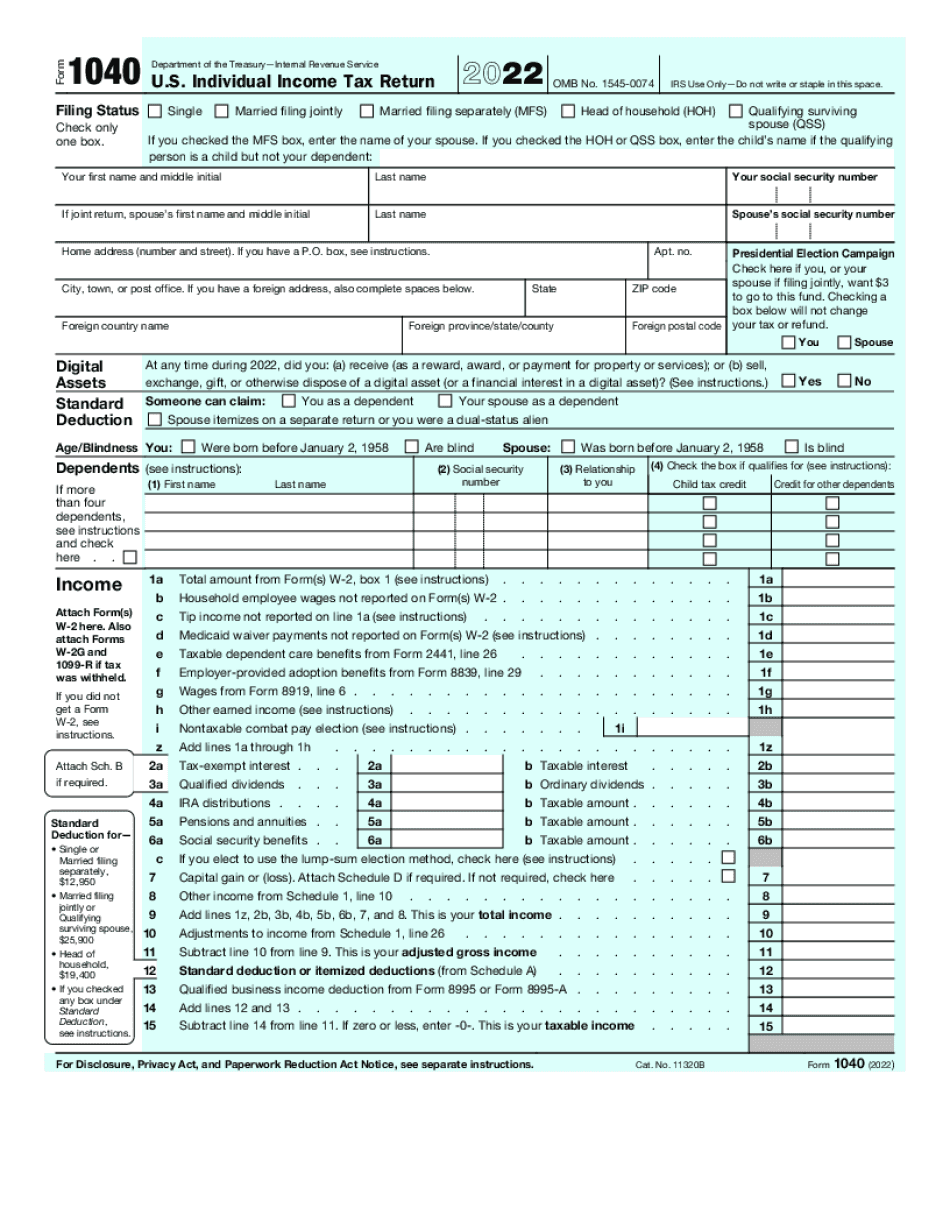

Printable Form 104 Schedule A Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file

Enter an estimate of your 2024 itemized deductions from Schedule A Form 1040 Such deductions may include qualifying home mortgage interest charitable contributions state and local taxes up to 10 000 and medical expenses in excess of 7 5 of your income 1 2 Printable Form 1040 Schedule A Click any of the IRS Schedule A form links below to download save view and print the file for the corresponding year These free PDF files are unaltered and are sourced directly from the publisher 2023 Schedule A Form 2023 Schedule A Instructions ETA 12 15 2022 Schedule A Form 2022 Schedule A Instructions

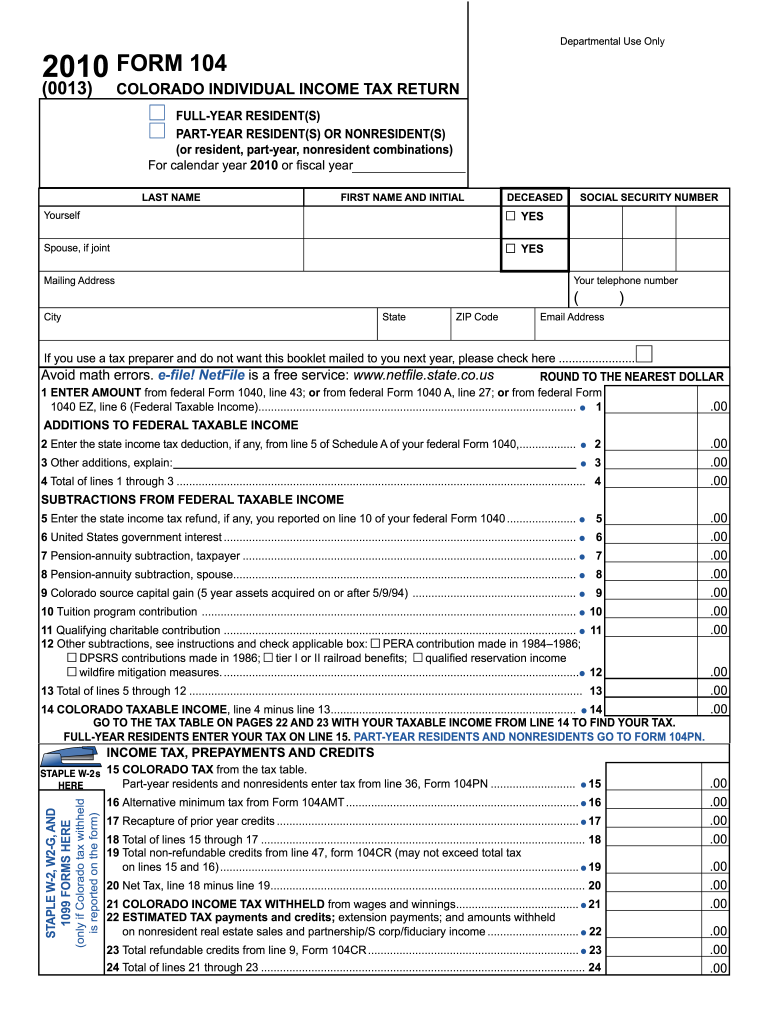

Printable Form 104 Schedule A

Printable Form 104 Schedule A

https://www.pdffiller.com/preview/100/77/100077550/large.png

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/Form_1040_2021.61dc944778e68.png

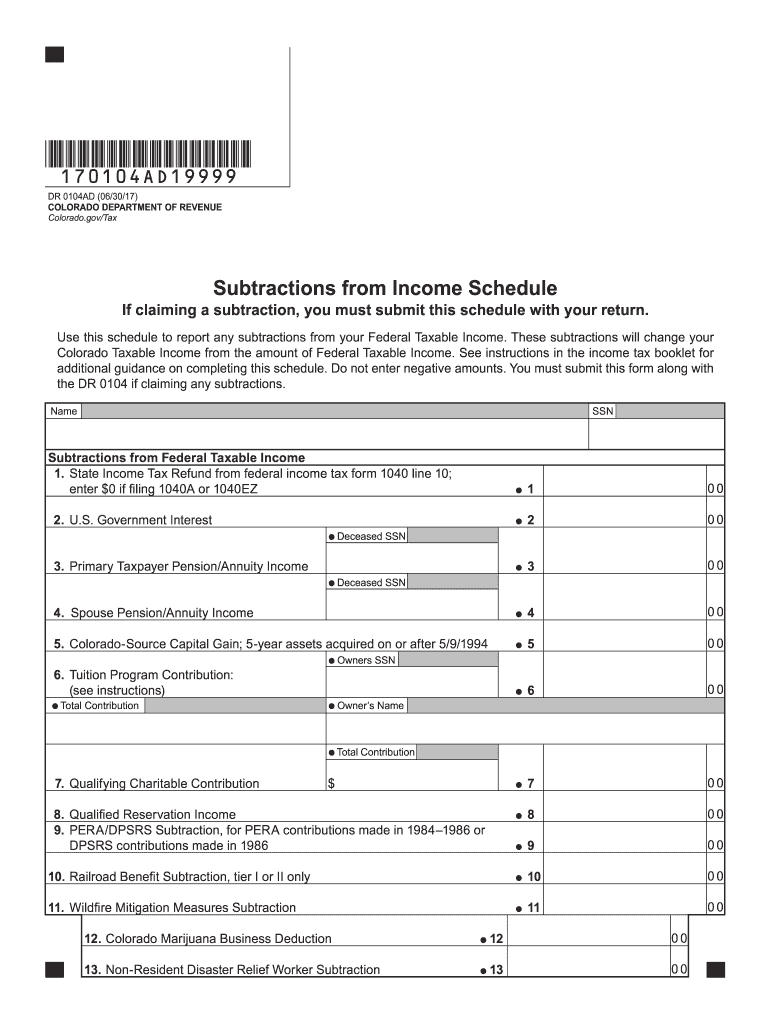

104ad Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/101/145/101145256/large.png

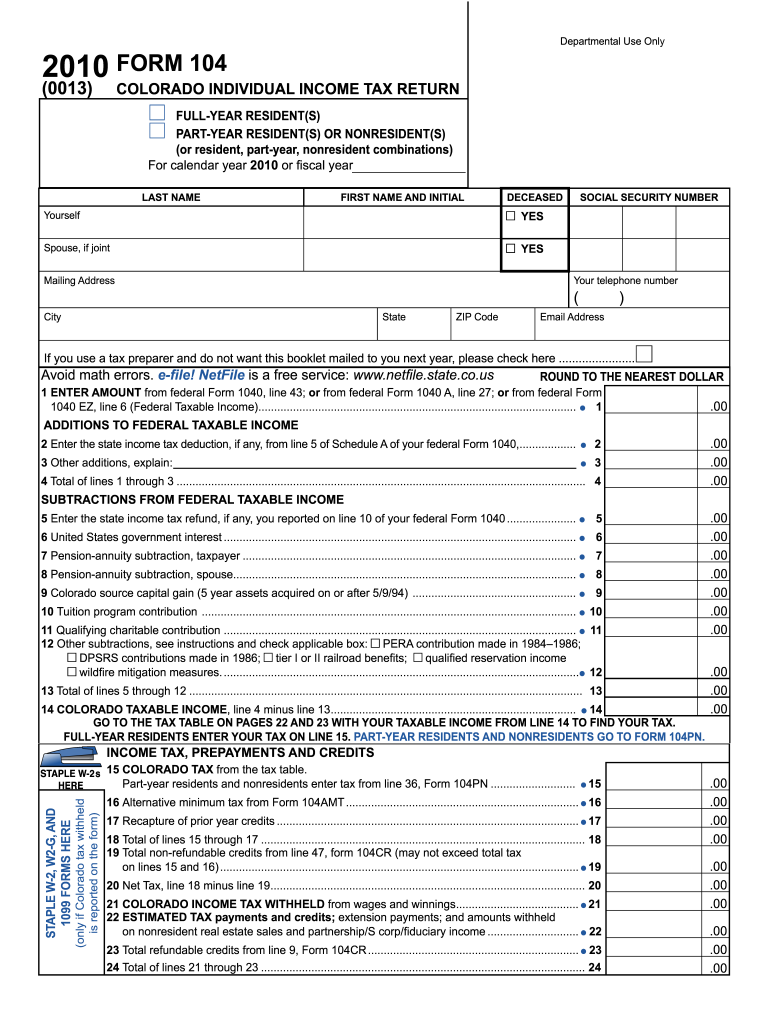

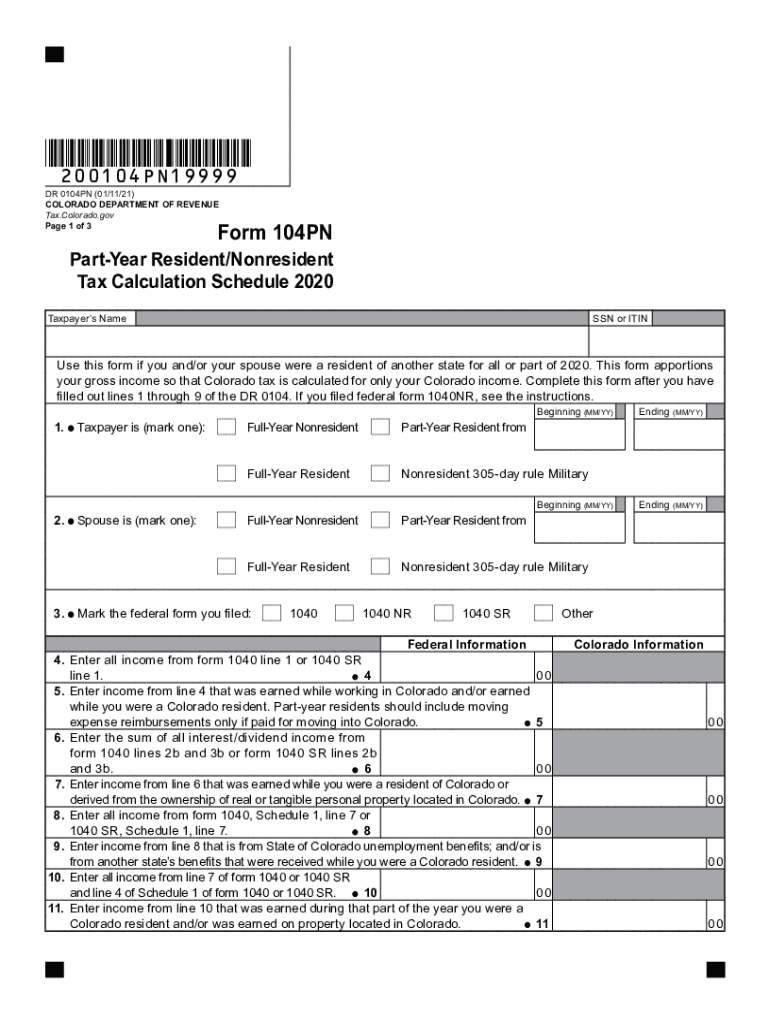

Form 104 is the general and simplest income tax return for individual residents of Colorado You may file by mail with paper forms or efile online contains Forms DR 0104 DR 0104CH DR 0900 DR 0104AD DR 0158 I DR 0104PN DR 0104US DR0104CR The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms schedules and instructions for the tax year 2024 TRAVERSE CITY MI US November 27 2023 EINPresswire

Colorado state income tax Form 104 must be postmarked by April 15 2024 in order to avoid penalties and late fees Printable Colorado state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023 Explain 5 Subtotal sum of lines 1 through 4 5 Colorado Subtractions 6 Subtractions from the DR 0104AD Schedule line 20 you must submit the DR 0104AD schedule with your return 6 7 Colorado Taxable Income subtract line 6 from line 5 7 Tax Prepayments and Credits see 104 Book for full year tax table and part year DR 0104PN Schedule 8

More picture related to Printable Form 104 Schedule A

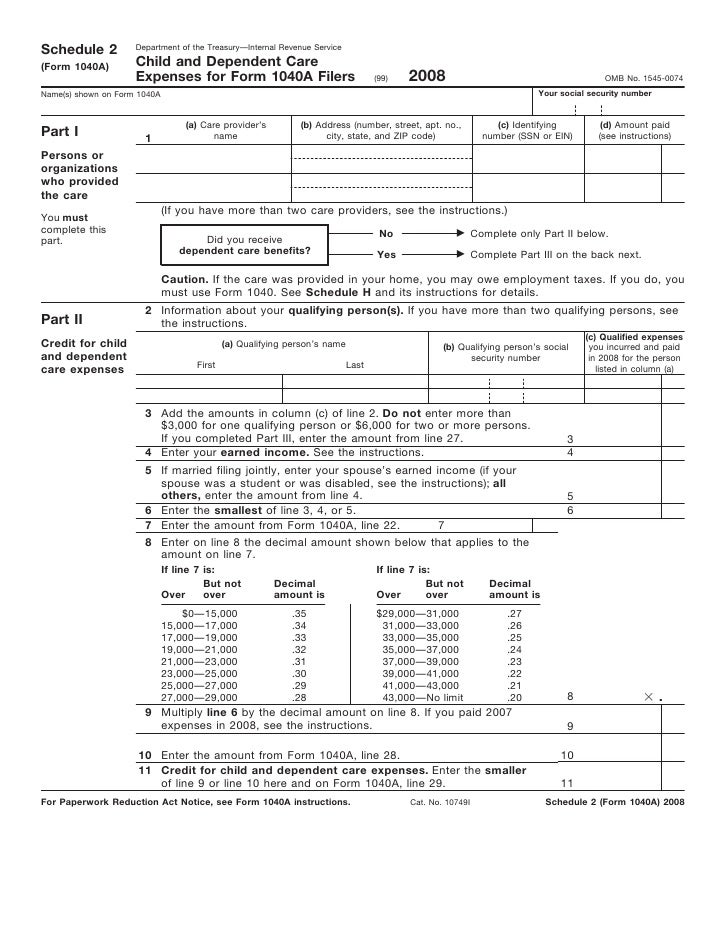

Form 1040A Schedule 2 Child And Dependent Care Expenses For Form 104

https://image.slidesharecdn.com/1273182/95/form-1040a-schedule-2child-and-dependent-care-expenses-for-form-1040a-filers-1-728.jpg?cb=1239369271

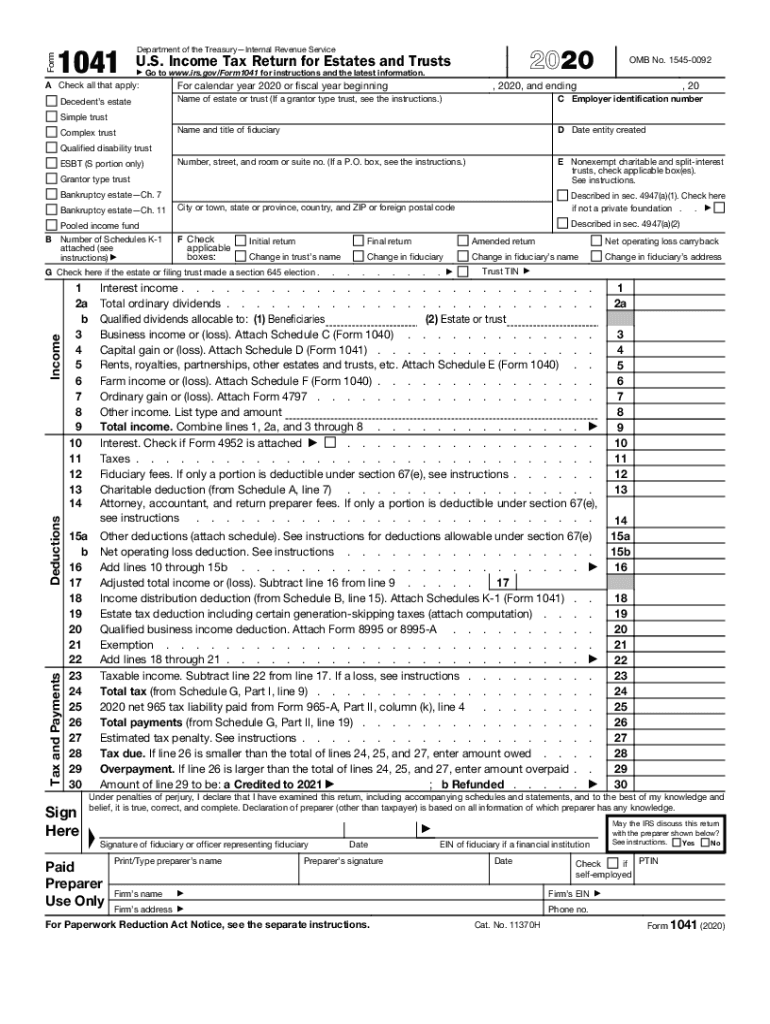

2020 Form IRS 1041 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/781/535781035/large.png

T5013 Box 135 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/105/100105362/large.png

Instructions about filing State income tax are available on each form The tax filing deadline for tax year 2023 is April 15 2024 however the state offers an automatic six month extension for filing as long as payment obligations are satisfied by April 15 To physically visit a Service Center for help please schedule an appointment Mailing Address For Form DR 0104 104 BOOK 2021 Booklet Includes Instructions DR 0104 Related Forms Tax Colorado gov y DR 0104CH 2021 Voluntary Contributions Schedule y DR 0900 2021 Individual Income Tax Payment Form y DR 0104AD 2021 Subtractions from Income Schedule y DR 0158 I 2021 Extension Payment for Colorado Individual Income Tax

Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2023 or other tax year beginning 2023 ending 20 See separate instructions Your first name and middle initial Last name 10068 Form 104 Must be filed with Form 102 or 103 Business Tangible Personal Property Return 53854 Form 103 SR For use by taxpayers with personal property in more than one township in a county Must be filed with Form 104 SR Single Return Business Tangible Personal Property 53855

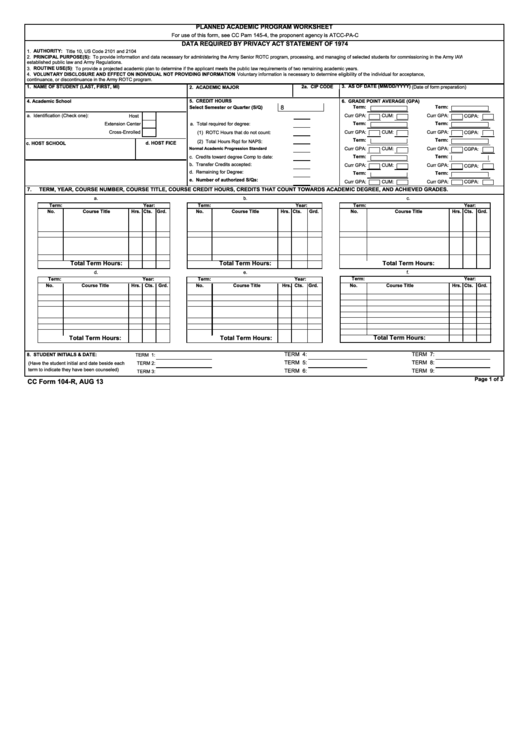

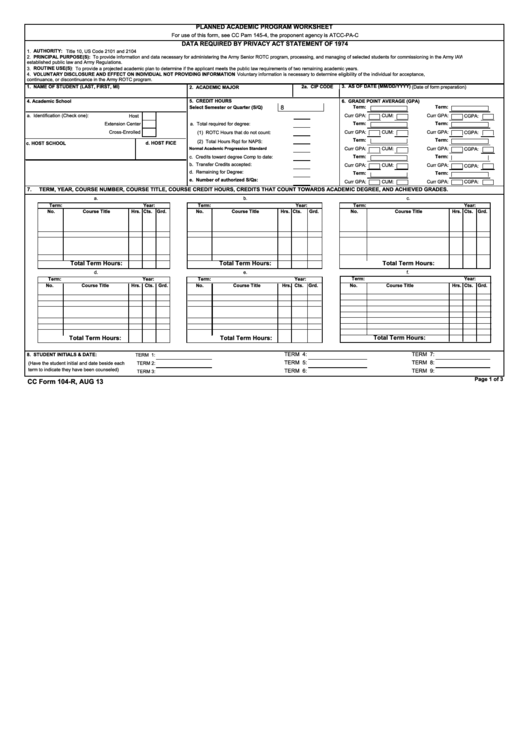

104 R Fillable Form Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/118/1182/118253/page_1_thumb_big.png

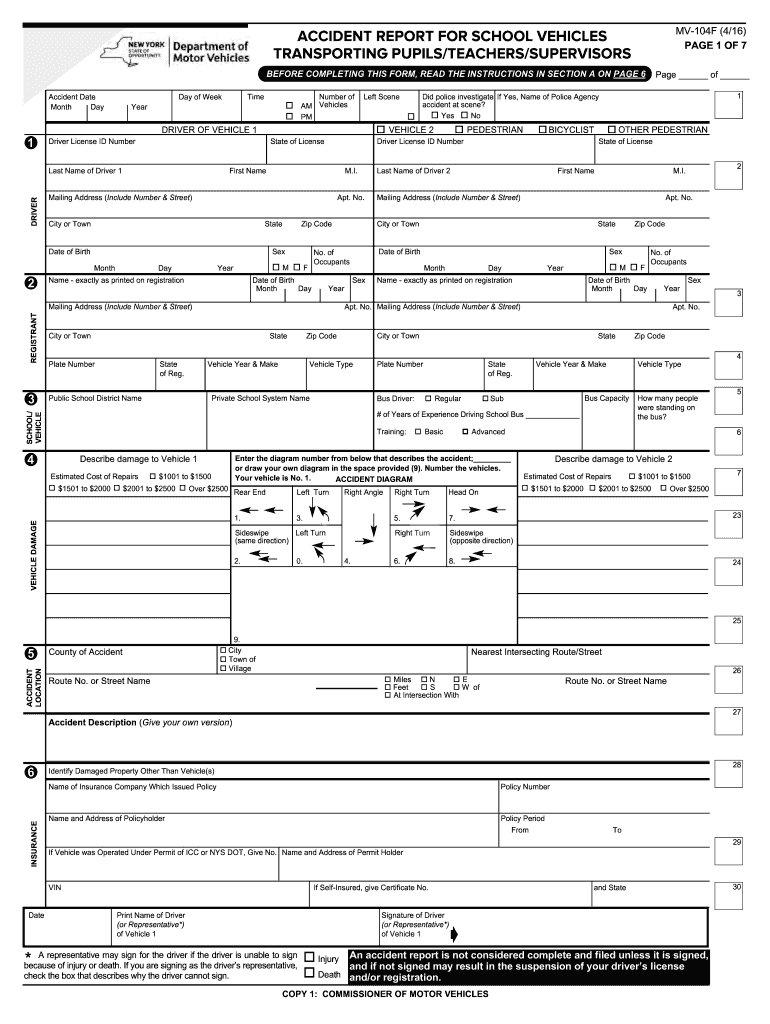

Printable Dmv Form 104 Printable Forms Free Online

https://www.signnow.com/preview/517/941/517941694/large.png

https://www.irs.gov/forms-pubs/schedules-for-form-1040

Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file

https://www.irs.gov/pub/irs-pdf/fw4.pdf?OWASP_CSRFTOKEN=BQQN-HUAO-NAP9-X5HP-KMT8-02VP-9CV8-TTSC

Enter an estimate of your 2024 itemized deductions from Schedule A Form 1040 Such deductions may include qualifying home mortgage interest charitable contributions state and local taxes up to 10 000 and medical expenses in excess of 7 5 of your income 1 2

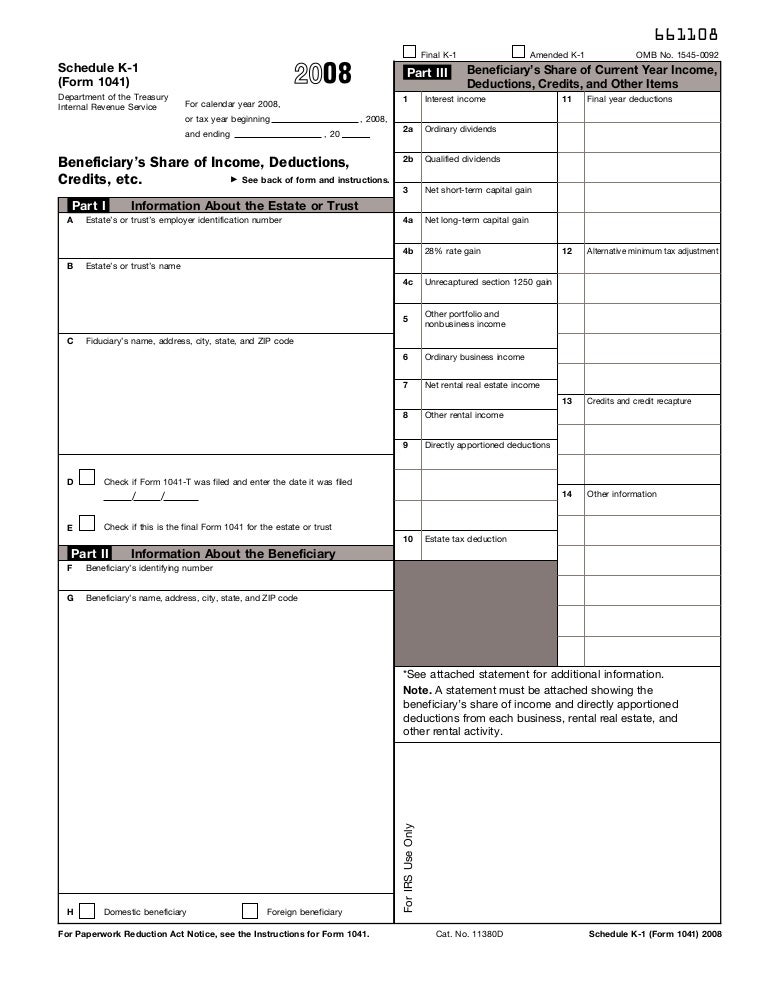

Form 104 Schedule K 1 Beneficiary s Share Of Income Deductions

104 R Fillable Form Printable Forms Free Online

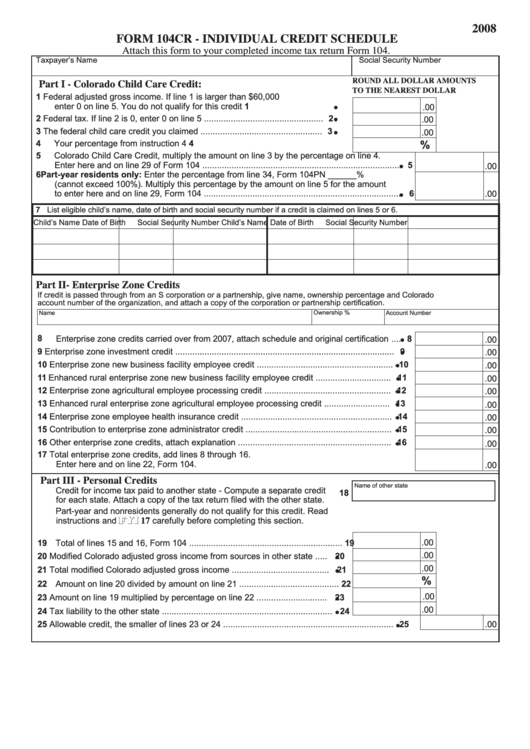

Form 104cr Individual Credit Schedule 2008 Printable Pdf Download

Colorado 2015 Form 104 Fill Out And Sign Printable PDF Template SignNow

Form 1040a 2023 PDF Fill Online Printable Fillable Blank

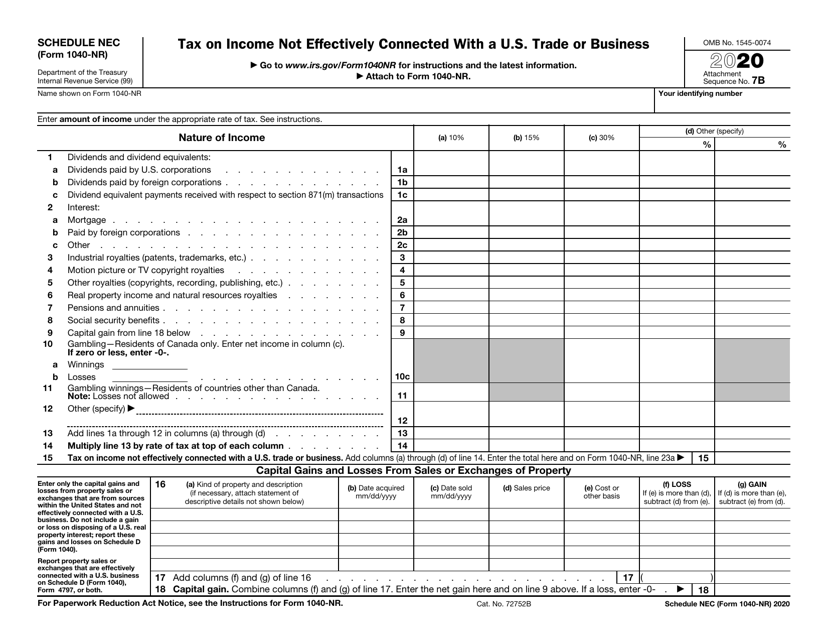

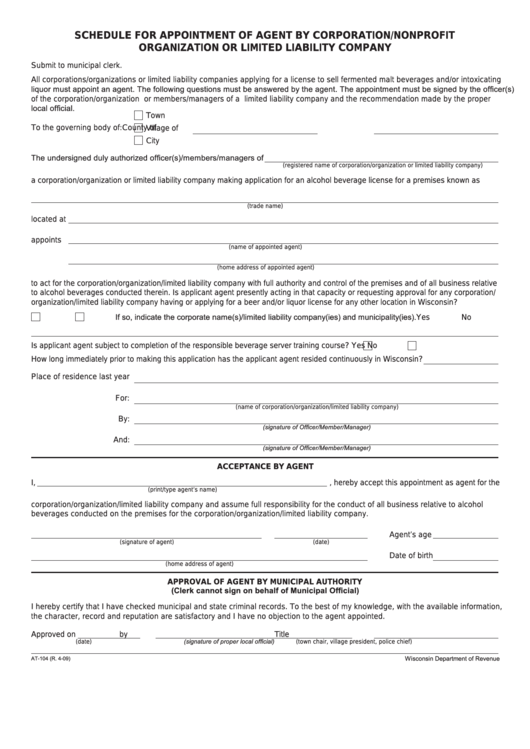

IRS Form 1040 NR Schedule NEC 2020 Fill Out Sign Online And Download Fillable PDF

IRS Form 1040 NR Schedule NEC 2020 Fill Out Sign Online And Download Fillable PDF

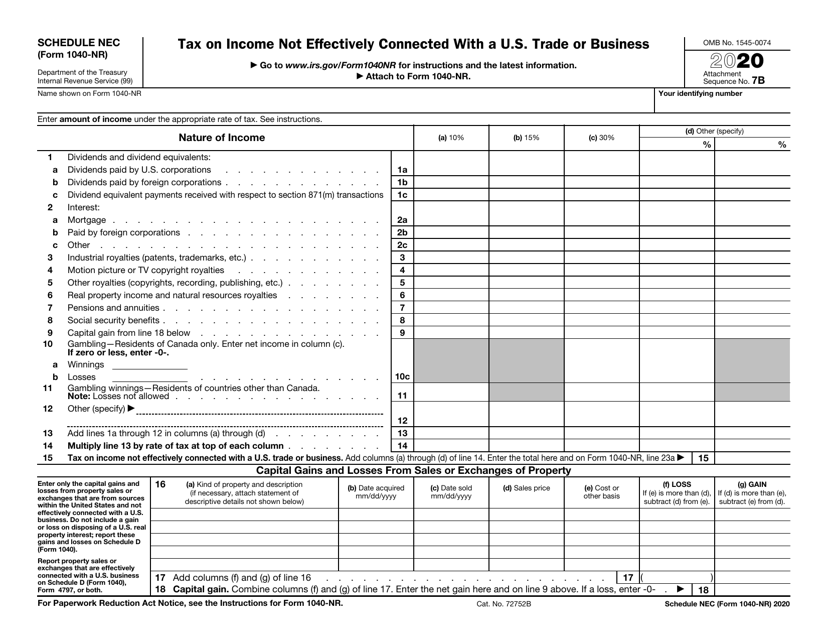

Cc Form 104 R Fillable Printable Forms Free Online

104 R Fill Out Sign Online DocHub

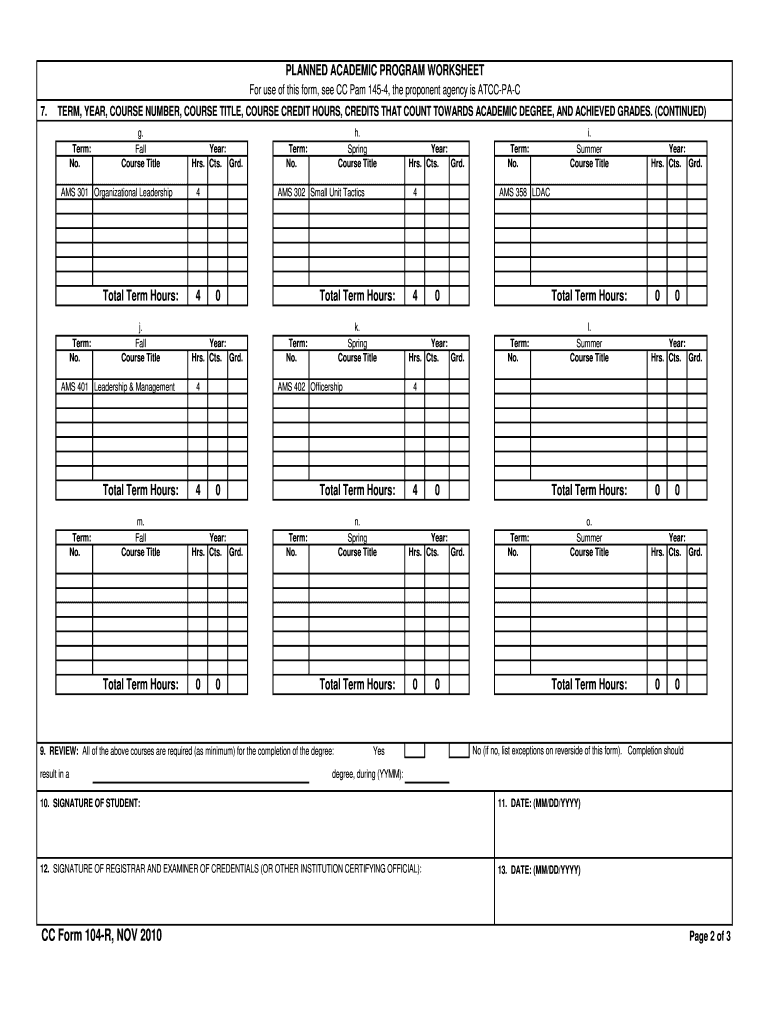

Form At 104 Schedule For Appointment Of Agent By Corporation nonprofit Organization Or Limited

Printable Form 104 Schedule A - Colorado state income tax Form 104 must be postmarked by April 15 2024 in order to avoid penalties and late fees Printable Colorado state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023