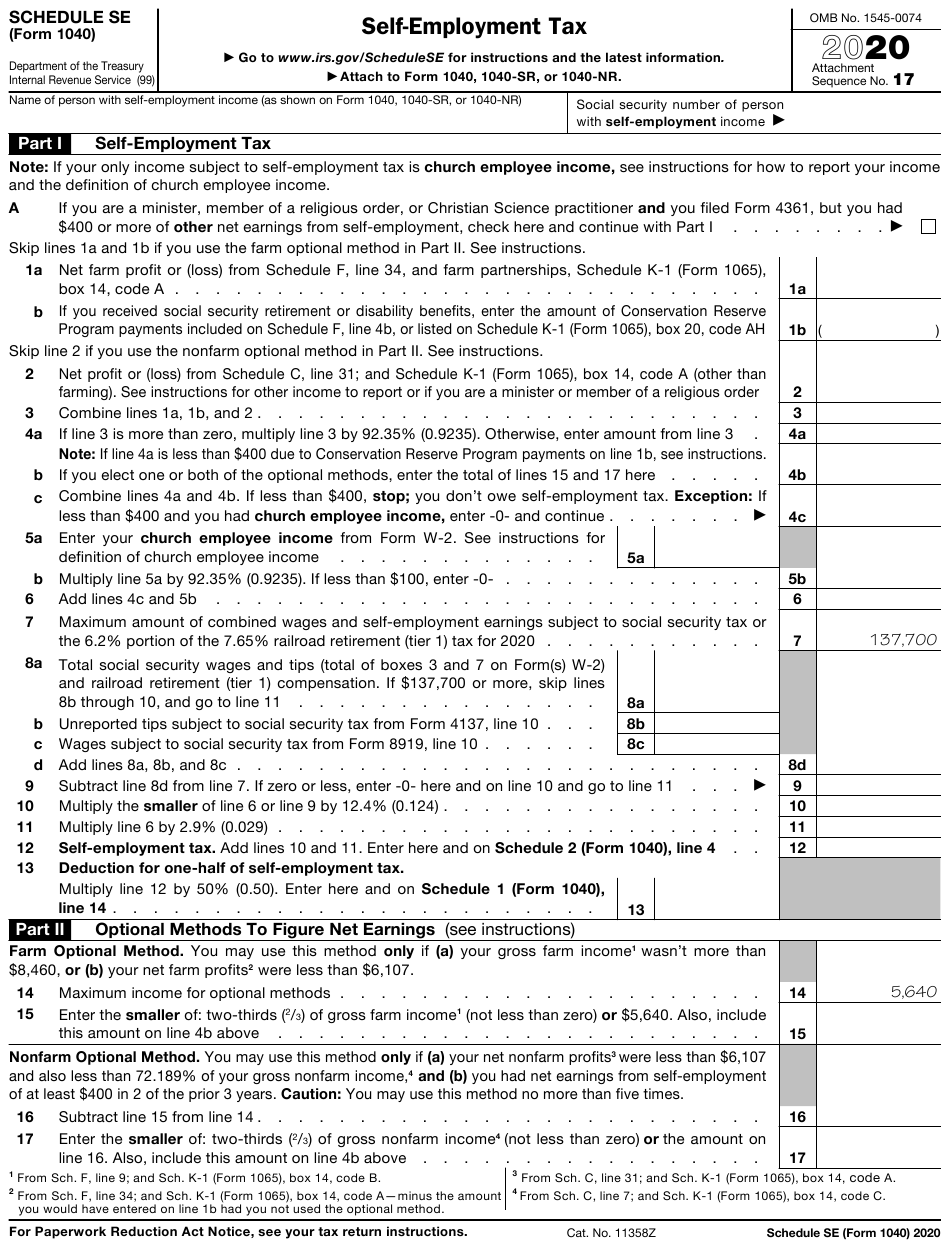

Printable Form For Self Employed Taxpayers If your net earnings from self employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040 SR instructions PDF Back to top How do I make my quarterly payments

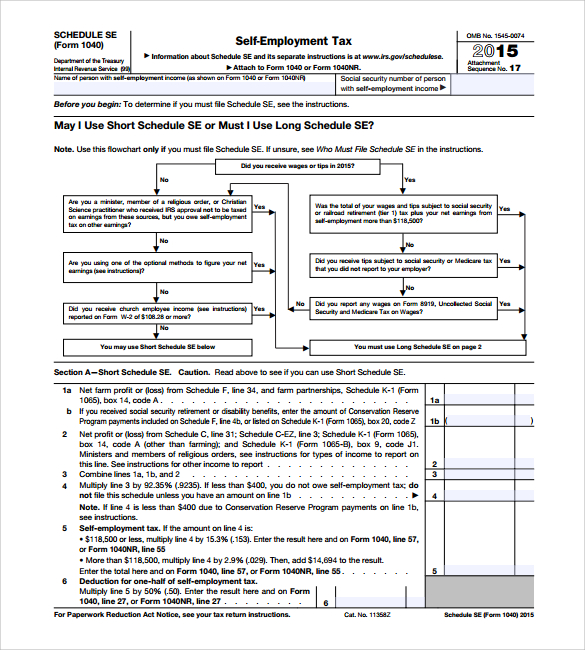

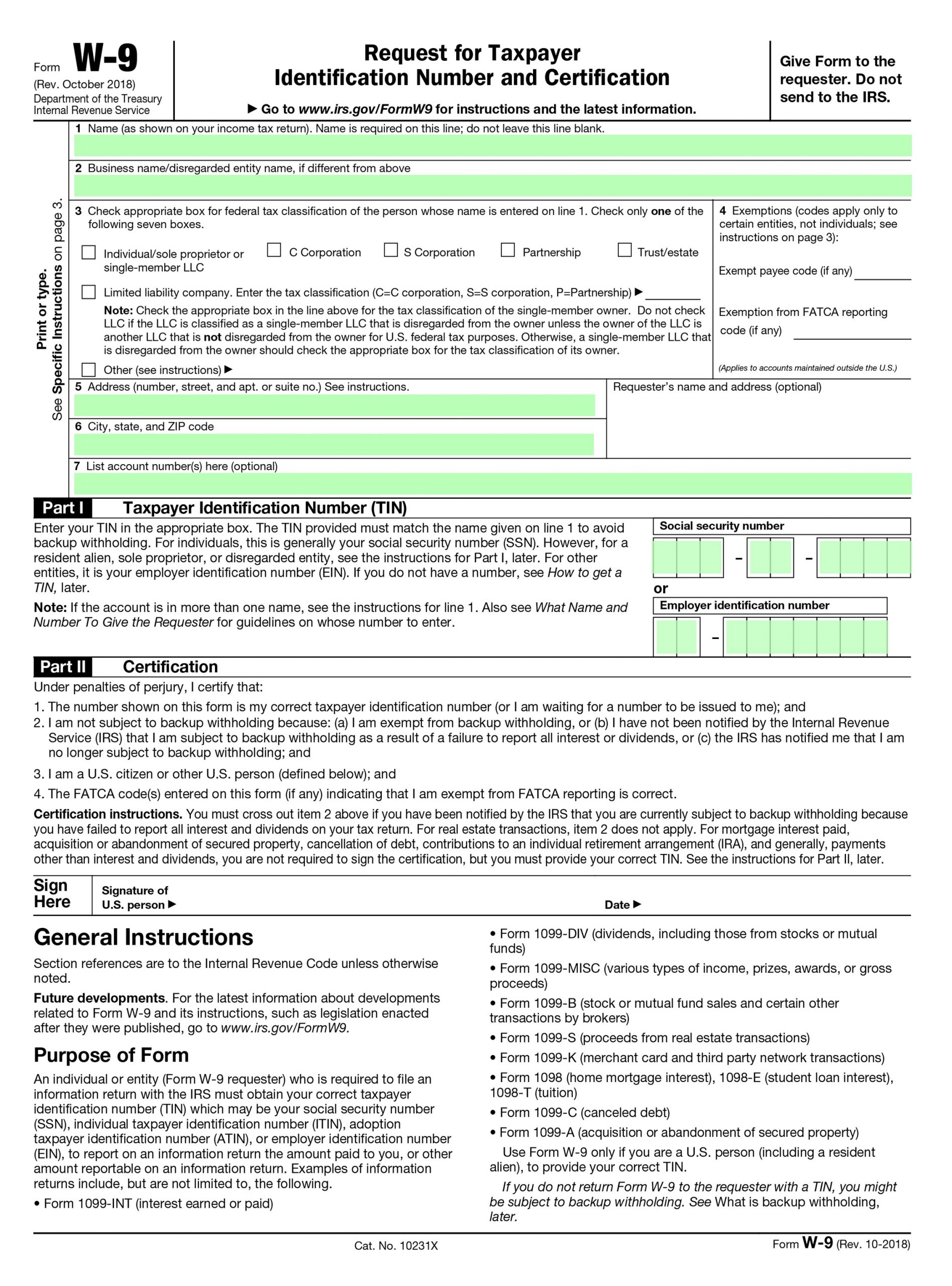

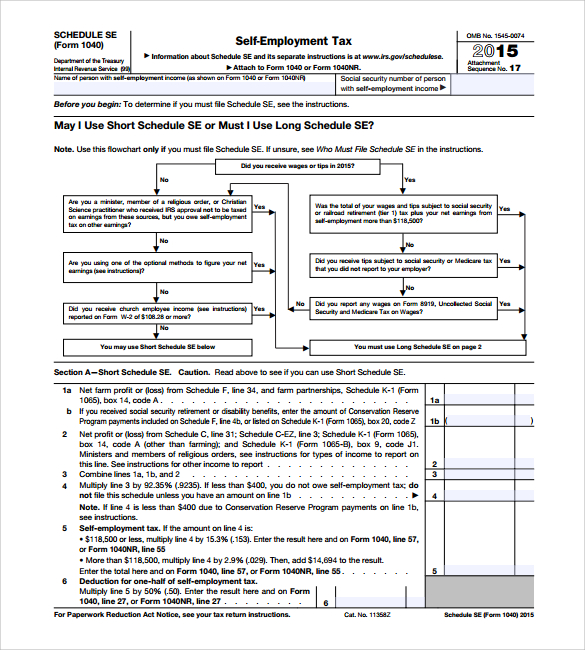

Current Revision Schedule SE Form 1040 PDF Instructions for Schedule SE Form 1040 Print Version PDF eBook epub EPUB Recent Developments Taxpayer Relief for Certain Tax Related Deadlines Due To Coronavirus Pandemic 14 APR 2020 Other Items You May Find Useful All Schedule SE Form 1040 Revisions About Publication 225 Farmer s Tax Guide Businesses Self Employed Standard mileage and other information Popular Earned Income Credit EITC Advance Child Tax Credit Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return Form W 4

Printable Form For Self Employed Taxpayers

Printable Form For Self Employed Taxpayers

https://www.employementform.com/wp-content/uploads/2022/10/self-employment-tax-form-pdf-2022.png

How To File Self Employment Taxes Step By Step Your Guide

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b83fd4bedd77a0b98f76_form-1040.png

2005 Self Employment Tax Form Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/2005-self-employment-tax-form.png

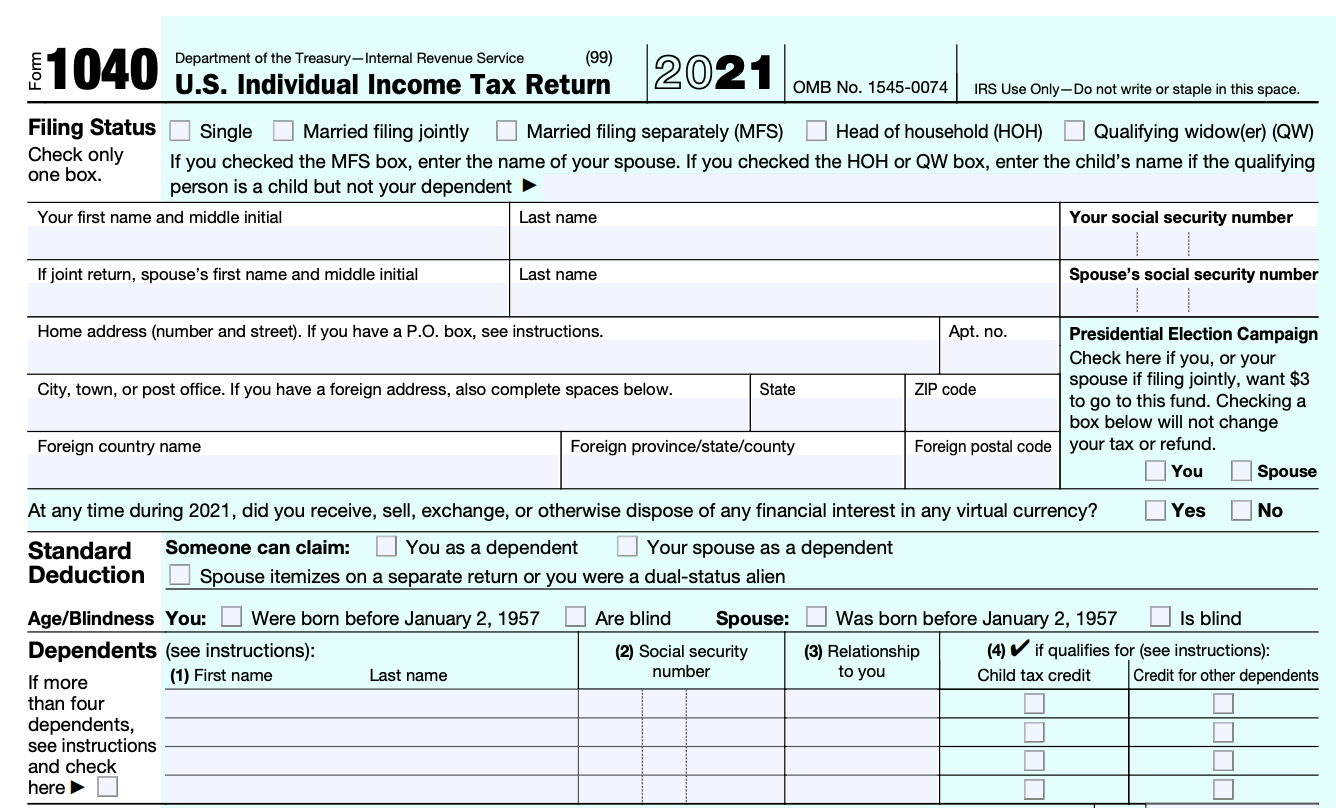

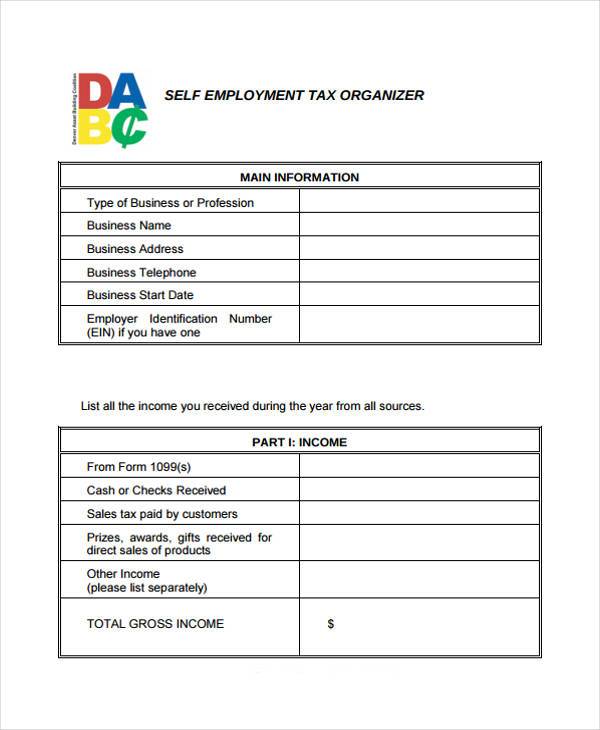

Here are five Internal Revenue Service IRS self employed tax forms and information that might be relevant to your tax situation 1 Form 1040 U S Individual Tax Return Most U S tax filers use Form 1040 even when they re not self employed This form is comprised of different sections where you can report your income and claim tax deductions 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3

Form 1099 NEC non employee compensation Will be issued to self employed individuals like independent contractors freelancers or side giggers who have been paid 600 or more Though wages might not trigger a 1099 NEC if they are under 600 you are still responsible for reporting all income whether a 1099 NEC was received or not You must pay SE tax and file IRS Form 1040 Schedule SE Self Employment Tax if either of the following applies Your net earnings from self employment were 400 or more or You had church employee income of 108 28 or more Though the self employment tax is in addition to your income tax you can deduct one half 50 percent of your SE tax

More picture related to Printable Form For Self Employed Taxpayers

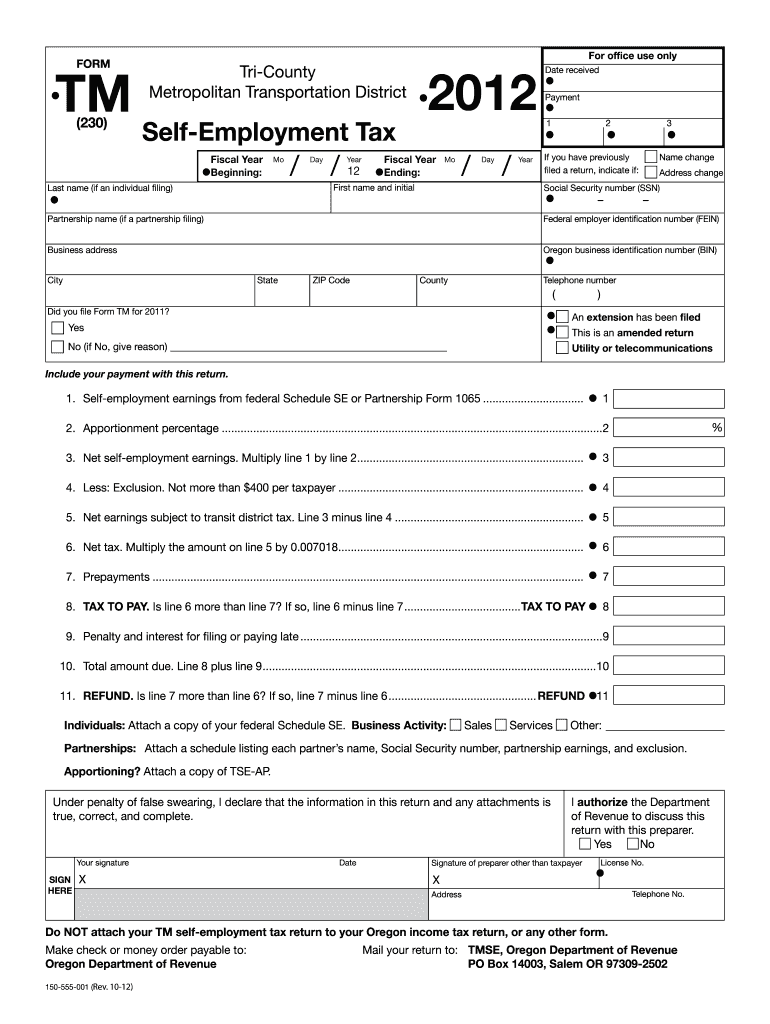

Trimet Self Employment Tax Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/33/809/33809653/large.png

FREE 50 Employment Forms In PDF MS Word Excel

https://images.sampleforms.com/wp-content/uploads/2017/02/Self-Employment-Tax-Form.jpg

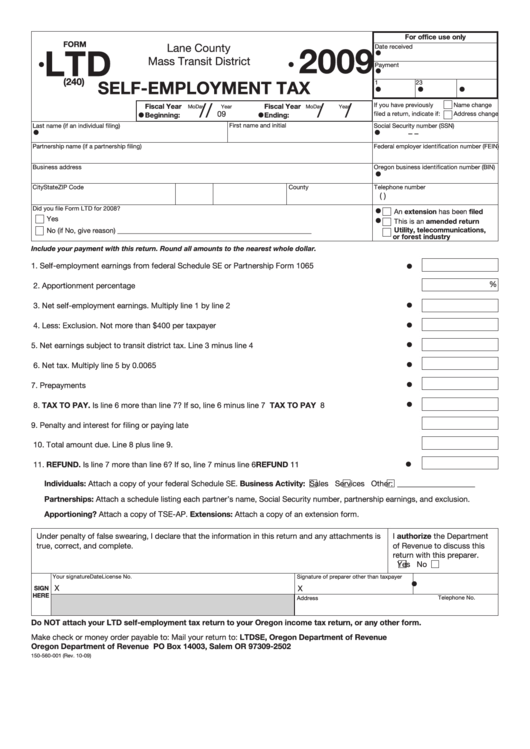

Fillable Form Ltd Self Employment Tax 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/199/1995/199580/page_1_thumb_big.png

Beginner s Tax Guide for the Self Employed Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 39 AM OVERVIEW Before you take your first step into the world of entrepreneurship there s a checklist of things you ll need to do to avoid tax problems while your venture is still in its infancy Use the IRS s Free File Fillable Forms available from mid January until mid October Pick up copies of tax forms at an IRS Taxpayer Assistance Center currently available only by appointment

Key Takeaways If you re self employed you ll need to file taxes throughout the year typically via quarterly payments The self employment tax is 15 3 a combination of Social Security and Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare your return and forms or schedules included in your individual return Estimates based on deductible business expenses calculated at the self employment tax income rate 15 3 for tax year 2022 Actual

FREE 6 Sample Self Employment Tax Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2016/01/18163109/Sample-Self-Employment-Tax.jpg

Self Employment Tax Return Form 2022 Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-return-form-2022.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

If your net earnings from self employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040 SR instructions PDF Back to top How do I make my quarterly payments

https://www.irs.gov/forms-pubs/about-schedule-se-form-1040

Current Revision Schedule SE Form 1040 PDF Instructions for Schedule SE Form 1040 Print Version PDF eBook epub EPUB Recent Developments Taxpayer Relief for Certain Tax Related Deadlines Due To Coronavirus Pandemic 14 APR 2020 Other Items You May Find Useful All Schedule SE Form 1040 Revisions About Publication 225 Farmer s Tax Guide

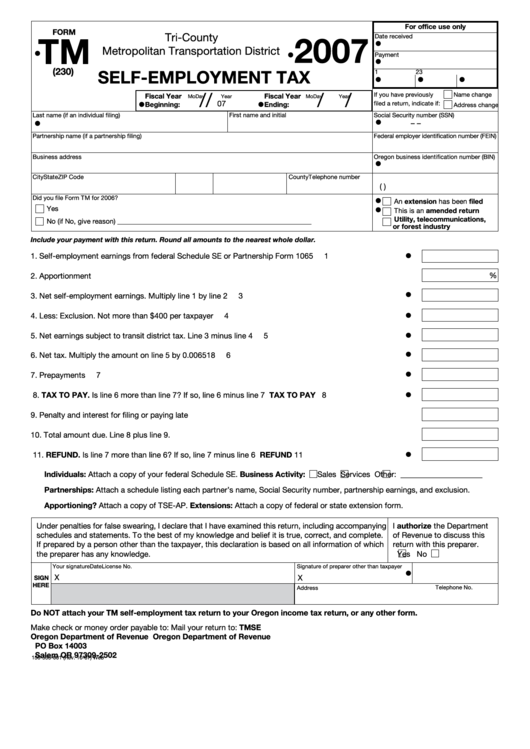

Fillable Form Tm Self Employment Tax 2007 Printable Pdf Download

FREE 6 Sample Self Employment Tax Forms In PDF

Tax Form Used For Self Employed Employment Form

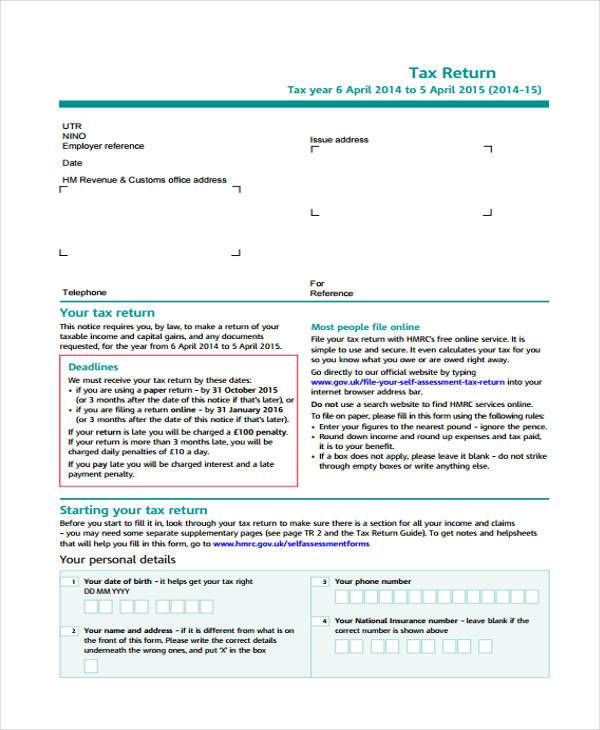

Self employment Short 2019 If You re Self employed Have Relatively Simple Tax Affairs And

FREE 9 Self Assessment Forms In PDF MS Word Excel

Self Employed Canada Tax Form Employment Form

Self Employed Canada Tax Form Employment Form

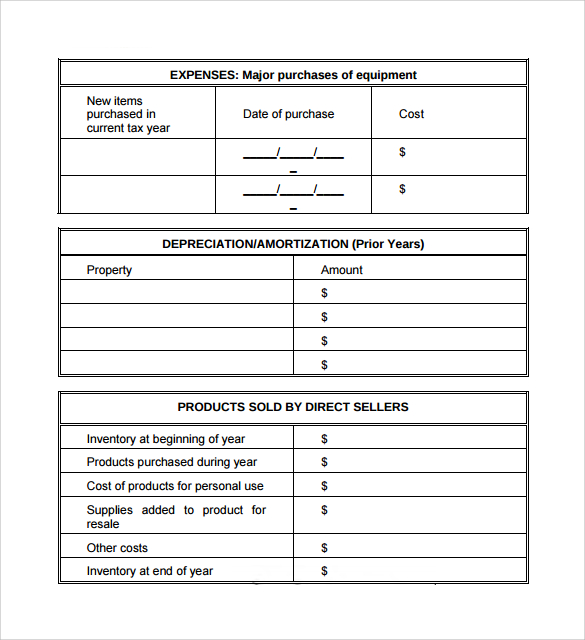

Self Employment Tax Form Editable Forms

FREE 6 Sample Self Employment Tax Forms In PDF

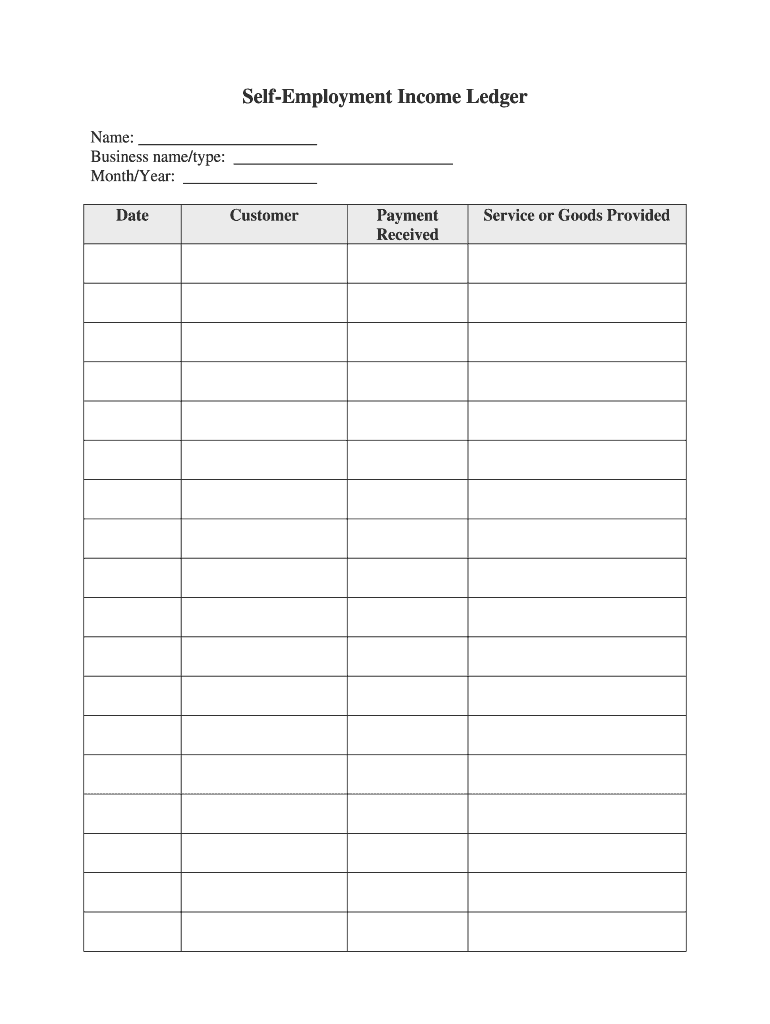

Self Employment Ledger 2020 2022 Fill And Sign Printable Template Online US Legal Forms

Printable Form For Self Employed Taxpayers - SOLVED by TurboTax Updated 2 hours ago Some TurboTax customers may be experiencing an issue where TurboTax is adding Form 7206 Self Employed Health Insurance Deduction when only one source of self employment income is present Form 2555 isn t being filed and long term care premiums aren t being included for the deduction