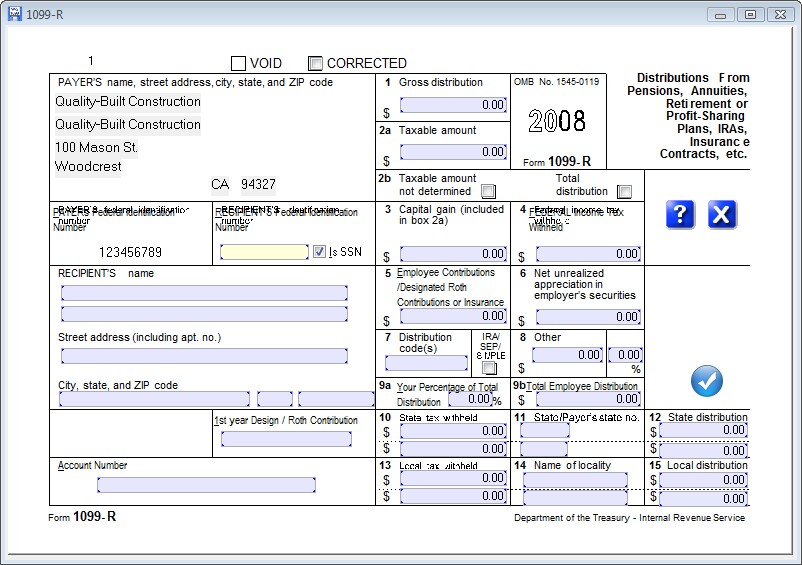

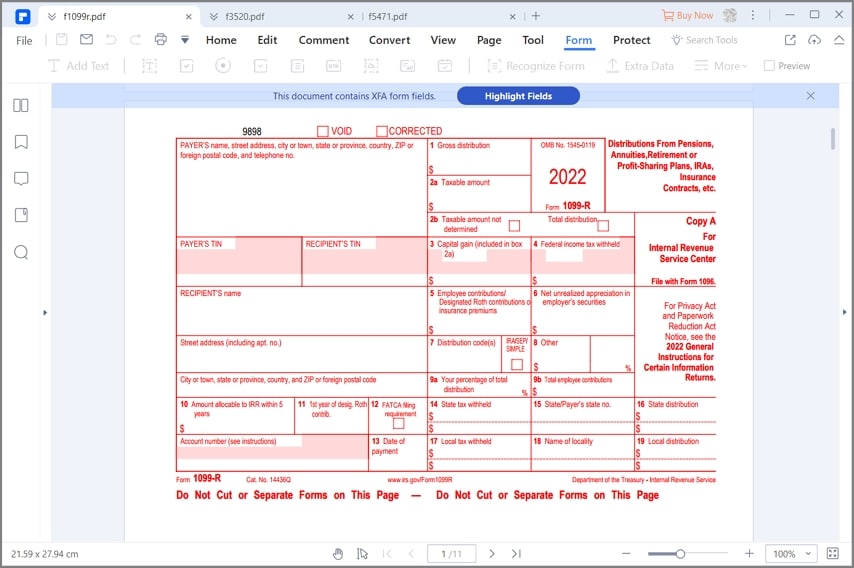

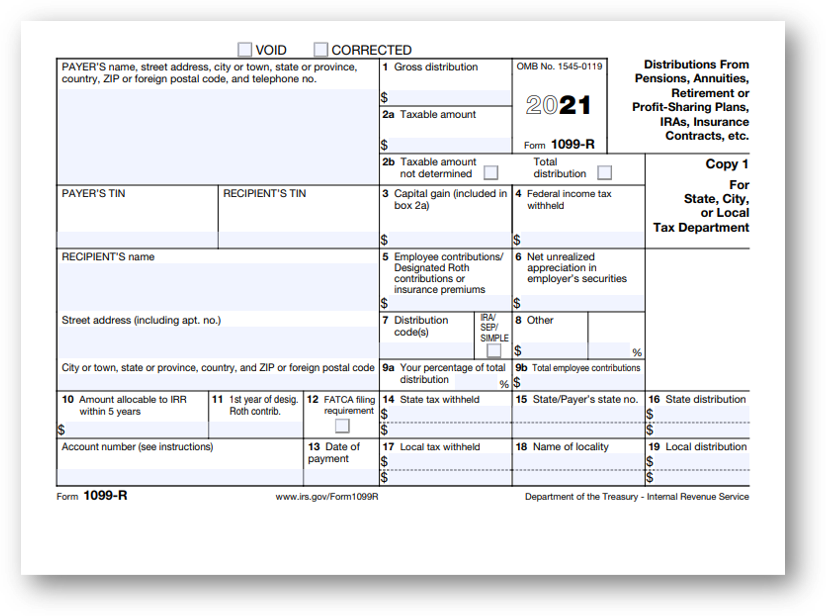

Printable Form It 1099 R A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

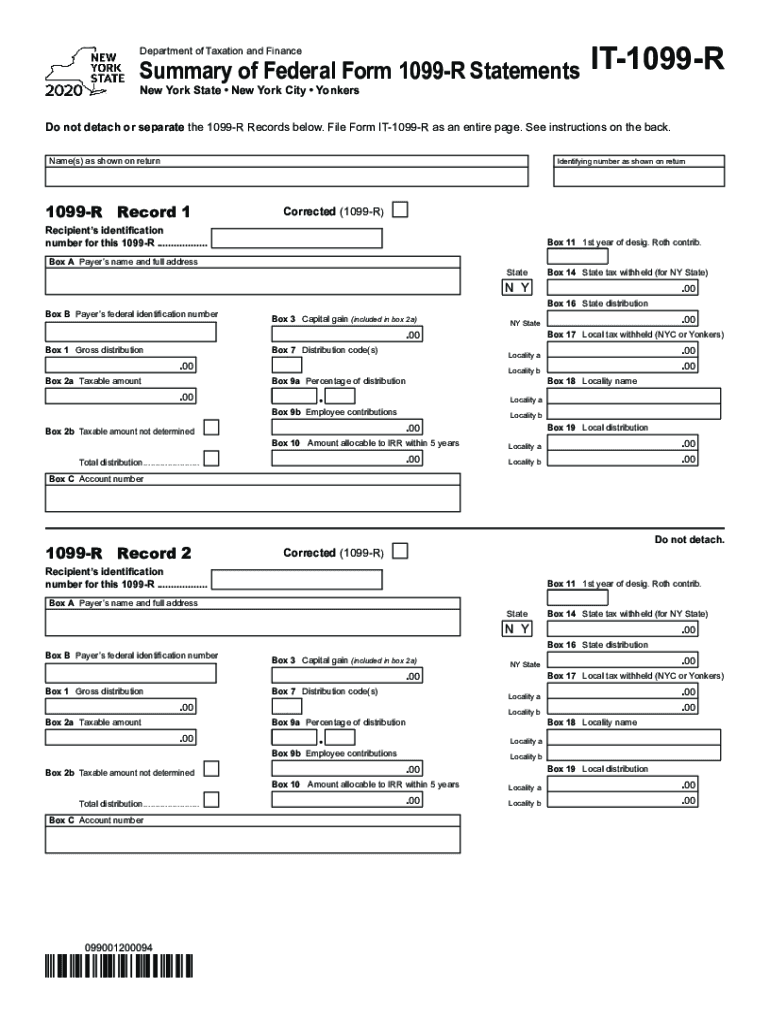

Department of Taxation and Finance Summary of Federal Form 1099 R Statements New York State New York City Yonkers IT 1099 R Do not detach or separate the 1099 R Records below File Form IT 1099 R as an entire page See instructions on the back Name s as shown on return Identifying number as shown on return 1099 R Record 1 Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity How to access your 1099 R tax form Sign in to your online account Go to OPM Retirement Services Online Click 1099 R Tax Form in the menu to view your most recent tax form

Printable Form It 1099 R

Printable Form It 1099 R

https://legaldocfinder.com/images/jumbotron/1099-r-sample.png

It 1099 R 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/541/595/541595143/large.png

Free Printable 1099 R Form Printable Templates

http://www.magtax.com/help/form1099r.jpg

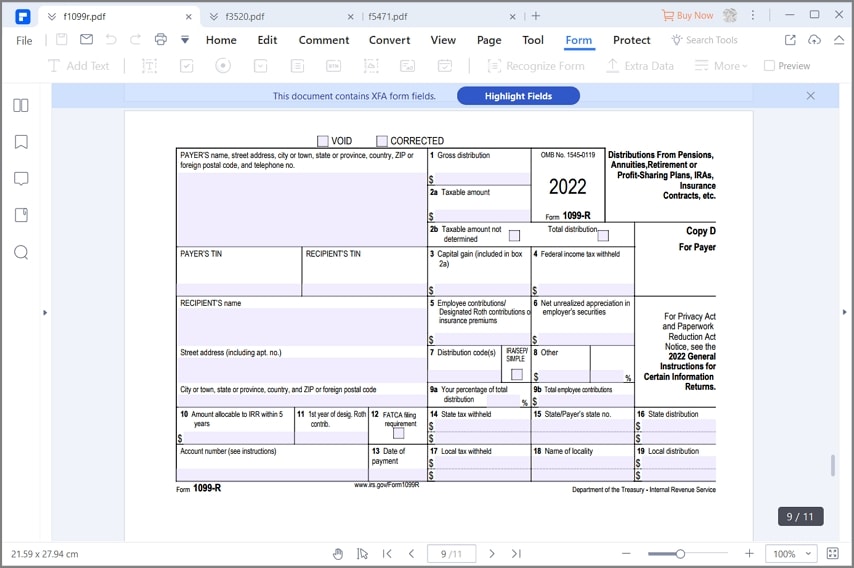

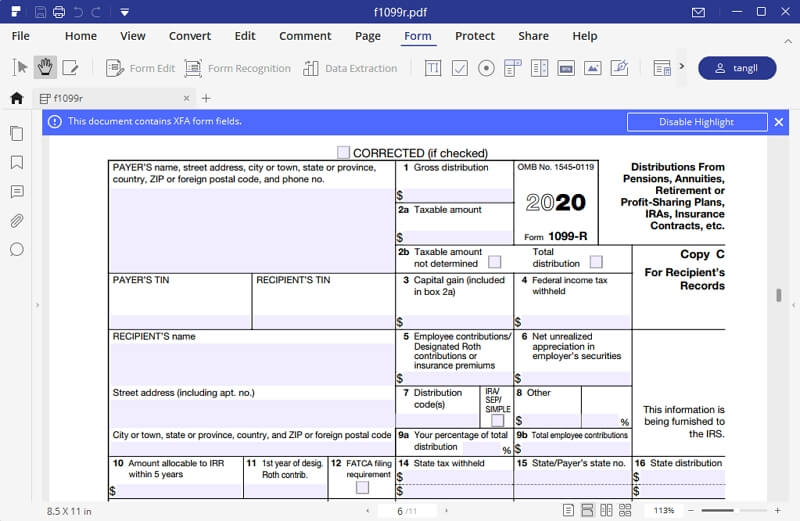

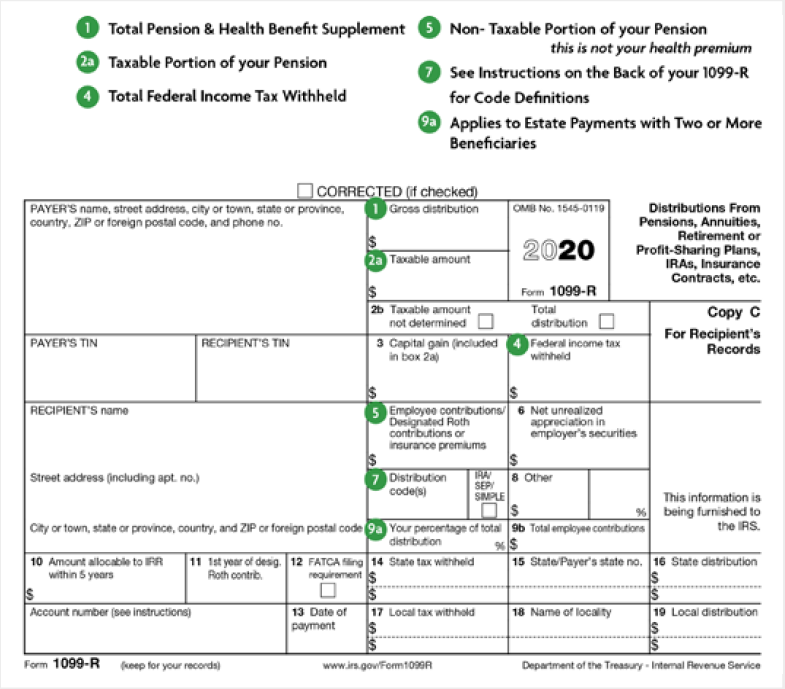

Questions and answers How do I get a copy of my 1099R Use Services Online Retirement Services to start change or stop Federal and State income tax withholdings request a duplicate tax filing statement 1099R change your Personal Identification Number PIN for accessing our automated systems Form 1099 R Simplified Method TaxSlayer Navigation Federal Section Income 1099 R RRB 1099 RRB 1099 R SSA 1099 Add or Edit a 1099 R Click here for options under Box 2a Taxable Amount or Keyword R If the taxpayer made after tax contributions toward a pension a portion of the annuity payment has already been taxed and isn t taxable now

Electronic filing is the fastest safest way to file but if you must file a paper Summary of Federal Form 1099 R Statements use our enhanced fill in Form IT 1099 R with 2D barcodes Benefits include no more handwriting type your entries directly into our form Form 1099 R is used to report distributions from annuities profit sharing plans retirement plans IRAs insurance contracts or pensions Anyone who receives a distribution over 10 should

More picture related to Printable Form It 1099 R

File Form 1099 R 2015 jpg Wikipedia

https://upload.wikimedia.org/wikipedia/commons/0/05/Form_1099-R%2C_2015.jpg

Understanding Your Form 1099 R MSRB Mass gov

https://www.mass.gov/files/styles/embedded_full_width/public/images/2021-01/1099-r_2020.jpg?itok=lqdGyU3i

Form 1099 R Instructions Information Community Tax

https://www.communitytax.com/wp-content/uploads/2016/04/Tax-Form-1099-R.jpg

Form 1099 R Form 1099 R is used to report the distribution of retirement benefits such as pensions annuities or other retirement plans Additional variations of Form 1099 R include Form CSA 1099R Form CSF 1099R and Form RRB 1099 R Most public and private pension plans that aren t part of the Civil Service system use the standard Form 1099 R 1099 NEC You ll receive a 1099 NEC nonemployee compensation for income you receive for contract labor or self employment of more than 600 Note Prior to tax year 2020 this information was reported on Form 1099 MISC If you work for more than one company you ll receive a 1099 NEC tax form from each company

A 1099 R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts You ll generally receive one for distributions of 10 or more The plan or account custodian completing the 1099 R must fill out three copies of every 1099 R they issue One for the IRS Printable version Form 1099 R 2015 In the United States Form 1099 R is a variant of Form 1099 used for reporting on distributions from pensions annuities retirement or profit sharing plans IRAs charitable gift annuities and Insurance Contracts Form 1099 R is filed for each person who has received a distribution of 10 or more from any

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-01.jpg

Formulaire IRS 1099 R Comment Le Remplir Correctement Et Facilement

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1099r-05.jpg

https://eforms.com/irs/form-1099/r/

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

https://www.tax.ny.gov/pdf/current_forms/it/it1099r_fill_in.pdf

Department of Taxation and Finance Summary of Federal Form 1099 R Statements New York State New York City Yonkers IT 1099 R Do not detach or separate the 1099 R Records below File Form IT 1099 R as an entire page See instructions on the back Name s as shown on return Identifying number as shown on return 1099 R Record 1

IRS Form 1099 R How To Fill It Right And Easily

IRS Form 1099 R How To Fill It Right And Easily

Formulario 1099 R Del IRS C mo Rellenarlo Bien Y F cilmente

Tax Form Focus IRS Form 1099 R STRATA Trust Company

How To Print And File 1099 R

SDCERS Form 1099 R Explained

SDCERS Form 1099 R Explained

IRS Form 1099 R What Every Retirement Saver Should Know

Understanding Your 1099 R Dallaserf

Seven Form 1099 R Mistakes To Avoid Retirement Daily On TheStreet Finance And Retirement

Printable Form It 1099 R - A 1099 R tax form is used to report the distribution of taxable retirement benefits If you receive taxable income from NYSLRS we will send you a 1099 R tax form for filing your taxes by January 31 of the following year Regardless of your delivery preference you will be able to view and print your 1099 R by signing in to Retirement