Printable Form 941 Schedule B Instructions for Schedule B Form 941 03 2023 Report of Tax Liability for Semiweekly Schedule Depositors Section references are to the Internal Revenue Code unless otherwise noted Revised 03 2023 Instructions for Schedule B Form 941 Introductory Material Future Developments

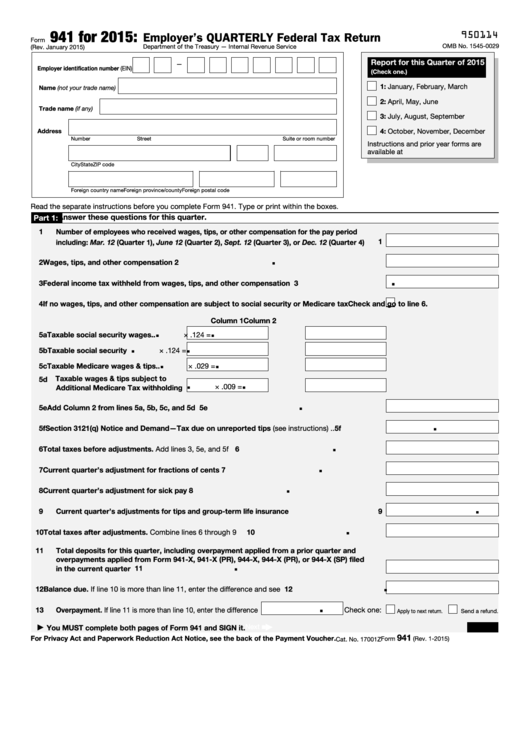

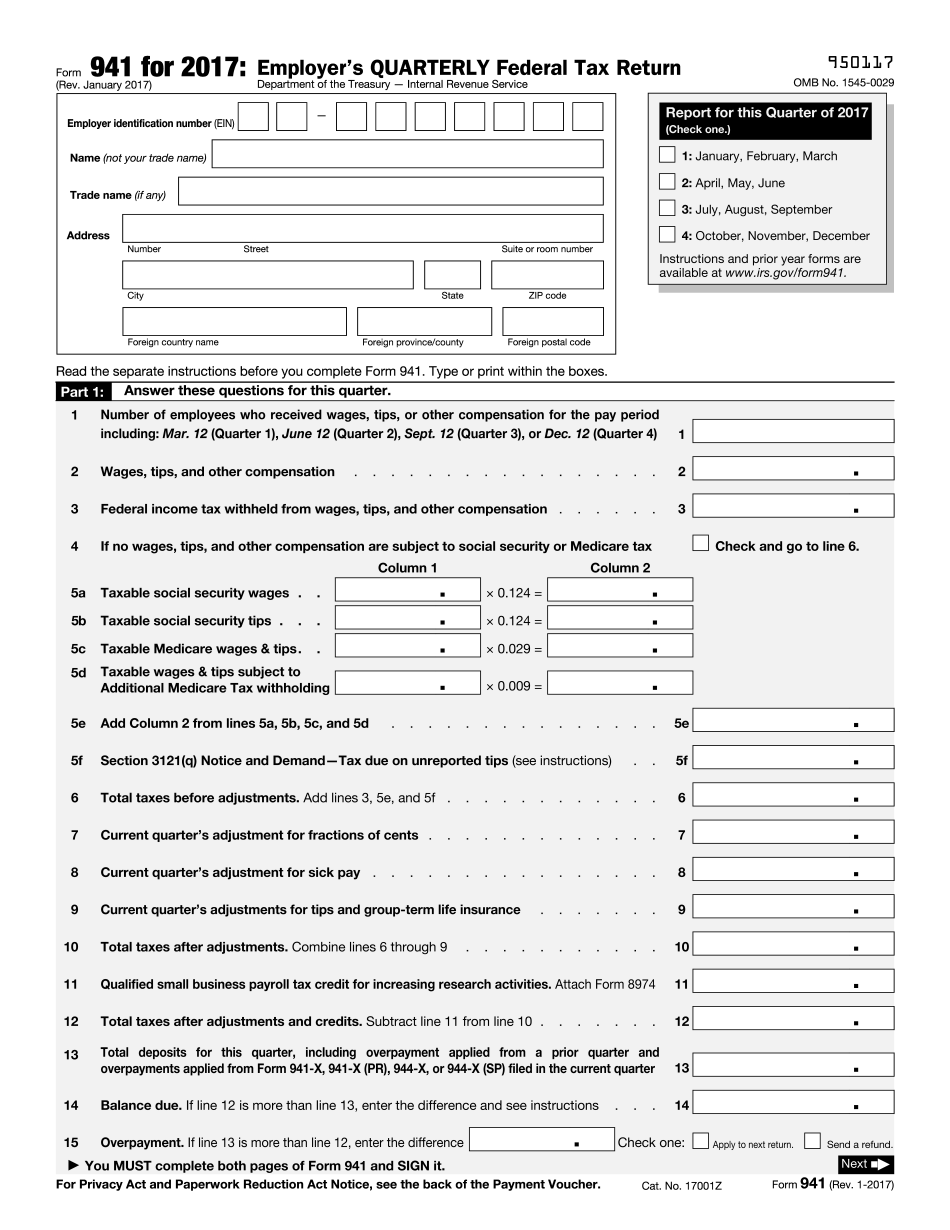

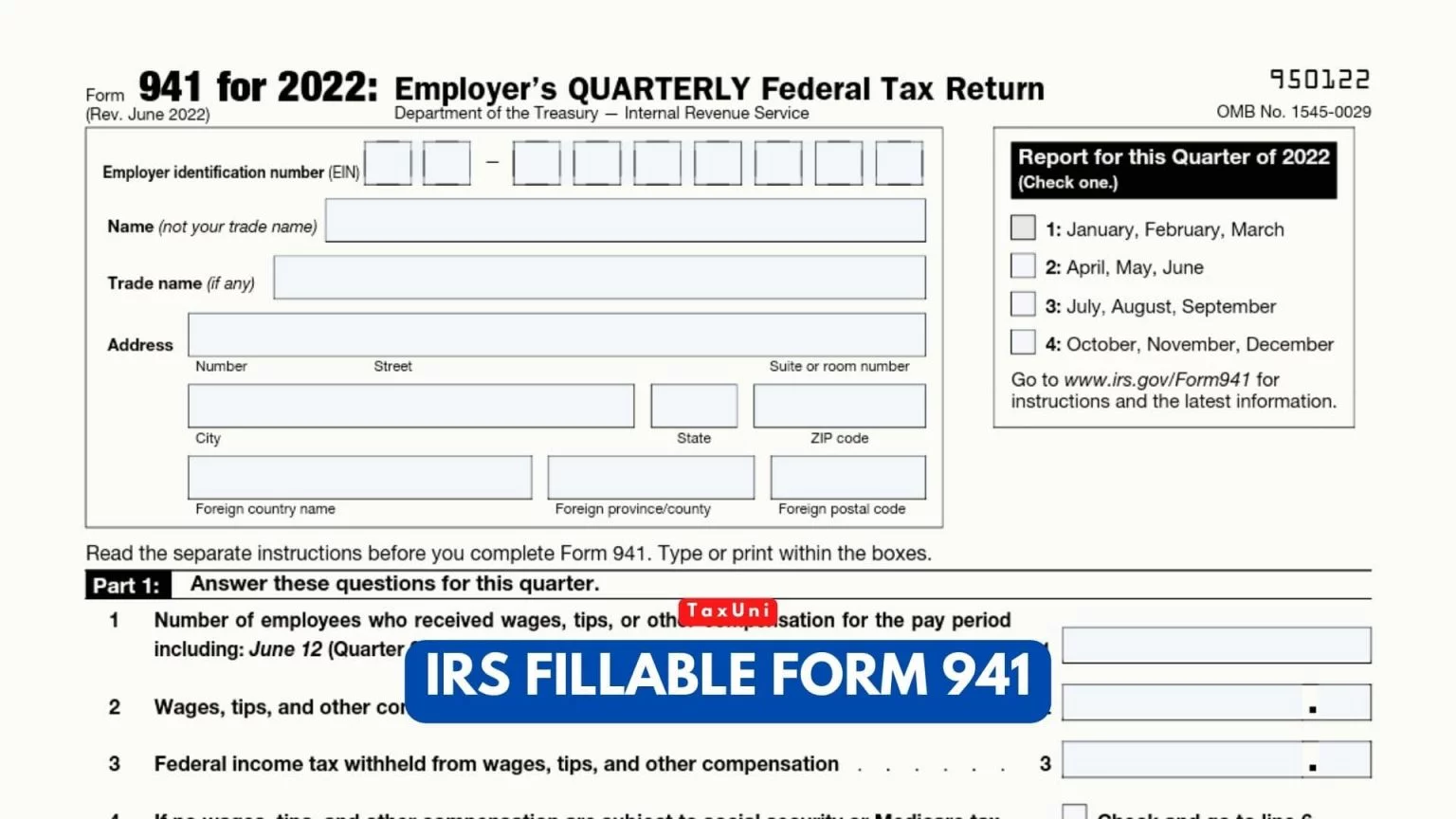

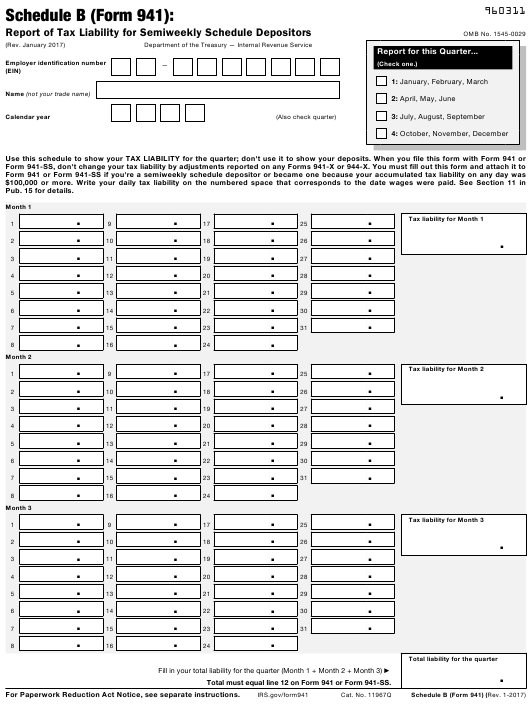

When you file Schedule B with your Form 941 Employer s QUARTERLY Federal Tax Return or Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands don t change your current quarter tax liability by adjustments reported on any Form 941 X or 944 X Am The updated Form 941 Employer s Quarterly Federal Tax Return was released on June 19 2020 The IRS released two drafts of the 941 instructions and released the final instructions on June 26 The instructions are 19 pages long The prior version was 12 pages The instructions include a worksheet Worksheet 1 to help with the computations

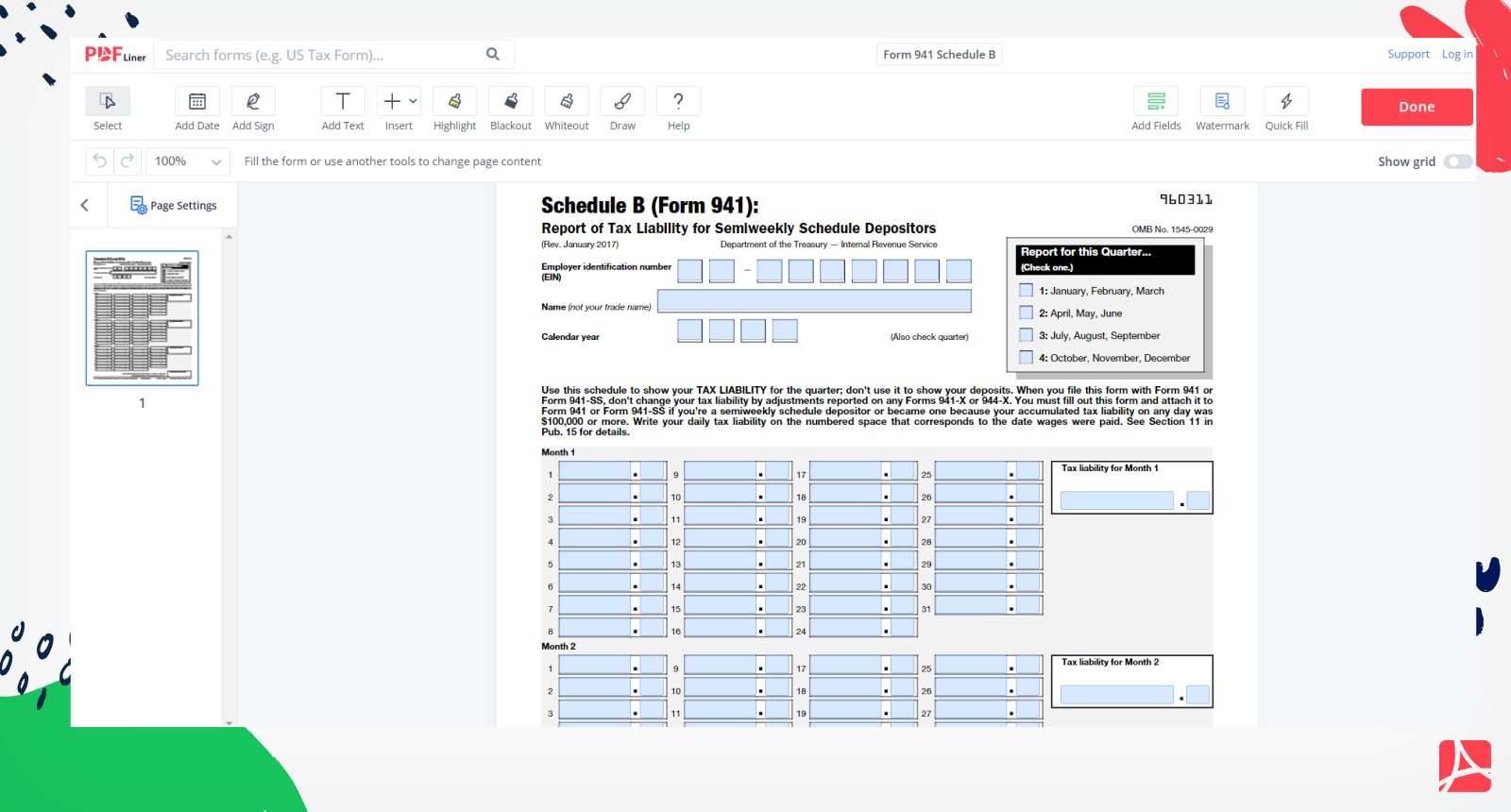

Printable Form 941 Schedule B

Printable Form 941 Schedule B

https://pdfliner.com/ckeditor/images/JasMlo9qIuiwvn7SYDGNXzqV3tGe8pyL5x4QTxTh.png

Printable Form 941 Schedule B Printable Forms Free Online

https://www.formsbirds.com/formimg/tax-support-document/1598/schedule-b-form-941-report-of-tax-liability-for-semiweekly-schedule-depositors-u-s-department-l1.png

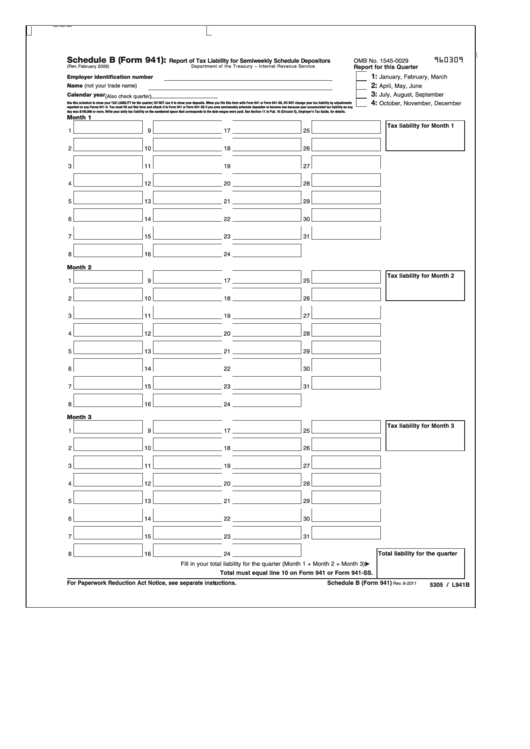

Schedule B Form 941 Report Of Tax Liability For Semiweekly Schedule Depositors 2009

https://data.formsbank.com/pdf_docs_html/90/904/90418/page_1_thumb_big.png

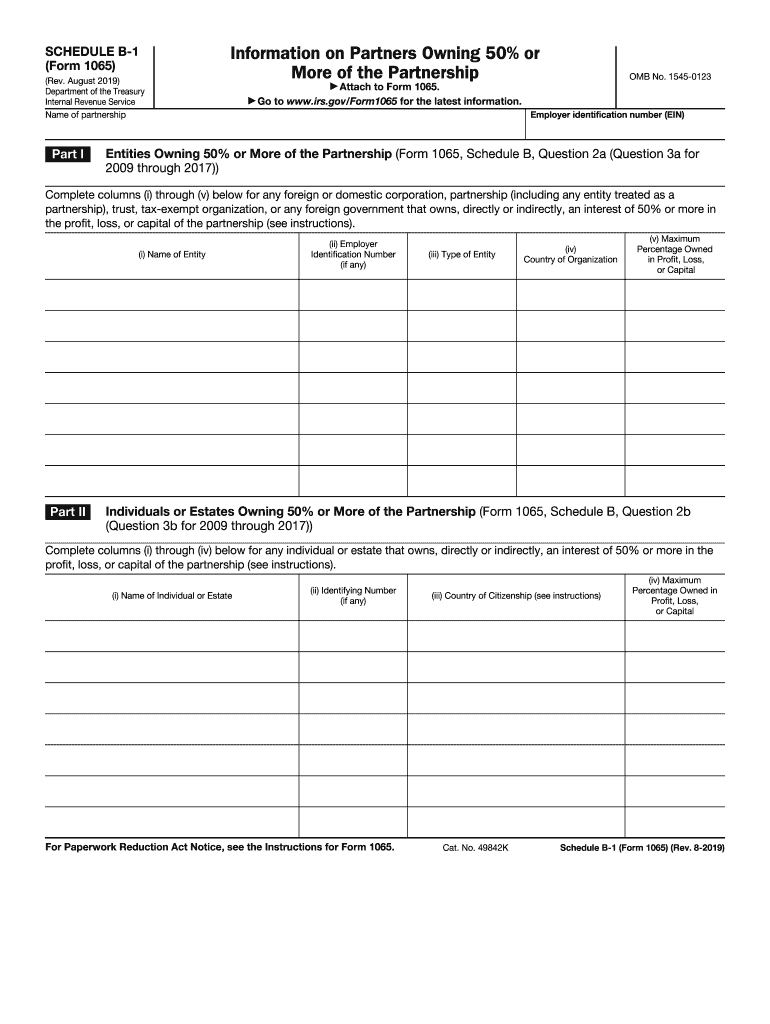

The IRS has released The 2023 Form 941 Employer s Quarterly Federal Tax Return and its instructions The instructions for Schedule B Report of Tax Liability for Semiweekly Schedule Depositors Schedule R Allocation Schedule for Aggregate Form 941 Filers and its instructions The Form 941 for 2023 contains no major changes On March 9 the IRS released the 2021 Form 941 Employer s Quarterly Federal Tax Return and its instructions The IRS also revised the instructions for Form 941 Schedule B and the instructions for Form 941 Schedule R When the IRS released the instructions Congress was considering changes to COVID 19 tax relief

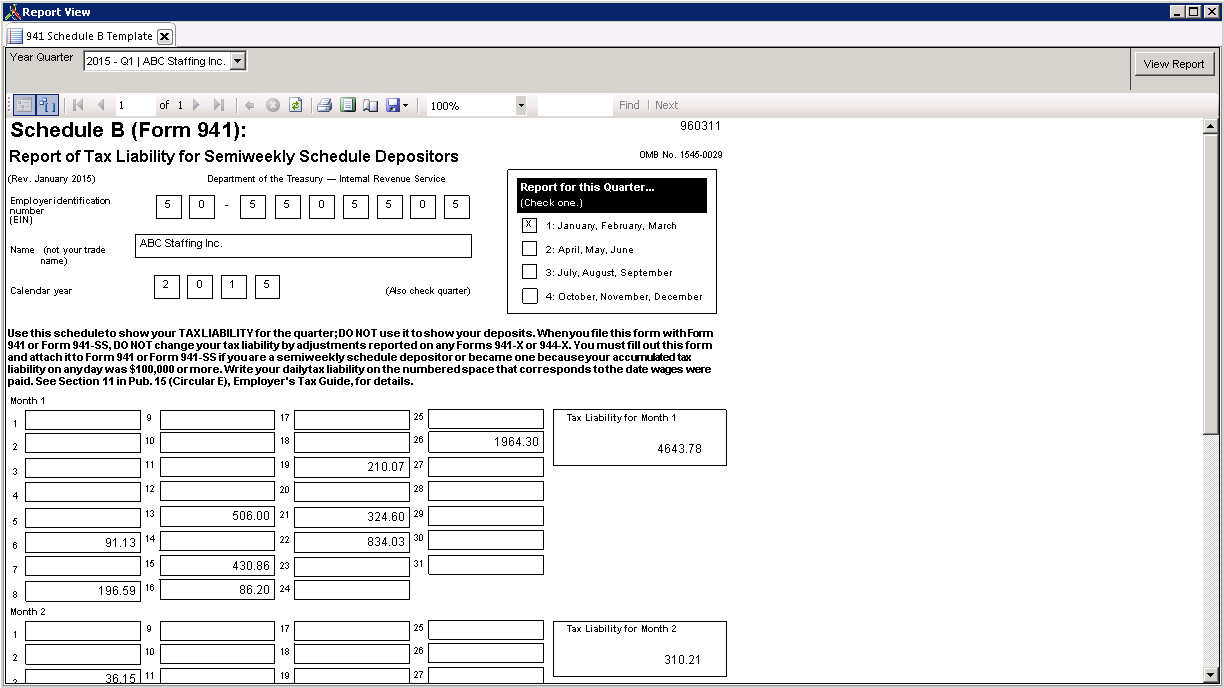

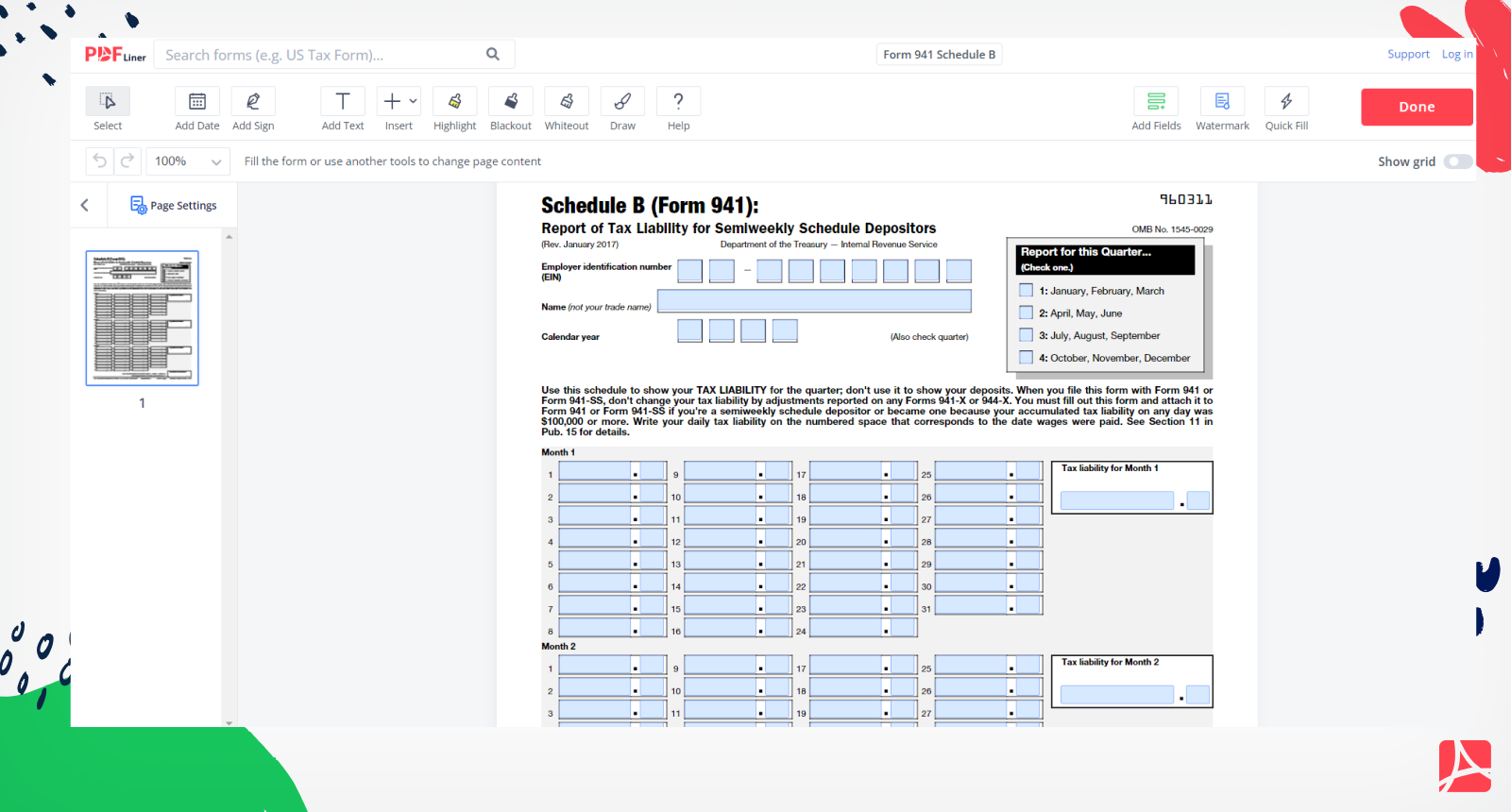

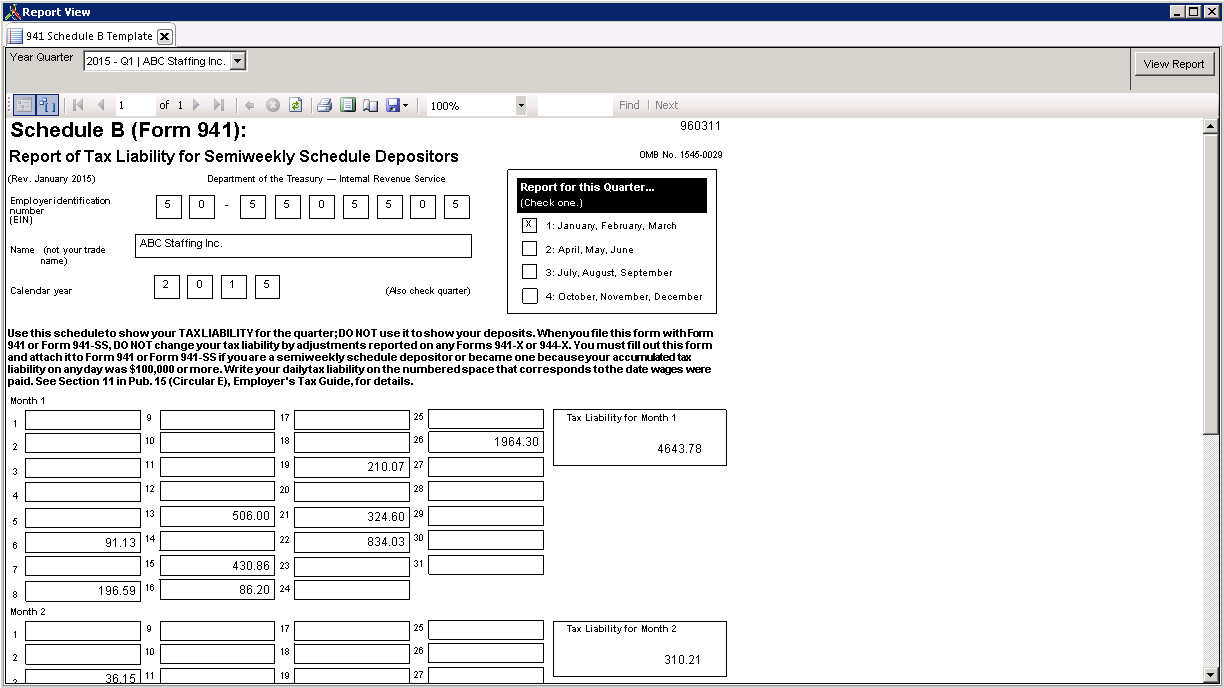

If you check this box deposit your payroll taxes semiweekly including Schedule B and attach it with Form 941 Part 3 Part 3 is where the employer must disclose whether the business closed or stopped paying wages and whether the business is seasonal The signer must also print their name and title e g president and include the date A Schedule B Form 941 also known as a Report of Tax Liability for Semiweekly Schedule Depositors is a form required by the Internal Revenue Service It is used by those who are semi weekly schedule depositors who report more than 50 000 in employment taxes or if they acquired more than 100 000 in liabilities during a single day in the tax year

More picture related to Printable Form 941 Schedule B

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

https://www.printableform.net/wp-content/uploads/2021/07/fillable-form-941-employer-s-quarterly-federal-tax.png

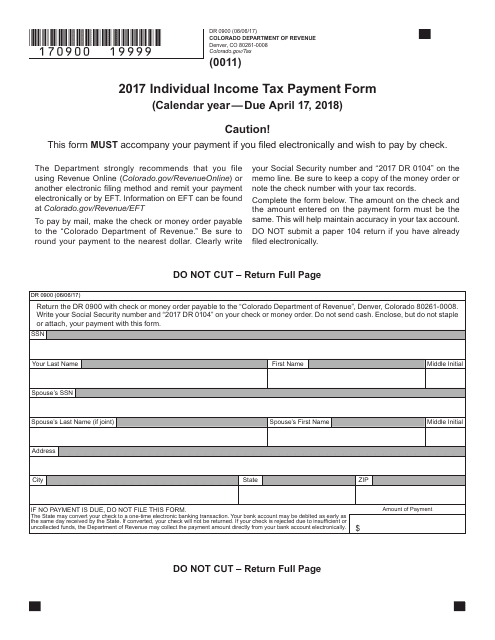

941 Form 2017 Printable TUTORE ORG Master Of Documents

https://data.templateroller.com/pdf_docs_html/1735/17352/1735218/form-dr-0900-2017-individual-income-tax-payment-form-colorado_big.png

Get IRS 941 Schedule B 2017 2023 US Legal Forms Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/400/414/400414967/big.png

A draft of the 2021 Form 941 Employer s Quarterly Federal Tax Return was released Jan 29 The September 2020 revision included guidance on the coronavirus related deferral of Social Security tax that has since expired The current 2021 draft removes that information Internal Revenue Service Form 941 Rev March 2023 Use with the January 2017 revision of Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors Section references are to the Internal Revenue Code unless otherwise noted Future Developments

To print the Schedule B you must also select the You were a semiweekly schedule depositor for any part of this quarter check box on the Form 941 page 2 and select ok Once 941 Form is displayed click the right arrow top left to go to following pages Schedules Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors Schedule D Form 941 Report of Discrepancies Caused by Acquisitions Statutory Mergers or Consolidations Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers Other Items You May Find Useful All Form 941 Revisions

Standard Report 941 Schedule B Template Avionte Classic

https://avionteclassicsupport.zendesk.com/hc/article_attachments/360063116634/941schedulebtemplate.png

Form 941 Employer s Quarterly Federal Tax Return Form 941 Employer

http://image.slidesharecdn.com/1272475/95/form-941-employers-quarterly-federal-tax-return-form-941-employers-quarterly-federal-tax-return-1-728.jpg?cb=1239356607

https://www.irs.gov/instructions/i941sb

Instructions for Schedule B Form 941 03 2023 Report of Tax Liability for Semiweekly Schedule Depositors Section references are to the Internal Revenue Code unless otherwise noted Revised 03 2023 Instructions for Schedule B Form 941 Introductory Material Future Developments

https://www.reginfo.gov/public/do/DownloadDocument?objectID=103448201

When you file Schedule B with your Form 941 Employer s QUARTERLY Federal Tax Return or Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands don t change your current quarter tax liability by adjustments reported on any Form 941 X or 944 X Am

Form 941 Schedule B Report Of Tax Liability For Semiweekly Schedul 2012 Form Irs 1040 Schedule

Standard Report 941 Schedule B Template Avionte Classic

Anexo B Formulario 941 Pr 2022 Fill Online Printable Fillable Blank Form 941 pr

941 Form 2022 Printable PDF Template

Ma Court Short Form Fillable Schedule A B Printable Forms Free Online

IRS Form 941 Schedule B 2023

IRS Form 941 Schedule B 2023

Printable Schedule B Form 941 Fillable Form 2023

Schedule B Form 941 2022

941 Form 2022 Schedule B Fill Online Printable Fillable Blank

Printable Form 941 Schedule B - Here s a step by step guide and instructions for filing IRS Form 941 1 Gather information needed to complete Form 941 Form 941 asks for the total amount of tax you ve remitted on behalf of your