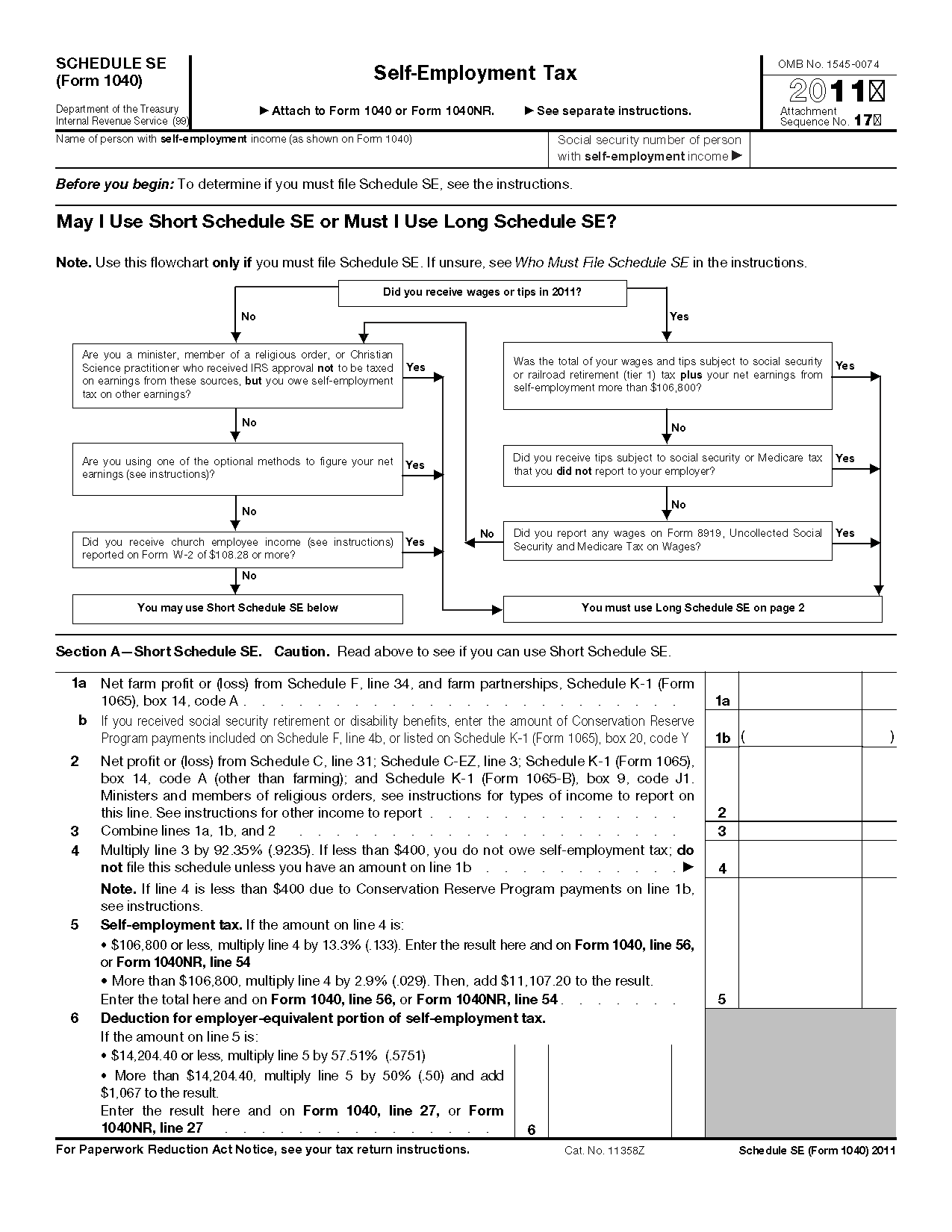

Printable Federal Tax Form Self Employment The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits Current Revision Schedule SE Form 1040 PDF

Online learning tools Who is self employed Generally you are self employed if any of the following apply to you You carry on a trade or business as a sole proprietor or an independent contractor You are a member of a partnership that carries on a trade or business Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability

Printable Federal Tax Form Self Employment

Printable Federal Tax Form Self Employment

https://www.pdffiller.com/preview/535/579/535579439/large.png

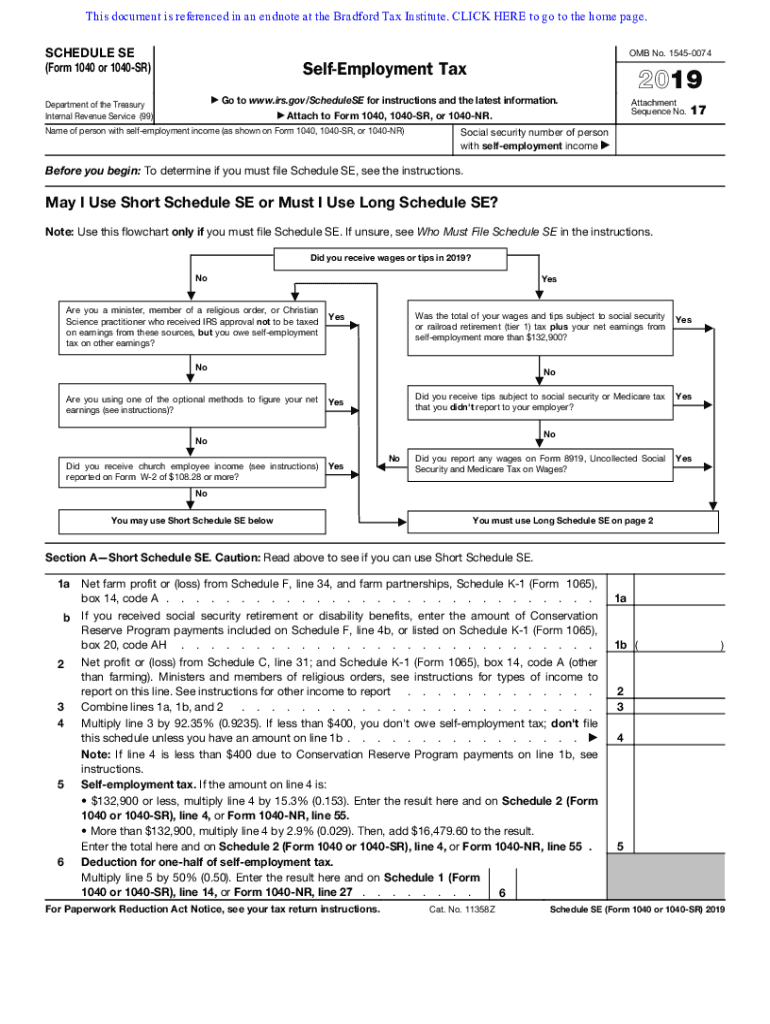

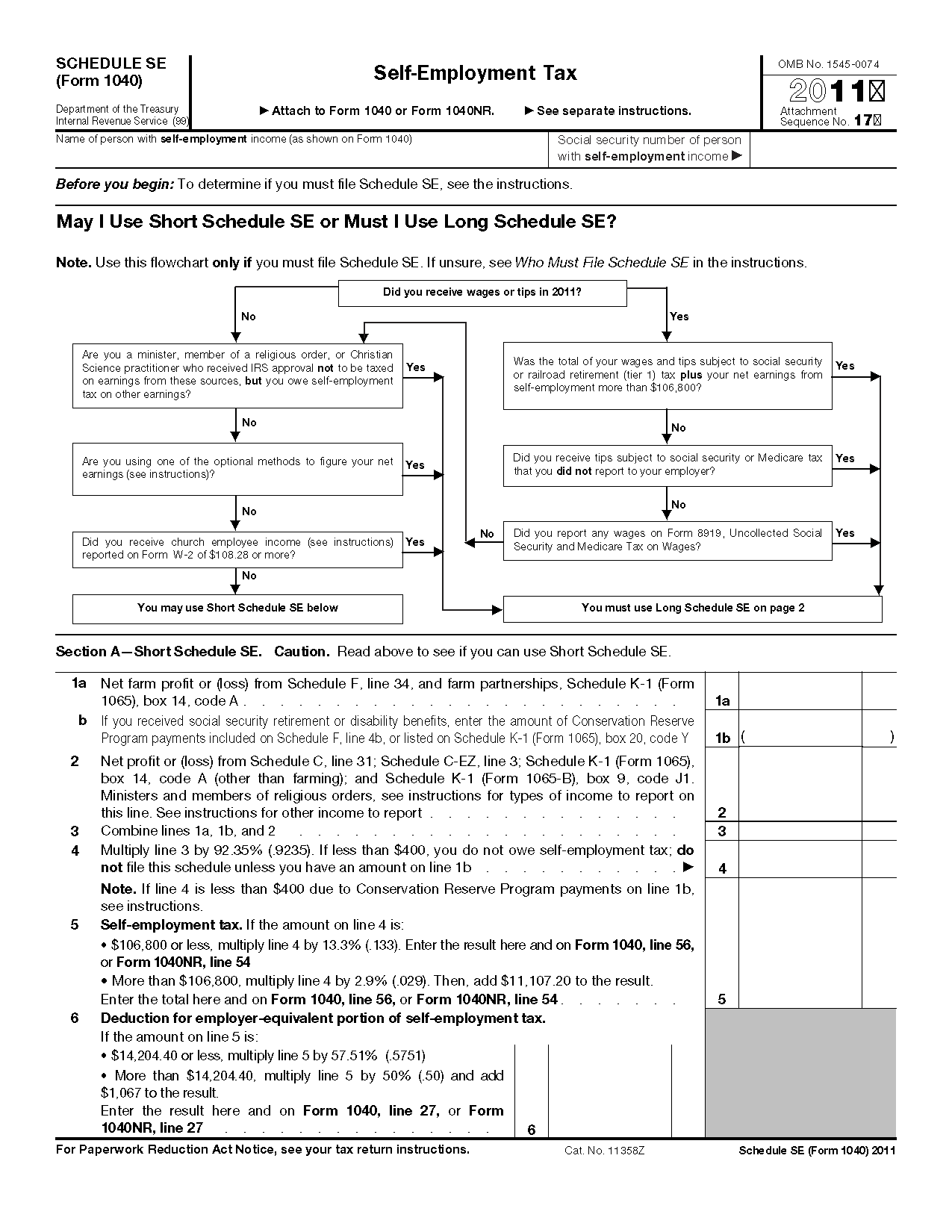

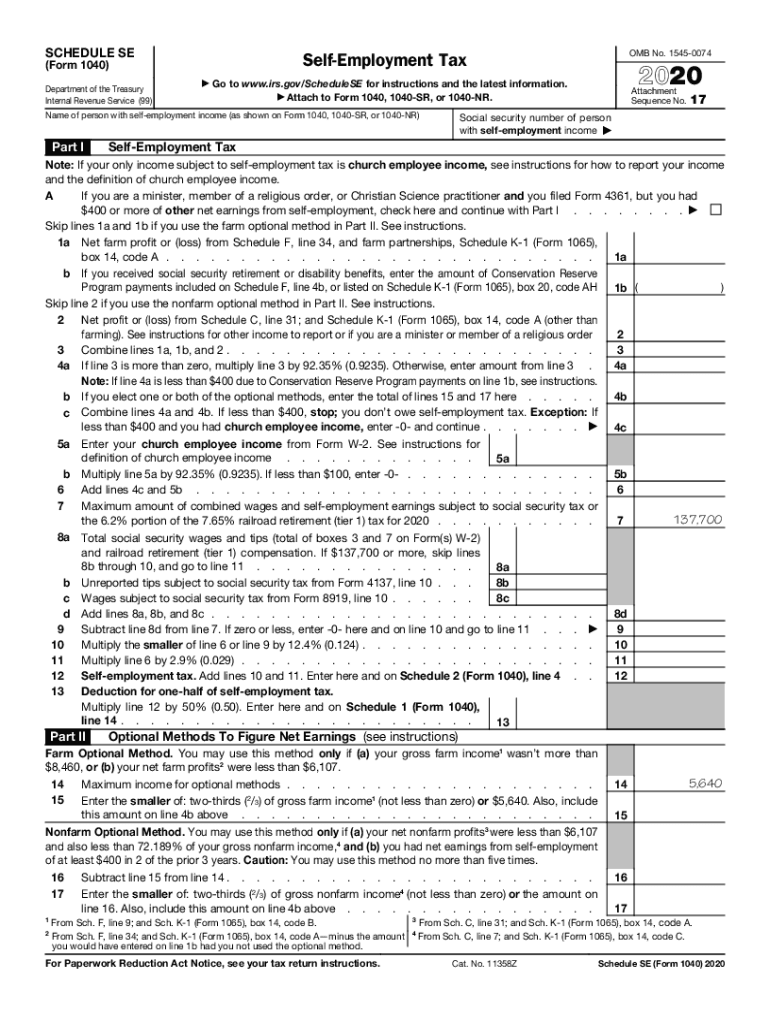

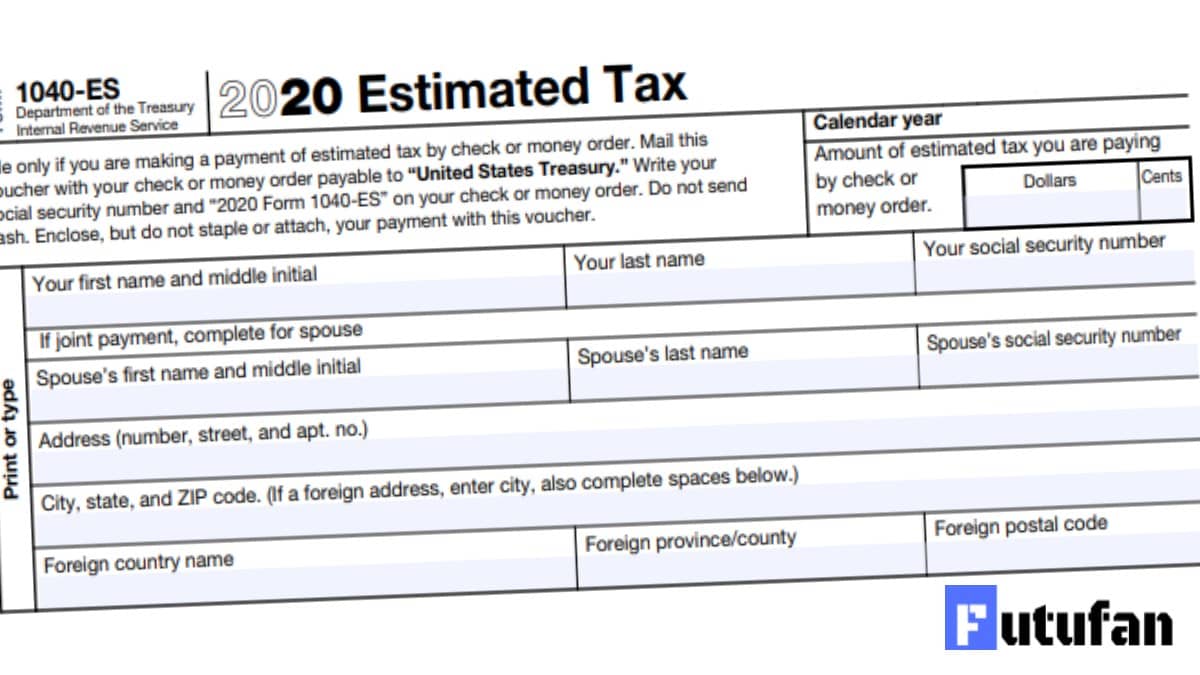

IRS Schedule Se Form 1040 Self Employment Tax 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/form-1040-schedule-se-self-employment-tax.png

2022 Self Employed Tax Form Employment Form

https://www.employementform.com/wp-content/uploads/2022/10/2022-self-employed-tax-form.jpg

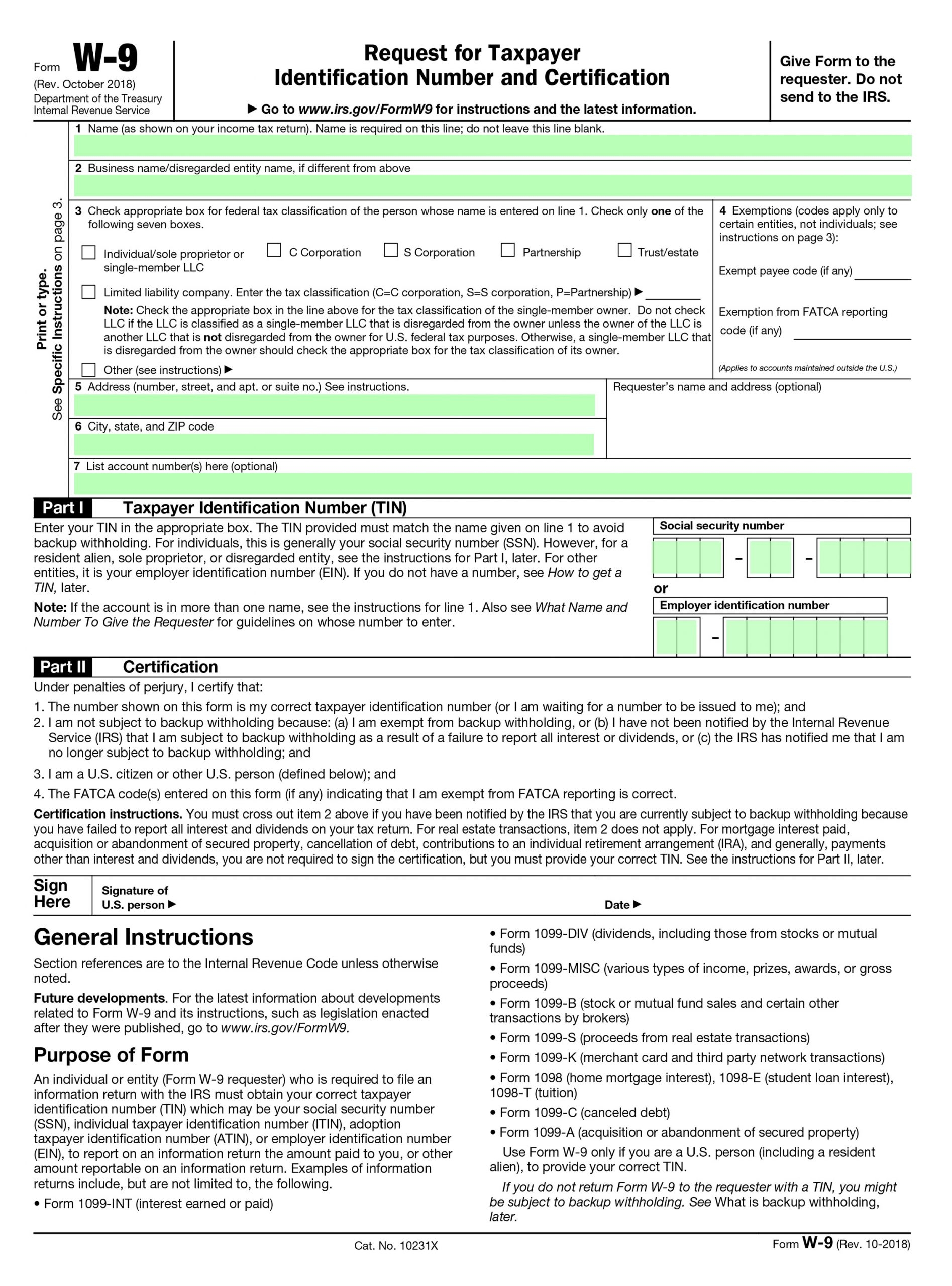

That may first involve securing a tax ID number You can get a tax ID number for free It s always a good idea for self employed people to get a separate tax ID number for their business so they can give it to customers that require a W 9 form from them A tax ID number is required if you have employees If you can carve out a little nook in The self employment tax rate for 2023 As noted the self employment tax rate is 15 3 of net earnings in 2023 That rate is the sum of a 12 4 Social Security tax also known as OASDI tax and a

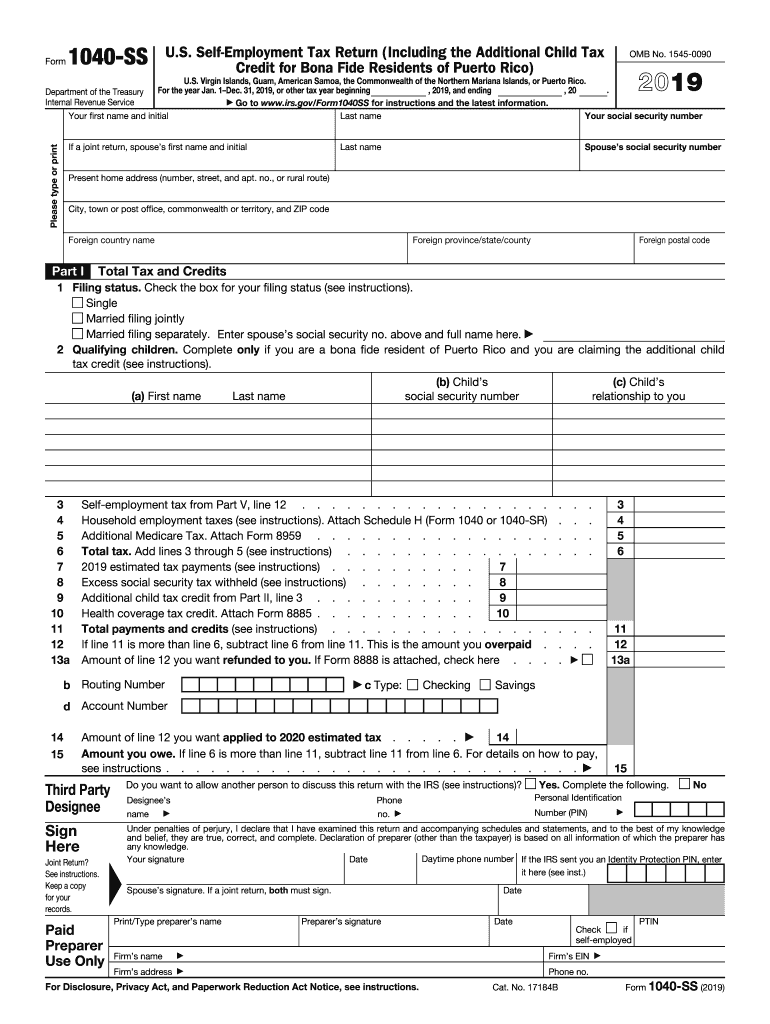

To help get you prepared for this tax season here are the forms you may need to file if you are self employed Forms You May Receive Form 1099 MISC Starting in tax year 2020 Form 1099 MISC was replaced by Form 1099 NEC non employee compensation for your freelance side gig or self employed income However you still may receive a 1099 File your self employed taxes with confidence Backed by our 100k accuracy guarantee Start Your Return Updated for tax year 2023 If you re even a moderately successful freelancer you likely know must file a tax return and pay taxes on your income But which tax forms do you need to file your self employment taxes At a glance

More picture related to Printable Federal Tax Form Self Employment

2019 Form 1040 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/492/225/492225665/large.png

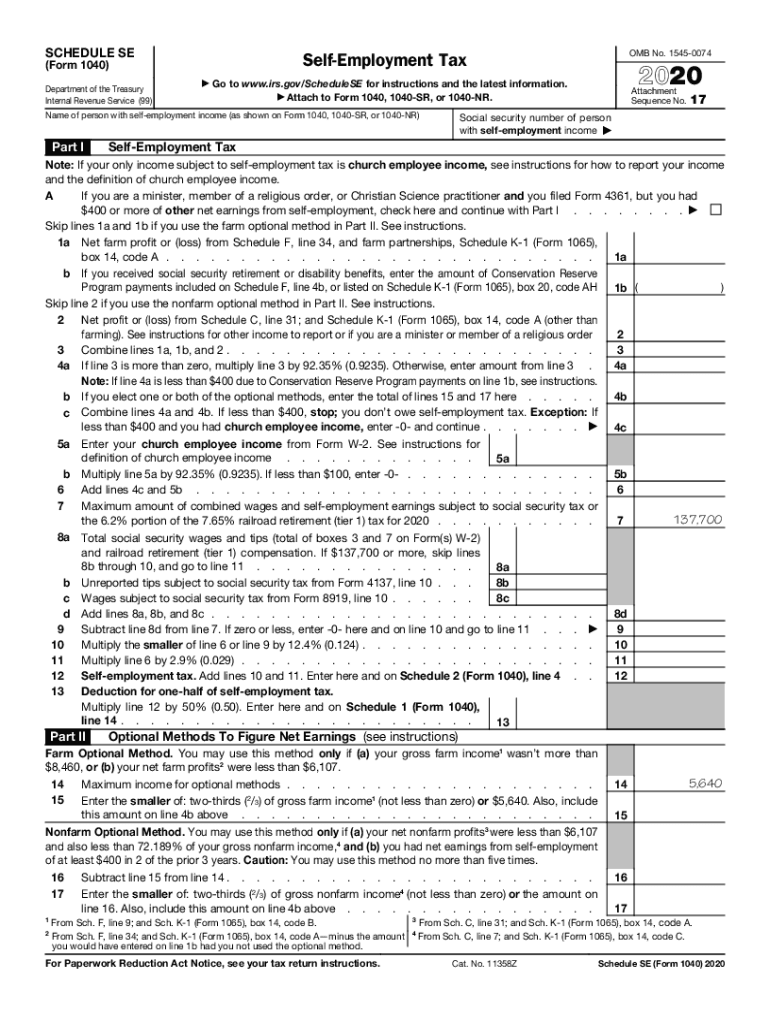

Self Employment Tax Form Editable Forms

http://www.editableforms.com/wp-content/uploads/2013/12/Self-Employment-Tax-Form-696x895.png

How To File Self Employment Taxes Step By Step Your Guide

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b9e5062816ec3f6caf30_schedule-se.png

Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return You use it to calculate your total self employment tax which you must report on another schedule of Form 1040 Schedule 2 Part II line 4 Self employment tax is a combination of your Social Security and Medicare tax similar to 1040 Schedule SE Federal Self Employment Tax Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule se pdf and you can print it directly from your computer More about the Federal 1040 Schedule SE eFile your Federal tax return now

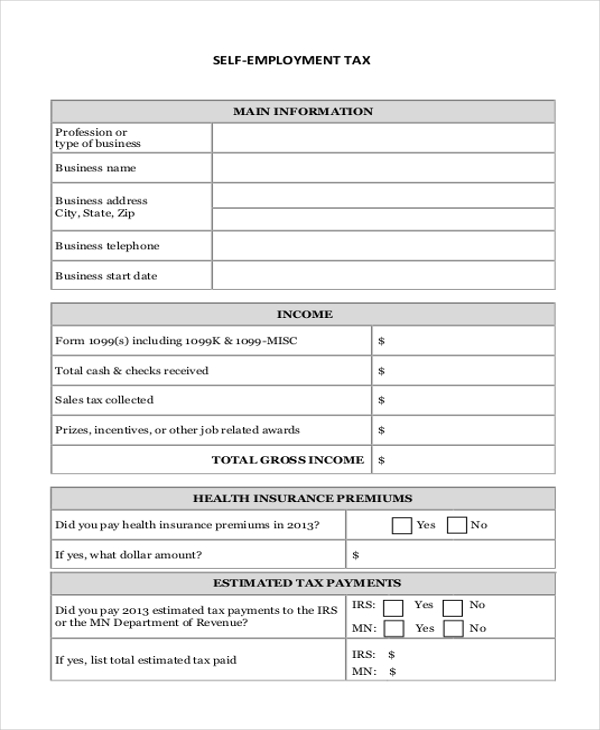

H R Block Online Self Employed Federal Forms Tax Year 2023 Form 1040 Individual Income Tax Return Form 1040 SR Individual Income Tax Return for Seniors Form 1040 SP Declaraci n de Impuestos de los Estados Unidos Sobre los Ingresos Personales Form 1040 Schedule 1 Additional Income and Adjustments to Income Form 1040 Schedule 2 Additional Taxes Personal Finance Money Home How to File Taxes When You re Self Employed The self employment tax consists of Social Security and Medicare taxes but you might have other taxes to pay

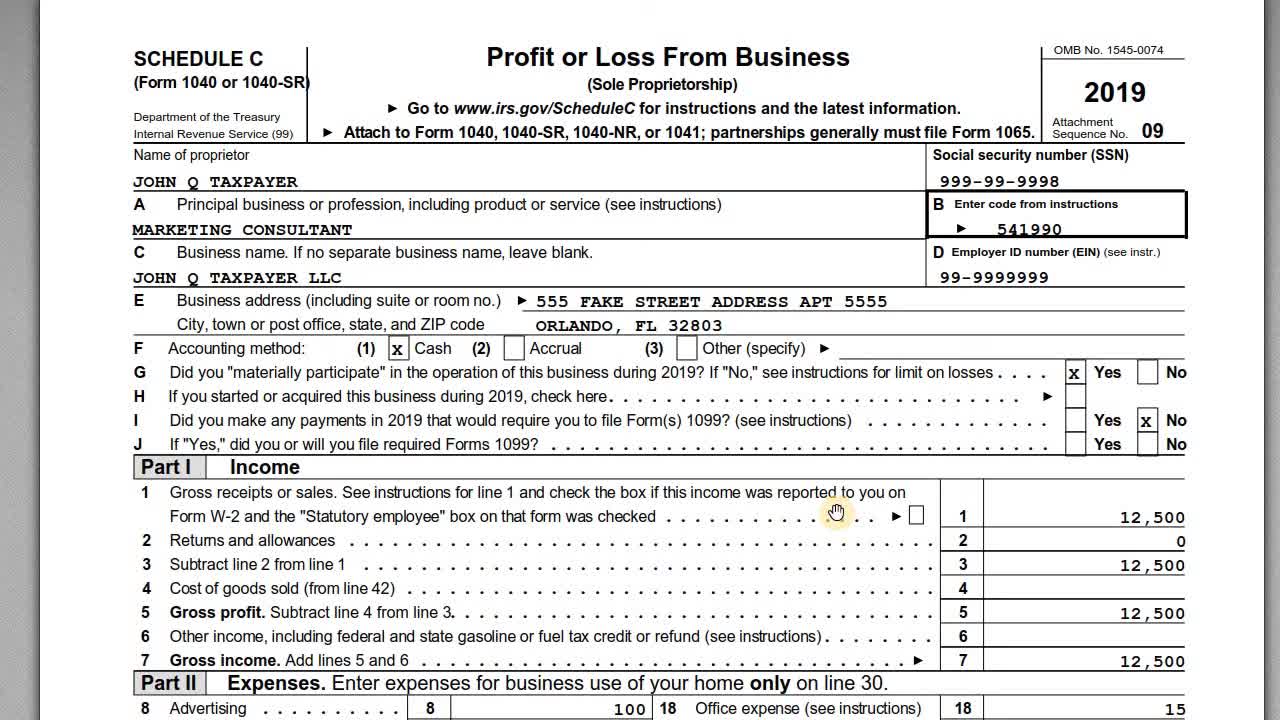

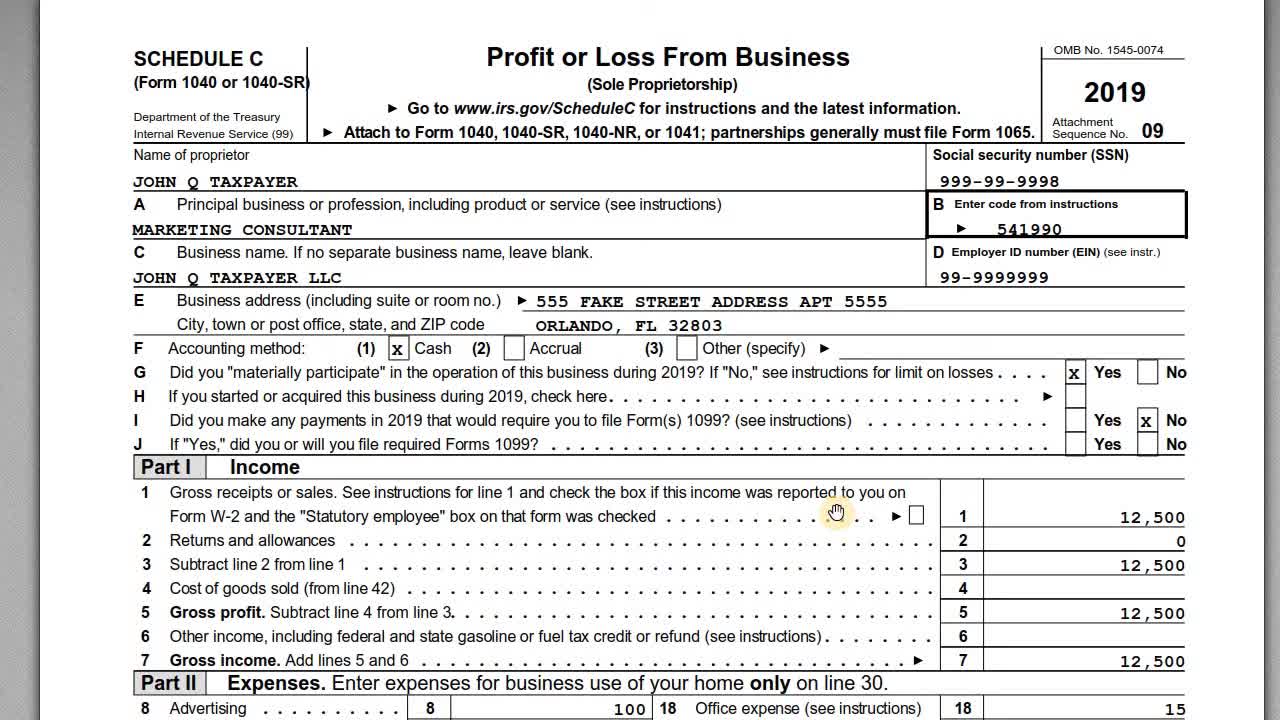

IRS Schedule C With Form 1040 Self Employment Taxes

https://sp.rmbl.ws/s8/6/j/f/l/X/jflXc.qR4e.1.jpg

Self Employment Tax Form 2022 Schedule C Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-form-2022-schedule-c.png

https://www.irs.gov/forms-pubs/about-schedule-se-form-1040

The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits Current Revision Schedule SE Form 1040 PDF

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

Online learning tools Who is self employed Generally you are self employed if any of the following apply to you You carry on a trade or business as a sole proprietor or an independent contractor You are a member of a partnership that carries on a trade or business

How To File Self Employment Taxes Step By Step Your Guide

IRS Schedule C With Form 1040 Self Employment Taxes

FREE 9 Sample Employee Tax Forms In MS Word PDF

Printable Fileable IRS Form 7202 Self Employed Sick Leave And Family Leave COVID CPA

Form 1040 SS U S Self Employment Tax Return Form 2014 Free Download

2020 Form IRS 1040 Schedule SE Fill Online Printable Fillable Blank PdfFiller

2020 Form IRS 1040 Schedule SE Fill Online Printable Fillable Blank PdfFiller

FREE 22 Sample Tax Forms In PDF Excel MS Word

Irs Form 1040es For 2023 Printable Forms Free Online

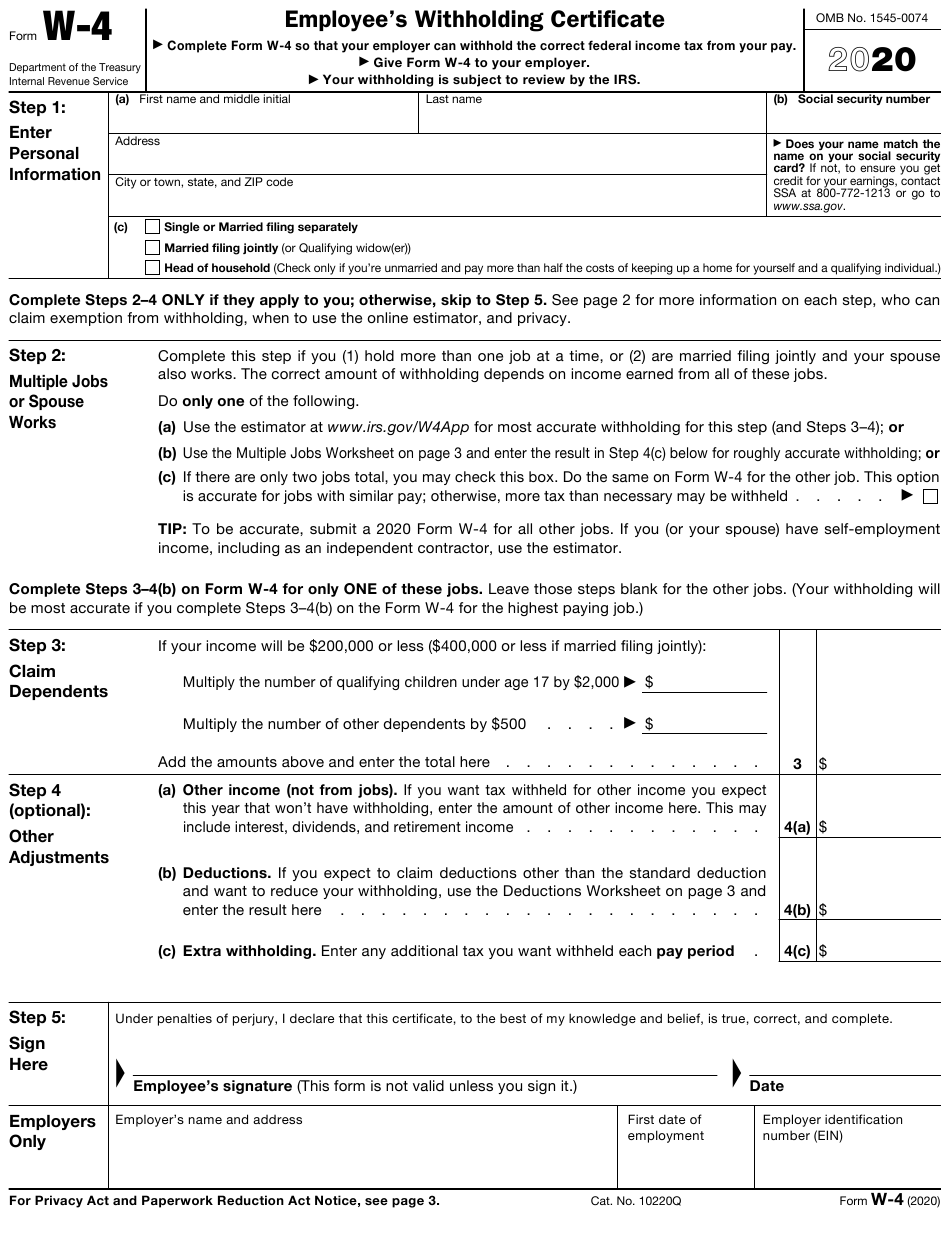

IRS W 4 Form Printable 2022 W4 Form

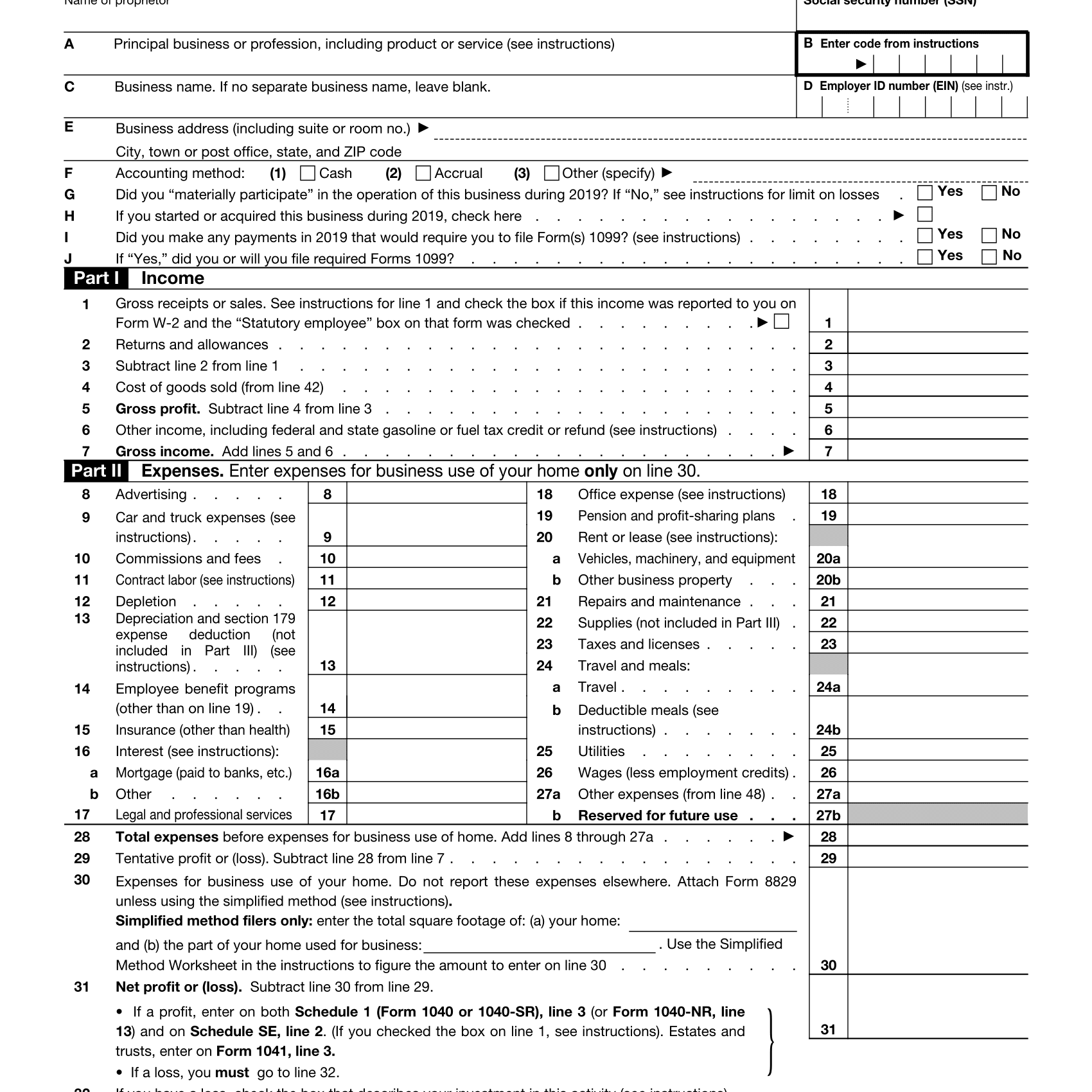

Printable Federal Tax Form Self Employment - What Is Form 1040 Schedule SE Schedule SE is used to calculate both your self employment tax due and your one half self employment tax deduction on IRS Form 1040 and Form 1040NR Schedule SE is generally required if you file Schedule C EZ Schedule C Schedule F or Schedule K 1 Form 1065