Printable Federal 8889 Tax Form Download or print the 2023 Federal Form 8889 Health Savings Accounts HSAs for FREE from the Federal Internal Revenue Service Toggle navigation TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms

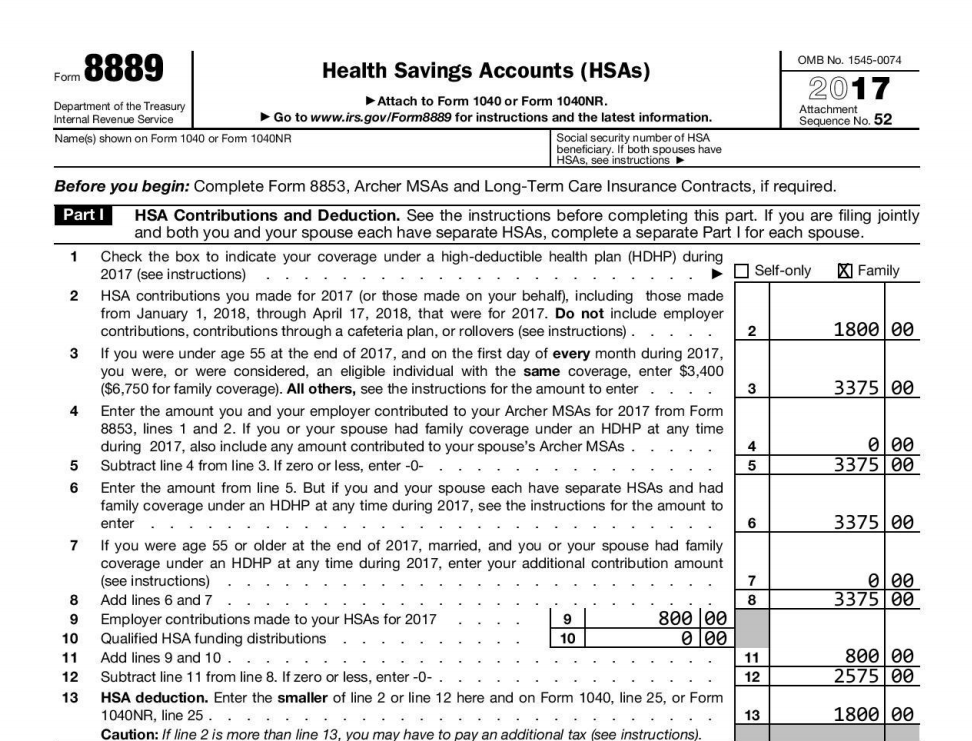

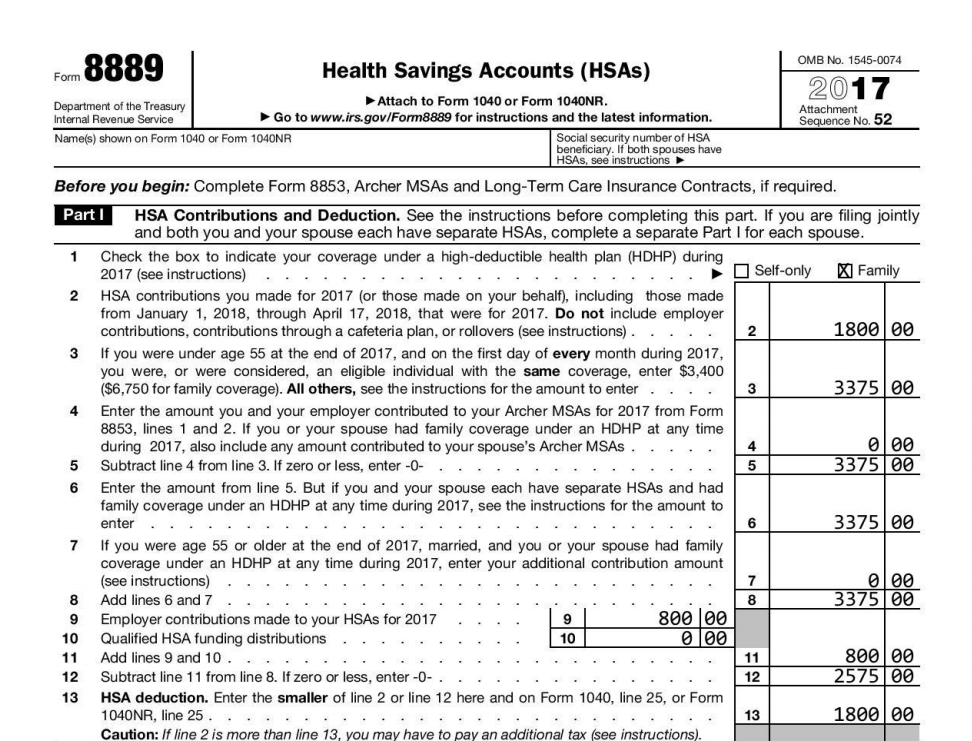

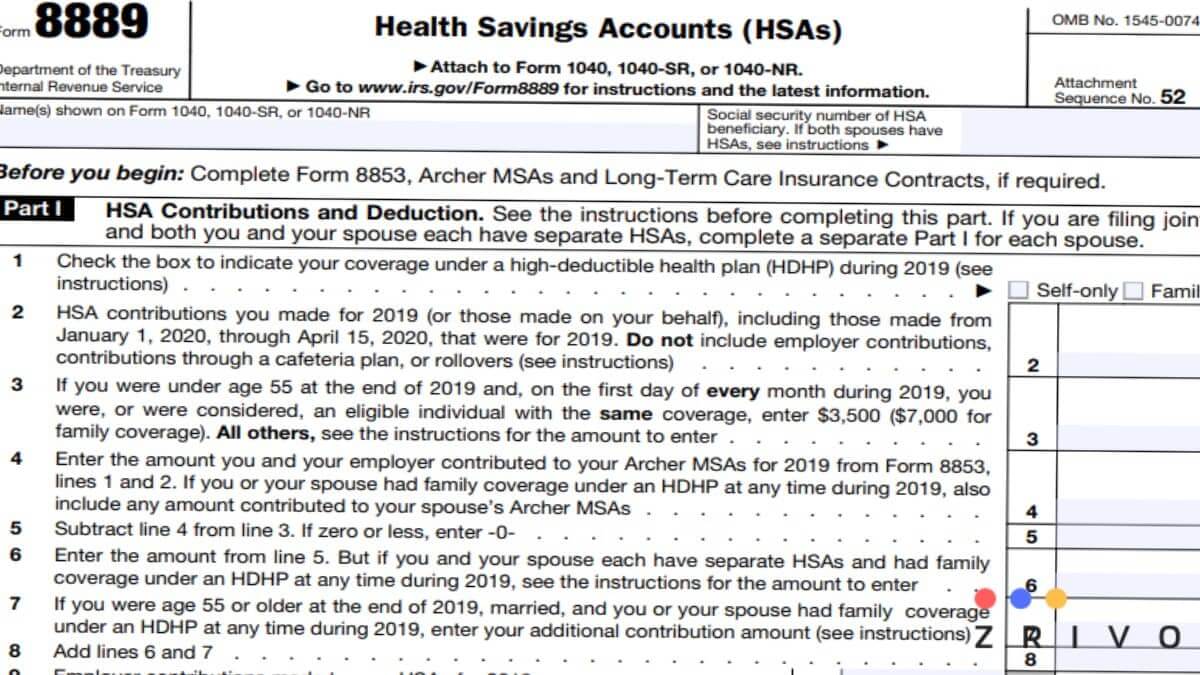

Health Savings Accounts If you are the beneficiary of a health savings account HSA then the IRS requires you to prepare Form 8889 with your tax return before you can deduct your contributions to the account The purpose of the form is to report your deductible contributions calculate the deduction report the distributions you take to pay Instructions The IRS has released the 2021 version of Form 8889 Health Savings Accounts HSAs and its instructions HSA holders and beneficiaries of deceased HSA holders must attach Form 8889 to their Forms 1040 1040 SR or 1040 NR to report tax related events affecting their HSAs including contributions and distributions

Printable Federal 8889 Tax Form

Printable Federal 8889 Tax Form

https://i.pinimg.com/originals/c7/f3/d9/c7f3d910e88442df8c57d31e3f7e7998.jpg

2017 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2018/02/2017-HSA-Form-8889-part-1-example.png

Form 8889 Health Savings Accounts HSAs 2014 Free Download

https://www.formsbirds.com/formimg/tax-support-document/8448/form-8889-health-savings-accounts-hsas-2014-l1.png

The IRS has released the 2020 version of Form 8889 Health Savings Accounts HSAs and its instructions and has updated Publication 969 Health Savings Accounts and Other Tax Favored Health Plans for 2020 tax returns HSA holders and beneficiaries of deceased HSA holders must attach Form 8889 to their Forms 1040 1040 SR or 1040 NR to What is Form 8889 Form 8889 Health Savings Accounts HSAs is used to report HSA contributions distributions and withdrawals We ll automatically fill out Form 8889 if you and or your employer contributed to an HSA usually indicated by code W in box 12 of the W 2 if you used funds in your HSA reported on Form 1099 SA or if you

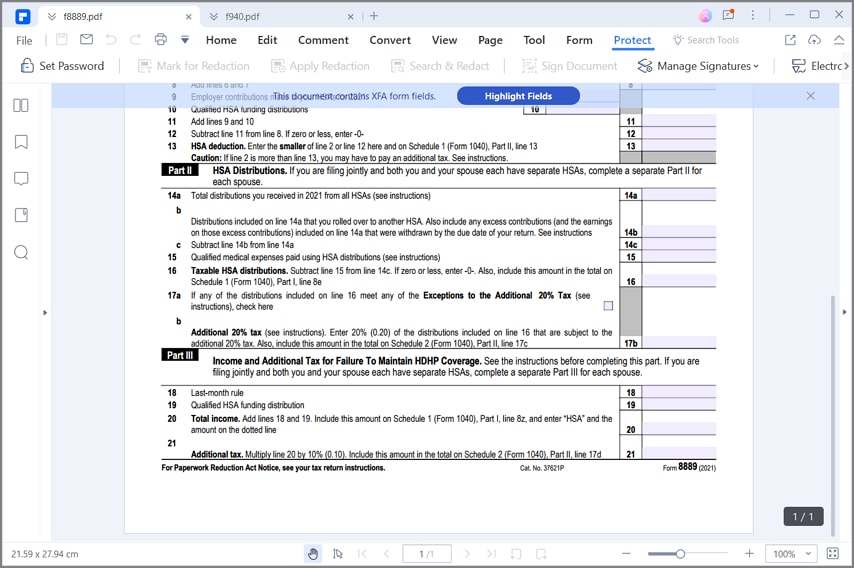

Prepare print and e file your Federal tax return for free Go to www FreeTaxUSA to start your free return today Form 8889 Department of the Treasury Internal Revenue Service No 37621P Form 8889 2023 Title 2023 Tax Federal Health Savings Accounts Author FreeTaxUSA Form 8889 Instructions Part II This section of tax Form 8889 assesses your distributions and verifies whether it was spent properly Line 15 determines how much was spent on qualified medical expenses any amount greater than box 14c will be penalized If the subtraction on line 16 is a positive number you will owe tax and penalty on the

More picture related to Printable Federal 8889 Tax Form

Form 8889 Instructions Information On The HSA Tax Form

https://www.communitytax.com/wp-content/uploads/2018/07/HSA-Beneficiary-Form-8889.jpg

2022 TAX REFUND DELAYED LONGER BECAUSE YOU FORGOT IRS Form 8889 YouTube

https://i.ytimg.com/vi/xwcoHv1LVF8/maxresdefault.jpg

Printable Federal Tax Forms Online Printable Forms Free Online

https://www.pdffiller.com/preview/521/567/521567036/big.png

Federal Form 8889 2023 Form 8889 is used to report Health Savings Account HSA activities including contributions deductions distributions and related tax obligations HSAs are accounts established for qualified medical expenses providing tax advantages for eligible individuals December 05 2023 On September 29 2023 the IRS released the 2023 instructions for Form 8889 Employees use this form to report HSA contributions and distributions Of note are the mentions of the changes to HSA administration since the end of the COVID 19 emergency The instructions mention that the preventive care safe harbor no longer

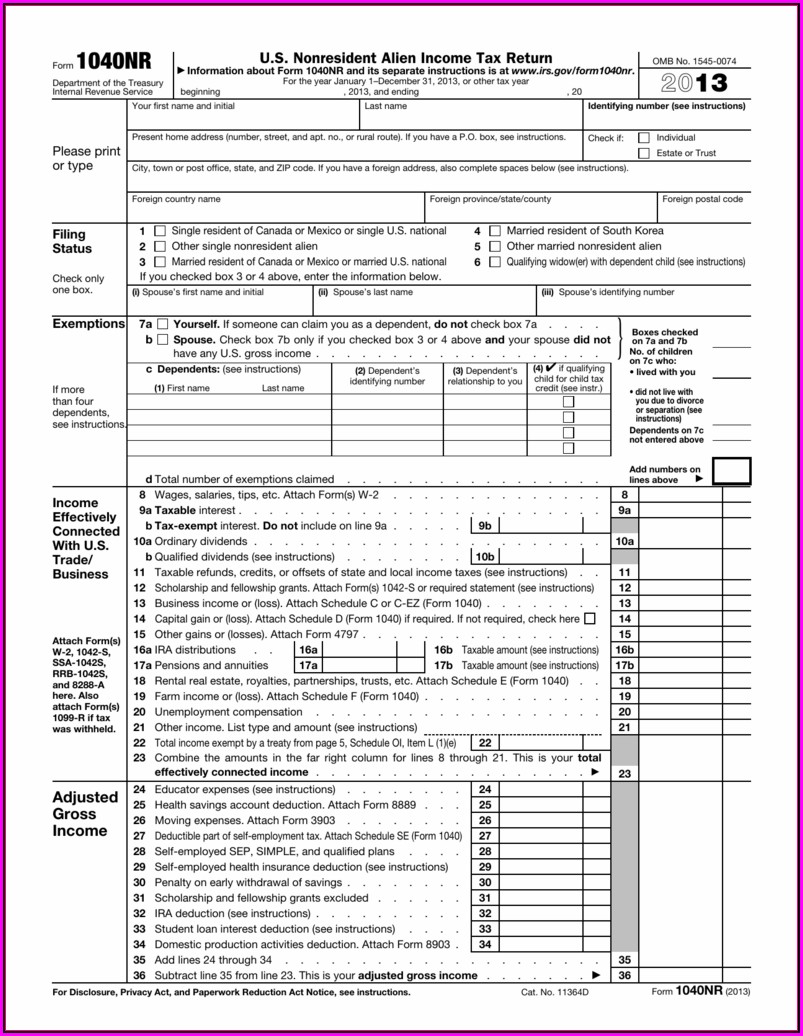

The IRS released draft instructions for Form 8889 Health Savings Accounts HSAs for the 2022 tax year to reflect several important legislative changes They include the extension of safe harbor and disregarded coverage for telehealth and other remote care services and no surprise billing for emergency or air ambulance services IRS Form 8889 is used to report HSA contributions distributions and your tax deductions You will complete this form using IRS Forms 1099 SA and 5498 SA provided by HSA Bank IRS Form 8853 is used to file Medical Savings Account MSA contributions and distributions if you currently have an MSA or have transferred your MSA to an HSA

IRS Form 8889 Instructions A Guide To Health Savings Accounts

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/irs_form_8889_featured_image.png

Instructions For Form 8889 2016 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/77/778/77833/page_1_thumb_big.png

https://www.taxformfinder.org/federal/form-8889

Download or print the 2023 Federal Form 8889 Health Savings Accounts HSAs for FREE from the Federal Internal Revenue Service Toggle navigation TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms

https://turbotax.intuit.com/tax-tips/health-care/what-is-the-irs-form-8889/L8hRNHx4o

Health Savings Accounts If you are the beneficiary of a health savings account HSA then the IRS requires you to prepare Form 8889 with your tax return before you can deduct your contributions to the account The purpose of the form is to report your deductible contributions calculate the deduction report the distributions you take to pay

Form 8889 T Fill Out Sign Online DocHub

IRS Form 8889 Instructions A Guide To Health Savings Accounts

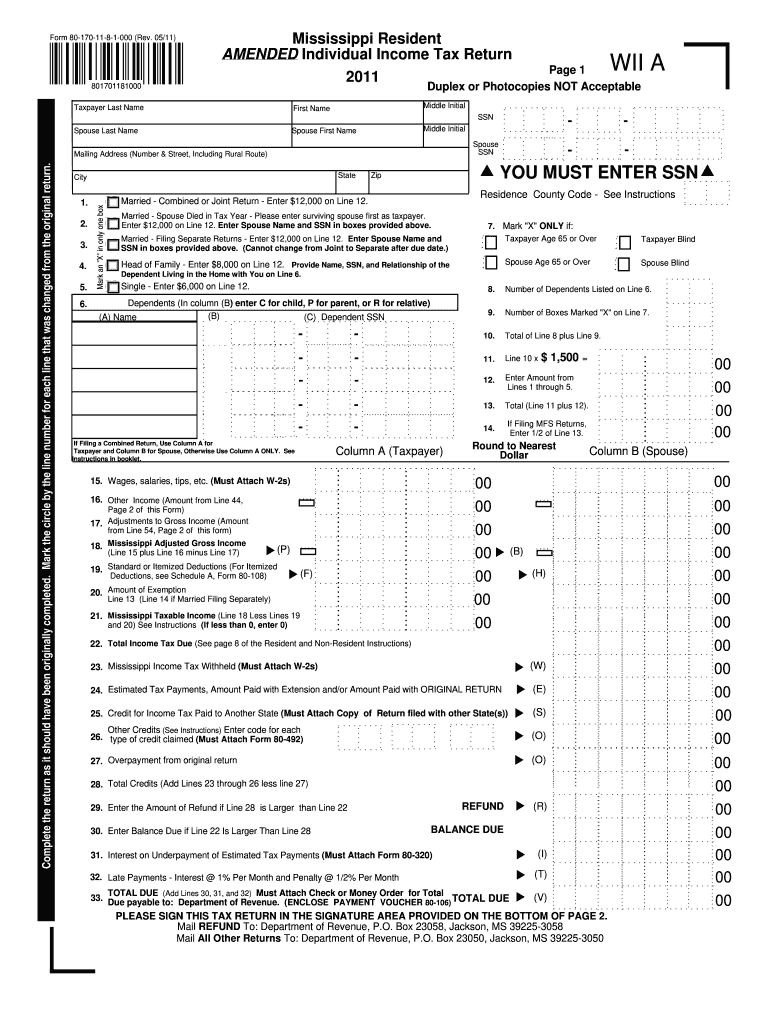

Free Printable State Tax Forms Printable Templates

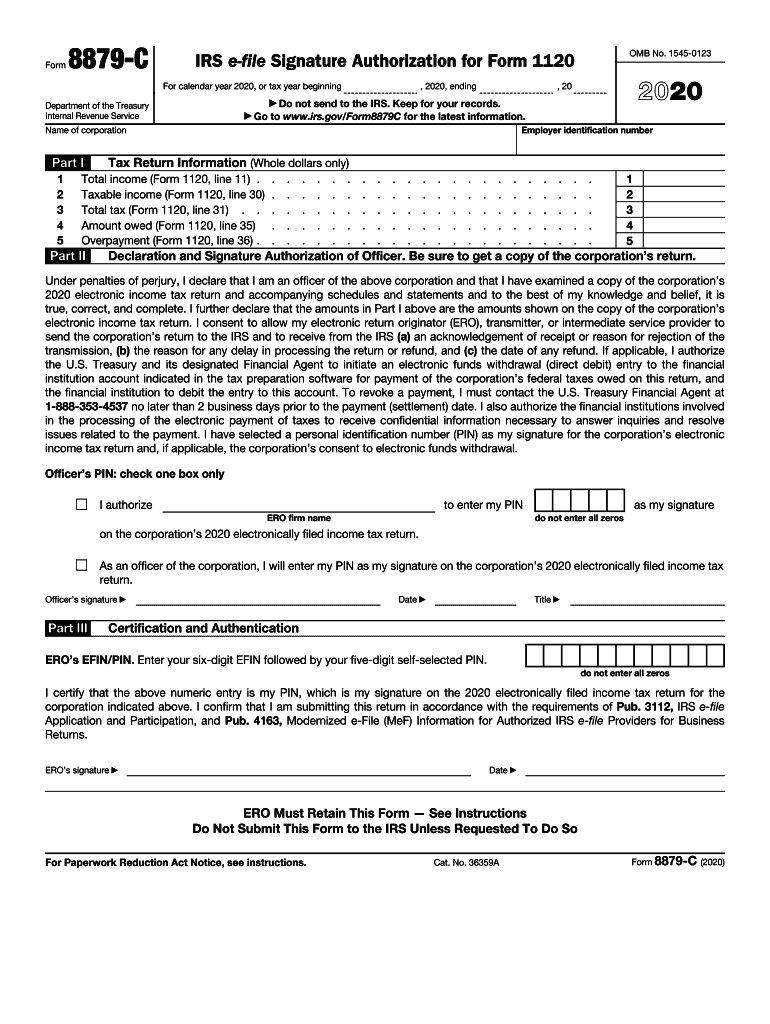

IRS 8879 C 2020 2022 Fill Out Tax Template Online US Legal Forms

Mississippi State Tax Form Fill And Sign Printable Template Online US Legal Forms

Form 8889 Instructions Information On The HSA Tax Form

Form 8889 Instructions Information On The HSA Tax Form

8889 Form 2023 2024

Como Preencher O Formul rio IRS 8889

Irs Form 8889 Instructions 2013 Form Resume Examples goVLq1N2va

Printable Federal 8889 Tax Form - Form 8889 Instructions Part II This section of tax Form 8889 assesses your distributions and verifies whether it was spent properly Line 15 determines how much was spent on qualified medical expenses any amount greater than box 14c will be penalized If the subtraction on line 16 is a positive number you will owe tax and penalty on the