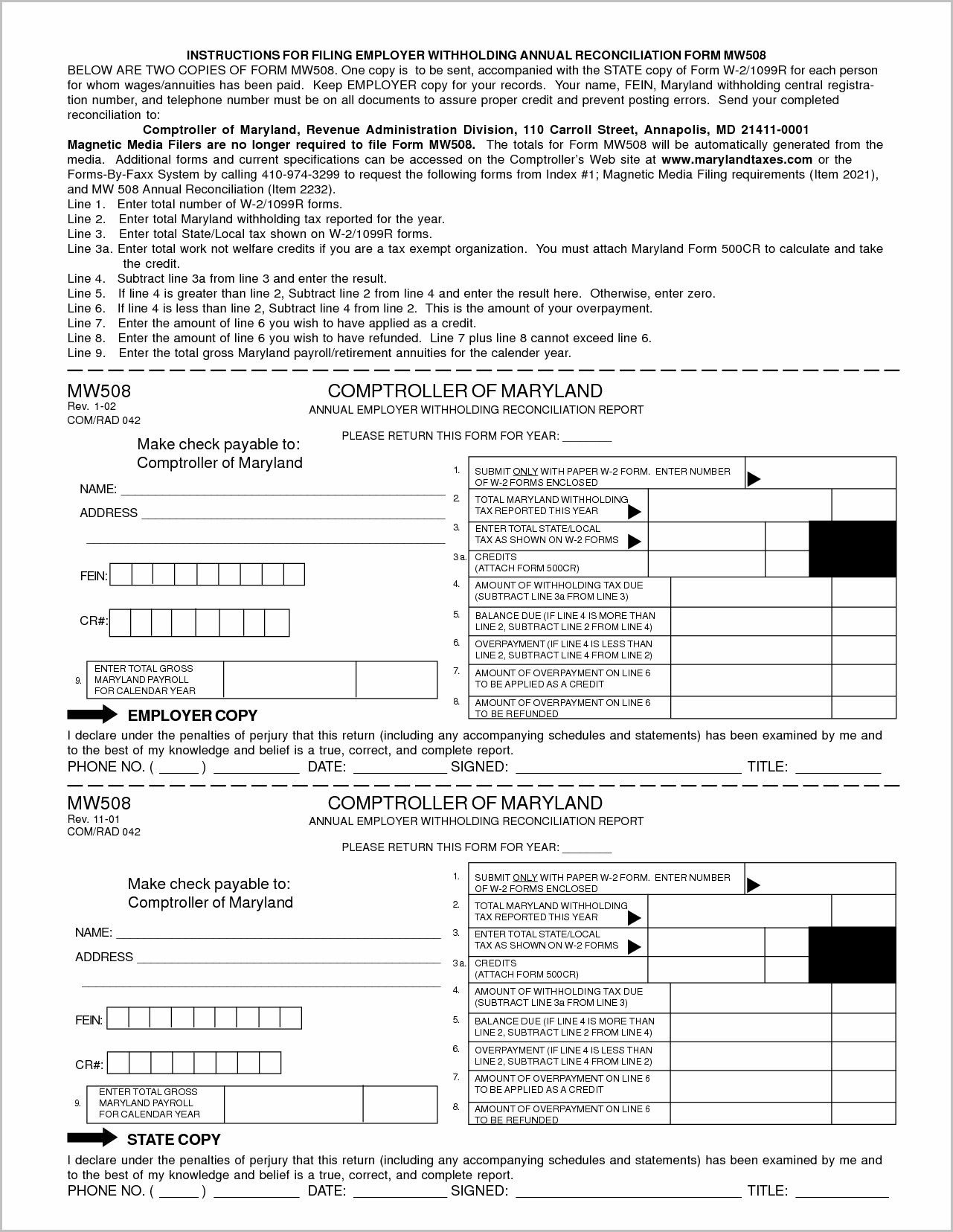

Download PDF Important Facts and Deadlines W 2s are information returns filled out by an employer and submitted to the Social Security Administration and employees They provide an official record of an employee s wages and federal state and local taxes paid throughout the calendar year 1 Select Annual Forms then W 2 Copies A D employer Select Continue If prompted tell us whether or not one or more employees were active participants in a retirement plan during the tax year On the Employer Copies Form W 2 page select View to open Acrobat Reader Review and print Copy D Employer s copy for your records

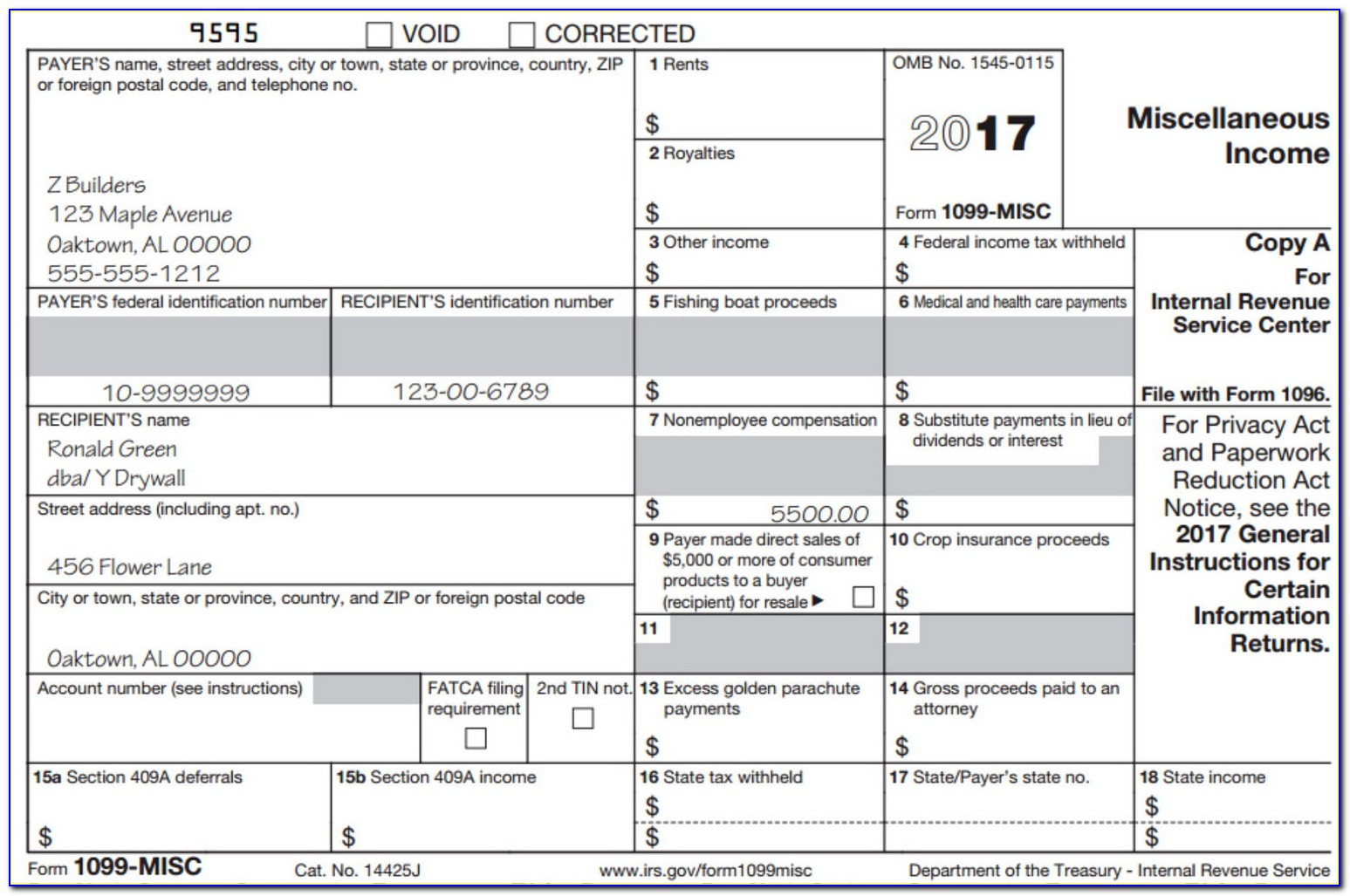

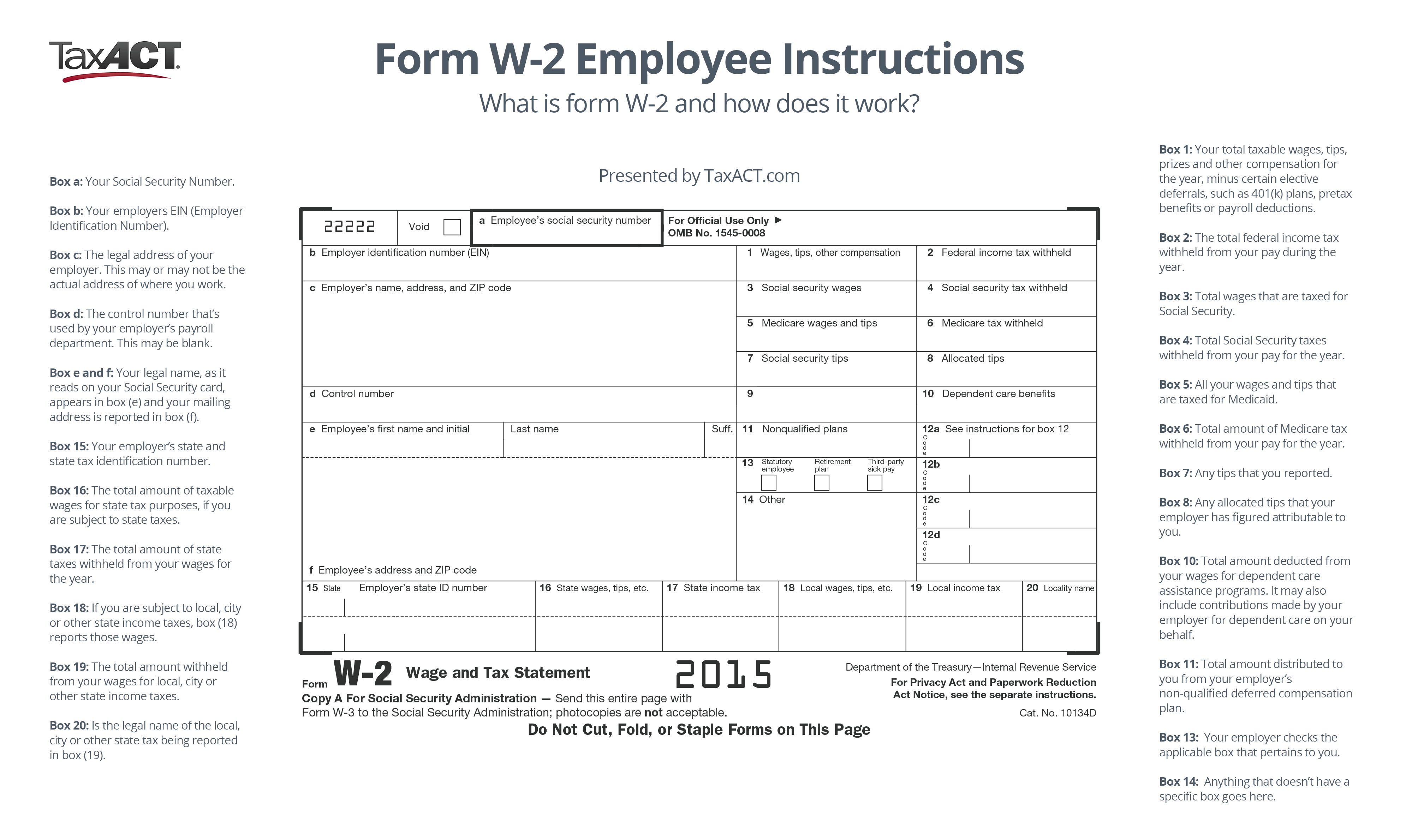

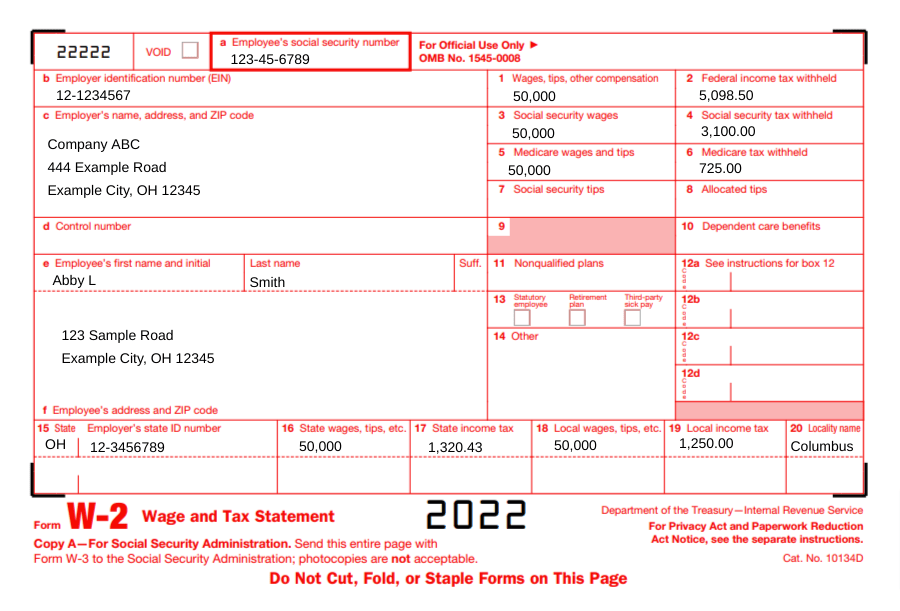

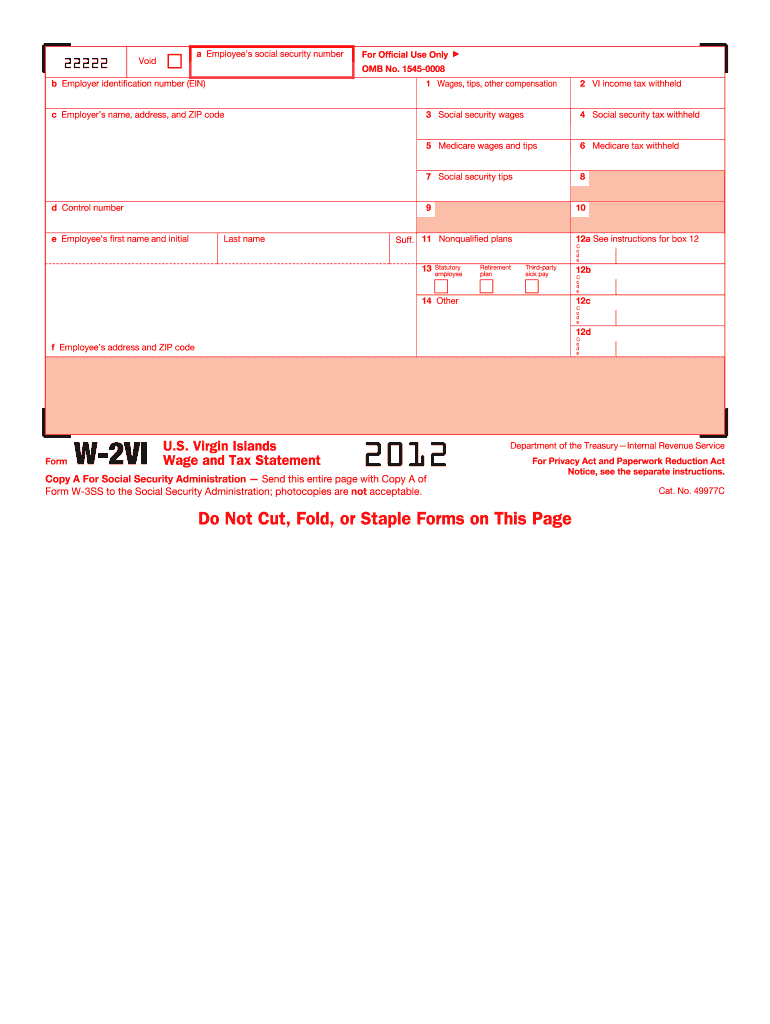

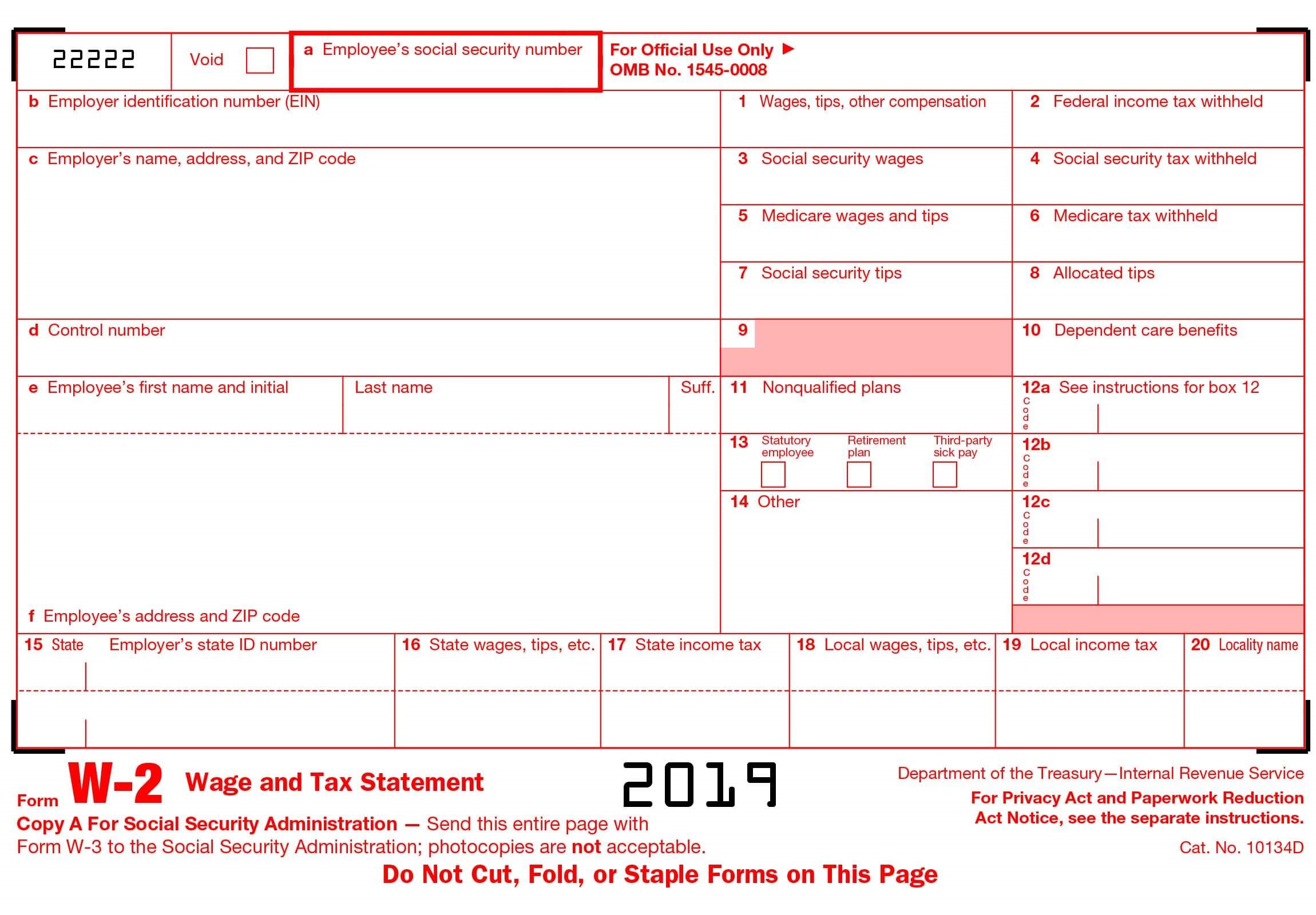

What is Form W 2 When should W 2s be filed What do you need to fill out a W 2 Instructions for filling out Form W 2 2023 W 2 PDF you can download Above is a fillable Form W 2 that you can print or download If you need a W 2 form from the previous year it is available to download below Download the 2022 version of Form W 2 There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form Independent contractors and folks who are self employed need a 1099 form instead

More picture related to Printable Enrollment W2 Form For Employees

Printable W2 Form For New Employee Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/03/printable-w2-forms-for-employees-form-resume-examples.jpg

What Is Form W 2 And How Does It Work TaxAct Blog

http://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions.png

2021 Form IRS W 2 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/539/448/539448884/large.png

1 Answer a few simple questions 2 Create an account 3 Print and download Sample W 2 Form Create Your Form 2020 2021 2022 2023 What is a W 2 Form A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return This service offers fast free and secure online W 2 filing options to CPAs accountants enrolled agents and individuals who process W 2s the Wage and Tax Statement and W 2Cs Statement of Corrected Income and Tax Amounts Verify Employees Social Security Numbers

Post a Job What Forms Do I Need for a New Hire The forms and paperwork you ll need for your new hire fall into the following four categories Federal and state government forms Internal new Any employee that you ve paid during the previous calendar year from January 1 to December 31 should receive one of these forms The W 2 form is crucial because it s how you report the total wages and compensation for the year to both your employee and the IRS

Free Printable W2 Form 2021 Printable Form Templates And Letter

https://formswift.com/seo-pages-assets/images/documents/w2/w2-sample.png

Printable W2 Form For New Employee Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/03/28-blank-w2-form-2016-in-2020-w2-forms-payroll-software.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-forms

Employment Tax Forms Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return

https://quickbooks.intuit.com/learn-support/en-us/employees-and-payroll/how-do-i-print-efile-a-w2-forms-in-quickbooks-desktop-for-an/00/1350590

Step 1 Set up your W 2 E filing The first step to electronically file your W 2s is to set it up Open QuickBooks Go to Employees then Payroll Center Open the QuickBooks Desktop Payroll Setup

What Is Form W 2 An Employer s Guide To The W 2 Tax Form Gusto

Free Printable W2 Form 2021 Printable Form Templates And Letter

Printable W2 Form For Employees Printable Form 2024

W2 Example Form Fill Out And Sign Printable PDF Template SignNow

W2 Form 2019 Online Print And Download Stubcheck

Printable W2 Form For New Employee

Printable W2 Form For New Employee

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

Printable W2 Forms

Printable W2 Form For Employees 2018

Printable Enrollment W2 Form For Employees - Download PDF Important Facts and Deadlines W 2s are information returns filled out by an employer and submitted to the Social Security Administration and employees They provide an official record of an employee s wages and federal state and local taxes paid throughout the calendar year 1