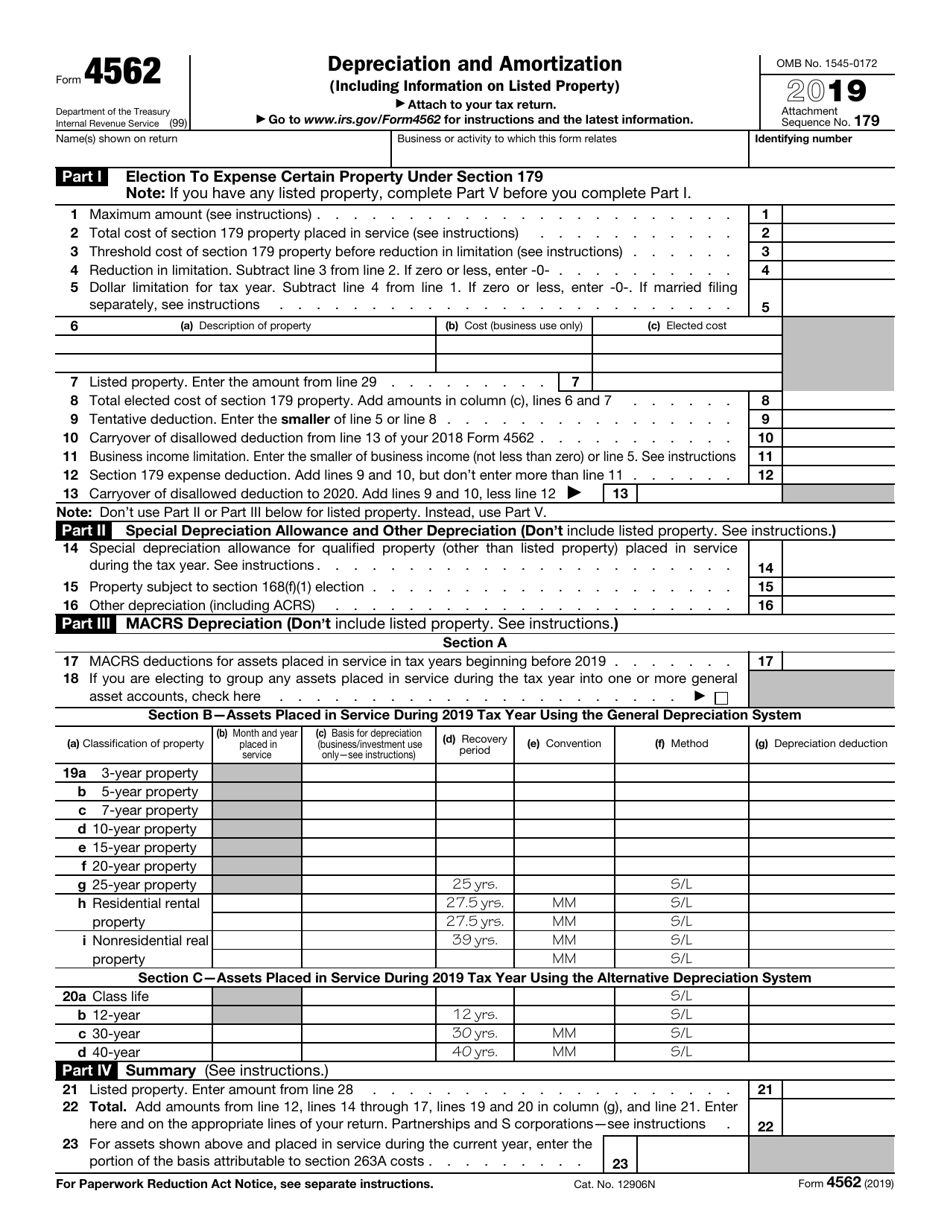

Printable Form For Irs Fm 4562 Form 4562 Department of the Treasury Internal Revenue Service Depreciation and Amortization Including Information on Listed Property Attach to your tax return

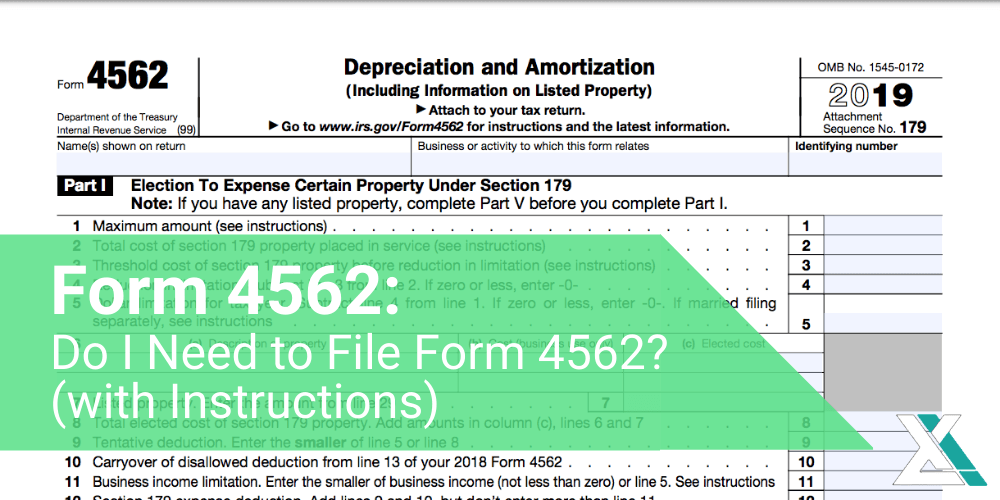

Use Form 4562 to Claim your deduction for depreciation and amortization Make the election under section 179 to expense certain property Provide information on the business investment use of automobiles and other listed property Download or print the 2023 Federal Form 4562 Depreciation and Amortization Including Information on Listed Property for FREE from the Federal Internal Revenue Service

Printable Form For Irs Fm 4562

![]()

Printable Form For Irs Fm 4562

https://cdn.shortpixel.ai/client/q_lqip,ret_wait,w_794,h_1024/https://www.excelcapmanagement.com/wp-content/uploads/2020/01/IRS-FORM-4562-794x1024.png

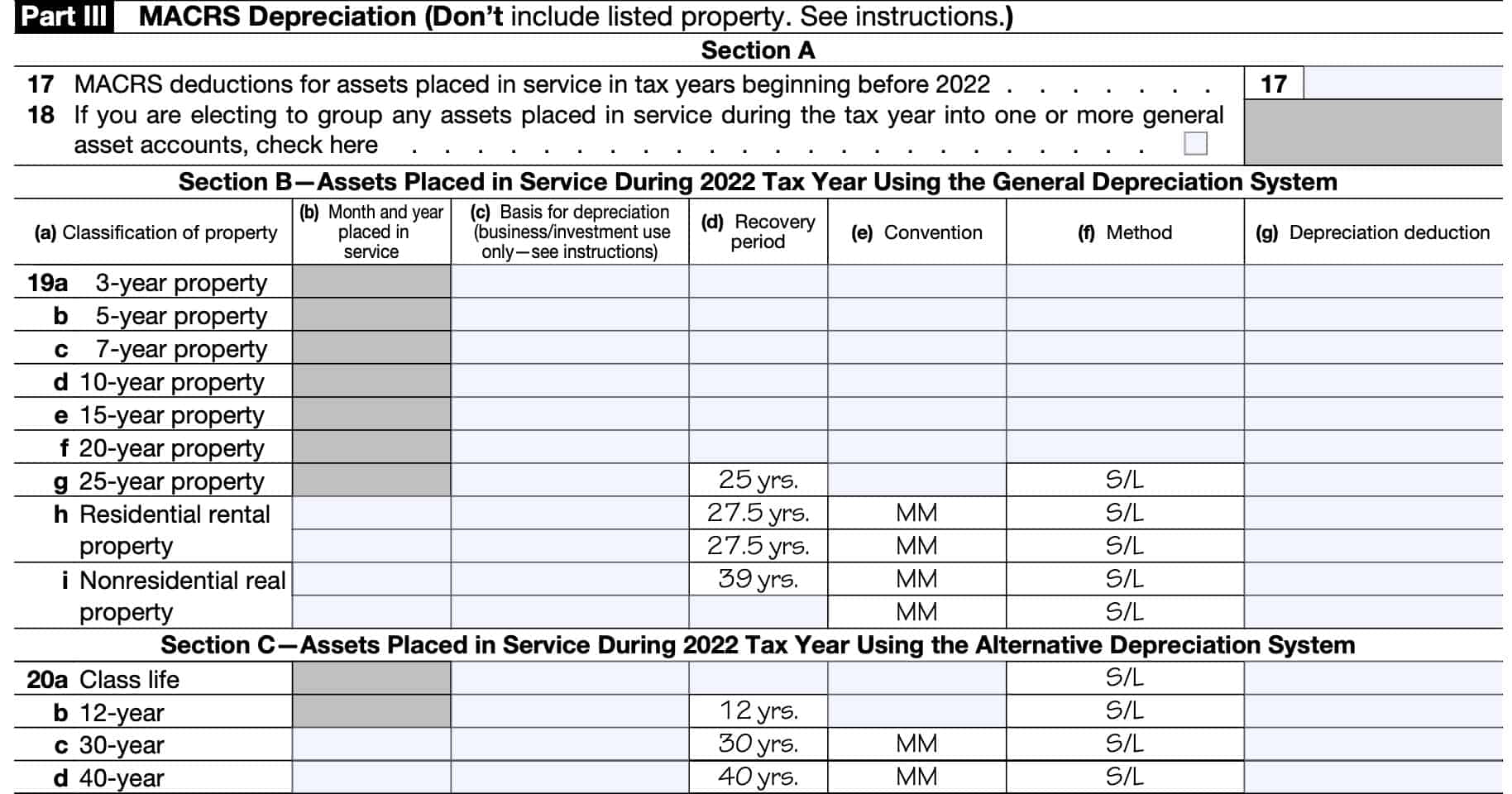

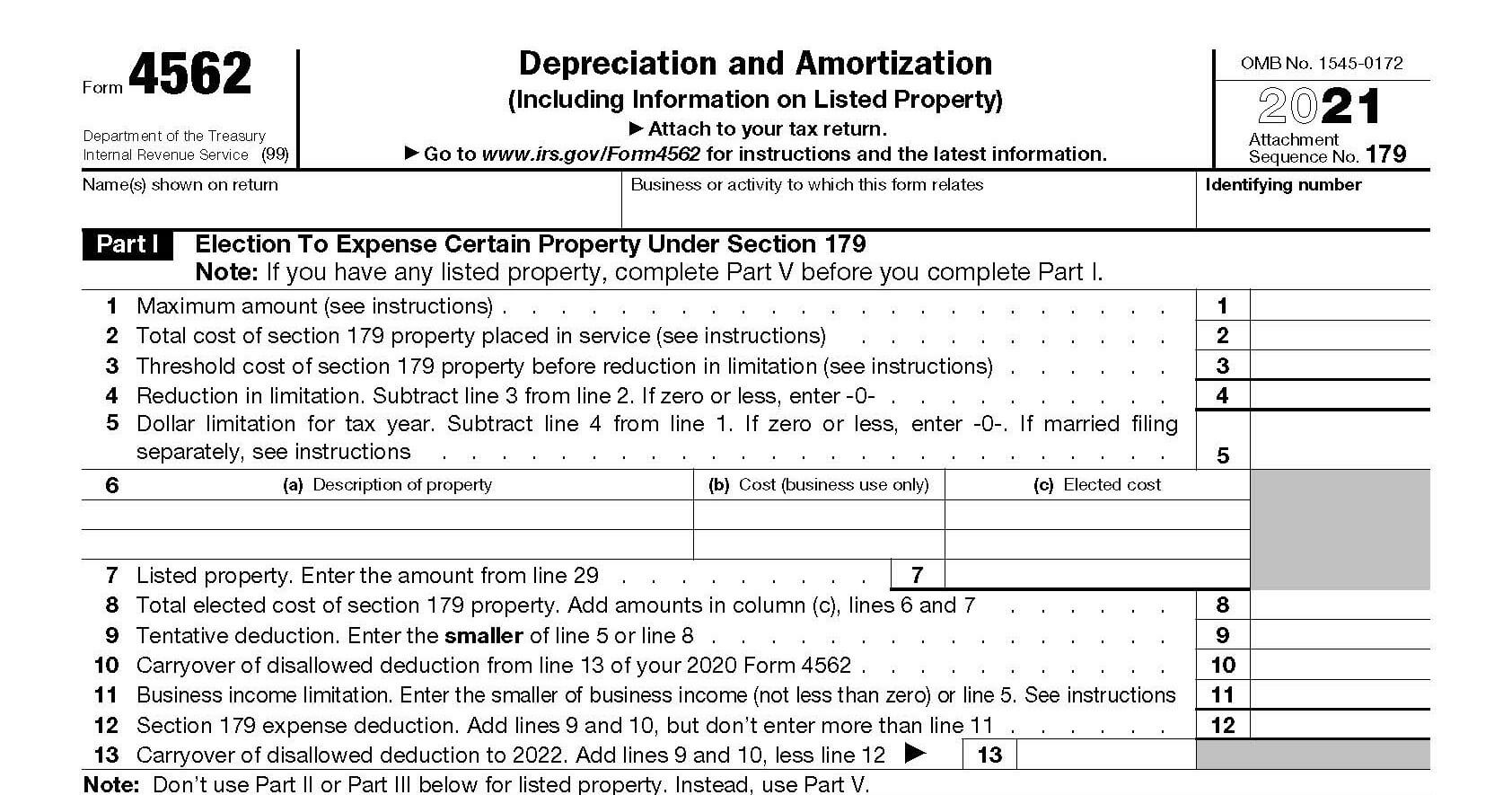

Fillable IRS Form 4562 Depreciation And Amortization Printable Blank PDF And Instructions

https://data.formsbank.com/pdf_docs_html/230/2307/230727/page_1_thumb_big.png

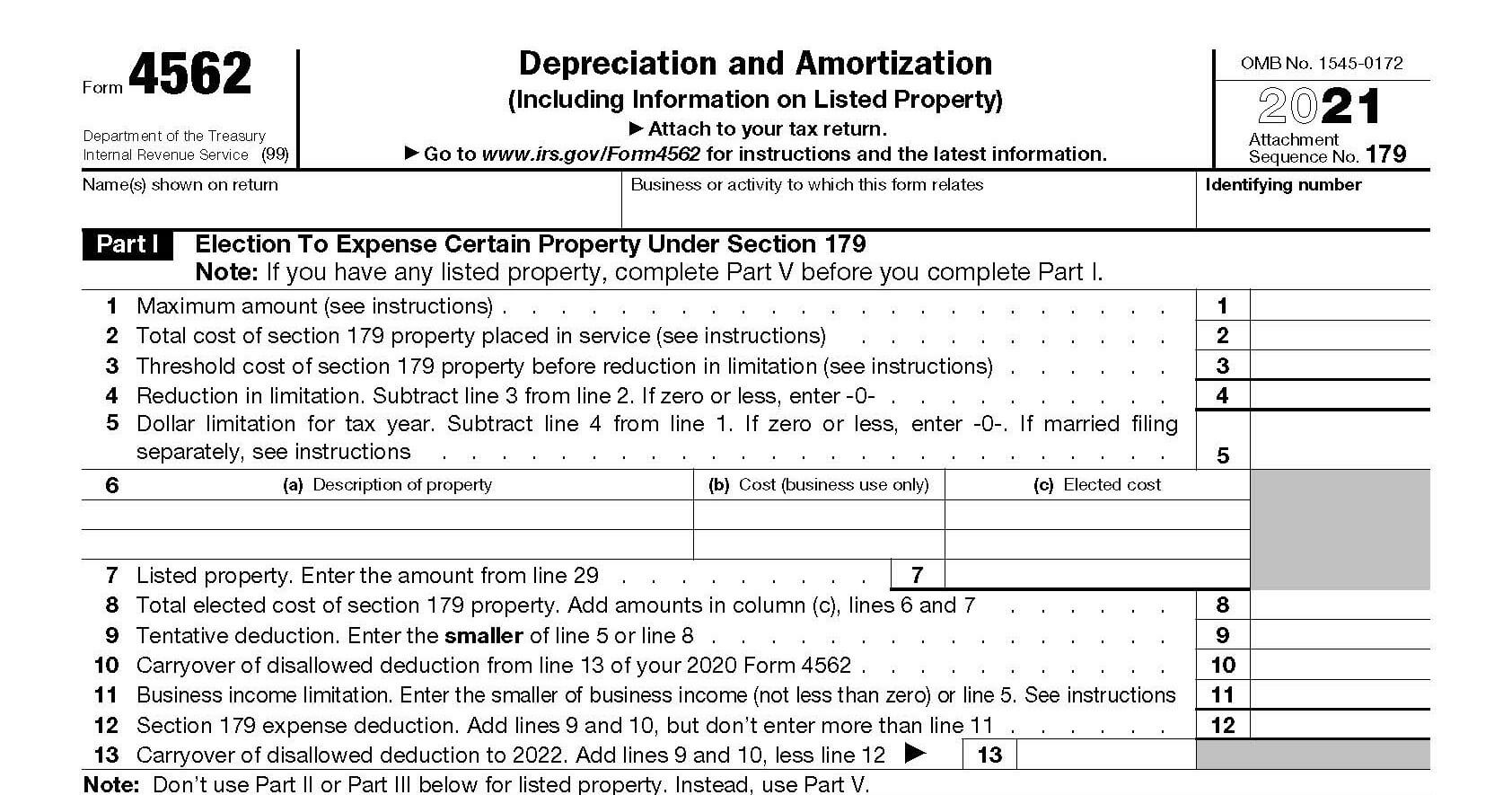

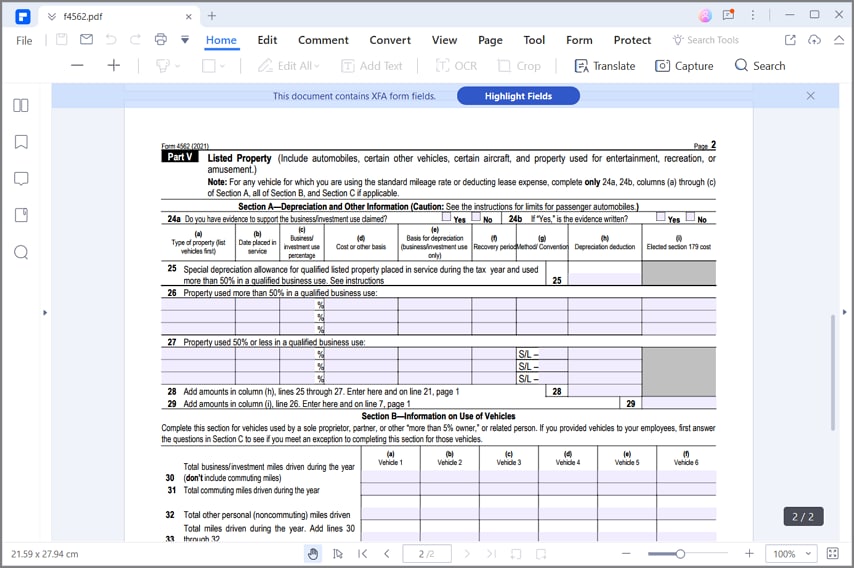

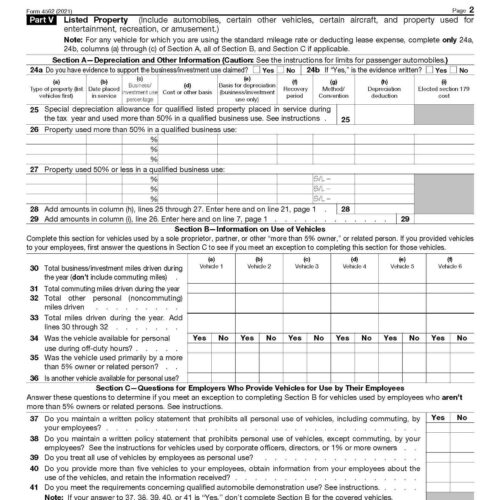

IRS Form 4562 Instructions Depreciation Amortization

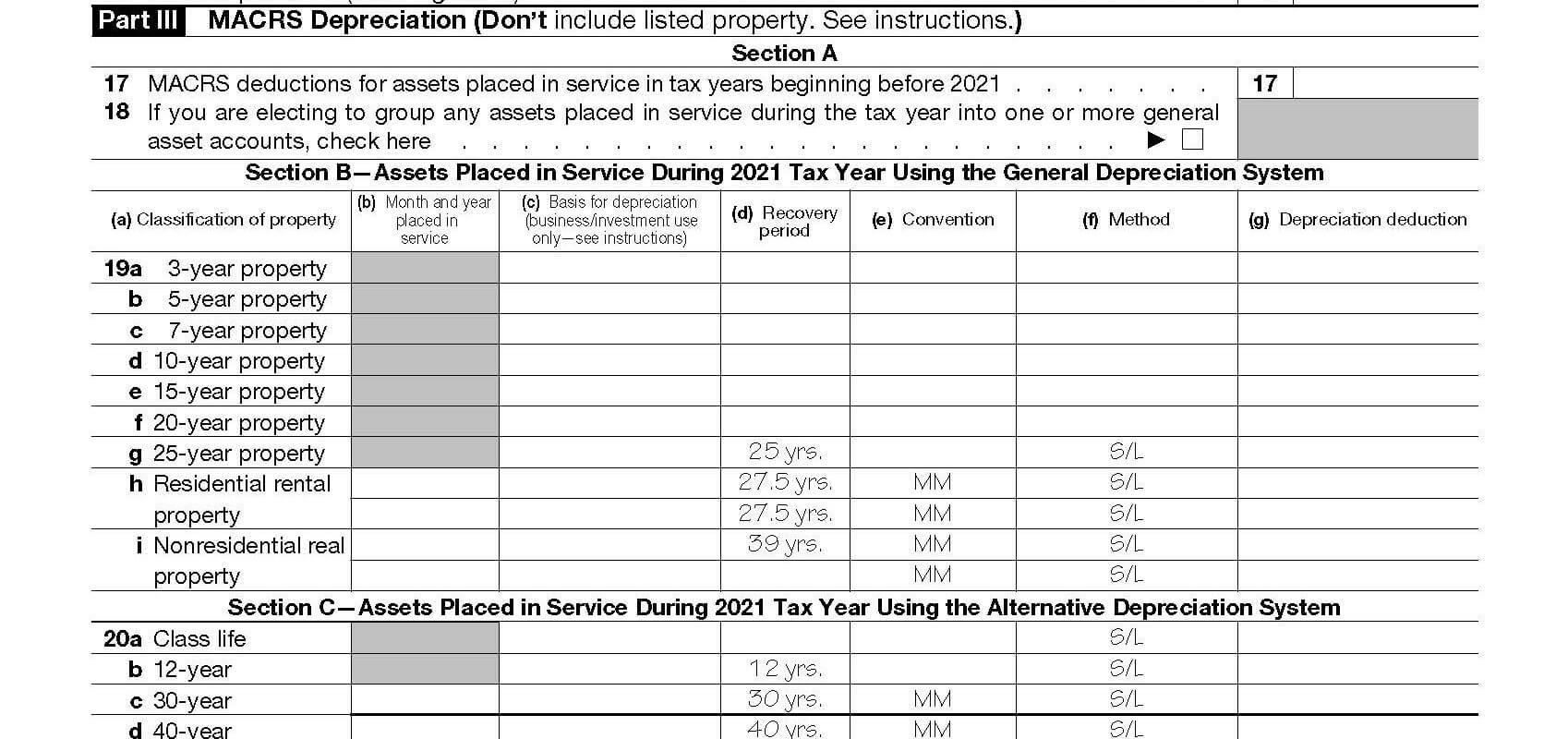

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/05/irs_form_4562_part_iii.jpg

We ll assume you ve assembled all the records you need to file your income tax On top of those you ll need the following to fill out Form 4562 The price of the asset you re depreciating A receipt for the asset you re depreciating The date the asset was put into use when you started using it for your business We last updated Federal Form 4562 in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government

IRS Form 4562 Amortization and Depreciation is the form companies must file to deduct a part or the entire value of assets and property they use in their trade or business Freelancers sole proprietors and companies can list depreciation deductions on Form 1065 Schedule C Form 1040 or other tax return forms depending on the business To complete Form 4562 you ll need to know the cost of assets like machinery and furniture as well as patents and trademarks There are six sections on the form and in each one you ll need to enter information to calculate the amount of depreciation or amortization for that section Form 4562 is also used for Section 179 expense deductions

More picture related to Printable Form For Irs Fm 4562

IRS Form 4562 Walkthrough Depreciation And Amortization YouTube

https://i.ytimg.com/vi/ysxPWH4P8x4/maxresdefault.jpg

How Do I Fill Out Irs Form 4562 For This Computer Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/19f/19fc3a7b-db11-41e9-875a-1cc04b32ea88/phpY30c47.png

2018 Form IRS 4562 Instructions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/465/403/465403306/large.png

4 Real estate Real estate can also be included on Form 4562 although the cost of land should be excluded since land does not lose value and should not be depreciated 5 Patents and copyrights Form 4562 Depreciation and Amortization A tax form distributed by the Internal Revenue Service IRS and used to claim deductions for the depreciation or amortization of a piece of property or

As the name suggests Form 4562 Depreciation and Amortization is an IRS form that business taxpayers use to claim deductions for depreciation and amortization of tangible or intangible assets However Form 4562 also has additional uses It is used to expense certain property under Section 179 and to provide information on the business or Purpose of IRS Tax Form 4562 The IRS Form 4562 titled Depreciation and Amortization is used to report depreciation amortization and certain business expenses Asset depreciation reporting Form 4562 is primarily used to report the depreciation of assets used in a business Depreciation is the gradual allocation of the cost of tangible

C mo Completar El Formulario 4562 Del IRS

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f4562_part1.jpg

4562 Form 2023 2024

https://www.zrivo.com/wp-content/uploads/2021/12/4562-Form-2021.jpg

https://www.irs.gov/pub/irs-pdf/f4562.pdf

Form 4562 Department of the Treasury Internal Revenue Service Depreciation and Amortization Including Information on Listed Property Attach to your tax return

https://www.irs.gov/forms-pubs/about-form-4562

Use Form 4562 to Claim your deduction for depreciation and amortization Make the election under section 179 to expense certain property Provide information on the business investment use of automobiles and other listed property

Form 4562 Fillable Printable Forms Free Online

C mo Completar El Formulario 4562 Del IRS

C mo Completar El Formulario 4562 Del IRS

How To Complete IRS Form 4562

C mo Completar El Formulario 4562 Del IRS

2014 Form IRS 4562 Instructions Fill Online Printable Fillable Blank PdfFiller

2014 Form IRS 4562 Instructions Fill Online Printable Fillable Blank PdfFiller

Form 4562 Depreciation Calculator DaneaKerrie

IRS Form 4562 2019 Fill Out Sign Online And Download Fillable PDF Templateroller

2021 Form IRS 4562 Instructions Fill Online Printable Fillable Blank PdfFiller

Printable Form For Irs Fm 4562 - We last updated Federal Form 4562 in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government